Beruflich Dokumente

Kultur Dokumente

12 Accounts Imp Ch3

Hochgeladen von

Ashish GangwalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

12 Accounts Imp Ch3

Hochgeladen von

Ashish GangwalCopyright:

Verfügbare Formate

CBSE

Class 12 Accountancy

Important Questions

Chapter 3

Change in Profit sharing ratio of Partners

Reconstitution of Partnership

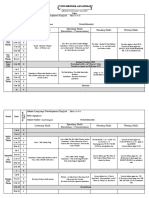

1: Amit and Kajal were partners in a firm sharing profits in the ratio of 3:2. With effect

from January 1, 2015 they agreed to share profits equally. For this purpose the goodwill

of the firm was valued at Rs. 60,000. Pass the necessary journal entry.

Solution:

Old ratio of Amit and Kajal = 3:2

New ratio of Amit and Kajal = 1:1

Sacrifice or Gain

Amit = (Sacrifice)

Kajal = (gain)

Debit Credit

Date Particulars L.F.

(Rs.) (Rs.)

Kajal capital A/c Dr. To

Amit’s Capital A/c 6,000 6,000

2015 jan. 1

(Adjustment for goodwill on change in

profit sharing ratio).

Accounting Treatment of Reserves and Accumulated Profits

Material downloaded from myCBSEguide.com. 1 / 11

Case (i) When reserves and accumulated profits/losses are to be distributed

At the time of change in profit sharing ratio, if there are some reserves or accumulated

profits/losses existing in the books of the firm, these should be distributed to partners in their

old profit sharing ratio.

Journal Entries

(i) For Transfer of Reserves & Accumulated Profits

Reserve A/cDr.

Profit & Loss A/cDr.

Workmen’s Compensation Reserve A/cDr. Excess of reserves over Actual Liability

Investment Fluctuation Reserve A/cDr. (Excess of Reserves over difference between Book

Value & Market Value)

To old Partner’s Capital or Current A/c (in old ratio)

(ii) For transfer of accumulated Losses.

Old Partner’s Capital or Current A/csDr. (in old ratio)

To Profit & Loss A/c (Dr. Balance)

To Deferred Revenue Expenditure A/c (e.g. Advertisement expense)

2: Vaishali, Vinod and Anjali are partners sharing profits in the ratio of 4:3:2. From

April 1, 2015; they decided to share the profits equally. On the date their book their

books showed a credit balance of Rs. 3,60,000 in the profit an loss account and a balance

of Rs. 90,000 in the General reserve. Record the journal entry for distribution of these

profits and reseves.

Solution:

Journal

Material downloaded from myCBSEguide.com. 2 / 11

Date Particulars L.F. Debit Credit

(Rs.) (Rs.)

Profit & Loss A/cDr.

General Reserve A/cDr.

To Vaishali’s Capital A/c 2,00,000

3,60,000

2015 Apr. 1 To Vinod’s Capital A/c 1,50,000

90,000

To Anjali’s Capital A/c 1,00,000

(Profit and general reserve distributed in

old ratio)

3: Anjun and Kanchan are partner sharing profits and losses in the ration of 3:2, From

April 1, 2015 they decided to share the profits in the ratio of 2:1 On that date, profit and

loss account showed a debit balance of Rs. 1,20,000. Record the Journal for transferring

this to partner’s capital accounts.

Solution:

Journal

Debit Credit

Date Particulars L.F.

(Rs.) (Rs.)

Anjun’s capital A/cDr.

Kanchan’s capital A/cDr.

72,000

2015 Apr. 1 To Profit and Loss A/c 1,20,000

48,000

(Undistributed losses transferred to

partners’ capital accounts in old ratio)

Case (ii) : When accumulated profits/losses are not be distributed at the time of change

in ratio

Partners may decide that reserves and accumulated profits/losses will not affected and

remains in the books with same figure. In this case, the gaining partner must Compensate

the sacrificing partner by the share gained by him i.e.

Gaining Partner’s Capital A/c.Dr.

