Beruflich Dokumente

Kultur Dokumente

Engg Econ

Hochgeladen von

Nikkita Senosa0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten2 SeitenThis document provides tutorial handouts for an Engineering Economy midterm covering topics like simple and compounded interest, annuity, gradient, and sample problems. It includes 18 formulas for calculations involving future worth, present worth, interest rates, annuity, perpetuity, and more. Three sample problems are shown working through calculations for loans with simple and compounded interest, an annuity paying a certain amount annually, and determining an annual payment to amortize a loan with ascending payments.

Originalbeschreibung:

Engg econ

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides tutorial handouts for an Engineering Economy midterm covering topics like simple and compounded interest, annuity, gradient, and sample problems. It includes 18 formulas for calculations involving future worth, present worth, interest rates, annuity, perpetuity, and more. Three sample problems are shown working through calculations for loans with simple and compounded interest, an annuity paying a certain amount annually, and determining an annual payment to amortize a loan with ascending payments.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten2 SeitenEngg Econ

Hochgeladen von

Nikkita SenosaThis document provides tutorial handouts for an Engineering Economy midterm covering topics like simple and compounded interest, annuity, gradient, and sample problems. It includes 18 formulas for calculations involving future worth, present worth, interest rates, annuity, perpetuity, and more. Three sample problems are shown working through calculations for loans with simple and compounded interest, an annuity paying a certain amount annually, and determining an annual payment to amortize a loan with ascending payments.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

PAMANTASAN NG LUNGSOD NG MAYNILA

University of the City of Manila

Engineering Mathematical Society

In Partnership with

Association of Civil Engineering Students

ENGINEERING ECONOMY MIDTERM TUTORIAL HANDOUTS

A.Y. 2019-2020

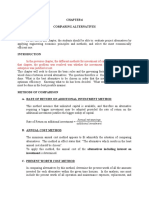

Engineering Economy is the analysis and evaluation of the factors GRADIENT

that will affect the economic success of engineering projects to the ARITHMETIC GRADIENT

end that a recommendation can be made which will insure the best 𝐺 (1+𝑖)𝑛 −1

(15) 𝑃𝐺 = [ − 𝑛] (1 + 𝑖)−𝑛

use of capital. 𝑖 𝑖

𝐺 (1+𝑖)𝑛 −1

(16) 𝐹𝐺 = [ − 𝑛]

𝑖 𝑖

This tutorial will cover the following topics: CALTECH

i. Simple and compounded interest (17) 𝑃𝐺 = ∑𝑛𝑥=1

𝐴+𝐺(𝑥−1)

𝑥

(1+𝑖)

ii. Annuity

iii. Gradient

GEOMETRIC GRADIENT

1+𝑟 𝑛

FORMULAS (1+𝑖)𝑛 −(1+𝑟)𝑛 1−(

1+𝑖

)

Designations (18) 𝑃 = 𝐴 [ ] = 𝐴[ ]

(𝑖−𝑟)(1+𝑖)𝑛 𝑖−𝑟

F=future worth (1+𝑖)𝑛 −(1+𝑟)𝑛

P=present worth (19) 𝐹 = 𝐴 [ ]

𝑖−𝑟

i=interest rate CALTECH

𝐴(1+𝐺)𝑥−1

n=time period in years (20) 𝑃𝐺 = ∑𝑛𝑥=1 𝑥

(1+𝑖)

I=interest amount

r=nominal interest

m=no. of compounding periods per year

A=annuity amount SAMPLE PROBLEMS

k=number of years delayed from the present yr

G=gradient amount Sample Problem No. 1: A P2000 loan was originally made at 8%

simple interest for 4 years. At the end of this period the loan was

SIMPLE INTEREST extended for 3 years., without the interest being paid, but the new

ORDINARY INTEREST (360 days) interest rate was made 10% compounded semi-annually. How much

(1) 𝐹 = 𝑃(1 + 𝑖𝑛) should the borrower pay at the end of 7 years?

EXACT SIMPLE INTEREST (365 days for ordinary year & 366

Solution: Divide the future worth between the simple interest rate

days for leap year)

and the compounded interest rate.

