Beruflich Dokumente

Kultur Dokumente

Cash Flow Analysis

Hochgeladen von

LULZCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cash Flow Analysis

Hochgeladen von

LULZCopyright:

Verfügbare Formate

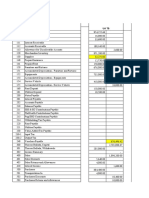

CASH FLOW ANALYSIS

Fixed capital = $500 million

Working capital = $132.00 million

Operating life= 10 years Selling price of methanol = $1,200 per tonne

Production capacity = 600000 t.p.a. Tax rate = 30%

Operating costs= $587.50 million Production rate (% of design capacity)= 100% 600000 tonnes

Annual variable expenses 515.000 million

Annual fixed expenses inclu 72.500 million

Annual depreciation = $50 million

Cash Flow Analysis

All figures are in $millions)

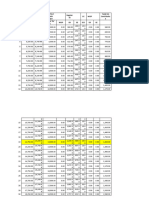

Total annual Depreciation Nominal

capital ACI = AS- (tax) AIT=(ACI- ANCI=ACI- ACF=ANCI-

Year investment ATC AS AFE AVE ATE ATE allowance, ATD ATD)T AIT ATC Sum(ACF)

1 632.000 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -632.00 -632.00

2 0.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 142.75 -489.25

3 0.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 142.75 -346.50

4 0.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 142.75 -203.75

5 0.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 142.75 -61.00

6 0.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 142.75 81.75

7 0.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 142.75 224.50

8 0.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 142.75 367.25

9 0.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 142.75 510.00

10 0.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 142.75 652.75

11 -132.000 720.00 22.50 515.00 537.50 182.50 50.00 39.75 142.75 274.75 927.50

500.00

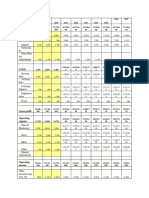

Year Sum(ACF) 1200

0 0 1000

1 -632.00

800

2 -489.25

3 -346.50 600

4 -203.75 400

5 -61.00

ACF

200

6 81.75

0

7 224.50 0 1 2 3 4 5 6 7 8 9 10 11 12

8 367.25 -200

9 510.00 -400

Payback period

10 652.75 -600

11 927.50

-800

Year

Das könnte Ihnen auch gefallen

- Thai Restaurant Cash FlowDokument33 SeitenThai Restaurant Cash FlowElizabethNoch keine Bewertungen

- Range of CompensationDokument4 SeitenRange of Compensationjasminejazz54321Noch keine Bewertungen

- Final IannaDokument83 SeitenFinal IannaJuzetteValerieSarceNoch keine Bewertungen

- TALLY REPORT (AutoRecovered) (AutoRecovered)Dokument11 SeitenTALLY REPORT (AutoRecovered) (AutoRecovered)officer lkoNoch keine Bewertungen

- HowMuchCandy To 100Dokument6 SeitenHowMuchCandy To 100Maximo ExNoch keine Bewertungen

- Chapter 9 Mintendo Game GirlDokument5 SeitenChapter 9 Mintendo Game GirlANANG DWI CAHYADINoch keine Bewertungen

- Revenue: Recurring Service Consulting Support Partnershi Ps Other/Man Ual AdjustmentsDokument6 SeitenRevenue: Recurring Service Consulting Support Partnershi Ps Other/Man Ual AdjustmentsGolam Samdanee TaneemNoch keine Bewertungen

- Emilie Payroll and ChequeDokument5 SeitenEmilie Payroll and ChequeEmilie JuneNoch keine Bewertungen

- 4 - Shrayan SarkarDokument6 Seiten4 - Shrayan SarkarKunal DagaNoch keine Bewertungen

- Case Study CharlieDokument9 SeitenCase Study CharlieHIMANSHU AGRAWALNoch keine Bewertungen

- Cash Budgeting - Case1Dokument10 SeitenCash Budgeting - Case1saurabh chaturvediNoch keine Bewertungen

- Post Closing Trial BalanceDokument25 SeitenPost Closing Trial Balancelala100% (1)

- Capital Investment Decisions Answers To End of Chapter ExercisesDokument3 SeitenCapital Investment Decisions Answers To End of Chapter ExercisesJay BrockNoch keine Bewertungen

- AF Ch. 4 - Analysis FS - ExcelDokument9 SeitenAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNoch keine Bewertungen

- Portfolio Management Project Adj. Closing NseiDokument19 SeitenPortfolio Management Project Adj. Closing Nseiparakh malhotraNoch keine Bewertungen

