Beruflich Dokumente

Kultur Dokumente

INTACC2 Liabilities Questions ARALJPIA

Hochgeladen von

Kiba YuutoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

INTACC2 Liabilities Questions ARALJPIA

Hochgeladen von

Kiba YuutoCopyright:

Verfügbare Formate

Mga fellow Accounting Students,,, now this is my side. Listen, look, listen, and LEARN.

INTACC2 – LIABILITIES

By: Dan Andrew Millano

Nature of Provision

I. Papasa Tayo Corp. is evaluating whether each of the following would be a liability, a

provision or a contingent liability, or none of these, in the financial statements of Papasa

Tayo Corp. as of 30 June 2019. Assume that Papasa Tayo Corp.’s financial statements

are authorized for issue on 24 August 2019:

§ An amount of P350,000 owing to Di Tayo Susuko Company for services

rendered during May 2019.

§ Long service leave, estimated to be P5,000,000 owing to employees in respect to

past services.

§ Costs of P260,000 estimated to be incurred for relocating employee D from

Papasa Tayo Corp’s head office location to another city. The staff member will

physically relocate during July 2019

§ Provision of P500,000 for the overhaul of a machine . The overhaul is needed

every 5 years and the machine was 5 years as at 30 June 2019

§ Damages awarded against Papasa Tayo Corp. resulting from a court case

decided on 26 June 2019. The judge has announced that the amount of

damages will be set at a future date. expected to be in September 2019. Papasa

Tayo Corp. has received advice from its lawyers that the amount of the damages

could be anything between P50,000 and P8 million.

How much should be reported as Provision in Papasa Tayo Corp.’s statement of

financial position as of 30 June 2019?

II. During current year, Kaya Natin To Corp. won a litigation award for P2,000,000 which

was tripled to P6,000,000 to include punitive damages. The defendant, who is

financially stable, has appealed only the P4,000,000 punitive damages. Kaya Natin To

Corp. was awarded P1,000,000 in an unrelated suit it filed, which was being appealed

by the defendant. Counsel is unable to estimate the outcome of the appeals. In its

current year income statement, Kaya Natin To Corp. should report what amount

of liability?

III. In May 2019, Tiwala Lang Corp. relocated an employee from the company’s head

office to an office in another city. As of June 30,2019, the company’s period end, the

relocation costs are estimated as follows:

§ Cost of shipping goods P30,000

§ Airfare P60,000

§ Temporary Accomodation costs for May and June P80,000

§ Temporary Accomodation costs for July and August P90,000

§ Reimbursement for lease break cost paid in July. The

lease was terminated in May P20,000

§ Reimbursement for costs of living increase for the

§ period May2019 to April 2020 P120,000

TOTAL P400,000

How much is the provision for relocation costs as of June 30,2019?

BONDS and NOTES PAYABLE

If silent always recognized @AC

IV. On March 1, 2019, Listen Look & Listen & Learn Company issued 10,000 of its

P1,000 face value bonds at 95 plus accrued interest. Listen Look & Listen & Learn

Company paid bond issue cost of P1,000,000. The bonds were dated November 1 ,

2018, mature on November 1, 2028 and bear interest at 12% payable semiannually on

November 1 and May 1.

1. The net amount that Listen Look & Listen & Learn receive from the bond

issuance is

2. Give the entry in the books of Listen Look & Listen & Learn (issuer)

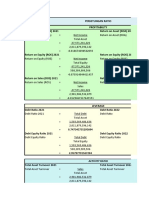

V. On January 1, 2019, Daybors Comapany issued 12%, P1000 face value 5-year

bonds @ 105. Interest on the bonds is payable annually every December 31. In

connection with the sale of these bonds, Daybors paid the following expenses

§ Promotion Cost. P100,000

§ Engraving and printing 400,000

§ Underwriter’s commissions 500,000

Using the straight line method, what amount should Marimar report as bond

interest expense for the year 2019?

VI. The Truth Will Set Be Free Company floated a serial bond issue in 2017. Details of

the issue are as follows

§ Total amount P5,000,000

§ Date of issue October 2, 2017

§ Proceeds from issue P4,900,000

§ Interest rate 5% per annum

§ Interest payment date October 1

§ Maturity date P1,000,000 annually, starting October 1, 2019

Using the bond outstanding method of amortizing discount, compute the interest

expense to be recognized for the year ended December 31, 2019

VII. On December 31, 2018, No Katsing issued P200,000 of 8% serial bonds, to be

repaid in the amount of P40,000 each year. Interest is payable annually on December

31. The bonds were issued to yield 10% a year. In its December 31, 2019 statement of

financial position, at what amount should No Katsing report the carrying amount of

the bonds?

