Beruflich Dokumente

Kultur Dokumente

BOP One Pager Jan 2019

Hochgeladen von

Ashwin Hasyagar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

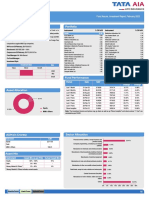

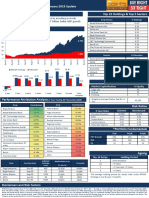

17 Ansichten1 SeiteThis document provides an update on a business opportunities strategy portfolio as of January 2019. It details the portfolio's top holdings, sector allocation, performance metrics, and attribution analysis. The portfolio is comprised mainly of large cap and mid cap stocks from sectors like banking & finance, FMCG, and retail. Since inception in January 2018, the portfolio has underperformed the Nifty 500 index, returning -3.05% versus -4.60% for the index. At the stock level, Hindustan Unilever, Bajaj Finance, and Bata India have been among the largest positive contributors to performance.

Originalbeschreibung:

x

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides an update on a business opportunities strategy portfolio as of January 2019. It details the portfolio's top holdings, sector allocation, performance metrics, and attribution analysis. The portfolio is comprised mainly of large cap and mid cap stocks from sectors like banking & finance, FMCG, and retail. Since inception in January 2018, the portfolio has underperformed the Nifty 500 index, returning -3.05% versus -4.60% for the index. At the stock level, Hindustan Unilever, Bajaj Finance, and Bata India have been among the largest positive contributors to performance.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten1 SeiteBOP One Pager Jan 2019

Hochgeladen von

Ashwin HasyagarThis document provides an update on a business opportunities strategy portfolio as of January 2019. It details the portfolio's top holdings, sector allocation, performance metrics, and attribution analysis. The portfolio is comprised mainly of large cap and mid cap stocks from sectors like banking & finance, FMCG, and retail. Since inception in January 2018, the portfolio has underperformed the Nifty 500 index, returning -3.05% versus -4.60% for the index. At the stock level, Hindustan Unilever, Bajaj Finance, and Bata India have been among the largest positive contributors to performance.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Business Opportunities Strategy

January 2019 Update

Holdings Performance

(%) of Market

Scrip Name Period Strategy Nifty 500

Value

Hindustan Unilever Ltd 9.66 1 Month 2.22 0.67

3 Months 6.54 0.59

HDFC Bank Ltd 7.19

6 Months -1.68 0.08

Bajaj Finance Ltd 6.38

9 Months 0.65 2.89

Bata India Ltd 6.34

Since Inception

Exide Industries Ltd 6.16 -3.05 -4.60

(16-Jan-2018)

ICICI Lombard General Insurance Company Ltd 5.29

Godrej Agrovet Ltd 5.18 Market Capitalization

Britannia Industries Ltd 5.11 Market Capitalization % Equity

Container Corporation Of India Ltd 4.96 Large Cap 51

Gruh Finance Ltd 4.80 Mid Cap 25

Kotak Mahindra Bank Ltd 4.79 Small Cap 24

Kansai Nerolac Paints Ltd 4.71 Weighted Average Market Cap (Rs.

121,104

Blue Star Ltd 4.36 In Crs)

Titan Company Ltd 4.27

*Portfolio Fundamentals

Future Lifestyle Fashions Ltd 3.48

HDFC Standard Life Insurance Company Ltd 3.37

TTM FY19E FY20E

Phoenix Mills Ltd 2.87

PAT Growth 18% 28% 23%

Ujjivan Financial Services Ltd 2.84

RoE 23% 23% 25%

Avanti Feeds Ltd 2.42

PE 44 39 32

Eveready Industries Ltd 2.14

Tata Global Beverages Ltd 2.12 Performance Attribution Analysis

Century Plyboards (India) Ltd 1.56 (Since Inception)

