Beruflich Dokumente

Kultur Dokumente

Formulae - Sheet - Corporate Banking, RM and Credit Analysis

Hochgeladen von

Shivran RoyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Formulae - Sheet - Corporate Banking, RM and Credit Analysis

Hochgeladen von

Shivran RoyCopyright:

Verfügbare Formate

For any queries Email - support@learnwithflip.

com or Call - 9243226045

(printed only one side)

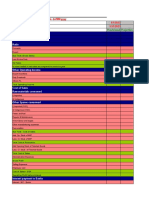

Corporate Banking, RM and Credit Analysis

Formula Sheet

Average Quarterly Total of the end of day balances for the quarter/Number of days in the

Balance (AQB) quarter

Purchase of finished goods + Raw material consumed + Power costs +

Cost of Production Depreciation & Amortization + Any other direct costs (-/+) Change in work in

progress

Depreciation & Amortization + Any other direct costs (-/+) Change in work in

Cost of Sales

progress (-/+) Change in finished goods

Maximum Permissible

Minimum of {(WCG-SNWC), (WCG-PNWC)}

Bank Finance

Gross sales (Manufacturing) – Excise duty + Net sales (Trading) + Other

Net Sales

operating income

Net Working Capital Total Current Assets – Total Current Liabilities

PAT PBT – Current tax – Deferred tax

PBITDA Total operating income – Total operating expense

PBIT – Interest expenses + Other income (including interest income) + Total

PBT

exceptional income – Total exceptional expenses

RAROC Expected return on investment (Net Income)/ Economic Capital

Working Capital Gap Total Current Assets – Other Current Liabilities

Ratios

Credit Availment (In G Creditors for purchases*12 / (Purchase of other finished goods + Raw

Months) material

Current Ratio Total current assets / total current liabilities

Debt Service Coverage [PAT + Interest Paid + Depreciation + Deferred tax provision] / (Interest Paid

Ratio + CPLTDpy) py- Previous year, CPLTD- Current portion of long-term debt

FG Holding (In Months) Finished Goods * 12/ Cost of Goods Sold

Fixed Assets Cover Ratio Total Fixed Assets / Total Debt

Fixed Assets Turnover Gross Sales / Gross Fixed Assets (GFA)

Interest Coverage Ratio (PAT+ Interest Expense+ Depreciation) / Interest Expense

Net Margin or PAT

Profit After Tax (PAT) / Total Income

Margin

PBDIT Margin PBDIT / Net Sales

PBIT Margin PBIT/ Net Sales

Raw Material Holding (In {(Closing balance Raw material + Closing balance Consumable spares) *12} /

Months) Raw material consumed

Receivables Holding (In

Total Debtors * 12 / Total Operating Income

Months)

PBIT / [Average of (total debt + tangible net worth + long term liability to be

ROCE

taken as quasi equity) for the previous year and current year]

ROE PAT / Capital and Reserves

Tangible Net Worth (Capital and Reserves + Deferred Tax Liability) – (Deferred Tax Asset+

(TNW) Intangible Assets + Revaluation Reserve)

WIP Holding (In Months) Stock in Process * 12/ Cost of Goods Sold

©Finitiat ives Learning India Pvt. Ltd. (FLIP). Proprietary content. Please do not misuse!

Das könnte Ihnen auch gefallen

- Corporate Banking - Credit Formulae SheetDokument1 SeiteCorporate Banking - Credit Formulae SheetSomyata RastogiNoch keine Bewertungen

- CB Products Credit Formulae Sheet 05082015Dokument1 SeiteCB Products Credit Formulae Sheet 05082015Prarthana GulatiNoch keine Bewertungen

- Ratio AnalysisDokument22 SeitenRatio AnalysisHemantsinh ParmarNoch keine Bewertungen

- Financial Ratios and Key Metrics for Business ProfilingDokument2 SeitenFinancial Ratios and Key Metrics for Business Profilinganand_study100% (1)

- Particulars: Form II Operating StatementDokument26 SeitenParticulars: Form II Operating StatementvineshjainNoch keine Bewertungen

- FAR Notes CH1: Income Statement & Balance Sheet & Discontinued Operations 1.0 (Becker 2017)Dokument7 SeitenFAR Notes CH1: Income Statement & Balance Sheet & Discontinued Operations 1.0 (Becker 2017)charles100% (1)

