Beruflich Dokumente

Kultur Dokumente

2-1 Modelo FCD

Hochgeladen von

PaolaRamosAlbarracinCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2-1 Modelo FCD

Hochgeladen von

PaolaRamosAlbarracinCopyright:

Verfügbare Formate

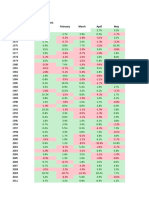

Note: $MM

Assumptions Opex%/Sales

Prj. 1 Sales Year 1 $110.0 Prj. 1 Capital Inv. $40.0 Min

Prj. 1 Sales Growth Rate 10.0% Prj. 1 Discount Rate 10% 15%

Prj. 1 COGS Growth Rate 4.7% Prj. 1 Tax Rate 40.0%

Prj. 1 OPEX/Sales % 20.0% Capital Investment

$35

Year 1 Year 2 Year 3 Year 4 $40

$45

Sales $110.0 $121.0 $133.1 $146.4

COGS $65.0 $68.1 $71.3 $74.6

Net Sales $45.0 $52.9 $61.8 $71.8

Total OPEX $22.0 $24.2 $26.6 $29.3

EBITDA $23.0 $28.7 $35.2 $42.5

Taxes $9.2 $11.5 $14.1 $17.0

Capital Investment ($40.0)