(2) 𝐼 = 𝑃𝑖𝑛

DIFFERENT INTEREST RATES 𝐹4 = 𝑃(1 + 𝑖𝑛)

NOMINAL INTEREST RATE 𝐹4 = 2000[1 + (0.08)(4)] = 2640

𝑟 𝑟 𝑚𝑛

(3) 𝑖 = 𝐹7 = 𝑃 (1 + )

𝑚 𝑚

EFFECTIVE INTEREST RATE

𝑟

0.10 (2)(3)

(4) 𝐸𝑅 = (1 + )𝑚 − 1 𝐹7 = 2640 (1 + )

𝑚 2

𝐹7 = 3537.85

COMPOUNDED INTEREST

(5) 𝐹 = 𝑃(1 + 𝑖)𝑛 Sample Problem No. 2: What is the present worth and the

𝑟

(6) 𝐹 = 𝑃(1 + )𝑚𝑛 accumulated amount of a 10-year annuity paying P10,000 at the end

𝑚

CONTINUOUS COMPOUNDING INTEREST of each year, with interest at 15% compounded annually?

(7) 𝐹 = 𝑃𝑒 𝑖𝑛

Solution: Determine the given in the problem and substitute into the

ANNUITY annuity formula.

ORDINARY ANNUITY

(1+𝑖)𝑛 −1 1 − (1 + 𝑖)−𝑛

(8) 𝐹 = 𝐴 [ ] 𝑃 = 𝐴[ ]

𝑖 𝑖

(1+𝑖)𝑛 −1 1−(1+𝑖)−𝑛

(9) 𝑃 = 𝐴 [

𝑖(1+𝑖)𝑛

] = 𝐴[

𝑖

] 1 − (1 + 0.15)−10

𝑃 = 10000 [ ]

ANNUITY DUE 0.15

1−(1+𝑖)1−𝑛 𝑃 = 50,187.69

(10) 𝑃 = 𝐴 [ + 1]

𝑖

(1+𝑖)𝑛+1 −1

(1 + 𝑖)𝑛 − 1

(11) 𝐹 = 𝐴 [ − 1] 𝐹 = 𝐴[ ]

𝑖 𝑖

DEFFERED ANNUITY (1 + 0.15)10 − 1

1−(1+𝑖)−𝑛 𝐹 = 10000 [ ]

(12) 𝑃 = 𝐴 [ ] (1 + 𝑖)−𝑘 0.15

𝑖

(1+𝑖)𝑛 −1 𝐹 = 203,037.18

(13) 𝐹 = 𝐴 [ ]

𝑖

PERPETUITY

𝐴

(14) 𝑃 =

𝑖

Sample Problem No. 3: A loan was to be amortized by a group of equal amount for his 41st to 59th birthdays in a fund

four end-of-the-year payments forming an ascending arithmetic earning 10% compounded annually. How much should

progression. The initial payment was to be P5,000 and the difference each of these amounts be?

between successive payments was to be P400. But the loan was 8. The surface area of a certain plant requires painting is

renegotiated to provide for the payment of equal rather uniformly 8,000 sq. ft. Two kinds of paint are available whose brands

varying sums. If the interest rate of the loan was 15%, what was the are A and B. Paint A cost P 1.40 per sq. ft. but needs

annual payment? renewal at the end of 4 yrs., while paint B cost P 1.80 per

sq. ft. If money is worth 12% effective, how often should

Solution: Compute for the present worth of the arithmetic gradient. paint B be renewed so that it will be economical as point

𝐺 (1 + 𝑖)𝑛 − 1 A?

𝑃𝐺 = [ − 𝑛] (1 + 𝑖)−𝑛 9. A contract has been signed to lease a building at P20,000

𝑖 𝑖

400 (1 + 0.15)4 − 1 per year with an annual increase of P1,500 for 8 years.

𝑃𝐺 = [ − 4] (1 + 0.15)−4 Payments are to be made at the end of each year, starting

0.15 0.15 one year from now. The prevailing interest rate is 7%.

𝑃𝐺 = 1514.57 What lump sum paid today would be equivalent to the 8-

1 − (1 + 𝑖)−𝑛 year lease payment plan?

𝑃𝐴 = 𝐴 [ ]

𝑖 10. Determine the present worth of a geometric gradient series

1 − (1 + 0.15)−4 with a cash flow of $50,000 in year 1 and increases of 6%

𝑃𝐴 = 5,000 [ ] each year through year 8. The interest rate is 10% per year.

