Beruflich Dokumente

Kultur Dokumente

Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6

Hochgeladen von

Raymundo EirahOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6

Hochgeladen von

Raymundo EirahCopyright:

Verfügbare Formate

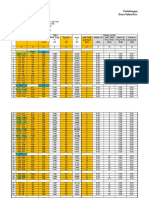

WITHHOLDING TAX TABLE

REVISED WITHHOLDING TAX TABLE

Effective January 1, 2018 to December 31, 2022

DAILY 1 2 3 4 5 6

P685

Compensation P685 P1,096 - P2,192 - P5,479 - P21,918 and

and

Range -P1,095 P2,191 P5,478 P21,917 above

below

0.00 P82.19

P356.16 P1,342.47 P6,602.74

Prescribed +20% +25%

0.00 +30% over +32% over +35% over

Withholding Tax over over

P2,192 P5,479 P21,918

P685 P1,096

WEEKLY 1 2 3 4 5 6

P4,808

Compensation P4,808 - P7,692 - P15,385 - P38,462 - P153,846

and

Range P7,691 P15,384 P38,461 P153,845 and above

below

0.00 P576.92

P2,500.00 P9,423.08 P46,346.15

Prescribed +20% +25%

0.00 +30% over +32% over +35% over

Withholding Tax over over

p15,385 P38,462 P153,846

P4,808 p7,692

SEMI-MONTHL

1 2 3 4 5 6

Y

P10,417 P10,417

Compensation P16,667 - P33,333 - P83,333 - P333,333

and -

Range P33,332 P83,332 P333,332 and above

below P16,666

0.00 P1,250.00

P5,416.67 P20,416.67 P100,416.67

Prescribed +20% +25%

0.00 +30% over +32% over +35% over

Withholding Tax over over

P33,333 P83,333 P333,333

P10,417 P16,667

MONTHLY 1 2 3 4 5 6

P20,833 P20,833

Compensation P33,333 - P66,667 - P166,667 - P666,667

and -

Range P66,666 P166,666 P666,666 and above

below P33,332

0.00 P2,500.00

P10,833.33 P40,833.33 P200,833.33

Prescribed +20% +25%

0.00 +30% over +32% over +35% over

Withholding Tax over over

P66,667 P166,667 P666,667

P20,833 33,333

REVISED WITHHOLDING TAX TABLE

Effective January 1, 2023 and onwards

DAILY 1 2 3 4 5 6

P685

Compensation P685 P1,096 - P2,192 - P5,479 - P21,918 and

and

Range -P1,095 P2,191 P5,478 P21,917 above

below

0.00 P82.19

P356.16 P1,342.47 P6,602.74

Prescribed +15% +20%

0.00 +25% over +30% over +35% over

Withholding Tax over over

P2,192 P5,479 P21,918

P685 P1,096

WEEKLY 1 2 3 4 5 6

P4,808

Compensation P4,808 - P7,692 - P15,385 - P38,462 - P153,846

and

Range P7,691 P15,384 P38,461 P153,845 and above

below

0.00 P576.92

P2,500.00 P9,423.08 P46,346.15

Prescribed +15% +20%

0.00 +25% over +30% over +35% over

Withholding Tax over over

p15,385 P38,462 P153,846

P4,808 p7,692

SEMI-MONTHL

1 2 3 4 5 6

Y

P10,417 P10,417

Compensation P16,667 - P33,333 - P83,333 - P333,333

and -

Range P33,332 P83,332 P333,332 and above

below P16,666

0.00 P1,250.00

P5,416.67 P20,416.67 P100,416.67

Prescribed +15% +20%

0.00 +25% over +30% over +35% over

Withholding Tax over over

P33,333 P83,333 P333,333

P10,417 P16,667

MONTHLY 1 2 3 4 5 6

P20,833 P20,833

Compensation P33,333 - P66,667 - P166,667 - P666,667

and -

Range P66,666 P166,666 P666,666 and above

below P33,332

0.00 P2,500.00

P10,833.33 P40,833.33 P200,833.33

Prescribed +15% +20%

0.00 +25% over +30% over +35% over

Withholding Tax over over

P66,667 P166,667 P666,667

P20,833 33,333

EXPANDED WITHHOLDING TAX

The Withholding of Creditable Tax at Source or simply called Expanded Withholding

Tax is a tax imposed and prescribed on the items of income payable to natural or

juridical persons, residing in the Philippines, by a payor-corporation/person which shall

be credited against the income tax liability of the taxpayer for the taxable year.

