Beruflich Dokumente

Kultur Dokumente

Art2020153 PDF

Hochgeladen von

NovindraOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Art2020153 PDF

Hochgeladen von

NovindraCopyright:

Verfügbare Formate

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

ResearchGate Impact Factor (2018): 0.28 | SJIF (2018): 7.426

Impact of Domestic Policies and External Factors

on the Competitiveness and Crude Palm Oil

Industry Actor’s Welfare in Indonesia

Novindra1, Bonar M. Sinaga2, Sri Hartoyo3, Erwidodo4

1

Department of Resource and Environmental Economics, Bogor Agricultural University, Indonesia

2

Department of Resource and Environmental Economics, Bogor Agricultural University, Indonesia

3

Department of Economics, Bogor Agricultural University, Indonesia

4

Indonesian Center for Agricultural Socioeconomic and Policy Studies, Indonesian Agency for Agricultural Research and Development,

Indonesia

Abstract: Indonesia must continue developing the palm oil downstream industries than only exporting crude palm oil (CPO), that have

very high value added in order to fulfill domestic needs and even be exported, so it can save foreign exchange (if we do not import CPO

derivative products) and generate greater foreign exchange value (if we export CPO derivative products). The objectives of this study

wereto evaluate the impact of domestic policies and external factors on the Indonesian-Malaysian CPO competitiveness and welfare of

oil palm farmers and CPO downstream industry actors in indonesia period 2015-2017. This study was conducted by formulating an

econometric model of CPO industry. The model specification was dynamic simultaneous equations that consisted of 71 behavioral and

48 identities equations, while model estimated and simulated by using 2SLS and Newton method. The result showed that domestic policy

through facilitation of increasing the production capacity of palm cooking oil, margarine and soap industries, as well as increasing CPO

demand by other industries can increase the competitiveness of Indonesian CPO exports, as well as increase the welfare of oil palm

farmers and CPO producers also net welfare.

Keywords: Competitiveness, CPO downstream industries, Oil palm farmers welfare, Net welfare

1. Introduction renewable energy segments such as biodiesel (General

Director of Agro-Industry, Ministry of Industry, 2015).

The global average productivity of oil palm is 3.96 tons of

oil per hectare per year, which amounts to 4 to 8 times per

hectare compared to the productivity of other vegetable oils

(such as sunflowers and rapeseeds). It is known that

rapeseed productivity amounts to 0.99 tons of oil per ha per

year, sunflower 0.71 tons of oil per ha per year, and soybean

0.52 tons of oil per ha per year. The global demand for

vegetable oil is estimated to be approximately 226.7 million

tons in 2025, which means there is an increase of

approximately 51 million tons from 2015. If the increase in

the global demand for vegetable oil is only provided by palm

oil, only 13 million ha of land is needed. While if the land is

filled with soybeans, sunflower, or rapeseed, then the land

area needed for each category are respectively 98.1 million,

71.8 million, and 51.5 million ha. This concludes that palm

oil is the most efficient producer of vegetable oil in regards

of land usage (saves up to 90 percent) and is also

environmentally friendly (Figure 1). This proves that palm

oil plays a role the global forests conservation. Figure 1: Total of World Production and

Consumption of Main Vegetable OilPeriod 2011-2015 and

It is known that crude palm oil (CPO) can be processed into Estimated Year 2025

more than 300 types of derivative products in food, Source: Sitanggang, 2018

chemical, and renewable energy segments, including

biodiesel. Previously, Indonesia could only produce 47 CPO This shows that the development of CPO downstream

derivative products, while Malaysia had reached 100 CPO industry in Indonesia is adequate, but some improvements

derivative products (Baihaqi, 2013). As time progresses, in are still needed, especially in its production capacity.

2014 and 2015, Indonesia was able to produce 154 and 169

types ofCPO derivative products in food, chemical, An increase in CPO production is usually followed by an

increase in Indonesian CPO exports, but during the span of

Volume 8 Issue 8, August 2019

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART2020153 10.21275/ART2020153 498

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

ResearchGate Impact Factor (2018): 0.28 | SJIF (2018): 7.426

2010 to 2018, Indonesia's CPO exports tend to decline. This industries so that CPO is utilized more by the Indonesian

decline is due to an increase in CPO demand by the CPO CPO downstream industry.

downstream industry in Indonesia with an average growth

rate of 8.97 percent during 2010-2018 (Oil World, 2018). Based on the description of the problems related to the CPO

The number of Indonesian CPO exports amounted to industry, it is necessary to conduct a research on the impact

5,701.29 thousand tons in 2007, then continued to increase of domestic policies and external factorson the Indonesian-

with a growth rate of 29.83 percent to 9,566.75 thousand Malaysian CPO competitiveness and the welfare of oil palm

tons in 2009. Then from 2010 to 2018, Indonesia's CPO farmers and CPO downstream industry actors in indonesia.

exports declined (except for 2015 and 2017) at the rate of

1.98 percent, where Indonesia's CPO exports in 2010 2. Research Method

amounted to 9,444.17 thousand tons and 6,554.50 thousand

tons in 2018 (UN Comtrade, 2019). The CPO and Derivative Products Supply and Demand

Model in Indonesia and Worldbuilt in this study is an

Indonesia should decrease the dependency on foreign econometric model as a dynamic simultaneous equation

exchange earnings from CPO exports, considering that system, which consists of 5 blocks, namely: Oil Palm