0.15

𝑃𝐴 = 14,274.89

𝑃 = 𝑃𝐺 + 𝑃𝐴 = 1514.57 + 14,274.89

ADDITIONAL PROBLEMS:

𝑃 = 15,789.46

1. A chemical engineer wishes to set up a special fund by

making uniform semi-annual end-of-the-period deposits for

Equate the present worth with the present amount if an ordinary

20 years. The fund is to provide P100,000 at the end of

annuity will be used.

each of the last five years of the 20-year period. If the

1 − (1 + 𝑖)−𝑛

𝑃𝐴 = 𝐴 [ ] interest is 8% compounded semi-annually, what is the

𝑖 required semi-annual deposit to be made?

1 − (1 + 0.15)−4 2. A perceptive engineer started saving for her retirement 15

15,789.46 = 𝐴 [ ] years ago by diligently saving $18,000 each year through

0.15

𝐴 = 5,530.50 the present time. She invested in a stock fund that averaged

a 12% rate of return over that period. If she makes the same

PROBLEMS: annual investment and gets the same rate of return in the

1. What is the annual rate of interest if P265 is earned in four future, how long will it be from now (time zero) before she

months on an investment of P15, 000? has $1,500,000 in her retirement fund?

2. A man wishes his son to receive P200, 000 ten years from 3. You are told that the present worth of an increasing

now. What amount should he invest if it will earn interest geometric gradient is $88,146. If the cash fl ow in year 1 is

of 10% compounded annually during the first 5 years and $25,000 and the gradient increase is 18% per year, what is

12% compounded quarterly during the next 5 years? the value of n? The interest rate is 10% per year.

3. A woman borrowed P3, 000 to be paid after 1.5 years with 4. Today you invest P100,000 into a fund that pays 25%

interest at 12% compounded semi-annually and P5, 000 to interest compounded annually. Three years later, you

be paid after 3 years at 12% compounded monthly. What borrow P50,000 from a bank at 20% annual interest and

single payment must she pay after 3.5 years at an interest invest in the fund. Two years later, you withdraw enough

rate of 16% compounded quarterly to settle the two money from the fund to repay the bank loan and all the

obligations? interest due on it. Three years from this withdrawal you

4. What is the future worth of P600 deposited at the end of start taking P20,000 per year out of the fund. After five

every month for 4 years if the interest rate is 12% withdrawals, you withdraw the balance in the fund. How

compounded quarterly? much was the last withdrawal?

5. Mr. Reyes borrows P600, 000 at 12% compounded

annually, agreeing to repay the loan in 15 equal annual

payments. How much of the original principal is still ANSWERS:

unpaid after he has made the 8th payment? 1. P6,193.39

6. M purchased a small lot in a subdivision, paying P200, 000 2. 6.2 years

down and promising to pay P15, 000 every 3 months for 3. 3.54 years

the next 10 years. The seller figured interest at 12% 4. P1,320,255

compounded quarterly.

(a) What was the cash price of the lot?

(b) If M missed the first 12 payments, what must he pay at

the time the 13th is due to bring him up to date?

(c) After making 8 payments, M wished to discharge his

remaining indebtedness by a single payment at the time

when the 9th regular payment was due, what must he

pay in addition to the regular payment then due?

(d) If M missed the first 10 payments, what must he pay

when the 11th payment is due to discharge his entire

indebtedness?

7. A man wishes to provide a fund for his retirement such that

from his 60th to 70th birthdays he will be able to withdraw

equal sums of P18, 000 for his yearly expenses. He invests

Das könnte Ihnen auch gefallen

- Chapter 2 Lesson 5 - Perpetuity, Capitalized Cost, Amortization, Uniform Arithmetic GradientDokument11 SeitenChapter 2 Lesson 5 - Perpetuity, Capitalized Cost, Amortization, Uniform Arithmetic GradientLeojhun PalisocNoch keine Bewertungen

- Engineering Economy LectureDokument16 SeitenEngineering Economy LectureEphraim RamosNoch keine Bewertungen

- Engineering EconomicsDokument16 SeitenEngineering EconomicsChristine M100% (1)

- Chapter 3.3 - Cashflow and Continuous Compounding Sample ProblemsDokument14 SeitenChapter 3.3 - Cashflow and Continuous Compounding Sample ProblemsArin ParkNoch keine Bewertungen