- Minwaly Trading & Consultancy PLC Rak Bakery Contrct Workers Payroll For The Month of Hidar 2009 E.CDokument2 SeitenMinwaly Trading & Consultancy PLC Rak Bakery Contrct Workers Payroll For The Month of Hidar 2009 E.CABDELLA ALINoch keine Bewertungen

- Option Chain (Equity Derivatives)Dokument3 SeitenOption Chain (Equity Derivatives)bharat singh koteriNoch keine Bewertungen

- 011 September 2022Dokument21 Seiten011 September 2022John Louie LagunaNoch keine Bewertungen

- Sss Withholding Tax TableDokument4 SeitenSss Withholding Tax TableKrichel SesimaNoch keine Bewertungen

- 740 BasisallotmentDokument1 Seite740 BasisallotmentzainalNoch keine Bewertungen

- 10 Column Heavy BombersDokument3 Seiten10 Column Heavy BombersVince Ferdinand Pajanustan100% (1)

- First Capital Securities LTD.: Buy/Sale ConfirmationDokument2 SeitenFirst Capital Securities LTD.: Buy/Sale ConfirmationEnamul HaqueNoch keine Bewertungen

- Gaji Dan Imbuhan PekerjaDokument5 SeitenGaji Dan Imbuhan PekerjaWiwienNoch keine Bewertungen

- Monthly Cash MonitoringDokument14 SeitenMonthly Cash MonitoringEden Aguilar PebidaNoch keine Bewertungen

- Todas Las Ventas Factura Cliente Número de DocumentoDokument4 SeitenTodas Las Ventas Factura Cliente Número de Documentodora saldarriagaNoch keine Bewertungen

- Chapter 4 Financial AnilsisDokument5 SeitenChapter 4 Financial AnilsisIzo Izo GreenNoch keine Bewertungen

- R&R2 WeekDokument7 SeitenR&R2 WeekMohammed SobuhNoch keine Bewertungen

- Val. ExcavadoraDokument1 SeiteVal. ExcavadoraJakelyn GutiérrezNoch keine Bewertungen

- Natalia Final Profit and Loss ProjectionsDokument18 SeitenNatalia Final Profit and Loss ProjectionsPaulDaniel101Noch keine Bewertungen

- CPSC - TruckingDokument32 SeitenCPSC - TruckingSari Sari Store VideoNoch keine Bewertungen

- Harrisons 2022 Annual Report Final CompressedDokument152 SeitenHarrisons 2022 Annual Report Final Compressedarusmajuenterprise80Noch keine Bewertungen

- Acct2015 - 2021 Paper Final SolutionDokument128 SeitenAcct2015 - 2021 Paper Final SolutionTan TaylorNoch keine Bewertungen

- Pe CCDokument56 SeitenPe CCNawair IshfaqNoch keine Bewertungen

- Natalia Profit and Loss FinalDokument18 SeitenNatalia Profit and Loss FinalPaulDaniel101100% (1)

- TUGAS AKL - P4-7, P4-8 - Niken Liza Mayasari - AM4C - 4112101091Dokument17 SeitenTUGAS AKL - P4-7, P4-8 - Niken Liza Mayasari - AM4C - 4112101091advokesmahmmbNoch keine Bewertungen

- Clearing BalancingDokument5 SeitenClearing BalancingIbrar HussainNoch keine Bewertungen

- 3.2 FCFE Exercise PartDokument4 Seiten3.2 FCFE Exercise PartHTNoch keine Bewertungen

- CGT21027 30APR HomeworkDokument7 SeitenCGT21027 30APR HomeworkBhargav D.S.Noch keine Bewertungen

- Error and Corrections Solutionpa CheckDokument5 SeitenError and Corrections Solutionpa Checkmartinfaith958Noch keine Bewertungen

- Daily Cash BookDokument4 SeitenDaily Cash BookAstromousom RoyNoch keine Bewertungen

- Cash FlowDokument5 SeitenCash FlowgarhgelhNoch keine Bewertungen

- Sorties Octobre 2022: Montant BilletsDokument1 SeiteSorties Octobre 2022: Montant BilletsADDIOUI HAMIDNoch keine Bewertungen

- Cab Case StudyDokument7 SeitenCab Case StudyPriyanka GoenkaNoch keine Bewertungen

- Less Clossing Stock (23,590) (15,360)Dokument2 SeitenLess Clossing Stock (23,590) (15,360)Elvis CharendaNoch keine Bewertungen

