Beruflich Dokumente

Kultur Dokumente

MAS Ratio Analysis

Hochgeladen von

DIonalynne0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten2 SeitenRatio analysis management advisory

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenRatio analysis management advisory

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten2 SeitenMAS Ratio Analysis

Hochgeladen von

DIonalynneRatio analysis management advisory

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

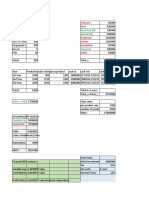

Ratio Year 2005 Year 2004 What it tells you?

Return on Investment: 147430 290710

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 = 0.13 𝑜𝑟 13% = 0.28 𝑜𝑟 28%

1168260 + 1146040 1146040 + 919480

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑂𝑤𝑛𝑒𝑟 ′ 𝑠 𝐸𝑞𝑢𝑖𝑡𝑦 2 2

Return on Assets: 147430 290710

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 = 0.08 𝑜𝑟 8% = 0.18 𝑜𝑟 18%

1854000 + 1669320 1669320 + 1511520

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 2 2

Net Profit Margin: 147430 290710

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 = 0.024 𝑜𝑟 2.4% = 0.053 𝑜𝑟 5.3%

6039750 5452010

𝑆𝑎𝑙𝑒𝑠

Asset Turnover: 6039750 5452010

𝑆𝑎𝑙𝑒𝑠 = 3.40 𝑡𝑖𝑚𝑒𝑠 = 3.39 𝑡𝑖𝑚𝑒𝑠

1854000 + 1669320 1699320 + 1511520

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 2 2

Return on Assets: 147430 6039750 290710 5452010

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑆𝑎𝑙𝑒𝑠 𝑥 = .08 𝑜𝑟 8% 𝑥 = 0.17 𝑜𝑟 17%

6039750 1854000 5452010 1699320

𝑥

𝑆𝑎𝑙𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

Average Collection Period: 365 365

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑅 𝑥 365 = 0.47 𝑡𝑖𝑚𝑒𝑠 = 0.37 𝑡𝑖𝑚𝑒𝑠

6039750 5452010

𝐴𝑛𝑛𝑢𝑎𝑙 𝐶𝑟𝑒𝑑𝑖𝑡 𝑆𝑎𝑙𝑒𝑠 12090 + 34800 3480 + 7550

2 2

Inventory Turnover: 3573070 3135730

𝐶𝑜𝑠𝑡 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑠𝑜𝑙𝑑 = 4.48 𝑡𝑖𝑚𝑒𝑠 = 4.11

738630 + 857090 857090 + 668200

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 2 2

Average age of Payables:

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑃 𝑥 365

𝑁𝑒𝑡 𝑃𝑢𝑟𝑐ℎ𝑎𝑠𝑒𝑠

Working Capital:

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡 − 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏

Current Ratio:

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏

Quick Ratio:

𝐶𝑎𝑠ℎ + 𝑀𝑘𝑡𝑏𝑙𝑒 𝑆𝑒𝑐. +𝐴𝑅

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏

Debt to Equity Ratio:

𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡

𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦

Times Interest Earned:

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 + (𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 + 𝑇𝑎𝑥𝑒𝑠)

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐸𝑥𝑝𝑒𝑛𝑠𝑒

Cash flow to Liabilities:

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐶𝑎𝑠ℎ 𝐹𝑙𝑜𝑤

𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

Das könnte Ihnen auch gefallen

- Mine Investment AnalysisDokument6 SeitenMine Investment AnalysisTriAnggaBayuPutra50% (2)

- C.finance Assignment 3Dokument3 SeitenC.finance Assignment 3fiza akhterNoch keine Bewertungen

- (MCOF19M028) CF AssignmentDokument5 Seiten(MCOF19M028) CF AssignmentFaaiz YousafNoch keine Bewertungen

- Corporate ValuationDokument9 SeitenCorporate ValuationPRACHI DASNoch keine Bewertungen

- FM2 Assignment 4 - Group 5Dokument7 SeitenFM2 Assignment 4 - Group 5TestNoch keine Bewertungen

