Beruflich Dokumente

Kultur Dokumente

Chap 4

Hochgeladen von

Christine Joy Original0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

932 Ansichten7 SeitenIas James hall Chapter 4 summary

Originaltitel

CHAP-4

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenIas James hall Chapter 4 summary

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

932 Ansichten7 SeitenChap 4

Hochgeladen von

Christine Joy OriginalIas James hall Chapter 4 summary

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

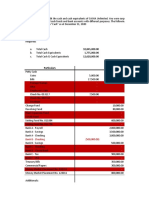

KEY TERMS two general areas of responsibility are performed packing slip - document that travels with the

independently. goods to the customer to describe the contents of

access control list (ACL) - lists containing the order.

information that defines the access privileges for credit memo - document used to authorize the

all valid users of the resource. An access control customer to receive credit for the merchandise point-of-sale (POS) systems - revenue system in

list assigned to each resource controls access to returned. which no customer accounts receivable are

system resources such as directories, files, maintained and inventory is kept on the store’s

programs, and printers. customer order - document indicating the type and shelves, not in a separate warehouse.

quantity of merchandise being requested.

accounts receivable (AR) subsidiary ledger - Prenumbered documents - Documents (sales

account record that shows activity by detail for deposit slip - written notification accompanying a orders, shipping notices, remittance advices, and

each account type, and containing, at minimum: bank deposit that specifies and categorizes the so on) sequentially numbered by the printer that

customer name; customer address; current funds (such as checks, bills, and coins) being allow every transaction to be identified uniquely.

balance; available credit; transaction dates; deposited.

invoice numbers; and credits for payments, Remittance advice - Source document that

returns, and allowances. electronic data interchange (EDI) - intercompany contains key information required to service the

exchange of computer-processible business customer’s account.

approved credit memo - the credit manager information in standard format.

evaluates the circumstances of the return and Remittance list - Cash prelist, where all cash

makes a judgment to grant (or disapprove) credit. inventory subsidiary ledger - ledger with inventory received is logged.

records updated from the stock release copy by Return slip - Document recording the counting

approved sales order - contains sales order the inventory control system. and inspect of items returned, prepared by the

information for the sales manager to review once receiving department employee.

the sales order is approved. journal voucher - accounting journal entries into an

accounting system for the purposes of making Role - Formal technique for grouping users

back-order - records that stay on file until the corrections or adjustments to the accounting data. according to the system resources they require to

inventories arrive from the supplier. Back-ordered For control purposes, all JVs should be approved perform their assigned tasks.

items are shipped before new sales are by the appropriate designated authority.

processed. Role-based access control (RBAC) - is a

journal voucher file - compilation of all journal method of restricting network access based on the

bill of lading - formal contract between the seller vouchers posted to the general ledger. roles of individual users within an enterprise.

and the shipping company that transports the

goods to the customer. ledger copy - copy of the sales order received S.O. pending file - It is where the sales order

along with the customer sales invoice by the billing (invoice copy) is placed until receipt of the sipping

cash receipts journal - records that include details department clerk from the sales department. notice, which describes the products that were

of all cash receipts transactions, including cash actually shipped to the customer.

sales, miscellaneous cash receipts, and cash multilevel security - it employs programmed

received. techniques that permit simultaneous access to a Sales invoice - Document that formally depicts

controller’s - the cash receipts department central system by many users with different the charges to the customer.

typically reports to the treasurer, who has access privileges but prevent them from obtaining Sales journal - Document that formally depicts the

responsibility for financial assets. Accounting information fo which they lack authorization charges to the customer.

functions report to the controller. Normally these

Sales order - Source document that captures REVIEW QUESTIONS General ledger clerk receives an accounts

such vital information as the name and address of receivable summary from accounts receivable

the customer making the purchase; the customer’s 1. What document initiates the sales department and a journal voucher summary from

account number; the name, number, and process? Cash receipt department.

description of the product; the quantities and unit A customer order usually in the form of a purchase

price of the items sold; and other financial order initiates the sales process

information. 5. What are the three authorization controls

2. Distinguish between a packing slip, a The three authorization controls are the following:

Sales order (credit copy) - Copy of sales order shipping notice, and a bill of lading. 1. Credit check

sent by the receive-order task to the check-credit The packing slip is the document that travels with 2. Return policy

task. It is used to check the credit-worthiness of a the goods to the customer to describe the contents 3. Remittance list

customer. of the order. The shipping notice is another

document which is forwarded to the billing function 6. What are the three rules that ensure that

Sales order (invoice copy) - Copy of sales order as evidence of that the customer’s order was filled no single employee or department

to be reconciled with the shipping notice,. It and shipped and it conveys pertinent new facts processes a transaction in its entirety?

describes the products that were actually shipped such as the date of shipment, the items and a. Transaction authorization should be

to the customer. quantities actually shipped, the name of the separate from transaction

carrier, and freight charges. The bill of lading is a processing.

Shipping log - Specifies orders shipped during formal contract between the seller and the b. Asset custody should be separate

the period. shipping company(carrier) to transport the goods from the task of asset record

to the customer and it establishes legal ownership keeping.

