Beruflich Dokumente

Kultur Dokumente

Community Property Checklist

Hochgeladen von

DR0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

121 Ansichten2 SeitenThis document provides an overview of community property law, outlining key concepts such as:

1. Community property includes assets acquired during marriage through earnings or efforts of either spouse. Separate property includes assets owned before marriage or received individually through gifts or inheritance.

2. Actions like commingling separate property in a joint bank account can change the character of the property from separate to community, with presumptions and accounting methods to determine property interests.

3. Spouses have rights to reimbursement for community funds used to improve or pay for the other spouse's separate property under certain circumstances like divorce or death.

Originalbeschreibung:

Cp

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides an overview of community property law, outlining key concepts such as:

1. Community property includes assets acquired during marriage through earnings or efforts of either spouse. Separate property includes assets owned before marriage or received individually through gifts or inheritance.

2. Actions like commingling separate property in a joint bank account can change the character of the property from separate to community, with presumptions and accounting methods to determine property interests.

3. Spouses have rights to reimbursement for community funds used to improve or pay for the other spouse's separate property under certain circumstances like divorce or death.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

121 Ansichten2 SeitenCommunity Property Checklist

Hochgeladen von

DRThis document provides an overview of community property law, outlining key concepts such as:

1. Community property includes assets acquired during marriage through earnings or efforts of either spouse. Separate property includes assets owned before marriage or received individually through gifts or inheritance.

2. Actions like commingling separate property in a joint bank account can change the character of the property from separate to community, with presumptions and accounting methods to determine property interests.

3. Spouses have rights to reimbursement for community funds used to improve or pay for the other spouse's separate property under certain circumstances like divorce or death.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

COMMUNITY PROPERTY

I. OVERVIEW spouse unless justice dictates 2. Discovery after death of spouse:

A. Does CP Law Apply? otherwise) spouse gets ½ of gifted CP, recoverable

B. Source? 2. Tort liability – look at whether tort was from deceased spouse's estate or

C. Actions that Alter Character of committed for benefit of SP or CP, and donee's estate.

satisfy out of that first, then reach F. Commingled Bank Accounts – SP not

Property?

other community. Cannot reach non- transmuted to CP, but presumption of CP

D. Statutory Presumptions?

tortfeasor's SP. unless rebutted by Exhaustion or Direct

E. Management & Control of CP During

D. Gifts/inheritances: SP Tracing accounting methods:

Marriage?

E. Real Property: look at when acquired; 1. Exhaustion method: no/low CP funds +

F. Disposition/division?

acquired when perfected; title can related deposit of SP, then acquisition of asset

II. DOES CP LAW APPLY? back to K date unless for single family asset = SP.

A. Economic Comm begins at legal residence as joint tenants. 2. Direct Tracing method: sufficient SP

marriage F. Rents, issues and profits: source rule funds + intent to use SP funds

G. Property Acquired on Credit 3. Presumption: Family Expense:

B. Valid Marriage: consent, capactity-18/or 1. Presumption: property acquired during expenditures for family expenses are

parent or court order, license and marriage on credit is presumptively on made with CP before SP, SP

solemnization community credit, and therefore CP. contributions are gifts.

1. CL marriage: CA does not recognize 2. Test: Look to primary intent of the 4. Note: Anti-Lucas statutes do not apply

CL marriage unless CL married in lender to determine the character of to joint bank accounts.

another state and came to CA. the property upon acquisition. G. CP Services (Time, Energy, Services)

a. Full faith and credit clause H. Life Insurance Used to Enhance Value of SP Business

C. Putative Spouse: Good faith belief based 1. Cash Value Whole policy: pro rata rule 1. Pereira – new/creative idea, long

of objectively reasonable basis of marriage 2. Term policy: last premium payment hours, modest salary – favors CP

= ½ Quasi-marital CP determines character a. SP = Value of business at marriage

D. Marriage by Estoppel - Both parties 3. CP Funded policy benefiting 3P: ½ + 10% annual simple interest

know they are not legally married but hold proceeds is CP b. CP = remainder

themselves out as a married—prevent I. Education Expenses– not CP (debt stays 2. Van Camp – capital investment, large

equitable injustice. with educated spouse), and subject to salary and bonuses – favors SP

