Beruflich Dokumente

Kultur Dokumente

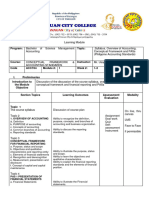

BUS 1B Accounting Principles - Managerial

Hochgeladen von

Angus SadpetCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BUS 1B Accounting Principles - Managerial

Hochgeladen von

Angus SadpetCopyright:

Verfügbare Formate

Lassen Community College Course Outline

BUS-1B Accounting Principles - Managerial 4.0 Units

I. Catalog Description

An introduction to managerial accounting, planning and decision making. The course

includes a study of cost behaviors, classifications, capture and reporting. Emphasis is

placed on costs systems, decision making using accounting data, budgeting,

manufacturing and cost accounting, and the preparation of managerial reports based on

accounting data. This course has been approved for online and hybrid delivery.

Prerequisite(s): Business 1A

1. Describe the accounting profession and the nature of work accountants perform.

2. Explain the need for accounting information systems and identify stakeholders who

use and rely on financial reporting.

3. Explain the nature and purpose of generally accepted accounting principles (GAAP)

and International Financial Reporting Standards (IFRS). Explain and apply the

components of the conceptual framework for financial accounting and reporting,

including the qualitative characteristics of accounting information, the assumptions

underlying accounting, the basic principles of financial accounting, and the

constraints and limitations on accounting information

4. Describe the accounting cycle from analysis and capture of economic business

activities to the preparation of the four primary financial statements.

5. Explain and apply generally accepted accounting principles to the measurement,

recording and reporting of current and long-term assets including inventories,

receivables, fixed assets and investments.

6. Explain and apply generally accepted accounting principles to the measurement,

recording and reporting of current and long-term liabilities including valuation and

issuance of common long-term debt financing.

7. Explain and apply generally accepted accounting principles to the measurement,

recording and reporting of stockholders’ equity including stock issuance and

repurchase, cash and stock dividends and basic earnings per share determination.

8. Explain and prepare a Statement of Cash Flows using good form and proper activity

classifications.

9. Identify and explain common internal controls, ethical considerations and the

management of a company’s risk.

10. Interpret company activity, profitability, liquidity and solvency through selection and

application of appropriate financial analysis tools.

Transfers to both UC/CSU

C-ID ACCT 120

68 Hours Lecture

Scheduled: Spring

II. Coding Information

Repeatability: Not Repeatable, Take 1 Time

Grading Option: Graded or Pass/No Pass

Credit Type: Credit - Degree Applicable

TOP Code: 050200

BUS-1B Accounting Principles - Managerial Page 1

III. Course Objectives

A. Course Student Learning Outcomes

1. Explain and illustrate the characteristics and cost flows in a given manufacturing

entity.

2. Describe and illustrate the use of accounting data and information in decision-

making.

B. Course Objectives

Upon successful completion of this course the student will be able to:

A. Identify and illustrate the primary activities and information needs of managers

and explain the role of the managerial accountant as a member of the management

team; compare and contrast financial and managerial accounting;

B. Define and illustrate various cost terms, concepts, and behaviors, and evaluate

their relevancy for different decision-making purposes;

C. Distinguish between product and period costs and prepare and evaluate a

Schedule of Cost of Goods Manufactured, Schedule of Cost of Goods Sold, and

Income Statement;

D. Prepare traditional and contribution-margin income statements and define related

terms;

E. Explain cost-volume-profit analysis, degree of operating leverage, and safety

margin and employ each as an analytical tool;

F. Describe the traditional types of product costing systems (including job-order and

process), illustrate the flow of costs in each, and prepare related accounting

records and reports;

G. Discuss the impact of technology on the business environment, its implications

for product and service costs, and the development of activity-based costing and

management;

H. Explain the purposes of budgeting, prepare a master budget and its component

schedules, and relate the budget to planning and control;

I. Explain the development and use of standard costs and flexible budgets, prepare

and interpret variance analysis reports and relate them to responsibility accounting

and control;

