Beruflich Dokumente

Kultur Dokumente

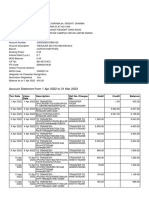

RR - For Retirement Benefit

Hochgeladen von

EDISON SAGUIRERCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

RR - For Retirement Benefit

Hochgeladen von

EDISON SAGUIRERCopyright:

Verfügbare Formate

For most employees, pension plans are their post -retirement safety nets, helping ensure that they

have enough resources to live comfortably in their golden years. While plans can have different

policies and provisions, one common question that arises in taxpayers’ minds is whether their

“nest eggs” are subject to income tax?

The proverbial but technical answer is – IT DEPENDS. The taxability of the payouts from employee

pension plans depends on a number of factors, including the nature of the payout.

In general, benefits are taxable.

Section 60 (B) of the Philippine Tax Code, as clarified by Revenue Memorandum Circular (RMC) No.

39-14, provides that the entire amount of benefits paid by a pension, stock bonus or profit -sharing

plan of any employer for the benefit of employees, is taxable on the part of the employees in the

year so distributed.

The same RMC explained that for non -contributory pension plans, the dividends distributed by the

pension fund to the covered employees are subject to income tax in th e year so distributed. If the

employee covered by the pension fund resigned and received benefits from the fund that do not

qualify as tax-exempt separation or retirement benefits, the entire amount of benefits received is

subject to income tax in the year so distributed.

For contributory pension plans, where the employee also contributes to the plan, the RMC states

that dividends distributed to the covered employees do not constitute a return of the employees’

voluntary contributions; hence, they are subje ct to income tax in the year so distributed.

Return of employee’s personal contributions and retirement benefits may be tax -exempt.

Under RMC No. 39 -14, it was made clear that payouts representing a return of an employee’s

personal contributions to the fun d are not taxable. Retirement benefits may also qualify as exempt

from income tax when the conditions under the Tax Code are satisfied.

AN ILLUSTRATION

If an employee contributed a total of P60,000 to the pension fund and upon his resignation

received benefits from the fund in the amount of P300,000 that do not qualify as tax -exempt

separation or retirement benefits, the P60,000 constitutes a return of his contribution to the fund

and is exempt from income tax. However, the P240,000 that the employee received in excess of

his contribution (P300,000 less P60,000) is subject to income tax in the year so distributed.

Any income or earnings from investments of the pension fund, such as dividends, are tax able to

the employee-member in the year so distributed if the distribution is effected before his retirement

from the company. On the other hand, upon the retirement of the employee and in accordance

with Section 32 (B) (6) of the Tax Code, the total benef its which the employee shall receive

consisting of his personal contributions, the employer’s counterpart contributions and the income

of the fund to which the employee is entitled and is distributed to him shall be exempt from

income tax. [BIR Ruling DA -(TSF-016) No. 542 -08 and BIR Ruling DA No. 377 -04]

REQUIREMENTS FOR EXEMPTION

Section 32 (B) (6) of the Tax Code outlines the following requirements for retirement benefits

received by officials or employees of private companies to be tax -exempt:

1. The ben efits received must be in accordance with a reasonable private benefit plan maintained

by the employer;

2. The retiring official or employee must have been in the service of the same employer for at

least 10 years and the employee should be at least 50 yea rs old at the time of his retirement; and

3. Such tax exemption privilege on retirement benefits must be availed of by an official or

employee only once.

Revenue Regulations (RR) No. 1 -68, the Private Retirement Plan Regulations, as amended by RR

No. 1-83, specifically requires that before availing of the privileges afforded by pension, gratuity,

profit sharing, or stock bonus plans, the employer must first obtain a BIR certification or ruling to

the effect that the qualification of the plan for tax exempti on has been determined. Thus, it is

important that the employer secures from the BIR a certification of qualification or a ruling, which

shall then serve as a basis that the company’s retirement plan indeed qualifies as a reasonable

retirement plan, which is an essential element for tax exemption.

Likewise, in the absence of any retirement plan, retirement benefits received by employees under

Republic Act (RA) No. 7641 are also exempt from income tax under Section (B) (6) of the Tax

Code.

RA 7641 provides that any employee may be retired upon reaching the retirement age established

in a collective bargaining agreement or other applicable employment contract. In the absence of a

retirement plan or agreement providing for retirement benefits of employees in th e establishment,

an employee upon reaching the age of 60 years or more, but not beyond 65 years which is

declared as the compulsory retirement age, and who has served at least five (5) years in the said

establishment, may retire and shall be entitled to re tirement pay equivalent to at least one - half

(1/2) month salary for every year of service, a fraction of at least 6 months being considered as

one whole year.