Operating Cash Flow ($40.0) $13.8 $17.2 $21.1 $25.5

NPV Project 1 $20.1

IRR Project 1 29.16%

Sales Growth Rate COGS Growth Rate

Opex%/Sales 10.2% K2:K201 4.0% M2:M201

M-L Max 9.2% 3.5%

20% 23% 10.8% 4.0%

11.3% 4.2%

Capital Investment 12.0% 4.9%

11.2% 4.7%

10.1% 3.8%

9.1% 3.2%

9.2% 3.4%

11.3% 3.8%

10.2% 4.1%

10.1% 3.3%

11.1% 4.4%

11.2% 4.9%

10.5% 4.6%

9.8% 3.2%

10.3% 3.2%

10.6% 3.7%

9.7% 3.8%

10.7% 4.6%

9.3% 3.7%

9.0% 3.3%

11.6% 4.9%

9.3% 4.0%

9.4% 3.4%

9.6% 3.8%

10.5% 3.9%

9.3% 3.3%

9.3% 3.6%

10.4% 3.4%

9.2% 3.1%

8.5% 3.6%

11.5% 4.5%

10.5% 4.3%

11.5% 4.4%

9.8% 3.6%

10.2% 4.1%

10.9% 4.5%

9.7% 3.3%

9.1% 3.4%

10.8% 4.3%

11.4% 4.9%

9.4% 3.3%

9.9% 3.8%

10.2% 3.4%

10.1% 4.9%

12.6% 4.7%

11.4% 4.5%

10.1% 3.7%

10.6% 3.8%

10.1% 4.1%

9.4% 3.3%

9.6% 3.4%

11.1% 4.0%

11.5% 4.7%

10.1% 4.4%

11.4% 5.0%

10.3% 3.8%

10.7% 5.0%

10.4% 4.2%

11.3% 4.5%

11.3% 4.4%

10.8% 3.4%

10.0% 3.7%

9.3% 3.3%

13.1% 4.7%

10.0% 3.8%

9.7% 3.1%

10.5% 4.9%

12.0% 4.9%

10.2% 3.7%

10.1% 3.7%

11.1% 4.8%

10.2% 3.3%

10.1% 3.3%

10.1% 4.7%

11.2% 4.9%

10.4% 4.2%

11.4% 4.6%

12.5% 4.7%

10.6% 3.9%

9.8% 4.2%

9.9% 4.0%

9.5% 4.5%

9.1% 3.2%

9.2% 3.1%

9.6% 3.2%

10.8% 4.4%

10.2% 4.4%

9.5% 3.6%

9.4% 3.7%

8.3% 3.3%

9.7% 3.8%

11.1% 4.9%

12.8% 5.0%

9.6% 3.5%

9.3% 3.3%

10.0% 3.5%

12.3% 5.0%

10.0% 3.1%

9.4% 3.7%

10.0% 4.2%

11.1% 4.3%

10.5% 3.4%

12.0% 4.7%

10.3% 3.2%

9.0% 3.2%

11.0% 4.3%

9.0% 3.8%

9.6% 3.1%

9.1% 3.9%

9.7% 4.0%

9.8% 3.8%

10.4% 4.1%

10.6% 4.7%

11.1% 4.5%

10.3% 4.6%

10.1% 4.6%

10.0% 4.2%

9.4% 4.1%

10.1% 4.1%

10.7% 4.6%

9.1% 3.5%

11.2% 4.7%

9.6% 3.2%

12.0% 4.9%

11.8% 4.4%

12.0% 4.5%

8.8% 3.1%

10.9% 4.4%

10.5% 3.7%

11.0% 4.5%

9.8% 4.1%

10.5% 4.5%

11.0% 4.1%

9.5% 3.3%

9.8% 3.2%

9.0% 3.1%

10.7% 4.1%

10.0% 4.3%

8.6% 3.3%

9.9% 3.3%

10.0% 3.8%

11.4% 3.8%

8.8% 3.7%

9.7% 3.2%

9.4% 3.2%

9.8% 3.2%

9.1% 4.0%

11.9% 4.9%

10.8% 4.2%

11.1% 4.8%

11.4% 4.0%

11.3% 4.4%

11.9% 4.8%

12.5% 4.8%

12.4% 4.8%

10.4% 4.2%

11.1% 4.0%

10.7% 4.4%

10.2% 4.3%

11.4% 4.5%

10.5% 4.1%

10.6% 4.7%

10.7% 3.7%

11.1% 4.0%

9.9% 3.8%

10.3% 3.9%

10.2% 4.8%

11.5% 4.2%

10.8% 4.4%

9.3% 4.6%

10.1% 3.7%

10.2% 4.0%

9.3% 3.2%

10.7% 4.1%

9.9% 4.1%

10.9% 4.1%

9.2% 3.2%

11.3% 5.0%

10.7% 3.8%

9.3% 4.7%

9.7% 3.5%

10.3% 3.2%

11.1% 3.8%

11.7% 4.5%

10.5% 4.3%

10.2% 3.9%

10.0% 4.0%

10.1% 4.6%

10.7% 3.8%

8.3% 3.8%

10.5% 4.8%

10.2% 4.4%

10.1% 4.1%

10.9% 4.7%

8.4% 3.3%

9.7% 3.7%

10.9% 4.0%

9.6% 4.3%

Note: $MM

Assumptions Opex%/Sales

Prj. 2 Sales Year 1 $120.0 Prj. 2 Capital Inv. $50.0 Min

Prj. 2 Sales Growth Rate 10.0% Prj. 2 Discount Rate 10% 18%

Prj. 2 COGS Growth Rate 5.0% Prj. 2 Tax Rate 40.0%

Prj. 2 OPEX/Sales % 20.0% Capital Investment

$45

Year 1 Year 2 Year 3 Year 4 $50

$55

Sales $120.0 $132.0 $145.2 $159.7

COGS $65.0 $68.3 $71.7 $75.2

Net Sales $55.0 $63.8 $73.5 $84.5

Total OPEX $24.0 $26.4 $29.0 $31.9

EBITDA $31.0 $37.4 $44.5 $52.5

Taxes $12.4 $14.9 $17.8 $21.0

Capital Investment ($50.0)