- AFMA Module 2a - Referencing SkillsDokument17 SeitenAFMA Module 2a - Referencing SkillsStephen FosuNoch keine Bewertungen

- Mill 2020Dokument52 SeitenMill 2020Yuran HerbertoNoch keine Bewertungen

- Hariharan A - F21143 - HCL - Capital BudgetingDokument3 SeitenHariharan A - F21143 - HCL - Capital BudgetingJoseph JohnNoch keine Bewertungen

- FM AssignmentDokument27 SeitenFM AssignmentMuhammad AkbarNoch keine Bewertungen

- Cargas Individuales Cantidad W Tipo (AC/DC) WAC WDC H/Día Dias/Sem 7 Días WH Ac WH DCDokument10 SeitenCargas Individuales Cantidad W Tipo (AC/DC) WAC WDC H/Día Dias/Sem 7 Días WH Ac WH DCHumbert Rojas LanuzaNoch keine Bewertungen

- Income Statement Format (KTV 1)Dokument30 SeitenIncome Statement Format (KTV 1)Darlene Jade Butic VillanuevaNoch keine Bewertungen

- Base - Proy 2Dokument16 SeitenBase - Proy 2Ivan Fernando Herrera RodriguezNoch keine Bewertungen

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Dokument6 SeitenPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNoch keine Bewertungen

- EOQ, CSL, ESC, FR CalculationsDokument4 SeitenEOQ, CSL, ESC, FR CalculationsPrakhar GuptaNoch keine Bewertungen

- Reg No: 189282J Y.A.P.M Yahampath: Calculation of RevenueDokument2 SeitenReg No: 189282J Y.A.P.M Yahampath: Calculation of Revenuece badullaNoch keine Bewertungen

- Question No 2: S.No Name of Assests Rate of Dep. WDV As On 1-4-2020Dokument10 SeitenQuestion No 2: S.No Name of Assests Rate of Dep. WDV As On 1-4-2020Sahastranshu RanjanNoch keine Bewertungen

- CMA SS August 2018Dokument12 SeitenCMA SS August 2018Goremushandu MungarevaniNoch keine Bewertungen

- Consulta Saldo GDDokument3 SeitenConsulta Saldo GDGuilherme OliveiraNoch keine Bewertungen

- Capital Investment 12-1 To 6 PanisalesDokument8 SeitenCapital Investment 12-1 To 6 PanisalesVincent PanisalesNoch keine Bewertungen

- Grand MLB Basic Commodities Corporation 2023'Dokument8 SeitenGrand MLB Basic Commodities Corporation 2023'Bambie Porras Jaca100% (1)

- Profitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019Von EverandProfitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019Noch keine Bewertungen

- OENG1168 - Assessment 3 - InstructionsDokument4 SeitenOENG1168 - Assessment 3 - InstructionsLULZNoch keine Bewertungen

- Freshleaf Q1 2020 Report PDFDokument16 SeitenFreshleaf Q1 2020 Report PDFLULZNoch keine Bewertungen

- Materials 12 01862 PDFDokument15 SeitenMaterials 12 01862 PDFLULZNoch keine Bewertungen

- Paper: A Novel Polysiloxane Elastomer Based On Reversible Aluminum-Carboxylate CoordinationDokument8 SeitenPaper: A Novel Polysiloxane Elastomer Based On Reversible Aluminum-Carboxylate CoordinationLULZNoch keine Bewertungen

- Experimental Study of Tribological Behavior of Casted Aluminium-BronzeDokument10 SeitenExperimental Study of Tribological Behavior of Casted Aluminium-BronzeLULZNoch keine Bewertungen

- Proc2083 Reaction Engineering: Module 03: Assessable Tutorial Question 03 (1%)Dokument2 SeitenProc2083 Reaction Engineering: Module 03: Assessable Tutorial Question 03 (1%)LULZNoch keine Bewertungen

- CapcostDokument2 SeitenCapcostHassen HadirNoch keine Bewertungen

- Worksheet 2bDokument3 SeitenWorksheet 2bLULZNoch keine Bewertungen

- Work Scope Ethane Extraction-V1Dokument6 SeitenWork Scope Ethane Extraction-V1LULZNoch keine Bewertungen

- REO CPA Review: Business CombinationDokument9 SeitenREO CPA Review: Business CombinationRoldan Hiano ManganipNoch keine Bewertungen

- Prelim ExamDokument13 SeitenPrelim ExamNah HamzaNoch keine Bewertungen

- MayaCredit SoA 2023SEPDokument3 SeitenMayaCredit SoA 2023SEPjepoy palaruanNoch keine Bewertungen