VIII. On July 1, 2019. ETC purchased a noncash asset with a list price of P260,000 by

issuing a five-year noninterest bearing note, The market or “going” rate of interest for

this note was 12%. The note will be paid in five annual P64,000 installments each June

30,2020 through 2024. The amount that should be recorded for the net liability on

July 1, 2019, is:

IX. Silver Company purchased merchandise for resale on January 1, 2019, for P5,000

plus a P20,000, two year note payable. The principal is due on December 31, 2020; the

note specified 8 percent interest payable each December 31. Silver’s going rate of

interest for this type of debt was 15%. How much is the carrying amount of the note

payable on December 31, 2019?

X. On December 31, 2019, Park Company purchased equipment from Ott Corp. and

issued a non-interest bearing note requiring payment of P50,000 annually for 10 years/

The first payment is due December 31, 2019, and the prevailing rate of interest for this

type of note at date of issuance is 12%. The interest expense to be reported by Park

in its 2020 income statement is?

XI. Funan Industries purchases new specialized manufacturing equipment on July 1,

2018. The equipment cash price is P79,000. Funan signs a deferred payment contract

that provides for a down payment of P10,000 and an 8 yr. note for 103,472. The note is

to be paid in 8 equal annual payments of P12,934. the payments include 10% interest

and are made on June 30 of each year, beginning June 30, 2019

a) What is the carrying amount of the note payable on December 31, 2019?

b) What is the total interest expense for the year ended December 31, 2019?

Das könnte Ihnen auch gefallen

- ASSET 2019 Mock Boards - FARDokument7 SeitenASSET 2019 Mock Boards - FARKenneth Christian WilburNoch keine Bewertungen

- Benjo Lopez CoDokument2 SeitenBenjo Lopez Conovy0% (1)

- AccountingDokument3 SeitenAccountingrenoNoch keine Bewertungen

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDokument171 SeitenIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionRengeline LucasNoch keine Bewertungen

- Quiz Bee4thyrDokument5 SeitenQuiz Bee4thyrlalala010899Noch keine Bewertungen

- De Guzman, Marie Pauline C. BSA 3-2 Transaction: ST ST ND NDDokument10 SeitenDe Guzman, Marie Pauline C. BSA 3-2 Transaction: ST ST ND NDMakoy BixenmanNoch keine Bewertungen

- AFAR Final Preboard 2018 PDFDokument22 SeitenAFAR Final Preboard 2018 PDFcardos cherryNoch keine Bewertungen

- Case No. 1: BM2008/BM2015 - Auditing and Assurance: Concepts and Application 1 & 2Dokument8 SeitenCase No. 1: BM2008/BM2015 - Auditing and Assurance: Concepts and Application 1 & 2Ken MateyowNoch keine Bewertungen

- Acctg. QB 1-1Dokument8 SeitenAcctg. QB 1-1Jinx Cyrus RodilloNoch keine Bewertungen

- Part 2 PRE2Dokument3 SeitenPart 2 PRE2School FilesNoch keine Bewertungen

- AP - Ppe, Int. & Invest PropDokument15 SeitenAP - Ppe, Int. & Invest PropJolina ManceraNoch keine Bewertungen

- This Study Resource Was: C. P6,050,000 D. P53,900Dokument2 SeitenThis Study Resource Was: C. P6,050,000 D. P53,900Nah HamzaNoch keine Bewertungen

- 04 Process Costing Exercise ProblemsDokument3 Seiten04 Process Costing Exercise ProblemsCharithea NaboNoch keine Bewertungen

- Review 105 - Day 13 P1: Notes ReceivableDokument21 SeitenReview 105 - Day 13 P1: Notes ReceivableAldrin ZolinaNoch keine Bewertungen

- Premiums and WarrantyDokument2 SeitenPremiums and WarrantyAJ Gaspar100% (1)

- Cash Basis & AccrualDokument5 SeitenCash Basis & AccrualFerb CruzadaNoch keine Bewertungen

- Lyceum First Preboard 2020Dokument3 SeitenLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Activity 2Dokument3 SeitenActivity 2LFGS Finals0% (1)

- MA2E Relevant Cost ExercisesDokument6 SeitenMA2E Relevant Cost ExercisesRolan PalquiranNoch keine Bewertungen

- 2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)Dokument2 Seiten2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)max pNoch keine Bewertungen

- 2.3G Homework (Questionnaire)Dokument4 Seiten2.3G Homework (Questionnaire)Bea GarciaNoch keine Bewertungen

- D2Dokument12 SeitenD2neo14Noch keine Bewertungen

- Auditing Problem 2Dokument1 SeiteAuditing Problem 2jhobs100% (1)