- SBI branch operating statement analysisDokument62 SeitenSBI branch operating statement analysisKartik DoshiNoch keine Bewertungen

- Financial Ratio Analysis ReportDokument3 SeitenFinancial Ratio Analysis ReportAjay Kumar Sharma100% (1)

- Cma Format - 29.08.2022 - 12.13PMDokument12 SeitenCma Format - 29.08.2022 - 12.13PMShreeRang ConsultancyNoch keine Bewertungen

- Tata Steel Annual Report 2022-23-413Dokument1 SeiteTata Steel Annual Report 2022-23-413mudikpatwariNoch keine Bewertungen

- SBI Branch Operating Statement AnalysisDokument15 SeitenSBI Branch Operating Statement Analysissiddharthzala0% (1)

- Cma AFSDokument14 SeitenCma AFSvijayNoch keine Bewertungen

- Case Study Three: Anandam: Professor: Victor GoodmanDokument6 SeitenCase Study Three: Anandam: Professor: Victor GoodmanYuki IsawaNoch keine Bewertungen

- Financial Ratios: Profitability Ratios Asset Quality RatiosDokument1 SeiteFinancial Ratios: Profitability Ratios Asset Quality RatiosInah SalcedoNoch keine Bewertungen

- Finance For Non-Finance Demand Supply Mgrs 2020021718Dokument39 SeitenFinance For Non-Finance Demand Supply Mgrs 2020021718lngcivilNoch keine Bewertungen

- Module 2: Conceptual Framework For Financial ReportingDokument5 SeitenModule 2: Conceptual Framework For Financial Reportingmonsta x noona-yaNoch keine Bewertungen

- RatiosDokument1 SeiteRatiosjasvinder123456100% (1)

- Sec-D FSADokument12 SeitenSec-D FSAFarukIslamNoch keine Bewertungen

- Finance RatiosDokument2 SeitenFinance Ratioscoolmaverick420100% (1)

- Exhibit 6.3 Margin Money For Working CapitalDokument12 SeitenExhibit 6.3 Margin Money For Working Capitalanon_285857320Noch keine Bewertungen

- Lecture Slides - Week 1 - Introduction and Short Term Financial ManagementDokument51 SeitenLecture Slides - Week 1 - Introduction and Short Term Financial ManagementSelin AkbabaNoch keine Bewertungen

- Cheat Sheet For Financial Accounting PDF FreeDokument1 SeiteCheat Sheet For Financial Accounting PDF FreeNahom endNoch keine Bewertungen

- Types of Ratios With Their Implications.: Ratio Formula Numerator DenominatorDokument14 SeitenTypes of Ratios With Their Implications.: Ratio Formula Numerator DenominatorFaiz Ur RehmanNoch keine Bewertungen

- RecipeDokument4 SeitenRecipesasyedaNoch keine Bewertungen

- Balance Sheet and P&L SummaryDokument56 SeitenBalance Sheet and P&L SummaryRohit SinghNoch keine Bewertungen

- Basics in FinanceDokument7 SeitenBasics in FinanceAshraf S. Youssef100% (1)

- Guidelines for analyzing key financial ratiosDokument4 SeitenGuidelines for analyzing key financial ratiosarunapecNoch keine Bewertungen

- Profit Loss Financials Valuation P&L BS FCFDokument4 SeitenProfit Loss Financials Valuation P&L BS FCFsalmanNoch keine Bewertungen

- Accounts FormatDokument25 SeitenAccounts FormatAnushka DharangaonkarNoch keine Bewertungen

- Business Management Notes - Final Accounts (Balance Sheet and P&L Account)Dokument8 SeitenBusiness Management Notes - Final Accounts (Balance Sheet and P&L Account)vaanya guptaNoch keine Bewertungen

- AccountingDokument1 SeiteAccountingniranjanisnairNoch keine Bewertungen

- Chapter 1 RatiosDokument81 SeitenChapter 1 Ratiospaola sabbanNoch keine Bewertungen

- NotesDokument3 SeitenNotesAanchal LathNoch keine Bewertungen

- Model FS - PFRS For SMEs (2022)Dokument17 SeitenModel FS - PFRS For SMEs (2022)Joel RazNoch keine Bewertungen