J. Explain the nature of and need for segment reporting and the relationship with

cost, revenue, profit, and investment centers; prepare and analyze related segment

reports;

K. Compare and contrast absorption costing and variable costing, prepare income

statements using both methods, and reconcile the resulting net incomes;

L. Define relevant costs and benefits and prepare analyses related to special

decisions;

M. Explain the nature of capital expenditure decisions and apply and evaluate various

methods used in making these decisions; including the time value of money and

N. Identify the ethical implications inherent in managerial accounting and reporting

and be able to apply strategies for addressing them.

IV. Course Content

A. Decision making: relevant costs and benefits

B. Basic cost management concepts

C. Cost-volume-profit analysis

BUS-1B Accounting Principles - Managerial Page 2

D. Job-order and process costing

E. Activity-based costing

F. Profit planning and budgeting

G. Standard costing and flexible budgeting

H. Responsibility accounting, segment reporting, and performance analysis

I. Absorption and variable costing

J. Capital expenditure decisions

K. Ethical issues

V. Assignments

A. Appropriate Readings

1. Text - "Accounting"

2. Wall Street Journal

3. Business Weekly

4. U.S. News and World Report

5. Money

B. Writing Assignments

Essay analysis of selected case studies.

C. Expected Outside Assignments

1. Completion of workbook/text assignments.

D. Specific Assignments that Demonstrate Critical Thinking

1. Essay analysis of selected case studies.

2. Completion of workbook assignments.

VI. Methods of Evaluation

Traditional Classroom Instruction

Problem solving exercises; oral and written assignments; quizzes and examinations,

which may include problem solving, essay and/or analysis interpretation and

presentation.

Correspondence Delivery

Same as face to face with the exception of the desired use of proctored exams and

exclusion of participation in classroom activities. Students will be expected to complete

assignments and activities equivalent to in-class assignments and activities. Written

correspondence and a minimum of six opportunities for feedback will be utilized to

maintain effective communication between instructor and student.

Online Evaluation

Students will be evaluated using online methods. Online students will complete assignments

as described in the course outline using a variety of online methods such as online

submission of research papers, asynchronous and synchronous discussions (chat/forum),

online quizzes and exams, postings to online website, and email communications in lieu of

traditional classroom assignments and evaluation methods.

Hybrid Evaluation

A combination of traditional classroom and online evaluations will be used. Traditional

Classroom: exercises/assignments, objective examinations and essay examinations. Online

delivery: exercises/assignments, online quizzes and exams, essay forum postings, and chat

rooms.

VII. Methods of Delivery

Check those delivery methods for which, this course has been separately approved by the

Curriculum/Academic Standards Committee.

BUS-1B Accounting Principles - Managerial Page 3

Traditional Classroom Delivery Correspondence Delivery

Hybrid Delivery Online Delivery

Traditional Classroom Instruction

Lecture, discussion

Correspondence Delivery

Assigned readings, instructor-generated typed handouts, typed lecture materials,

exercises and assignments equal to face-to-face instructional delivery. Written

correspondence and a minimum of six opportunities for feedback will be utilized to

maintain effective communication between instructor and student.

Online Delivery

Online written lectures and/or video lectures will be made available to students online.

Students will be expected to participate in forum-based discussions and online

exercises/assignments contained on website. Additionally, discussion papers, email

communications, postings to forums, and web-links will comprise the method of instruction.

Hybrid Delivery

A combination of traditional classroom and online instruction will be utilized. 34 hours will

be taught face-to-face by the instructor and the other 34 hours will be instructed online

through the technology platform adopted by the District. Traditional class instruction will

consist of exercises/assignments, lectures, visual aids, and practice exercises. Online delivery

will consist of exercises/assignments, lecture posts, discussions, adding extra resources and

other media sources as appropriate.