Material downloaded from myCBSEguide.com. 3 / 11

To Sacrificing Partner’s Capital A/c

4: Keshav, Meenakshi and Mohit sharing profit and losses in the ratio of 1:2:2, decide to

share future profit equally with effect from April 1, 2015. On that date general reserve

showed a balance of Rs. 40,000. Partners do not want to distribute the reservwes. You

are required to give the adjusting entry.

Solution : Keshav; Meenakshi; Mohit

Old ratio 1/5 : 2/5 : 2/5

New ratio 1/3 : 1/3 : 1/3

Sacrifice or Gain

Keshav = 1/5 – 1/3 = (gain)

Meenakishi = 2/5 – 1/3 = (Sacrifice)

Mohit = 2/5 – 1/3 = (Sacrifice)

Journal

Debit Credit

Date Particulars L.F.

(Rs.) (Rs.)

Keshav’s capital A/c Dr.

To Meenakshi capital A/c

16,000

2015 Apr. 1 32,000

16,000

To Mohit’s capital A/c

(Adjustment for General reserve on change

Material downloaded from myCBSEguide.com. 4 / 11

in profit sharing ratio)

5 : Neha, Niharika, and Nitin are partners sharing profits and losses in the ratio of 2:3:4.

They decided to change their ratio and their new ratio is 4:3:2. They also decided to pass

a single journal entry to adjust the following without affecting their book values.

(Rs.)

Profit & Loss account80,000

General Reserve40,000

Advertisement Suspense A/c30,000

You are required to give the single journal entry to adjust the above.

Solution :

Profit & Loss Account80,000

Add : General Reserve40,000

_____________

Less : Advertisement Suspense1,20,000

Total amount to be adjusted30,000

_____________

90,000

NehaNiharikaNitin

Old ratio2/93/94/9

New ratio4/93/92/9

Sacrifice or Gain

Material downloaded from myCBSEguide.com. 5 / 11

Neha = 2/9 – 4/9 = 2/9 (Gain)

Niharika = 3/9 – 3/9 = 0 (No change)

Nitin = 4/9 – 2/9 = 2/9 (Sacrifice)

Journal

Debit Credit

Date Particulars L.F.

(Rs.) (Rs.)

Neha’s capital A/c Dr.

To Nitin’s capital A/c 20,000 20,000

(Adjustment for Profit & Loss A/c, General

Reserves and Advertisement Suspense A/c)

Accounting treatment for Revaluation of Assets and Reassessment of Liabilities on

change in Profit sharing ratio :

At the time of change in profit sharing ratio of existing partners, Assets and liabilities of a

firm must be revalued because actual realizable value of assets and liabilities may different

from their book values. Change in the assets and liabilities belongs to the period to change in

profit sharing ratio and therefore it must be shared in old profit sharing ratio.

Revaluation of assets and liabilities may be treated in two ways:

(i) When revised values are to be shown in the books.

(ii) When revised values are not be shown in the books.

When revised values are to be shown in the books :

In this case revaluation of assets and liabilities is completed with the help of “Revaluation

Account”. This account is also known as “Profit and Loss Adjustment Account”. All losses due

to revaluation are shown in debit side of this account and all gains due to revaluation are

shown in credit side of this account.

Material downloaded from myCBSEguide.com. 6 / 11

6: Piyush, Puja and Praveen are partners sharing profits and losses in the ratio of 3:3:2.

There balance sheet as on March 31st 2015 was as follows :

Liabilities (Rs.) Assets (Rs.)

Sundry creditors 74,000

Cash at bank

Bank Loan 48,000 88,000

Sundry debtors

Capital: 72,000 2,40,000

Stock

Piyush 4,00,000 10,00,000 3,18,000

Machinery

Puja 3,00,000 4,00,000

Building

Praveen 3,00,000 11,20,000 11,20,000

Partners decided that with effect from April 1, 2015, they would share profits and losses in

the ratio of 4:3:2. It was agreed that :

(i) Stock be valued at Rs. 2,20,000.

(ii) Machinery is to be depreciated by 10%

(iii) A provision for doubtful debts is to be made on debtors at 5%.