E. Unmarried Cohabitants: K law applies reimbursement if funded with CP and a. CP = Value of labor at market rate

to treat as partnership/joint venture education enhanced earning capacity, – Family expenses paid from CP

(cannot be meretricious). Can either UNLESS: b. SP = remainder

expressly K into CP, or implied K based on 1. Community has already substantially 3. If value increases between end of

conduct. benefited (presumed if 10+ years since EC but before divorce, swap SP and

F. Domestic registered partners. graduation) CP, above.

2. Other spouse also received CP funded H. CP Funds Used to Improve SP

G. QCP = Property from non-CP state which education 1. Spouse uses CP to improve OWN SP =

would be CP if it were in a CP state. 3. Education reduced need for spousal No Gift reimbursement for greater of

1. Treated as: SP during marriage, CP for support cost of improvement or enhanced

creditors. IV. ACTIONS THAT ALTER THE value.

2. Divorce: QCP = CP = divided 50/50 CHARACTER OF PROPERTY? 2. Spouse uses C to improve OTHER

a. QCP Real Property: 50/50 SPOUSE'S SP: gift presumed, but may

A. In CA, parties may agree to opt out of

i. Offset with other CP to avoid have right to reimbursement (split in

SP and CP classifications for any or all

partition jdx - argue both)

assets/acquisitions (no consideration

3. Death of Acquiring spouse: QCP = CP 3. Spouse uses SP to improve CP:

required)

= divided 50/50 (personal ppty) a. Divorce Anti-Lucas– reimburse

B. Premarital Agreements

a. QCP Real Property: passes to for DIP

1. Reqs: (1) In writing and (2) Signed by

acquiring spouse by devise b/c no PJ b. Death Lucas – if title in joint &

both parties.

over him equal form, no reimb. unless proof

2. Exceptions: (1) Oral agmt fully

b. Remedy: If CP funds used to buy of agmt to reimburse

performed [marriage alone not

out-of-state property resulting or I. CP Funds Used to Pay Off Purchase

enough]; (2) detrimental reliance

constructive trust Price Owed on SP Acquired Before

[cannot K out of child support]

4. Death of Non-acquiring spouse: gets Marriage (MORTGAGE)

3. Defenses to enforcement:

no QCP if predeceases acquiring 1. CP gets pro rata ownership interest to

a. Involuntarily signed –

spouse. the extent it reduces principal debt (not

presumption of involuntary

H. Duration of Economic Community: interest, insurance, tax).

signature, unless:

From marriage until (1) Permanent 2. Principal debt reduction with

i. Represented by indie counsel

physical separation and (2) CP/Purchase price

(or waived counsel in writing

communicated and subjective intent not J. CP Funds Used to Pay Support

and informed of terms & effects

to resume marital relations. Payments from Previous Marriage –

in writing); and

1. Valuation: Assets valued at date of must reimburse current CP.

ii. Given 7+ days between advise

trial, unless good cause requires K. Transfer and Encumbrance – no spouse

to seek counsel and signing

otherwise. may transfer or encumber their ½ interest

date.

III. SOURCE b. Unconscionability (court in CP.

A. Source Rule: property takes the decides) re: 1. Exception: Family law attorney's real

character of the item used to acquire or i. Wavier of spousal support: property lien

produce it. provision unenforceable if (1) no V. STATUTORY PRESUMPTIONS?

B. Earnings: during marriage = CP; before representation by indie counsel; A. Community Presumption – all assets

or after marriage = SP. or (2) even w/indie counsel, acquired during marriage are

1. Good Will = Total value – Assets; CP if terms unconscionable when presumptively CP.

earned during marriage ENFORCED. B. Married Woman's Special

2. Stock Options – awarded and vested ii. Other provisions: provision Presumption

during marriage = CP. Awarded but not unenforceable if (1) no fair, 1. Pre-1975 presumption:

vested during marriage, look at intent reasonable and full disclosure of Pre-1975, title is Leads to

for giving stock option: party's property or financial taking using CP: Presumption

a. Reward past services: DOH – obligation (or waiver of such); that Property is:

DOD/DOH – DOE and (2) terms unconscionable In W's name alone W's SP

b. Retention: DOG – DOD/DOG – DOE when MADE.