VIII. Representative Texts and Supplies

Warren, Reeve, and Duchac, Accounting, 26th Edition, 2016 Cengage Learning, ISBN

9781285743615

IX. Discipline/s Assignment

Business, Accounting

X. Course Status

Current Status: Active

Original Approval Date: 6/18/1990

Revised By: Andy Rupley

Curriculum/Academic Standards Committee Revision Date: 04/02/2019

BUS-1B Accounting Principles - Managerial Page 4

Das könnte Ihnen auch gefallen

- Course OutlineDokument4 SeitenCourse OutlineAhmad MuzzammilNoch keine Bewertungen

- 1 Course Outline Cost Acc. For Students 1.18.22Dokument6 Seiten1 Course Outline Cost Acc. For Students 1.18.22MOHAIMEN GUIMBANoch keine Bewertungen

- Principles of Accounting Course OutlineDokument4 SeitenPrinciples of Accounting Course OutlinefuriousTaherNoch keine Bewertungen

- AF5115Dokument5 SeitenAF5115Chin LNoch keine Bewertungen

- Acctg 106 Cost Acctg0be Syllabus Template 1Dokument8 SeitenAcctg 106 Cost Acctg0be Syllabus Template 1Trine De LeonNoch keine Bewertungen

- Diploma in Accounting Program BUSI 293 I PDFDokument10 SeitenDiploma in Accounting Program BUSI 293 I PDFSheena MachinjiriNoch keine Bewertungen

- MBM 804 Module OutlineDokument6 SeitenMBM 804 Module OutlineAutorix InvestmentsNoch keine Bewertungen

- Management Accounting - Costing and Budgeting (Edexcel)Dokument21 SeitenManagement Accounting - Costing and Budgeting (Edexcel)Nguyen Dac Thich100% (1)

- 2023-2024 Acct4005Dokument9 Seiten2023-2024 Acct4005Enosh JOyNoch keine Bewertungen

- ACC350 Outline FinalDokument12 SeitenACC350 Outline FinalHamza AsifNoch keine Bewertungen

- Syllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021Dokument10 SeitenSyllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021SYED HUSSAINNoch keine Bewertungen

- ACC502Dokument6 SeitenACC502waheedahmedarainNoch keine Bewertungen

- Principles of Financial Accounting 1Dokument6 SeitenPrinciples of Financial Accounting 1Amonie ReidNoch keine Bewertungen

- Managerial Accounting STANDARD PDFDokument0 SeitenManagerial Accounting STANDARD PDFMichael YuNoch keine Bewertungen

- BBDokument9 SeitenBBChreann RachelNoch keine Bewertungen

- Managerial Accounting-Qazi Saud AhmedDokument4 SeitenManagerial Accounting-Qazi Saud Ahmedqazisaudahmed100% (1)

- Financial Statement Analysis: Standard Course OutlineDokument6 SeitenFinancial Statement Analysis: Standard Course OutlineMahmoud ZizoNoch keine Bewertungen

- 7110 Nos SW 10Dokument3 Seiten7110 Nos SW 10mstudy123456Noch keine Bewertungen

- ACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022Dokument14 SeitenACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022NURHAM SUMLAYNoch keine Bewertungen

- Cost Accounting and Financial ManagementDokument921 SeitenCost Accounting and Financial Managementmalikkamran06552989% (18)

- DW FMAAContentSpecificationOutlinesDokument7 SeitenDW FMAAContentSpecificationOutlinesbahaasaffarino9Noch keine Bewertungen

- N. Cruz-Course Material For Strategic Cost ManagementDokument134 SeitenN. Cruz-Course Material For Strategic Cost ManagementEmmanuel VillafuerteNoch keine Bewertungen

- Fundamentals of Accountancy Business and ManagementDokument86 SeitenFundamentals of Accountancy Business and ManagementJosie Ann VelascoNoch keine Bewertungen

- Metropolitan Community College Course Outline FormDokument5 SeitenMetropolitan Community College Course Outline FormJimmy MehtaNoch keine Bewertungen