Tax Rates

TAX TYPE TAX ATC

DESCRIPTION

RATE IND CORP

Professional fees (Lawyers, CPA's,

WE

Engineers, etc.)

- if the gross income for the current

5% WI010

year did not exceed P3M

- if gross income is more than 3M or

10% WI011

VAT registered regardlessof amount

Professional fees (Lawyers, CPA's,

WE

Engineers, etc.)

- if gross income for the current year

10% WC010

did not exceed P720,000

- if gross income exceeds P720,000 15% WC011

Professional entertainer such as, but

WE not limited to actors and actresses,

singers, lyricist, composers, emcees

- if the gross income for the current

5% WI020

year did not exceed P3M

- if gross income is more than 3M or

10% WI021

VAT registered regardless of amount

Professional entertainer such as, but

WE not limited to actors and actresses,

singers, lyricist, composers, emcees

- if gross income for the current year

10% WC020

did not exceed P720,000

- if gross income exceeds P720,000 15% WC021

Professional athletes including

WE basketball players, pelotaris and

jockeys

- if the gross income for the current

5% WI030

year did not exceed P3M

- if gross income is more than 3M or

10% WI031

VAT registered regardless of amount

Professional athletes including

WE

basketball players, pelotaris and

jockeys

- if gross income for the current year

10% WC030

did not exceed P720,000

- if gross income exceeds P720,000 15% WC031

All directors and producers involved in

WE movies, stage, television and musical

productions

- if the gross income for the current

5% WI040

year did not exceed P3M

- if gross income is more than 3M or

10% WI041

VAT registered regardless of amount

All directors and producers involved in

WE movies, stage, television and musical

productions

- if gross income for the current year

10% WC040

did not exceed P720,000

- if gross income exceeds P720,000 15% WC041

WE Management and technical consultants

- if the gross income for the current

5% WI050

year did not exceed P3M

- if gross income is more than 3M or

10% WI051

VAT registered regardless of amount

WE Management and technical consultants

- if gross income for the current year

10% WC050

did not exceed P720,000

- if gross income exceeds P720,000 15% WC051

Business and Bookkeeping agents and

WE

agencies

- if the gross income for the current

5% WI060

year did not exceed P3M

- if gross income is more than 3M or

10% WI061

VAT registered regardless of amount

Business and Bookkeeping agents and

WE

agencies

- if gross income for the current year

10% WC060

did not exceed P720,000

- if gross income exceeds P720,000 15% WC061

Insurance agents and insurance

WE

adjusters

- if the gross income for the current

5% WI070

year did not exceed P3M

- if gross income is more than 3M or

10% WI071

VAT registered regardless of amount

Insurance agents and insurance

WE

adjusters

- if gross income for the current year

10% WC070

did not exceed P720,000

- if gross income exceeds P720,000 15% WC071

WE Other Recipients of Talent Fees

- if the gross income for the current

5% WI080

year did not exceed P3M

- if gross income is more than 3M or

10% WI081

VAT registered regardless of amount

WE Other Recipients of Talent Fees

- if gross income for the current year

10% WC080

did not exceed P720,000

- if gross income exceeds P720,000 15% WC081

Fees of Director who are not employees

WE

of the company

- if the gross income for the current

5% WI090

year did not exceed P3M

- if gross income is more than 3M or

10% WI091

VAT registered regardless of amount

Rentals Oon gross rental or lease for

the continued use or possession of

personal property in excess of P10,000

annually and real property used in

WE 5% WI100 WC100

business which the payor or obligor has

not taken title or is not taking title, or

in which has no equity; poles, satellites,

transmission facilities and billboards

Cinemathographic film rentals and

other payments to resident indivduals

WE 5% WI110 WC110

and corporate cinematographic film

owners, lessors and distributors

Income payments to certain

WE 2% WI120 WC120

contractors

WE Income distribution to the beneficiaries 15% WI130

of estate and trusts

Gross Commission of service fees of

customs, insurance, stock, immigration

and commercial brokers, fees of agents

of professional entertainers and real

WE

estate service practitioners

(RESPs)(i.e. real estate consultants,

real estate appraisers and real estate

brokers

- if the gross income for the current

5% WI139

year did not exceed P3M

- if gross income is more than 3M or

10% WI140

VAT registered regardless of amount

Gross Commission of service fees of

customs, insurance, stock, immigration

and commercial brokers, fees of agents