- Hewlett Packard Enterprise Co Com in Dollar US in ThousandsDokument6 SeitenHewlett Packard Enterprise Co Com in Dollar US in Thousandsluisa Fernanda PeñaNoch keine Bewertungen

- Prati BhaDokument4 SeitenPrati BhaABHIJEET RATHODNoch keine Bewertungen

- Es - Group 8Dokument4 SeitenEs - Group 8Papa NketsiahNoch keine Bewertungen

- FinManSemis2 UmaliDokument7 SeitenFinManSemis2 UmaliJenny Shane UmaliNoch keine Bewertungen

- Balance Sheet: With The Assumption We Can Use All The Plants and EquipmentDokument4 SeitenBalance Sheet: With The Assumption We Can Use All The Plants and EquipmentPriadarshini Subramanyam DM21B093Noch keine Bewertungen

- Excel Advanced Excel For Finance EXERCISEDokument91 SeitenExcel Advanced Excel For Finance EXERCISEhaz002Noch keine Bewertungen

- Ford FS PaiDokument13 SeitenFord FS PaiAna Felna R. MirallesNoch keine Bewertungen

- BTDokument6 SeitenBTthanhlong2692000Noch keine Bewertungen

- Topic:-Evaluate The Financial Performance of Marks &spencer PLCDokument27 SeitenTopic:-Evaluate The Financial Performance of Marks &spencer PLCAnonymous ohYFoO4Noch keine Bewertungen

- Financial ManagementDokument46 SeitenFinancial ManagementNanaSanjaya100% (4)

- Red Chilli WorkingsDokument10 SeitenRed Chilli WorkingsImran UmarNoch keine Bewertungen

- London School of Commerce: AssignmentDokument12 SeitenLondon School of Commerce: AssignmentMohammad Abu HurairaNoch keine Bewertungen

- An0090 Xls EngDokument27 SeitenAn0090 Xls Engdiana sofia galvisNoch keine Bewertungen

- STATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Dokument5 SeitenSTATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Fatima Ansari d/o Muhammad AshrafNoch keine Bewertungen

- Electricity Bill Advertising: Software RentDokument5 SeitenElectricity Bill Advertising: Software RentHasiburNoch keine Bewertungen

- Capital Budgeting Solution1Dokument100 SeitenCapital Budgeting Solution1MBaralNoch keine Bewertungen

- Problema 11Dokument8 SeitenProblema 11zimbolixNoch keine Bewertungen

- Course Title: Financial Analysis & Control Course Code: FIN408 Section: 01 Semester: Summer, 21Dokument6 SeitenCourse Title: Financial Analysis & Control Course Code: FIN408 Section: 01 Semester: Summer, 21Tamim RahmanNoch keine Bewertungen

- Case StudyDokument4 SeitenCase StudyDivyank SinghalNoch keine Bewertungen

- Name: Hopkins ID: Professor Nan Zhou: Financial Economics Assignment 02Dokument6 SeitenName: Hopkins ID: Professor Nan Zhou: Financial Economics Assignment 02da bNoch keine Bewertungen

- Financial Management 1Dokument8 SeitenFinancial Management 1KaranNoch keine Bewertungen

- Capital Budgeting BSNLDokument10 SeitenCapital Budgeting BSNLAşhwįnį GawasNoch keine Bewertungen

- 5 3Dokument6 Seiten5 3Evelyn MorilloNoch keine Bewertungen

- Shivani Yadav SheetDokument10 SeitenShivani Yadav SheetanandNoch keine Bewertungen

- Topic: Time Value of Money: BY Kajal VipaniDokument50 SeitenTopic: Time Value of Money: BY Kajal VipaniAakarshak nandwaniNoch keine Bewertungen

- Provisional: Provisional Income Tax CalculationDokument1 SeiteProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNoch keine Bewertungen

- New Microsoft Excel WorksheetDokument10 SeitenNew Microsoft Excel WorksheetakbarNoch keine Bewertungen

- Assignment ..Dokument5 SeitenAssignment ..Mohd Saddam Saqlaini100% (1)

