Beruflich Dokumente

Kultur Dokumente

GAO 2009 Report

Hochgeladen von

Jeremy Turnage0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten1 SeiteGAO 2009 Report

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenGAO 2009 Report

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten1 SeiteGAO 2009 Report

Hochgeladen von

Jeremy TurnageGAO 2009 Report

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

May 2009

MILITARY HOUSING PRIVATIZATION

Accountability Integrity Reliability

Highlights

Highlights of GAO-09-352, a report to the

DOD Faces New Challenges Due to Significant

Growth at Some Installations and Recent Turmoil in

the Financial Markets

Subcommittee on Readiness, Committee

on Armed Services, House of

Representatives

Why GAO Did This Study What GAO Found

In response to challenges the DOD has made significant progress since 1996 to remove inadequate family

Department of Defense (DOD) was housing from DOD’s inventory by transferring these homes to developers, but

facing to repair, renovate, and it will be several more years before all of these inadequate houses are either

construct military family housing, replaced or renovated. Developers had replaced or renovated about 67

Congress enacted the Military percent of the inadequate privatized housing as of February 2009.

Housing Privatization Initiative in

1996. The initiative enables DOD to

leverage private sector resources to While about 70 percent of military housing privatization projects are

construct or renovate family exceeding DOD’s expected occupancy rate of 90 percent, each service has

housing. As of March 2009, DOD some projects below this rate. Some privatization projects with occupancy

had awarded 94 projects and rates below 90 percent are challenged to generate enough revenue to fund

attracted over $22 billion in private construction, make debt payments, and set aside funds for recapitalization,

financing. DOD plans to privatize which could negatively affect the condition and attractiveness of privatized

98 percent of its domestic family homes and make it harder to compete with other homes in the community.

housing through 2012. Since GAO’s

last housing privatization report in Base realignment and closure actions, overseas rebasing, Army modularity,

2006, major force structure and grow-the-force initiatives are challenging DOD’s ability to provide family

initiatives have placed new

demands on DOD for housing.

housing at some installations, and the services are taking steps to mitigate the

challenge. Among other measures, Army developed an approach where an

GAO was asked to assess (1) the already awarded project is retrofitted with a new or another already awarded

progress of DOD’s housing project. Once retrofitted, Army’s total investment in the developer carrying

privatization program, (2) the out the projects must stay below a certain percentage of the capital costs of

occupancy rates of the housing both projects combined, not a percentage of each project separately. This

projects, (3) the impact of various practice often results in DOD investing additional funds towards retrofitted

force structure initiatives and projects. The House Appropriations Committee directed DOD to report on

DOD’s efforts to mitigate any the status of each privatization project underway on a semiannual basis.

challenges, and (4) the effect of However, DOD’s most recent semiannual report did not include information

financial market turmoil on some on the retrofitting model it is using for certain projects. Including information

projects. To perform this work,

GAO visited 13 installations with

on the changed status of privatized projects in DOD’s report would assist

privatization projects; analyzed congressional oversight of the program.

project performance data; and

interviewed DOD officials, real Several factors related to turmoil in the financial markets have reduced

estate consultants, and private available funds for project construction, resulting in more renovations relative

developers. to new construction and reduced amenities at some newly awarded projects.

First, higher interest rates in bond financing have increased the cost of some

What GAO Recommends projects. Second, due to the diminished value of bond insurance, developers

are having to set aside project funds to increase assurances the debt is repaid

GAO recommends that DOD

provide more current information but that reduces available funds for construction. Third, financial turmoil has

on investment caps and the impact resulted in lower rates of return on invested funds. Consequently, as more

of the current financial market on homes are renovated given effects of today’s financial markets, more

projects in its semiannual report to recapitalization funds could be required. In H.R. Conf. Rep. No. 110-424, the

Congress. In response to a draft of conference committee expressed interest in monitoring developers’

this report, DOD concurred with contributions to recapitalization accounts in DOD’s semiannual report.

our recommendations. However, information these effects have had on housing privatization projects

was not included in DOD’s most recent report. By including this information

To view the full product, including the scope

and methodology, click on GAO-09-352. in its semiannual report, DOD could provide defense committees with a more

For more information, contact Brian Lepore at current view of the financial market effects on these privatized projects.