(iv) Building is to be appreciated by 20%

(v) A liability for Rs. 5,000 included in sundry creditors is not likely to arise. Partners agreed

that the revised value are to be recorded in the books. You are required to prepare journal,

revaluation account, partner’s capital Accounts and revised Balance Sheet.

Solution:

Journal

Debit Credit

Date Particulars L.F.

(Rs.) (Rs.)

Revaluation A/c Dr.

To Stock

2015 Apr. 1

To Provision for doubtful debts A/c

(Revaluation of assets) 20,000

31,800

Material downloaded from myCBSEguide.com. 7 / 11

Building A/c 56,200 4,400

April 1 Sundry creditor A/c 80,000 85,000

To Revaluation A/c 5,000 10,800

(Revaluation of assets and liabilities) 28,800 10,800

Revaluation A/c 7,800

To Piyush’s capital A/c

April 1 To Pooja’s capital A/c

To Praveen’s capital A/c

(Profit on revaluation)

Revaluation Account

Particulars (Rs.) Particulars (Rs.)

To Stock

To Machinery

20,000

To Provision for doubtful

31,800 80,000

Debts By Building

4,400 5,000

To Profits transferred to By Sundry creditors

28,800

To Piyush’s capital A/c10,800

To Pooja’s capital A/c10,800

To Praveen’s capital A/c7,200 85,000 85,000

Partner’s Capital A/cs

Dr. Cr.

Particulars Piyush Pooja praveen Particulars Piyush Pooja Praveen

By bal. b/d

By

To balance 4,00,000 3,00,000 3,00,000

4,10,800 3,10,800 3,07,200 Revaluation

b/d 10,800 10,800 7,200

A/c

Material downloaded from myCBSEguide.com. 8 / 11

4,10,800 3,10,800 3,07,200 4,10,800 3,10,800 3,37,200

Balance Sheet

As on April 1, 2015

Liabilities (Rs.) Assets (Rs.)

Sundry creditors Cash at bank 74,000

Bank Loan 43,000 Sundry debtors88,000 83,600

Capital account : 72,000 Less : provision 5% 4,400 2,20,000

Piyush’s4,10,800 10,28,800 Stock 2,86,200

Pooja’s3,10,800 Machinery 4,80,000

Praveen’s3,07,200 Building

11,43,800 11,43,800

When revised values are not to be shown in the books.

7 : In 6, Partners agreed that the revised value of assets and liabilities are not to be

shown in the books. You are required to record the effect by passing a single journal

entry. Also prepare the revised Balance Sheet.

Solution :

Gain due to revaluation

80,000

Building 5,00

Sundry creditors 85,000

Less : Loss due to revaluation

Total A 20,000

Stock

Total B 31,800

Machinery

Total (A – B) 4,400

Provision for doubtful debts

56,200

Net gain from revoluation

Material downloaded from myCBSEguide.com. 9 / 11

28,800

Old Ratio = 3:3:2

New Ratio = 4:3:2

Sacrifice or Gain

Piyush = 3/8 – 4/9 = -5/72 (Gain)

Pooja = 3/8 – 3/9 = 3/72 (Sacrifice)

Praveen = 2/8 – 2/9 = 2/72 (Sacrifice)

Amount to be adjusted :

Piyush = = Rs. 2,000 Debit

Pooja = = Rs. 1,200 Credit

Praveen = = Rs. 800 Credit

Journal

Debit Credit

Date Particulars L.F.

(Rs.) (Rs.)

Piyush’s capital A/c Dr.

To Pooja’s capital A/c

2015 Apr. 1 2,000 -----------

To Praveen’s capital A/c

(Adjustment for profit on revaluation)

Journal

Particulars Piyush Pooja praveen Particulars Piyush Pooja Praveen

To Pooja’s

1,200 - -

To Praveen By balance

Material downloaded from myCBSEguide.com. 10 / 11

Capital A/c 800 - - b/d 4,00,000 3,00,000 3,00,000

To Balance 3,98,000 3,01,200 3,09,800 By Piyaush’s - 1,200 -

b/d Capital A/c

4,10,800 3,10,800 3,07,200 4,00,000 3,01,200 3,00,200

Balance Sheet

As on April 1, 2015

Balance Sheet of Vijay, Vivek and Vinay

Abilities (Rs.) Assets (Rs.)