Indonesia also imports CPO derivative products. Indonesia Plantation Block, Palm Oil Block, Palm Cooking Oil Block,

must continue to develop the CPO downstream industry Margarine Block, and Soap Block. The formulated model

rather than exclusively export CPO, which may bring consists of 71 structural equations and 48 identity equations.

enormous added value in order to fulfill domestic needs and The model is estimated by 2SLS (two-stage least squares)

even export derivative products to save foreign exchange (if method, and after a fit estimation result is obtained, the

CPO derivative products are not imported) and to generate model is validated and simulated using Newton's method to

greater foreign exchange value (from exports of CPO determine the impact of domestic policies and external

derivative products) (Novindra et al., 2013). factors on Indonesian-Malaysian CPO competitiveness and

the welfare of oil palm farmers and CPO downstream

During the period 2008-2018, the average demand for CPO industry actors in indonesia.

by the palm cooking oil, margarine, and soap industries,

among others, amounted to 3,997.06 thousand tons, 306.91 The type of data used in the study is secondary data with a

thousand tons, 478.95 thousand tons, and 2,507.00 thousand time series from 1990 to 2017. The data sources in this study

tons per year. While the average share of CPO demand by were obtained from several agencies namely: Central Bureau

the palm cooking oil, margarine, soap, and other industries of Statistics (BPS), Directorate General of Plantation-

to Indonesia's CPO production was 14.14 percent, 1.09 Ministry of Agriculture, Ministry Trade, UN Comtrade,

percent, 1.69 percent and 8.87 percent (CIC, 2018). Capricorn Indonesia Consult (CIC), FAO and other related

Furthermore, during 2010-2018, the average growth rate of agencies or publications. Data processing is done by

Indonesian exports of palm cooking oil, margarine, and soap computer programs, namely: SAS/ETS for Windows 9.4.

to the world were 13.69 percent, 7.51 percent and 3.23

percent respectively, while the average growth rate of 3. Result and Discussion

Indonesian imports of palm cooking oil, margarine and soap

from the world are respectively 1,589.60 percent, 18.23 The results of the model validation period 2015-2017show

percent and 15.46 percent (UN Comtrade, 2019). This shows that each equation has an average root mean square percent

that investment in the CPO downstream industry must error (RMSPE) of 26.93 percent and U-Theil of 0.11. Thus,

continue to be increased (especially its production capacity) in general the model built has predictive power that is

so that domestic CPO demand increases in order to increase adequately valid and is well used to carry out simulations.

production of CPO derivative products thereby reducing

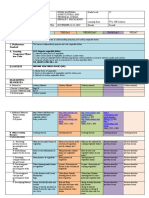

imports and even increasing exports of Indonesian CPO In the study, the domestic policiesare(1) Indonesia’s CPO

derivative products to the world. export tax tariff is set at 6%, (2) setting a domestic market

obligation (DMO) equivalent to the effect of Indonesia’s

In terms of Indonesia's CPO demand and supply, Indonesia's CPO export tax tariff (set at 6%) in increasing domestic

CPO production far exceeds domestic demand. During 2013 CPO supply, and (3) increasing production capacity of palm

until 2018, the average production of Indonesian CPO cooking oil, margarine and soap industries respectively to

(33,065.60 thousand tons) was almost 4 times greater than 5%, 10% and 40%, and an increase in CPO demand by other

the average domestic CPO demand (8,691.67 thousand industries by 30%, while the change in external factors are

tons), but the amount of CPO exports was excessive (for the increase in world crude oil prices by 15% and an

example due to increasingof world CPO prices and/or increase in import tax on CPO by India by 100%.

worldcrude oil prices) can cause insufficient fulfillment of

CPO demand by the domestic CPO downstream industry, The impact analysis of domestic policies and changes in

thus hampering the development of Indonesia's CPO external factors on the Indonesian-Malaysian

downstream industry. Therefore the government needs to CPOcompetitiveness and the welfare of oil palm farmers and

implement a policy to limit the excessive amount of CPO palm oil downstream industries actors in Indonesia period

exports and support the development of the CPO 2015-2017 are carried out with various alternative of

downstream industry including the tariff policy (export duty) simulation scenarios, namely: (1)Indonesian CPO export tax

of the CPO or domestic market obligation (DMO), followed tariff is set at 6% (S1), (2) Determination of domestic

by policies to facilitate the increase of investment that market obligation (DMO), that equivalent to the impact of

expands the number and capacity of CPO downstream Indonesia’s CPO export tax tariff (set at 6%) in increasing

Volume 8 Issue 8, August 2019

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART2020153 10.21275/ART2020153 499

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

ResearchGate Impact Factor (2018): 0.28 | SJIF (2018): 7.426

domestic CPO supply, (3) Increasing production capacity of Table 1(b): Impact of Domestic Policies and Changes in

palm cookingoil, margarine and soap industries respectively External Factors on Indonesian-Malaysian CPO

by 5%, 10%, and 40%, and an increase in CPO demand by Competitiveness based on RCA Indicator

other industries by 30% (S3), (4) Increasing world crude oil Period 2015-2017

prices by 15% (S4), (5) Increasing CPO import tax by India Basic Value Changes (∆)

by 100% (S5), (6) Combination of scenario 5 and scenario 3 No Description (Before