- New Cma Without Password-Def Trax Treatedfinal-Interest For CC and TLDokument90 SeitenNew Cma Without Password-Def Trax Treatedfinal-Interest For CC and TLanon_599712233Noch keine Bewertungen

- FormulasDokument2 SeitenFormulasSana KhanNoch keine Bewertungen

- Enterp7a Financial MGMTDokument17 SeitenEnterp7a Financial MGMTVanessa Tattao IsagaNoch keine Bewertungen

- Financial Ratios Formula KeyDokument1 SeiteFinancial Ratios Formula KeyHeidi100% (5)

- FAC512 Financial Accounting - Pre-Reading For Session 2 PDFDokument3 SeitenFAC512 Financial Accounting - Pre-Reading For Session 2 PDFVrutik Jentibhai SanghaniNoch keine Bewertungen

- 2020 Session 1 CM CompleteDokument31 Seiten2020 Session 1 CM CompleteAbhishek BaruaNoch keine Bewertungen

- Understanding Financial Statements and Cash FlowsDokument16 SeitenUnderstanding Financial Statements and Cash Flowsadib nassarNoch keine Bewertungen

- MacroEcon Ch4mylab To ReviseDokument4 SeitenMacroEcon Ch4mylab To ReviseJosue VitaleNoch keine Bewertungen

- Inventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv TurnoverDokument3 SeitenInventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv Turnoverjoe91bmwNoch keine Bewertungen

- Er - 6 - Guideline For Detailed Budget and Financial Forecast - Ro - Version 4 - Ro Energy sgs4Dokument3 SeitenEr - 6 - Guideline For Detailed Budget and Financial Forecast - Ro - Version 4 - Ro Energy sgs4nicoclau2005Noch keine Bewertungen

- FAR NotesDokument4 SeitenFAR NotesOwlHeadNoch keine Bewertungen

- Tarea - 3 Bis - Caso Dyaton Products - Formato ADokument8 SeitenTarea - 3 Bis - Caso Dyaton Products - Formato AMiguel VázquezNoch keine Bewertungen

- Financial RatiosDokument1 SeiteFinancial Ratioselmer subaNoch keine Bewertungen

- Understanding FRDokument11 SeitenUnderstanding FRKarthi KeyanNoch keine Bewertungen

- PrefaceDokument2 SeitenPrefaceAfsal ParakkalNoch keine Bewertungen

- Ratio Analysis: Meaning, Classification and Limitation of Ratio AnalysisDokument26 SeitenRatio Analysis: Meaning, Classification and Limitation of Ratio AnalysisRajShikharSrivastavaNoch keine Bewertungen

- Financial RatioDokument8 SeitenFinancial RatioFabiano JoeyNoch keine Bewertungen

- Lecture 2Dokument24 SeitenLecture 2Bình MinhNoch keine Bewertungen

- FormulasDokument2 SeitenFormulasHydra JrNoch keine Bewertungen

- Finman Formulas Prelims 3Dokument3 SeitenFinman Formulas Prelims 3eiaNoch keine Bewertungen

- Colcap EstadosDokument528 SeitenColcap EstadosJosé TenjicaNoch keine Bewertungen

- Ratios - Maruti 2017-18Dokument6 SeitenRatios - Maruti 2017-18chandel08Noch keine Bewertungen

- Ratio Analysis FormulaeDokument3 SeitenRatio Analysis FormulaeKalyani ShindeNoch keine Bewertungen

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Von EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Bewertung: 3.5 von 5 Sternen3.5/5 (17)

- Maverick - Research - How Blockchain Undermines The Value Proposition of Platform BusinessesDokument21 SeitenMaverick - Research - How Blockchain Undermines The Value Proposition of Platform BusinessesShivran RoyNoch keine Bewertungen

- Steelathon PDFDokument2 SeitenSteelathon PDFShivran RoyNoch keine Bewertungen

- Technology2020 and Beyond PDFDokument48 SeitenTechnology2020 and Beyond PDFMegha BepariNoch keine Bewertungen

- TR ACADEMY 20 - Presentation PDFDokument7 SeitenTR ACADEMY 20 - Presentation PDFFreudestein UditNoch keine Bewertungen

