Beruflich Dokumente

Kultur Dokumente

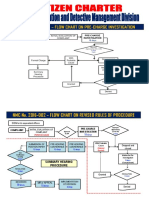

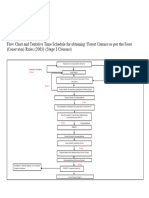

Assessment Flow Chart

Hochgeladen von

Bobby Olavides SebastianOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assessment Flow Chart

Hochgeladen von

Bobby Olavides SebastianCopyright:

Verfügbare Formate

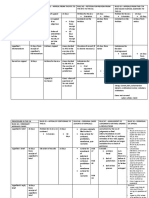

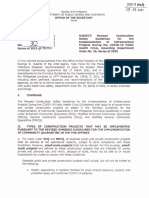

Informal PAN1 Option

Conference (Reply to PAN NO REPLY - Taxpayer “In Default”

(30 day period) or not)

Formal Letter of

Demand/Final

Reply within Assessment

Reply to PAN 15 days2

15 days Notice (FLD/FAN)3

(If Assessed by CIR’s Duly Authorized Representative) (If Assessed by CIR)

30 days 30 days

CIR’S DULY AUTHORIZED CIR ACTUAL

REPRESENTATIVE

PROTEST4

PROTEST (if Assessed by CIR)5

(Plus 60 days for

-or-

Supporting

Administrative Appeal (if Assessed by

Documents if

CIR’s Duly Authorized Representative)

Reinvestigation)

Inaction With Inaction With

180 days Decision 180 days Decision

Final Decision on Final Decision on

Option a Disputed Option a Disputed

(Appeal or Assessment (Appeal or Await Decision Assessment

Wait) (FDDA)3 Wait) (FDDA)3

Appeal within

Await

30 days from

Decision

180 days inaction Appeal within

30 days from

180 days inaction

Decision3

(Without Remedy Request for

Appeal within Option Appeal within Option

of Appeal Reconsideration

Appeal to CTA 30 days (Appeal to CTA Appeal to CTA 30 days (Appeal or

to CTA) 30 days from

from Denial or CIR) from Denial MR)

Receipt of Denial Motion for

Reconsideration

Motion for

Decision3 Reconsideration

1

Shall show in detail the facts and the law, rules and regulations, or jurisprudence on which the proposed assessment is based (Does not toll 30

2 An FDL/FAN issued beyond 15 days from filing of response to PAN valid if issued within the period of limitation to assess internal revenue taxes day period to

3

Shall state the facts, the law, rules and regulations, or jurisprudence on which it is based; otherwise, the assessment shall be void

Appeal to CTA)

4

Either a Request for Reconsideration (based on existing records; may involve questions of fact, law or both) or

Request for Reinvestigation (based on newly discovered or additional evidence; may involve questions of fact, law or both)

5

Request for Reconsideration only BJS

Das könnte Ihnen auch gefallen

- BIR Process Per RR 18-2013Dokument1 SeiteBIR Process Per RR 18-2013Kram Ynothna BulahanNoch keine Bewertungen

- NMC 2016 Rules of ProcedureDokument2 SeitenNMC 2016 Rules of ProcedurePetronilo GuidangenNoch keine Bewertungen

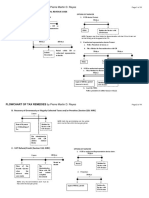

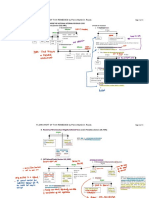

- Tax Remedies MappingDokument6 SeitenTax Remedies MappingRikka Cassandra ReyesNoch keine Bewertungen

- Tax Remedies DiagramDokument15 SeitenTax Remedies DiagramDomie AbataNoch keine Bewertungen

- Flow Chart On Pre-Charge Evaluation, Admin CaseDokument28 SeitenFlow Chart On Pre-Charge Evaluation, Admin Caseecjaybersandayan100% (1)

- Pre-Assessment Notice (PAN) : Appeal To CTA en BancDokument1 SeitePre-Assessment Notice (PAN) : Appeal To CTA en Banc18isloveNoch keine Bewertungen

- Remedies of a TaxpayerDokument1 SeiteRemedies of a TaxpayerPrincess Mae SamborioNoch keine Bewertungen

- Remedies LKGDokument41 SeitenRemedies LKGHNicdaoNoch keine Bewertungen

- Tax Remedies Flowchart (Revised)Dokument6 SeitenTax Remedies Flowchart (Revised)GersonGamas0% (1)

