Beruflich Dokumente

Kultur Dokumente

Rumus PTS

Hochgeladen von

Yosua PhoenCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Rumus PTS

Hochgeladen von

Yosua PhoenCopyright:

Verfügbare Formate

UNIVERSITAS ATMA JAYA YOGYAKARTA

Fakultas Ekonomika dan Bisnis

Jalan Babarsari No.43, Caturtunggal, Depok, Janti,Kabupaten Sleman,DIY – 55281

Telepon:(0274) 487711

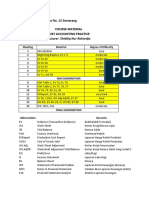

Asistensi #1 : Manajemen Keuangan

I. == Rasio Likuiditas ==

1) Current Ratio Aktiva lancar (kas,piutang dagang,persediaan) dan hutang lancer

(hutang dagang,hutang wesel,hutang gaji)

Rumus :

Current Assets CA

Current Ratio = =

Current Liabilities CL

2) Quick Ratio

Current Assets - Inventory

Quick Ratio = ; Inventory : persediaan

Current Liabilities

3) Cash Ratio

Cash

Cash Ratio =

Current Liabilities

4) Net Working Capital to Total Assets (NWC-TA)

NWC

NWC-TA = x 100 % utk mencari rasio

Total Assets

NWC = CA – CL

5) Interval Measure

Current Assets

Interval Measure =

Average daily operating cost

1|Yosua Phoen Yong Siang

II. == Rasio Aktivitas ==

1) Inventory Activity (Perputaran Persediaan)

COGS (Cost Of Good Sold) HPP (Harga Pokok Penjualan)

Inventory Activity = =

Inventory Persediaan

2) Total Assets Turnover (Perputaran Aktiva)

Sales Penjualan

TAT = =

Total Assets Total Aktiva

3) Day’s Sales in Inventory (Penjualan Inventaris)

365 days 365 hari

Penjualan Inventaris = =

Inventory turnover Perputaran Persediaan

4) Receivables turnover (Perputaran Piutang)

Sales Penjualan

RT = =

Account Receivables Persediaan

5) Day’s Sales in Receivables (Penjualan Piutang)

365 days 365 hari

Penjualan Piutang = =

Receivables turnover Perputaran Piutang

6) NWC Turnover

Sales Penjualan

NWC Turnover = =

NWC NWC

7) Fixed Assets Turnover (Perputaran Aset Tetap)

Sales

FAT =

Total Assets

2|Yosua Phoen Yong Siang

III. == Rasio Solvabilitas ==

1) Total Debt Ratio co ekuitas : modal,pendapatan,prive,beban2

Total Debt Total Assets - Total Equity Total Aset - Total Ekuitas TA - TE

TBR = = = =

Total Assets Total Assets Total Aset TA

2) Debt-Equity Ratio

Total Debt Total Likuiditas (total hutang) TL

DER = = =

Total Equity Total Ekuitas TE

3) Equity Multiplier

Total Assets TA

EM = =

Total Equity TE

4) LTD (Long-Term Debt) Ratio

LTD LTD Utang jk panjang

LTD Ratio = = ; LTD =

LTD + total equity LTD + TE Modal

5) Time Interest Earned Ratio

EBIT Pendapatan sblm bunga & pajak

TIE Ratio = =

Interest bunga

6) Cash Coverage Ratio

EBIT + Depreciation EBIT + depresiasi

CC Ratio = =

Interest bunga

3|Yosua Phoen Yong Siang

IV. == Rasio Profitabilitas ==

1) Profit Margin

Nett Income Pendpt bersih NI

PM = = =

Sales Penjualan Sales

2) ROA (Return On Assets)

Nett Income NI

ROA = =

Total Assets TA

3) ROE (Return On Equity)

Nett Income NI

ROE = =

Total Equity TE

4) ROI (Return On Investment)

Penjualan - Investasi

ROI = x 100 %

Investasi

V. == Rasio Pasar ==

1) Price Earnings Ratio

Price Per Share Harga per saham

PER = =

Earning Per Share Penghasilan per saham

2) Market to Book ratio

Market value per share Nilai Pasar

MB Ratio = =

Book value per share Nilai buku per saham

Total Ekuitas

BVPS =

Jumlh saham yg beredar

4|Yosua Phoen Yong Siang

Langkah2 melihat laporan keuangan : Utk romawi V :