S4 S5

(S6), (7) Combination of scenario 4 and scenario 1 (S7), (8) Simulation)

Combination of scenario 4 and scenario 2 (S8), (9) 1 RCA- Indonesian CPO Export to India 16.50 0.0002 -0.002

Combination of scenarios 1 and scenario 3 (S9), and (10) RCA- Malaysian CPO Export to India 16.79 -0.02 0.01

Combination of scenario 2 and scenario 3 (S10). 2 RCA- Indonesian CPO Export to Netherlands 35.81 0.26 -0.20

RCA- Malaysian CPO Export to Netherlands 38.05 0.01 -0.02

Based on Table 1a-Table 1d, the conditions preceding the 3 RCA- Indonesian CPO Export to Singapore 35.61 -0.17 0.12

simulation with comparative advantage index (revealed RCA- Malaysian CPO Export to Singapore 1.08 0.001 -0.002

comparative advantage/RCA index) of Indonesia and 4 RCA- Indonesian CPO Export to Italy 136.06 0.29 -0.27

Malaysia have a high level of competitiveness in exporting RCA- Malaysian CPO Export to Italy 129.87 -0.41 0.30

CPO to ten major importing countries. Malaysia is superior

5 RCA- Indonesian CPO Export to Spain 79.85 0.19 -0.14

to Indonesia in competing with CPO exports to India and

RCA- Malaysian CPO Export to Spain 112.36 0.19 -0.16

Pakistan (in line with Salleh et al. 2016), Netherlands, Spain,

6 RCA- Indonesian CPO Export to Germany 81.51 0.90 -0.71

Tanzania, England, while Indonesia is superior to Malaysia

RCA- Malaysian CPO Export to Germany 5.14 0.04 -0.03

incompeting CPO exports to Singapore, Italy, Germany, and

7 RCA- Indonesian CPO Export to Tanzania 23.65 -0.03 0.003

Kenya. Domestic policy simulations through increasing the

RCA- Malaysian CPO Export to Tanzania 30.77 -0.18 0.10

production capacity of the palm cooking oil, margarine and

8 RCA- Indonesian CPO Export to England 21.80 0.19 -0.13

soap industries by 5%, 10% and 40% respectively, and

RCA- Malaysian CPO Export to England 22.11 0.22 -0.17

increasing the demand for CPO by other industries by 30%

9 RCA- Indonesian CPO Export to Kenya

(S3) led to an increase of Indonesia’s CPO 6.72 0.02 -0.01

exportscompetitiveness to main importing countries (except RCA- Malaysian CPO Export to Kenya 3.60 0.03 -0.02

Germany). Also simulating changes in external factors, an 10 RCA- Indonesian CPO Export to Pakistan 3.33 0.01 -0.01

increase in world crude oil prices by 15% led to an increase RCA- Malaysian CPO Export to Pakistan 31.95 -0.18 0.16

of Indonesia's CPO exports competitiveness to major

importing countries (except Singapore and Tanzania). Table 1 (c): Impact of Domestic Policies and Changes in

External Factors on Indonesian-Malaysian CPO

Table 1 (a): Impact of Domestic Policies and Changes in Competitiveness based on RCA Indicator

External Factors on Indonesian-Malaysian CPO Period 2015-2017

Competitiveness based on RCA Indicator

Period 2015-2017 Basic Value Changes (∆)

No Description (Before

Simulation) S6 S7 S8

Basic Value Changes (∆)

No Description (Before 1 RCA- Indonesian CPO Export to India 16.50 0.005 -0.06 -0.01

Simulation) S1 S2 S3

RCA- Malaysian CPO Export to India 16.79 0.004 0.07 0.003

1 RCA- Indonesian CPO Export to India 16.50 -0.06 -0.01 0.01 2 RCA- Indonesian CPO Export to Netherlands 35.81 -0.17 -0.34 -0.47

RCA- Malaysian CPO Export to India 16.79 0.09 0.02 -0.01 RCA- Malaysian CPO Export to Netherlands 38.05 -0.06 0.24 0.28

2 RCA- Indonesian CPO Export to Netherlands 35.81 -0.61 -0.74 0.03 3 RCA- Indonesian CPO Export to Singapore 35.61 0.15 0.86 -0.10

RCA- Malaysian CPO Export to Netherlands 38.05 0.23 0.28 -0.03 RCA- Malaysian CPO Export to Singapore 1.08 -0.001 0.08 0.01

3 RCA- Indonesian CPO Export to Singapore 35.61 1.07 0.07 0.03 4 RCA- Indonesian CPO Export to Italy 136.06 -0.15 -0.33 -0.11

RCA- Malaysian CPO Export to Singapore 1.08 0.08 0.01 0.001 RCA- Malaysian CPO Export to Italy 129.87 0.07 0.83 0.31

4 RCA- Indonesian CPO Export to Italy 136.06 -0.64 -0.40 0.11 5 RCA- Indonesian CPO Export to Spain 79.85 -0.05 -0.33 0.06

RCA- Malaysian CPO Export to Italy 129.87 1.25 0.73 -0.23 RCA- Malaysian CPO Export to Spain 112.36 -0.35 1.00 0.48

5 RCA- Indonesian CPO Export to Spain 79.85 -0.52 -0.12 0.10 6 RCA- Indonesian CPO Export to Germany 81.51 -0.72 0.65 0.49