- BES4 Assignment4Dokument2 SeitenBES4 Assignment4look porrNoch keine Bewertungen

- Engineering Economy Lecture 1 PDFDokument2 SeitenEngineering Economy Lecture 1 PDFMichael Angelo Jugador Bas100% (1)

- Capitalized CostDokument4 SeitenCapitalized CostDhduNoch keine Bewertungen

- M3 Ordinary Annuity Sample ProblemDokument7 SeitenM3 Ordinary Annuity Sample ProblemChelsiemea VargasNoch keine Bewertungen

- Amortization and Uniform Arithmetic GradientDokument20 SeitenAmortization and Uniform Arithmetic GradientCyril Jay G. OrtegaNoch keine Bewertungen

- MODULE 04 - Engineering Economy - DepreciationDokument22 SeitenMODULE 04 - Engineering Economy - DepreciationNoel So jr100% (2)

- AnnuityDokument29 SeitenAnnuityChristed aljo barroga100% (1)

- 6-Comparing AlternativesDokument7 Seiten6-Comparing AlternativesKlucifer XinNoch keine Bewertungen

- Module 2Dokument29 SeitenModule 2Malik MalikNoch keine Bewertungen

- Board ProblemsDokument30 SeitenBoard ProblemsGlyzel Dizon100% (1)

- Engineering Economy: Capital FinancingDokument17 SeitenEngineering Economy: Capital FinancingJohn Kenneth MantesNoch keine Bewertungen

- Activity 3 Engineering Economy: P A P A, I, N G, I, N P 5,000 (P 5,000 P 6,631.285+ P1,255.411 P 7,886.68Dokument5 SeitenActivity 3 Engineering Economy: P A P A, I, N G, I, N P 5,000 (P 5,000 P 6,631.285+ P1,255.411 P 7,886.68taliya coco100% (1)

- Lesson 9 - Comparison of AlternativesDokument5 SeitenLesson 9 - Comparison of AlternativesRV0% (1)

- Geometric GradientDokument20 SeitenGeometric GradientDarkie DrakieNoch keine Bewertungen

- Engineering Economy: Cheerobie B. AranasDokument27 SeitenEngineering Economy: Cheerobie B. AranasCllyan ReyesNoch keine Bewertungen

- MODULE 05 - Engineering Economy - Present EconomyDokument12 SeitenMODULE 05 - Engineering Economy - Present EconomyNoel So jr100% (1)

- Gradient Series and AsDokument8 SeitenGradient Series and AsJayrMenes100% (1)

- MODULE 3 Engineering EconomyDokument34 SeitenMODULE 3 Engineering EconomyJohn Carlo Bacalando IINoch keine Bewertungen

- MODULE 3 Engineering EconomyDokument34 SeitenMODULE 3 Engineering EconomyJohn Carlo Bacalando IINoch keine Bewertungen

- Final PDFDokument21 SeitenFinal PDFWaleed OsmanNoch keine Bewertungen

- SW 5 Problem No. 34Dokument2 SeitenSW 5 Problem No. 34Javadd Kilam100% (1)

- Engineering Economy Part 3Dokument13 SeitenEngineering Economy Part 3Josiah FloresNoch keine Bewertungen

- Chapter 2 Lesson 3 - Discount, Inflation, and TaxDokument9 SeitenChapter 2 Lesson 3 - Discount, Inflation, and TaxMae AsuncionNoch keine Bewertungen

- Economics AnnuityDokument2 SeitenEconomics AnnuityGeodetic Engineering FilesNoch keine Bewertungen

- Engineering Economy 111Dokument17 SeitenEngineering Economy 111Kristopher Ehilla Recto67% (3)

- Sample Problems - Mech 1Dokument26 SeitenSample Problems - Mech 1Heart VenturanzaNoch keine Bewertungen

- Capital Recovery CostDokument2 SeitenCapital Recovery CostShahnaz NadivaNoch keine Bewertungen

- An Annuity Is A Series of Equal Payments Occurring at Equal Periods of Time Annuities Occur in The Following InstancesDokument20 SeitenAn Annuity Is A Series of Equal Payments Occurring at Equal Periods of Time Annuities Occur in The Following InstancesBolocon, Harvey Jon DelfinNoch keine Bewertungen

