Beruflich Dokumente

Kultur Dokumente

Chapter 18 PDF

Hochgeladen von

Arun KCOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 18 PDF

Hochgeladen von

Arun KCCopyright:

Verfügbare Formate

CHAPTER 18

BANKING AND INSURANCE

Coverage

18.1 The two main activities covered under this 18.5 Financial intermediaries incur liabilities on

sector are banking and insurance which their own account on financial markets by

comprises of: borrowing funds which they lend on different

commercial banks; terms and conditions to other institutional

banking department of Reserve Bank of units. Thus, they intermediate between

India (RBI); lenders and borrowers by channeling funds

public non-banking financial from one to other, putting them at risk in

corporations; the process.

organised non-banking financial

companies engaged in trading in 18.6 Some financial intermediaries raise most of

shares, investment holdings, mutual their funds by taking deposits; others do so

funds, loan finance and the like by issuing bills, bonds or other securities.

activities; They lend funds by making loans or

unorganised non-banking financial advances, or by purchasing bills, bonds or

institutions/undertakings such as other securities. The pattern of their

professional money lenders and pawn financial assets is different from that of their

brokers; liabilities and in this way transform the funds

post office savings banks including they receive in ways more suited to the

operations concerning cumulative time requirements of borrowers. Financial

deposits and national saving intermediaries also provide auxiliary financial

certificates; services like currency exchange, advice

co-operative credit societies; and about investments, purchase of real estate

life and non-life insurance activities. or taxation. The output of such services is

valued on the basis of the fees or

18.2 Under the NIC 1998, this sector consists of commissions charged, in the same way as

codes 651-Monetary Intermediation, 659- other services. However, many financial

Other financial intermediation, 660- intermediaries do not charge explicitly for

Insurance and pension funding, except the intermediation services which they

compulsory social security, 671- Activities provide to their customers so that there may

auxiliary to financial intermediation, except be no receipts from sales (for example issue

insurance and pension funding, and 672- of cheque books) which can be used to value

Activities auxiliary to insurance and pension these services. Therefore, it becomes

funding. difficult to value the output of financial

intermediation for which no explicit charges

Methods of Estimation of GVA and are made and for which there are no sales

Sources of Data receipts. Such output is valued indirectly

through financial intermediation services

Estimates at Current Prices indirectly measured (FISIM). The financial

18.3 Annual Reports/Accounts of the public sector intermediaries are able to provide services

banks, companies and corporations like Life for which they do not charge explicitly by

Insurance Corporation (LIC), State Financial paying or charging different rates of interest

Corporations etc. are major sources of data. to borrowers and lenders. They pay lower

The budget documents of Department of rates of interest to those from whom they

Posts provide the necessary data in the case borrow and charge higher rates of interest

of post office savings and postal life from those whom they lend. The resulting

insurance. (Appendix 18.1) net receipts of interest are used to defray

their expenses and provide an operating

18.4 Banks: The gross output of banks and similar surplus. This scheme of interest rates avoids

financial institutions is estimated in two the need to charge their customers

components viz., actual service charges and individually for services provided. The total

the imputed service charges. The concept of value of FISIM is measured in the System of

imputed service charge and its methodology National Accounts as the total property

of estimation are discussed in the subsequent income receivable by financial intermediaries

paragraphs. The GDP from this sector is minus their total interest payable, excluding

estimated by income method using readily the value of any property income receivable

available source material for each of the from the investment of their own funds; as

sub-sectors. such income does not arise from financial

intermediation.

National Accounts Statistics-Sources & Methods, 2007 Î 162

CHAPTER 18

18.7 In other words, the banking enterprises and consumers are used. These are taken

render services to their customers in the from the same source material from which

form of maintaining their accounts and value added is estimated. The proportions

advising them on financial matters. In of imputed service charges so worked out

return for these services, customers are for the each of the industries, such as

charged a nominal amount which is agriculture, forestry, manufacturing,

substantially smaller than the expenses of services, etc., are treated as separate input

the enterprises. On the other hand, the items in the respective industries. In the

banks provide loans and advances and the case of households and government such

returns on such transactions are much charges are considered as an item of private

higher than the payments made to and government consumption expenditure.

depositors. This net return accruing to

banks is large enough to meet their 18.11 Data on income, expenditure and

expenses and to earn a profit. If the appropriation of commercial banks are

financial enterprises are treated like any available annually from the 'Statistical

other productive enterprise, their income in Tables relating to Banks in India' published

the production account would only be limited by the RBI.