- BBA - Accounting For ManagersDokument3 SeitenBBA - Accounting For ManagersKanishq BawejaNoch keine Bewertungen

- Intermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseDokument11 SeitenIntermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseSZANoch keine Bewertungen

- FA MBA Quarter I SNU Course Outline 2020Dokument7 SeitenFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajNoch keine Bewertungen

- MGT402 - MAA - Course OutlineDokument6 SeitenMGT402 - MAA - Course OutlineRajesh SinghNoch keine Bewertungen

- Accounting III ACCT 1120: Metropolitan Community College Course Outline FormDokument5 SeitenAccounting III ACCT 1120: Metropolitan Community College Course Outline FormHumberto Romero ZecuaNoch keine Bewertungen

- AC418 Module OutlineDokument5 SeitenAC418 Module OutlinetinashekuzangaNoch keine Bewertungen

- Winter Syllabus ACCT 3025Dokument9 SeitenWinter Syllabus ACCT 3025Brettavius Decimus MeridiusNoch keine Bewertungen

- 511 Ac & Finance For ManagersDokument3 Seiten511 Ac & Finance For ManagersYonasNoch keine Bewertungen

- Cost Acctg Syllabus 2nd Sem 2324Dokument6 SeitenCost Acctg Syllabus 2nd Sem 2324Jericho GeranceNoch keine Bewertungen

- Course Outline: Accounting Department Faculty of Economics and Business, Universitas BrawijayaDokument15 SeitenCourse Outline: Accounting Department Faculty of Economics and Business, Universitas Brawijaya01 - Naura Nuhaa TsabitaNoch keine Bewertungen

- Learning Mod 1 CfasDokument20 SeitenLearning Mod 1 CfasKristine CamposNoch keine Bewertungen

- ACC111 Course CompactDokument2 SeitenACC111 Course CompactKehindeNoch keine Bewertungen

- 1 Basics of CMADokument39 Seiten1 Basics of CMAkhushi shahNoch keine Bewertungen

- Managerial Accounting STANDARDDokument37 SeitenManagerial Accounting STANDARDCyn SyjucoNoch keine Bewertungen

- ACCT 354 WinterSummer2020Dokument10 SeitenACCT 354 WinterSummer2020Nguyen NguyenNoch keine Bewertungen

- AFM Course Outline PDFDokument4 SeitenAFM Course Outline PDFPrateek saxenaNoch keine Bewertungen

- Course Outline Introduction To Financial AccountingDokument8 SeitenCourse Outline Introduction To Financial AccountingLuciferNoch keine Bewertungen

- AC516 Syllabus StudentsDokument14 SeitenAC516 Syllabus StudentsRodney CabandoNoch keine Bewertungen

- Samcis Ae212 Course-GuideDokument10 SeitenSamcis Ae212 Course-GuideUchayyaNoch keine Bewertungen

- Dr. Gloria D. Lacson Foundation Colleges, IncDokument5 SeitenDr. Gloria D. Lacson Foundation Colleges, IncMa. Liza MagatNoch keine Bewertungen

- Financial Statement Analysis First LectureDokument17 SeitenFinancial Statement Analysis First LectureDavid Obuobi Offei KwadwoNoch keine Bewertungen

- 511 Ac & Finance For ManagersDokument3 Seiten511 Ac & Finance For ManagersMesi YE GINoch keine Bewertungen

- AF5115 Jul 2014Dokument3 SeitenAF5115 Jul 2014AwesomeNoch keine Bewertungen

- AccountsDokument6 SeitenAccountsAshishchoubeyNoch keine Bewertungen

- Accounting Manual and Computerised 5 N1348Dokument15 SeitenAccounting Manual and Computerised 5 N1348RichardNoch keine Bewertungen

- JD Manager Revenue Management 1Dokument5 SeitenJD Manager Revenue Management 1Gopaul PersaudNoch keine Bewertungen