RCA- Malaysian CPO Export to Spain 112.36 0.81 0.30 -0.19 RCA- Malaysian CPO Export to Germany 5.14 -0.04 0.05 0.06

6 RCA- Indonesian CPO Export to Germany 81.51 -0.25 -0.40 -0.02 7 RCA- Indonesian CPO Export to Tanzania 23.65 0.01 -0.15 -0.05

RCA- Malaysian CPO Export to Germany 5.14 0.01 0.02 -0.01 RCA- Malaysian CPO Export to Tanzania 30.77 0.11 0.03 -0.19

7 RCA- Indonesian CPO Export to Tanzania 23.65 -0.12 -0.01 0.01 8 RCA- Indonesian CPO Export to England 21.80 -0.09 -3.79 0.03

RCA- Malaysian CPO Export to Tanzania 30.77 0.21 -0.01 0.01 RCA- Malaysian CPO Export to England 22.11 -0.19 0.49 0.28

8 RCA- Indonesian CPO Export to England 21.80 -3.98 -0.16 0.05 9 RCA- Indonesian CPO Export to Kenya 6.72 -0.01 -0.05 0.01

RCA- Malaysian CPO Export to England 22.11 0.26 0.06 -0.02 RCA- Malaysian CPO Export to Kenya 3.60 -0.03 0.04 0.04

9 RCA- Indonesian CPO Export to Kenya 6.72 -0.06 -0.01 0.003 10 RCA- Indonesian CPO Export to Pakistan 3.33 0.01 -0.16 -0.07

RCA- Malaysian CPO Export to Kenya 3.60 0.01 0.01 -0.002 RCA- Malaysian CPO Export to Pakistan 31.95 0.14 0.07 -0.10

10 RCA- Indonesian CPO Export to Pakistan 3.33 -0.17 -0.07 0.02

RCA- Malaysian CPO Export to Pakistan 31.95 0.25 0.07 -0.02

Volume 8 Issue 8, August 2019

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART2020153 10.21275/ART2020153 500

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

ResearchGate Impact Factor (2018): 0.28 | SJIF (2018): 7.426

Table 1 (d): Impact of Domestic Policies and Changes in the CPO domestic supply will decrease the CPO domestic

External Factors on Indonesian-Malaysian CPO price the most (Novindra et al., 2011).

Competitiveness based on RCA Indicator

Period 2015-2017 Table 2 (a): Impact of Domestic Policies and Changes in

Basic Value Changes (∆) External Factors on Welfare of Oil Palm Farmers

No Description (Before and Palm Oil Downstream Industry Actors

Simulation) S9 S10 in Indonesia Period 2015-2017

Changes

1 RCA- Indonesian CPO Export to India 16.50 -0.05 -0.01 No. Description (Billion Rp)

S1 S2 S3

RCA- Malaysian CPO Export to India 16.79 0.08 0.01 1 ∆ Oil Palm Farmers Surplus -11.22 -584.48 46.22

2 RCA- Indonesian CPO Export to Netherlands 35.81 -0.58 -0.71 2 ∆ Palm Oil Pro duc er Surplus -560.46 -17849.11 5326.44

RCA- Malaysian CPO Export to Netherlands 38.05 0.20 0.24 3 ∆ Palm Co o king Oil Pro duc er Surplus -1.95 -50.34 -411.50

3 RCA- Indonesian CPO Export to Singapore 35.61 1.10 0.09 4 ∆ Margarin Pro duc er Surplus -1.16 -18.74 -231.70

5 ∆ So ap Pro duc er Surplus -0.14 -2.54 -94.53

RCA- Malaysian CPO Export to Singapore 1.08 0.08 0.01

6 ∆ Pro duc e r Surpl us -574.93 -18505.21 4634.94

4 RCA- Indonesian CPO Export to Italy 136.06 -0.52 -0.29 7 ∆ Palm Oil Co ns umer Surplus 178.62 5712.99 -1792.74

RCA- Malaysian CPO Export to Italy 129.87 1.02 0.49 8 ∆ Palm Co o king Oil Co ns umer Surplus 0.27 7.03 57.16

5 RCA- Indonesian CPO Export to Spain 79.85 -0.42 -0.02 9 ∆ Margarin Co ns umer Surplus 0.03 0.43 5.20

RCA- Malaysian CPO Export to Spain 112.36 0.63 0.10 10 ∆ So ap Co ns umer Surplus 0.04 0.76 26.91

6 RCA- Indonesian CPO Export to Germany 81.51 -0.27 -0.42 11 ∆ Co ns ume r Surpl us 178.96 5721.20 -1703.48

12 ∆ Go vernment Inc o me fro m CPO Expo rt Tax 2887.34 0.00 0.00

RCA- Malaysian CPO Export to Germany 5.14 0.00 0.01

13 ∆ Go v e rnme nt Inc o me 2887.34 0.00 0.00

7 RCA- Indonesian CPO Export to Tanzania 23.65 -0.11 -0.01 14 ∆ Ne t Surpl us 2491.37 -12784.01 2931.46

RCA- Malaysian CPO Export to Tanzania 30.77 0.22 -0.01 15 ∆ Palm Oil Fo reign Exc hange Inc o me -83.67 -226.06 50.43

8 RCA- Indonesian CPO Export to England 21.80 -3.93 -0.11 16 ∆ Palm Co o king Oil Fo reign Exc hange Inc o me 2.79 62.79 609.53