Sundry creditors 74,000

Cash at bank

Bank Loan 43,000 88,000

Sundry Debtors

Capital account: 72,000 2,40,000

Stock

Piyush’s3,98,000 10,10,000 3,18,000

Machinery

Pooja’s3,01,200 4,00,000

Building

Praveen’s3,00,800

11,20,000 11,20,000

Material downloaded from myCBSEguide.com. 11 / 11

Das könnte Ihnen auch gefallen

- Chapter 1 - Accounting For Partnership Firms - Fundamentals - Volume IDokument68 SeitenChapter 1 - Accounting For Partnership Firms - Fundamentals - Volume IVISHNUKUMAR S VNoch keine Bewertungen

- Senior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3Dokument26 SeitenSenior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3bhaiyarakeshNoch keine Bewertungen

- CBSE Class 12 Enterprise Growth Strategies NotesDokument13 SeitenCBSE Class 12 Enterprise Growth Strategies NotesAbheejit VijayNoch keine Bewertungen

- Class XII Accountancy Paper For Half Yearly PDFDokument13 SeitenClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNoch keine Bewertungen

- Class XII Accountancy Project AnalysisDokument41 SeitenClass XII Accountancy Project AnalysisIshika BothraNoch keine Bewertungen

- 100 QUESTIONS AccountsDokument84 Seiten100 QUESTIONS AccountsShraddha Bansal100% (1)

- Eco Material 2Dokument8 SeitenEco Material 21149Noch keine Bewertungen

- Principle of Management: S.No Title Page NoDokument15 SeitenPrinciple of Management: S.No Title Page NoVIVEK S 2127262100% (2)

- Chapter 1 - Nature and Significance of ManagementDokument6 SeitenChapter 1 - Nature and Significance of ManagementSachin Rana0% (1)

- 66 3 1Dokument23 Seiten66 3 1bhaiyarakeshNoch keine Bewertungen

- Marking Scheme for Business Studies ExamDokument74 SeitenMarking Scheme for Business Studies ExamNavya JindalNoch keine Bewertungen

- Viva On Project and CfsDokument7 SeitenViva On Project and CfsCrazy GamerNoch keine Bewertungen

- Retirement AnswersDokument7 SeitenRetirement AnswersshubhamsundraniNoch keine Bewertungen

- Solution Class 12 - Accountancy Accountancy Section A: Lsss 1 / 19Dokument19 SeitenSolution Class 12 - Accountancy Accountancy Section A: Lsss 1 / 19Mohamed IbrahimNoch keine Bewertungen

- 4 Retirement and Death of A PartnerDokument9 Seiten4 Retirement and Death of A PartnerAman Kakkar0% (1)

- Santhra 2017Dokument18 SeitenSanthra 2017VeenaNoch keine Bewertungen

- Math Project WorkDokument10 SeitenMath Project WorkBasanta K SahuNoch keine Bewertungen

- Class 12 THB CH-1Dokument9 SeitenClass 12 THB CH-1Kavita TomarNoch keine Bewertungen

- Physical Education Notes 2020 by Subhash DeyDokument5 SeitenPhysical Education Notes 2020 by Subhash DeySEEMA RANINoch keine Bewertungen

- XII Accountancy Sample PQ & MS (23-24)Dokument30 SeitenXII Accountancy Sample PQ & MS (23-24)umangchh2306Noch keine Bewertungen

- Principle of ManagementDokument18 SeitenPrinciple of ManagementVeenaNoch keine Bewertungen

- 20 Sample Papers - Economics (Solved) PDFDokument227 Seiten20 Sample Papers - Economics (Solved) PDFSimha SimhaNoch keine Bewertungen

- Cash Flow Statement Sample QuestionsDokument2 SeitenCash Flow Statement Sample QuestionsAyush ChauhanNoch keine Bewertungen

- Foreign Exchange - Sandeep GargDokument17 SeitenForeign Exchange - Sandeep GargRiddhima DuaNoch keine Bewertungen