- BUS120 Unit Outline 2021T2Dokument11 SeitenBUS120 Unit Outline 2021T2cloudella byrdeNoch keine Bewertungen

- Unit Plan Teacher: Miss Courtney J. Skemp Grade: 10-12 Approximate Time Required: 13 DaysDokument10 SeitenUnit Plan Teacher: Miss Courtney J. Skemp Grade: 10-12 Approximate Time Required: 13 Daysapi-143180568Noch keine Bewertungen

- Financial Analysis 1Dokument3 SeitenFinancial Analysis 1Kendra LeslyNoch keine Bewertungen

- ACC203Dokument7 SeitenACC203waheedahmedarainNoch keine Bewertungen

- Course Outline: Shawn RichardsDokument11 SeitenCourse Outline: Shawn Richardslily northNoch keine Bewertungen

- Corporate Finance Workbook: A Practical ApproachVon EverandCorporate Finance Workbook: A Practical ApproachNoch keine Bewertungen

- International Financial Statement AnalysisVon EverandInternational Financial Statement AnalysisBewertung: 1 von 5 Sternen1/5 (1)

- 300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionVon Everand300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionNoch keine Bewertungen

- Financial Literacy and Attitudes To CryptocurrenciesDokument96 SeitenFinancial Literacy and Attitudes To CryptocurrenciesAngus SadpetNoch keine Bewertungen

- Gervais FTG2019 Overconfidence Slides NoTransitionsDokument98 SeitenGervais FTG2019 Overconfidence Slides NoTransitionsAngus SadpetNoch keine Bewertungen

- SSRN-id3861152 Pablo FernandezDokument17 SeitenSSRN-id3861152 Pablo FernandezAngus SadpetNoch keine Bewertungen

- Factors Associated With Longevity of Small, Family-Owned FirmsDokument1 SeiteFactors Associated With Longevity of Small, Family-Owned FirmsAngus SadpetNoch keine Bewertungen

- SSRN Id3482083Dokument96 SeitenSSRN Id3482083Angus SadpetNoch keine Bewertungen

- International Journal of Entrepreneurship: Printed ISSN: 1099-9264 PDF ISSN: 1939-4675Dokument116 SeitenInternational Journal of Entrepreneurship: Printed ISSN: 1099-9264 PDF ISSN: 1939-4675Angus SadpetNoch keine Bewertungen

- When Mbas Meet Henokiens: What Can We Learn From Long-Lived Family Firms?Dokument17 SeitenWhen Mbas Meet Henokiens: What Can We Learn From Long-Lived Family Firms?Angus SadpetNoch keine Bewertungen

- Negative Affect and Overconfidence: A Laboratory InvestigationDokument41 SeitenNegative Affect and Overconfidence: A Laboratory InvestigationAngus SadpetNoch keine Bewertungen

- Intrum Epr 2019Dokument84 SeitenIntrum Epr 2019Angus SadpetNoch keine Bewertungen

- Jda 2015 0071Dokument13 SeitenJda 2015 0071Angus SadpetNoch keine Bewertungen

- Financial Literacy and Attitudes To CryptocurrenciesDokument96 SeitenFinancial Literacy and Attitudes To CryptocurrenciesAngus SadpetNoch keine Bewertungen

- Market Reactions To Stock Splits: Experimental Evidence: John Duffy Jean Paul Rabanal Olga A. Rud February 22, 2021Dokument34 SeitenMarket Reactions To Stock Splits: Experimental Evidence: John Duffy Jean Paul Rabanal Olga A. Rud February 22, 2021Angus SadpetNoch keine Bewertungen

- Differences18 PDFDokument1 SeiteDifferences18 PDFAngus SadpetNoch keine Bewertungen

- Annual Financial Statements December 2016 - Toyota Caetano PortugalDokument163 SeitenAnnual Financial Statements December 2016 - Toyota Caetano PortugalAngus SadpetNoch keine Bewertungen