- Interest & DiscountDokument5 SeitenInterest & DiscountThur MykNoch keine Bewertungen

- Deferred AnnuityDokument8 SeitenDeferred AnnuityLAURENCE JAN BAGAANNoch keine Bewertungen

- Engineering Economy: Annuity Due, Deferred Annuity and PerpetuityDokument8 SeitenEngineering Economy: Annuity Due, Deferred Annuity and PerpetuityHENRICK IGLENoch keine Bewertungen

- Annuity Due and Deferred AnnuityDokument2 SeitenAnnuity Due and Deferred Annuityolivia leonor100% (2)

- Solution 1-5 1Dokument4 SeitenSolution 1-5 1Dan Edison RamosNoch keine Bewertungen

- Seatwork EEco AnnuityDokument17 SeitenSeatwork EEco AnnuityJr de GuzmanNoch keine Bewertungen

- Straight Line & Sinking Fund MethodDokument2 SeitenStraight Line & Sinking Fund MethodNathan Dungog100% (1)

- Annuity Due and Perpetuity Sample ProblemsDokument5 SeitenAnnuity Due and Perpetuity Sample ProblemsErvin Russel RoñaNoch keine Bewertungen

- Engineering Economy Lecture3Dokument34 SeitenEngineering Economy Lecture3Jaed Caraig100% (2)

- Problem Set EconDokument22 SeitenProblem Set EconDaniel Viterbo RodriguezNoch keine Bewertungen

- Engineering Economy: Annuity and Capitalized CostDokument22 SeitenEngineering Economy: Annuity and Capitalized CostKì Hyö JüngNoch keine Bewertungen

- De Module 2Dokument9 SeitenDe Module 2Abigail Siatrez100% (1)

- Eeco HWDokument19 SeitenEeco HWRejed VillanuevaNoch keine Bewertungen

- Uniform-Arithmetic-Gradient Encon 1 PDFDokument4 SeitenUniform-Arithmetic-Gradient Encon 1 PDFErina SmithNoch keine Bewertungen

- Basic EE Week 8 Lesson - 864873286Dokument33 SeitenBasic EE Week 8 Lesson - 864873286Reinier FrancoNoch keine Bewertungen

- InstallDokument2 SeitenInstallNoreen Stella EbadNoch keine Bewertungen

- Problem Set 4 With Solution - AnnuityDokument14 SeitenProblem Set 4 With Solution - AnnuityNoel So jrNoch keine Bewertungen

- Baldevino Assignment 1Dokument9 SeitenBaldevino Assignment 1Nathaniel Baldevino100% (1)

- Interest & DiscountDokument44 SeitenInterest & DiscountJunior Noel0% (1)

- Engineering Economy Simple InterestDokument1 SeiteEngineering Economy Simple InterestNoreen Guiyab TannaganNoch keine Bewertungen

- DepreciationDokument4 SeitenDepreciationDrakath0rk100% (2)

- 4 Capitalized Cost BondDokument32 Seiten4 Capitalized Cost BondkzutoNoch keine Bewertungen

- Engineering Economics Upm Samples 10Dokument4 SeitenEngineering Economics Upm Samples 10Cesia MontelloNoch keine Bewertungen

- FInalDokument7 SeitenFInalRyan Martinez0% (1)

- ULO 3B FinallDokument11 SeitenULO 3B FinallRegine Mae Lustica Yaniza100% (1)

- Cost of Capital Doc For PDF Encrypted PDFDokument8 SeitenCost of Capital Doc For PDF Encrypted PDFsarvesh gunessNoch keine Bewertungen

- Case 1: C Case 2: Cap Market, No Production. CDokument1 SeiteCase 1: C Case 2: Cap Market, No Production. CjoeydanzaNoch keine Bewertungen

- Week 13 - Future Value of AnnuitiesDokument23 SeitenWeek 13 - Future Value of AnnuitiesKrysthel Almendras-SarmientoNoch keine Bewertungen

- Nurse Education Today: Natalie M. Agius, Ann WilkinsonDokument8 SeitenNurse Education Today: Natalie M. Agius, Ann WilkinsonSobiaNoch keine Bewertungen

- Irregular Verbs Lesson PlanDokument13 SeitenIrregular Verbs Lesson Planapi-311868026Noch keine Bewertungen