- XII Sahodaya Set 1 BSDokument6 SeitenXII Sahodaya Set 1 BSClash with Sid67% (3)

- CBSE Accountancy 12th Term 2 CH 2Dokument4 SeitenCBSE Accountancy 12th Term 2 CH 2Nirmal GuptaNoch keine Bewertungen

- PsychologyDokument19 SeitenPsychologyAnushkaGuptaNoch keine Bewertungen

- Tata Steel Ir 2022 23Dokument18 SeitenTata Steel Ir 2022 23harshita girdharNoch keine Bewertungen

- Senior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3Dokument26 SeitenSenior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3bhaiyarakeshNoch keine Bewertungen

- Accountancy Project Ratio AnalysisDokument21 SeitenAccountancy Project Ratio AnalysisTanmay ChaitanyaNoch keine Bewertungen

- Bata India Balance Sheet Data for Previous YearsDokument1 SeiteBata India Balance Sheet Data for Previous YearsSanket BhondageNoch keine Bewertungen

- 06 Sample PaperDokument40 Seiten06 Sample Papergaming loverNoch keine Bewertungen

- Applied: Mathematics Project WorkDokument18 SeitenApplied: Mathematics Project WorkAnusha GhoshNoch keine Bewertungen

- 2.change in Profit Sharing Ratio, Admission of A PartnerDokument25 Seiten2.change in Profit Sharing Ratio, Admission of A PartnerTinkuNoch keine Bewertungen

- Physical Education ProjectDokument60 SeitenPhysical Education Projectparikhkaran947Noch keine Bewertungen

- Accountancy Project Work - XIIDokument41 SeitenAccountancy Project Work - XIIkawsarNoch keine Bewertungen

- Admission of A PartnerDokument11 SeitenAdmission of A PartnerKinley DorjiNoch keine Bewertungen

- CBSE Previous Year Question Papers Class 12 AccountancyDokument222 SeitenCBSE Previous Year Question Papers Class 12 AccountancySujal BhavsarNoch keine Bewertungen

- PresentationDokument22 SeitenPresentationDipanjanNoch keine Bewertungen

- India's Disinvestment Plans Raise Funds for Key ProjectsDokument8 SeitenIndia's Disinvestment Plans Raise Funds for Key Projectschandanprakash30Noch keine Bewertungen

- Studymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1Dokument19 SeitenStudymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1SukhmnNoch keine Bewertungen

- Business Studies Project On Principles of ManagementDokument36 SeitenBusiness Studies Project On Principles of Managementanshuman prajapatiNoch keine Bewertungen

- Senior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3Dokument26 SeitenSenior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3bhaiyarakeshNoch keine Bewertungen

- Project Report PepsiCoDokument29 SeitenProject Report PepsiCoRahul MehtaNoch keine Bewertungen

- 652oswaal Case-Based Questions Accountancy 12th (Issued by CBSE in April-2021)Dokument7 Seiten652oswaal Case-Based Questions Accountancy 12th (Issued by CBSE in April-2021)Nitesh kuraheNoch keine Bewertungen

- Indian School Al Seeb Department of Commerce and Humanities Class Xii Business Studies Project-2021 - 22Dokument10 SeitenIndian School Al Seeb Department of Commerce and Humanities Class Xii Business Studies Project-2021 - 22Nihal AnilNoch keine Bewertungen

- 2 - Accounting FOR Partnership: Fundamentals: Case Study Based Questions Case Study-IDokument7 Seiten2 - Accounting FOR Partnership: Fundamentals: Case Study Based Questions Case Study-IabiNoch keine Bewertungen

- Letter of Job ApplicationDokument2 SeitenLetter of Job ApplicationReet100% (1)

- Lakme Lever Private Limited - Financial Reports, Balance Sheets and More - ToflerDokument4 SeitenLakme Lever Private Limited - Financial Reports, Balance Sheets and More - Toflerkiyohe44160% (1)

- Economics Project Rough DraftDokument3 SeitenEconomics Project Rough DraftTisha ShahNoch keine Bewertungen