to the charges made on customers which

would mean that the banks would have a 18.12 Banking department of RBI: The functions

negative operating surplus and most likely of the Issue Department of RBI are like that of

negative value added. To circumvent this a government department and for this reason

difficulty, an imputed income equivalent to it is treated as an administrative department

interest and dividend receipts of banking and of the Central Government. The rest of the

financial enterprises net of interest paid to activities of the RBI are considered under the

depositors is defined income earned in Banking Department. The Annual Report of

return for services rendered and is entered the RBI presents the balance-sheet of the

as a receipt item in the production account. Issue and Banking Departments separately.

However, the profit and loss account of the

18.8 A similar argument can be extended in the two departments is presented in a combined

case of insurance enterprises where the form. Details regarding individual items of

premium for insurance constitutes the main income and expenditure in respect of the two

source of income and they receive income departments separately are collected directly

from investment as well. In the case of from the RBI annually for the purpose of

general insurance, imputed service charges estimation of GDP.

are measured as the receipts on account of

premia plus interest and dividends earned 18.13 Non-banking financial enterprises: There

less expenditure on account of claims are about eighty public sector financial

paid. corporations and companies of Central and

State Governments. The estimates of these

18.9 Whenever the production of output is enterprises are prepared from the details

recorded in the system the use of that available in the annual reports which are

output must be explicitly accounted for analysed annually.

elsewhere in the System of National

Accounts. Hence FISIM must be recorded as 18.14 Non-Government Non-Banking Financial

being disposed of in one or more of the companies (NGNBFCs): The Reserve Bank of

following ways– as intermediate India (RBI) annually publishes a study on

consumption by enterprises, as final the ‘Performance of Non-Government

consumption by households & government, Financial and Investment Companies’ in its

or as exports to non-residents. In principle, Bulletin. The study is based on the Annual

the total output should, therefore, be Accounts of around eight hundred to one

allocated among the various recipients or thousand companies. This number varies

users of the services for which no explicit from year to year. The tables presented in

charges are made. the study include ‘Combined Income,

Expenditure and Appropriation Accounts’ for

18.10 The imputed service charges which form a the selected financial and investment

component of financial sector output are companies. The same is being utilised to

partly treated as intermediate consumption obtain the estimates of GVA at current prices

of industries and partly as the final of the non-banking financial companies.

consumption of government and the

households. For determining these 18.15 The methodology followed for current price

proportions the basic data on loans and estimates of GVA and FISIM of this sub-

deposits/sum assured relating to enterprises sector is to estimate the GVA of the sample

National Accounts Statistics-Sources & Methods, 2007 Î 163

CHAPTER 18

companies, by analysing the data on subtraction of only interest paid in the 1993-

income, expenditure and profits provided in 94 series (being insignificant in MFs) had

the RBI sample study. The ratio of the paid resulted in an output of the MFs, which was

up capital of the population to the paid up not an appropriate measure of its implicit

capital of the sample forms the blowing up output, as the entire property income

factor. becomes the implicit output. In the new series

the imputed value of services of UTI has been

18.16 The RBI publishes the sample study on the calculated as total income on account of

non-government Financial and Investment dividend, interest, profit on sale/redemption

Companies in the Bulletin every year. Each of investment minus interest, dividend paid to

study presents the data for three the unit holders and undistributed profit.

consecutive financial years for a common set

of companies. 18.20 Unorganised non-banking financial

institutions: No direct data are available for

18.17 Thus, for a particular year, three different measuring the volume of activity of

estimates of GVA are derived based on the unorganised non-banking financial

successive sample studies. It becomes very undertakings and own-account money

difficult at the time of revision of estimates lenders. Efforts made to collect data on

to decide which study should be considered income and expenditure of the members of

as representative. Whenever the results of a various stock exchanges in the country

study are published, the temptation is to through mail enquiry resulted in very poor

examine the estimates from the most recent response. On the basis of discussions with

study to revise the estimates. However, it the officials of the Delhi stock exchange and

has been observed that at times the results other knowledgeable authorities one-third of

of the study for a financial year vary the gross/net value added in the organised

considerably and introduces volatility in the activities have been assumed to be the

estimates of GVA and other aggregates. corresponding estimates of the activities of

Further the growth rate based on PUC is the unorganised non-banking financial

always positive, while the sector itself may enterprises. The NSSO has taken up these

actually have a negative growth. Such activities along with other service activities in

situations give scope for arbitrariness in the 63rd survey (2006-07), the results of

using a particular set of estimates. which are expected to provide information on

unorganized financial services in the country.