- FSBDokument8 SeitenFSBShivran RoyNoch keine Bewertungen

- Outreach Networks Case StudyDokument9 SeitenOutreach Networks Case Studymothermonk100% (3)

- Ankur Kaushik - Rank 37 - IR Notes PDFDokument29 SeitenAnkur Kaushik - Rank 37 - IR Notes PDFShivran RoyNoch keine Bewertungen

- TR ACADEMY 20 - Presentation PDFDokument7 SeitenTR ACADEMY 20 - Presentation PDFFreudestein UditNoch keine Bewertungen

- Airport Lounge TNCDokument4 SeitenAirport Lounge TNCShivran RoyNoch keine Bewertungen

- Job Description Template ProjectmanagerDokument2 SeitenJob Description Template ProjectmanagerShivran RoyNoch keine Bewertungen

- TR ACADEMY 20 - Presentation PDFDokument7 SeitenTR ACADEMY 20 - Presentation PDFFreudestein UditNoch keine Bewertungen

- Airport Lounge TNCDokument4 SeitenAirport Lounge TNCShivran RoyNoch keine Bewertungen

- TLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayDokument10 SeitenTLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayShivran RoyNoch keine Bewertungen

- TLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayDokument10 SeitenTLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayShivran RoyNoch keine Bewertungen

- Oil and Gas August 2019Dokument43 SeitenOil and Gas August 2019shahavNoch keine Bewertungen

- Elect CVB DSFDokument32 SeitenElect CVB DSFShivran RoyNoch keine Bewertungen

- GeM ManualDokument30 SeitenGeM ManualvimalrampNoch keine Bewertungen

- Steelathon PDFDokument2 SeitenSteelathon PDFShivran RoyNoch keine Bewertungen

- 7s Framework Southwest PDFDokument2 Seiten7s Framework Southwest PDFShivran RoyNoch keine Bewertungen

- E.L.I.T.E. General Management Program 2020 BrochureDokument16 SeitenE.L.I.T.E. General Management Program 2020 BrochureShivran RoyNoch keine Bewertungen

- 5 ValuationDokument5 Seiten5 ValuationSaumitr MishraNoch keine Bewertungen

- Syallabus of Insolvency PDFDokument1 SeiteSyallabus of Insolvency PDFShivran RoyNoch keine Bewertungen

- 1 MonthDokument24 Seiten1 MonthShivran RoyNoch keine Bewertungen

- Ril Treasury JD Fnc19Dokument1 SeiteRil Treasury JD Fnc19Shivran RoyNoch keine Bewertungen

- Job Title: Manager, Trade Finance Operation Team, Reliance Industries LimitedDokument1 SeiteJob Title: Manager, Trade Finance Operation Team, Reliance Industries LimitedShivran RoyNoch keine Bewertungen

- Economic and Political Weekly Economic and Political WeeklyDokument11 SeitenEconomic and Political Weekly Economic and Political WeeklyShivran RoyNoch keine Bewertungen

- CON McKinsey7S Worksheet PDFDokument1 SeiteCON McKinsey7S Worksheet PDFShivran RoyNoch keine Bewertungen

- Perspectives on India's Changing External Sector Management Post-1992Dokument9 SeitenPerspectives on India's Changing External Sector Management Post-1992Shivran RoyNoch keine Bewertungen

- AsianPaints ReportDokument47 SeitenAsianPaints Reportshanky22Noch keine Bewertungen

- Midterm Exam 1Dokument7 SeitenMidterm Exam 1bobtanlaNoch keine Bewertungen

- Essentials of Federal Taxation 3rd Edition Spilker Test BankDokument67 SeitenEssentials of Federal Taxation 3rd Edition Spilker Test Bankdilysiristtes5Noch keine Bewertungen

- Assignment - Chapter 5 (Due 10.11.20)Dokument4 SeitenAssignment - Chapter 5 (Due 10.11.20)Tenaj KramNoch keine Bewertungen

- PP Descriptives-FACRDokument11 SeitenPP Descriptives-FACRMisbah IlyasNoch keine Bewertungen

- 10%SFDP & 10% - 12monDokument6 Seiten10%SFDP & 10% - 12monNicolo MendozaNoch keine Bewertungen