3. Pension Benefits = #Years employed In W & H's name ½ W's SP & ½ CP

C. Transmutation - during marriage agmt

while married/#Year necessary for but not in JT form (TIC); upon

that changes the character of property

pension or “Husband & divorce

(evidence of transmutation in a will is not

a. Death of non-participant spouse: Wife” or “Mr. & W = 3/4

admissible in before-death proceedings)

interest terminates and interest not Mrs.” H = 1/4

1. Before 1985: oral agmts permitted

devisable In W's name + W and X are TIC

2. On or After January 1,1985: agmt must

b. Military Spouses get CP in military some 3P, X (presumption

be (1) in writing; (2) signed by

retirement applies)

adversely affected spouse; (3) expressly

c. Preemption: ERISA state change in ownership is being a. Irrebuttable presumption: if BFP

4. Disability/Workman's Comp: treated made. purchases property in reliance on

as wage replacement and classified a. Exception: Gifts of tangible Ws' title

according to when received, but if personal ppty (clothes, jewelry) + b. Rebuttable presumption: as

replaces pension CP not substantial in value between H & W (by showing no

5. Severance Pay – argue both wage D. Gifts Between Spouses intent to gift; no consent)

replacement (SP) and earned during EC 1. Writing + Donative intent + Delivery 2. On or After January 1, 1975: MWSP

(CP). of property (implied where spouse does not apply (although an inference

6. Federal Preemption: U.S. Savings purchases property in name of other of gift may be made)

Bonds (exception to “gifts to others” spouse or to pay community debt; but if C. Jointly Held Property Presumption

rule, supra) SP is for down payment on CP, no gift (Title lists both spouse’s name; N/A to

C. Personal Injury Damages presumed and there is entitlement to joint bank acct)

1. Tort recovery reimbursement) 1. Death of a Spouse [Lucas]: If title is

a. SP if other spouse is tortfeaser E. Gifts to Others – neither spouse can held in joint and equal form, there is a

b. CP if CoA arose during marriage make a gift of CP w/out other's consent presumption that any SP used to

(but upon divorce, goes to injured 1. Discovery during lifetime: restore gift acquire an asset was a gift, and

to CP estate deceased spouse has no SP interest and

COMMUNITY PROPERTY

no reimbursement claim, unless agmt c. 2+ child/issues = 1/3

proves contrary intent. 2. Testate – Each spouse is entitled to

2. Divorce or Legal Separation [Anti- dispose of all of their SP, and ½ of their

Lucas] CP

a. Note: Title doc required for Anti- a. Widow's Election Will: If deceased

Lucas. spouse tried to give away more than

b. Post-1984 Contributions of SP to his ½ CP in the will, surviving

acquire or improve CP is entitled to spouse may take:

reimbursement w/out interest for i. Under the will – allow the

contributions to DIP (Down- devise, and rest of will remains

payments, Improvements, Principal valid; or

payments on mortgage) ii. Against the will – not allow

c. Ownership: property acquired the devise and claim her ½ CP,

during marriage in joint & equal but relinquish all testamentary

form presumed CP absent express gifts in her favor.

statement in deed/instrument or 3. QCP

written agmt b/t parties that ppty is a. Acquiring spouse has testamentary

SP power over ½ CP, other ½ goes to

D. Fiduciary Duty Presumption (Conf. survivor

Relationship) b. Non-acquiring spouse has no

1. Presumption of undue influence if one testamentary power if he dies first –

spouse gains an advantage from a it all goes to acquiring spouse.

transaction with the other.

2. Grossly negligent/reckless investment

of CP is breach of spouse's fiduciary

duty to the other.

VI. MANAGEMENT AND CONTROL OF

CP DURING MARRIAGE?

A. General rule – Equal Management

Powers: each spouse has equal

management and control over CP, except

as below.

B. CP Personal Property – neither spouse

may make a gift without the other's

consent. Remedy: void and recover gift;

or ½ gift from donor or donee's estate.

