Beruflich Dokumente

Kultur Dokumente

Expense Reimbursement Policies

Hochgeladen von

api-239704145Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Expense Reimbursement Policies

Hochgeladen von

api-239704145Copyright:

Verfügbare Formate

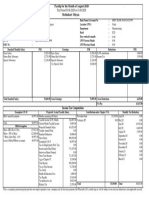

El Dorado Union High School District Faculty Association

Membership Expense Reimbursement Policies

The rules governing the control for necessary expenses for members on Association business as authorized by the

EDUHSDFA Executive Board are as follows:

1. Transportation - Requires advanced approval from the Executive Board

a. Plane: Actual, most economical coach fare (attach receipt)

b. Train, Bus, Tax/Uber/Lyft: Actual fare (attach receipt)

c. Auto:

i. Standard IRS Business Mileage Rate

ii. Mileage reimbursement will be calculated using the shortest highway route

iii. Mileage reimbursement cannot exceed the cost of coach plane fare

iv. Toll roads and bridges reimbursed at actual cost

d. Parking: Actual costs excluding valet parking (attach receipt)

2. Lodging - Requires advanced approval from the Executive Board (attach statement)

a. CTA/NEA Conferences - Half the cost of a double-occupancy hotel room. Those wishing a single room

must pay the difference except for extenuating circumstances which must be approved in advance.

b. Other travel or conference - Cost of a standard hotel room.

c. If travel by auto results in an extra night hotel room, such charge is not reimbursable.

d. Personal charges such as laundry, personal telephone calls, snacks, movies, and entertainment are not

reimbursable.

3. Meals (attach receipts)

a. Reimbursement is not allowed when a meal is provided by the local, Service Center Council, CTA or

NEA.

b. Individual meal limit is $40 including tax and tip.

c. Actual amounts paid in including tax and tip not to exceed $80.00 per any one day.

d. Receipts are required for all meal reimbursements of $10.00 or more.

e. Meals are defined as breakfast, lunch and dinner (includes beverage, dessert, tax and tip)

f. Maximum tip reimbursable percentage is 18%

g. Extra meals required by auto travel are not reimbursable

4. Other Reimbursements - Requires advanced approval from the Executive Board (attach statement)

a. Conference registration

b. Membership promotion activities

c. Meeting expenses

d. Bargaining expenses

e. Gifts

5. Deadline for filing expense report

All expense reimbursements must be filed within thirty (30) days of the end of the month in which the expenses

were incurred. An additional thirty (30) day period may be granted by the Executive Board for extenuating

circumstances set forth is an attached letter to the expense reimbursement.

No submissions will be approved older than twelve months without the approval of the Executive Board on an

exception basis due to extenuating circumstances.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Confirmation Hotel ParisDokument2 SeitenConfirmation Hotel ParisByn TranNoch keine Bewertungen

- August 2019 Pres Letter 1Dokument2 SeitenAugust 2019 Pres Letter 1api-239704145Noch keine Bewertungen

- Eduhsdfa Exec Board Meeting Minutes 3-1-19Dokument1 SeiteEduhsdfa Exec Board Meeting Minutes 3-1-19api-239704145Noch keine Bewertungen

- Eduhsdfa Rep Council Meeting Minutes 3-4-19Dokument2 SeitenEduhsdfa Rep Council Meeting Minutes 3-4-19api-239704145Noch keine Bewertungen

- Eduhsdfa Rep Council Meeting Minutes 1-7-19Dokument2 SeitenEduhsdfa Rep Council Meeting Minutes 1-7-19api-239704145Noch keine Bewertungen

- Eduhsdfa Rep Council Meeting Minutes 2-11-19Dokument2 SeitenEduhsdfa Rep Council Meeting Minutes 2-11-19api-239704145Noch keine Bewertungen

- Eduhsdfa Meeting Minutes 11-6-18Dokument2 SeitenEduhsdfa Meeting Minutes 11-6-18api-239704145Noch keine Bewertungen

- Eduhsdfa Meeting Minutes 12-4-18Dokument2 SeitenEduhsdfa Meeting Minutes 12-4-18api-239704145Noch keine Bewertungen

- Eduhsdfa Meeting Minutes 8-21-18Dokument2 SeitenEduhsdfa Meeting Minutes 8-21-18api-239704145Noch keine Bewertungen

- Eduhsdfa Meeting Minutes 8-7-18Dokument2 SeitenEduhsdfa Meeting Minutes 8-7-18api-239704145Noch keine Bewertungen

- Eduhsdfa Meeting Minutes 5-21-18Dokument1 SeiteEduhsdfa Meeting Minutes 5-21-18api-239704145Noch keine Bewertungen

- Eduhsdfa General Meeting Minutes 5-1-18Dokument3 SeitenEduhsdfa General Meeting Minutes 5-1-18api-239704145Noch keine Bewertungen