- Balance Sheet 2.1Dokument3 SeitenBalance Sheet 2.1neeshNoch keine Bewertungen

- 14 Marks AnswersDokument42 Seiten14 Marks Answerskuvira LodhaNoch keine Bewertungen

- Econ Math ProjectDokument14 SeitenEcon Math ProjectAndy ChiuNoch keine Bewertungen

- Capital Budgeting TybmsDokument38 SeitenCapital Budgeting TybmsKushNoch keine Bewertungen

- UntitledDokument13 SeitenUntitledAnne GuamosNoch keine Bewertungen

- Financial ModelDokument6 SeitenFinancial ModelMuneeb MateenNoch keine Bewertungen

- Sales and Cost Plan (Income Statement)Dokument4 SeitenSales and Cost Plan (Income Statement)Ramira EdquilaNoch keine Bewertungen

- DCF Case Sample 1Dokument4 SeitenDCF Case Sample 1Gaurav SethiNoch keine Bewertungen

- EconomicsDokument5 SeitenEconomicsbrian mochez01Noch keine Bewertungen

- Financial StatementDokument36 SeitenFinancial StatementJigoku ShojuNoch keine Bewertungen

- Business - Valuation - Modeling - Assessment FileDokument6 SeitenBusiness - Valuation - Modeling - Assessment FileGowtham VananNoch keine Bewertungen

- Final CaseDokument25 SeitenFinal CaseSakshi SharmaNoch keine Bewertungen

- Case01 02Dokument24 SeitenCase01 02Sakshi SharmaNoch keine Bewertungen

- Final Assignment ValuationDokument5 SeitenFinal Assignment ValuationSamin ChowdhuryNoch keine Bewertungen

- Ias 36 Example Simple Impairment Test of CGU Based On Value in UseDokument7 SeitenIas 36 Example Simple Impairment Test of CGU Based On Value in Usedevanand bhawNoch keine Bewertungen

- Group 1 - Phuket Beach Hotel - Acc 121Dokument11 SeitenGroup 1 - Phuket Beach Hotel - Acc 121Ronnie EnriquezNoch keine Bewertungen

- Financial Plan (Ippizandayaw)Dokument6 SeitenFinancial Plan (Ippizandayaw)Jayson IbaleNoch keine Bewertungen

- ValuationDokument21 SeitenValuationammarNoch keine Bewertungen

- 7 Ezeebuy SolutionDokument10 Seiten7 Ezeebuy SolutionRohan JindalNoch keine Bewertungen

- Practice Question Session 3Dokument10 SeitenPractice Question Session 3Shubham KumarNoch keine Bewertungen

- Problems and Solutions On Advance Tax: Problem No. 1Dokument8 SeitenProblems and Solutions On Advance Tax: Problem No. 1NishantNoch keine Bewertungen

- Mock Test SolutionsDokument11 SeitenMock Test SolutionsMyraNoch keine Bewertungen

- Class 5 Project Selection ExerciseDokument18 SeitenClass 5 Project Selection ExerciseVinodshankar BhatNoch keine Bewertungen

- A Simple Model: Integrating Financial StatementsDokument10 SeitenA Simple Model: Integrating Financial Statementssps fetrNoch keine Bewertungen

- Bakiache CitiDokument8 SeitenBakiache CitiMalevolent IncineratorNoch keine Bewertungen

- WBS WPL PT Palu GadaDokument10 SeitenWBS WPL PT Palu GadaLucky AristioNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Modules 1-8 Answer To Guides QuestionsDokument15 SeitenModules 1-8 Answer To Guides QuestionsBlackblight •Noch keine Bewertungen

- Aims of The Big Three'Dokument10 SeitenAims of The Big Three'SafaNoch keine Bewertungen

- Ice Cream CaseDokument7 SeitenIce Cream Casesardar hussainNoch keine Bewertungen

- E Commerce AssignmentDokument40 SeitenE Commerce AssignmentHaseeb Khan100% (3)

- Test Present Simple TenseDokument2 SeitenTest Present Simple TenseSuchadaNoch keine Bewertungen

