Beruflich Dokumente

Kultur Dokumente

EFM Simple DCF Model 4

Hochgeladen von

Anonymous xv5fUs4AvCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

EFM Simple DCF Model 4

Hochgeladen von

Anonymous xv5fUs4AvCopyright:

Verfügbare Formate

Company Valuation

Financial Model Template

Project name

DCF Model

Last updated

May 17th, 2018

Powered by

www.efinancialmodels.com

Disclaimer: eFinancialModels.com provides the template as is and assumes no liability for any eventual

mistakes within the model nor ommissions of it. All eventual data erves as example only and cannot be

relied upon. Each template needs to be adjusted for the individual project and customized by the user. The

user is self responsible to thoroughly review and adjust the model. However eFinancialModels.com

appreciates your feedback.

Confidential

Confidential 1/3 10/04/2019

DCF Model May 17th, 2018

Confidential

Abbreviations

A Actual figure

CAPEX Capital Expenditures

COGS Cost of goods sold

DCF Discounted Free Cash Flows

D&A Depreciation & Amortization

EBIT Earnings before interest and taxes

EBITDA Earnings before interest, taxes, depreciation and amortization

EV Enteprise Value

F Forecasted figure

NPV Net Present Value

OPEX Operating costs

P/B Price to Book Ratio

P/E Price Earnings Ratio

ROE Return on Equity

ROIC Return on Invested Capital

t Tax rate %

TV Terminal Value

USD United States Dollar

Powered by

www.efinancialmodels.com

Confidential 2/3 10/04/2019

DCF Model May 17th, 2018

Confidential

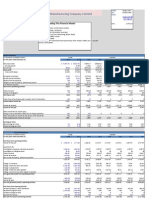

All amounts in USD

DCF Valuation 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

TV EV/EBITDA Muliple % 5.0x

WACC % 12.0%

Discounted Free Cash Flow Analysis (DCF)

EBIT USD 701,667 673,167 932,658 825,458 695,231

Adjusted Tax (1-t) USD (175,417) (168,292) (233,165) (206,364) (173,808)

Addback D&A USD 153,333 183,333 216,667 243,333 400,000

Change in NWC USD (357,534) (55,377) (58,146) (61,053) (64,105)

CAPEX USD (450,000) (500,000) (400,000) (500,000) (400,000)

Subtotal USD (127,951) 132,832 458,015 301,374 457,318

Terminal Value USD 5,476,154

Free Cash Flow to Firm (FCFF) USD (127,951) 132,832 458,015 301,374 5,933,472

Discounting Period Years 1.00 1.00 1.00 1.00 1.00

Discount Factor x 0.89 0.80 0.71 0.64 0.57

Discounted Free Cash Flows USD (114,242) 105,893 326,006 191,529 3,366,811

Net Present Value USD 3,875,996

Enterprise Value USD 3,875,996

Cash USD 679,500

Financial Debt USD (3,500,000)

Equity Value USD 1,055,496

Implied Multiples

EV/EBITDA x 4.7x

PE x 2.0x

P/B x 4.6x

All amounts in USD

Valuation Considerations

Enterprise Value USD 3,875,996 Free Cash Flow to Firm (FCFF)

Cash USD 679,500 7,000,000

Financial Debt USD (3,500,000) 6,000,000

Equity Value USD 1,055,496

5,000,000

Implied Multiples 4,000,000

EV/EBITDA x 4.7x 3,000,000

PE x 2.0x

2,000,000

P/B x 4.6x

1,000,000

Model Check 0

Balance Sheet Y 0 2018 A 2019 A 2020 A 2021 A 2022 A

-1,000,000

All amounts in USD

Assumptions

General Assumptions

Currency USD

First Forecast Year Year 2019

Interest rate % 4%

Tax rate % 25%

Days Receivables Days Sales 60

Days Inventory Days COGS 70

Days Payables Days COGS 45

All amounts in USD

Financial Overview

USD

Revenues EBITDA %

8,000,000 25.0%

7,000,000

20.0%

6,000,000

5,000,000 15.0%

4,000,000

3,000,000 10.0%

2,000,000

5.0%

1,000,000

0 0.0%

2016 A 2017 A 2018 A 2019 A 2020 A 2021 A 2022 A 2023 A

All amounts in USD

Income Statement Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

Revenues USD 3,800,000 4,500,000 5,000,000 5,500,000 5,775,000 6,063,750 6,366,938 6,685,284