Shipping notice - Document that informs the and responsibility for asset in transit. c. The organization should be

billing department that the customer’s order has structured so that the perpetration of

been filled and shipped. 3. What function does the receiving a fraud requires collusion between

department serve in the revenue cycle? two or more individuals.

Stock records - Formal accounting records for When items are returned, the receiving

controlling inventory assets. department employee counts, inspects, and 7. At which points in the revenue cycle are

prepares a return slip describing the items. The independent verification controls

Stock release - Document that identifies which goods, along with a copy of the return slip, go to necessary?

items of inventory must be located and picked the warehouse to be restocked. The employee Independent verification controls in the revenue

from the warehouse shelves. then sends the second copy of the return slip to cycle exist at the following points:

the sales function to prepare a credit memo. 1. The shipping function verifies that

Universal product code (UPC) - Label containing The sales return process begins in the receiving the goods sent from the

price information (and other data) that is attached department, where personnel receive, count, warehouse are correct in type and

to items purchased in a point-of-sale system. inspect for damage, and send returned products to quantity. Before the goods are

the warehouse. The receiving clerk prepares a sent to the customer, the stock

Verified stock release - After stock is picked, return slip, which is forwarded to the sales release document and the packing

verification of the order for accuracy and release of department for processing. slip are reconciled.

the goods. 2. The billing function reconciles the

4. The general ledger clerk receives original sales order with the

summary data from which department? shipping notice to ensure that

What form of summary data?

customers are billed for only the An edit run is the first run; it detects most data decisions about existing customers that involve

quantities shipped. entry errors. Only "clean" data progresses to the ensuring only that the current transaction does not

3. Prior to posting to control sort run. The sort run sequences the transaction exceed the customer's credit limit may be dealt

accounts, the general ledger records according to its primary key field and with very quickly.

function reconciles journal possibly a secondary key field. Once the data is

vouchers and summary reports sorted, the update program posts the transactions 13. What is multilevel security?

prepared independently in to the appropriate corresponding records in the Multilevel security employs programmed

different function areas. The billing master file. During a sequential update, each techniques that permit simultaneous access to a

function summarizes the sales record is copied from the original master file to the central system by many users with different

journal, inventory control new master file regardless of whether the balance access privileges but prevents them from obtaining

summarizes the changes in the is affected information for which they lack authorization

inventory subsidiary ledger, the

cash receipts function summarizes 11. What are the key features of a POS 14. Why does billing receive a copy of the

the cash receipts journal, and system? sales order when the order is approved but

accounts receivable summarizes A point of sale system immediately does not bill until the goods are shipped?

the AR subsidiary ledger. records both cash and credit transactions and The billing department's receipt of the

inventory information. The sales journal, accounts sales order occurs in most instances before the

8. What is the purpose of physical controls? receivable, and inventory accounts may be goods are actually shipped; thus, the economic

Purpose of this section is to support the system updated in real-time, or a transaction file may be event is not complete. Some of the goods may not

concepts presented in the previous section with used to later update a master file. be available to ship; thus, the customer should not

models depicting people, organizational units, and be billed until the goods are shipped and the

physical documents and files. This helps you 12. How is a credit check in the advanced economic event is complete.

envision the segregation of duties and technology systems fundamentally different

independent verifications, which are essential to from a credit check in the basic technology 15. Why was EDI devised?

effective internal control regardless of the system? EDI technology was devised to expedite

technology in place. In addition, it highlights In the advanced technology system, the routine transactions between manufacturers and

inefficiencies intrinsic to manual systems, which system logic, not a human being, makes the wholesalers and between wholesalers and

gave rise to modern systems using improved decision to grant or deny credit based on the retailers. The customer’s computer is connected

technologies. customer's credit history contained in the credit directly to the seller’s computer via telephone

history file. If credit is denied, the sales clerk lines. When the customer’s computer detects the

9. How can we prevent inventory from being should not be able to force the transaction to need to order inventory, it automatically transmits

reordered automatically each time the continue. an order to the seller. The seller’s system receives

system detects a low inventory level? In the basic technology system, credit the order and processes it automatically. This

The on-order information will prevent items from checking of prospective customers is a function of system requires little or no human involvement.

being accidentally reordered and will assist the credit department, which has responsibility for

customer service clerks in advising customers as ensuring the proper application of the firm's credit 16. What assets are at greatest risk in a POS

to the status of inventory and expected due dates policies. The complexity of credit procedures will system?

for out-of-stock items. vary depending on the organization, its Inventory and cash. Customers have direct

relationship with the customer, and the materiality access to inventory in the POS system.

10. Distinguish between an edit run, a sort of the transaction. Credit approval for first-time

run, and an update run. customers may take time and involve consultation 17. In a manual system, after which event is the

with an outside credit bureau. In contrast, credit sales process should the customer be billed?