While the above discussion outlines the possible exemption of payouts from employees’ pension

plan, the tax implications on how these payouts will be spent, invested and enjoyed could also

prove to be interesting.

This article is for general information only and is not a substitute for professional advice where

the facts and circumstances warrant. Th e views and opinion expressed above are those of the

authors and do not necessarily represent the views of SGV & Co.

Das könnte Ihnen auch gefallen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Sbi Loan DataDokument1 SeiteSbi Loan DataWHITE DEVILNoch keine Bewertungen

- Exchange 2023 06 22Dokument1 SeiteExchange 2023 06 22Md Mintu MiahNoch keine Bewertungen

- Rules On Gross Income TaxationDokument15 SeitenRules On Gross Income TaxationEar TanNoch keine Bewertungen

- Bpi DraftDokument6 SeitenBpi DraftTrisha TarucNoch keine Bewertungen

- Principles of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceDokument2 SeitenPrinciples of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceCindy SweNoch keine Bewertungen

- ADIB Bank - AEDDokument4 SeitenADIB Bank - AEDTehseenNoch keine Bewertungen

- Key Fact Statement CorporateDokument7 SeitenKey Fact Statement CorporateRAM MAURYANoch keine Bewertungen

- Us Master BinDokument11 SeitenUs Master BinPhan Văn Bình100% (1)

- Deposit Details Statement: Deposit Balances For Account ID: 7047305111Dokument2 SeitenDeposit Details Statement: Deposit Balances For Account ID: 7047305111sanjaybiduNoch keine Bewertungen

- Problem Set 6Dokument2 SeitenProblem Set 6Gisel Lopez FelixNoch keine Bewertungen

- Financial Literacy and Spending HabitsDokument4 SeitenFinancial Literacy and Spending HabitsKaye Jay Enriquez100% (2)

- Wise Deposit Note 838670253 1836683943 enDokument3 SeitenWise Deposit Note 838670253 1836683943 enadminNoch keine Bewertungen

- Assesment Notice 2017Dokument1 SeiteAssesment Notice 2017Shounak KossambeNoch keine Bewertungen

- Screenshot 2023-06-16 at 6.42.28 PMDokument17 SeitenScreenshot 2023-06-16 at 6.42.28 PMAnreddy Ajantha ReddyNoch keine Bewertungen

- Pensions and Individual Retirement Accounts (Iras) : An OverviewDokument26 SeitenPensions and Individual Retirement Accounts (Iras) : An OverviewtareNoch keine Bewertungen

- Chapter 3 Understanding Money and Its Management Last PartDokument28 SeitenChapter 3 Understanding Money and Its Management Last PartSarah Mae WenceslaoNoch keine Bewertungen

- Annual Property Return Statement FORM NO.I.II - III.IV.VDokument12 SeitenAnnual Property Return Statement FORM NO.I.II - III.IV.VEr Pranabesh SenNoch keine Bewertungen

- Audit of CashDokument6 SeitenAudit of CashMikaela SalvadorNoch keine Bewertungen

- Buying A HouseDokument4 SeitenBuying A Houseapi-325824593Noch keine Bewertungen

- GetDocStream PDFDokument1 SeiteGetDocStream PDFEllaNoch keine Bewertungen

- G As Oa 8 L3 WDN Tvic 4Dokument15 SeitenG As Oa 8 L3 WDN Tvic 4Srishti SharmaNoch keine Bewertungen

- ITDFDokument2 SeitenITDFdepakmunirajNoch keine Bewertungen

- 01activity Borrowing WorkbookDokument12 Seiten01activity Borrowing WorkbookMatthewNoch keine Bewertungen

- FileDokument2 SeitenFileSudeep Raj Karki67% (3)

- 03 DevMath 04 TXT - Ebook Earning and Saving MoneyDokument22 Seiten03 DevMath 04 TXT - Ebook Earning and Saving Money2qncki2bwbckaNoch keine Bewertungen

- WORD Deposit InsuranceDokument21 SeitenWORD Deposit InsuranceLinh LinhNoch keine Bewertungen

- Transaction-Dispute-Form NAVEENDokument7 SeitenTransaction-Dispute-Form NAVEENSPG CAMPUSNoch keine Bewertungen

- Suvigya: Details Furnished by You WereDokument1 SeiteSuvigya: Details Furnished by You WereMKMK JilaniNoch keine Bewertungen

- MGTC70H (Personal Financial Management) L01: Final Exam Date: August 28, 2012Dokument5 SeitenMGTC70H (Personal Financial Management) L01: Final Exam Date: August 28, 2012agcoreNoch keine Bewertungen

- ITR Acknowledgement FY 2019-20Dokument1 SeiteITR Acknowledgement FY 2019-20taramaNoch keine Bewertungen