18.18 In order to avoid the uncertainty, which

stems from different estimates thrown by 18.21 Post office savings bank: Banking activities

different sets of samples for the same year, of the Department of Posts cover post office

the current price estimates of GVA of savings bank, cumulative time deposit

NGNBFCs are prepared by using the RBI account, national savings certificates, and

study results of a particular year appearing other schemes. For these services, GVA is

in all the available studies in the current estimated as a proportion of management

series of national accounts. This would mean expenses, data on which are available from

the pooling of the sample companies to get the budget documents. GVA, in this case,

a more stable estimate. comprises compensation of employees and

rent only. The proportion of GVA to

18.19 GVA from mutual funds (MFs): The Unit management expenses is assumed to be the

Trust of India is considered as a financial same as observed in respect of commercial

intermediary. In the 1993-94 series, the banks.

imputed value of services in respect of UTI

was estimated in the same manner as that of 18.22 Co-operative credit societies: The details

banks and other financial intermediaries. The of the factor incomes of co-operative credit

income side represents the income from societies are obtained directly from “Statistical

assets, namely, equity as well as debt Statements Relating to Co-operative

instruments. This income includes income Movement in India, Vol. I Credit societies

from dividend, interest and profit on published by NABARD”. However, estimates

sale/redemption of investment. Since, MFs do of profits given in these publications are net of

not work on deposits of other sectors, the income tax whereas in the measurement of

interest payments are either nil or negligible. domestic product profits need to be gross of

The MFs work on the funds raised by such taxes. To obtain these estimates, direct

collective investments made by its unit data are obtained on details of income and

holders. Hence, the major returns to unit expenditure of a sample of co-operative credit

holders/shareholders are dividends, unlike the societies.

interest payments in the case of banks. The

National Accounts Statistics-Sources & Methods, 2007 Î 164

CHAPTER 18

18.23 Insurance: There are two types of deducting net liabilities under Assurances

insurance; life and non-life insurance. Life and Life Annuity Contracts from Life Fund.

insurance is an activity whereby a In respect of private life insurance

policyholder makes regular payments to an companies, data is available in their annual

insurer in return for which the insurer accounts and these are collected and

guarantees to provide the policyholder with analysed in the CSO.

an agreed sum, or an annuity, at a given

date or earlier if the policyholder dies 18.26 The GVA by the life insurance business

beforehand. Non-life insurance covers all conducted by the Department of Posts is

other risks; accidents, sickness, fire etc. A estimated by analysing the 'Appropriation

policy that provides a benefit in the case of Accounts' brought out by the same

death within a given period but in no other department. Profits and dividends are

circumstances, usually called term assumed to be nil.

insurance, is regarded as non-life insurance

because as with other non-life insurance, a 18.27 General insurance: Gross factor incomes are

claim is payable only if a specified obtained by analysing the accounts given in

contingency occurs and not otherwise. the annual reports of the General Insurance

Corporation and its subsidiaries viz., Oriental

18.24 The output of insurance represents the value Insurance Company, United India Insurance

of the service provided by insurance Company, National Insurance Company and

corporations in arranging payments of The New India Assurance Company.

claims and benefits in exchange for the Similarly, the GVA in respect of private non-

receipts of premiums and contributions. life insurance companies, is compiled from

Premiums are usually paid regularly, often at the details available in their annual

the start of an insurance period, whereas accounts, which are collected and analysed

claims fall due later. In the mean time in the CSO.

between the payment of premiums being

made and the claim being receivable, the 18.28 Employees State Insurance Corporation: It is

sum involved is at the disposal of the treated as a casualty insurance enterprise

insurance corporation to invest and earn and included under general insurance sector.

income from it. The income thus earned The estimates are prepared using data from

allows the insurance corporations to charge its annual reports.