Growth 18% 11% 10% 5% 5% 5% 5%

COGS USD (1,800,000) (2,500,000) (2,600,000) (2,970,000) (3,118,500) (3,274,425) (3,438,146) (3,610,054)

Gross Margin USD 2,000,000 2,000,000 2,400,000 2,530,000 2,656,500 2,789,325 2,928,791 3,075,231

% % 52.6% 44.4% 48.0% 46.0% 46.0% 46.0% 46.0% 46.0%

Sales & Marketing USD (290,000) (330,000) (450,000) (459,000) (500,000) (600,000) (600,000) (690,000)

General & Admin USD (300,000) (350,000) (800,000) (816,000) (900,000) (600,000) (800,000) (850,000)

Other operating expenses USD (600,000) (330,000) (330,000) (400,000) (400,000) (440,000) (460,000) (440,000)

OPEX USD (1,190,000) (1,010,000) (1,580,000) (1,675,000) (1,800,000) (1,640,000) (1,860,000) (1,980,000)

EBITDA USD 810,000 990,000 820,000 855,000 856,500 1,149,325 1,068,791 1,095,231

% % 21.3% 22.0% 16.4% 15.5% 14.8% 19.0% 16.8% 16.4%

Depreciation & Amortization USD (200,000) (200,000) (220,000) (153,333) (183,333) (216,667) (243,333) (400,000)

EBIT USD 610,000 790,000 600,000 701,667 673,167 932,658 825,458 695,231

% % 16.1% 17.6% 12.0% 12.8% 11.7% 15.4% 13.0% 10.4%

Interest payment USD (13,333) (40,000) (48,000) (138,000) (132,000) (124,000) (116,000) (108,000)

Interest rate % 4.0% 4.0% 4.0% 4.0% 4.0%

EBT USD 596,667 750,000 552,000 563,667 541,167 808,658 709,458 587,231

% % 15.7% 16.7% 11.0% 10.2% 9.4% 13.3% 11.1% 8.8%

Tax rate % 10% 8% 5% 25% 25% 25% 25% 25%

Taxes paid USD (60,000) (62,500) (30,000) (140,917) (135,292) (202,165) (177,364) (146,808)

Net Income USD 536,667 687,500 522,000 422,750 405,875 606,494 532,093 440,423

% % 14.1% 15.3% 10.4% 7.7% 7.0% 10.0% 8.4% 6.6%

All amounts in USD

Balance Sheet Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

Cash USD 200,000 937,500 679,500 348,049 181,881 346,896 361,270 537,587

Receivables USD 600,000 550,000 600,000 904,110 949,315 996,781 1,046,620 1,098,951

Inventory USD 450,000 550,000 600,000 569,589 598,068 627,972 659,371 692,339

Fixed Assets USD 1,900,000 2,000,000 2,300,000 2,596,667 2,913,333 3,096,667 3,353,333 3,353,333

Total Assets USD 3,150,000 4,037,500 4,179,500 4,418,414 4,642,598 5,068,315 5,420,593 5,682,210

Payables USD 230,000 330,000 450,000 366,164 384,473 403,696 423,881 445,075

Financial debt USD 3,900,000 4,000,000 3,500,000 3,400,000 3,200,000 3,000,000 2,800,000 2,600,000

Equity USD (980,000) (292,500) 229,500 652,250 1,058,125 1,664,619 2,196,712 2,637,135

Liabilities & Shareholder's Equity USD 3,150,000 4,037,500 4,179,500 4,418,414 4,642,598 5,068,315 5,420,593 5,682,210

Check 0 0 0 0 0 0 0 0

All amounts in USD

Cash Flow Statement Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

Cash Flow from Operations (CFO)

Net income USD NA 687,500 522,000 422,750 405,875 606,494 532,093 440,423

Addback interest USD NA 40,000 48,000 138,000 132,000 124,000 116,000 108,000

Addback D&A USD NA 200,000 220,000 153,333 183,333 216,667 243,333 400,000

Change in receivables USD NA 50,000 (50,000) (304,110) (45,205) (47,466) (49,839) (52,331)