of professional entertainers and real

WE

estate service practitioners

(RESPs)(i.e. real estate consultants,

real estate appraisers and real estate

brokers

- if gross income for the current year

10% WC139

did not exceed P720,000

- if gross income exceeds P720,000 15% WC140

Professional fees paid to medical

practitioners (includes doctors of

medicine, doctors of veterinary science

WE

& dentist) by hospitals & clinics or

paid directly by HMO and/or other

semilar establishments

- if the gross income for the current year

5% WI151

did not exceed P3M

- if gross income is more than 3M or

10% WI150

VAT registered regardless of amount

Professional fees paid to medical

practitioners (includes doctors of

medicine, doctors of veterinary science

WE

& dentist) by hospitals & clinics or

paid directly by HMO and/or other

semilar establishments

- if gross income for the current year

10% WC151

did not exceed P720,000

- if gross income exceeds P720,000 15% WC150

Payment by the General Professional

WE

Partnership (GPPs) to its partners

- if gross income for the current year

10% WI152

did not exceed P720,000

- if gross income exceeds P720,000 15% WI153

1% OF

Income payments made by credit card 1/2 of

WE WI158 WC158

companies gross

amount

Additional Income Payments to govt

personnel from importers, shipping

WE 15% WI159

and airline companies or their agents

for overtime services

Income Payment made by NGAs, LGU,

& etc to its local/resident suppliers of

WE 1% WI640 WC640

goods other than those covered by

other rates of withholding tax

Income Payment made by NGAs, LGU,

& etc to its local/resident suppliers of

WE 2% WI157 WC157

services other than those covered by

other rates of withholding tax

Income Payment made by top

withholding agents to their

WE local/resident suppliers of goods other 1% WI158 WC158

than those covered by other rates of

withholding tax

Income Payment made by top

withholding agents to their

WE local/resident suppliers of services 2% WI160 WC160

other than those covered by other rates

of withholding tax

Commissions, rebates, discounts and

other similar considerations

paid/granted to independent and/or

WE

exclusive sales representatives and

marketing agents and sub-agents of

companies, including multi-level

marketing companies

- if the gross income for the current

5% WI515 WC515

year did not exceed P3M

- if the gross income is more than

P3M or VAT registered regardless of 10% WI516 WC516

amount

Gross payments to embalmers by

WE 1% WI530

funeral parlors

Payments made by pre-need companies

WE 1% WI535 WC535

to funeral parlors

WE Tolling fees paid to refineries 5% WI540 WC540

Income payments made to suppliers of

agricultural supplier products in excess

WE 1% WI610 WC610

of cumulative amount of P300,000

within the same taxable year

Income payments on purchases of

minerals, mineral products and quarry

resources, such as but not limited to

WE silver, gold, granite, gravel, sand, 5% WI630 WC630

boulders and other mineral products

except purchases by Bangko Sentral ng

Pilipinas

Income payments on purchases of

minerals, mineral products and quarry

resources by Bangko Sentral ng

WE 1% WI632 WC632

Pilipinas ((BSP) from gold

miners/suppliers under PD 1899, as

amended by RA No. 7076

On gross amount of refund given by

WE MERALCO to customers with active 15% WI650 WC650

contracts as classified by MERALCO

On gross amount of refund given by

MERALCO to customers with

WE 15% WI651 WC651

terminated contracts as classified by

MERALCO

On gross amount of interest on the

refund of meter deposits whether paid

WE directly to the customers or applied 10% WI660 WC660

against customer's billings of

Residential and General Service

customers whose monthly electricity

consumption exceeds 200 kwh as

classified by MERALCO

On gross amount of interest on the

refund of meter deposits whether paid

directly to the customers or applied

against customer's billings of

WE 10% WI661 WC661

Non-Residential customers whose

monthly electricity consumption

exceeds 200 kwh as classified by

MERALCO

On gross amount of interest on the refund

of meter deposits whether paid directly to

the customers or applied against

customer's billings of Residential and

WE 10% WI662 WC662

General Service customers whose

monthly electricity consumption exceeds

200 kwh as classified by other by other

electric Distribution Utilities (DU)

On gross amount of interest on the refund

of meter deposits whether paid directly to

the customers or applied against

customer's billings of Non-Residential

WE 10% WI663 WC663

customers whose monthly electricity

consumption exceeds 200 kwh as

classified by other electric Distribution

Utilities (DU)

