Beruflich Dokumente

Kultur Dokumente

More FRIA

Hochgeladen von

Martel John Milo0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten3 Seitencases

Originaltitel

More-FRIA

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldencases

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten3 SeitenMore FRIA

Hochgeladen von

Martel John Milocases

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

GARCIA v. PAL Jose Marcel Panlilio, et. al. v. RTC Br. 51, et. al. G.R. No.

173846;

Garcia and Dumago v. Philippine Airlines (G.R. No. 164856) February 2, 2011

Facts: Petitioners were corporate officers of Silahis International Hotel Inc.

(SIHI) who were charged with violation of the SSS law in relation to the

Petitioners-employees filed a complaint for illegal dismissal against Revised Penal Code. The criminal case was raffled in RTC Br 51.

respondent PAL who dismissed them after they were allegedly caught Meanwhile, a petition for suspension of payments and rehabilitation

in the act of sniffing shabu within its premises. The Labor Arbiter ruled was pending in RTC Br 24. SIHI's petition was granted and a

for the petitioners and ordered immediately for their reinstatement. Prior suspension order was issued by RTC Br 24, staying all claims against

to this decision, SEC had placed PAL under an Interim Rehabilitation SIHI. On the basis of RTC 24's order, petitioners now claim that the

Receiver, and subsequently under a Permanent Rehabilitation proceeding before RTC Br 51 should be suspended. RTC Br 51 denied

Receiver. PAL appealed and the Labor Tribunal ruled in their favor. the petitioners' motion and ruled that the stay order does not include the

Subsequently, the Labor Arbiter issued a writ of execution for the suspension of criminal proceedings. This decision was affirmed by the

reinstatement and issued a notice of garnishment. The Labor Tribunal CA. Hence, this case.

affirmed the writ and notice but suspended and referred the action to

the Rehabilitation Receiver of PAL. On appeal, CA found for respondent Issue: Whether or not the stay order stays criminal cases

PAL.

Held: No. Section 18 of FRIA explicitly provides that criminal actions

Issue: against the individual officer of a corporation are not subject to the Stay

Whether or not PAL being under corporate rehabilitation suspends any or Suspension Order in rehabilitation proceedings. The prosecution of

monetary claims to it. the officers of the corporation has no bearing on the pending

rehabilitation of the corporation, especially since they are charged in

Ruling: YES. their individual capacities. Such being the case, the purpose of the law

for the issuance of the stay order is not compromised, since the

It is settled that upon appointment by the SEC of a rehabilitation

appointed rehabilitation receiver can still fully discharge his functions as

receiver, all actions for claims before any court, tribunal or board

mandated by law. It bears to stress that the rehabilitation receiver is not

against the corporation shall ipso jure be suspended. As stated early

charged to defend the officers of the corporation. If there is anything

on, during the pendency of petitioners’ complaint before the Labor

that the rehabilitation receiver might be remotely interested in is

Arbiter, the SEC placed respondent under an Interim Rehabilitation

whether the court also rules that petitioners are civilly liable. Such a

Receiver. After the Labor Arbiter rendered his decision, the SEC

scenario, however, is not a reason to suspend the criminal proceedings,

replaced the Interim Rehabilitation Receiver with a Permanent

because as aptly discussed in Rosario, should the court prosecuting the

Rehabilitation Receiver.

officers of the corporation find that an award or indemnification is

While reinstatement pending appeal aims to avert the continuing threat warranted, such award would fall under the category of claims, the

or danger to the survival or even the life of the dismissed employee and execution of which would be subject to the stay order issued by the

his family, it does not contemplate the period when the employer- rehabilitation court. The penal sanctions as a consequence of violation

corporation itself is similarly in a judicially monitored state of being of the SSS law, in relation to the revised penal code can therefore be

resuscitated in order to survive. implemented if petitioners are found guilty after trial. However, any civil

indemnity awarded as a result of their conviction would be subject to

the stay order issued by the rehabilitation court. Only to this extent can

Sps. Sobrejuanite vs. ASB Development Corporation the order of suspension be considered obligatory upon any court,

tribunal, branch or body where there are pending actions for claims

Facts: against the distressed corporation.