- Cbse Business Studies XII Sample Paper 1Dokument6 SeitenCbse Business Studies XII Sample Paper 1Firdosh KhanNoch keine Bewertungen

- Cost Accounting NayanDokument17 SeitenCost Accounting NayanSoudaminiNoch keine Bewertungen

- Project On Cash Flow and Ratio Analysis of CompanyDokument85 SeitenProject On Cash Flow and Ratio Analysis of Companysomyajit SahooNoch keine Bewertungen

- Pre Board II FfgsDokument15 SeitenPre Board II Ffgslibrarian.dewasNoch keine Bewertungen

- ITC Report and Accounts 2023 184Dokument1 SeiteITC Report and Accounts 2023 184Nishith RanjanNoch keine Bewertungen

- Business Studies Project: Made By: Rahil JainDokument29 SeitenBusiness Studies Project: Made By: Rahil JainChirag KothariNoch keine Bewertungen

- 12 Accountancy Notes CH03 Change in Profit Sharing Ratio of Existing Partness 01Dokument7 Seiten12 Accountancy Notes CH03 Change in Profit Sharing Ratio of Existing Partness 01Archit GargNoch keine Bewertungen

- Partnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)Dokument6 SeitenPartnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)DevanshuNoch keine Bewertungen

- RECONSTITUTION OF PARTNERSHIPDokument7 SeitenRECONSTITUTION OF PARTNERSHIPajay yadavNoch keine Bewertungen

- 12 Accounts Imp Ch1Dokument22 Seiten12 Accounts Imp Ch1Tushar Tyagi100% (1)

- Vardhman International School: Holiday Homework (AY: 2022-23) Research WorkDokument2 SeitenVardhman International School: Holiday Homework (AY: 2022-23) Research WorkAshish GangwalNoch keine Bewertungen

- Class XI Entrepreneurship Ii Term Examination Answer KeyDokument3 SeitenClass XI Entrepreneurship Ii Term Examination Answer KeyAshish GangwalNoch keine Bewertungen

- Language Development English: Affiliated To The CISCE, New DelhiDokument4 SeitenLanguage Development English: Affiliated To The CISCE, New DelhiAshish GangwalNoch keine Bewertungen

- Class 6 P.A.1 Syllabus and DatesheetDokument2 SeitenClass 6 P.A.1 Syllabus and DatesheetAshish GangwalNoch keine Bewertungen

- Math Readiness: Affiliated To The CISCE, New DelhiDokument4 SeitenMath Readiness: Affiliated To The CISCE, New DelhiAshish GangwalNoch keine Bewertungen

- BST Test 20 DecDokument4 SeitenBST Test 20 DecAshish GangwalNoch keine Bewertungen

- Language Development English: Affiliated To The CISCE, New DelhiDokument4 SeitenLanguage Development English: Affiliated To The CISCE, New DelhiAshish GangwalNoch keine Bewertungen

- Business Studies Class XII I Pre-Board Paper (2021-22)Dokument4 SeitenBusiness Studies Class XII I Pre-Board Paper (2021-22)Ashish GangwalNoch keine Bewertungen

- S Subject: ARTS: Affiliated To The CISCE, New DelhiDokument3 SeitenS Subject: ARTS: Affiliated To The CISCE, New DelhiAshish GangwalNoch keine Bewertungen

- Mock Test 2 Datesheet FinalDokument1 SeiteMock Test 2 Datesheet FinalAshish GangwalNoch keine Bewertungen

- S Subject: ARTS Class: U. K. G Subject Teacher: Swati GangwalDokument3 SeitenS Subject: ARTS Class: U. K. G Subject Teacher: Swati GangwalAshish GangwalNoch keine Bewertungen

- Academic Remarks For MarksheetDokument2 SeitenAcademic Remarks For MarksheetAshish GangwalNoch keine Bewertungen

- Seedling Group of Schools: Warm RegardsDokument1 SeiteSeedling Group of Schools: Warm RegardsAshish GangwalNoch keine Bewertungen

- Pa 2 Datesheet Class I - Ix & XiDokument1 SeitePa 2 Datesheet Class I - Ix & XiAshish GangwalNoch keine Bewertungen