C. CP Real Property – Joinder of both

spouses required.

1. BFP w/out notice of marriage: voidable

for 1 year

2. BFP w/notice of marriage: voidable

anytime

D. CP Business – CP; managing spouse can

act alone, but must give written notice to

other spouse for sale, lease or

encumbrance of substantially all business

property.

E. Debts [Q-CP = CP for Spousal K

debts] (creditor rts)

1. CP: can be reached for either S's

premarital & marital debts

a. Exception: earnings of non-debtor

spouse cannot be reached for

premarital debts if held in separate

account, no right to withdraw, and

not commingled w/CP

2. SP: non-debtor's SP cannot be reached

for satisfaction of debts, unless for

medical expenses (based on duty to

support, which continues until divorce);

non-debtor has right to reimbursement

for child support if debtor-spouse has

SP & didn’t use it

3. After Divorce: creditor may not reach

CP awarded to non-debtor spouse

unless court assigned the debt.

VII. DISPOSITION/DIVISION?

A. Distribution upon Divorce – Equal

Division Rule

1. Equal Division Rule: absent property

settlement agreement, each community

asset (and liability) must be divided

equally.

2. Exception: Economic Circumstances

(adjust CP accordingly to reach 50/50)

a. Family residence is awarded to

parent with custody [loss of home

would uproot kids]

b. Closely held corp. is awarded to

owner.

c. Pension is awarded to pensioner.

3. Exception: Statutory (one spouse ends

up with more than 50%)

a. Spouse misappropriated CP

b. Educational debts stay with

educated spouse

c. Personal injury award goes to

injured spouse, unless interest of

justice require otherwise

d. Tort liability incurred by 1 spouse

NOT based on activity for the

benefit of the community

e. "Negative Community" – if CP

liabilities exceed CP assets, each

spouse's relative ability to pay is

considered.

B. Distribution upon Death

1. Intestate – Survivor inherits ½ CP

(other ½ is already theirs) + Portion of

SP (depending on who else is surviving)

a. No heirs = 100%

b. 1 child/issue, parents/issue = 1/2

Das könnte Ihnen auch gefallen

- Ca Bar - Community PropertyDokument8 SeitenCa Bar - Community PropertyAlexandra DelatorreNoch keine Bewertungen

- Community Property OutlineDokument19 SeitenCommunity Property OutlineNeel VakhariaNoch keine Bewertungen

- Community Property - Checklist (1) Basic Presumptions (You MUST Put This at The Top of EVERY Community Property Essay)Dokument3 SeitenCommunity Property - Checklist (1) Basic Presumptions (You MUST Put This at The Top of EVERY Community Property Essay)Kat-Jean FisherNoch keine Bewertungen

- Final Contracts OutlineDokument29 SeitenFinal Contracts Outlineblondimofo100% (1)

- Essay Approach - Community PropertyDokument29 SeitenEssay Approach - Community PropertyDRNoch keine Bewertungen

- Stage Issue Rule Description Related Cases/Rules: Federal Rules of Civil Procedure Rules ChartDokument11 SeitenStage Issue Rule Description Related Cases/Rules: Federal Rules of Civil Procedure Rules ChartJo Ann TaylorNoch keine Bewertungen

- PMBR Contracts I PDFDokument52 SeitenPMBR Contracts I PDFno contractNoch keine Bewertungen

- MBE BN ContractsDokument64 SeitenMBE BN ContractsZviagin & CoNoch keine Bewertungen

- ONLY FRE Rules OutlineDokument25 SeitenONLY FRE Rules OutlineBilly Alvarenga Guzman100% (1)

- Exam Tip 2Dokument40 SeitenExam Tip 2nicole100% (1)

- Community Property Final Outline - ADDokument62 SeitenCommunity Property Final Outline - ADAlexandra DelatorreNoch keine Bewertungen

- Mbe FullDokument81 SeitenMbe FullgomathiNoch keine Bewertungen

- MBE Subject Matter OutlineDokument8 SeitenMBE Subject Matter OutlineSalam TekbaliNoch keine Bewertungen