The spouses Sobrejuanite and ASB Development Corporation

Bank of the Philippine Islands vs Sarabia Manor Hotel Corporation

(ASBDC) entered into a contract to sell a condominium located in

G.R. No. 175844 July 29, 2013

Mandaluyong. After full payment and after repeated demands, the

J. Perlas-Bernabe

ASBDC failed to make good of its obligation due to the rehabilitation

Facts: Sarabia is a corporation duly organized and existing under

plan of ASB Group of Companies, which includes ASBDC. The spouses

Philippine laws, with principal place of business at 101 General Luna

resorted the intervention of the Housing and Land Use Regulatory

Street, Iloilo City. It was incorporated on February 22, 1982, with an

Board (HLURB). HLURB resolved the complaint in favor of the spouses

authorized capital stock of P10,000,000.00, fully subscribed and paid-

Sobrejuanite. This was affirmed by the Office of the President. On

up, for the primary purpose of owning, leasing, managing and/or

appeal, the Court of Appeals reversed and set aside the decision of the

operating hotels, restaurants, barber shops, beauty parlors, sauna and

Office of the President. It ratiocinated that the Sobrejuanite’s complaint

steam baths, massage parlors and such other businesses incident to or

for rescission and damages is a claim under the contemplation of

necessary in the management or operation of hotels.

Presidential Decree (PD) No. 902-A or the SEC Reorganization Act and

In 1997, Sarabia obtained a P150,000,000.00 special loan package

A.M. No. 00-8-10-SC or the Interim Rules of Procedure on Corporate

from Far East Bank and Trust Company (FEBTC) in order to finance the

Rehabilitation. Therefore, the Securities and Exchange Commission

construction of a five-storey hotel building (New Building) for the

(SEC) has jurisdiction over the complaint, not HLURB.

purpose of expanding its hotel business. An additional P20,000,000.00

Issue: stand-by credit line was approved by FEBTC in the same year.

The foregoing debts were secured by real estate mortgages over

Whether claim of spouses Sobrejuanite lies with the jurisdiction of SEC. several parcels of land owned by Sarabia and a comprehensive surety

Held: agreement dated September 1, 1997 signed by its stockholders. By

virtue of a merger, Bank of the Philippine Islands (BPI) assumed all of

Yes. FEBTC’s rights against Sarabia. Sarabia started to pay interests on its

loans as soon as the funds were released in October 1997. However,

As provided under Section 6(c) of PD No. 902-A, all actions for claims largely because of the delayed completion of the New Building, Sarabia

against corporations, partnerships or associations under management incurred various cash flow problems. Thus, despite the fact that it had

or receivership pending before any court, tribunal, board or body shall more assets than liabilities at that time, it, nevertheless, filed, on July

be suspended accordingly. The afore cited law defines claim as the 26, 2002, a Petition for corporate rehabilitation (rehabilitation petition)

debts or demands of a pecuniary nature. In settled jurisprudence, claim with prayer for the issuance of a stay order before the RTC as it

means actions involving monetary considerations or all claims or foresaw the impossibility to meet its maturing obligations to its creditors

demands, of whatever nature or character against a debtor or its when they fall due.

property, whether for money or otherwise. It is evident that the In its proposed rehabilitation plan, Sarabia sought for the restructuring

spouses claim falls within the definition of PD 902-A and settled of all its outstanding loans, submitting that the interest payments on the

jurisprudence. Hence, jurisdiction, as correctly held by the Court of same be pegged at a uniform escalating rate of: (a) 7% per annum

Appeals, lies with SEC and not HLURB. The ratio behind is "equality is (p.a.) for the years 2002 to 2005; (b) 8% p.a. for the years 2006 to

equity." When a corporation threatened by bankruptcy is taken over by 2010; (c) 10% p.a. for the years 2011 to 2013; (d) 12% p.a. for the

a receiver, all the creditors should stand on equal footing. Not anyone of years 2014 to 2015; and (e) 14% p.a. for the year 2018. Likewise,

them should be given any preference by paying one or some of them Sarabia sought to make annual payments on the principal loans starting

ahead of the others. This is precisely the reason for the suspension of in 2004, also in escalating amounts depending on cash flow. Further, it

all pending claims against the corporation under receivership. Instead proposed that it should pay off its outstanding obligations to the

of creditors vexing the courts with suits against the distressed firm, they government and its suppliers on their respective due dates, for the sake

are directed to file their claims with the receiver who is a duly appointed of its day to day operations.

officer of the SEC. Finding Sarabia’s rehabilitation petition sufficient in form and substance,

the RTC issued a Stay Order on August 2, 2002. It also appointed

Liberty B. Valderrama as Sarabia’s rehabilitation receiver (Receiver).