Scrip Contribution

Sectoral Allocation Hindustan Unilever

Bajaj Finance

2.34%

2.26%

Bata India 2.24%

Sector Allocation (%) Britannia Industries 1.27%

Exide Industries 0.90%

Banking & Finance 34.68 H D F C Bank 0.89%

Kotak Mahindra Bank 0.66%

FMCG 19.03 Gruh Finance 0.55%

Retail 12.69 Future Lifestyle Fashion 0.40%

Titan Industries 0.24%

Agriculture 7.61 ICICI Lombard General Insurance 0.08%

Container Corpn. Of India -0.16%

Engineering & Electricals 6.49 Phoenix Mills -0.26%

Construction 6.26 Kansai Nerolac Paints -0.52%

Blue Star -0.82%

Auto & Auto Ancillaries 6.16 HDFC Standard Life Insurance Company -0.83%

Tata Global Beverages -0.89%

Logistic Services 4.96 Godrej Agrovet -1.02%

Tea & Coffee 2.12 Ujjivan Financial Services -1.31%

Century Plyboards (India) -1.47%

Cash - Avanti Feeds -2.68%

Eveready Industries India -2.92%

* Earnings as of September 2018 quarter and market price as on 31st December 2018 ; Data Source: MOAMC Internal Research; The above strategy returns are of a Model Client and

returns of Individual Client may differ depending on time of entry in the Strategy. Investments in Securities are subject to market and other risks and there is no assurance or guarantee

that the objectives of any of the strategies of the Portfolio Management Services will be achieved. These stocks are a part of the existing PMS strategy as on 31st December 2018. These

Stocks may or may not be bought for new clients. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. The

strategy may or may not have any present or future holdings in these stocks. The companies mentioned above are only for the purpose of explaining the concept and should not be

construed as recommendations from MOAMC. Based as per the closing market prices on 31st December 2018. Name of the PMS Strategy does not in any manner indicate its future

prospects and returns.

Das könnte Ihnen auch gefallen

- UTIFLEXICAPFUNDDokument2 SeitenUTIFLEXICAPFUNDmeghaNoch keine Bewertungen

- Utivalueopportunitiesfund 193Dokument2 SeitenUtivalueopportunitiesfund 193201 TVNoch keine Bewertungen

- Utiniftyindexfund 12820200210 213216Dokument2 SeitenUtiniftyindexfund 12820200210 213216VarathavasuNoch keine Bewertungen

- Value Product Note October-20Dokument2 SeitenValue Product Note October-20Swades DNoch keine Bewertungen

- Uti Children'S Career Fund - Investment Plan: JANUARY 2023Dokument3 SeitenUti Children'S Career Fund - Investment Plan: JANUARY 2023rout.sonali20Noch keine Bewertungen

- Canara Robeco Emerging Equities PDFDokument1 SeiteCanara Robeco Emerging Equities PDFJasmeet Singh NagpalNoch keine Bewertungen

- Tata Multi Cap FundDokument1 SeiteTata Multi Cap FundHarsh SrivastavaNoch keine Bewertungen

- Tata Multi Cap FundDokument1 SeiteTata Multi Cap FundJeremiah SolomonNoch keine Bewertungen

- NTDOP Product Note 31st October 2020Dokument2 SeitenNTDOP Product Note 31st October 2020Swades DNoch keine Bewertungen

- Tata India Consumption FundDokument1 SeiteTata India Consumption FundJeremiah SolomonNoch keine Bewertungen

- Top 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110Dokument1 SeiteTop 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110editor's cornerNoch keine Bewertungen

- 578380618monthly Communique May, 2022Dokument12 Seiten578380618monthly Communique May, 2022Dhairya BuchNoch keine Bewertungen

- 590784414monthly Communique March, 2022Dokument12 Seiten590784414monthly Communique March, 2022Dhairya BuchNoch keine Bewertungen

- Dividend Aristocrats Smallcase _ Managed by Windmill CapitalDokument4 SeitenDividend Aristocrats Smallcase _ Managed by Windmill Capitalnimesh_vermaNoch keine Bewertungen

- Sbi Life Balanced Fund PerformanceDokument1 SeiteSbi Life Balanced Fund PerformanceVishal Vijay SoniNoch keine Bewertungen

- EMERGING OPPORTUNITIES FUND INVESTMENT REPORTDokument1 SeiteEMERGING OPPORTUNITIES FUND INVESTMENT REPORTJeremiah SolomonNoch keine Bewertungen

- IOP V2 Product Note 31st October 2020Dokument2 SeitenIOP V2 Product Note 31st October 2020Swades DNoch keine Bewertungen

- 8ccff Pms Communique August 22Dokument13 Seiten8ccff Pms Communique August 22pradeep kumarNoch keine Bewertungen