- MTRCB Rules of ProcedureDokument1 SeiteMTRCB Rules of ProcedureSai PastranaNoch keine Bewertungen

- CIRP timeline under IBC 2016Dokument2 SeitenCIRP timeline under IBC 2016D Dhananjay thigale100% (1)

- Incidents After AnswerDokument39 SeitenIncidents After AnswerBernice RayaNoch keine Bewertungen

- Acn Smaw I Utpras Tesda Op Ias 01 f05 ADokument2 SeitenAcn Smaw I Utpras Tesda Op Ias 01 f05 ATvet AcnNoch keine Bewertungen

- Flowchart of Tax Remedies 2019 Update TRDokument11 SeitenFlowchart of Tax Remedies 2019 Update TRAbraham Marco De GuzmanNoch keine Bewertungen

- Compliance Audit Action CatalogueDokument4 SeitenCompliance Audit Action CatalogueJanu MaglenteNoch keine Bewertungen

- Protest Property Tax Assessment ProcedureDokument1 SeiteProtest Property Tax Assessment ProcedureMonalieNoch keine Bewertungen

- Tax Remidies of The TaxpayerDokument6 SeitenTax Remidies of The TaxpayerJustin Robert RoqueNoch keine Bewertungen

- Flowchart of Tax Remedies 2017 Update PRDokument11 SeitenFlowchart of Tax Remedies 2017 Update PRMarjorie Kate CresciniNoch keine Bewertungen

- VenezuelaDokument1 SeiteVenezuelaSHUBHSMITA SNoch keine Bewertungen

- Flowchart of Tax Remedies I. Remedies Un PDFDokument12 SeitenFlowchart of Tax Remedies I. Remedies Un PDFJunivenReyUmadhayNoch keine Bewertungen

- Flowchart of Remedies (NIRC)Dokument3 SeitenFlowchart of Remedies (NIRC)Lorelyn FNoch keine Bewertungen

- FLOWCHART OF TAX REMEDIES by Pierre Martin D. ReyesDokument11 SeitenFLOWCHART OF TAX REMEDIES by Pierre Martin D. ReyesKEMPNoch keine Bewertungen

- TAX ASSESSMENT PROCEDURESDokument15 SeitenTAX ASSESSMENT PROCEDURESEmille LlorenteNoch keine Bewertungen

- Remedy TaxDokument1 SeiteRemedy TaxAndrea IvanneNoch keine Bewertungen

- Administrative Remedies Judicial RemediesDokument1 SeiteAdministrative Remedies Judicial RemediesAndrea IvanneNoch keine Bewertungen

- Tesda Op Ias 01 f05 A BartendingDokument4 SeitenTesda Op Ias 01 f05 A BartendingVeronica Joy CelestialNoch keine Bewertungen

- Flowchart of Tax Remedies 2019 Update TRDokument11 SeitenFlowchart of Tax Remedies 2019 Update TRBlackjack SharedNoch keine Bewertungen

- Studying 04 Flowchart of Tax Remedies 2019 Update TR (1) WithMarginNotesDokument11 SeitenStudying 04 Flowchart of Tax Remedies 2019 Update TR (1) WithMarginNotesCelestino LawNoch keine Bewertungen

- PM Reyes Flowchart of Tax Remedies (Feb 2023 Update)Dokument11 SeitenPM Reyes Flowchart of Tax Remedies (Feb 2023 Update)Avril ZamudioNoch keine Bewertungen

- Tesda Op Ias 02 F05Dokument2 SeitenTesda Op Ias 02 F05Neomi ChloeNoch keine Bewertungen

- AAFCO IDC - Flow - Chart - 2018 - ProcessDokument1 SeiteAAFCO IDC - Flow - Chart - 2018 - ProcessBirdie ScottNoch keine Bewertungen

- Tax Remedies in Flowchart 102019Dokument2 SeitenTax Remedies in Flowchart 102019Cecilbern ayen BernabeNoch keine Bewertungen

- Tax Remedies Flowchart RevisedDokument1 SeiteTax Remedies Flowchart RevisedJake MacTavishNoch keine Bewertungen

- SPMS Annex A Court PerformanceDokument1 SeiteSPMS Annex A Court PerformanceTess LegaspiNoch keine Bewertungen

- Civil Procedure - Relief TableDokument4 SeitenCivil Procedure - Relief TableDessa CaballeroNoch keine Bewertungen

- Modes of Appeal TableDokument3 SeitenModes of Appeal TablemarydalemNoch keine Bewertungen