Change in inventory USD NA (100,000) (50,000) 30,411 (28,479) (29,903) (31,399) (32,969)

Change in payables USD NA 100,000 120,000 (83,836) 18,308 19,224 20,185 21,194

CFO USD NA 977,500 810,000 356,549 665,832 889,015 830,374 884,318

Investing Cash Flow (CFI)

CAPEX USD (300,000) (520,000) (450,000) (500,000) (400,000) (500,000) (400,000)

CFI USD (300,000) (520,000) (450,000) (500,000) (400,000) (500,000) (400,000)

Cash Flow from Financing

Change in Financial debt USD 100,000 (500,000) (100,000) (200,000) (200,000) (200,000) (200,000)

Interest charges USD (40,000) (48,000) (138,000) (132,000) (124,000) (116,000) (108,000)

Equity financing USD 0 0 0 0 0 0 0

Dividends USD 0 0 0 0 0 0 0

CFI USD 60,000 (548,000) (238,000) (332,000) (324,000) (316,000) (308,000)

Change in Cash USD 737,500 (258,000) (331,451) (166,168) 165,015 14,374 176,318

Cash beginning USD 200,000 937,500 679,500 348,049 181,881 346,896 361,270

Cash end of month USD 937,500 679,500 348,049 181,881 346,896 361,270 537,587

All amounts in USD

Key Financial Ratios Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

Financial Debt / EBITDA x 4.8x 4.0x 4.3x 4.0x 3.7x 2.6x 2.6x 2.4x

Debt Service Coverage x NA NA NA -0.5x 0.4x 1.4x 1.0x 19.3x

EBIT/Interest x 45.8x 19.8x 12.5x 5.1x 5.1x 7.5x 7.1x 6.4x

Current Ratio x 5.4x 6.2x 4.2x 5.0x 4.5x 4.9x 4.9x 5.2x

Days Receivables Days Sales 58 45 44 60 60 60 60 60

Days Inventory Days COGS 91 80 84 70 70 70 70 70

Days Payables Days COGS 47 48 63 45 45 45 45 45

EBITDA Margin % 21.3% 22.0% 16.4% 15.5% 14.8% 19.0% 16.8% 16.4%

Revenue growth % NA 18.4% 11.1% 10.0% 5.0% 5.0% 5.0% 5.0%

ROIC % NA NA NA 15.6% 13.0% 16.7% 13.8% 11.2%

ROE % -54.8% -108.1% -1657.1% 95.9% 47.5% 44.6% 27.6% 18.2%

Revenues/Assets x 1.2x 1.1x 1.2x 1.2x 1.2x 1.2x 1.2x 1.2x

Invested Capital USD 2,720,000 2,770,000 3,050,000 3,704,201 4,076,244 4,317,723 4,635,443 4,699,548

All amounts in USD

Tangible Fixed Assets Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

CAPEX USD NA 300,000 520,000 450,000 500,000 400,000 500,000 400,000

Fixed Assets (Gross) USD 2,300,000 2,750,000 3,250,000 3,650,000 4,150,000 4,550,000

Depreciation period Years 15

Depreciation

2018 A 2,300,000 153,333 153,333 153,333 153,333 153,333

2019 F 450,000 30,000 30,000 30,000 30,000

2020 F 500,000 33,333 33,333 33,333

2021 F 400,000 26,667 26,667

2022 F 500,000 33,333

Depreciation USD 153,333 183,333 216,667 243,333 400,000

Accumulated depreciation USD 0 153,333 336,667 553,333 796,667 1,196,667

Fixed Assets (Net) USD 2,300,000 2,596,667 2,913,333 3,096,667 3,353,333 3,353,333

Powered by

www.efinancialmodels.com

Confidential 3 / 10/04/2019 10/04/2019

Das könnte Ihnen auch gefallen

- Valuation Model - Comps, Precedents, DCF, Football Field - BlankDokument10 SeitenValuation Model - Comps, Precedents, DCF, Football Field - BlankNmaNoch keine Bewertungen

- Financial Modelling For Startups Excel-TemplateDokument4 SeitenFinancial Modelling For Startups Excel-TemplateLorenaNoch keine Bewertungen