lower premiums than would be the case

otherwise. This income comes from the 18.29 Estimates at Constant Prices

investment of the technical reserves of the The estimates of GVA at constant prices are

insurance corporations, which are assets of prepared separately for each of the

the policyholders, and does not include any sub-sectors. In general, the base year

income from the investment of the insurance estimates are carried forward using indicators

corporations’ own funds. The technical measuring the volume of activity in the

reserves of an insurance corporation consist corresponding sub-sector. A suitable indicator

of pre-paid premiums, reserves against is prepared in each case to measure the

outstanding claims, actuarial reserves for life volume of activity. In cases where the

insurance and reserves for with-profit volume of activity is measured in value terms

insurance. The output of the insurance i.e., at current prices, these are deflated by

activity, which represents the service the wholesale price index of all commodities

provided to policyholders, is calculated to obtain the corresponding quantum index.

separately for life and non-life insurance as: However, in the case of commercial banks,

Total actual premiums or contributions the estimates of GVA at current prices are

earned; deflated by the implicit GDP price deflator, in

Plus total premium or contribution respect of commodity producing sectors. For

supplements; the Banking Department of RBI, the deflator

Less claims or benefits due; used is the implicit price deflator of

Less increases (plus decreases) in commercial banks. Indicators used in the

actuarial reserves and reserves for with- preparation of constant price estimates are

profit insurance. presented at Appendix 18.2

18.25 Life insurance: The annual Report and Quality and limitations of data base

Accounts published by the LIC give 18.30 The overall position regarding the availability

necessary details for preparation of the of data for this sector is satisfactory except in

estimates of GVA. However, as regards the case of unorganised non-banking financial

profits, the LIC declares every two years, enterprises and own-account money lenders.

surplus derived as the balance after However, for some of the sub-sectors

National Accounts Statistics-Sources & Methods, 2007 Î 165

CHAPTER 18

sufficient details are not available on the incomes. This is particularly true for private

distribution of management expenses to non-banking financial companies, co-operative

enable direct measurement of the factor societies and post office savings banks.

Appendix 18.1

SOURCE MATERIAL USED

Item Sources of data

1. Commercial banks Annual Reports/Account.

2. Banking department of RBI RBI Annual Report.

3. Public sector financial corporations Annual Reports.

4. Private non-banking financial RBI bulletins.

companies

5. Post office savings banks Budget documents of Department of Post

6. Co-operative credit societies Statistical statements relating to co-operative

movement in India, Vol. I Credit societies (NABARD)

and data on income and expenditure of sample

co-operative societies obtained directly.

7. Life Insurance i) Annual Reports and Accounts (LIC);

ii) Annual Reports and Accounts of private life

insurance companies;

iii) Valuation Reports; and

iv) Appropriation Accounts: Postal Services.

8. General Insurance Annual Reports and Accounts.

9. Employees State Insurance Corporation Annual Reports.

Appendix 18.2

INDICATORS USED IN THE PREPARATIONOF CONSTANT PRICE ESTIMATES

Item Indicators

1. Commercial banks, Estimates of GVA at current prices are deflated

by implicit GDP price deflator of commodity

producing sectors.

2. Banking Department of RBI, Estimates of GVA at current prices are deflated

by implicit GDP price deflator of commercial

banks.

3. Post Office Savings bank CPI index.

4. Non- banking financial companies and Total net receipts deflated by WPI.

corporations

5. Co-operative credit societies Average of indices of deposits (deflated) and

membership.

6. Life insurance corporation Average of deflated indices of change in life

fund and sum assured.

7. Postal life insurance Average deflated indices of life fund and sum

assured.

8. Non-life insurance Deflated index of premium net of claims and

surrenders.

National Accounts Statistics-Sources & Methods, 2007 Î 166

CHAPTER 18

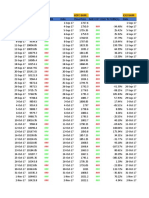

Appendix 18.3

ESTIMATES OF GDP - BANKING AND INSURANCE, 1999-2000

(Rs. crore)

S. No. Sector/Sub Sectors 1999-2000

1 Gross Domestic Product 1,05,662

1.1 Banking 94,114

1.1.1 Banks 40,485

1.1.2 Banking Deptt. of RBI 10,875

1.1.3 Post office saving banks 745

1.1.4 Non-banking financial cos. & Corpn. incl. UTI 34,088

1.1.5 Co-op. credit societies 7,733

1.1.6 E.P.F.O. 188

1.2 Insurance 11,548

1.2.1 Life insurance 5,930

1.2.2 Postal life insurance 75

1.2.3 Non-life insurance 5,543

***

National Accounts Statistics-Sources & Methods, 2007 Î 167

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- SvfinalreportDokument46 SeitenSvfinalreportArun KCNoch keine Bewertungen