- Practical Accounting 2 First Pre-Board ExaminationDokument15 SeitenPractical Accounting 2 First Pre-Board ExaminationKaren Eloisse89% (9)

- Theories: Far Eastern University - Manila Quiz No. 1Dokument6 SeitenTheories: Far Eastern University - Manila Quiz No. 1Kenneth Christian WilburNoch keine Bewertungen

- Synthesis - AudProb (Q)Dokument8 SeitenSynthesis - AudProb (Q)Anna Gian SobrevillaNoch keine Bewertungen

- Audit of PPE 2Dokument2 SeitenAudit of PPE 2Raz MahariNoch keine Bewertungen

- ConsignmentDokument2 SeitenConsignmentJenica Joyce BautistaNoch keine Bewertungen

- 1Dokument2 Seiten1Your MaterialsNoch keine Bewertungen

- Auditing Appplications PrelimsDokument5 SeitenAuditing Appplications Prelimsnicole bancoroNoch keine Bewertungen

- Fin ExamDokument6 SeitenFin ExamKissesNoch keine Bewertungen

- Accounting ForDokument18 SeitenAccounting ForKriztleKateMontealtoGelogoNoch keine Bewertungen

- AFAR 01 Partnership AccountingDokument6 SeitenAFAR 01 Partnership AccountingAriel DimalantaNoch keine Bewertungen

- 162 020Dokument5 Seiten162 020Angelli LamiqueNoch keine Bewertungen

- Prelim Exam Aud AnswersDokument5 SeitenPrelim Exam Aud Answerslois martinNoch keine Bewertungen

- P1.004 - PPE Depreciation and Derecognition (Illustrative Problems)Dokument2 SeitenP1.004 - PPE Depreciation and Derecognition (Illustrative Problems)Patrick Kyle AgraviadorNoch keine Bewertungen

- Audit of Allowance For Doubtful AccountsDokument4 SeitenAudit of Allowance For Doubtful AccountsCJ alandyNoch keine Bewertungen

- Liabs 2Dokument3 SeitenLiabs 2Iohc NedmiNoch keine Bewertungen

- Conceptual FrameworkDokument65 SeitenConceptual FrameworkKatKat OlarteNoch keine Bewertungen

- DocxDokument6 SeitenDocxMico Duñas CruzNoch keine Bewertungen

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDokument12 SeitenGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNoch keine Bewertungen

- Solve Me PDFDokument1 SeiteSolve Me PDFWinona Anne EscarezNoch keine Bewertungen

- MB2 2013 Ap Set BDokument6 SeitenMB2 2013 Ap Set BMary Queen Ramos-UmoquitNoch keine Bewertungen

- Corporation HandoutDokument6 SeitenCorporation HandoutAndrea M. AdofinaNoch keine Bewertungen

- This Study Resource WasDokument4 SeitenThis Study Resource WasReznakNoch keine Bewertungen

- Events After The Reporting Period NCA Held For Disposal Discontinued OperationsDokument2 SeitenEvents After The Reporting Period NCA Held For Disposal Discontinued OperationsJeremiah DavidNoch keine Bewertungen

- This Study Resource WasDokument9 SeitenThis Study Resource WasAnna TaylorNoch keine Bewertungen

- Advanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Dokument6 SeitenAdvanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Jem ValmonteNoch keine Bewertungen

- MAS - Group 5Dokument7 SeitenMAS - Group 5beleky watersNoch keine Bewertungen

- IntangiblesDokument15 SeitenIntangiblesJ RodriguezNoch keine Bewertungen

- Cpar - Ap 09.15.13Dokument18 SeitenCpar - Ap 09.15.13KamilleNoch keine Bewertungen

- Q06A Audit of Non Cash AssetsDokument7 SeitenQ06A Audit of Non Cash AssetsChristine Jane ParroNoch keine Bewertungen

- Intangible Assets Assignment - No Answers - For PostingDokument2 SeitenIntangible Assets Assignment - No Answers - For Postingemman neriNoch keine Bewertungen

- Competency AssessmentDokument5 SeitenCompetency AssessmentMiracle FlorNoch keine Bewertungen

- MAS 25A 27TH BATCH With AnswersDokument12 SeitenMAS 25A 27TH BATCH With AnswersSarah Jane GanigaNoch keine Bewertungen

- Quizzer Answers KeyDokument4 SeitenQuizzer Answers KeyDaneen GastarNoch keine Bewertungen

- FAR MOCK Edited PDFDokument21 SeitenFAR MOCK Edited PDFKorinth BalaoNoch keine Bewertungen

- Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASDokument1 SeiteInstruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASKylene Edelle LeonardoNoch keine Bewertungen

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Dokument5 SeitenLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganNoch keine Bewertungen