- Merger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationDokument49 SeitenMerger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationGugaNoch keine Bewertungen

- JPM Proforma & Valuation Work - 2.20.16Dokument59 SeitenJPM Proforma & Valuation Work - 2.20.16bobo411Noch keine Bewertungen

- Apple Model - FinalDokument32 SeitenApple Model - FinalDang TrangNoch keine Bewertungen

- BpmToolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)Dokument66 SeitenBpmToolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)kunjan2165Noch keine Bewertungen

- Business - Valuation - Modeling - Assessment FileDokument6 SeitenBusiness - Valuation - Modeling - Assessment FileGowtham VananNoch keine Bewertungen

- Valuation Cash Flow A Teaching NoteDokument5 SeitenValuation Cash Flow A Teaching NotesarahmohanNoch keine Bewertungen

- Discounted Cash FlowDokument43 SeitenDiscounted Cash Flowsachin_ma09Noch keine Bewertungen

- 06 06 Football Field Walmart Model Valuation BeforeDokument47 Seiten06 06 Football Field Walmart Model Valuation BeforeIndrama Purba0% (1)

- Assignment ..Dokument5 SeitenAssignment ..Mohd Saddam Saqlaini100% (1)

- Football Field Chart Template: Strictly ConfidentialDokument3 SeitenFootball Field Chart Template: Strictly ConfidentialDebanjan MukherjeeNoch keine Bewertungen

- DCF Valuation-BDokument11 SeitenDCF Valuation-BElsaNoch keine Bewertungen

- 3 Statement Model: Strictly ConfidentialDokument13 Seiten3 Statement Model: Strictly ConfidentialLalit mohan PradhanNoch keine Bewertungen

- Basic Rental Analysis WorksheetDokument8 SeitenBasic Rental Analysis WorksheetGleb petukhovNoch keine Bewertungen

- Discount Factor TemplateDokument5 SeitenDiscount Factor TemplateRashan Jida ReshanNoch keine Bewertungen

- Valuation of A FirmDokument13 SeitenValuation of A FirmAshish RanjanNoch keine Bewertungen

- NYSF Practice TemplateDokument22 SeitenNYSF Practice TemplaterapsjadeNoch keine Bewertungen

- Tesla FinModelDokument58 SeitenTesla FinModelPrabhdeep DadyalNoch keine Bewertungen

- Project Finance Training Model SampleDokument282 SeitenProject Finance Training Model SampleKumar SinghNoch keine Bewertungen

- Equity Beta and Asset Beta Conversion Template: Strictly ConfidentialDokument3 SeitenEquity Beta and Asset Beta Conversion Template: Strictly ConfidentialLalit KheskwaniNoch keine Bewertungen

- Habib Bank Limited - Financial ModelDokument69 SeitenHabib Bank Limited - Financial Modelmjibran_1Noch keine Bewertungen

- AAPL DCF ValuationDokument12 SeitenAAPL DCF ValuationthesaneinvestorNoch keine Bewertungen

- CAT ValuationDokument231 SeitenCAT ValuationMichael CheungNoch keine Bewertungen

- Case 1 SwanDavisDokument4 SeitenCase 1 SwanDavissilly_rabbit0% (1)

- Financial Model Template TransactionDokument39 SeitenFinancial Model Template Transactionapi-400197296Noch keine Bewertungen

- DCF TemplateDokument6 SeitenDCF TemplatemichelelinNoch keine Bewertungen

- Pharmaceuticals Industry Comps TemplateDokument6 SeitenPharmaceuticals Industry Comps TemplateManoj KumarNoch keine Bewertungen

- FM TemplateDokument3 SeitenFM TemplateWynn WizzNoch keine Bewertungen

- Investment Feasibility AssessmentDokument27 SeitenInvestment Feasibility Assessmentad001Noch keine Bewertungen

- Blank Financial ModelDokument109 SeitenBlank Financial Modelrising_aboveNoch keine Bewertungen

- Hampton PortfolioDokument1 SeiteHampton Portfolioapi-314234873Noch keine Bewertungen

- Boulder Utility 20-Year Cash Flow SummaryDokument2 SeitenBoulder Utility 20-Year Cash Flow SummaryMatt SebastianNoch keine Bewertungen