Income payments made by political

parties and candidates of local and

national elections on all their purchases of

goods and services relkated to campaign

expenditures, and income payments made

WE 5% WI680 WC680

by individuals or juridical persons for

their purchases of goods and services

intented to be given as campaign

contribution to political parties and

candidates

Income payments received by Real Estate

WE 1% WC690

Investment Trust (REIT)

WE Interest income denied from any other 15% WI710 WC710

debt instruments not within the coverage

of deposit substitutes and Revenue

Regulations 14-2012

Income payments on locally produced

WE 1% WI720 WC720

raw sugar

Das könnte Ihnen auch gefallen

- Phone Bill Jan 2022Dokument6 SeitenPhone Bill Jan 2022Maxime VogneNoch keine Bewertungen

- Tax Updates Vs Tax Code OldDokument7 SeitenTax Updates Vs Tax Code OldGianna Chloe S Victoria100% (1)

- Taxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Dokument15 SeitenTaxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Harold Dan AcebedoNoch keine Bewertungen

- Importance of Withholding Tax System: Compensation ExpandedDokument14 SeitenImportance of Withholding Tax System: Compensation ExpandedJAYAR MENDZ100% (1)

- Process Flow of Payment RequestDokument9 SeitenProcess Flow of Payment Requestrowena balaguerNoch keine Bewertungen

- PRTC - TAX-Final PB - May 2022Dokument16 SeitenPRTC - TAX-Final PB - May 2022Luna VNoch keine Bewertungen

- Payment Information Account Summary: P.O. BOX 15284 Wilmington, de 19850Dokument4 SeitenPayment Information Account Summary: P.O. BOX 15284 Wilmington, de 19850Marco100% (1)

- Primer On Train LawDokument8 SeitenPrimer On Train LawVeronica ChanNoch keine Bewertungen

- Military Modelling 201309Dokument84 SeitenMilitary Modelling 201309Clifford Holm89% (9)

- Financial Services - Previous Years Questions & Answers - JeganrajDokument82 SeitenFinancial Services - Previous Years Questions & Answers - Jeganrajjeganrajraj100% (1)

- Taxation - Withholding TaxDokument15 SeitenTaxation - Withholding TaxJohn Francis IdananNoch keine Bewertungen

- PRTC 1stpb - 05.22 Sol TaxDokument21 SeitenPRTC 1stpb - 05.22 Sol TaxCiatto SpotifyNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Bux - Multi-Wallet OverviewDokument29 SeitenBux - Multi-Wallet OverviewEllen BrillantesNoch keine Bewertungen

- B.E. San Diego, Inc. vs. Alzul DigestDokument2 SeitenB.E. San Diego, Inc. vs. Alzul DigestMarie Chielo100% (3)

- PRTC TAX-1stPB 0522 220221 091723Dokument16 SeitenPRTC TAX-1stPB 0522 220221 091723MOTC INTERNAL AUDIT SECTIONNoch keine Bewertungen

- Train LawDokument23 SeitenTrain LawDennis BudanoNoch keine Bewertungen

- Income Tax On Employed Taxpayer and Mixed Income EarnerDokument20 SeitenIncome Tax On Employed Taxpayer and Mixed Income EarnerFritzie Grace C. FraycoNoch keine Bewertungen

- Obli - 24 BE-San Diego V AlzulDokument3 SeitenObli - 24 BE-San Diego V AlzulMonica MoranteNoch keine Bewertungen

- Withholding Tax Table 2019Dokument1 SeiteWithholding Tax Table 2019Gelie RaelNoch keine Bewertungen

- Pag-Ibig: Monthly Compensation Employee Share Employer ShareDokument6 SeitenPag-Ibig: Monthly Compensation Employee Share Employer ShareJun Wilson MawiratNoch keine Bewertungen

- Revised Withholding Tax TableDokument2 SeitenRevised Withholding Tax TableNina CastilloNoch keine Bewertungen

- Minimum Wage Earners: (Return To Index)Dokument11 SeitenMinimum Wage Earners: (Return To Index)Shaina Jane LibiranNoch keine Bewertungen

- Tax Table: Effective Date January 1, 2018 To December 31, 2022Dokument9 SeitenTax Table: Effective Date January 1, 2018 To December 31, 2022Renz VillaramaNoch keine Bewertungen