- Ashish CertificateDokument1 SeiteAshish CertificateAshish GangwalNoch keine Bewertungen

- Office Order - Class 1 To 12 Teachers For ERP Marks EntryDokument2 SeitenOffice Order - Class 1 To 12 Teachers For ERP Marks EntryAshish GangwalNoch keine Bewertungen

- 25th Wedding Anniversary: Mr. Murli Manohar Mathur Mrs. Suman MathurDokument3 Seiten25th Wedding Anniversary: Mr. Murli Manohar Mathur Mrs. Suman MathurAshish GangwalNoch keine Bewertungen

- Unit Ii-An Entrepreneur Multiple Choice QuestionsDokument16 SeitenUnit Ii-An Entrepreneur Multiple Choice QuestionsAshish Gangwal100% (1)

- 1 Entrepreneurship - What, Why and HowDokument17 Seiten1 Entrepreneurship - What, Why and HowAshish Gangwal100% (1)

- 3 Entrepreneurial JourneyDokument20 Seiten3 Entrepreneurial JourneyAshish GangwalNoch keine Bewertungen

- Academic Remarks For MarksheetDokument2 SeitenAcademic Remarks For MarksheetAshish Gangwal100% (1)

- KP Horary Table 1 249 PDFDokument5 SeitenKP Horary Table 1 249 PDFSunil ThombareNoch keine Bewertungen

- KizaksaknaDokument2 SeitenKizaksaknaT Suan Lian TonsingNoch keine Bewertungen

- 12 HouseDokument20 Seiten12 HouseRomani Bora100% (1)

- Aissce Practical Examination (2020-21) Shree Narayana Central School Ahmedabad Sample Paper For Revision by Simmi PrakashDokument1 SeiteAissce Practical Examination (2020-21) Shree Narayana Central School Ahmedabad Sample Paper For Revision by Simmi PrakashAshish GangwalNoch keine Bewertungen

- Touch and See Your Solution: Finding Solutions For Your Problems in Bhagvad GitaDokument1 SeiteTouch and See Your Solution: Finding Solutions For Your Problems in Bhagvad Gitaanu50% (2)

- 31 Circular 2021Dokument3 Seiten31 Circular 2021Ashish GangwalNoch keine Bewertungen

- SEEDLING Modern High School Class IX Protor Details: S No. School Code Role User Name Login IDDokument3 SeitenSEEDLING Modern High School Class IX Protor Details: S No. School Code Role User Name Login IDAshish GangwalNoch keine Bewertungen

- Notification: CBSE/Training Unit/2020 18.09.2020Dokument2 SeitenNotification: CBSE/Training Unit/2020 18.09.2020Ashish GangwalNoch keine Bewertungen

- PA2 Blueprint Ep Class 11Dokument1 SeitePA2 Blueprint Ep Class 11Ashish GangwalNoch keine Bewertungen

- LAB 3 - Rockwell Hardness TestingDokument10 SeitenLAB 3 - Rockwell Hardness TestingLEKA THOBEJANENoch keine Bewertungen

- Class Notes LUCT-updatedDokument56 SeitenClass Notes LUCT-updatedYousef AzhariNoch keine Bewertungen

- Narrative Report - Food Safety and SanitationDokument4 SeitenNarrative Report - Food Safety and SanitationMarjorie Dela CruzNoch keine Bewertungen

- CTF France PDFDokument2 SeitenCTF France PDFmeka_nathNoch keine Bewertungen

- Tikaria Expansion Project, ACC Daily Checklist For SlipformDokument2 SeitenTikaria Expansion Project, ACC Daily Checklist For SlipformRaju100% (1)

- Working With Groups Towards Com Dev't: Nsg. Process Cont.Dokument19 SeitenWorking With Groups Towards Com Dev't: Nsg. Process Cont.Czarina Dawn BelargaNoch keine Bewertungen

- Five Model Intragroup Conflict ManagemantDokument22 SeitenFive Model Intragroup Conflict ManagemantmarsNoch keine Bewertungen

- Financial Accounting - ATD IIDokument8 SeitenFinancial Accounting - ATD IIlavina atienoNoch keine Bewertungen