Operating Cash Flow ($50.0) $18.6 $22.4 $26.7 $31.5

NPV Project 2 $27.0

IRR Project 2 30.82%

COGS Growth Rate

Opex%/Sales 5.6% L2:L201

M-L Max 4.7%

20% 27% 4.8%

4.3%

Capital Investment 4.6%

5.5%

5.7%

5.9%

4.2%

5.3%

4.8%

5.8%

5.3%

4.9%

5.1%

4.2%

4.8%

4.1%

4.6%

5.1%

4.9%

4.7%

5.5%

5.1%

4.6%

5.5%

5.2%

5.8%

5.8%

5.6%

4.1%

5.5%

4.5%

4.2%

5.5%

5.1%

4.4%

4.7%

4.8%

5.7%

4.4%

5.0%

5.4%

4.3%

5.9%

4.8%

5.2%

5.4%

5.8%

4.9%

6.0%

5.1%

5.3%

5.2%

5.0%

4.3%

5.4%

5.9%

4.5%

4.8%

5.7%

4.5%

5.7%

5.6%

4.1%

4.6%

5.8%

4.1%

5.2%

4.1%

5.4%

5.1%

4.6%

5.2%

5.7%

4.4%

5.5%

4.3%

5.8%

4.4%

4.1%

5.9%

5.2%

5.6%

5.6%

5.1%

4.6%

4.0%

4.2%

5.2%

4.3%

5.4%

4.6%

5.4%

5.8%

5.3%

4.6%

5.9%

4.4%

4.2%

5.2%

4.8%

4.4%

4.8%

4.6%

4.0%

4.5%

5.9%

5.3%

5.6%

4.8%

4.7%

4.4%

5.1%

5.4%

5.5%

4.8%

6.0%

4.7%

4.5%

4.7%

4.8%

4.5%

5.3%

4.9%

4.3%

4.4%

5.6%

4.9%

5.9%

5.7%

4.9%

5.3%

5.0%

5.0%

5.9%

5.4%

5.4%

5.3%

5.8%

4.8%

5.8%

5.8%

5.7%

5.9%

5.1%

5.8%

4.3%

4.5%

5.0%

5.5%

4.4%

6.0%

4.6%

4.2%

4.4%

5.5%

4.6%

5.6%

5.0%

5.1%

5.4%

5.0%

4.0%

5.5%

4.8%

5.0%

5.2%

4.3%

5.6%

5.9%

5.9%

5.5%

5.7%

4.8%

4.4%

5.9%

5.5%

5.4%

5.6%

5.5%

4.6%

5.6%

6.0%

4.2%

4.9%

5.8%

5.0%

4.3%

5.7%

4.9%

5.0%

5.6%

4.8%

4.1%

5.0%

4.7%

4.2%

4.7%

4.7%

Das könnte Ihnen auch gefallen

- Copia de Flujo de Caja DescontadoDokument12 SeitenCopia de Flujo de Caja DescontadoAndrea Torres EchevarríaNoch keine Bewertungen

- Sol 3.1 - Flujo de Caja DescontadoDokument12 SeitenSol 3.1 - Flujo de Caja DescontadoAndrea Torres EchevarríaNoch keine Bewertungen

- X - Modelo FCD (Alumno)Dokument22 SeitenX - Modelo FCD (Alumno)Ariel Fernando Rodriguez OrellanaNoch keine Bewertungen

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDokument31 SeitenFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNoch keine Bewertungen

- Benitez, Jewel Ann Q. Analysis #1Dokument2 SeitenBenitez, Jewel Ann Q. Analysis #1MIKASANoch keine Bewertungen

- Table 531 2Dokument15 SeitenTable 531 2UfficioNoch keine Bewertungen

- Nielsen Market Pulse Q3 2016Dokument8 SeitenNielsen Market Pulse Q3 2016K57.CTTT BUI NGUYEN HUONG LYNoch keine Bewertungen

- BOLT DCF ValuationDokument1 SeiteBOLT DCF ValuationOld School ValueNoch keine Bewertungen

- Tasas Ponderadas MensualesDokument2 SeitenTasas Ponderadas MensualesErika SalazarNoch keine Bewertungen

- Interest 2Dokument1 SeiteInterest 2Vivienne Rozenn LaytoNoch keine Bewertungen

- Benitez, Jewel Ann Q. Analysis #2Dokument10 SeitenBenitez, Jewel Ann Q. Analysis #2MIKASANoch keine Bewertungen

- Pei ExcelDokument1 SeitePei ExcelbelaNoch keine Bewertungen

- Pei ExcelDokument1 SeitePei ExcelbelaNoch keine Bewertungen

- Pei ExcelDokument1 SeitePei ExcelbelaNoch keine Bewertungen

- HbA1c Performance Evaluation 1503Dokument15 SeitenHbA1c Performance Evaluation 1503Ainun JariahNoch keine Bewertungen