Shipment of goods marks the completion of functions over two departments for the custody of receipt of the shipping notice and the stock release

the economic event and the point at which the the assets during two distinct phases of the documents, the billing department prepares the

customer should be billed. Upon receipt of the revenue cycle. The warehouse attendants have sales invoice, which is the customer's bill reflecting

shipping notice and stock release, the billing clerk custody over the finished goods until they receive charges for items shipped, which may be different

compiles the relevant facts about the transaction a stock release form from the sales department. from items ordered, taxes and freight, and any

(product prices, handling charges, freight, taxes, The warehouse clerks pick the inventory items discounts offered. The sales order department

and discount terms) and bills the customer. from the warehouse and send them to shipping should not prepare the bills because the

along with a copy of the stock release form. The salespeople may bill their favorite clients less than

18. What is bill of lading? shipping department is only able to ship goods that they should be billed. The salespeople place the

A bill of lading is a formal contract it receives from the warehouse personnel. Further, order, and thus start the wheels in motion for

between the seller and the shipping company that it must match the goods with a packing slip and inventory to be shipped. Further, the salespeople

transports the goods to the customer. It also shipping notice that originates from the sales should not be allowed to determine how much the

serves as a shipment receipt when the carrier department. Thus, warehouse personnel are not customers pay for their inventory, because they

delivers the goods at a predetermined destination. allowed to ship out any unauthorized inventory may be tempted to charge lower prices and

This document must accompany the shipped items because the shipping personnel would not receive kickbacks. The accounts receivable

products, no matter the form of transportation, and have the corresponding paperwork. The additional department receives the sales orders and posts

must be signed by an authorized representative paperwork required is considered a necessary them to the accounts receivable subsidiary ledger.

from the carrier, shipper, and receiver. cost for the added benefit of control over inventory. As remittance advices are received, they are

The warehouse personnel do not keep the posted to the customer's account in the accounts

19. What documents initiates the billing formal accounting records. The asset custodial receivable subsidiary ledger. The accounts

process? tasks must be kept separate from the formal receivable department should not be allowed to

The shipping notice is proof that the product record-keeping tasks. The inventory control keeps prepare the bills since this department has custody

has been shipped and is the trigger document that the formal accounting records of inventory stock over the accounts receivable assets. Accounts

initiates the billing process. items. receivable personnel record customer payments

and track unpaid bills by customers. If they were

20. Where in the cash receipts process does allowed to prepare the bills, they might not bill

supervision play an important role? 2. Distinguish between the sales order, certain customers and receive a kickback from the

Supervision plays an important role in the billing, and AR departments. Why can’t the customers for the free goods.

mail room where both the check (asset) and sales order or AR departments prepare the

remittance advice (accounting records) are in the bills?

hands of one person. Mail room fraud can result, The sales order department (included in the 3. Explain the purpose of having mail room

which involves stealing the check and destroying sales department in the text) is responsible for procedures.

the remittance advice to cover the theft. taking the customer order and placing it into a The checks received in payment for accounts

standard format. This department records receivable are a crucial asset for the firm. These

DISCUSSION QUESTIONS information such as the customer's name, checks must be protected from individuals who

address, account number, quantities and units of might try to deposit these checks into their own

1. Why do firms have separate departments each item, discounts, freight preferences, etc. The accounts. The process of having a member of the

for warehousing and shipping? What about sales order processing may, in some instances, mailroom personnel open the mail and record all

warehousing and inventory control? play a role in verifying or determining the promised checks received before they are routed to the

Doesn’t this just create more paperwork? shipping date. cashier or the accounts receivable department is

The separation of the warehouse and the The billing department receives a copy of the to ensure that the accounts receivable personnel

shipping department allows for segregation of sales order from the sales department. Upon

do not engage in such activities as lapping the in many ways like over evaluation of assets and

accounts receivable accounts. under evaluation of liabilities.

7. Why is access control over revenue cycle Credit policy implies that the terms at

documents just as important as the which credits are forwarded to the organization's

4. Explain how segregation of duties is physical control devices over cash and customer. Inconsistently applied credit policies

accomplished in an integrated data inventory? may result in an overstatement of accounts

processing environment. Access control to the billing and accounts receivable. Nonstandard or substandard

In this environment, segregation of duties is receivable records that are part of the revenue customers having long dues can be provided with

accomplished through multilevel security cycle is just as important as the physical control further credits, this would result in an

procedures. Multilevel security employs devices over cash and inventory because these overstatement of accounts receivable

programmed techniques that permit simultaneous records affect the collectability of an asset—

access to a central system by many users with accounts receivable—which should eventually be 10. Give three examples of access control in a

different access privileges but prevents them from converted into cash. If these records are not POS system.

obtaining information for which they lack adequately controlled, inventory may not be A. Assign each clerk to a separate cash

authorization. ultimately converted into the cash amount register for an entire shift. When the clerk

deserved by the firm. leaves the register to take a break, the

cash drawer should be locked to prevent

5. How could an employee embezzle funds by 8. How can reengineering of the sales order unauthorized access.

issuing an unauthorized sales credit memo processing subsystem be accomplished B. Magnetic tags are attached to

if the appropriate segregation of duties and using the Internet? merchandise, which will sound an alarm

authorization controls were not in place? In the past decade, the Internet has become when removed from the store.