- SynthesisDokument19 SeitenSynthesisMej AgaoNoch keine Bewertungen

- Accounting ProjectDokument2 SeitenAccounting ProjectAngel Grefaldo VillegasNoch keine Bewertungen

- National Bank of Pakistan Internship ReportDokument58 SeitenNational Bank of Pakistan Internship Reportbbaahmad89Noch keine Bewertungen

- Chapter 6 Financial Statements Tools For Decision MakingDokument25 SeitenChapter 6 Financial Statements Tools For Decision MakingEunice NunezNoch keine Bewertungen

- Newyork Review of Books 8 October 2015Dokument60 SeitenNewyork Review of Books 8 October 2015Hugo Coelho100% (1)

- Simple, Compound Interest and Annuity Problems For Special ClassDokument2 SeitenSimple, Compound Interest and Annuity Problems For Special ClassPaolo PerezNoch keine Bewertungen

- Audit of PPEDokument2 SeitenAudit of PPEChi VirayNoch keine Bewertungen

- Topic: Financial Management Function: Advantages of Profit MaximizationDokument4 SeitenTopic: Financial Management Function: Advantages of Profit MaximizationDilah PhsNoch keine Bewertungen

- CR Sample L6 Module 2 PDFDokument4 SeitenCR Sample L6 Module 2 PDFDavid JonathanNoch keine Bewertungen

- Call For Expression of Interest Ip Selection Co Financing Initiative Migration Governance 0Dokument27 SeitenCall For Expression of Interest Ip Selection Co Financing Initiative Migration Governance 0lightnorth96Noch keine Bewertungen

- Acc 219 Notes Mhaka CDokument62 SeitenAcc 219 Notes Mhaka CfsavdNoch keine Bewertungen

- Product Costing Material Ledger1Dokument31 SeitenProduct Costing Material Ledger1Anand NcaNoch keine Bewertungen

- Royal Caribbean Cruises Client ReportDokument36 SeitenRoyal Caribbean Cruises Client Reportمرزا احسن بیگNoch keine Bewertungen

- UNIBIC Foods India PVT LTDDokument8 SeitenUNIBIC Foods India PVT LTDkalimaniNoch keine Bewertungen

- Universiti Teknologi Mara Final Examination: Confidential LW/OCT2010/LAW585Dokument4 SeitenUniversiti Teknologi Mara Final Examination: Confidential LW/OCT2010/LAW585AliceAinaaNoch keine Bewertungen

- Laporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting DateDokument6 SeitenLaporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting Datedok wahab siddikNoch keine Bewertungen

- Financial StatementsDokument21 SeitenFinancial Statementsastute kidNoch keine Bewertungen

- Proyeksi INAF - Kelompok 3Dokument43 SeitenProyeksi INAF - Kelompok 3Fairly 288Noch keine Bewertungen

- The Triangle of Microfinance-EdDokument29 SeitenThe Triangle of Microfinance-EdAdela Miranti YuniarNoch keine Bewertungen

- Crown Valley Financial Plaza 100% Leased!Dokument2 SeitenCrown Valley Financial Plaza 100% Leased!Scott W JohnstoneNoch keine Bewertungen

- Sample: Financial Aid ApplicationDokument12 SeitenSample: Financial Aid Applicationsm smNoch keine Bewertungen

- Iyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeDokument9 SeitenIyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeJudy Silvestre BẹnóngNoch keine Bewertungen

- ZEROPAY WhitepaperDokument15 SeitenZEROPAY WhitepaperIlham NurrohimNoch keine Bewertungen

- RY-Expected Optimal Exercise TimeDokument10 SeitenRY-Expected Optimal Exercise TimeryaksickNoch keine Bewertungen

- Canning The Eastern Question PDFDokument285 SeitenCanning The Eastern Question PDFhamza.firatNoch keine Bewertungen

- Current Ratio AnalysisDokument3 SeitenCurrent Ratio Analysisnandini swamiNoch keine Bewertungen

- Practice Set 1Dokument6 SeitenPractice Set 1moreNoch keine Bewertungen

- A Briefing Report On Implementing An Enterprise System at NestléDokument9 SeitenA Briefing Report On Implementing An Enterprise System at NestléTom Jacob90% (10)

- IFRS 9 Training Slides For MLDC - DAY 1Dokument43 SeitenIFRS 9 Training Slides For MLDC - DAY 1Onche Abraham100% (1)

- Lab 4Dokument32 SeitenLab 4M Aiman Syafiq0% (1)

- Chapter 13. CH 13-11 Build A Model: (Par Plus PIC)Dokument7 SeitenChapter 13. CH 13-11 Build A Model: (Par Plus PIC)AmmarNoch keine Bewertungen