- TCS ValuationDokument264 SeitenTCS ValuationSomil Gupta100% (1)

- Financial Analysis Modeling CFIDokument13 SeitenFinancial Analysis Modeling CFImike110*100% (1)

- Alibaba IPO Financial Model WallstreetMojoDokument52 SeitenAlibaba IPO Financial Model WallstreetMojoJulian HutabaratNoch keine Bewertungen

- Lecture - 5 - CFI-3-statement-model-completeDokument37 SeitenLecture - 5 - CFI-3-statement-model-completeshreyasNoch keine Bewertungen

- Ch02 P14 Build A Model AnswerDokument4 SeitenCh02 P14 Build A Model Answersiefbadawy1Noch keine Bewertungen

- Finance Simulation - Capital BudgetingDokument1 SeiteFinance Simulation - Capital BudgetingKarthi KeyanNoch keine Bewertungen

- Merger ModelDokument3 SeitenMerger Modelcyberdevil321Noch keine Bewertungen

- Markaz-GL On Financial ProjectionsDokument10 SeitenMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNoch keine Bewertungen

- DCF ModellDokument7 SeitenDCF ModellziuziNoch keine Bewertungen

- Gail India Oil and GasDokument38 SeitenGail India Oil and GasKumar SinghNoch keine Bewertungen

- 1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesDokument46 Seiten1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesfdallacasaNoch keine Bewertungen

- Flow Valuation, Case #KEL778Dokument31 SeitenFlow Valuation, Case #KEL778javaid jamshaidNoch keine Bewertungen

- 3.NPER Function Excel Template 1Dokument9 Seiten3.NPER Function Excel Template 1w_fibNoch keine Bewertungen

- Sensitivity Analysis TableDokument3 SeitenSensitivity Analysis TableBurhanNoch keine Bewertungen

- 1) Template Detailed ModelDokument20 Seiten1) Template Detailed Modelabdul5721Noch keine Bewertungen

- OptionStategy r2Dokument4 SeitenOptionStategy r2Lokesh KumarNoch keine Bewertungen

- 107 16 BIWS Financial Statements ValuationDokument50 Seiten107 16 BIWS Financial Statements ValuationFarhan ShafiqueNoch keine Bewertungen

- FCFE Analysis of TATA SteelDokument8 SeitenFCFE Analysis of TATA SteelJobin Jose KadavilNoch keine Bewertungen

- Valuation - CocacolaDokument14 SeitenValuation - CocacolaLegends MomentsNoch keine Bewertungen

- Yates Financial ModellingDokument18 SeitenYates Financial ModellingJerryJoshuaDiazNoch keine Bewertungen

- Assumption Sheet Financial ModelDokument5 SeitenAssumption Sheet Financial ModelVishal SachdevNoch keine Bewertungen

- Fomula Spreadsheet (WACC and NPV)Dokument7 SeitenFomula Spreadsheet (WACC and NPV)vaishusonu90Noch keine Bewertungen

- Lbo W DCF Model SampleDokument43 SeitenLbo W DCF Model SamplePrashantK100% (1)

- Hammond Manufacturing Company Limited: Guide of Reading This Financial ModelDokument4 SeitenHammond Manufacturing Company Limited: Guide of Reading This Financial ModelHongrui (Henry) Chen100% (1)

- SBDC Valuation Analysis ProgramDokument8 SeitenSBDC Valuation Analysis ProgramshanNoch keine Bewertungen

- DCF-Model Son 20221105Dokument5 SeitenDCF-Model Son 20221105HoangSon DANGNoch keine Bewertungen

- Аквакультура стратегплан PDFDokument28 SeitenАквакультура стратегплан PDFAnonymous xv5fUs4AvNoch keine Bewertungen

- ExecutivesummaryDokument7 SeitenExecutivesummaryAnonymous xv5fUs4AvNoch keine Bewertungen

- Japon Invest InvoDokument29 SeitenJapon Invest InvoAnonymous xv5fUs4AvNoch keine Bewertungen

- Infographic - RAS Manual - v3Dokument1 SeiteInfographic - RAS Manual - v3Anonymous xv5fUs4AvNoch keine Bewertungen