RCA- Malaysian CPO Export to England 22.11 0.24 0.03 17 ∆ Margarin Fo reign Exc hange Inc o me 0.02 0.26 8.63

9 RCA- Indonesian CPO Export to Kenya 6.72 -0.06 -0.01 18 ∆ So ap Fo reign Exc hange Inc o me 0.01 0.10 4.12

19 ∆ Fo re i g n Ex c ha ng e Inc o me -80.85 -162.91 672.71

RCA- Malaysian CPO Export to Kenya 3.60 0.01 0.005

20 ∆ Palm Oil Fo reign Exc hange Expenditure 0.01 0.03 -0.01

10 RCA- Indonesian CPO Export to Pakistan 3.33 -0.15 -0.06 21 ∆ Fo re i g n Ex c ha ng e Ex pe ndi ture 0.01 0.03 -0.01

RCA- Malaysian CPO Export to Pakistan 31.95 0.23 0.05 22 ∆ Ba l a nc e o f Tra de -80.84 -162.88 672.70

According to Table 2a-Table 2d, the simulation that causes Table 2(b) Impact of Domestic Policies and Changes in

the largest increase in the surplus of oil palm farmers (IDR External Factors on Welfare of Oil Palm Farmers

46.22 billion) is the existence of an increase in the and Palm Oil Downstream Industry Actors

production capacity of palm cooking oil, margarine and soap in Indonesia Period 2015-2017

industries by 5%, 10% and 40% respectively, and an No. Description (Billion Rp)

Changes

increase in CPO demand by other industries by 30%, S4 S5

because the price of fresh fruit bunch has increased the most. 1 ∆ Oil Palm Farmers Surplus 16.85 -15.12

On the other hand, setting a domestic market obligation 2 ∆ Pal m Oi l Pro duc er Surpl us 648.52 -480.58

(DMO) equivalent to the effect of Indonesia’s CPO export 3 ∆ Pal m Co o ki ng Oi l Pro duc er Surpl us 2.03 -1.31

tax tariff (set at 6%) in increasing domestic CPO supplyhas 4 ∆ Margari n Pro duc er Surpl us 0.98 -0.40

caused the largest decrease in the surplus of oil palm farmers 5 ∆ So ap Pro duc er Surpl us 0.13 -0.06

(IDR 584.48 billion) because the price of fresh fruit bunch 6 ∆ Pro duc e r Surpl us 668.50 -497.48

has decreased the most. 7 ∆ Pal m Oi l Co ns umer Surpl us -206.62 153.16

8 ∆ Pal m Co o ki ng Oi l Co ns umer Surpl us -0.28 0.18

Likewise, the simulation that caused the largest increase in 9 ∆ Margari n Co ns umer Surpl us -0.02 0.01

the CPO producer surplus (IDR 5,326.44 billion) was ifthere 10 ∆ So ap Co ns umer Surpl us -0.04 0.02

was an increase in the production capacity of palm cooking 11 ∆ Co ns ume r Surpl us -206.97 153.37

oil, margarine and soap industries by 5%, 10% and 12 ∆ Go vernment Inc o me fro m CPO Expo rt Tax 0.00 0.00

40%respectively, and increased CPO demand by other 13 ∆ Go v e rnme nt Inc o me 0.00 0.00

industries by 30%, because the domestic CPO prices 14 ∆ Ne t Surpl us 461.54 -344.10

experienced the greatest increase. The developing of CPO 15 ∆ Pal m Oi l Fo rei gn Exc hange Inc o me 679.61 -525.35

domestic downstream industries will increase the 16 ∆ Pal m Co o ki ng Oi l Fo rei gn Exc hange Inc o me -2.70 1.53

CPOdomestic demand, hence increase the CPO prices that is 17 ∆ Margari n Fo rei gn Exc hange Inc o me -0.02 0.00

received by CPO producers(Novindra et al., 2011). On the 18 ∆ So ap Fo rei gn Exc hange Inc o me -0.01 0.002

other hand, setting a domestic market obligation (DMO) 19 ∆ Fo re i g n Ex c ha ng e Inc o me 676.89 -523.82

equivalent to the effect of Indonesia’s CPO export tax tariff 20 ∆ Pal m Oi l Fo rei gn Exc hange Expendi ture 0.14 -0.11

(set at 6%) in increasing domestic CPO supply caused the 21 ∆ Fo re i g n Ex c ha ng e Ex pe ndi ture 0.14 -0.11

largest decrease in CPO producer surplus (IDR 17,849.11 22 ∆ Ba l a nc e o f Tra de 677.02 -523.93

billion) because the domestic CPO price experienced the

greatest decline.This is because the increasing in CPO The simulation that increases the surplus of the largest CPO

domestic supply with DMO has not been supported by the consumers (IDR 5,712.99 billion) is the determination of a

development of CPO downstream industries, thus increasing domestic market obligation (DMO) which is equivalent to

Volume 8 Issue 8, August 2019

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART2020153 10.21275/ART2020153 501

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

ResearchGate Impact Factor (2018): 0.28 | SJIF (2018): 7.426

the impact of Indonesia’s CPO export tax tariff

determination (set 6%) in increasing CPO domestic supply. The domestic policy that causes the greatestincreases innet