- AppoinmentDokument23 SeitenAppoinmentRISHAB NANGIANoch keine Bewertungen

- Assessment FlowchartDokument6 SeitenAssessment FlowchartJess SerranoNoch keine Bewertungen

- FC TimelineDokument1 SeiteFC TimelineVamsidhar GubbalaNoch keine Bewertungen

- Summary of AppealsDokument2 SeitenSummary of AppealsUtkarsh GuptaNoch keine Bewertungen

- Tesda-Op-Ias-01-F05-A-Computer Systems ServicingDokument4 SeitenTesda-Op-Ias-01-F05-A-Computer Systems ServicingVeronica Joy CelestialNoch keine Bewertungen

- FlowchartDokument1 SeiteFlowchartCharleene GutierrezNoch keine Bewertungen

- NEW Penalties (IBC Not Updated)Dokument5 SeitenNEW Penalties (IBC Not Updated)Mallesh ArjaNoch keine Bewertungen

- Compliance Audit ProceduresDokument1 SeiteCompliance Audit ProceduresCabanatuan School of Beauty and wellnessNoch keine Bewertungen

- Disbarment Procedures Before IBP and SCDokument3 SeitenDisbarment Procedures Before IBP and SCada mae santonia100% (1)

- Tax 2 - Government's Role in The Assessment and Collection of TaxesDokument1 SeiteTax 2 - Government's Role in The Assessment and Collection of TaxesKatherine AlombroNoch keine Bewertungen

- Small Company Compliance CalendarDokument4 SeitenSmall Company Compliance Calendarchandan guptaNoch keine Bewertungen

- Form Based On LTIA-ISDokument3 SeitenForm Based On LTIA-ISCasey Del Gallego EnrileNoch keine Bewertungen

- Corporate Insolvency Resolution Process + Extension Not ExceedingDokument1 SeiteCorporate Insolvency Resolution Process + Extension Not Exceedingkandagatla prudhviiNoch keine Bewertungen

- Complaint Filed: Administrative Complaint and Investigation Procedure For The Central OfficeDokument4 SeitenComplaint Filed: Administrative Complaint and Investigation Procedure For The Central OfficeAngeline ChavesNoch keine Bewertungen

- Tax Remidies of The TaxpayerDokument8 SeitenTax Remidies of The TaxpayerNikki Coleen SantinNoch keine Bewertungen

- Lecture 7 - Labor LawDokument4 SeitenLecture 7 - Labor LawNBT OONoch keine Bewertungen

- IBP Disbarment and Supreme Court Suspension ProceduresDokument5 SeitenIBP Disbarment and Supreme Court Suspension Proceduresada mae santoniaNoch keine Bewertungen

- BIR Tax Assessment Process - OutlineDokument2 SeitenBIR Tax Assessment Process - OutlineNicole Aldrianne OmegaNoch keine Bewertungen

- Audit and Determination - DiagramaDokument1 SeiteAudit and Determination - Diagramaraquel greigeNoch keine Bewertungen

- Toyota GR: (Global Registration For A Big Issue in The Market)Dokument4 SeitenToyota GR: (Global Registration For A Big Issue in The Market)Cornel IvanNoch keine Bewertungen

- Auditor 2023 PDFDokument5 SeitenAuditor 2023 PDFPratulNoch keine Bewertungen

- Rem TimelineDokument58 SeitenRem TimelineTin-tin AquinoNoch keine Bewertungen

- Film Financing and Television Programming - PhilippinesDokument20 SeitenFilm Financing and Television Programming - PhilippinesBobby Olavides SebastianNoch keine Bewertungen

- BSP Warning Advisory On Virtual CurrenciesDokument2 SeitenBSP Warning Advisory On Virtual CurrenciesBobby Olavides SebastianNoch keine Bewertungen

- Airport Construction Influencing FactorsDokument4 SeitenAirport Construction Influencing FactorsIbrahim AdelNoch keine Bewertungen

- SEC Advisory Secret2SuccessDokument3 SeitenSEC Advisory Secret2SuccessBobby Olavides SebastianNoch keine Bewertungen

- SEC MSRD Request For Comments On The Updated Proposed Rules On Initial Coin OfferingDokument46 SeitenSEC MSRD Request For Comments On The Updated Proposed Rules On Initial Coin OfferingBobby Olavides SebastianNoch keine Bewertungen

- Managing Airport Construction ProjectsDokument10 SeitenManaging Airport Construction ProjectsTATATAHER100% (1)