Moreover, Section 7 of the Contract to Sell allows the developer to Thereafter, BPI filed its Opposition.

extend the period of delivery on account of causes beyond its control, Issue: Whether or not the BPI’s opposition proper.

such as financial reverses. Held: No. Recognizing the volatile nature of every business, the rules

on corporate rehabilitation have been crafted in order to give

companies sufficient leeway to deal with debilitating financial "does not take over the control and management of the debtor

predicaments in the hope of restoring or reaching a sustainable corporation." [61] Likewise, the rehabilitation receiver that will replace

operating form if only to best accommodate the various interests of all the interim receiver is tasked only to monitor the successful

its stakeholders, may it be the corporation’s stockholders, its creditors implementation of the rehabilitation plan. [62] There is nothing in the

and even the general public. concept of corporate rehabilitation that would ipso facto deprive [63] the

Board of Directors and corporate officers of a debtor corporation, such

Thus, rehabilitation shall be undertaken when it is shown that the as ASB Realty, of control such that it can no longer enforce its right to

continued operation of the corporation is economically more feasible recover its property from an errant lessee.

and its creditors can recover, by way of the present value of payments

projected in the plan, more, if the corporation continues as a going To be sure, corporate rehabilitation imposes several

concern than if it is immediately liquidated. Among other rules that restrictions on the debtor corporation. The rules enumerate the

foster the foregoing policies, Section 23, Rule 4 of the Interim Rules of prohibited corporate actions and transactions [64] (most of which

Procedure on Corporate Rehabilitation (Interim Rules) states that a involve some kind of disposition or encumbrance of the corporation's

rehabilitation plan may be approved even over the opposition of the assets) during the pendency of the rehabilitation proceedings but none

creditors holding a majority of the corporation’s total liabilities if there is of which touch on the debtor corporation's right to sue. The implication

a showing that rehabilitation is feasible and the opposition of the therefore is that our concept of rehabilitation does not restrict this

creditors is manifestly unreasonable. Also known as the “cram-down” particular power, save for the caveat that all its actions are monitored

clause, this provision, which is currently incorporated in the FRIA, is closely by the receiver, who can seek an annulment of any prohibited or

necessary to curb the majority creditors’ natural tendency to dictate anomalous transaction or agreement entered into by the officers of the

their own terms and conditions to the rehabilitation, absent due regard debtor corporation.

to the greater long-term benefit of all stakeholders. Otherwise stated, it

forces the creditors to accept the terms and conditions of the G.R. No. 165571 January 20, 2009 PHILIPPINE NATIONAL BANK

rehabilitation plan, preferring long-term viability over immediate but and EQUITABLE PCI BANK, Petitioners, vs. HONORABLE COURT

incomplete recovery. OF APPEALS, SECURITIES AND EXCHANGE COMMISSION EN

BANC

Although undefined in the Interim Rules, it may be said that the

opposition of a distressed corporation’s majority creditor is manifestly FACTS:

unreasonable if it counter-proposes unrealistic payment terms and ASB Realty filed with the SEC a verified petition for

conditions which would, more likely than not, impede rather than aid its rehabilitation with prayer for suspension of actions and proceedings

rehabilitation. The unreasonableness becomes further manifest if the pending rehabilitation pursuant to Presidential Decree No. (PD) 902-A,

rehabilitation plan, in fact, provides for adequate safeguards to fulfill the as amended. The case was docketed as SEC Case No. 05-00-6609.

majority creditor’s claims, and yet the latter persists on speculative or Private respondents stated that they possess sufficient properties to

unfounded assumptions that his credit would remain unfulfilled. While cover their obligations but foresee inability to pay them within a period

Section 23, Rule 4 of the Interim Rules states that the rehabilitation of one year. They cited the sudden non-renewal and/or massive

court shall consider certain incidents in determining whether the withdrawal by creditors of their loans to ASB Holdings, the glut in the

opposition is manifestly unreasonable, BPI neither proposes Sarabia’s real estate market, severe drop in the sale of real properties, peso

liquidation over its rehabilitation nor questions the controlling interest of devaluation, and decreased investor confidence in the economy which

Sarabia’s shareholders or owners. resulted in the non-completion of and failure to sell their projects and

default in the servicing of their credits as they fell due.