- ID Classification Bivalve Molluscs Production AreasDokument2 SeitenID Classification Bivalve Molluscs Production AreasAnonymous xv5fUs4AvNoch keine Bewertungen

- Development of Aquaculture at The Russian Far EastDokument13 SeitenDevelopment of Aquaculture at The Russian Far EastAnonymous xv5fUs4AvNoch keine Bewertungen

- 2015 AquaecomgmtDokument26 Seiten2015 AquaecomgmtAnonymous xv5fUs4AvNoch keine Bewertungen

- Sales Plan Template 21Dokument3 SeitenSales Plan Template 21Anonymous xv5fUs4AvNoch keine Bewertungen

- Sample - Japan Aquafeed Market-IMARCDokument56 SeitenSample - Japan Aquafeed Market-IMARCAnonymous xv5fUs4AvNoch keine Bewertungen

- Business PlanDokument52 SeitenBusiness PlantienNoch keine Bewertungen

- SPC XL 2010 For Microsoft Excel: Use The Links Below To Explore The Examples Control Chart ExamplesDokument56 SeitenSPC XL 2010 For Microsoft Excel: Use The Links Below To Explore The Examples Control Chart ExamplesRavindra ErabattiNoch keine Bewertungen

- Pareto Chart 02Dokument39 SeitenPareto Chart 02Anonymous xv5fUs4AvNoch keine Bewertungen

- ObzorDokument4 SeitenObzorAnonymous xv5fUs4AvNoch keine Bewertungen

- Project PlanDokument4 SeitenProject PlanAnonymous xv5fUs4AvNoch keine Bewertungen

- 103-Marine SpeciesDokument6 Seiten103-Marine SpeciesAnonymous xv5fUs4AvNoch keine Bewertungen

- SADCOunderwaterfishfarmingsystemDokument13 SeitenSADCOunderwaterfishfarmingsystemAnonymous xv5fUs4AvNoch keine Bewertungen

- Aqua 1 0002 0002Dokument2 SeitenAqua 1 0002 0002Anonymous xv5fUs4AvNoch keine Bewertungen

- BRO Biobrane Aquaculture ENDokument2 SeitenBRO Biobrane Aquaculture ENAnonymous xv5fUs4AvNoch keine Bewertungen

- Aquaculture Risk ManagementDokument4 SeitenAquaculture Risk ManagementHafez MabroukNoch keine Bewertungen

- Aqua USADokument4 SeitenAqua USAAnonymous xv5fUs4AvNoch keine Bewertungen

- Aqua 1 0001 0001 PDFDokument4 SeitenAqua 1 0001 0001 PDFAnonymous xv5fUs4AvNoch keine Bewertungen

- Rainbow Trout Culture in Submersible CagDokument1 SeiteRainbow Trout Culture in Submersible CagAnonymous xv5fUs4AvNoch keine Bewertungen

- CEIC RussiaDokument2 SeitenCEIC RussiaAnonymous xv5fUs4AvNoch keine Bewertungen

- 125906381Dokument4 Seiten125906381Anonymous xv5fUs4AvNoch keine Bewertungen

- Business ProposalDokument26 SeitenBusiness ProposalAnonymous xv5fUs4AvNoch keine Bewertungen

- Business PlanDokument23 SeitenBusiness PlanAnonymous xv5fUs4AvNoch keine Bewertungen

- Maritime ReportDokument20 SeitenMaritime ReportAnonymous xv5fUs4AvNoch keine Bewertungen

- CEIC ChinaDokument2 SeitenCEIC ChinaAnonymous xv5fUs4AvNoch keine Bewertungen

- CEIC GlobalDokument2 SeitenCEIC GlobalAnonymous xv5fUs4AvNoch keine Bewertungen

- Fish Market FAO2018 PDFDokument30 SeitenFish Market FAO2018 PDFAnonymous xv5fUs4AvNoch keine Bewertungen

- Warren Buffet CaseDokument4 SeitenWarren Buffet Casetania shaheenNoch keine Bewertungen

- FSW-Cash Flow 070218Dokument8 SeitenFSW-Cash Flow 070218March AthenaNoch keine Bewertungen