- Tax Table: Effective Date January 1, 2018 To December 31, 2022Dokument9 SeitenTax Table: Effective Date January 1, 2018 To December 31, 2022Renz VillaramaNoch keine Bewertungen

- Tax TableDokument9 SeitenTax TableRenz VillaramaNoch keine Bewertungen

- Tax Table: Effective Date January 1, 2018 To December 31, 2022Dokument9 SeitenTax Table: Effective Date January 1, 2018 To December 31, 2022Renz VillaramaNoch keine Bewertungen

- Witthholding Tax TableDokument2 SeitenWitthholding Tax TableFrenzy PopperNoch keine Bewertungen

- Daily 1 2 3 4 5 6: Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022Dokument2 SeitenDaily 1 2 3 4 5 6: Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022DENR-NCR Legal DivisionNoch keine Bewertungen

- Withholding Tax TableDokument2 SeitenWithholding Tax TableJENNIFER SIALANANoch keine Bewertungen

- Withholding Tax TableDokument2 SeitenWithholding Tax TableJENNIFER SIALANANoch keine Bewertungen

- Withholding Tax TableDokument2 SeitenWithholding Tax TableJENNIFER SIALANANoch keine Bewertungen

- Tax TablesDokument6 SeitenTax TablesGeromil HernandezNoch keine Bewertungen

- RR 11 2018 - Annex D - Revised Withholding Tax Table - 2018 2022 PDFDokument1 SeiteRR 11 2018 - Annex D - Revised Withholding Tax Table - 2018 2022 PDFRiña Lizte AlteradoNoch keine Bewertungen

- Revised Withholding Tax Table: Daily 1 2 3 4 5 6Dokument1 SeiteRevised Withholding Tax Table: Daily 1 2 3 4 5 6Renzo Ross Certeza SarteNoch keine Bewertungen

- Annex D RR 11-2018 PDFDokument1 SeiteAnnex D RR 11-2018 PDFKarl Anthony MargateNoch keine Bewertungen

- Annex D RR 11-2018Dokument1 SeiteAnnex D RR 11-2018Maureen PascualNoch keine Bewertungen

- Annex D RR 11-2018-Revised Witholding Tax TableDokument1 SeiteAnnex D RR 11-2018-Revised Witholding Tax TableDuko Alcala EnjambreNoch keine Bewertungen

- WHT TableDokument2 SeitenWHT TableJoneric RamosNoch keine Bewertungen

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDokument8 SeitenNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNoch keine Bewertungen

- Withholding Taxes & Tax TablesDokument9 SeitenWithholding Taxes & Tax Tableslloyd limNoch keine Bewertungen

- Annex E RR 11-2018Dokument2 SeitenAnnex E RR 11-2018Bernardino PacificAceNoch keine Bewertungen

- 2023 WT Table Annex E RR 11-2018Dokument2 Seiten2023 WT Table Annex E RR 11-2018Cee MoralesNoch keine Bewertungen

- Revised Withholding Tax Table: Daily 1 2 3 4 5 6Dokument2 SeitenRevised Withholding Tax Table: Daily 1 2 3 4 5 6Maureen PascualNoch keine Bewertungen

- OCA Circular No. 35-2024Dokument4 SeitenOCA Circular No. 35-2024tpr1nc3ss6Noch keine Bewertungen

- I - Problem On PayrollDokument39 SeitenI - Problem On PayrollHazel Joy UgatesNoch keine Bewertungen

- PRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressDokument16 SeitenPRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressNovemae CollamatNoch keine Bewertungen

- BIR Withholding Tax Table Effective January 1, 2023Dokument3 SeitenBIR Withholding Tax Table Effective January 1, 2023Gennelyn OdulioNoch keine Bewertungen

- Old Tax Law Vs Train Law Tax PH Lessons - CompressDokument7 SeitenOld Tax Law Vs Train Law Tax PH Lessons - CompressRonron De ChavezNoch keine Bewertungen

- Business Math GZAS 1-2 Q2Dokument4 SeitenBusiness Math GZAS 1-2 Q2Gherrie Zethrida SingsonNoch keine Bewertungen

- Train Law PhilippinesDokument64 SeitenTrain Law PhilippinesThe BeatlessNoch keine Bewertungen

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDokument14 SeitenLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNoch keine Bewertungen

- Tabc - Train - Noel N. Cobangbang, CpaDokument117 SeitenTabc - Train - Noel N. Cobangbang, CpaIsaac CursoNoch keine Bewertungen