- BSP Circular No. 944-2017 (Guidelines For Virtual Currency (VC) Exchanges)Dokument6 SeitenBSP Circular No. 944-2017 (Guidelines For Virtual Currency (VC) Exchanges)Bobby Olavides SebastianNoch keine Bewertungen

- SEC Advisory Public Participation in Initial Coin OfferingDokument2 SeitenSEC Advisory Public Participation in Initial Coin OfferingBobby Olavides SebastianNoch keine Bewertungen

- 2021NOTICE Extension of Enrollment in OSTDokument1 Seite2021NOTICE Extension of Enrollment in OSTBobby Olavides SebastianNoch keine Bewertungen

- SEC Advisory PHILIPPINE GLOBAL COINDokument2 SeitenSEC Advisory PHILIPPINE GLOBAL COINBobby Olavides SebastianNoch keine Bewertungen

- SEC Advisory Re MiningDokument3 SeitenSEC Advisory Re MiningBobby Olavides SebastianNoch keine Bewertungen

- Regulatory Framework For The Accreditation of Gaming SystemDokument8 SeitenRegulatory Framework For The Accreditation of Gaming SystemBobby Olavides SebastianNoch keine Bewertungen

- SEC Advisory PhilcrowdDokument2 SeitenSEC Advisory PhilcrowdBobby Olavides SebastianNoch keine Bewertungen

- SEC Advisory PluggleDokument3 SeitenSEC Advisory PluggleBobby Olavides SebastianNoch keine Bewertungen

- SEC Advisory OnecashDokument2 SeitenSEC Advisory OnecashBobby Olavides SebastianNoch keine Bewertungen

- E-Filing RuleDokument6 SeitenE-Filing RuleThe Supreme Court Public Information Office100% (1)

- Guidelines On VideoconferencingDokument23 SeitenGuidelines On VideoconferencingBobby Olavides SebastianNoch keine Bewertungen

- TESDA - Program Registration Forms Land-BasedDokument26 SeitenTESDA - Program Registration Forms Land-BasedBobby Olavides SebastianNoch keine Bewertungen

- Supreme Court: Administrative Circular No. 14 - 2021Dokument1 SeiteSupreme Court: Administrative Circular No. 14 - 2021Bobby Olavides SebastianNoch keine Bewertungen

- UTPRAS Guidelines (HTTP://WWW - Tesda.gov - ph/About/TESDA/42)Dokument5 SeitenUTPRAS Guidelines (HTTP://WWW - Tesda.gov - ph/About/TESDA/42)Bobby Olavides SebastianNoch keine Bewertungen

- Building Code Requirements and Permit FeesDokument6 SeitenBuilding Code Requirements and Permit FeesBobby Olavides SebastianNoch keine Bewertungen

- SEC Amends FRB No. 6 on Deposits for Future Stock SubscriptionDokument5 SeitenSEC Amends FRB No. 6 on Deposits for Future Stock SubscriptionAbraham GuiyabNoch keine Bewertungen

- 2019OpinionNo19 40Dokument3 Seiten2019OpinionNo19 40Bobby Olavides SebastianNoch keine Bewertungen

- TIN Card As ID For Notarization PurposesDokument9 SeitenTIN Card As ID For Notarization PurposesBobby Olavides SebastianNoch keine Bewertungen

- RMC 66-03 (Taxability of PAL)Dokument4 SeitenRMC 66-03 (Taxability of PAL)Bobby Olavides SebastianNoch keine Bewertungen

- All POGOs SPs - Compliance With The 60-40 Foreign Equity RequirementDokument1 SeiteAll POGOs SPs - Compliance With The 60-40 Foreign Equity RequirementBobby Olavides SebastianNoch keine Bewertungen

- Supreme Court: Administrative Circular No. 15 - 2021Dokument2 SeitenSupreme Court: Administrative Circular No. 15 - 2021Eunice SagunNoch keine Bewertungen

- Cheaper Medicines Act of 2008Dokument28 SeitenCheaper Medicines Act of 2008Bobby Olavides SebastianNoch keine Bewertungen

- Revised Construction Safety Guidelines During COVID-19Dokument12 SeitenRevised Construction Safety Guidelines During COVID-19Bobby Olavides SebastianNoch keine Bewertungen

- SB 1564Dokument59 SeitenSB 1564Bobby Olavides SebastianNoch keine Bewertungen

- U.S. Strategy For Pakistan and AfghanistanDokument112 SeitenU.S. Strategy For Pakistan and AfghanistanCouncil on Foreign Relations100% (2)