- Applying Digital Analysis Using Benford's Law To Detect Fraud-The Dangers of Type I ErrorsDokument7 SeitenApplying Digital Analysis Using Benford's Law To Detect Fraud-The Dangers of Type I Errorskutukupret0% (1)

- The Equity PremiumDokument29 SeitenThe Equity PremiumAngus SadpetNoch keine Bewertungen

- Godinho 2016Dokument49 SeitenGodinho 2016Angus SadpetNoch keine Bewertungen

- Predicting The Risk of Corporate FailureDokument330 SeitenPredicting The Risk of Corporate FailureAngus SadpetNoch keine Bewertungen

- A Model of Bankruptcy Prediction: Calibration of Atman's Z-Score For JapanDokument34 SeitenA Model of Bankruptcy Prediction: Calibration of Atman's Z-Score For JapanAngus SadpetNoch keine Bewertungen

- Five Factor Asset Pricing ModelDokument52 SeitenFive Factor Asset Pricing Modelmathfreak123Noch keine Bewertungen

- DM Fdfo 2014 PDFDokument69 SeitenDM Fdfo 2014 PDFAngus SadpetNoch keine Bewertungen

- Market Timing by Global Fund ManagersDokument22 SeitenMarket Timing by Global Fund ManagersAngus SadpetNoch keine Bewertungen

- Business Valuation PresentationDokument43 SeitenBusiness Valuation PresentationAngus Sadpet100% (1)

- OPTIMAL ACCOUNTING BASED DEFAULT PREDICTION MODEL FOR THE UK SMEsDokument20 SeitenOPTIMAL ACCOUNTING BASED DEFAULT PREDICTION MODEL FOR THE UK SMEsAngus SadpetNoch keine Bewertungen

- Why Do SMEs Hold Cash? Evidence From PortugalDokument51 SeitenWhy Do SMEs Hold Cash? Evidence From PortugalAngus SadpetNoch keine Bewertungen

- More On The Role of Switching Costs in Service Markets: A Research NoteDokument7 SeitenMore On The Role of Switching Costs in Service Markets: A Research NoteAngus SadpetNoch keine Bewertungen

- Three Essays On Corporate Cash HoldingsDokument161 SeitenThree Essays On Corporate Cash HoldingsAngus SadpetNoch keine Bewertungen

- The Credit Overhang: Follow The Money - Where's All The Cash On U.S. Corporate Balance SheetsDokument13 SeitenThe Credit Overhang: Follow The Money - Where's All The Cash On U.S. Corporate Balance SheetsAngus SadpetNoch keine Bewertungen

- Co-Existence of Cash and DebtDokument40 SeitenCo-Existence of Cash and DebtAngus SadpetNoch keine Bewertungen

- Power and Water - Final BrochureDokument7 SeitenPower and Water - Final BrochureEngr Muhammad HussainNoch keine Bewertungen

- Analisi Perusahaan PT AsahimasDokument14 SeitenAnalisi Perusahaan PT AsahimasLutfi UmyrahNoch keine Bewertungen

- Thq002-Inst. Sales PDFDokument2 SeitenThq002-Inst. Sales PDFAndrea AtendidoNoch keine Bewertungen

- Present Values, The Objectives of The Firm, and Corporate GovernanceDokument5 SeitenPresent Values, The Objectives of The Firm, and Corporate GovernanceRamesh TiwariNoch keine Bewertungen

- A Study On Service Quality at HERO Motocorp Service Centre at Shubham Motors, KamrejDokument7 SeitenA Study On Service Quality at HERO Motocorp Service Centre at Shubham Motors, KamrejJANANI.K 19BBA BPMNoch keine Bewertungen

- Coordinated Assignment 2 Spring 2021Dokument4 SeitenCoordinated Assignment 2 Spring 2021Affan AhmedNoch keine Bewertungen

- Process Flowchart APMD - Sales Cycle ARDokument1 SeiteProcess Flowchart APMD - Sales Cycle ARvictor odtohanNoch keine Bewertungen