(202) 512-4523 or Leporeb@gao.gov.

United States Government Accountability Office

Das könnte Ihnen auch gefallen

- Gao 2018Dokument61 SeitenGao 2018Jeremy TurnageNoch keine Bewertungen

- Global Construction Rate Trend Report: Q2 2021 Regional Insights and Rate TrendsDokument14 SeitenGlobal Construction Rate Trend Report: Q2 2021 Regional Insights and Rate TrendsKirimaja CipinangNoch keine Bewertungen

- Fannie Mae and Freddie Mac Investor-PresentationDokument92 SeitenFannie Mae and Freddie Mac Investor-PresentationmwredaNoch keine Bewertungen

- 1G - NR Ma'am - TELUS CorporationDokument13 Seiten1G - NR Ma'am - TELUS CorporationAkash GuptaNoch keine Bewertungen

- Investing For A Sustainable Recovery: International Construction COSTS 2021Dokument22 SeitenInvesting For A Sustainable Recovery: International Construction COSTS 2021POD ExpertNoch keine Bewertungen

- GAO On GSEsDokument73 SeitenGAO On GSEsZerohedgeNoch keine Bewertungen

- RFQ Pre-Qualify Escos Att B Response RFQDokument15 SeitenRFQ Pre-Qualify Escos Att B Response RFQzakariaNoch keine Bewertungen

- CWEarly NCAHMA HUD Changes - April 7th 2010 97 VersionDokument10 SeitenCWEarly NCAHMA HUD Changes - April 7th 2010 97 VersionARANGWALANoch keine Bewertungen

- NIBS OSCC EPAmodular-construction 2015Dokument30 SeitenNIBS OSCC EPAmodular-construction 2015Ahmad FirooziNoch keine Bewertungen

- Finance Options For Infrastructure Juan Costain: South Asia Regional Workshop On Investment ClimateDokument10 SeitenFinance Options For Infrastructure Juan Costain: South Asia Regional Workshop On Investment ClimatesajeevpallathNoch keine Bewertungen

- Privatization Lessons From JordanDokument4 SeitenPrivatization Lessons From JordanHussam AnanzehNoch keine Bewertungen

- Financial Assumptions Key to Feasibility Study SuccessDokument7 SeitenFinancial Assumptions Key to Feasibility Study SuccessKeziah ReveNoch keine Bewertungen

- Builder Annual ReportDokument112 SeitenBuilder Annual ReportCosmo Z LiuNoch keine Bewertungen

- DELLFY10 Q2 Earnings PresentationDokument23 SeitenDELLFY10 Q2 Earnings PresentationwagnebNoch keine Bewertungen

- International Financial Management 10Dokument33 SeitenInternational Financial Management 10胡依然Noch keine Bewertungen

- InfralinePlus Interview - Gagan SidhuDokument4 SeitenInfralinePlus Interview - Gagan Sidhugagan sidhuNoch keine Bewertungen

- Surety Forecast Septermber 2011 - FinalDokument6 SeitenSurety Forecast Septermber 2011 - FinaltomsantoniNoch keine Bewertungen

- Read The EmailsDokument153 SeitenRead The Emailscrainsnewyork100% (1)

- Management Discussion and Analysis ReportDokument14 SeitenManagement Discussion and Analysis ReportMoheed UddinNoch keine Bewertungen

- SH 2015 Q2 1 ICRA ConstructionDokument7 SeitenSH 2015 Q2 1 ICRA ConstructionJj018320Noch keine Bewertungen

- 2023 Engineering and Construction Industry Outlook PDFDokument12 Seiten2023 Engineering and Construction Industry Outlook PDFManuel del MoralNoch keine Bewertungen

- Public Private PartnershipsDokument25 SeitenPublic Private PartnershipsTHOMASKUTTYNoch keine Bewertungen