- Financial Weekly Highlights Two Dark Horse Stocks With Over 60% Upside PotentialDokument2 SeitenFinancial Weekly Highlights Two Dark Horse Stocks With Over 60% Upside PotentialRanjan BeheraNoch keine Bewertungen

- IOP One Pager Jan 2019Dokument1 SeiteIOP One Pager Jan 2019Ashwin HasyagarNoch keine Bewertungen

- Top 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Dokument1 SeiteTop 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Prafful TriPathiNoch keine Bewertungen

- Tata Whole Life Mid Cap Equity FundDokument1 SeiteTata Whole Life Mid Cap Equity FundK Dviya VennelaNoch keine Bewertungen

- SBI Multi Asset Allocation Fund FactsheetDokument1 SeiteSBI Multi Asset Allocation Fund FactsheetamanNoch keine Bewertungen

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDokument1 SeiteSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNoch keine Bewertungen

- 2020756102monthly Communique June, 2022Dokument13 Seiten2020756102monthly Communique June, 2022Dhairya BuchNoch keine Bewertungen

- Mirae Asset India Opportunities Fund holdings and sector allocationDokument31 SeitenMirae Asset India Opportunities Fund holdings and sector allocationNamrata ShettiNoch keine Bewertungen

- Factsheet_Nifty_FinServ_25_50Dokument2 SeitenFactsheet_Nifty_FinServ_25_50solankisanjay2875Noch keine Bewertungen

- Tata Mid Cap Growth Fund December 2019Dokument2 SeitenTata Mid Cap Growth Fund December 2019ChromoNoch keine Bewertungen

- HDFC MF Factsheet April 2023-1Dokument1 SeiteHDFC MF Factsheet April 2023-1Jayashree PawarNoch keine Bewertungen

- Utimidcapfund 16020220823 053119Dokument2 SeitenUtimidcapfund 16020220823 053119meghaNoch keine Bewertungen

- UlipDokument1 SeiteUlipsanu091Noch keine Bewertungen

- Kotak Equity OpportunitiesDokument8 SeitenKotak Equity OpportunitiesKiran VidhaniNoch keine Bewertungen

- Portfolio X-Ray Report: 8500427624 : Asset Allocation % Top 10 Underlying Holdings Asset AllocationDokument6 SeitenPortfolio X-Ray Report: 8500427624 : Asset Allocation % Top 10 Underlying Holdings Asset AllocationTripat SinghNoch keine Bewertungen

- HYBRID FUND NAV AND PORTFOLIO SNAPSHOTDokument1 SeiteHYBRID FUND NAV AND PORTFOLIO SNAPSHOTramana purushothamNoch keine Bewertungen

- Multi Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110Dokument1 SeiteMulti Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110editor's cornerNoch keine Bewertungen

- 633857573151526178Dokument124 Seiten633857573151526178Deepak KotwayNoch keine Bewertungen

- Bajaj Finance Q2 FY19 Investor Presentation HighlightsDokument47 SeitenBajaj Finance Q2 FY19 Investor Presentation HighlightsAnonymous NJDmHvjNoch keine Bewertungen

- Tata Quant PortfolioDokument1 SeiteTata Quant PortfolioDeepanshu SatijaNoch keine Bewertungen

- SBI Contra FundDokument2 SeitenSBI Contra FundScribbydooNoch keine Bewertungen

- NIFTY Growth Sectors 15 Apr2020Dokument1 SeiteNIFTY Growth Sectors 15 Apr2020amitNoch keine Bewertungen

- LIC - IPO - RetailDokument8 SeitenLIC - IPO - RetailMSME SULABH TUMAKURUNoch keine Bewertungen

- 824e0-leaflet-motilal-oswal-nifty-microcap-250-index-fund-one-pager-rd-feb-2024Dokument2 Seiten824e0-leaflet-motilal-oswal-nifty-microcap-250-index-fund-one-pager-rd-feb-2024final bossuNoch keine Bewertungen

- Ind Nifty FMCGDokument2 SeitenInd Nifty FMCGSUMITNoch keine Bewertungen

- Edelweiss Balanced Advantage Fund: Investment ObjectiveDokument1 SeiteEdelweiss Balanced Advantage Fund: Investment ObjectivePavankopNoch keine Bewertungen

- Motilal Oswal Focused Midcap Strategy Performance & HoldingsDokument2 SeitenMotilal Oswal Focused Midcap Strategy Performance & HoldingsHimanshu TamrakarNoch keine Bewertungen