- May 2014 Investor - PresentationDokument62 SeitenMay 2014 Investor - Presentationtipu001Noch keine Bewertungen

- COBIT 2019 Design Toolkit With Description - Group X.XLSX - DF2Dokument8 SeitenCOBIT 2019 Design Toolkit With Description - Group X.XLSX - DF2Aulia NisaNoch keine Bewertungen

- Becton Dickinson: Designing The New Strategic, Operational, and Financial Planning ProcessDokument2 SeitenBecton Dickinson: Designing The New Strategic, Operational, and Financial Planning ProcessSHIVALKAR J0% (1)

- Preston University, Islamabad Campus: Strategic Human Resource ManagementDokument5 SeitenPreston University, Islamabad Campus: Strategic Human Resource ManagementowaishazaraNoch keine Bewertungen

- Core Competencies 2012Dokument223 SeitenCore Competencies 2012Zahirul HaqNoch keine Bewertungen

- Rift Valley University Business and Social Sciences Department of Business AdministrationDokument11 SeitenRift Valley University Business and Social Sciences Department of Business AdministrationAdanechNoch keine Bewertungen

- Annual Report 2010 11Dokument192 SeitenAnnual Report 2010 11Deepak KumarNoch keine Bewertungen

- Isb511 - Assg Ind 1Dokument19 SeitenIsb511 - Assg Ind 12022923703Noch keine Bewertungen

- Unit 3: Human Resource Management: Assignment BriefDokument4 SeitenUnit 3: Human Resource Management: Assignment BriefGharis Soomro100% (1)

- Partha Kundu, PMP: PH: 425-313-7316 (H), 425-281-0324 (C)Dokument3 SeitenPartha Kundu, PMP: PH: 425-313-7316 (H), 425-281-0324 (C)Haripada DasNoch keine Bewertungen

- ACCT 423 Cheat Sheet 1.0Dokument2 SeitenACCT 423 Cheat Sheet 1.0HelloWorldNowNoch keine Bewertungen

- Vendor Registration Form: Section 1: Company Details and General InformationDokument4 SeitenVendor Registration Form: Section 1: Company Details and General Informationsurya123sNoch keine Bewertungen

- Acc 101Dokument10 SeitenAcc 101green bothNoch keine Bewertungen

- Shingo Model Booklet-V14.8Dokument64 SeitenShingo Model Booklet-V14.8Maria Guadalupe Trejo VegaNoch keine Bewertungen

- Topic 3 - Compensation IncomeDokument13 SeitenTopic 3 - Compensation IncomeRoxanne DiazNoch keine Bewertungen

- NP EX19 8a JinruiDong 2Dokument14 SeitenNP EX19 8a JinruiDong 2Ike DongNoch keine Bewertungen

- ACCA F9 Revision Question Bank-49-51Dokument3 SeitenACCA F9 Revision Question Bank-49-51rbaamba100% (1)

- SBR TableauDokument10 SeitenSBR TableauSRIRAG S PUDHUVEL 21BAF043Noch keine Bewertungen

- Software Outsourcing Market in Eastern Europe - A Complete Guide ( (White Paper by N-iX)Dokument22 SeitenSoftware Outsourcing Market in Eastern Europe - A Complete Guide ( (White Paper by N-iX)Kostiantyn Didur100% (1)

- GST Accounting PDFDokument17 SeitenGST Accounting PDFBOO KIANG MINGNoch keine Bewertungen

- TEMPLATE 5 WHYs Investigation Report - Ver1Dokument22 SeitenTEMPLATE 5 WHYs Investigation Report - Ver1Eduardo CamposNoch keine Bewertungen

- Tally - ERP 9: Major Features of - Power of SimplicityDokument8 SeitenTally - ERP 9: Major Features of - Power of SimplicityfawwazNoch keine Bewertungen

- Mondelez Research Note 1Dokument1 SeiteMondelez Research Note 1api-249461242Noch keine Bewertungen