- 01-3 Plan Lineal VendedorDokument26 Seiten01-3 Plan Lineal VendedorJefer AnHe VelezNoch keine Bewertungen

- Ponderada Bancos 21Dokument2 SeitenPonderada Bancos 21mariaNoch keine Bewertungen

- Giverny Capital - Annual Letter 2018 Web PDFDokument18 SeitenGiverny Capital - Annual Letter 2018 Web PDFMario Di MarcantonioNoch keine Bewertungen

- Stock Valuation TempDokument5 SeitenStock Valuation TempANH Nguyen TrucNoch keine Bewertungen

- US Small CapsDokument13 SeitenUS Small Capsjulienmessias2Noch keine Bewertungen

- Comisiones Multiproductos.Dokument3 SeitenComisiones Multiproductos.larry.01.laysNoch keine Bewertungen

- Giverny Capital Annual Letter 2019Dokument17 SeitenGiverny Capital Annual Letter 2019milandeepNoch keine Bewertungen

- NO. Uraian Pekerjaan Volume Satuan Harga Satuan Harga Bobot Pek. Persiapan RP 4,375,000.00Dokument3 SeitenNO. Uraian Pekerjaan Volume Satuan Harga Satuan Harga Bobot Pek. Persiapan RP 4,375,000.00Ahmad RiyantoNoch keine Bewertungen

- CL Colgate CAGNY 2017Dokument141 SeitenCL Colgate CAGNY 2017Ala BasterNoch keine Bewertungen

- Serrano - Probability Distribution Test ProblemDokument6 SeitenSerrano - Probability Distribution Test ProblemJosheyne Marzialli SerranoNoch keine Bewertungen

- Greater Western Sydney Data Snapshot 2016Dokument3 SeitenGreater Western Sydney Data Snapshot 2016Anonymous OdNagDNoch keine Bewertungen

- Monthly Fact Sheet April 2021Dokument4 SeitenMonthly Fact Sheet April 2021ALNoch keine Bewertungen

- 2011 Data SheetDokument2 Seiten2011 Data SheetAlabama PossibleNoch keine Bewertungen

- Tanque AcueductosDokument3 SeitenTanque AcueductosplguevarasNoch keine Bewertungen

- XLS EngDokument4 SeitenXLS EngShubhangi JainNoch keine Bewertungen

- 352 - Infographic Market Pulse Q1 2018 - 1525948613Dokument2 Seiten352 - Infographic Market Pulse Q1 2018 - 1525948613K57.CTTT BUI NGUYEN HUONG LYNoch keine Bewertungen

- Market Pulse Q1 - 18Dokument2 SeitenMarket Pulse Q1 - 18Duy Nguyen Ho ThienNoch keine Bewertungen

- Data For Ratio DetectiveDokument1 SeiteData For Ratio DetectiveRoyan Nur HudaNoch keine Bewertungen

- Axial 5 Minute DCF ToolDokument11 SeitenAxial 5 Minute DCF ToolziuziNoch keine Bewertungen

- Revenues % Growth Operating Income Oper. Margin % Shares Outstanding Shares RepurchasedDokument7 SeitenRevenues % Growth Operating Income Oper. Margin % Shares Outstanding Shares RepurchasedAaron FosterNoch keine Bewertungen

- 2007 2018 PIT Counts by StateDokument219 Seiten2007 2018 PIT Counts by StateGus BovaNoch keine Bewertungen

- Hedge Fund Indices MayDokument3 SeitenHedge Fund Indices Mayj.fred a. voortmanNoch keine Bewertungen

- Finance Detective - Ratio AnalysisDokument2 SeitenFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNoch keine Bewertungen

- IpcDokument6 SeitenIpcalejandro fuentesNoch keine Bewertungen

- Columna1 Columna2 Columna3 Tasa de Desempleo Tasa de InflacionDokument7 SeitenColumna1 Columna2 Columna3 Tasa de Desempleo Tasa de Inflacionjorge eliecer ibarguen palaciosNoch keine Bewertungen