- Train by SGV ColorDokument32 SeitenTrain by SGV ColorFlorenz AmbasNoch keine Bewertungen

- WITHHOLDING TAX TABLE RenzoDokument1 SeiteWITHHOLDING TAX TABLE RenzoAshrill DumpNoch keine Bewertungen

- 2018-Tax Reform For Acceleration and Inclusion2Dokument14 Seiten2018-Tax Reform For Acceleration and Inclusion2Sinetch EteyNoch keine Bewertungen

- Tax Final Exam Practice Material - CompressDokument10 SeitenTax Final Exam Practice Material - CompressNovemae CollamatNoch keine Bewertungen

- TRAIN LAW - Individual Income TaxationDokument25 SeitenTRAIN LAW - Individual Income TaxationJennilyn SantosNoch keine Bewertungen

- Income TaxationDokument41 SeitenIncome TaxationErlindss Ilustrisimo GadainganNoch keine Bewertungen

- Ra10963: Tax Reform For Acceleration and Inclusion Law (Train)Dokument6 SeitenRa10963: Tax Reform For Acceleration and Inclusion Law (Train)fantasighNoch keine Bewertungen

- Perhitungan Hidrolis SaluaDokument16 SeitenPerhitungan Hidrolis SaluaDharmawanNoch keine Bewertungen

- Manage FinanceDokument11 SeitenManage FinanceGurjinder Hanjra100% (2)

- Income Taxation MIDTERMSDokument7 SeitenIncome Taxation MIDTERMSgamit gamitNoch keine Bewertungen

- Income Tax Credits - ReviewerDokument10 SeitenIncome Tax Credits - Reviewer버니 모지코Noch keine Bewertungen

- BAC 2 - PRELIMS - PAYROLL AccountingDokument10 SeitenBAC 2 - PRELIMS - PAYROLL AccountingReynalyn GalvezNoch keine Bewertungen

- Far-1 3Dokument2 SeitenFar-1 3Raymundo EirahNoch keine Bewertungen

- Far-1 13Dokument3 SeitenFar-1 13Raymundo EirahNoch keine Bewertungen

- Far-1 14Dokument3 SeitenFar-1 14Raymundo EirahNoch keine Bewertungen

- Far-1 4Dokument3 SeitenFar-1 4Raymundo Eirah100% (1)

- Far-1 1Dokument4 SeitenFar-1 1Raymundo EirahNoch keine Bewertungen

- Far 1Dokument3 SeitenFar 1Raymundo EirahNoch keine Bewertungen

- Far-1 2Dokument3 SeitenFar-1 2Raymundo EirahNoch keine Bewertungen

- Theory in AuditDokument3 SeitenTheory in AuditRaymundo EirahNoch keine Bewertungen

- Aud 1Dokument3 SeitenAud 1Raymundo EirahNoch keine Bewertungen

- Far-1 2Dokument3 SeitenFar-1 2Raymundo EirahNoch keine Bewertungen

- Far-1 3Dokument2 SeitenFar-1 3Raymundo EirahNoch keine Bewertungen

- Far 1Dokument3 SeitenFar 1Raymundo EirahNoch keine Bewertungen

- Far-1 4Dokument3 SeitenFar-1 4Raymundo Eirah100% (1)