- BOP Strategy Earnings UpdateDokument25 SeitenBOP Strategy Earnings UpdateHetanshNoch keine Bewertungen

- Ind Nifty FMCGDokument2 SeitenInd Nifty FMCGGopi nathNoch keine Bewertungen

- Value Investing: Managing Your Money Using Principles!Dokument8 SeitenValue Investing: Managing Your Money Using Principles!Parthiv JethiNoch keine Bewertungen

- Tracing Missing ShareholdersDokument19 SeitenTracing Missing Shareholdersmrpatel121152Noch keine Bewertungen

- Ind Nifty FMCGDokument2 SeitenInd Nifty FMCGParesh chaklasiyaNoch keine Bewertungen

- TopDividendYieldStocks 15march2023Dokument4 SeitenTopDividendYieldStocks 15march2023Dwaipayan MojumderNoch keine Bewertungen

- BAJAJCON 02022022171231 Investor PresentationDokument31 SeitenBAJAJCON 02022022171231 Investor PresentationKalai selvanNoch keine Bewertungen

- Ind Nifty FMCGDokument2 SeitenInd Nifty FMCGDharmendra Singh GondNoch keine Bewertungen

- Ind Nifty FMCGDokument2 SeitenInd Nifty FMCGdebajitduarah72Noch keine Bewertungen

- TopDividendYieldStocks 15012024Dokument4 SeitenTopDividendYieldStocks 15012024Midastar TradingNoch keine Bewertungen

- Ind Nifty BankDokument2 SeitenInd Nifty BankVishal GandhleNoch keine Bewertungen

- SAPM Assignment 2Dokument10 SeitenSAPM Assignment 2jhilikNoch keine Bewertungen

- NIFTY Bank Index OverviewDokument2 SeitenNIFTY Bank Index OverviewAhmedNasirNoch keine Bewertungen

- Ind Nifty Bank PDFDokument2 SeitenInd Nifty Bank PDFÄñîRûddhâ JâdHäv ÂjNoch keine Bewertungen

- Balance Sheet StructuresVon EverandBalance Sheet StructuresAnthony N BirtsNoch keine Bewertungen

- Old Bridge 5-Year PerformanceDokument3 SeitenOld Bridge 5-Year PerformanceAshwin HasyagarNoch keine Bewertungen

- EV Landscape - Opportunities For India's Auto Component IndustryDokument112 SeitenEV Landscape - Opportunities For India's Auto Component IndustryPreran PrasadNoch keine Bewertungen

- AlchemyDokument8 SeitenAlchemyAshwin HasyagarNoch keine Bewertungen

- From The Desk of Business Head and CIO - January 2019: Mr. Prateek AgrawalDokument4 SeitenFrom The Desk of Business Head and CIO - January 2019: Mr. Prateek AgrawalAshwin HasyagarNoch keine Bewertungen

- IOP One Pager Jan 2019Dokument1 SeiteIOP One Pager Jan 2019Ashwin HasyagarNoch keine Bewertungen

- VIDF - Monthly Returns May 2017Dokument2 SeitenVIDF - Monthly Returns May 2017Ashwin HasyagarNoch keine Bewertungen

- NTDOP One Pager Jan 2019Dokument1 SeiteNTDOP One Pager Jan 2019Ashwin HasyagarNoch keine Bewertungen

- VallumDiscovery Stakeholders March2016Dokument4 SeitenVallumDiscovery Stakeholders March2016Ashwin HasyagarNoch keine Bewertungen

- Product Labelling: Birla Sun Life Resurgent India Fund - Series 3 (A Closed Ended Equity Scheme)Dokument28 SeitenProduct Labelling: Birla Sun Life Resurgent India Fund - Series 3 (A Closed Ended Equity Scheme)Ashwin HasyagarNoch keine Bewertungen

- CEP Risk Ratios PDFDokument1 SeiteCEP Risk Ratios PDFAshwin HasyagarNoch keine Bewertungen

- ICICI Pru Absolute - ReturnDokument4 SeitenICICI Pru Absolute - ReturnAshwin HasyagarNoch keine Bewertungen

- ICICI Pru Large - CapDokument4 SeitenICICI Pru Large - CapAshwin HasyagarNoch keine Bewertungen

- Transformer IndustryDokument6 SeitenTransformer IndustryAshwin HasyagarNoch keine Bewertungen