- Manual G Ingles - V6Dokument68 SeitenManual G Ingles - V6Phùng Thế Kiên50% (2)

- Tescom Technical Training - Pressure Regulators Explained - Ver1.1Dokument19 SeitenTescom Technical Training - Pressure Regulators Explained - Ver1.1Amod DeshpandeNoch keine Bewertungen

- DSE4610 DSE4620 Operators ManualDokument86 SeitenDSE4610 DSE4620 Operators ManualJorge Carrasco100% (6)

- Distance Relay Setting CalculationDokument8 SeitenDistance Relay Setting Calculation1453h100% (7)

- AS Film Production Lesson.Dokument13 SeitenAS Film Production Lesson.MsCowanNoch keine Bewertungen

- IOQC2021 PartII Questions enDokument13 SeitenIOQC2021 PartII Questions enDhamodharan SrinivasanNoch keine Bewertungen

- SolutionsManual NewDokument123 SeitenSolutionsManual NewManoj SinghNoch keine Bewertungen

- Financial Statements Ias 1Dokument34 SeitenFinancial Statements Ias 1Khalid AzizNoch keine Bewertungen

- NTCC Project - Fake News and Its Impact On Indian Social Media UsersDokument41 SeitenNTCC Project - Fake News and Its Impact On Indian Social Media UsersManan TrivediNoch keine Bewertungen

- Building A Vacuum Forming TableDokument9 SeitenBuilding A Vacuum Forming TableWil NelsonNoch keine Bewertungen

- Led Matrix A-788bsDokument5 SeitenLed Matrix A-788bsjef fastNoch keine Bewertungen

- Fundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFDokument68 SeitenFundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFbrainykabassoullw100% (10)

- Safe Use of Power Tools Rev0Dokument92 SeitenSafe Use of Power Tools Rev0mohapatrarajNoch keine Bewertungen

- 4th - STD - MM - Kerala Reader Malayalam Vol 1Dokument79 Seiten4th - STD - MM - Kerala Reader Malayalam Vol 1Rajsekhar GNoch keine Bewertungen

- Lesson PlansDokument12 SeitenLesson Plansapi-282722668Noch keine Bewertungen

- ECE3073 P4 Bus Interfacing Answers PDFDokument3 SeitenECE3073 P4 Bus Interfacing Answers PDFkewancamNoch keine Bewertungen

- SR Cheat Sheets PDFDokument4 SeitenSR Cheat Sheets PDFDevin ZhangNoch keine Bewertungen

- How To Install Mesa (OpenGL) On Linux Mint - 6 StepsDokument2 SeitenHow To Install Mesa (OpenGL) On Linux Mint - 6 Stepsankitfrnd45Noch keine Bewertungen

- Ecoflam Burners 2014 enDokument60 SeitenEcoflam Burners 2014 enanonimppNoch keine Bewertungen

- 1349122940100212diggerDokument24 Seiten1349122940100212diggerCoolerAdsNoch keine Bewertungen

- WRhine-Main-Danube CanalDokument6 SeitenWRhine-Main-Danube CanalbillNoch keine Bewertungen

- Ebook Essentials of Kumar Clarks Clinical Medicine PDF Full Chapter PDFDokument67 SeitenEbook Essentials of Kumar Clarks Clinical Medicine PDF Full Chapter PDFjanet.cochran431100% (19)

- CH 11 International TradeDokument20 SeitenCH 11 International TradeSANTU GHORAINoch keine Bewertungen

- Subject-Verb AgreementDokument10 SeitenSubject-Verb AgreementLouie Jay Cañada AbarquezNoch keine Bewertungen

- Monorail Hoist SystemDokument17 SeitenMonorail Hoist SystemypatelsNoch keine Bewertungen

- Attention: 6R60/6R75/6R80 Installation GuideDokument4 SeitenAttention: 6R60/6R75/6R80 Installation GuideEdwinferNoch keine Bewertungen

- Water Determination in Gases and LPG: KF MaxDokument4 SeitenWater Determination in Gases and LPG: KF MaxMohamed MosbahNoch keine Bewertungen

- TSAR-1 Reverb Quick GuideDokument1 SeiteTSAR-1 Reverb Quick GuidedraenkNoch keine Bewertungen