- Padala Rama Reddi College A Study On Customer Perception Towards Gold As An InvestmentDokument74 SeitenPadala Rama Reddi College A Study On Customer Perception Towards Gold As An InvestmentMubeenNoch keine Bewertungen

- ICICI Prudential Life Insurance ProspectusDokument616 SeitenICICI Prudential Life Insurance ProspectusshamruthaNoch keine Bewertungen

- Valuation of SharesDokument6 SeitenValuation of SharesMargaret Socceroos KuiNoch keine Bewertungen

- 5 TomCollier SPEE Annual Parameters SurveyDokument20 Seiten5 TomCollier SPEE Annual Parameters SurveymdshoppNoch keine Bewertungen

- MB0045 - Mba 2 SemDokument19 SeitenMB0045 - Mba 2 SemacorneleoNoch keine Bewertungen

- Performance of Regional Rural Banks in Punjab-A Financial PerspectiveDokument14 SeitenPerformance of Regional Rural Banks in Punjab-A Financial PerspectiveLevi AckermanNoch keine Bewertungen

- Oscillator PDFDokument2 SeitenOscillator PDFSandeep MishraNoch keine Bewertungen

- Aima Blank DDQDokument24 SeitenAima Blank DDQcmaasset100% (2)

- Lahore College For Women University, Lahore: Course Title: Financial Reporting and AnalysisDokument3 SeitenLahore College For Women University, Lahore: Course Title: Financial Reporting and AnalysissimNoch keine Bewertungen

- About Edge Growth - Recruitment IntroDokument9 SeitenAbout Edge Growth - Recruitment IntroMatthew SibandaNoch keine Bewertungen

- Chpater 4 SolutionsDokument13 SeitenChpater 4 SolutionsAhmed Rawy100% (1)

- Investor CurriculumDokument22 SeitenInvestor CurriculumR. SinghNoch keine Bewertungen

- Bs 1000 03 - 2016Dokument5 SeitenBs 1000 03 - 2016rashidnyouNoch keine Bewertungen

- Ioannis Branikas: University of Oregon Office Contact InformationDokument2 SeitenIoannis Branikas: University of Oregon Office Contact InformationpjNoch keine Bewertungen

- CAPITALGAINS 3rdsep PDFDokument202 SeitenCAPITALGAINS 3rdsep PDFPhani Kumar SomarajupalliNoch keine Bewertungen

- FMSDokument12 SeitenFMSMahesh SatapathyNoch keine Bewertungen

- Project Name: 5 The Pavement, Clapham Common, London SW4 0HZDokument2 SeitenProject Name: 5 The Pavement, Clapham Common, London SW4 0HZjordenNoch keine Bewertungen

- IMChap 018Dokument12 SeitenIMChap 018MaiNguyenNoch keine Bewertungen

- Fernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Dokument3 SeitenFernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Kailash KumarNoch keine Bewertungen

- Are Market Efficient PDFDokument2 SeitenAre Market Efficient PDFVignesh BhatNoch keine Bewertungen

- OBIADokument3 SeitenOBIASAlah MOhammedNoch keine Bewertungen

- aRIA WhitePaper PartIII Myth Vs Reality PDFDokument14 SeitenaRIA WhitePaper PartIII Myth Vs Reality PDFNeculaesei AndreiNoch keine Bewertungen

- Software Requirements Specification: Business Accounting and PayrollDokument119 SeitenSoftware Requirements Specification: Business Accounting and Payrollzoyabhavana100% (2)

- Case Study: PointDokument1 SeiteCase Study: PointprasadzinjurdeNoch keine Bewertungen

- PT Chandra Asri Petrochemical TBKDokument2 SeitenPT Chandra Asri Petrochemical TBKIshidaUryuuNoch keine Bewertungen

- Finding Value Amoung The Lows The Walter J Schloss ApproachDokument2 SeitenFinding Value Amoung The Lows The Walter J Schloss ApproachrlmohlaNoch keine Bewertungen

- K-10 Colgate Palmolive 1994-1992Dokument96 SeitenK-10 Colgate Palmolive 1994-1992salwanahotmailcomNoch keine Bewertungen

- Put BackspreadDokument2 SeitenPut BackspreadAKSHAYA AKSHAYANoch keine Bewertungen