An employee who has access to incoming an integral part of our everyday lives, its ability to C. Locked showcases are used to display

payments, either cash or check, as well as the quickly gather the data we need in a matter of jewelry and costly electronic equipment.

authorization to issue credit memos may pocket seconds vastly improve a company's margin of

the cash or check of a payment for goods error. With the Internet's ability to quickly process 11. Discuss the trade-off in choosing to update

received. This employee could then issue a credit and gather data, it would greatly improve sales the general ledger accounts in real time versus

memo to this person's account so that the order processing subsystem by automating much batch.

customer does not show a balance due. of the data processing and ensuring the margin In real-time processing, changes are

profit is high through lower rate of error. With the updated in real-time as and when such changes

6. What task can the AR department engage ability to quickly determine the inventory level, it occur; whereas, in batch processing changes are

in to verify that all customer’s checks have will reduce extra cost a company may incur due to grouped and each group is processed in a single

been appropriately deposited and backorder items and will prevent a company from batch.

recorded? over selling items causing customers to lose faith In choosing between real-time or batch

The company should periodically, perhaps in the company. update, the following points could be taken into

monthly, send an account summary to each consideration. If the basis is updating method, in

customer listing invoices and amounts paid by 9. What financial statement misrepresentations real-time processing changes are made at the time

check number and date. This form allows the may result from an inconsistently applied such changes occur while in batch processing,

customer to verify the accuracy of the records. If credit policy? Be specific. updates are accumulated and are processed in

any payments are not recorded, they will notify the Financial misinterpretations are made by batches. If the basis is staffing requirements, in

company of the discrepancy. These reports should showing the financial figures in such a way that the real-time processing it increases while batch

not be handled by the accounts receivable clerk or overall financial position of the company looks processing does not require the recruitment of

the cashier. healthier than what is in real life. This can be done additional staff.

department stores, and other types of retail place, no individual in either the buying or selling

12. If an automated credit checking function organizations. Generally, only cash, checks, and company actually authorizes or approves a

denies a customer credit, should the sales bank credit card sales are valid. Unlike particular EDI transaction. In its purest form, the

clerk ever be authorized to override the manufacturing firms, the organization maintains no exchange is completely automated.

decision? If so when? customer accounts receivable. Unlike some EDI poses unique control problems for an

The sales clerk is not authorized to manufacturing firms, inventory is kept on the organization. One problem is ensuring that, in the

override the decision because within the revenue store's shelves, not in a separate warehouse. The absence of explicit authorization, only valid

cycle, the credit department is segregated from the customers personally pick the items they wish to transactions are processed. Another risk is that a

rest of the process so formal authorization of a buy and carry them to the checkout location, trading partner, or someone masquerading as a

transaction is an independent event. where the transaction begins. Shipping, packing, trading partner, will access the firm’s accounting

Often, compensation for sales staff is bills of lading, etc. are not relevant to POS records in a way that is unauthorized by the

based on their individual sales performance. In systems. trading partner agreement.

such cases, sales staff have an incentive to

maximize sales volume and thus may not 15. Is a POS system that uses bar coding and a 17. Discuss the two common methods of

adequately consider the creditworthiness of laser light scanner foolproof against achieving multilevel security in a system.

prospective customers. By acting in an inaccurate updates? Discuss. Two methods for achieving multilevel

independent capacity, the credit department may First, the checkout clerk scans the security are the access control list (ACL) and role-

objectively detect risky customers and disallow universal product code (UPC) label on the items based access control (RBAC). Through these

poor and irresponsible sales decisions. being purchased with a laser light scanner. The techniques, purchasing, receiving, AP, cash

scanner, which is the primary input device of the disbursement and general ledger are limited in

13. How can advanced technology transaction POS system, may be handheld or mounted on the their access based on the privileges assigned to

processing systems reduce fraud? checkout table. The POS system is connected them.

Advanced technology transaction online to the inventory file from which it retrieves

processing systems reduce fraud in such a way product price data and displays this on the clerk’s

that there is authorization of transactions. The terminal. The inventory quantity on hand is MULTIPLE CHOICE QUESTION

objective of this is to ensure that only valid reduced in real time to reflect the items sold. As 1. Which function or department records

transactions are being processed and thus items fall to minimum levels, they are automatically a sale in the sales journal?

reducing the occurrence of fraud. reordered. When all the UPCs are scanned, the C. sales department

system automatically calculates taxes, discounts, In accounting system, one of the special

14. What makes POS systems different from and the total for the transaction. journals is sales journal. In this, only sales

revenue cycles of manufacturing firms? made by a company on account are

In point-of-sale systems, the customer 16. How is EDI more than technology? What recorded. Credit sales of inventory and

literally has possession of the items purchased, unique control problems may it pose? merchandise are recorded in this journal.

thus the inventory is in hand. Typically, for EDI is more than just a technology. It

manufacturing firms, the order is placed and the represents a business arrangement between the 2. Which functions should be

good is shipped to the customer at some later time buyer and seller in which they agree, in advance, segregated?

period. Thus, updating inventory at the time of sale to the terms of their relationship. For example, B. Picking goods from the warehouse

is necessary in point-of-sale systems since the they agree to the selling price, the quantities to be shelves and updating the inventory

inventory is changing hands, while it is not sold, guaranteed delivery times, payment terms, subsidiary ledger

necessary in manufacturing firms until the goods and methods of handling disputes. These terms The function segregated is opening the

are actually shipped to the customer. Also, POS are specified in a trading partner agreement and mail and recording the cash receipts in the

systems are used extensively in grocery stores, are legally binding. Once the agreement is in journal. Segregation duties are very

important to the internal control structure reconciliation of stock release document legal ownership and responsibility for

as it founds the faults in the system. Its with the packing slip. assets in transit.

main duties are approval, accounting and

asset custody. The above-mentioned 5. The bill of lading is prepared by 8. Which of the following sets of tasks

function is used in reconciling or C. Shipping clerk should not be separated?

accounting purpose. The shipping clerk packages to goods, E. All of the above tasks should be

The person who performs the above attaches the packing slip, completes the separated

function cannot make the deposit. In his shipping notice, and prepares a bill of As a part of independent verification

duties no person can perform the same lading. control, duties must be segregated

task. Different job assignments are between the employees to avoid fraud in

provided to different person according to 6. Which of the following is NOT an cash transactions.

shift wise. independent verification control?