- Build Operate TransferDokument4 SeitenBuild Operate Transfertazeb AbebeNoch keine Bewertungen

- The Future Refinancing Crisis in CREDokument24 SeitenThe Future Refinancing Crisis in CREPacific Commercial Investments, Inc.100% (2)

- REITSDokument68 SeitenREITSsamathagondiNoch keine Bewertungen

- GX Global Chemical 2017 ReportDokument20 SeitenGX Global Chemical 2017 ReportarrivaNoch keine Bewertungen

- WhitePaper AVEVA RethinkingProjectDelivery 04-20Dokument10 SeitenWhitePaper AVEVA RethinkingProjectDelivery 04-20Furqan SiddiquiNoch keine Bewertungen

- Water PPPS: Training & WorkshopDokument23 SeitenWater PPPS: Training & WorkshopShreyaNoch keine Bewertungen

- Comparisons Between FIDIC 1999 and Ethiopian PPA 2011 Conditions of Contract in Terms of TimeDokument10 SeitenComparisons Between FIDIC 1999 and Ethiopian PPA 2011 Conditions of Contract in Terms of TimeMohammed AdaneNoch keine Bewertungen

- Using Project Finance To Fund Infrastructure InvestmentsDokument16 SeitenUsing Project Finance To Fund Infrastructure InvestmentsThomasNoch keine Bewertungen

- Us 2023 Outlook ChemicalDokument12 SeitenUs 2023 Outlook ChemicalrajjjjjkumarNoch keine Bewertungen

- Federal Update: Annual Privatization Report 2004Dokument4 SeitenFederal Update: Annual Privatization Report 2004reasonorgNoch keine Bewertungen

- PAWCM PPT 3 - Principles of Project FinanceDokument44 SeitenPAWCM PPT 3 - Principles of Project FinanceYashodhan JoshiNoch keine Bewertungen

- Assignment Gilbert LumbertDokument6 SeitenAssignment Gilbert LumbertHenri De sloovereNoch keine Bewertungen

- Public Private Partnerships: Finances For Infrastructural and Building ProjectsDokument24 SeitenPublic Private Partnerships: Finances For Infrastructural and Building ProjectsVivek BNoch keine Bewertungen

- Blackbook TybmsDokument68 SeitenBlackbook TybmsTonu PawarNoch keine Bewertungen

- NEDA-ODA Review Main Report (2009)Dokument38 SeitenNEDA-ODA Review Main Report (2009)ivy4iskoNoch keine Bewertungen

- Module 3.2 Learning Activity 1 Assessment 2 Discussion Forum Topic 2Dokument2 SeitenModule 3.2 Learning Activity 1 Assessment 2 Discussion Forum Topic 2Aldryn Jude NicdaoNoch keine Bewertungen

- 1 Consider The Following Statement Government Funded Projects Intended To ServeDokument1 Seite1 Consider The Following Statement Government Funded Projects Intended To ServeAmit PandeyNoch keine Bewertungen

- ARCADIS 2022 Global Construction Disputes Report PDFDokument28 SeitenARCADIS 2022 Global Construction Disputes Report PDFJawad AhammadNoch keine Bewertungen

- Alternative Financing - PPPDokument18 SeitenAlternative Financing - PPPNaomi Alberg-BlijdNoch keine Bewertungen

- If 10600Dokument3 SeitenIf 10600chichponkli24Noch keine Bewertungen

- Coursework 1 Roberto PeraltaDokument7 SeitenCoursework 1 Roberto PeraltaRoberto PeraltaNoch keine Bewertungen

- Undertaking Emission Reduction Projects PDFDokument7 SeitenUndertaking Emission Reduction Projects PDFAnonymous GDc0FB9N8yNoch keine Bewertungen

- Infrastructure Development Through Public-Private PartnershipsDokument6 SeitenInfrastructure Development Through Public-Private PartnershipsRamith De SilvaNoch keine Bewertungen

- Infrastructure Funds PrimerDokument4 SeitenInfrastructure Funds PrimermayorladNoch keine Bewertungen