This is because the increase in CPO domestic supply due to welfare (surplus) (IDR 5,433.24 billion) is the increasing of

the DMO has caused the largest decline in domestic CPO Indonesia’s CPO export tax tariff by 6% and an increase in

prices. On the other hand, the simulation of increasing the production capacity of palm cooking oil, margarine and

production capacity of palm cooking oil, margarine and soap soap industries by 5%, 10% and 40%, as well as an increase

industries by 5%, 10% and 40% respectively, and increasing in CPO demand by other industries by 30%. While the

CPO demand by other industries by 30%, caused the largest determination of domestic market obligation (DMO) that

decrease in consumer CPO surplus (IDR 1,792.74 billion) equivalent with impacts the increasing of Indonesian CPO

due to the domestic CPO prices experiencing the biggest export tax tariff by 6% in increasing domestic CPO supply

increase. causes the greatest decrease in net welfare (IDR 12,784.01

billion). The DMO caused decreasing in producer surplus

Table 2 (c): Impact of Domestic Policies and Changes in (IDR 18,505.21billion) larger than increasing in consumer

External Factors on Welfare of Oil Palm Farmers surplus (IDR5,721.20 billion), so that net welfare is

and Palm Oil Downstream Industry Actors decreasing (IDR 12,784.01 billion).

in Indonesia Period 2015-2017

Changes Table 2 (d): Impact of Domestic Policies and Changes in

No. Description (Billion Rp)

S6 S7 S8 External Factors on Welfare of Oil Palm Farmers

1 ∆ Oil Palm Farmers Surplus 31.09 5.63 -568.06 and Palm Oil Downstream Industry Actors

2 ∆ Palm Oil Produc er Surplus 4845.22 87.92 -17214.99 in Indonesia Period 2015-2017

Changes

3 ∆ Palm Cooking Oil Produc er Surplus -412.82 0.08 -48.34 No. Description (Billion Rp)

S9 S10

4 ∆ Margarin Produc er Surplus -232.12 -0.18 -17.76

1 ∆ Oil Palm Farmers Surplus 34.98 -536.25

5 ∆ Soap Produc er Surplus -94.60 -0.02 -2.41

2 ∆ Palm Oil Pro duc er Surplus 4764.73 -12341.92

6 ∆ Pro duc e r Surpl us 4136.77 93.44 -17851.57

3 ∆ Palm Co o king Oil Pro duc er Surplus -413.47 -461.54

7 ∆ Palm Oil Cons umer Surplus -1630.97 -28.02 5509.13

4 ∆ Margarin Pro duc er Surplus -232.92 -250.90

8 ∆ Palm Cooking Oil Cons umer Surplus 57.34 -0.01 6.75

5 ∆ So ap Pro duc er Surplus -94.68 -97.23

9 ∆ Margarin Cons umer Surplus 5.21 0.004 0.41

6 ∆ Pro duc e r Surpl us 4058.64 -13687.84

10 ∆ Soap Cons umer Surplus 26.93 0.005 0.72

7 ∆ Palm Oil Co ns umer Surplus -1603.92 4171.95

11 ∆ Co ns ume r Surpl us -1541.49 -28.02 5517.01

8 ∆ Palm Co o king Oil Co ns umer Surplus 57.43 64.06

12 ∆ Government Inc ome from CPO Export Tax 0.00 2923.74 0.00

9 ∆ Margarin Co ns umer Surplus 5.22 5.61

13 ∆ Go ve rnme nt Inc o me 0.00 2923.74 0.00

10 ∆ So ap Co ns umer Surplus 26.96 27.65

14 ∆ Ne t Surpl us 2595.28 2989.15 -12334.56

11 ∆ Co ns ume r Surpl us -1514.31 4269.28

15 ∆ Palm Oil Foreign Exc hange Inc ome -475.24 594.56 449.64

12 ∆ Go vernment Inc o me fro m CPO Expo rt Tax 2888.91 0.00

16 ∆ Palm Cooking Oil Foreign Exc hange Inc ome 611.06 0.09 60.12

13 ∆ Go v e rnme nt Inc o me 2888.91 0.00

17 ∆ Margarin Foreign Exc hange Inc ome 8.63 0.01 0.25

14 ∆ Ne t Surpl us 5433.24 -9418.56

18 ∆ Soap Foreign Exc hange Inc ome 4.13 0.001 0.09 15 ∆ Palm Oil Fo reign Exc hange Inc o me -33.04 -172.94

19 ∆ Fo re i gn Exc hange Inc o me 148.57 594.66 510.09 16 ∆ Palm Co o king Oil Fo reign Exc hange Inc o me 612.32 670.99

20 ∆ Palm Oil Foreign Exc hange Expenditure -0.12 0.15 0.16 17 ∆ Margarin Fo reign Exc hange Inc o me 8.66 8.88

21 ∆ Fo re i gn Exc hange Expe ndi ture -0.12 0.15 0.16 18 ∆ So ap Fo reign Exc hange Inc o me 4.13 4.22

22 ∆ Bal anc e o f Trade 148.46 594.81 510.26 19 ∆ Fo re i g n Ex c ha ng e Inc o me 592.07 511.14