D. The billing department reconciles 9. Which of the following is often called a

the shipping notice with the sales compensating control?

3. Which of the following is incompatible invoice to ensure that customers are A.Supervision

task? billed for only the quantities shipped. Implementing adequate segregation of

C. The AR clerk authorizes the write-off The cashier collects the cash receipts from duties requires that a firm employ a

of bad debts the customers and presents remittance sufficiently large number of employees.

Weak internal control structure: advices, to ensure that the amounts are Achieving adequate segregation of duties

Account receivable clerk authorizes the entered properly for reconciliation. As a often presents difficulties for small

write-off bad debts indicates the weak part of independent verification control, organizations. Obviously, it is impossible

internal control structure. The effective duties must be segregated between the to separate five incompatible tasks among

internal control structure is that all the employees to avoid fraud in cash three employees.

accounting records get matched when the transactions. In other words, cash Therefore, in small organizations or in

audit takes place. If there is no control on collections should be made by one functional areas that lack sufficient

the accounting records that means the employee and the remittances should be personnel, management must compensate

internal control structure is weak. Reduced made by another employee to avoid cash for the absence of segregation controls

records of transfers between warehouse have any falsification of information with close supervision. For this reason,

often results in the ineffective controls in In the present case, both the cash receipts supervision is often called a compensating

internal structure. and cash remittances are handled by a control.

single person only. It will lead to fraud by

4. Which control helps to ensure that the the employee and falsification of financial 10. Which document triggers the billing

inventory items shipped to the information. Therefore, it is not an function?

customer are the correct type and the independent verification control. A. Shipping notice

correct amount? The shipping notice provides proof that the

D. Reconcile stock release document 7. Which department defines terms for product has been shipped and is the

and packing slip shipped goods ownership? trigger document that initiates the billing

The effective control that helps ensuring a D. Bill of Lading process.

check of the inventory systems that The bill of lading is a formal contract

shipped to the customer are correct type between the seller and the shipping

and amount, a proper and effective company to transport the goods to the

customer. This ownership establishes

Das könnte Ihnen auch gefallen

- Chapter 5Dokument8 SeitenChapter 5Christine Joy OriginalNoch keine Bewertungen

- Purchasing Review QuestionsDokument10 SeitenPurchasing Review QuestionscerapyaNoch keine Bewertungen

- Input Error Correction (Accounting Information System)Dokument14 SeitenInput Error Correction (Accounting Information System)Rachel Garcia0% (1)

- Day 1 financial statement reviewDokument12 SeitenDay 1 financial statement reviewneo14Noch keine Bewertungen

- ApabkakakaDokument2 SeitenApabkakakaDania Sekar WuryandariNoch keine Bewertungen

- Walker BooksDokument3 SeitenWalker BooksLAILATURRAHMINoch keine Bewertungen

- AP Solutions 2016Dokument13 SeitenAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- SteeplechaseDokument3 SeitenSteeplechaseArvey Peña DimacaliNoch keine Bewertungen

- Chapter 10Dokument6 SeitenChapter 10Melissa Kayla ManiulitNoch keine Bewertungen

- Ans To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsDokument188 SeitenAns To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsLouise GazaNoch keine Bewertungen

- Walker BooksDokument2 SeitenWalker BooksJN Villacruel Abayari100% (2)

- Existence or Occurrence Completeness Rights and Obligations Valuation or AllocationDokument3 SeitenExistence or Occurrence Completeness Rights and Obligations Valuation or AllocationReyes, Jessica R.Noch keine Bewertungen

- Audit of EquityDokument5 SeitenAudit of EquityKarlo Jude Acidera0% (1)

- Isc Is An International Manufacturing Company With Over 100 SubsidiariesDokument2 SeitenIsc Is An International Manufacturing Company With Over 100 SubsidiariesAmit PandeyNoch keine Bewertungen

- Accounting InformationDokument3 SeitenAccounting Informationnenette cruzNoch keine Bewertungen

- Sales and Collection Cycle AuditDokument4 SeitenSales and Collection Cycle Auditimpurespirit0% (1)

- AP.2906 InvestmentsDokument6 SeitenAP.2906 InvestmentsmoNoch keine Bewertungen

- The Expenditure Cycle: Purchases and Cash Disbursements ProceduresDokument4 SeitenThe Expenditure Cycle: Purchases and Cash Disbursements ProceduresAnne Rose EncinaNoch keine Bewertungen

- AGNPO Prelims ReviewerDokument84 SeitenAGNPO Prelims ReviewerKurt Morin CantorNoch keine Bewertungen