- Introduction To BondsDokument5 SeitenIntroduction To BondsHuu Duy100% (1)

- Atmanirbhar Bharat A Study Based On Budget 2021 2022 1616066143Dokument5 SeitenAtmanirbhar Bharat A Study Based On Budget 2021 2022 1616066143santoshsadanNoch keine Bewertungen

- Financial Statement Analysis of HUL and Dabur India LtdDokument12 SeitenFinancial Statement Analysis of HUL and Dabur India LtdEdwin D'SouzaNoch keine Bewertungen

- Commercial Dispatch Eedition 7-10-19Dokument16 SeitenCommercial Dispatch Eedition 7-10-19The DispatchNoch keine Bewertungen

- List of ports used by trojansDokument9 SeitenList of ports used by trojansJavier CabralNoch keine Bewertungen

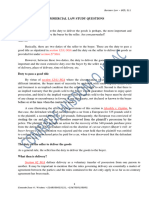

- Commercial Law Study QuestionsDokument33 SeitenCommercial Law Study QuestionsIfeanyi NdigweNoch keine Bewertungen

- ITR62 Form 15 CADokument5 SeitenITR62 Form 15 CAMohit47Noch keine Bewertungen

- OmniVision OV9716Dokument2 SeitenOmniVision OV9716cuntadinNoch keine Bewertungen

- Statement Showing The List of Lps Applications of Isnapur (V) Patancheru (M)Dokument14 SeitenStatement Showing The List of Lps Applications of Isnapur (V) Patancheru (M)dpkrajaNoch keine Bewertungen

- The Main Factors Which Influence Marketing Research in Different Countries AreDokument42 SeitenThe Main Factors Which Influence Marketing Research in Different Countries AreHarsh RajNoch keine Bewertungen

- ASTM D 5957 Flood Testing Horizontal Waterproofing InstallationsDokument5 SeitenASTM D 5957 Flood Testing Horizontal Waterproofing InstallationsILSEN N. DAETNoch keine Bewertungen

- 26 - Submission of Calibration Certificate of Relative Testing EquipmentsDokument18 Seiten26 - Submission of Calibration Certificate of Relative Testing EquipmentsUgrasen ChaudharyNoch keine Bewertungen

- ABB Connectivity PackagesDokument102 SeitenABB Connectivity Packagestin_gabby4876100% (1)

- Chapman, J. C. and Gaydarska, B. I. (2006) 'Parts and Wholes. Fragmentation in Prehistoric Conte XTDokument245 SeitenChapman, J. C. and Gaydarska, B. I. (2006) 'Parts and Wholes. Fragmentation in Prehistoric Conte XTSetsuna NicoNoch keine Bewertungen

- Bus. Plan Template EditedDokument4 SeitenBus. Plan Template EditedLovely magandaNoch keine Bewertungen

- Maintenance Manual: FanucDokument182 SeitenMaintenance Manual: FanucCnc Tien100% (2)

- STM Turbine Overspeed Failure Investigation-1Dokument11 SeitenSTM Turbine Overspeed Failure Investigation-1Abdulrahman AlkhowaiterNoch keine Bewertungen

- Walkable and Bikeable Cities - PDF PENTINGDokument77 SeitenWalkable and Bikeable Cities - PDF PENTINGMauliana DewiNoch keine Bewertungen

- Streeter v. Secretary, Department of Corrections Et Al - Document No. 3Dokument2 SeitenStreeter v. Secretary, Department of Corrections Et Al - Document No. 3Justia.comNoch keine Bewertungen

- Career Interest Inventory HandoutDokument2 SeitenCareer Interest Inventory HandoutfernangogetitNoch keine Bewertungen

- Wattyl Killrust Brochure 2Dokument6 SeitenWattyl Killrust Brochure 2Tech 84Noch keine Bewertungen

- TL594 Pulse-Width-Modulation Control Circuit: 1 Features 3 DescriptionDokument33 SeitenTL594 Pulse-Width-Modulation Control Circuit: 1 Features 3 Descriptionاحمد زغارىNoch keine Bewertungen