20 ∆ Palm Oil Fo reign Exc hange Expenditure 0.002 0.02

Then, the simulation that caused the biggest increase in the 21 ∆ Fo re i g n Ex c ha ng e Ex pe ndi ture 0.002 0.02

surplus of CPO downstream industries producers (palm

22 ∆ Ba l a nc e o f Tra de 592.07 511.16

cooking oil, margarine and soap) (IDR 3.13 billion) is if

there is an increase in world crude oil prices by 15%, due to The second largest positive trade balance (IDR 672.70

the price of palm cooking oil, margarine and soap billion) is when there is an increase in the production

experiencing the greatest increase. However, the simulation capacity of palm cooking oil, margarine and soap industries

of a 15% increase in world crude oil prices caused the by 5%, 10% and 40% respectively, also an increase in CPO

largest decrease in the consumer surplus of the CPO demand by other industries by 30%. This is in line with the

downstream industries.(IDR 0.34 billion).This is because high flow of CPO and its derivatives export, so that this

increasing in world crude oil price makes increasing in the simulation can increase the competitiveness of Indonesian

world CPO import and the world CPO prices. Then, CPO exports.The biggest negative trade balance (IDR

Indonesian CPO export increases and makes CPO domestic 523.93 billion) is when India increases its CPO import tax

supply decrease. Decreasing in CPO domestic supply makes by 100%. This is because when India increase their import

CPO domestic price increase. Increasing CPO domestic tax tariff so Indonesian CPO export to India is decrease.

prices are causing CPO demand by the palm oil downstream

industry to decline (Hartoyo et al.,2011). Declining in CPO

demand by the CPOdownstream industriesmake the

production of CPO derivative products decrease and then the

price of CPO derivative product increase (palm cooking oil,

margarine and soap).

Volume 8 Issue 8, August 2019

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART2020153 10.21275/ART2020153 502

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

ResearchGate Impact Factor (2018): 0.28 | SJIF (2018): 7.426

4. Conclusion and Suggestion [5] M.B. Baihaqi, “PengusahaMinta Dana BK CPO

untukHilirisasi,”. [Online].

4.1. Conclusion Available:http://neraca.co.id/article/24670/pengusaha-

minta-dana-bk-cpo-untuk-hilirisasi. [Accessed:

Based on the results and discussion, a number of things can January. 5, 2018].

be concluded as follows: [6] Novindra, B.M.Sinaga,

1) Domestic policy through facilitating the increase of D.S.Priyarsono,“DampakKebijakanPajakEksporMinya

production capacity of the palm cooking oil, margarine kSawitdanDomestic Market Obligation

and soap industries, as well as the increase CPO demand padaKesejahteraanKonsumenMinyakSawit di

by other industries can heighten the competitiveness of Indonesia,”InOrange Book V EkonomidanManajemen:

Indonesian CPO exports to major importing countries KetahananPangan,IPB Press,Bogor, 2013.

(except Germany) and improve the welfare of oil palm [7] Novindra, B.M.Sinaga, D.S.Priyarsono, “Impacts of

farmers and CPO producers because they increase the Domestic Policies and External Factors on the Crude

largest surplus for oil palm farmers and CPO producers. Palm Oil Producers’s and Consumer’s Welfare in

2) Domestic policy through the increase of CPO export tax Indonesia,” Master of Science Thesis Report, Bogor

tariff and the increase of production capacity of palm Agricultural University, Indonesia, 2011.

cooking oil, margarine and soap industries, also the [8] Oil World, 17 Oils Fats and Biodiesel, ISTA Mielke

increase of demand for CPO by other industries can GmbH. Langenberg, Hamburg, Germany, 2018.

heighten the largest net welfare and produce a positive [9] S. Hartoyo, E.I.K. Putri, Novindra, Hastuti, “Dampak

trade balance. Kenaikan Harga Minyak Bumi terhadap Ketersediaan

3) Increased import tax on CPO by India caused a decline in Minyak Goreng Sawit Domestik,” Jurnal Ekonomi dan

net welfare, and it can be anticipated by increasing the Pembangunan Indonesia, 11(2):169-179, 2011.

production capacity of palm cooking oil, margarine and [10] T. Sitanggang, “Indonesia Palm Oil Supply and

soap industries, as well as increasing CPO demand by Demand,”Inpaper of Indonesian Palm Oil Conference,

other industries, which then increase the net welfare. Bali, October 31st- November 2nd 2018.

[11] UN Comtrade] United Nations Commodity

4.2. Suggestion Trade,“UNComtrade Statistics Database,”.[Online].

Available:http://comtrade.un.org/data. [Accessed:July.

Some things that can be suggested from this study are as 9, 2019].

follows:

1) In order to facilitate an increase in the production Author Profile

capacity of the CPO downstream industry in Indonesia,

the government needs to increase a CPO export tax tariff Novindra received a Bachelor of Agriculture degree

to fulfill the CPO needs of its downstream industry and in Agribusiness Managementand a Master of Science

the government needs to continue to provide investment degree in Agricultural Economics from Bogor

incentives for CPO downstream industries such as tax Agricultural University in 2003 and 2011,

allowances, tax holidays, investment promotions and respectively. During 2007-now, he works as a lecturer

import duty exemptions on the import of machinery and in Agricultural EconomicsDivison, Department of Resource and

Environmental Economics, Faculty of Economics and

goods and materials for industrial development in the Management, Bogor Agricultural University.

context of investment.

2) In order to deal with the determination of CPO import

tariff by India and other major importing countries, the

government should facilitate an increase in the

production capacity of the CPO downstream industry in

Indonesia.