- Bustamante, Jilian Kate A. (Activity 3)Dokument4 SeitenBustamante, Jilian Kate A. (Activity 3)Jilian Kate Alpapara BustamanteNoch keine Bewertungen

- Bus. Combi Probs and SolnDokument3 SeitenBus. Combi Probs and SolnRyan Prado AndayaNoch keine Bewertungen

- Define Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudDokument3 SeitenDefine Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudSomething ChicNoch keine Bewertungen

- Chapter 3Dokument11 SeitenChapter 3Christlyn Joy BaralNoch keine Bewertungen

- Buygasco 1Dokument6 SeitenBuygasco 1Jane ChungNoch keine Bewertungen

- Chapter 8: Quality Control: Questions 3 To 5Dokument12 SeitenChapter 8: Quality Control: Questions 3 To 5Janeth NavalesNoch keine Bewertungen

- 08 InvestmentquestfinalDokument13 Seiten08 InvestmentquestfinalAnonymous l13WpzNoch keine Bewertungen

- Auditing Problems Since 1977Dokument7 SeitenAuditing Problems Since 1977Io AyaNoch keine Bewertungen

- Audit of Cash ActivityDokument13 SeitenAudit of Cash ActivityIris FenelleNoch keine Bewertungen

- AGS CUP 6 Auditing Final RoundDokument19 SeitenAGS CUP 6 Auditing Final RoundKenneth RobledoNoch keine Bewertungen

- Chapter 5-Statement of Cash Flows and Articulation: Multiple ChoiceDokument39 SeitenChapter 5-Statement of Cash Flows and Articulation: Multiple ChoiceLeonardoNoch keine Bewertungen

- Quiz 2 - Corp Liqui and Installment SalesDokument8 SeitenQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNoch keine Bewertungen

- Chapter 04 AnsDokument4 SeitenChapter 04 AnsDave Manalo100% (1)

- Psa 401Dokument5 SeitenPsa 401novyNoch keine Bewertungen

- Risk-based auditing quiz answersDokument3 SeitenRisk-based auditing quiz answersRaven ShadowsNoch keine Bewertungen

- Generalized Data Input Systems (GDIS) .: AdvantagesDokument15 SeitenGeneralized Data Input Systems (GDIS) .: AdvantagesCheyenne Marie WingkeeNoch keine Bewertungen

- BBCIS security and controlsDokument11 SeitenBBCIS security and controlsArvey Peña DimacaliNoch keine Bewertungen

- AuditingDokument60 SeitenAuditingarianasNoch keine Bewertungen

- AIS James Hall Chapter 5 Problem 8 Answer KeyDokument3 SeitenAIS James Hall Chapter 5 Problem 8 Answer KeyPrecious Anne Cantaros100% (1)

- Case 7, 8, 9Dokument4 SeitenCase 7, 8, 9Arvey Peña Dimacali100% (1)

- Strategic Business Analysis: ASSIGNMENT #5: Analyzing Resources and CapabilitiesDokument5 SeitenStrategic Business Analysis: ASSIGNMENT #5: Analyzing Resources and CapabilitiesJonas Avanzado TianiaNoch keine Bewertungen

- Compensating Controls Provide Reasonable AssuranceDokument2 SeitenCompensating Controls Provide Reasonable AssuranceJm V Martir100% (1)

- Chapter 5 Summary (The Expenditure Cycle Part I)Dokument11 SeitenChapter 5 Summary (The Expenditure Cycle Part I)Janica GaynorNoch keine Bewertungen

- Suzette Washington CaseDokument30 SeitenSuzette Washington CaseMary Queen Ramos-Umoquit100% (1)

- Nadiatul - HW Week 7Dokument4 SeitenNadiatul - HW Week 7nadxco 1711Noch keine Bewertungen

- Acct. 162 - EPS, BVPS, DividendsDokument5 SeitenAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueNoch keine Bewertungen

- 9 13 14 SolutionDokument4 Seiten9 13 14 SolutionMina MinaNoch keine Bewertungen

- AP Ist Quiz 6419Dokument11 SeitenAP Ist Quiz 6419Veron Briones50% (2)

- Answered - BCD Company Offer Its Investors Option - BartlebyDokument1 SeiteAnswered - BCD Company Offer Its Investors Option - BartlebyTrisha AgraamNoch keine Bewertungen

- 1Dokument35 Seiten1Rommel CruzNoch keine Bewertungen

- Long Problems For Prelim'S Product: Case 1Dokument7 SeitenLong Problems For Prelim'S Product: Case 1Mae AstovezaNoch keine Bewertungen

- ExamView Pro - DEBT FINANCING - TST PDFDokument15 SeitenExamView Pro - DEBT FINANCING - TST PDFShannon ElizaldeNoch keine Bewertungen

- Chapter 03Dokument30 SeitenChapter 03ajbalcitaNoch keine Bewertungen

- Practical Accounting - Part 1Dokument17 SeitenPractical Accounting - Part 1Kenneth Bryan Tegerero Tegio100% (1)

- Shareholder's Equity ProblemsDokument4 SeitenShareholder's Equity ProblemsKHAkadsbdhsgNoch keine Bewertungen

- Walker Books IncDokument17 SeitenWalker Books Incroselle0212Noch keine Bewertungen