- First State of The Nation Address of ArroyoDokument9 SeitenFirst State of The Nation Address of ArroyoJennifer Sisperez Buraga-Waña LptNoch keine Bewertungen

- Chapter 018Dokument12 SeitenChapter 018api-281340024Noch keine Bewertungen

- TIA Portal v11 - HMI ConnectionDokument4 SeitenTIA Portal v11 - HMI ConnectionasdasdasdasdasdasdasadaNoch keine Bewertungen

- Course Title: Cost Accounting Course Code:441 BBA Program Lecture-3Dokument20 SeitenCourse Title: Cost Accounting Course Code:441 BBA Program Lecture-3Tanvir Ahmed ChowdhuryNoch keine Bewertungen

- Student Teaching Edtpa Lesson Plan TemplateDokument7 SeitenStudent Teaching Edtpa Lesson Plan Templateapi-3531253350% (1)

- The Experience of God Being Consciousness BlissDokument376 SeitenThe Experience of God Being Consciousness BlissVivian Hyppolito100% (6)

- Sen. Jinggoy Estrada vs. Office of The Ombudsman, Et. Al.Dokument2 SeitenSen. Jinggoy Estrada vs. Office of The Ombudsman, Et. Al.Keziah HuelarNoch keine Bewertungen

- The Voice of PLC 1101Dokument6 SeitenThe Voice of PLC 1101The Plymouth Laryngectomy ClubNoch keine Bewertungen

- BLUEBOOK CITATION GUIDEDokument12 SeitenBLUEBOOK CITATION GUIDEMichaela PortarcosNoch keine Bewertungen

- Orbit BioscientificDokument2 SeitenOrbit BioscientificSales Nandi PrintsNoch keine Bewertungen

- ExpressionismDokument16 SeitenExpressionismRubab ChaudharyNoch keine Bewertungen

- Subsurface Sewage DisposalDokument174 SeitenSubsurface Sewage DisposalSanthi KrishnaNoch keine Bewertungen

- Ra 1425 Rizal LawDokument7 SeitenRa 1425 Rizal LawJulie-Mar Valleramos LabacladoNoch keine Bewertungen

- Sarawak Energy FormDokument2 SeitenSarawak Energy FormIvy TayNoch keine Bewertungen

- Silent SpringDokument28 SeitenSilent Springjmac1212Noch keine Bewertungen

- Understanding key abdominal anatomy termsDokument125 SeitenUnderstanding key abdominal anatomy termscassandroskomplexNoch keine Bewertungen

- PeripheralDokument25 SeitenPeripheralMans FansNoch keine Bewertungen

- Final Exam, Business EnglishDokument5 SeitenFinal Exam, Business EnglishsubtleserpentNoch keine Bewertungen

- Marketing Strategy of Singapore AirlinesDokument48 SeitenMarketing Strategy of Singapore Airlinesi_sonet96% (49)

- 13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsDokument14 Seiten13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsWillSmathNoch keine Bewertungen

- PDF To Sas DatasetsDokument6 SeitenPDF To Sas DatasetsSiri KothaNoch keine Bewertungen

- Endoplasmic ReticulumDokument4 SeitenEndoplasmic Reticulumnikki_fuentes_1100% (1)

- Toyota TPMDokument23 SeitenToyota TPMchteo1976Noch keine Bewertungen

- Love in Plato's SymposiumDokument31 SeitenLove in Plato's Symposiumac12788100% (2)

- Ds B2B Data Trans 7027Dokument4 SeitenDs B2B Data Trans 7027Shipra SriNoch keine Bewertungen

- 150 Most Common Regular VerbsDokument4 Seiten150 Most Common Regular VerbsyairherreraNoch keine Bewertungen

- Ko vs. Atty. Uy-LampasaDokument1 SeiteKo vs. Atty. Uy-LampasaMaria Janelle RosarioNoch keine Bewertungen

- Mcquillin Murphy ResumeDokument1 SeiteMcquillin Murphy Resumeapi-253430225Noch keine Bewertungen

- The Beatles - Allan Kozinn Cap 8Dokument24 SeitenThe Beatles - Allan Kozinn Cap 8Keka LopesNoch keine Bewertungen

- Syntax - English Sentence StructureDokument2 SeitenSyntax - English Sentence StructurePaing Khant KyawNoch keine Bewertungen