- Marketing Project FinalDokument19 SeitenMarketing Project FinalArun KCNoch keine Bewertungen

- Consumer Behavior Mini ProjectDokument80 SeitenConsumer Behavior Mini ProjectArun KCNoch keine Bewertungen

- A Report ON: Understanding Customers Needs and PreferencesDokument36 SeitenA Report ON: Understanding Customers Needs and PreferencesArun KCNoch keine Bewertungen

- In Retrospect: Revenue 2008-09 13,132 2009-10 16,645 2010-11 17,611Dokument6 SeitenIn Retrospect: Revenue 2008-09 13,132 2009-10 16,645 2010-11 17,611Arun KCNoch keine Bewertungen

- SvfinalreportDokument46 SeitenSvfinalreportArun KCNoch keine Bewertungen

- Carcinoma of Upper Gastrointestinal SystemDokument65 SeitenCarcinoma of Upper Gastrointestinal SystemArun KCNoch keine Bewertungen

- Purchase OrderDokument1 SeitePurchase OrderArun KCNoch keine Bewertungen

- Technical AnalysisDokument61 SeitenTechnical AnalysisArun KCNoch keine Bewertungen

- Financial Goals Worksheet (Basic) : Step 1 Step 2 Step 3Dokument6 SeitenFinancial Goals Worksheet (Basic) : Step 1 Step 2 Step 3Arun KCNoch keine Bewertungen

- Self Study FormDokument1 SeiteSelf Study FormArun KCNoch keine Bewertungen

- Financial Planning Goal Worksheet v1Dokument8 SeitenFinancial Planning Goal Worksheet v1Arun KCNoch keine Bewertungen

- RBIDokument28 SeitenRBIGauravSinhaNoch keine Bewertungen

- Sureti Insurance Marketing PVT LTDDokument1 SeiteSureti Insurance Marketing PVT LTDArun KCNoch keine Bewertungen

- Company Profile & Internship DetailsDokument2 SeitenCompany Profile & Internship DetailsArun KCNoch keine Bewertungen

- Mini Project On Nse Nifty (Bank)Dokument74 SeitenMini Project On Nse Nifty (Bank)Arun KCNoch keine Bewertungen

- New Doc 2019-11-04 22.20.01Dokument4 SeitenNew Doc 2019-11-04 22.20.01Arun KCNoch keine Bewertungen

- JD - SSB-Analyst-1Dokument1 SeiteJD - SSB-Analyst-1Arun KCNoch keine Bewertungen

- SSRN Id2621942Dokument15 SeitenSSRN Id2621942Arun KCNoch keine Bewertungen

- Pricing Strategy of LenovoDokument5 SeitenPricing Strategy of LenovoShriya Dhar50% (2)

- Interesting Sudoku GameDokument34 SeitenInteresting Sudoku GamejitnikhilNoch keine Bewertungen

- II MBA SpecialisationDokument120 SeitenII MBA SpecialisationArun KCNoch keine Bewertungen

- Week 2 - E Text - Part 1 - Residential Status and Tax IncidenceDokument13 SeitenWeek 2 - E Text - Part 1 - Residential Status and Tax IncidenceArun KCNoch keine Bewertungen

- SAPMDokument16 SeitenSAPMArun KCNoch keine Bewertungen

- GST and It's Implementation: T. Syamala Devi, A.NagamaniDokument6 SeitenGST and It's Implementation: T. Syamala Devi, A.NagamaniArun KCNoch keine Bewertungen

- Top 100 Finance and Accounting QuestionsDokument7 SeitenTop 100 Finance and Accounting QuestionsArun KC0% (1)

- GST E Book PDFDokument63 SeitenGST E Book PDFnaveen chaudharyNoch keine Bewertungen

- Transfer PricingDokument10 SeitenTransfer PricingArun KCNoch keine Bewertungen

- Accounting Interview QuesDokument8 SeitenAccounting Interview QuesArun KCNoch keine Bewertungen

- Top 100 Finance and Accounting QuestionsDokument7 SeitenTop 100 Finance and Accounting QuestionsArun KCNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Critique PaperDokument1 SeiteCritique PapernicolealerNoch keine Bewertungen

- Robodrill 01Dokument298 SeitenRobodrill 01vuchinhvdcNoch keine Bewertungen

- Serbia Malta & Bermuda Medical Instructions PDFDokument3 SeitenSerbia Malta & Bermuda Medical Instructions PDFGISI KeyBOarD0% (1)