- FFA FA S22-A23 Examiner's ReportDokument11 SeitenFFA FA S22-A23 Examiner's ReportM.Huzaifa ShahbazNoch keine Bewertungen

- Chap 010Dokument16 SeitenChap 010Xeniya Morozova KurmayevaNoch keine Bewertungen

- MODULE 1 Lecture Notes (Jeff Madura)Dokument4 SeitenMODULE 1 Lecture Notes (Jeff Madura)Romen CenizaNoch keine Bewertungen

- Origination Costs and Fees: ExercisesDokument8 SeitenOrigination Costs and Fees: ExercisesJanine IgdalinoNoch keine Bewertungen

- Appraiser's/Broker's Exam Mock QuestionsDokument7 SeitenAppraiser's/Broker's Exam Mock QuestionsJosue Sandigan Biolon SecorinNoch keine Bewertungen

- Case 66 - Malayan Insurance Company v. Alibudbud, G.R. No. 209011april 20, 2016.Dokument3 SeitenCase 66 - Malayan Insurance Company v. Alibudbud, G.R. No. 209011april 20, 2016.bernadeth ranolaNoch keine Bewertungen

- Working Capital ProductivityDokument6 SeitenWorking Capital ProductivitySatwant Singh100% (1)

- Gen Math 2nd Quarter Exam 2022-2023Dokument3 SeitenGen Math 2nd Quarter Exam 2022-2023Ryan HermosoNoch keine Bewertungen

- FIN 444 Final ProjectDokument13 SeitenFIN 444 Final ProjectAli Abdullah Munna 1410788030Noch keine Bewertungen

- ACCA F9 Revision Kit ACCA 2.4 Old Past Paper Solved Old Professional Scheme 2002 - 2007Dokument237 SeitenACCA F9 Revision Kit ACCA 2.4 Old Past Paper Solved Old Professional Scheme 2002 - 2007Haider Ali60% (5)

- Sample Paper 2Dokument15 SeitenSample Paper 2TrostingNoch keine Bewertungen

- MAC3761 New Exam Pack For 2022 With Formula Notes: StudywizDokument123 SeitenMAC3761 New Exam Pack For 2022 With Formula Notes: StudywizBenineNoch keine Bewertungen

- P&GDokument12 SeitenP&GSunil Biyani100% (1)

- 3-Vil-Rey Planners and Builders vs. Lexber, Inc.Dokument19 Seiten3-Vil-Rey Planners and Builders vs. Lexber, Inc.Angelie FloresNoch keine Bewertungen

- DTDokument19 SeitenDTJanesene Sol100% (4)

- Vgs Products Loan Requirements Draft 01 30Dokument4 SeitenVgs Products Loan Requirements Draft 01 30api-111865522Noch keine Bewertungen

- 6.debt Market and Forex Market-TheoriticalDokument27 Seiten6.debt Market and Forex Market-TheoriticaljashuramuNoch keine Bewertungen

- Appollo Ispat Complex LTDDokument155 SeitenAppollo Ispat Complex LTDMahbub E AL MunimNoch keine Bewertungen

- Ispat Wages and Salary MNGTDokument92 SeitenIspat Wages and Salary MNGTBhaskar BhaskiNoch keine Bewertungen

- National General Election - Our Vote To Be DecisiveDokument8 SeitenNational General Election - Our Vote To Be DecisiveNehaNoch keine Bewertungen

- Partnership DeedDokument2 SeitenPartnership DeedSafal Visa71% (7)

- Assessment of The Determinants of Non-Performing Loans and Their Effects On Performance of Commercial Banks in KenyaDokument23 SeitenAssessment of The Determinants of Non-Performing Loans and Their Effects On Performance of Commercial Banks in KenyaOIRCNoch keine Bewertungen

- Sd159 BondsDokument217 SeitenSd159 BondsBurton PhillipsNoch keine Bewertungen

- Credit Transactions - RevisedDokument123 SeitenCredit Transactions - RevisedLiene Lalu NadongaNoch keine Bewertungen

- WAPDA Rules for Motor Vehicle AdvancesDokument37 SeitenWAPDA Rules for Motor Vehicle AdvancesShahzad ShafiNoch keine Bewertungen