The ASB Group submitted a rehabilitation plan to enable it to

[ GR No. 181126, Jun 15, 2011 ] UMALE v. ASB REALTY meet all of its obligations. The consortium of creditor banks moved for

CORPORATION its disapproval on the ground that it is not viable; the proposals are

unrealistic; and it collides with the freedom of contract and the

FACTS: constitutional right against non-impairment of contracts, particularly the

ASB Realty commenced an action in the Metropolitan Trial release of portions of mortgaged properties and waiver of interest,

Court (MTC) of Pasig City for unlawful detainer [7] of the subject penalties, and other charges.

premises against petitioner Leonardo S. Umale (Umale). Umale also

challenged ASB Realty's personality to recover the subject premises Petitioners contend that the SEC’s approval of the

considering that ASB Realty had been placed under receivership by the Rehabilitation Plan impairs the Mortgage Trust Indenture by forcing

Securities and Exchange Commission (SEC) and a rehabilitation them to release the real properties secured in their favor to become part

receiver had been duly appointed. Under Section 14(s), Rule 4 of the of the asset pool. They argue that the SEC’s approval of the

Administrative Memorandum No. 00-8-10SC, otherwise known as the Rehabilitation Plan is a state action that impairs the remedies available

Interim Rules of Procedure on Corporate Rehabilitation (Interim Rules), to petitioners under the MTI, which essentially abrogates the contract

it is the rehabilitation receiver that has the power to "take possession, itself.

control and custody of the debtor's assets." Since ASB Realty claims

that it owns the subject premises, it is its duly-appointed receiver that Upon appointment of a management committee, rehabilitation

should sue to recover possession of the same. receiver, board or body, pursuant to this Decree, all actions for claims

against corporations, partnerships or associations under management

The MTC agreed with Umale that only the rehabilitation or receivership pending before any court, tribunal, board or body shall

receiver could file suit to recover ASB Realty's property. [18] Having be suspended." By that statutory provision, it is clear that the approval

been placed under receivership, ASB Realty had no more personality to of the Rehabilitation Plan and the appointment of a rehabilitation

file the complaint for unlawful detainer. receiver merely suspend the actions for claims against respondent

corporations. Petitioner bank’s preferred status over the unsecured

The RTC ruled that ASB Realty retained all its corporate creditors relative to the mortgage liens is retained, but the enforcement

powers, including the power to sue, despite the appointment of a of such preference is suspended. The loan agreements between the

rehabilitation receiver. Citing the Interim Rules, the RTC noted that the parties have not been set aside and petitioner bank may still enforce its

rehabilitation receiver was not granted therein the power to file preference when the assets of ASB Group of Companies will be

complaints on behalf of the corporation. The CA affirmed the RTC. liquidated. Considering that the provisions of the loan agreements are

merely suspended, there is no impairment of contracts, specifically its

ISSUE: Whether ASB Realty can file suit to recover an unlawfully lien in the mortgaged properties.

detained corporate property despite the fact that the corporation had

already been placed under rehabilitation? Such suspension "shall not prejudice or render ineffective the

status of a secured creditor as compared to a totally unsecured

creditor," for what P.D. No. 902-A merely provides is that all actions for

HELD: claims against the distressed corporation, partnership or association

The intention of the law is "to effect a feasible and viable shall be suspended. This arrangement provided by law is intended to

rehabilitation by preserving a floundering business as a going concern, give the receiver a chance to rehabilitate the corporation if there should

because the assets of a business are often more valuable when so still be a possibility for doing so, without being unnecessarily disturbed

maintained than they would be when liquidated." [58] This concept of by the creditors’ actions against the distressed corporation. However, in

preserving the corporation's business as a going concern while it is the event that rehabilitation is no longer feasible and the claims against

undergoing rehabilitation is called debtor-in-possession or debtor-in- the distressed corporation would eventually have to be settled, the

place. This means that the debtor corporation (the corporation secured creditors, like petitioner bank, shall enjoy preference over the

undergoing rehabilitation), through its Board of Directors and corporate unsecured creditors.