References

[1] A. Koutsoyiannis, Theory of Econometrics: An

Introductory Exposition of Econometric Methods,

Second Edition, MacMillan Press, London, 1977.

[2] [CIC] Capricorn Indonesia Consult, “CIC Statistics

Database,” Jakarta, 2018.

[3] General Director of Agro-Industry, Ministry of

Industry, “StrategiPercepatan Diversifikasi Industri

HilirKelapaSawit,”Inseminar of Palm Oil Industry

Development Conference, Jakarta,September 9th-

10th2015.

[4] K.M. Salleh, R. Abdullah, M.A.K. Rahman, N. Balu,

A.Z.A.Nordin, “Revealed Comparative Advantage and

Competitiveness of Malaysian Palm Oil Exports

againts Indonesia in Five Major Markets,” Oil Palm

Industry Economic Journal, 16(1):1-7, 2016.

Volume 8 Issue 8, August 2019

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART2020153 10.21275/ART2020153 503

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 500 Phrases and Expression PDFDokument26 Seiten500 Phrases and Expression PDFنعمت الله هادیNoch keine Bewertungen

- Physiological Functions and Metabolism of Essential Dietary Element IodineDokument4 SeitenPhysiological Functions and Metabolism of Essential Dietary Element IodinefitrizeliaNoch keine Bewertungen

- Determiners Both Either Neither Grammar Esl Exercises WorksheetDokument2 SeitenDeterminers Both Either Neither Grammar Esl Exercises WorksheetMaría VallejoNoch keine Bewertungen

- Deskripsi Dillenia Indica LDokument17 SeitenDeskripsi Dillenia Indica LEly SavitriNoch keine Bewertungen

- Good Day! Peace and All Good, One With You!Dokument5 SeitenGood Day! Peace and All Good, One With You!arfieleNoch keine Bewertungen

- NETZSCH - Food Applications - EDokument24 SeitenNETZSCH - Food Applications - ETien Din Tran100% (1)

- Daily Lesson Log in CookeryDokument4 SeitenDaily Lesson Log in CookeryRhoale Macasaddu100% (1)

- Product Development HistoryDokument1 SeiteProduct Development HistoryMicah GalangNoch keine Bewertungen

- Background Report - KenyaDokument30 SeitenBackground Report - KenyaJona Polinar Alanano AlbertoNoch keine Bewertungen

- Inventori Harian KCM Jember (Juni 2020) TerbaruDokument251 SeitenInventori Harian KCM Jember (Juni 2020) TerbaruarifNoch keine Bewertungen

- Present Perfect TenseDokument14 SeitenPresent Perfect TenseJesslynTehNoch keine Bewertungen

- Feeding Program Activity DesignDokument2 SeitenFeeding Program Activity DesignCAMILLE RAMOSNoch keine Bewertungen

- Chefs at GoogleDokument21 SeitenChefs at Googleearn5kNoch keine Bewertungen

- Get Smart Plus 1 FlashcardsDokument331 SeitenGet Smart Plus 1 FlashcardsElena Ned0% (1)

- Instrumen Saringan Membaca Tahun 1Dokument13 SeitenInstrumen Saringan Membaca Tahun 1Hirdawati Abdul HamidNoch keine Bewertungen

- Contoh Soal Bahasa Inggris Kelas 8 Part 1Dokument4 SeitenContoh Soal Bahasa Inggris Kelas 8 Part 1gggdghh0% (1)

- Pizza Recipe: Cooked Pizza SauceDokument14 SeitenPizza Recipe: Cooked Pizza Saucerana1184Noch keine Bewertungen

- Class11 Nutrition Health and Well BeingDokument21 SeitenClass11 Nutrition Health and Well Beingshreyanshsaha439Noch keine Bewertungen

- Universal Robina Corporation Business PlanDokument95 SeitenUniversal Robina Corporation Business PlanAngelica PostreNoch keine Bewertungen

- Umbi GembiliDokument8 SeitenUmbi GembiliZakaria SandyNoch keine Bewertungen

- BAR OPERATIONS GUIDEDokument11 SeitenBAR OPERATIONS GUIDERishabh ChawdaNoch keine Bewertungen

- 24604-Article Text-87708-1-10-20230805Dokument6 Seiten24604-Article Text-87708-1-10-20230805saniaajibahNoch keine Bewertungen

- 8, Salad ToolsDokument13 Seiten8, Salad ToolsLORNa CARLOSNoch keine Bewertungen

- GrosaryDokument10 SeitenGrosaryVaibhav SinglaNoch keine Bewertungen

- Vegetative PropagationDokument23 SeitenVegetative PropagationAaron DizonNoch keine Bewertungen

- Pharmaceutical Care For Dialysis PatientsDokument6 SeitenPharmaceutical Care For Dialysis PatientsalfinadyaNoch keine Bewertungen

- Food Cost ControlDokument5 SeitenFood Cost ControlPraveenNoch keine Bewertungen

- Dick Whittington and His Cat in the KitchenDokument17 SeitenDick Whittington and His Cat in the KitchenSam MitchellNoch keine Bewertungen

- Recipe Book 1.Zp210082Dokument27 SeitenRecipe Book 1.Zp210082tomevoNoch keine Bewertungen

- Chipotle Chicken & Vegetable SoupDokument4 SeitenChipotle Chicken & Vegetable SoupYulieka KusumawatiNoch keine Bewertungen