- BBS 4th Year Final WorkDokument48 SeitenBBS 4th Year Final WorkNamuna Joshi88% (8)

- 10 M Shefaque Ahmed Oct 11Dokument8 Seiten10 M Shefaque Ahmed Oct 11Anonymous uRR8NyteNoch keine Bewertungen

- Account Statement From 1 Sep 2020 To 6 Oct 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument2 SeitenAccount Statement From 1 Sep 2020 To 6 Oct 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePAWAN SHARMANoch keine Bewertungen

- Management SOPDokument12 SeitenManagement SOPsparkle shresthaNoch keine Bewertungen

- Shil Gift Tax Chapter End SolutionDokument3 SeitenShil Gift Tax Chapter End SolutionMD. MUSTARIKUL ISLAM RAJUNoch keine Bewertungen

- Quiz 2 Mô PhỏngDokument11 SeitenQuiz 2 Mô PhỏngTường LinhNoch keine Bewertungen

- Faizsiz Yapı Modeli-Mehmet Hicabi SEÇKİNERDokument44 SeitenFaizsiz Yapı Modeli-Mehmet Hicabi SEÇKİNERMEHMET HİCABİ SEÇKİNERNoch keine Bewertungen

- Interim ReportDokument20 SeitenInterim ReportanushaNoch keine Bewertungen

- A Boost For Your Career in Finance: Benefits IncludeDokument2 SeitenA Boost For Your Career in Finance: Benefits IncludeSarthak ShuklaNoch keine Bewertungen

- EXPANZS Registration - DayalanDokument1 SeiteEXPANZS Registration - DayalanManikandan BaskaranNoch keine Bewertungen

- Preparation of Monthly Transcripts of A SelfDokument4 SeitenPreparation of Monthly Transcripts of A SelfEsther Akpan100% (2)

- FINS1613 File 04 - All 3 Topics Practice Questions PDFDokument16 SeitenFINS1613 File 04 - All 3 Topics Practice Questions PDFisy campbellNoch keine Bewertungen

- SamCERA PE Perf Report Q1 20 SolovisDokument1 SeiteSamCERA PE Perf Report Q1 20 SolovisdavidtollNoch keine Bewertungen

- SSPUSADVDokument1 SeiteSSPUSADVLuz AmparoNoch keine Bewertungen

- Optimal Risky Portfolios Chapter 7 PracticeDokument2 SeitenOptimal Risky Portfolios Chapter 7 PracticeRehabUddinNoch keine Bewertungen

- Thế Giới Di Động 2022Dokument14 SeitenThế Giới Di Động 2022Phạm Thu HằngNoch keine Bewertungen

- Hospital Supply, IncDokument3 SeitenHospital Supply, Incmade3875% (4)

- 4.02 Business Banking Check Parts (B) - 2Dokument7 Seiten4.02 Business Banking Check Parts (B) - 2TrinityNoch keine Bewertungen

- Assignment On Analysis of Annual Report ofDokument9 SeitenAssignment On Analysis of Annual Report oflalagopgapangamdas100% (1)

- Cover Cek MaybankDokument2 SeitenCover Cek MaybankArifa HasnaNoch keine Bewertungen

- Full Download Corporate Financial Accounting 13th Edition Warren Solutions ManualDokument35 SeitenFull Download Corporate Financial Accounting 13th Edition Warren Solutions Manualmasonh7dswebb100% (37)

- Laporan Keuangan Tahunan Good - 2020Dokument148 SeitenLaporan Keuangan Tahunan Good - 2020angelina chandraNoch keine Bewertungen

- ABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFDokument4 SeitenABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFAlfredo del Mundo Jr.80% (5)

- CSEC POA June 2012 P1 PDFDokument12 SeitenCSEC POA June 2012 P1 PDFjunior subhanNoch keine Bewertungen

- QUIZ W1 W3 MaterialsDokument11 SeitenQUIZ W1 W3 MaterialsLady BirdNoch keine Bewertungen

- National Insurance Company Ltd. Policy No: 57150031216760012077 1 Year Liability Only From 00:00:01 Hours On 28-Jan-2022 To Midnight of 27/01/2023Dokument2 SeitenNational Insurance Company Ltd. Policy No: 57150031216760012077 1 Year Liability Only From 00:00:01 Hours On 28-Jan-2022 To Midnight of 27/01/2023Benson BennyNoch keine Bewertungen

- Class TestDokument6 SeitenClass TestMayank kaushikNoch keine Bewertungen