- AP21136 - PPP AssignmentDokument9 SeitenAP21136 - PPP Assignmentpooja apteNoch keine Bewertungen

- ConstructionDokument8 SeitenConstructionMohanraj VenuNoch keine Bewertungen

- BOBCAPS NPA Conference - Key Takeaways 1mar19 - BOBCAPS ResearchDokument17 SeitenBOBCAPS NPA Conference - Key Takeaways 1mar19 - BOBCAPS ResearchPardeep KumarNoch keine Bewertungen

- THESIS Chapters 1-3Dokument22 SeitenTHESIS Chapters 1-3Kris Ian Ray DuranNoch keine Bewertungen

- Kosmont Oakland City-Wide EIFD Power Point Sent To Zennie62Media, Inc.Dokument22 SeitenKosmont Oakland City-Wide EIFD Power Point Sent To Zennie62Media, Inc.Zennie AbrahamNoch keine Bewertungen

- miglo2016Dokument27 Seitenmiglo2016dtkduyen18Noch keine Bewertungen

- Project Finance 2008Dokument176 SeitenProject Finance 2008Piyush VakilNoch keine Bewertungen

- Session 1 To 3Dokument32 SeitenSession 1 To 3nisargpritamlondheNoch keine Bewertungen

- Session 1 ToDokument127 SeitenSession 1 TonisargpritamlondheNoch keine Bewertungen

- Financing Strategies for Large LNG Export ProjectsDokument12 SeitenFinancing Strategies for Large LNG Export ProjectsMegha BepariNoch keine Bewertungen

- Preface: Guidelines For PPP ProjectsDokument48 SeitenPreface: Guidelines For PPP ProjectsmanugeorgeNoch keine Bewertungen

- Product Development Risks Jet Engine Case"TITLE"Conflict of Interests GM Works Chairman Case" TITLE"Project Delays Assam Gas Cracker GAIL CaseDokument2 SeitenProduct Development Risks Jet Engine Case"TITLE"Conflict of Interests GM Works Chairman Case" TITLE"Project Delays Assam Gas Cracker GAIL CaseVINAY KORWARNoch keine Bewertungen

- GovTech Maturity Index: The State of Public Sector Digital TransformationVon EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNoch keine Bewertungen

- Realizing the Potential of Public–Private Partnerships to Advance Asia's Infrastructure DevelopmentVon EverandRealizing the Potential of Public–Private Partnerships to Advance Asia's Infrastructure DevelopmentNoch keine Bewertungen

- Class ActionDokument43 SeitenClass ActionJeremy TurnageNoch keine Bewertungen

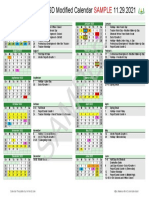

- 2022-2023 ACPSD Traditional CalendarDokument1 Seite2022-2023 ACPSD Traditional CalendarJeremy TurnageNoch keine Bewertungen

- Augusta Redistricting MapDokument1 SeiteAugusta Redistricting MapJeremy TurnageNoch keine Bewertungen

- 2022-2023 ACPSD Modified Calendar DRAFTDokument1 Seite2022-2023 ACPSD Modified Calendar DRAFTJeremy TurnageNoch keine Bewertungen

- SRNS Vaccination Requirement and Exemption ProcessDokument7 SeitenSRNS Vaccination Requirement and Exemption ProcessJeremy TurnageNoch keine Bewertungen

- Donte Bell PR BoloDokument1 SeiteDonte Bell PR BoloJeremy TurnageNoch keine Bewertungen

- Graph Covid Case CountsDokument1 SeiteGraph Covid Case CountsJeremy TurnageNoch keine Bewertungen

- North Augusta Pubic Safety Headquarters Conceptual Site PlanDokument1 SeiteNorth Augusta Pubic Safety Headquarters Conceptual Site PlanJeremy TurnageNoch keine Bewertungen

- HUB Site RenderingsDokument2 SeitenHUB Site RenderingsJeremy TurnageNoch keine Bewertungen