- Affidavit: IN WITNESS WHEREOF, I Have Hereunto Affixed MyDokument2 SeitenAffidavit: IN WITNESS WHEREOF, I Have Hereunto Affixed Myceleste LorenzanaNoch keine Bewertungen

- X FEDEX EIDokument13 SeitenX FEDEX EINISREEN WAYANoch keine Bewertungen

- CRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020Dokument48 SeitenCRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020MohitNoch keine Bewertungen

- English CV Chis Roberta AndreeaDokument1 SeiteEnglish CV Chis Roberta AndreeaRoby ChisNoch keine Bewertungen

- 13 ECCMinorAmendReqDokument2 Seiten13 ECCMinorAmendReqal bentulanNoch keine Bewertungen

- CELLULAR RESPIRATION Review WorksheetDokument8 SeitenCELLULAR RESPIRATION Review WorksheetYasi0% (1)

- Ship Captain's Medical Guide - 22nd EdDokument224 SeitenShip Captain's Medical Guide - 22nd EdcelmailenesNoch keine Bewertungen

- Manual GISDokument36 SeitenManual GISDanil Pangestu ChandraNoch keine Bewertungen

- 1635 The Papal Stakes - Eric FlintDokument1.813 Seiten1635 The Papal Stakes - Eric Flintwon100% (2)

- Knopp2017 Article OnceACheaterAlwaysACheaterSeriDokument11 SeitenKnopp2017 Article OnceACheaterAlwaysACheaterSeriAnda F. CotoarăNoch keine Bewertungen

- Baseline Capacity Assessment For OVC Grantee CSOsDokument49 SeitenBaseline Capacity Assessment For OVC Grantee CSOsShahid NadeemNoch keine Bewertungen

- 2457-Article Text-14907-2-10-20120724Dokument6 Seiten2457-Article Text-14907-2-10-20120724desi meleniaNoch keine Bewertungen

- B 700 FDokument25 SeitenB 700 FMohammed HdyliNoch keine Bewertungen

- 4Dx - Series B Capital Raising IMDokument42 Seiten4Dx - Series B Capital Raising IMsamNoch keine Bewertungen

- Breastfeeding PlanDokument7 SeitenBreastfeeding Planapi-223713414Noch keine Bewertungen

- Atomic Structure Worksheet: Name PeriodDokument4 SeitenAtomic Structure Worksheet: Name Periodapi-496534295100% (1)

- Monopoly Tycoon TipsDokument8 SeitenMonopoly Tycoon TipsVictoria SmithNoch keine Bewertungen

- Chapter 2Dokument5 SeitenChapter 2ERICKA MAE NATONoch keine Bewertungen

- Chapter 4. Acid Base Problem Set: O O CH CH OH O O-H CH CH ODokument2 SeitenChapter 4. Acid Base Problem Set: O O CH CH OH O O-H CH CH Osnap7678650Noch keine Bewertungen

- SCIENCE-DRRR - Q1 - W1 - Mod2Dokument16 SeitenSCIENCE-DRRR - Q1 - W1 - Mod2Jay DhelNoch keine Bewertungen

- School Administration and Supervision MAED 605Dokument24 SeitenSchool Administration and Supervision MAED 605Jaynie Ann TapdasanNoch keine Bewertungen

- Plain and Laminated Elastomeric Bridge Bearings: Standard Specification ForDokument4 SeitenPlain and Laminated Elastomeric Bridge Bearings: Standard Specification ForFRANZ RICHARD SARDINAS MALLCONoch keine Bewertungen

- Nursing Care of A Family With An InfantDokument26 SeitenNursing Care of A Family With An InfantJc GarciaNoch keine Bewertungen

- Pia AlgebraDokument12 SeitenPia AlgebraCarvajal EdithNoch keine Bewertungen

- Locus of Control and The Flow Experience: An Experimental AnalysisDokument19 SeitenLocus of Control and The Flow Experience: An Experimental Analysisdolf78Noch keine Bewertungen

- Eprubete. Culori. UtilizareDokument3 SeitenEprubete. Culori. UtilizareCuCUNoch keine Bewertungen

- Gec 014 Prelim ExaminationDokument2 SeitenGec 014 Prelim ExaminationcykablyatNoch keine Bewertungen