- Tax BudgetDokument31 SeitenTax BudgetJim ParkerNoch keine Bewertungen

- Sample Optimization - Exercise (Mywork)Dokument6 SeitenSample Optimization - Exercise (Mywork)sushant ahujaNoch keine Bewertungen

- Class Exercise Fashion Company Three Statements Model - CompletedDokument16 SeitenClass Exercise Fashion Company Three Statements Model - CompletedbobNoch keine Bewertungen

- Pivot Tables2 Crypto Forecasting 16 MarchDokument332 SeitenPivot Tables2 Crypto Forecasting 16 MarchNaresh KumarNoch keine Bewertungen

- Pivot Tables2 12 March 2021Dokument103 SeitenPivot Tables2 12 March 2021Naresh KumarNoch keine Bewertungen

- Roches ExcelDokument4 SeitenRoches ExcelJaydeep SheteNoch keine Bewertungen

- AÑO AÑO PIB Inflacion Desempleo: Historico de IndicadoresDokument2 SeitenAÑO AÑO PIB Inflacion Desempleo: Historico de IndicadoresNicolas SarmientoNoch keine Bewertungen

- Exhibit 1 Selected Pinkerton's Financial Data (In $millions)Dokument1 SeiteExhibit 1 Selected Pinkerton's Financial Data (In $millions)Abhishek KumarNoch keine Bewertungen

- Views On Markets and SectorsDokument19 SeitenViews On Markets and SectorskundansudNoch keine Bewertungen

- CINA Deluxe DQP For Breast ER PR and Her2 Prognostic Factors Manxia 2 9 ..Dokument12 SeitenCINA Deluxe DQP For Breast ER PR and Her2 Prognostic Factors Manxia 2 9 ..MayNoch keine Bewertungen

- Salinan REVISI Window Dressing CalcDokument148 SeitenSalinan REVISI Window Dressing CalcPTPN XIIINoch keine Bewertungen

- Relative ValuationDokument1 SeiteRelative Valuationjuan.farrelNoch keine Bewertungen

- Chapter - 4 DATA ANALYSIS AND FINDINGSDokument31 SeitenChapter - 4 DATA ANALYSIS AND FINDINGSKenanNoch keine Bewertungen

- EPAM Q2 2017 Fact Sheet 08-02-17Dokument20 SeitenEPAM Q2 2017 Fact Sheet 08-02-17Rajesh KumarNoch keine Bewertungen

- HARRIS COUNTY - Spring Branch ISD - 2006 Texas School Survey of Drug and Alcohol UseDokument102 SeitenHARRIS COUNTY - Spring Branch ISD - 2006 Texas School Survey of Drug and Alcohol UseTexas School Survey of Drug and Alcohol Use100% (1)

- BURNET COUNTY - Marble Falls ISD - 2007 Texas School Survey of Drug and Alcohol UseDokument103 SeitenBURNET COUNTY - Marble Falls ISD - 2007 Texas School Survey of Drug and Alcohol UseTexas School Survey of Drug and Alcohol UseNoch keine Bewertungen

- 6 DCF ModelDokument14 Seiten6 DCF ModelkumarmayurNoch keine Bewertungen

- How Capitalism Can Work For Everyone: Audiobook Reference GuideDokument30 SeitenHow Capitalism Can Work For Everyone: Audiobook Reference GuideBayuNoch keine Bewertungen

- Deficit: BUDGET DEFICIT (Excluding Grants) / GDP RATIO IN 2002 AND 2003Dokument10 SeitenDeficit: BUDGET DEFICIT (Excluding Grants) / GDP RATIO IN 2002 AND 2003Mayank GargNoch keine Bewertungen

- Act1 Business Acc. HubiernaDokument3 SeitenAct1 Business Acc. Hubiernanew genshinNoch keine Bewertungen

- Accounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Dokument81 SeitenAccounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Layla MainNoch keine Bewertungen

- Unit - 4.4 Hawtrey's Theory.Dokument3 SeitenUnit - 4.4 Hawtrey's Theory.Mahima guptaNoch keine Bewertungen