- Bar Bri Crim Law Outline With NotesDokument9 SeitenBar Bri Crim Law Outline With NotesavaasiaNoch keine Bewertungen

- Partnership Law Attack SheetDokument1 SeitePartnership Law Attack SheetKylee ColwellNoch keine Bewertungen

- Civil Procedure Cheat Sheet: by ViaDokument3 SeitenCivil Procedure Cheat Sheet: by ViaMartin LaiNoch keine Bewertungen

- My Torts Outline QUICKSHEETDokument14 SeitenMy Torts Outline QUICKSHEETryguy1212Noch keine Bewertungen

- A Short Guide To Answering A Business Organizations Essay QuestionDokument5 SeitenA Short Guide To Answering A Business Organizations Essay QuestionIkram AliNoch keine Bewertungen

- Class 3: MC Practice Questions: Torts: To: de Cardenas, Gaston L.Dokument1 SeiteClass 3: MC Practice Questions: Torts: To: de Cardenas, Gaston L.Gaston Luis De Cardenas0% (1)

- Jason Conflicts of Laws OutlineDokument8 SeitenJason Conflicts of Laws OutlineSiddoNoch keine Bewertungen

- Wills Trusts BarDokument7 SeitenWills Trusts BarroruangNoch keine Bewertungen

- An Overview of Real PropertyDokument15 SeitenAn Overview of Real PropertyStacy OliveiraNoch keine Bewertungen

- Hearsay Exceptions-Unavailability Required Hearsay Exceptions - Availability ImmaterialDokument2 SeitenHearsay Exceptions-Unavailability Required Hearsay Exceptions - Availability ImmaterialNader100% (1)

- Crimlawchart BoldtDokument7 SeitenCrimlawchart Boldtsctsmn4444Noch keine Bewertungen

- Habit Describes Specific Conduct and Makes No Moral JudgmentDokument4 SeitenHabit Describes Specific Conduct and Makes No Moral JudgmentJohn CarelliNoch keine Bewertungen

- FINALEvidenceDokument78 SeitenFINALEvidencekashitampo0% (1)

- Mbe - Contracts and SalesDokument2 SeitenMbe - Contracts and SalesJenna AliaNoch keine Bewertungen

- Chart - ComparisonDokument9 SeitenChart - ComparisonCraig ThompsonNoch keine Bewertungen

- Barbri Property 2Dokument8 SeitenBarbri Property 2KortnyNoch keine Bewertungen

- MBE SM OutlineDokument8 SeitenMBE SM OutlineMegan McCormackNoch keine Bewertungen

- BarBri Wills II PDFDokument3 SeitenBarBri Wills II PDFno contractNoch keine Bewertungen

- MPT WorkshopDokument13 SeitenMPT WorkshopStacy OliveiraNoch keine Bewertungen

- Domestic Relations - OutlineDokument15 SeitenDomestic Relations - Outlinejsara1180Noch keine Bewertungen

- MBE TortsDokument8 SeitenMBE Tortstconn8276100% (2)

- Evidence OutlineDokument14 SeitenEvidence OutlineLivros juridicosNoch keine Bewertungen

- PMBR Flash Cards - Contracts - 2007Dokument142 SeitenPMBR Flash Cards - Contracts - 2007jackojidemasiadoNoch keine Bewertungen

- Civil Procedure SkeletonDokument8 SeitenCivil Procedure SkeletonTOny AwadallaNoch keine Bewertungen

- K 2 Bar OutliineDokument29 SeitenK 2 Bar OutliineACDCNoch keine Bewertungen

- Kaplan Notes HOMICDEDokument5 SeitenKaplan Notes HOMICDETimothy HuangNoch keine Bewertungen

- MBE QuickSheet TortsDokument13 SeitenMBE QuickSheet TortsCK DNoch keine Bewertungen

- THEMIS LSE - TORTS RawDokument73 SeitenTHEMIS LSE - TORTS RawKenyNoch keine Bewertungen

- Property Final OutlineDokument28 SeitenProperty Final OutlineshirleylawNoch keine Bewertungen