- Wanted Poster - Marcos PizzaDokument1 SeiteWanted Poster - Marcos PizzaJeremy TurnageNoch keine Bewertungen

- Modified Academic CalendarDokument1 SeiteModified Academic CalendarJeremy TurnageNoch keine Bewertungen

- 2021-22 School CalendarDokument1 Seite2021-22 School CalendarJeremy TurnageNoch keine Bewertungen

- Modified School Year Calendar FAQsDokument2 SeitenModified School Year Calendar FAQsJeremy TurnageNoch keine Bewertungen

- Dhec Oct 17 2021Dokument1 SeiteDhec Oct 17 2021Jeremy TurnageNoch keine Bewertungen

- Missing Soldier SPC Tyeisha Staley 35th Signal 18oct2021Dokument1 SeiteMissing Soldier SPC Tyeisha Staley 35th Signal 18oct2021Jeremy Turnage100% (1)

- Players WantedDokument1 SeitePlayers WantedJeremy TurnageNoch keine Bewertungen

- Swainsboro City Council LawsuitDokument12 SeitenSwainsboro City Council LawsuitJeremy TurnageNoch keine Bewertungen

- Augusta-Richmond County Coroner Investigative ReportDokument2 SeitenAugusta-Richmond County Coroner Investigative ReportJeremy TurnageNoch keine Bewertungen

- RCSS Student Behavior Letter 09-30-2021Dokument1 SeiteRCSS Student Behavior Letter 09-30-2021Jeremy TurnageNoch keine Bewertungen

- GMAS Sample Student Report PagesDokument6 SeitenGMAS Sample Student Report PagesJeremy TurnageNoch keine Bewertungen

- GMAS Sample Student Report PagesDokument6 SeitenGMAS Sample Student Report PagesJeremy TurnageNoch keine Bewertungen

- September 28 Parent LetterDokument1 SeiteSeptember 28 Parent LetterJeremy TurnageNoch keine Bewertungen

- Powerup PowerPointDokument5 SeitenPowerup PowerPointJeremy TurnageNoch keine Bewertungen

- Complaint For Declaratory and Injunctive ReliefDokument30 SeitenComplaint For Declaratory and Injunctive ReliefJeremy TurnageNoch keine Bewertungen

- Forced Entry PolicyDokument3 SeitenForced Entry PolicyJeremy TurnageNoch keine Bewertungen

- Aiken County Schools Remote LearningDokument21 SeitenAiken County Schools Remote LearningJeremy TurnageNoch keine Bewertungen

- Colleton County Man Charged With Assisted Suicide, Drugs and Other CrimesDokument13 SeitenColleton County Man Charged With Assisted Suicide, Drugs and Other CrimesJeremy TurnageNoch keine Bewertungen

- Aiken County Schools COVID NumbersDokument3 SeitenAiken County Schools COVID NumbersJeremy Turnage100% (1)

- Incident ReportDokument3 SeitenIncident ReportJeremy Turnage100% (1)

- 2020-01-12 Task Force On Confederate Monuments Street Names and Landmarks Final ReportDokument33 Seiten2020-01-12 Task Force On Confederate Monuments Street Names and Landmarks Final ReportJeremy TurnageNoch keine Bewertungen

- Use Acupressure to Conceive FasterDokument15 SeitenUse Acupressure to Conceive Fastersale18100% (1)

- Montgomery County Ten Year Comprehensive Water Supply and Sewerage Systems Plan (2003)Dokument228 SeitenMontgomery County Ten Year Comprehensive Water Supply and Sewerage Systems Plan (2003)rebolavNoch keine Bewertungen

- SVIMS-No Que-2Dokument1 SeiteSVIMS-No Que-2LikhithaReddy100% (1)

- Nursing Care PlansDokument10 SeitenNursing Care PlansGracie S. Vergara100% (1)

- SPA For Banks From Unit OwnersDokument1 SeiteSPA For Banks From Unit OwnersAda DiansuyNoch keine Bewertungen

- Mabuhay Wedding Package2006Dokument3 SeitenMabuhay Wedding Package2006Darwin Dionisio ClementeNoch keine Bewertungen