- ATI PN Maternal Newborn Proctored Exam Test Bank (38 Versions) (New-2022)Dokument7 SeitenATI PN Maternal Newborn Proctored Exam Test Bank (38 Versions) (New-2022)kapedispursNoch keine Bewertungen

- Albert EinsteinDokument3 SeitenAlbert EinsteinAgus GLNoch keine Bewertungen

- Bsee25 Lesson 1Dokument25 SeitenBsee25 Lesson 1Renier ArceNoNoch keine Bewertungen

- Running Head: Problem Set # 2Dokument4 SeitenRunning Head: Problem Set # 2aksNoch keine Bewertungen

- Worldpay Social Gaming and Gambling Whitepaper Chapter OneDokument11 SeitenWorldpay Social Gaming and Gambling Whitepaper Chapter OneAnnivasNoch keine Bewertungen

- UntitledDokument9 SeitenUntitledRexi Chynna Maning - AlcalaNoch keine Bewertungen

- IMMI S257a (s40) Requirement To Provide PIDsDokument4 SeitenIMMI S257a (s40) Requirement To Provide PIDsAshish AshishNoch keine Bewertungen

- Richard Neutra - Wikipedia, The Free EncyclopediaDokument10 SeitenRichard Neutra - Wikipedia, The Free EncyclopediaNada PejicNoch keine Bewertungen

- Declarations On Higher Education and Sustainable DevelopmentDokument2 SeitenDeclarations On Higher Education and Sustainable DevelopmentNidia CaetanoNoch keine Bewertungen

- Presidential Form of GovernmentDokument4 SeitenPresidential Form of GovernmentDivy YadavNoch keine Bewertungen

- Reaserch ProstitutionDokument221 SeitenReaserch ProstitutionAron ChuaNoch keine Bewertungen

- Weavers, Iron Smelters and Factory Owners NewDokument0 SeitenWeavers, Iron Smelters and Factory Owners NewWilliam CookNoch keine Bewertungen

- I.T. Past Papers Section IDokument3 SeitenI.T. Past Papers Section IMarcia ClarkeNoch keine Bewertungen

- Week 8 - 13 Sale of GoodsDokument62 SeitenWeek 8 - 13 Sale of Goodstzaman82Noch keine Bewertungen

- Allstate Car Application - Sign & ReturnDokument6 SeitenAllstate Car Application - Sign & Return廖承钰Noch keine Bewertungen

- IJHSS - A Penetrating Evaluation of Jibanananda Das' Sensibilities A Calm Anguished Vision - 3Dokument10 SeitenIJHSS - A Penetrating Evaluation of Jibanananda Das' Sensibilities A Calm Anguished Vision - 3iaset123Noch keine Bewertungen

- People V GGGDokument7 SeitenPeople V GGGRodney AtibulaNoch keine Bewertungen

- He Hard Truth - If You Do Not Become A BRAND Then: Examples Oprah WinfreyDokument11 SeitenHe Hard Truth - If You Do Not Become A BRAND Then: Examples Oprah WinfreyAbd.Khaliq RahimNoch keine Bewertungen

- Country in A Box ProjectDokument6 SeitenCountry in A Box Projectapi-301892404Noch keine Bewertungen

- Technical AnalysisDokument4 SeitenTechnical AnalysisShaira Ellyxa Mae VergaraNoch keine Bewertungen

- Read The Following Case Study Carefully and Answer The Questions Given at The End: Case # 3. ElectroluxDokument3 SeitenRead The Following Case Study Carefully and Answer The Questions Given at The End: Case # 3. ElectroluxDarkest DarkNoch keine Bewertungen

- 21 Century Literature From The Philippines and The World: Department of EducationDokument20 Seiten21 Century Literature From The Philippines and The World: Department of EducationAoi Miyu ShinoNoch keine Bewertungen

- The Renaissance PeriodDokument8 SeitenThe Renaissance PeriodAmik Ramirez TagsNoch keine Bewertungen

- Sample OTsDokument5 SeitenSample OTsVishnu ArvindNoch keine Bewertungen

- Risk AssessmentDokument11 SeitenRisk AssessmentRutha KidaneNoch keine Bewertungen