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Dokument7 SeitenRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNoch keine Bewertungen

- FAR-04 Share Based PaymentsDokument3 SeitenFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Chapter 4Dokument6 SeitenChapter 4Christine Joy Original100% (1)

- Chapter 4Dokument8 SeitenChapter 4Christine Joy OriginalNoch keine Bewertungen

- Chapter 4 The Revenue CycleDokument6 SeitenChapter 4 The Revenue CycleRose Vera Mae EncinaNoch keine Bewertungen

- FINANCIAL ANALYSIS OF URCDokument13 SeitenFINANCIAL ANALYSIS OF URCChristine Joy OriginalNoch keine Bewertungen

- Strategic Management. Case Analysis. DELLDokument13 SeitenStrategic Management. Case Analysis. DELLPamela CardenazNoch keine Bewertungen

- Criteria For Songwriting Relevance To The Theme: (30%)Dokument3 SeitenCriteria For Songwriting Relevance To The Theme: (30%)Christine Joy OriginalNoch keine Bewertungen

- FIN 301 Porter Chapter 7-2Dokument1 SeiteFIN 301 Porter Chapter 7-2Christine Joy OriginalNoch keine Bewertungen

- CPA Review: Code of Ethics for Professional Accountants in the PhilippinesDokument20 SeitenCPA Review: Code of Ethics for Professional Accountants in the PhilippinesJedidiah SmithNoch keine Bewertungen

- Result - 11 - 16 - 2020, 6 - 32 - 53 PMDokument1 SeiteResult - 11 - 16 - 2020, 6 - 32 - 53 PMChristine Joy OriginalNoch keine Bewertungen

- Group Work on Hypothesis TestingDokument1 SeiteGroup Work on Hypothesis TestingChristine Joy OriginalNoch keine Bewertungen

- Consolidated Financial Statements Test Bank ChapterDokument12 SeitenConsolidated Financial Statements Test Bank ChapterRadizaJisiNoch keine Bewertungen

- LTCC and Franchise Long Exam PDFDokument9 SeitenLTCC and Franchise Long Exam PDFChristine Joy Original50% (2)

- Test Bank For Auditing A Risk Based Approach 11th Edition by Karla M Johnstone Zehms PDFDokument78 SeitenTest Bank For Auditing A Risk Based Approach 11th Edition by Karla M Johnstone Zehms PDFChristine Joy OriginalNoch keine Bewertungen

- Chapter 1 Data and Statistics CengageDokument31 SeitenChapter 1 Data and Statistics CengageChristine Joy Original100% (2)

- Ans 7.12Dokument1 SeiteAns 7.12Christine Joy OriginalNoch keine Bewertungen

- Untitled DocumentDokument17 SeitenUntitled DocumentChristine Joy OriginalNoch keine Bewertungen

- Aud Theo Dept. MIDTERM EXAMDokument8 SeitenAud Theo Dept. MIDTERM EXAMChristine Joy OriginalNoch keine Bewertungen

- This Study Resource Was: SolutionDokument1 SeiteThis Study Resource Was: SolutionChristine Joy OriginalNoch keine Bewertungen

- Case AnalysesDokument4 SeitenCase AnalysesChristine Joy OriginalNoch keine Bewertungen

- Bouncing ChecksDokument5 SeitenBouncing ChecksLAARNI ESTRADANoch keine Bewertungen

- Auditing Theory Test BankDokument32 SeitenAuditing Theory Test BankJane Estrada100% (2)

- Self-Regulation Group ReportDokument1 SeiteSelf-Regulation Group ReportChristine Joy OriginalNoch keine Bewertungen

- Fredrick Cerniaz - FREE QUIZes AND MAJOR EXAM POINTS IF YOUR REPLY PDFDokument1 SeiteFredrick Cerniaz - FREE QUIZes AND MAJOR EXAM POINTS IF YOUR REPLY PDFChristine Joy OriginalNoch keine Bewertungen

- My Reflection Paper On Self-Care and Stress Mana : Fredrick M Cerniaz Bsit-1B October 2018Dokument1 SeiteMy Reflection Paper On Self-Care and Stress Mana : Fredrick M Cerniaz Bsit-1B October 2018Christine Joy OriginalNoch keine Bewertungen

- Cerniaz, Fredrick EssayDokument2 SeitenCerniaz, Fredrick EssayChristine Joy OriginalNoch keine Bewertungen

- My Reflection Paper On Self-Care and Stress Mana : Fredrick M Cerniaz Bsit-1B October 2018Dokument1 SeiteMy Reflection Paper On Self-Care and Stress Mana : Fredrick M Cerniaz Bsit-1B October 2018Christine Joy OriginalNoch keine Bewertungen

- Example:: NclobDokument7 SeitenExample:: NclobChristine Joy OriginalNoch keine Bewertungen

- My Autobiography: A Look Back at 19 Years of Life and GrowthDokument1 SeiteMy Autobiography: A Look Back at 19 Years of Life and GrowthChristine Joy OriginalNoch keine Bewertungen

- Accounting For Branch Operations Sept 17Dokument10 SeitenAccounting For Branch Operations Sept 17Christine Joy OriginalNoch keine Bewertungen