- Lec 2Dokument10 SeitenLec 2amitava deyNoch keine Bewertungen

- Hargrave, Cyrus Lead 2014 "Baad Team": Late-Breaking BCSP NotesDokument1 SeiteHargrave, Cyrus Lead 2014 "Baad Team": Late-Breaking BCSP NotesEric MooreNoch keine Bewertungen

- Appendix F - Property ValueDokument11 SeitenAppendix F - Property ValueTown of Colonie LandfillNoch keine Bewertungen

- TheoriesDokument87 SeitenTheoriesCzari MuñozNoch keine Bewertungen

- Municipal Best Practices - Preventing Fraud, Bribery and Corruption FINALDokument14 SeitenMunicipal Best Practices - Preventing Fraud, Bribery and Corruption FINALHamza MuhammadNoch keine Bewertungen

- The Night Artist ComprehensionDokument6 SeitenThe Night Artist ComprehensionDana TanNoch keine Bewertungen

- Bureau of Energy EfficiencyDokument2 SeitenBureau of Energy EfficiencyrkNoch keine Bewertungen

- English 7 WorkbookDokument87 SeitenEnglish 7 WorkbookEiman Mounir100% (1)

- Active Directory Infrastructure DesigndocumentDokument6 SeitenActive Directory Infrastructure Designdocumentsudarshan_karnatiNoch keine Bewertungen

- Trial of Warrant Cases by MagistrateDokument15 SeitenTrial of Warrant Cases by MagistrateSaurav KumarNoch keine Bewertungen

- LP DLL Entrep W1Q1 2022 AujeroDokument5 SeitenLP DLL Entrep W1Q1 2022 AujeroDENNIS AUJERO100% (1)

- Second Assessment - Unknown - LakesDokument448 SeitenSecond Assessment - Unknown - LakesCarlos Sánchez LópezNoch keine Bewertungen

- 6 Certification DefaultDokument2 Seiten6 Certification DefaultBhakta PrakashNoch keine Bewertungen

- Winter ParkDokument7 SeitenWinter Parksadafkhan210% (1)

- Sekolah Menengah Kebangsaan Sultan Abu Bakar, Jalan Beserah, 25300 Kuantan, PahangDokument18 SeitenSekolah Menengah Kebangsaan Sultan Abu Bakar, Jalan Beserah, 25300 Kuantan, PahangChandrika RamodaranNoch keine Bewertungen

- The Ancient CeltsDokument2 SeitenThe Ancient CeltsArieh Ibn GabaiNoch keine Bewertungen

- Crisologo-Jose Vs CA DigestDokument1 SeiteCrisologo-Jose Vs CA DigestMarry LasherasNoch keine Bewertungen

- Agile Data Warehouse Design For Big Data Presentation (720p - 30fps - H264-192kbit - AAC) PDFDokument90 SeitenAgile Data Warehouse Design For Big Data Presentation (720p - 30fps - H264-192kbit - AAC) PDFMatian Dal100% (2)

- List of Solar Energy Operating Applications 2020-03-31Dokument1 SeiteList of Solar Energy Operating Applications 2020-03-31Romen RealNoch keine Bewertungen

- Resume for College Professor PositionDokument3 SeitenResume for College Professor PositionYours PharmacyNoch keine Bewertungen

- Project Muse 205457Dokument30 SeitenProject Muse 205457Andrew KendallNoch keine Bewertungen

- Bio New KMJDokument11 SeitenBio New KMJapi-19758547Noch keine Bewertungen

- Literature ReviewDokument6 SeitenLiterature Reviewapi-549249112Noch keine Bewertungen

- Poetry and PoliticsDokument21 SeitenPoetry and Politicshotrdp5483Noch keine Bewertungen

- Romanian Society For Lifelong Learning Would Like To Inform You AboutDokument2 SeitenRomanian Society For Lifelong Learning Would Like To Inform You AboutCatalin MihailescuNoch keine Bewertungen

- Lesson Plan 2021Dokument68 SeitenLesson Plan 2021ULYSIS B. RELLOSNoch keine Bewertungen

- ARP Poisoning Using ETTERCAP and WIRESHARKDokument3 SeitenARP Poisoning Using ETTERCAP and WIRESHARKBenny LangstonNoch keine Bewertungen

- Annotated Bibliography Wet Nurse SlaveryDokument7 SeitenAnnotated Bibliography Wet Nurse SlaveryNicholas MusauNoch keine Bewertungen

- University Student Council: University of The Philippines Los BañosDokument10 SeitenUniversity Student Council: University of The Philippines Los BañosSherwin CambaNoch keine Bewertungen