- Non-Vessel Operating Common Carrier Extensive Network: About C.H. Robbinson - Courier and Logistics ServicesDokument11 SeitenNon-Vessel Operating Common Carrier Extensive Network: About C.H. Robbinson - Courier and Logistics Servicesmike mNoch keine Bewertungen

- Íz@3 È8Â BARANGAYÂGUADALUP Jan C Ç/Â!!5qÎ Barangay Guadalupe Cebu City SK OfficeDokument2 SeitenÍz@3 È8Â BARANGAYÂGUADALUP Jan C Ç/Â!!5qÎ Barangay Guadalupe Cebu City SK OfficeRodelLaborNoch keine Bewertungen

- Sustainable Transportation: An Direction StrategyDokument58 SeitenSustainable Transportation: An Direction StrategymfaizaNoch keine Bewertungen

- Airtel BillDokument8 SeitenAirtel BillSaleem KhanNoch keine Bewertungen

- Order Details: Your Order Number Is: RBLSH1401779Dokument1 SeiteOrder Details: Your Order Number Is: RBLSH1401779Satish PavuluriNoch keine Bewertungen

- 6. Participants Information List - 結算用Dokument91 Seiten6. Participants Information List - 結算用Jigisha Vasa100% (1)

- PsDokument1 SeitePsCarrie EvansNoch keine Bewertungen

- Receipt: Customer Details: INVOICE NUMBER: C11067 / 2021 / 247Dokument1 SeiteReceipt: Customer Details: INVOICE NUMBER: C11067 / 2021 / 247Mirella DánielNoch keine Bewertungen

- Ansbacher Cayman Report Appendix 5Dokument434 SeitenAnsbacher Cayman Report Appendix 5thestorydotieNoch keine Bewertungen

- Oct-22 302020Dokument8 SeitenOct-22 302020itsyour vinESNoch keine Bewertungen

- Value Chain Analysis OF: Presented BY: Arpan, Bishnu Monica Subhashre KalyanDokument21 SeitenValue Chain Analysis OF: Presented BY: Arpan, Bishnu Monica Subhashre KalyanSHIVANSHUNoch keine Bewertungen

- BillDokument2 SeitenBillBilal SalimNoch keine Bewertungen

- Prob QuestionsDokument108 SeitenProb QuestionsAntaripaBhuyanNoch keine Bewertungen

- Emailreceipt 20211027R3865847169Dokument3 SeitenEmailreceipt 20211027R3865847169Milica BrankovićNoch keine Bewertungen

- Lecture 04 - Transport Mode Selection and Logistics Decisions PDFDokument55 SeitenLecture 04 - Transport Mode Selection and Logistics Decisions PDFEsteban ValdebenitoNoch keine Bewertungen

- Allianz General Insurance Company (Malaysia) BerhadDokument6 SeitenAllianz General Insurance Company (Malaysia) BerhadSiti Nurazlin FariddunNoch keine Bewertungen

- Types of CheckDokument2 SeitenTypes of CheckRoberto UbosNoch keine Bewertungen

- To More Efficiently Manage Its Inventory, Treynor Corporation Maintains Its Internal Inventory RecordsDokument3 SeitenTo More Efficiently Manage Its Inventory, Treynor Corporation Maintains Its Internal Inventory Recordslaale dijaanNoch keine Bewertungen

- Auditing Expenditure CycleDokument7 SeitenAuditing Expenditure CycleHannaj May De GuzmanNoch keine Bewertungen

- Booking 711000016071Dokument1 SeiteBooking 711000016071CAROLINA CORTESNoch keine Bewertungen

- Jio 4G Prepaid Plans - Redeem 50 Voucher On MyJio AppDokument1 SeiteJio 4G Prepaid Plans - Redeem 50 Voucher On MyJio AppElango GopalNoch keine Bewertungen

- Reimbursement Expense Receipt: Entity Name: CABUNGAAN ES Fund Cluster: - Date: July 12, 2018 RER No.: 5Dokument3 SeitenReimbursement Expense Receipt: Entity Name: CABUNGAAN ES Fund Cluster: - Date: July 12, 2018 RER No.: 5Mechille Seriño RoqueNoch keine Bewertungen

- Ref - No. 4857458-15788895-3: Sharafat AliDokument4 SeitenRef - No. 4857458-15788895-3: Sharafat AliYash RajpalNoch keine Bewertungen

- 2D46D407Dokument1 Seite2D46D407Dhyan MothukuriNoch keine Bewertungen

- SAP SD Consignment Sales Process.Dokument2 SeitenSAP SD Consignment Sales Process.praveennbsNoch keine Bewertungen

- 2022 ItrDokument9 Seiten2022 Itrjoel.henderson3Noch keine Bewertungen

- