Beruflich Dokumente

Kultur Dokumente

Petrobras - Century Bond

Hochgeladen von

千舞神乐Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Petrobras - Century Bond

Hochgeladen von

千舞神乐Copyright:

Verfügbare Formate

Petrobras – Century Bond

Team member: Duo Cao, Xiaojun Kong, Chao Tang, Luping Zhang, Shengjie Zheng

The following analysis is about Petrobras, an oil company operating in the oil, natural gas, and

energy industries in Brazil. The company issued a 100-year bond in 2015 which has a

considerable coupon rate. As bond analysts of an insurance company, we consider investing the

100-year bond to make the maturity of assets match the maturity of liabilities. Duration and

convexity are used to analyze 10-year, 30-year, and 100-year bonds. According to the bond

analysis, firm analysis, other firm comparable analysis, and macro analysis, we suggest not to

buy the 100-year bond. The following article explains the research and assumptions in details.

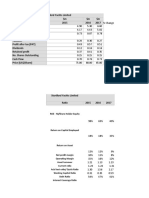

Bond analysis

The chart (Exhibit 1) shows the main characteristics of 100-year, 30-year, and 10-year bonds.

The cash flows equal to the bond prices, which are $86.00, $95.08 and $100.20 respectively.

Duration is calculated as the weight average of the times to each coupon payments. To be more

precise, we use YTM to modify the MacAulay Duration, which is 12.55, 11.29 and 4.94.

Duration measures the interest rate risk, and a high duration value shows a high interest rate. In

this perspective, the risk of a 100-year bond is highest, with a 12.55 modified duration. And 10-

year bond’s duration is only 4.94, which has the lowest risk. Convexity reflects the rate of

change of the slope of the price-yield curve. And investors normally desire a high convexity,

because a high convexity means the higher benefit with decreasing interest rate and lower loss

with increasing interest rate. And the 100-year bond has a higher convexity with 315. Comparing

the 100-year and 30-year bond, the price of the 100-year bond is better than that of the 20-year

bond with 100 basis point yield change.

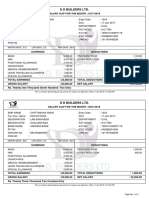

Firm Analysis

To analysis the current standing of the company, we need to focus on some financial metrics of

Petrobras for its solvency. Some short-term ratios and long-term ratios are shown in Exhibit 2.

The current ratio which measures the company’s ability to pay obligations is 1.89 in 2017 while

the cash asset ratio is 0.98. Basically, higher current ratio lowers liquidity risk. The current ratio

with growing trend indicates that Petrobras has enough to cover its current liabilities if they are

theoretically due immediately. In the long run, the debt ratio is 43.47% which is appropriate.

However, the debt to equity ratio of Petrobras in 2017 is 104.05%. Typically, it shows a growing

trend of leverage ratio from 2011 to 2017, resulting in volatile earnings. The company becomes

aggressive in financing its growth with debt. The international rating agency downgraded its

bond rating which illustrates a negative situation. Moody’s LT Corp downgraded from Ba2 to

Ba3, while Standard & Poor’s downgraded from BBB- to B+.

Other Firm Comparable Analysis

There are four comparable companies, Chevron Corp (CVX), Gazprom PJSC (GAZP), China

Petroleum & Chemical Corp (SNP), and ConocoPhillips (COP). First, we use bond rating to

compare their ability to pay the coupons. We calculate the median values from 2013-2017 of

selected ratios for each firm to judge the bond rating. The outcome refers to Exhibit 3. We use

Moody’s Financial Metrics bond rating class as criteria (Exhibit 4). None of these firms have a

rate over Baa, which means all bonds may be classified as a junk bond. To be specific, four of

these companies get a C rate except for Gazprom PJSC, B rating. We can conclude that

Petrobras, CVX, SNP, and COP all perform worse than GAZP to pay the coupons. The outcome

seems dangerous. So, we also take data from the firm’s financial reports into consideration. We

use Altman’s Z-scores model to calculate every firm’s Z-scores (Exhibit 5). We can find that both

target company Petrobras and comparable firm COP have a Z-scores below 1.23, which means

vulnerability to bankruptcy. However, the Z-sores of other three comparable companies, CVX,

GAZP, and SNP, is between 1.23 and 2.90, which indicates a grey area. In conclusion, none of

these companies are safe from bankruptcy and have adequate ability to pay the coupons. What’s

more, Petrobras doesn’t have an obvious advantage over comparable companies, which means

the bonds all of the five firms are not so worthy of investing.

Macro Analysis

We should consider all the three factors in the macro environment. If general interest increases,

Petrobras would suffer from holding loss of its bond investment. And an upswing future oil price

in real term could enhance Petrobras’s profitability, building up the confidence of the investment

in a 100-year bond. Besides, currency risk is significant, because dollar depreciation would lower

the return from the bond investment in USD when translating into Brazilian real. So the macro

environment could significantly influence the return on the Petrobras 100-year bond.

Conclusion

Based on our comprehensive analysis, we suggest that should not buy the Petrobras 100-year

bond. Although the 100-year bond has the highest convexity, the company does not worth

investing for its current forecasted operation condition. Petrobras is now assessed to be

vulnerability to bankruptcy and may not be able to repay its debt. Since the industry Petrobras

operates is relatively in a maturity stage, there would be not much growth in the future. In

addition, the current macro environment is quite dynamic for a long-term investment, especially

in a foreign country. High risk exists in this long-term bond issued by Petrobras.

Exhibit1 Three Bonds Analysis

100-year bond 30-year bond 10-year bond

Cash flow $86.00 $95.08 $100.20

MacAulay Duration 13.05 11.73 5.10

Modified Duration 12.55 11.29 4.94

Convexity 315 203 29

Price change with 100 basis point decrease $12.34 $11.78 $5.10

Price change with 100 basis point increase -$9.59 -$9.84 -$4.81

Exhibit 2 Petrobras Financial Ratios

2017 2016 2015 2014 2013 2012 2011 2010

Current ratio 1.89 1.80 1.52 1.63 1.49 1.70 1.78 1.89

Cash ratio 0.98 0.88 0.90 0.83 0.56 0.70 0.77 0.99

43.47

Debt Ratio % 47.93% 54.75% 44.25% 35.57% 29.34% 25.92% 22.43%

Debt to equity (%) 104.05 124.17 151.83 90.67 63.33 44.44 29.27 17.85

Exhibit 3 Comparable Companies Ratios

Petrobra Chevron Gazprom China Petroleum ConocoPhillip

s Corp PJSC & Chemical Corp s

EBIT/Assets (%) 4.56% 0.66% 7.97% 5.42% 2.18%

Operating profit margin (%) 12.76% 1.32% 22.38% 3.54% 5.50%

EBITA to interest coverage (multiple) 1.83 0.00 20.33 9.46 7.69

Debt/EBITDA (multiple) 6.83 4.97 3.27 4.14 5.04

Debt/(Debt + Equity) 67.58% 41.29% 33.32% 46.54% 58.02%

Funds from operations/Total debt 0.061 0.223 0.213 0.192 0.076

(multiple)

Retained cash flow/Net debt (multiple) 0.03 -0.10 0.17 0.31 0.05

Bond Rating C C B C C

Exhibit 4 Bond Rating S tandards

Aaa Aa A Baa Ba B C

EBIT/Assets (%) 20.9% 15.6% 13.8% 10.9% 9.1% 7.1% 4.0%

Operating profit margin (%) 22.0% 17.1% 17.6% 14.1% 11.2% 8.9% 4.1%

EBITA to interest coverage (multiple) 28.9 15.1 9.7 5.9 3.5 1.7 0.6

Debt/EBITDA (multiple) 0.58 2.03 1.83 2.58 3.41 5.26 8.35

Debt/(Debt + Equity) 19.3% 50.2% 38.6% 46.2% 51.7% 72.0% 98.0%

Funds from operations/Total debt (multiple) 1.335 0.385 0.425 0.296 0.206 0.120 0.031

Retained cash flow/Net debt (multiple) 1.3 0.3 0.4 0.3 0.2 0.1 0.0

Exhibit 5 Comparable Companies

Financial Characteristics of Petrobras Chevron Gazprom China Petroleum & ConocoPhillips

FY2017 Corp PJSC Chemical Corp

EBIT/Total assets 0.053 0.007 0.046 0.057 0.022

Sales/Assets 0.341 0.503 0.359 1.442 0.397

Shareholders' equity/Total 0.480 1.429 1.931 1.148 0.724

liabilities

Retained earnings/Total assets 0.000 0.686 0.633 0.330 0.401

Working capital/Total assets 0.088 0.003 0.048 -0.032 0.097

Z-Scores 0.771 1.709 1.886 2.357 1.179

Vulnerability Gray area Gray area Gray area Vulnerability to

Indication

to bankruptcy bankruptcy

Das könnte Ihnen auch gefallen

- Executive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Dokument12 SeitenExecutive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Navin N Meenakshi ChandraNoch keine Bewertungen

- Assignment 2Dokument12 SeitenAssignment 2Nimra SiddiqueNoch keine Bewertungen

- Implememntation Polaroid - Corporation - TemplateDokument11 SeitenImplememntation Polaroid - Corporation - TemplateShirazeeNoch keine Bewertungen

- 16 - Manju - Infosys Technolgy Ltd.Dokument15 Seiten16 - Manju - Infosys Technolgy Ltd.rajat_singlaNoch keine Bewertungen

- Case 4 For AnanlysisDokument2 SeitenCase 4 For AnanlysisLaura HNoch keine Bewertungen

- F Capital Structure On Tesco PLC and Sainbury S PerformanceDokument13 SeitenF Capital Structure On Tesco PLC and Sainbury S PerformanceFESTUS EFOSA EFOSANoch keine Bewertungen

- Evaluating Reliance's Dividend Policy and ValuationDokument11 SeitenEvaluating Reliance's Dividend Policy and ValuationYash Aggarwal BD20073Noch keine Bewertungen

- Cours 2 Essec 2018 Lbo PDFDokument81 SeitenCours 2 Essec 2018 Lbo PDFmerag76668Noch keine Bewertungen

- Group 5 - AHP Capital StructureDokument4 SeitenGroup 5 - AHP Capital StructureAanand SrivastavaNoch keine Bewertungen

- Ratio Analysis Case Study SolutionDokument7 SeitenRatio Analysis Case Study SolutionRanjuNoch keine Bewertungen

- Equity Valuation Project: GroupDokument20 SeitenEquity Valuation Project: Groupsushilgoyal86100% (1)

- Aarti DrugsDokument34 SeitenAarti DrugsSiddhi ShindeNoch keine Bewertungen

- Ratio Analysis: Pakistan State OilDokument19 SeitenRatio Analysis: Pakistan State OilMUHAMMAD MUDASSAR TAHIR NCBA&ENoch keine Bewertungen

- Term Valued CFDokument14 SeitenTerm Valued CFEl MemmetNoch keine Bewertungen

- Syndicate 3 - Nike-Case 7 - YP64ADokument7 SeitenSyndicate 3 - Nike-Case 7 - YP64ADimas Kusuma AndanuNoch keine Bewertungen

- Hotel dividend policies analyzed over 5 yearsDokument3 SeitenHotel dividend policies analyzed over 5 yearsvineet383Noch keine Bewertungen

- Exercises w3Dokument6 SeitenExercises w3hqfNoch keine Bewertungen

- Discount Rates: IV: Mopping UpDokument29 SeitenDiscount Rates: IV: Mopping UpElliNoch keine Bewertungen

- PG One Pager CopyDokument2 SeitenPG One Pager CopyAlexandra Denise PeraltaNoch keine Bewertungen

- Group3 - DIY - Garware Wall Ropes - Stock PitchDokument5 SeitenGroup3 - DIY - Garware Wall Ropes - Stock PitchBhushanam BharatNoch keine Bewertungen

- Ratio AnalysisDokument30 SeitenRatio AnalysiskmillatNoch keine Bewertungen

- Lbo Case StudyDokument6 SeitenLbo Case StudyRishabh MishraNoch keine Bewertungen

- Investment Banking ClassDokument20 SeitenInvestment Banking Classlaiba mujahidNoch keine Bewertungen

- MAD AssignmentDokument4 SeitenMAD AssignmentSWETHA LAGISETTINoch keine Bewertungen

- Ratio AnalysisDokument11 SeitenRatio AnalysisMadavee JinadasaNoch keine Bewertungen

- Financial Projections Model v6.8.4Dokument28 SeitenFinancial Projections Model v6.8.4george.komnasNoch keine Bewertungen

- Mydeco Corp's financial ratios and valuation metrics over timeDokument2 SeitenMydeco Corp's financial ratios and valuation metrics over timehelloNoch keine Bewertungen

- Cement Industry RatiosDokument6 SeitenCement Industry RatiosSiddharth ShahNoch keine Bewertungen

- Stortford Yachts Limited ratio analysis reveals operational issuesDokument8 SeitenStortford Yachts Limited ratio analysis reveals operational issuesMuhammad Ali SamarNoch keine Bewertungen

- Analisis FinancieroDokument124 SeitenAnalisis FinancieroJesús VelázquezNoch keine Bewertungen

- BA 115 HomeworkDokument4 SeitenBA 115 HomeworkDindee GutierrezNoch keine Bewertungen

- CBM RatioDokument9 SeitenCBM RatioImran HossainNoch keine Bewertungen

- 2019-09-21T174353.577Dokument4 Seiten2019-09-21T174353.577Mikey MadRat100% (1)

- RatioDokument11 SeitenRatioAnant BothraNoch keine Bewertungen

- SAPMDokument3 SeitenSAPMAbhishek katkarNoch keine Bewertungen

- Ratio Analysis: Profitability RatiosDokument5 SeitenRatio Analysis: Profitability RatiosATANU ROYCHOUDHURYNoch keine Bewertungen

- Marriott-Corporation - HBR CaseDokument4 SeitenMarriott-Corporation - HBR CaseAsif RahmanNoch keine Bewertungen

- BANK3011 Workshop Week 4 SolutionsDokument5 SeitenBANK3011 Workshop Week 4 SolutionsZahraaNoch keine Bewertungen

- FM 2 Real Project 2Dokument12 SeitenFM 2 Real Project 2Shannan Richards100% (1)

- GGP Final2010Dokument23 SeitenGGP Final2010Frank ParkerNoch keine Bewertungen

- Key Operating Financial DataDokument1 SeiteKey Operating Financial DataShbxbs dbvdhsNoch keine Bewertungen

- Financial Ratios Analysis OF ONGC (2005-09) : Submitted To:-Mrs - Smita SahooDokument10 SeitenFinancial Ratios Analysis OF ONGC (2005-09) : Submitted To:-Mrs - Smita Sahoobinga35Noch keine Bewertungen

- Books-a-Million Investment AnalysisDokument4 SeitenBooks-a-Million Investment AnalysisdkrauzaNoch keine Bewertungen

- Arcadia - Syndicate 9Dokument6 SeitenArcadia - Syndicate 9Uus FirdausNoch keine Bewertungen

- Equity Valuation Report - Corticeira AmorimDokument3 SeitenEquity Valuation Report - Corticeira AmorimFEPFinanceClubNoch keine Bewertungen

- Stryker Corporation - Assignment 22 March 17Dokument4 SeitenStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- BF AssignmentDokument13 SeitenBF AssignmentMomina waseemNoch keine Bewertungen

- Investment Banking Assignment by MadihaDokument3 SeitenInvestment Banking Assignment by MadihamadihaNoch keine Bewertungen

- 31 RatiosDokument9 Seiten31 RatiosMd. Shazedul islamNoch keine Bewertungen

- Retail Bakeries Financial Industry Analysis - SageworksDokument4 SeitenRetail Bakeries Financial Industry Analysis - SageworksMichael Enrique Pérez MoreiraNoch keine Bewertungen

- YPF SA EV/EBITDA NTM ratio significantly below peersDokument3 SeitenYPF SA EV/EBITDA NTM ratio significantly below peersIsra MachicadoNoch keine Bewertungen

- Conocophillips: Price, Consensus & SurpriseDokument1 SeiteConocophillips: Price, Consensus & Surprisederek_2010Noch keine Bewertungen

- Anandam CompanyDokument8 SeitenAnandam CompanyNarinderNoch keine Bewertungen

- Nba Advanced - Happy Hour Co - DCF Model v2Dokument10 SeitenNba Advanced - Happy Hour Co - DCF Model v2Siddhant AggarwalNoch keine Bewertungen

- Capital Structure Changes and Duration AnalysisDokument9 SeitenCapital Structure Changes and Duration AnalysisKinNoch keine Bewertungen

- Daktronics Analysis 1Dokument27 SeitenDaktronics Analysis 1Shannan Richards100% (3)

- Corporate Finance Corporate Finance: 2020-22 - By: Purvi Jain JSW Steel Ltd. JSW Steel LTDDokument11 SeitenCorporate Finance Corporate Finance: 2020-22 - By: Purvi Jain JSW Steel Ltd. JSW Steel LTDpurvi jainNoch keine Bewertungen

- LBO - UncompletedDokument10 SeitenLBO - UncompletedRachel TangNoch keine Bewertungen

- Q3 - Analysis and Discussion (Ratios)Dokument7 SeitenQ3 - Analysis and Discussion (Ratios)hannahudNoch keine Bewertungen

- Schaum's Outline of Basic Business Mathematics, 2edVon EverandSchaum's Outline of Basic Business Mathematics, 2edBewertung: 5 von 5 Sternen5/5 (1)

- SBI Statement 1.11 - 09.12Dokument2 SeitenSBI Statement 1.11 - 09.12Manju GNoch keine Bewertungen

- DDMP - DRT CaseDokument29 SeitenDDMP - DRT CaseankitgrewalNoch keine Bewertungen

- IPO Fact Sheet - Accordia Golf Trust 140723Dokument4 SeitenIPO Fact Sheet - Accordia Golf Trust 140723Invest StockNoch keine Bewertungen

- Transfer by Trustees To Beneficiary: Form No. 4Dokument1 SeiteTransfer by Trustees To Beneficiary: Form No. 4Sudeep SharmaNoch keine Bewertungen

- Regional Planning Techniques PDFDokument131 SeitenRegional Planning Techniques PDFRicha Sagarika0% (1)

- Pay - Slip Oct. & Nov. 19Dokument1 SeitePay - Slip Oct. & Nov. 19Atul Kumar MishraNoch keine Bewertungen

- Lead Dev Talk (Fork) PDFDokument45 SeitenLead Dev Talk (Fork) PDFyosiamanurunNoch keine Bewertungen

- 5d7344794eaa11567835257 1037739Dokument464 Seiten5d7344794eaa11567835257 1037739prabhakaran arumugamNoch keine Bewertungen

- Taxes are the Lifeblood of GovernmentDokument23 SeitenTaxes are the Lifeblood of GovernmentVikki AmorioNoch keine Bewertungen

- Social Science Class Viii WORKSHEET-1-Map WorkDokument2 SeitenSocial Science Class Viii WORKSHEET-1-Map WorkChahal JainNoch keine Bewertungen

- Service Operations As A Secret WeaponDokument6 SeitenService Operations As A Secret Weaponclaudio alanizNoch keine Bewertungen

- Coal Bottom Ash As Sand Replacement in ConcreteDokument9 SeitenCoal Bottom Ash As Sand Replacement in ConcretexxqNoch keine Bewertungen

- Introduction to Study of Textile OrganizationDokument48 SeitenIntroduction to Study of Textile OrganizationShyam C ANoch keine Bewertungen

- Digital Duplicator DX 2430 Offers High-Speed PrintingDokument2 SeitenDigital Duplicator DX 2430 Offers High-Speed PrintingFranzNoch keine Bewertungen

- Market Structure and Game Theory (Part 4)Dokument7 SeitenMarket Structure and Game Theory (Part 4)Srijita GhoshNoch keine Bewertungen

- Capital Budgeting Project Instruction RubricDokument3 SeitenCapital Budgeting Project Instruction RubricSunil Kumar0% (1)

- CMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementDokument10 SeitenCMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementCharusat UniversityNoch keine Bewertungen

- CRM ProcessDokument9 SeitenCRM ProcesssamridhdhawanNoch keine Bewertungen

- Cbo Score of The Aca - FinalDokument364 SeitenCbo Score of The Aca - FinalruttegurNoch keine Bewertungen

- Cold Chain Infrastructure in IndiaDokument17 SeitenCold Chain Infrastructure in Indiainammurad12Noch keine Bewertungen

- In The Books of Nil Kamal Ltd. Particulars 2012 2013 Change % ChangeDokument21 SeitenIn The Books of Nil Kamal Ltd. Particulars 2012 2013 Change % ChangeRaj KamaniNoch keine Bewertungen

- Measuring and Valuing Intangible AssetsDokument52 SeitenMeasuring and Valuing Intangible AssetsFilip Juncu100% (1)

- Basel III: Bank Regulation and StandardsDokument13 SeitenBasel III: Bank Regulation and Standardskirtan patelNoch keine Bewertungen

- Chapter 21 AppDokument2 SeitenChapter 21 AppMaria TeresaNoch keine Bewertungen

- Investment Opportunities in Bosnia and Herzegovina 2016Dokument69 SeitenInvestment Opportunities in Bosnia and Herzegovina 2016Elvir Harun Ibrovic100% (1)

- Activity 2 Applied Economics March 12 2024Dokument1 SeiteActivity 2 Applied Economics March 12 2024nadinebayransamonte02Noch keine Bewertungen

- AssignmentDokument8 SeitenAssignmentnaabbasiNoch keine Bewertungen

- Difference Between EPF GPF & PPFDokument3 SeitenDifference Between EPF GPF & PPFSrikanth VsrNoch keine Bewertungen

- Global Hotels and ResortsDokument32 SeitenGlobal Hotels and Resortsgkinvestment0% (1)

- The Communistic Societies of The United StatesFrom Personal Visit and Observation by Nordhoff, Charles, 1830-1901Dokument263 SeitenThe Communistic Societies of The United StatesFrom Personal Visit and Observation by Nordhoff, Charles, 1830-1901Gutenberg.org100% (2)