officers, remains in control of its business and properties, subject only

to the monitoring of the appointed rehabilitation receiver. [59] The

concept of debtor-in-possession, is carried out more particularly in the

SEC Rules, the rule that is relevant to the instant case. [60] It states

therein that the interim rehabilitation receiver of the debtor corporation

PHILIPPINE BANK OF COMMUNICATIONS, Petitioner, unilateral and detrimental to its creditors and the

vs. BASIC POLYPRINTERS AND PACKAGING public.

CORPORATION, Respondent. G.R. No. 187581 October

20, 2014 FACTS: FACTS: Basic Polyprinters, along with

the eight other corporations belonging to the Limtong

Group of Companies filed a joint petition for

suspension of payments with approval of the

proposed rehabilitation in the RTC. The RTC issued a

stay order, and eventually approved the

rehabilitation plan, but the CA reversed the RTC and

directed the petitioning corporations to file their

individual petitions for suspension of payments and

rehabilitation in the appropriate courts. Accordingly,

Basic Polyprinters brought its individual petition,

averring therein that: (a) its business since

incorporation had been very viable and financially

profitable; (b) it had obtained loans from various

banks, and had owed accounts payable to various

creditors; (c) the Asian currency crisis, devaluation of

the Philippine peso, and the current state of affairs of

the Philippine economy; (d) its operations would be

hampered and would render rehabilitation difficult

should its creditors enforce their claims through legal

actions, including foreclosure proceedings; (e)

included in its overall Rehabilitation Program was the

full payment of its outstanding loans in favor of

petitioner PBCOM and other banks

ISSUES: Whether or not material financial

commitment is required in a rehabilitation plan.

HELD: Yes. The Court held that a material financial

commitment is significant in a rehabilitation plan. A

material financial commitment becomes significant in

gauging the resolve, determination, earnestness and

good faith of the distressed corporation in financing

the proposed rehabilitation plan.

This commitment may include the voluntary

undertakings of the stockholders or the would-be

investors of the debtor-corporation indicating their

readiness, willingness and ability to contribute funds

or property to guarantee the continued successful

operation of the debtor corporation during the period

of rehabilitation.

However, the Court held that Basic Polyprinters

commitment was insufficient for the following

reasons: The commitment to add P10,000,000.00

working capital appeared to be doubtful considering

that the insurance claim from which said working

capital would be sourced had already been written-

off by Basic Polyprinters’s affiliate, Wonder Book

Corporation. The conversion of all deposits for future

subscriptions to common stock and the treatment of

all payables to officers and stockholders as trade

payables was hardly constituting material financial

commitments. Such “conversion” of cash advances

to trade payables was, in fact, a mere re-

classification of the liability entry and had no effect

on the shareholders’ deficit. Basic Polyprinters’s

rehabilitation plan likewise failed to offer any

proposal on how it intended to address the low

demands for their products and the effect of direct

competition from stores like SM, Gaisano, Robinsons,

and other malls. Basic Polyprinters’s proposal to

enter into the dacion en pagoto create a source of

“fresh capital” was not feasible because the object

thereof would not be its own property but one

belonging to its affiliate, TOL Realty and

Development Corporation, a corporation also

undergoing rehabilitation. Hence, the Court held that

the rehabilitation plan for Basic Polyprinters to be

genuine and in good faith, for it was, in fact,

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shang v. St. FrancisDokument2 SeitenShang v. St. FrancisMartel John MiloNoch keine Bewertungen

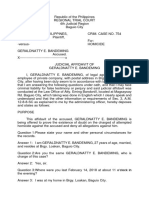

- Judicial Affidavit of Expert WitnessDokument6 SeitenJudicial Affidavit of Expert WitnessMartel John MiloNoch keine Bewertungen

- Microsoft v. Rolando DigestDokument3 SeitenMicrosoft v. Rolando DigestMartel John Milo100% (4)