1. Buka idx.co.id 1) Buka finance.yahoo.co.id

2. Klik perusahaan tercatat 2) Tuliskan nama

3. Pilih laporan keuangan perusahaan.nama kota

4. Pilih saham (UNVR.JK) pakai tanda titik

5. Masukan kode saham ( Unilever = UNVR) stlh nama perusahaan

6. Pilih tahun

7. Pilih financial steatment / sama dengan

8. Period = tahunan

9. Lihat EBIT = laba sblm bunga,pajak,.....

********DEUS PROVIDEBIT********

Asistensi #2 : Manajemen Keuangan

5|Yosua Phoen Yong Siang

Asistensi #3 : Manajemen Keuangan

RUMUS :

1. Plowback Ratio (b) 1 – Divident Payment Ratio

2. Internal Growth Rate

ROA x b

1 - ROA x b

3. ROE Profit Margin x Total Asset Turnover x Equity Multiplier

NI Sales Total Asset

x x

Sales TotalAsset Total Equity

4. Sustaninable Growth Rate

ROE x b

1 - ROE x b

5. Divident Payment Ratio Cash Divident

Net Income

6. Future Value PV x (1 + r)t

7. Present Value FV

(1 + r)t

6|Yosua Phoen Yong Siang

Asistensi #4 : Manajemen Keuangan

RUMUS :

1

1. PV Annuity 1-

(1+r)t

C×[ ]

r

2. FV Annuity

(1+r)𝑡 - 1

C×[ ]

r

3. EAR Quoted Rate m

[1+ ] -1

m

4. Bound Value [1−

1

]

(1+𝑟)𝑡 𝐹

C× +

𝑟 (1+𝑟)𝑡

Keterangan :

C = Coupun Rate

R = Rate per period

t = Number of Period

F = Fare value

7|Yosua Phoen Yong Siang

Das könnte Ihnen auch gefallen

- Kementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisDokument2 SeitenKementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisAntique NariswariNoch keine Bewertungen

- Classification and Measurement of Financial AssetsDokument2 SeitenClassification and Measurement of Financial AssetsRahmat DarmawanNoch keine Bewertungen

- Cash and Liquidity Denitto Giantoro - 20.0102.0071Dokument10 SeitenCash and Liquidity Denitto Giantoro - 20.0102.0071Denitto Giantoro100% (2)

- Tugas: English For Accounting (SESSION 12)Dokument4 SeitenTugas: English For Accounting (SESSION 12)Muh Insanul KamilNoch keine Bewertungen

- Bab 1 Managerial Accounting: An OverviewDokument18 SeitenBab 1 Managerial Accounting: An Overviewedhi asmiranthoNoch keine Bewertungen

- Cara Menghitung Eva: Summary of Financial Statement 31 December 2006 (Million Rupiah)Dokument4 SeitenCara Menghitung Eva: Summary of Financial Statement 31 December 2006 (Million Rupiah)Kusma WennyNoch keine Bewertungen

- K Pvif: Tabel PV Dari RP 1 Pada Akhir Periode Ke-N (Tabel Pvif)Dokument4 SeitenK Pvif: Tabel PV Dari RP 1 Pada Akhir Periode Ke-N (Tabel Pvif)Valentina AlenNoch keine Bewertungen

- Surya Toto Indonesia - Lap Keu - 31 - Des - 2018 - ReleasedDokument99 SeitenSurya Toto Indonesia - Lap Keu - 31 - Des - 2018 - ReleasedAyu SeptiasariNoch keine Bewertungen

- Exercise 1: Nama: Irfan Sebastian NPM: C00200027Dokument4 SeitenExercise 1: Nama: Irfan Sebastian NPM: C00200027Emmanuella GrachiaNoch keine Bewertungen

- Indonesian Accounting Class Discussion on Solving Accounting Challenge ProblemsDokument34 SeitenIndonesian Accounting Class Discussion on Solving Accounting Challenge Problemssuci monalia putriNoch keine Bewertungen

- E3-5 (LO 3) Adjusting Entries: InstructionsDokument6 SeitenE3-5 (LO 3) Adjusting Entries: InstructionsAntonios Fahed0% (1)