- Self-Regulation Group ReportDokument1 SeiteSelf-Regulation Group ReportChristine Joy OriginalNoch keine Bewertungen

- AC2204 - Laundry Industry - ExcelDokument21 SeitenAC2204 - Laundry Industry - ExcelChristine Joy OriginalNoch keine Bewertungen

- AC3105 - Group 7Dokument1 SeiteAC3105 - Group 7Christine Joy OriginalNoch keine Bewertungen

- It Lesson 03-04-2020 PDFDokument1 SeiteIt Lesson 03-04-2020 PDFChristine Joy OriginalNoch keine Bewertungen

- Retail Management Multiple Choice QuestionsDokument8 SeitenRetail Management Multiple Choice Questionsshilpashree_mbaNoch keine Bewertungen

- Meeting ScriptDokument3 SeitenMeeting ScriptSarahNoch keine Bewertungen

- Fine Living Uganda Cleaning Business DepartmentDokument6 SeitenFine Living Uganda Cleaning Business DepartmentNakityo PhionaNoch keine Bewertungen

- Daniel P PinkDokument12 SeitenDaniel P PinkNautNoch keine Bewertungen

- Choco Balls FinalDokument8 SeitenChoco Balls Finalrhys_jaya100% (2)

- Process NumericalDokument11 SeitenProcess NumericalDeepak R GoradNoch keine Bewertungen

- Director Manager Enterprise Sales in Houston TX Resume Steven HartleyDokument4 SeitenDirector Manager Enterprise Sales in Houston TX Resume Steven HartleyStevenHartleyNoch keine Bewertungen

- Open DOAS ASSUMPTION Princess RachelDokument2 SeitenOpen DOAS ASSUMPTION Princess RachelRoyal DragonNoch keine Bewertungen

- OCEJO PEREZ VS INT'L BANK GR NO L-10658Dokument1 SeiteOCEJO PEREZ VS INT'L BANK GR NO L-10658Ria GabsNoch keine Bewertungen

- Nestle Summer Training ProjectDokument28 SeitenNestle Summer Training ProjectSagar ShindeNoch keine Bewertungen

- Understanding Advertising: Its History, Definition and ImpactDokument56 SeitenUnderstanding Advertising: Its History, Definition and ImpactAshishVargheseNoch keine Bewertungen

- MK0006 - Services Marketing and Customer Relationship Management Assignment Set-1Dokument10 SeitenMK0006 - Services Marketing and Customer Relationship Management Assignment Set-1RK Singh0% (1)

- Appraisal Sample PDFDokument22 SeitenAppraisal Sample PDFkiruthikaNoch keine Bewertungen

- Bill Bishop - Penguins (Book) Chapter 17Dokument5 SeitenBill Bishop - Penguins (Book) Chapter 17Sergiu Alexandru VlasceanuNoch keine Bewertungen

- Amul's vision, mission, objectives and productsDokument23 SeitenAmul's vision, mission, objectives and productsAlonnyNoch keine Bewertungen

- Emerging Trends in Sales Management: - by Richa BBA'IV'-ADokument11 SeitenEmerging Trends in Sales Management: - by Richa BBA'IV'-ANicole BradNoch keine Bewertungen

- Responsibility CentersDokument15 SeitenResponsibility CentersAkashdeep GhummanNoch keine Bewertungen

- Kel A - Materi 1Dokument13 SeitenKel A - Materi 1NikoNoch keine Bewertungen

- Lums Leveragingthestyloshoesexperience 130119101835 Phpapp01Dokument20 SeitenLums Leveragingthestyloshoesexperience 130119101835 Phpapp01Bushra UmarNoch keine Bewertungen

- Case CRM 2021 Final ADDokument166 SeitenCase CRM 2021 Final ADTrần Anh TuấnNoch keine Bewertungen

- Ebay Money Loophole Evil CorporationDokument14 SeitenEbay Money Loophole Evil CorporationJeremy WeaverNoch keine Bewertungen

- 9 HagerServiceDokument10 Seiten9 HagerServiceNedim HadžiaganovićNoch keine Bewertungen

- Perry Belcher - Secret Selling System - Nerd NotesDokument118 SeitenPerry Belcher - Secret Selling System - Nerd Notesgeorge100% (4)

- FinalDokument39 SeitenFinalSheerin SultanNoch keine Bewertungen

- 12 Business Studies Sp02Dokument13 Seiten12 Business Studies Sp02MANTAVYA VYASNoch keine Bewertungen

- Orient Energy SystemsDokument4 SeitenOrient Energy Systemsasif_shafiqNoch keine Bewertungen

- Resume SUHRIDDokument3 SeitenResume SUHRIDRealtyGuruz InvestmentCatalystsNoch keine Bewertungen

- Nature and Role of SellingDokument13 SeitenNature and Role of SellingShoaib ImtiazNoch keine Bewertungen

- Report On House Keeping Department For Nathm Internship at Yak N YetiDokument54 SeitenReport On House Keeping Department For Nathm Internship at Yak N YetiRanjita Adhikari87% (15)

- IKEA Offers A Wide Range of Well-Designed, Functional Home Furnishing Products atDokument25 SeitenIKEA Offers A Wide Range of Well-Designed, Functional Home Furnishing Products atSana Naeem67% (3)