- Concept Buliders v. NLRCDokument2 SeitenConcept Buliders v. NLRCMartel John MiloNoch keine Bewertungen

- Combination Testate Legitime Testate Free Portion Intestate ShareDokument4 SeitenCombination Testate Legitime Testate Free Portion Intestate ShareMartel John MiloNoch keine Bewertungen

- Petition For Declaration of Nullity of Marriage Art. 36 1 2Dokument7 SeitenPetition For Declaration of Nullity of Marriage Art. 36 1 2Martel John MiloNoch keine Bewertungen

- Regional Trial Court: CIVIL CASE No. 123456Dokument8 SeitenRegional Trial Court: CIVIL CASE No. 123456Martel John MiloNoch keine Bewertungen

- Judicial Affidavit of Expert WitnessDokument6 SeitenJudicial Affidavit of Expert WitnessMartel John MiloNoch keine Bewertungen

- 7th Day Adventist V Northeastern MissionDokument2 Seiten7th Day Adventist V Northeastern MissionMartel John Milo100% (1)

- Lim v. Phil. Fishing GearDokument2 SeitenLim v. Phil. Fishing GearMartel John MiloNoch keine Bewertungen

- Sulo NG Bayan v. AranetaDokument1 SeiteSulo NG Bayan v. AranetaMartel John MiloNoch keine Bewertungen

- Secrecy of Bank and Foreign Currency CasesDokument30 SeitenSecrecy of Bank and Foreign Currency CasesMartel John MiloNoch keine Bewertungen

- Cases FRIADokument8 SeitenCases FRIAMartel John MiloNoch keine Bewertungen

- Regional Trial Court: Republic of The Philippines First Judicial Region Branch 4 - Baguio CityDokument4 SeitenRegional Trial Court: Republic of The Philippines First Judicial Region Branch 4 - Baguio CityMartel John MiloNoch keine Bewertungen

- 56-58. The Lawyer and The ClientDokument2 Seiten56-58. The Lawyer and The ClientMartel John MiloNoch keine Bewertungen

- BPI v. Lifetime MarketingDokument10 SeitenBPI v. Lifetime MarketingMartel John MiloNoch keine Bewertungen

- PALEDokument70 SeitenPALEMartel John MiloNoch keine Bewertungen

- Finals Corpo1Dokument19 SeitenFinals Corpo1Martel John MiloNoch keine Bewertungen

- JADokument4 SeitenJAMartel John MiloNoch keine Bewertungen

- Dy Teban Trading, Inc V ChingDokument20 SeitenDy Teban Trading, Inc V ChingMartel John MiloNoch keine Bewertungen

- BON V People-NatresDokument2 SeitenBON V People-NatresMartel John MiloNoch keine Bewertungen

- NPC v. City of Cabanatuan-DigestDokument2 SeitenNPC v. City of Cabanatuan-DigestMartel John Milo100% (1)

- Chu vs. TaminDokument4 SeitenChu vs. TaminMartel John MiloNoch keine Bewertungen

- Roberto Umil V Ramos DigestDokument2 SeitenRoberto Umil V Ramos DigestMartel John MiloNoch keine Bewertungen

- People V Doria DigestedDokument3 SeitenPeople V Doria DigestedMartel John Milo100% (2)

- People V GerenteDokument1 SeitePeople V GerenteMartel John MiloNoch keine Bewertungen

- People V Doria DigestedDokument3 SeitenPeople V Doria DigestedMartel John Milo100% (2)

- Roberto Umil V Ramos DigestDokument2 SeitenRoberto Umil V Ramos DigestMartel John MiloNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Asian v. JalandoniDokument9 SeitenAsian v. JalandoniAnthony SalazarNoch keine Bewertungen

- Canadian Law - Inside The ContractDokument2 SeitenCanadian Law - Inside The ContractNic PaolellaNoch keine Bewertungen

- Northern Motors v. SapinosoDokument3 SeitenNorthern Motors v. SapinosoNorberto Sarigumba IIINoch keine Bewertungen

- Lecture 03 FA at FV Through OCIDokument1 SeiteLecture 03 FA at FV Through OCIJohnallenson DacosinNoch keine Bewertungen