- Efficiency of Employee Recruitment Through Online and Conventional MediaDokument10 SeitenEfficiency of Employee Recruitment Through Online and Conventional MediaSt NurulNoch keine Bewertungen

- Corporations: Organization and Capital Stock Transactions ProblemsDokument2 SeitenCorporations: Organization and Capital Stock Transactions ProblemsvivienNoch keine Bewertungen

- Best Choice Towing Brothers Earn Over $100KDokument3 SeitenBest Choice Towing Brothers Earn Over $100KJimmy Ramirez GiraldoNoch keine Bewertungen

- Nur Haliza Daeng Besse - Inventory Dan Aktiva TetapDokument28 SeitenNur Haliza Daeng Besse - Inventory Dan Aktiva TetapNurhaliza DaengNoch keine Bewertungen

- Briggs Manufacturing Quarterly Budget ReportDokument8 SeitenBriggs Manufacturing Quarterly Budget ReportChika Slalubahagia SlamanyaNoch keine Bewertungen

- Unit 7Dokument12 SeitenUnit 7ALEXANDRA VACANoch keine Bewertungen

- Soal 1: 1. Computed Equivalent Unit For Production CostDokument10 SeitenSoal 1: 1. Computed Equivalent Unit For Production CostRaihan Rohadatul 'AisyNoch keine Bewertungen

- Akm P21-1, P21-2Dokument5 SeitenAkm P21-1, P21-2nandya rizkyNoch keine Bewertungen

- Latihan Soal Analysis of Financial StatementDokument7 SeitenLatihan Soal Analysis of Financial StatementCaroline H24Noch keine Bewertungen

- Economic ActivityDokument3 SeitenEconomic ActivityDewiamillinaqsNoch keine Bewertungen

- CADokument30 SeitenCAZulfa Aulia Nurul PutriNoch keine Bewertungen

- PT. Bintang Makmur invoice for Anugerah, Toko BukuDokument3 SeitenPT. Bintang Makmur invoice for Anugerah, Toko Bukubahrumjaji100% (1)

- PT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYADokument3 SeitenPT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYARama fauziNoch keine Bewertungen

- Business English Assignment Seeks to Improve TeachingDokument12 SeitenBusiness English Assignment Seeks to Improve TeachingInas Afifah ZahraNoch keine Bewertungen

- Long-Term Financial Planning and Growth: Mcgraw-Hill/IrwinDokument25 SeitenLong-Term Financial Planning and Growth: Mcgraw-Hill/Irwinkota lainNoch keine Bewertungen

- All Values in The Economic System Are Measured in Terms of MoneyDokument2 SeitenAll Values in The Economic System Are Measured in Terms of MoneyYayank Emilia Darma100% (2)

- PT Semen Gresik's Supply Chain AnalysisDokument8 SeitenPT Semen Gresik's Supply Chain Analysisasfrnfarid100% (1)

- Trial Balance Adjustments Account Titles DR KR DR KR: Firdaus Company Worksheet For The Ended Period August 31, 2016Dokument8 SeitenTrial Balance Adjustments Account Titles DR KR DR KR: Firdaus Company Worksheet For The Ended Period August 31, 2016Marsa ArrahmanNoch keine Bewertungen

- CONVERSATION: Vegetable Shopping TripDokument3 SeitenCONVERSATION: Vegetable Shopping TripYelfi Dwi AnahyuNoch keine Bewertungen

- Akbif - Latihan Soal - Kelompok 4-1Dokument16 SeitenAkbif - Latihan Soal - Kelompok 4-1amelia0% (1)

- E7 11Dokument2 SeitenE7 11-kuro Yuki-Noch keine Bewertungen

- Soal UTS GANJIL 2018-2019 B'Rita FathiahDokument5 SeitenSoal UTS GANJIL 2018-2019 B'Rita FathiahDaeng Buana SaputraNoch keine Bewertungen

- Akuntansi Biaya FOHDokument21 SeitenAkuntansi Biaya FOHSilvia RamadhaniNoch keine Bewertungen

- Tugas AkbiDokument44 SeitenTugas AkbiLafidan Rizata FebiolaNoch keine Bewertungen