- Sec Vs InterportDokument5 SeitenSec Vs InterportChase DaclanNoch keine Bewertungen

- Gov. Rick Perry 2007 TaxesDokument60 SeitenGov. Rick Perry 2007 TaxesHouston ChronicleNoch keine Bewertungen

- Building A Sustainable Future: Annual Report 2020Dokument177 SeitenBuilding A Sustainable Future: Annual Report 2020AaNoch keine Bewertungen

- Liquidity Management in Banks Treasury Risk ManagementDokument11 SeitenLiquidity Management in Banks Treasury Risk Managementashoo khoslaNoch keine Bewertungen

- Strategic Cost ManagementDokument24 SeitenStrategic Cost Managementsai500Noch keine Bewertungen

- Accounting For Business CombinationDokument11 SeitenAccounting For Business CombinationMaika CrayNoch keine Bewertungen

- Project Cost Estimating Manual: Seventh EditionDokument148 SeitenProject Cost Estimating Manual: Seventh EditionBilal Hussein SousNoch keine Bewertungen

- CSEC Principles of AccountsDokument6 SeitenCSEC Principles of AccountsNatalie0% (1)

- Introduction To Financial DerivativesDokument80 SeitenIntroduction To Financial Derivativessnehakopade0% (1)

- Interest Rate and RiskDokument42 SeitenInterest Rate and RiskchandoraNoch keine Bewertungen

- Company AccountsDokument105 SeitenCompany AccountsKaustubh BasuNoch keine Bewertungen

- Soft Copy ReportDokument3 SeitenSoft Copy ReportChristine Nathalie BalmesNoch keine Bewertungen

- A161 Tutorial 4 - Annual Report Fin AnalysisDokument10 SeitenA161 Tutorial 4 - Annual Report Fin AnalysisAmeer Al-asyraf MuhamadNoch keine Bewertungen

- CA Foundation MTP 2020 Paper 1 AnsDokument9 SeitenCA Foundation MTP 2020 Paper 1 AnsSaurabh Kumar MauryaNoch keine Bewertungen

- Activity No. 2 (Moredo) : Problem 1Dokument3 SeitenActivity No. 2 (Moredo) : Problem 1Eloisa Joy MoredoNoch keine Bewertungen

- Dying To Make A ProfitDokument14 SeitenDying To Make A ProfitChris Ryan100% (1)

- BERKS BROADCASTING vs. CRAUMERDokument2 SeitenBERKS BROADCASTING vs. CRAUMERLara YuloNoch keine Bewertungen

- Approved List of ValuersDokument7 SeitenApproved List of ValuersTim Tom100% (1)

- Application Form Self Help Groups For PrintoutDokument5 SeitenApplication Form Self Help Groups For Printoutnilya7081Noch keine Bewertungen

- Recipe For Indices and Forex InvestingDokument84 SeitenRecipe For Indices and Forex InvestingAbdulafees Abdullahi Adebayo100% (4)

- Assemble Smartphone Case SolutionDokument3 SeitenAssemble Smartphone Case SolutionPravin Mandora50% (2)

- Turnaround Management: Prof Ashish K MitraDokument27 SeitenTurnaround Management: Prof Ashish K MitraAnuj GuptaNoch keine Bewertungen

- Zed Pay Full PlanDokument36 SeitenZed Pay Full Plankukaramp349Noch keine Bewertungen

- Test Bank For Accounting Principles Volume 1 7th Canadian EditionDokument24 SeitenTest Bank For Accounting Principles Volume 1 7th Canadian EditionPaigeDiazrmqp98% (49)

- Chapter 5 ReconciliationDokument7 SeitenChapter 5 ReconciliationDevender SinghNoch keine Bewertungen

- Sunnix Memo To BoardDokument4 SeitenSunnix Memo To BoardDennie IdeaNoch keine Bewertungen

- The Fuller Method Learn To Grow Your Money Exponentially - V4.0 14 PDFDokument35 SeitenThe Fuller Method Learn To Grow Your Money Exponentially - V4.0 14 PDFartlet100% (1)