- Town and Country Enterprises, Inc. v. QuisumbingDokument2 SeitenTown and Country Enterprises, Inc. v. QuisumbingAnjNoch keine Bewertungen

- Sample Contract With Interim SuperintendentDokument3 SeitenSample Contract With Interim Superintendentyachiru121Noch keine Bewertungen

- People vs. RTCDokument13 SeitenPeople vs. RTCjulieanne07Noch keine Bewertungen

- Transfer of Title by A Non-Owner (Nemo Dat)Dokument9 SeitenTransfer of Title by A Non-Owner (Nemo Dat)Dennis GreenNoch keine Bewertungen

- Emergency Ambulance Service AgreementDokument68 SeitenEmergency Ambulance Service AgreementDIVINE WORD HOSPITALNoch keine Bewertungen

- Multiple ChoiceDokument5 SeitenMultiple ChoicePrincess Frean VillegasNoch keine Bewertungen

- National Union Fire Insurance v. Stolt NielsenDokument3 SeitenNational Union Fire Insurance v. Stolt NielsenMICAELA NIALANoch keine Bewertungen

- Lease Agreement Myrna BanoDokument3 SeitenLease Agreement Myrna BanoMon Anthony MolobocoNoch keine Bewertungen

- The Law of Trusts PDFDokument548 SeitenThe Law of Trusts PDFha he100% (1)

- Uwezo Application FormDokument6 SeitenUwezo Application Formjunction cyberNoch keine Bewertungen

- Deed of Sale of Motor VehicleDokument1 SeiteDeed of Sale of Motor VehicleRalph AnitoNoch keine Bewertungen

- The Law of Towage 1. Chapter1FinalDokument50 SeitenThe Law of Towage 1. Chapter1FinalCatherine PanaguitonNoch keine Bewertungen

- Lesson 5 FranchisingDokument53 SeitenLesson 5 FranchisingSuxian ToleroNoch keine Bewertungen

- Draft Notice Agenda and Notes - 1st Board Meeting Through VCDokument2 SeitenDraft Notice Agenda and Notes - 1st Board Meeting Through VCCA Tanmay JaiminiNoch keine Bewertungen

- Norton v. McOsker, 407 F.3d 501, 1st Cir. (2005)Dokument12 SeitenNorton v. McOsker, 407 F.3d 501, 1st Cir. (2005)Scribd Government DocsNoch keine Bewertungen

- PRKAB OzDurAcForm 03022014 Ortaklik Yapisi 1dgDokument1 SeitePRKAB OzDurAcForm 03022014 Ortaklik Yapisi 1dg777 TRADENoch keine Bewertungen

- Brown POQDokument4 SeitenBrown POQJonas GonzalesNoch keine Bewertungen

- Article 1279Dokument6 SeitenArticle 1279Danica BalinasNoch keine Bewertungen

- Fact Sheet 02 10 2020 - 0Dokument2 SeitenFact Sheet 02 10 2020 - 0fakey mcaliasNoch keine Bewertungen

- Dissertation - Legality of Shell Companies As Per Company's LawDokument51 SeitenDissertation - Legality of Shell Companies As Per Company's Lawabhay kaul100% (1)

- Mudharabah Assignment - Muhammad Fadlil Kirom - AIB-17-IPDokument4 SeitenMudharabah Assignment - Muhammad Fadlil Kirom - AIB-17-IPAdil KiromNoch keine Bewertungen

- Klaus Mittelbachert Vs East India Hotels LTDDokument4 SeitenKlaus Mittelbachert Vs East India Hotels LTDPunyashlok DashNoch keine Bewertungen

- Insurance Sector in IndiaDokument72 SeitenInsurance Sector in IndiaTannya BrahmeNoch keine Bewertungen

- Country Bankers Insurance Vs Keppel CebuDokument26 SeitenCountry Bankers Insurance Vs Keppel CebuAlfred LacandulaNoch keine Bewertungen

- RFQ - Earth Pit Construction and Reconditioning WorkDokument11 SeitenRFQ - Earth Pit Construction and Reconditioning WorkShashiNoch keine Bewertungen

- Negotiable Instruments: - MicaellagarciaDokument4 SeitenNegotiable Instruments: - MicaellagarciaMicaella100% (1)