- Auditing TheDokument3 SeitenAuditing TheRaymundo EirahNoch keine Bewertungen

- Far-1 1Dokument4 SeitenFar-1 1Raymundo EirahNoch keine Bewertungen

- Aud 5Dokument5 SeitenAud 5Raymundo EirahNoch keine Bewertungen

- Aud 6Dokument4 SeitenAud 6Raymundo EirahNoch keine Bewertungen

- Aud 4Dokument4 SeitenAud 4Raymundo EirahNoch keine Bewertungen

- ScriptDokument1 SeiteScriptRaymundo EirahNoch keine Bewertungen

- Aud 2Dokument7 SeitenAud 2Raymundo EirahNoch keine Bewertungen

- Aud 1Dokument3 SeitenAud 1Raymundo EirahNoch keine Bewertungen

- Aud 5Dokument5 SeitenAud 5Raymundo EirahNoch keine Bewertungen

- Aud 3Dokument3 SeitenAud 3Raymundo EirahNoch keine Bewertungen

- Aud 1Dokument3 SeitenAud 1Raymundo EirahNoch keine Bewertungen

- Aud 1Dokument3 SeitenAud 1Raymundo EirahNoch keine Bewertungen

- Aud 5Dokument5 SeitenAud 5Raymundo EirahNoch keine Bewertungen

- Aud 4Dokument4 SeitenAud 4Raymundo EirahNoch keine Bewertungen

- Aud 3Dokument3 SeitenAud 3Raymundo EirahNoch keine Bewertungen

- Aud 2Dokument7 SeitenAud 2Raymundo EirahNoch keine Bewertungen

- 1 Sample Confirmation Letter 1Dokument1 Seite1 Sample Confirmation Letter 1Raymundo EirahNoch keine Bewertungen

- TRDokument15 SeitenTRBhaskar BhaskiNoch keine Bewertungen

- Bank Reconciliation StatementDokument4 SeitenBank Reconciliation StatementRadhakrishna MishraNoch keine Bewertungen

- Alam IDokument24 SeitenAlam ISureshkumaryadavNoch keine Bewertungen

- BPMLT TemplateDokument4 SeitenBPMLT TemplateraaghuNoch keine Bewertungen

- TCL Digital Exam Instructions Music and Rock&Pop - Delhi Centre 22-23 1Dokument4 SeitenTCL Digital Exam Instructions Music and Rock&Pop - Delhi Centre 22-23 1Vibhakar VaidyaNoch keine Bewertungen

- Invoice ManualDokument6 SeitenInvoice ManualipanNoch keine Bewertungen

- FCI - GST - Manual On Returns and PaymentsDokument30 SeitenFCI - GST - Manual On Returns and PaymentsAmber ChaturvediNoch keine Bewertungen

- FABM2 Module 7 SLMDokument30 SeitenFABM2 Module 7 SLMMarjeanetteAgpaoaReyesNoch keine Bewertungen

- Mad City MoneyDokument7 SeitenMad City Moneyapi-284610043Noch keine Bewertungen

- Public Service Commission, West Bengal Advertisement No. 9/2017Dokument3 SeitenPublic Service Commission, West Bengal Advertisement No. 9/2017Hassan SayedNoch keine Bewertungen

- LSZRMR 1 FWLF 4 e D29Dokument7 SeitenLSZRMR 1 FWLF 4 e D29Ranganadh KoppadaNoch keine Bewertungen

- Internship Report On Muslim Commercial BankDokument39 SeitenInternship Report On Muslim Commercial Bankazam_mughal201Noch keine Bewertungen

- Journalizing and Posting 1 Autosaved AutosavedDokument33 SeitenJournalizing and Posting 1 Autosaved AutosavedGUILA REIGN MIRANDANoch keine Bewertungen

- Customer Name Card Account No MR Chandrashekar K 4375 XXXX XXXX 6003Dokument5 SeitenCustomer Name Card Account No MR Chandrashekar K 4375 XXXX XXXX 6003Chandrashekar KNoch keine Bewertungen

- RMC No. 40-2023Dokument1 SeiteRMC No. 40-2023Nadine CruzNoch keine Bewertungen

- People of The Philippines Vs Lea Sagan Juliano (G. R. No. 134120: January 17, 2005)Dokument2 SeitenPeople of The Philippines Vs Lea Sagan Juliano (G. R. No. 134120: January 17, 2005)Mera ArpilledaNoch keine Bewertungen

- Credit Card Advantage Release Notes ArticleDokument10 SeitenCredit Card Advantage Release Notes ArticleiamagoodboyNoch keine Bewertungen

- The Payment System in LesothoDokument10 SeitenThe Payment System in LesothoWishfulDownloadingNoch keine Bewertungen

- 00 Edition 8 Catalog All PagesDokument404 Seiten00 Edition 8 Catalog All PagesRadovan KnezevicNoch keine Bewertungen

- Desludge List 2Dokument28 SeitenDesludge List 2ssd.amconseptageNoch keine Bewertungen

- MRT-07,08,09,10 SolutionDokument13 SeitenMRT-07,08,09,10 SolutionNeeraj SattavanNoch keine Bewertungen

- Notice: Now You Can Pay Your Bill Online. For Online Payment Please Visit HTTPS://GMDWSB - Assam.gov - in orDokument1 SeiteNotice: Now You Can Pay Your Bill Online. For Online Payment Please Visit HTTPS://GMDWSB - Assam.gov - in orGaryNoch keine Bewertungen