- Contracts Quicksheet ExercisesDokument17 SeitenContracts Quicksheet ExercisesZviagin & CoNoch keine Bewertungen

- Torts CA BAR Exam OutlineDokument17 SeitenTorts CA BAR Exam OutlinechrisngoxNoch keine Bewertungen

- Torts Weisberg 2018 OutlineDokument28 SeitenTorts Weisberg 2018 OutlineLeopold bloomNoch keine Bewertungen

- Criminal Law OutlineDokument5 SeitenCriminal Law OutlineThomas JeffersonNoch keine Bewertungen

- Torts MBE Workshop ReviewDokument4 SeitenTorts MBE Workshop ReviewSophia HepheastouNoch keine Bewertungen

- Civil Procedure Mentor OutlineDokument7 SeitenCivil Procedure Mentor OutlineLALANoch keine Bewertungen

- Barbri Lecture OutlinesDokument14 SeitenBarbri Lecture OutlinesElsa SchulzNoch keine Bewertungen

- Final Contracts OutlineDokument61 SeitenFinal Contracts OutlineGrant Burchfield100% (1)

- Bar Secrets: I. 3 Elements of All TortsDokument19 SeitenBar Secrets: I. 3 Elements of All Tortssdcohen23Noch keine Bewertungen

- Evicence Outline 1Dokument68 SeitenEvicence Outline 1krys10938Noch keine Bewertungen

- Bar Bri Outline IIIDokument186 SeitenBar Bri Outline IIITianna GadbawNoch keine Bewertungen

- 2011 Wills JohansonDokument26 Seiten2011 Wills JohansonNino GambiniNoch keine Bewertungen

- Rigos Bar Review Series "Uniform" Multistate Essay Exam (Mee) Review Family Law Magic Memory OutlinesDokument4 SeitenRigos Bar Review Series "Uniform" Multistate Essay Exam (Mee) Review Family Law Magic Memory Outlinessomeguy813Noch keine Bewertungen

- Property Cheat SheetDokument46 SeitenProperty Cheat SheetShawn AcostaNoch keine Bewertungen

- Attack Outline - Advanced TortsDokument18 SeitenAttack Outline - Advanced TortsKeiara PatherNoch keine Bewertungen

- Denise-Torts 2 PG OutlineDokument2 SeitenDenise-Torts 2 PG Outlinedrjf3Noch keine Bewertungen

- MPRE Unpacked: Professional Responsibility Explained & Applied for Multistate Professional Responsibility ExamVon EverandMPRE Unpacked: Professional Responsibility Explained & Applied for Multistate Professional Responsibility ExamNoch keine Bewertungen

- Passing the Bar Exam: A Step-by-Step Guide for California Bar Re-TakersVon EverandPassing the Bar Exam: A Step-by-Step Guide for California Bar Re-TakersNoch keine Bewertungen

- Essay Approach - CorporationsDokument23 SeitenEssay Approach - CorporationsDRNoch keine Bewertungen

- Finz (2004)Dokument850 SeitenFinz (2004)DR100% (5)

- 1 Winkler OutlinesDokument500 Seiten1 Winkler OutlinesDRNoch keine Bewertungen

- WillsDokument99 SeitenWillsDR100% (2)

- Torts BARBRIDokument157 SeitenTorts BARBRIDR100% (6)

- Evidence PDFDokument144 SeitenEvidence PDFDRNoch keine Bewertungen

- Criminal Law BARBRIDokument134 SeitenCriminal Law BARBRIDR75% (4)

- Real PropertyDokument212 SeitenReal PropertyChad Au100% (1)

- Criminal Procedure PDFDokument156 SeitenCriminal Procedure PDFDRNoch keine Bewertungen

- Constitutional Law BARBRIDokument214 SeitenConstitutional Law BARBRIDR100% (1)

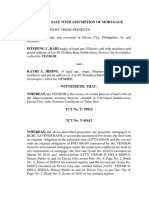

- Dos With Assumption of MortgageDokument3 SeitenDos With Assumption of MortgagejosefNoch keine Bewertungen