- Jawaban Kuis Uph Debt InvestmentDokument3 SeitenJawaban Kuis Uph Debt InvestmentSagita RajagukgukNoch keine Bewertungen

- PrakbiDokument195 SeitenPrakbiTheresia TjiaNoch keine Bewertungen

- Book Ak Bi P-11 Contoh Soal Joint Cost Physical Method + JawabanDokument2 SeitenBook Ak Bi P-11 Contoh Soal Joint Cost Physical Method + JawabanRynaldo xf100% (1)

- Session 17Dokument23 SeitenSession 17Serena KassabNoch keine Bewertungen

- Chapter 21 Latihan SoalDokument10 SeitenChapter 21 Latihan SoalJulyaniNoch keine Bewertungen

- FIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFDokument6 SeitenFIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFAdindaNoch keine Bewertungen

- Uas AKMDokument14 SeitenUas AKMThorieq Mulya MiladyNoch keine Bewertungen

- Table PvifDokument10 SeitenTable PviftinaNoch keine Bewertungen

- Activity-And Strategy-Based Responsibility AccountingDokument57 SeitenActivity-And Strategy-Based Responsibility AccountingMuhammad Rusydi AzizNoch keine Bewertungen

- Financial Statements SummaryDokument27 SeitenFinancial Statements SummaryRina KusumaNoch keine Bewertungen

- Tugas AEB 1Dokument6 SeitenTugas AEB 1Dhimas Wachid Nur SaputraNoch keine Bewertungen

- Correcting Grammar and Choosing AnswersDokument8 SeitenCorrecting Grammar and Choosing AnswersAdelJH TampubolonNoch keine Bewertungen

- Bab 8 Costing by Product and Joint ProductDokument5 SeitenBab 8 Costing by Product and Joint ProductAntonius Sugi Suhartono100% (1)

- Akuntansi DagangDokument13 SeitenAkuntansi DagangAsmarani SiregarNoch keine Bewertungen

- Accounting CommunityDokument20 SeitenAccounting Communitywhyme_bNoch keine Bewertungen

- Accounting for Pensions and Postretirement Benefits ExpenseDokument3 SeitenAccounting for Pensions and Postretirement Benefits ExpensedwitaNoch keine Bewertungen

- Tugas Uts (Irmawati Datu Manik) 176602083Dokument39 SeitenTugas Uts (Irmawati Datu Manik) 176602083Klopo KlepoNoch keine Bewertungen

- Daftar Sponsorship Lembaga Bimbingan Belajar di SurabayaDokument2 SeitenDaftar Sponsorship Lembaga Bimbingan Belajar di SurabayaOscar LeeNoch keine Bewertungen

- Silvia Apiati Bahasa Inggris BisnisDokument9 SeitenSilvia Apiati Bahasa Inggris BisnisGenie FmNoch keine Bewertungen

- Bab 8 by ProductDokument5 SeitenBab 8 by ProductSilvani Margaretha SimangunsongNoch keine Bewertungen

- Activity 2Dokument7 SeitenActivity 2Mae FerrerNoch keine Bewertungen

- Manufacturing Company Account Names and CodesDokument1 SeiteManufacturing Company Account Names and CodesBiomaraja NusantaraNoch keine Bewertungen

- Rangkuman Rumus Analisis RasioDokument3 SeitenRangkuman Rumus Analisis Rasiomuloko dmn93Noch keine Bewertungen

- AFS - FormulasDokument2 SeitenAFS - FormulasWaqar AhmadNoch keine Bewertungen

- Session 13 Ratio AnalysisDokument17 SeitenSession 13 Ratio AnalysisVivi VianNoch keine Bewertungen

- Hampton Machine Tool CompanyDokument6 SeitenHampton Machine Tool CompanyClaudia Torres50% (2)

- Intermediate Financial Accounting I: Intangible AssetsDokument46 SeitenIntermediate Financial Accounting I: Intangible Assetsmukesh00888Noch keine Bewertungen

- Unit 2 Financial Statement AnalysisDokument17 SeitenUnit 2 Financial Statement AnalysisalemayehuNoch keine Bewertungen

- Accounting for PPE under IAS 16Dokument7 SeitenAccounting for PPE under IAS 16Phebieon MukwenhaNoch keine Bewertungen