- PT6 Training ManualDokument64 SeitenPT6 Training ManualAnderson Guimarães100% (2)

- Critical Criminal Justice IssuesDokument132 SeitenCritical Criminal Justice IssuesAnnamarella Amurao CardinezNoch keine Bewertungen

- Moral Character ViolationsDokument2 SeitenMoral Character ViolationsAnne SchindlerNoch keine Bewertungen

- Fitness WalkingDokument192 SeitenFitness Walkingjha.sofcon5941100% (1)

- Gebauer 2012Dokument26 SeitenGebauer 2012Seán GallagherNoch keine Bewertungen

- TSS-TS-TATA 2.95 D: For Field Service OnlyDokument2 SeitenTSS-TS-TATA 2.95 D: For Field Service OnlyBest Auto TechNoch keine Bewertungen

- Aço X6NiCrTiMoVB25!15!2 - 1.4980 Austenitic SteelDokument2 SeitenAço X6NiCrTiMoVB25!15!2 - 1.4980 Austenitic SteelMoacir MachadoNoch keine Bewertungen

- Case Report on Right Knee FuruncleDokument47 SeitenCase Report on Right Knee Furuncle馮宥忻Noch keine Bewertungen

- Health 6 Q 4 WK 6 Module 6 Version 4Dokument16 SeitenHealth 6 Q 4 WK 6 Module 6 Version 4Kassandra BayogosNoch keine Bewertungen

- Carpentry Shop: Building, Doors, Windows, Trusses, WorkbenchesDokument105 SeitenCarpentry Shop: Building, Doors, Windows, Trusses, WorkbenchesVinod KumarNoch keine Bewertungen

- Treatment of Fruit Juice Concentrate Wastewater by Electrocoagulation - Optimization of COD Removal (#400881) - 455944Dokument5 SeitenTreatment of Fruit Juice Concentrate Wastewater by Electrocoagulation - Optimization of COD Removal (#400881) - 455944Victoria LeahNoch keine Bewertungen

- Maximizing Oredrive Development at Khoemacau MineDokument54 SeitenMaximizing Oredrive Development at Khoemacau MineModisa SibungaNoch keine Bewertungen

- EEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanDokument3 SeitenEEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanBELJUNE MARK GALANANNoch keine Bewertungen

- 1 Colmac DX Ammonia Piping Handbook 4th EdDokument64 Seiten1 Colmac DX Ammonia Piping Handbook 4th EdAlbertoNoch keine Bewertungen

- Pulsar2 User Manual - ENDokument83 SeitenPulsar2 User Manual - ENJanette SouzaNoch keine Bewertungen

- Venus in MulaDokument2 SeitenVenus in MulaGovind BallabhNoch keine Bewertungen

- Introduction To Animal Science For Plant ScienceDokument63 SeitenIntroduction To Animal Science For Plant ScienceJack OlanoNoch keine Bewertungen

- Physical Education Worksheet AssessmentsDokument3 SeitenPhysical Education Worksheet AssessmentsMichaela Janne VegigaNoch keine Bewertungen

- Benefits and Limitations of Vojta ApproachDokument50 SeitenBenefits and Limitations of Vojta ApproachAlice Teodorescu100% (3)

- Study On Marketing Strategies of Fast Food Joints in IndiaDokument35 SeitenStudy On Marketing Strategies of Fast Food Joints in IndiaNiveditaParaashar100% (1)

- Pet - WikipediaDokument12 SeitenPet - Wikipediabdalcin5512Noch keine Bewertungen

- Manual de Referencia PlanmecaDokument288 SeitenManual de Referencia PlanmecaJorge Escalona Hernandez100% (2)

- Rockwool 159: 2.2 Insulation ProductsDokument1 SeiteRockwool 159: 2.2 Insulation ProductsZouhair AIT-OMARNoch keine Bewertungen

- 3 Types of Chemical BondsDokument12 Seiten3 Types of Chemical BondsSaediRisquéBriskeyNoch keine Bewertungen