- NTPCDokument26 SeitenNTPCShradha LakhmaniNoch keine Bewertungen

- United Way Michigan ALICE ReportDokument250 SeitenUnited Way Michigan ALICE ReportWDET 101.9 FMNoch keine Bewertungen

- Department of Sales and Promotion Name Abdur Raffay Khan Submitted To Irfan NasirDokument2 SeitenDepartment of Sales and Promotion Name Abdur Raffay Khan Submitted To Irfan NasirZainNoch keine Bewertungen

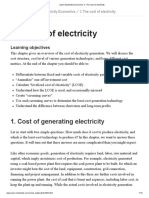

- Open Electricity Economics - 3. The Cost of Electricity PDFDokument13 SeitenOpen Electricity Economics - 3. The Cost of Electricity PDFfaheemshelotNoch keine Bewertungen

- Marketing Program - Product StrategyDokument43 SeitenMarketing Program - Product StrategybetsaidaNoch keine Bewertungen

- Victorinox Sak Katalog 2022Dokument186 SeitenVictorinox Sak Katalog 2022HeruNoch keine Bewertungen

- Business Analysis of NestleDokument39 SeitenBusiness Analysis of NestleFaiZan Mahmood100% (2)

- EFU LIFE PresentationDokument20 SeitenEFU LIFE PresentationZawar Afzal Khan0% (1)

- Org Management Week 10Dokument15 SeitenOrg Management Week 10Jade Lyn LopezNoch keine Bewertungen

- Depreciation Solution PDFDokument10 SeitenDepreciation Solution PDFDivya PunjabiNoch keine Bewertungen

- Agro IndustrializationDokument24 SeitenAgro IndustrializationDrasko PeracNoch keine Bewertungen

- New World Order A Cup of TeaDokument48 SeitenNew World Order A Cup of Teaapi-19972088100% (3)

- Evolution of Asian RegionalismDokument1 SeiteEvolution of Asian Regionalismaimee0dayaganonNoch keine Bewertungen

- Journal - Universal CreditDokument1 SeiteJournal - Universal CreditDaryl CableNoch keine Bewertungen

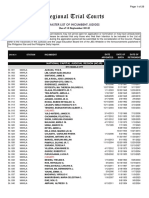

- Regional Trial Courts: Master List of Incumbent JudgesDokument26 SeitenRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaNoch keine Bewertungen

- TransactionSummary PDFDokument2 SeitenTransactionSummary PDFWenjie65Noch keine Bewertungen

- Inventory ProblemsDokument2 SeitenInventory ProblemsKhaja MohiddinNoch keine Bewertungen

- Samplepractice Exam 12 April 2017 Questions and AnswersDokument17 SeitenSamplepractice Exam 12 April 2017 Questions and AnswersMelody YayongNoch keine Bewertungen

- ODMP Inception Report Volume 1 (Of 2)Dokument134 SeitenODMP Inception Report Volume 1 (Of 2)Ase JohannessenNoch keine Bewertungen

- Contract I Reading ListDokument11 SeitenContract I Reading ListBUYONGA RONALDNoch keine Bewertungen

- Final OutputDokument44 SeitenFinal OutputJopie ArandaNoch keine Bewertungen

- Ca De-4Dokument4 SeitenCa De-4Kevin Marcos FelicianoNoch keine Bewertungen

- TCW MODULE Complete Version 2pdfdocxDokument188 SeitenTCW MODULE Complete Version 2pdfdocxReñer Aquino BystanderNoch keine Bewertungen

- Seychelles 2010 Article IV Consultation Staff Report IMFDokument91 SeitenSeychelles 2010 Article IV Consultation Staff Report IMFrunawayyyNoch keine Bewertungen

- FM Unit 2Dokument2 SeitenFM Unit 2Prabudh BansalNoch keine Bewertungen

- Chapter 1Dokument33 SeitenChapter 1projects_masterz100% (1)

- Cabinet Members 2020Dokument2 SeitenCabinet Members 2020AMNoch keine Bewertungen

- The Language of Report WritingDokument22 SeitenThe Language of Report WritingAgnes_A100% (1)

- Abc PDFDokument6 SeitenAbc PDFAnonymous leF4GPYNoch keine Bewertungen