- Fin 621Dokument3 SeitenFin 621animations482047Noch keine Bewertungen

- Chapter 14 Other SolutionDokument18 SeitenChapter 14 Other SolutionChristine BaguioNoch keine Bewertungen

- Sample Paper 14 CBSE Accountancy Class 12: Install NODIA App To See The Solutions. Click Here To InstallDokument45 SeitenSample Paper 14 CBSE Accountancy Class 12: Install NODIA App To See The Solutions. Click Here To Installumangsingh054Noch keine Bewertungen

- Depreciation at DeltaDokument111 SeitenDepreciation at DeltaYash Pal Singh100% (2)

- Adjusting Entries for Home Office and Branch BooksDokument4 SeitenAdjusting Entries for Home Office and Branch BooksMarcoNoch keine Bewertungen

- FASB's Major Changes to Accounting for Business CombinationsDokument42 SeitenFASB's Major Changes to Accounting for Business Combinationsmohamed eliwaNoch keine Bewertungen

- Intangible Investments, Scaling, and The Trend in The Accrual-Cash Flow AssociationDokument69 SeitenIntangible Investments, Scaling, and The Trend in The Accrual-Cash Flow AssociationKári FinnssonNoch keine Bewertungen

- Ipcc Capsule PDFDokument189 SeitenIpcc Capsule PDFnikita kambliNoch keine Bewertungen

- Chapter 15 DayagDokument5 SeitenChapter 15 DayagMel ChuaNoch keine Bewertungen

- Shareholders' Equity SectionDokument30 SeitenShareholders' Equity SectionAlly DeanNoch keine Bewertungen

- Stockholders' Equity Accounts With Normal BalancesDokument3 SeitenStockholders' Equity Accounts With Normal BalancesMary67% (3)

- ABM Module DDokument4 SeitenABM Module Daakash1004Noch keine Bewertungen

- Accounting For Income Tax-Report ScriptDokument6 SeitenAccounting For Income Tax-Report ScriptJeane Mae BooNoch keine Bewertungen

- Lois Bell Interior Design November Financial StatementsDokument2 SeitenLois Bell Interior Design November Financial StatementsshigekaNoch keine Bewertungen

- CH4 MinicaseDokument4 SeitenCH4 Minicasemervin coquillaNoch keine Bewertungen

- Financial and Managerial AccountingDokument1 SeiteFinancial and Managerial Accountingcons theNoch keine Bewertungen

- Mid-Term Assignment: Company: Hoa Binh Construction (HBC) Item: Accounts ReceivableDokument9 SeitenMid-Term Assignment: Company: Hoa Binh Construction (HBC) Item: Accounts ReceivableANoch keine Bewertungen

- On January 1 2017 Holland Corporation Paid 8 Per ShareDokument1 SeiteOn January 1 2017 Holland Corporation Paid 8 Per ShareAmit PandeyNoch keine Bewertungen

- S6 E Working FinalDokument9 SeitenS6 E Working FinalROHIT PANDEYNoch keine Bewertungen

- ACC5116 - Module 1Dokument6 SeitenACC5116 - Module 1Carl Dhaniel Garcia SalenNoch keine Bewertungen

- Financial Accounting (Bbaw2103)Dokument10 SeitenFinancial Accounting (Bbaw2103)tachaini2727Noch keine Bewertungen

- PP For Chapter 2 - Analyzing Transactions - FinalDokument49 SeitenPP For Chapter 2 - Analyzing Transactions - FinalSozia TanNoch keine Bewertungen

- Visa Vertical and Horizontal Analysis ExampleDokument9 SeitenVisa Vertical and Horizontal Analysis Examplechad salcidoNoch keine Bewertungen

- Engineering Economics and Accountancy - JNTUH-EEA-Unit-IVDokument31 SeitenEngineering Economics and Accountancy - JNTUH-EEA-Unit-IVDr Gampala PrabhakarNoch keine Bewertungen

- UST AMV ACC 4 QUIZ 1 INVESTMENT EQUITY SECURITIESDokument9 SeitenUST AMV ACC 4 QUIZ 1 INVESTMENT EQUITY SECURITIESMildred Angela DingalNoch keine Bewertungen

- Doing Financial ProjectionsDokument6 SeitenDoing Financial ProjectionsJitendra Nagvekar50% (2)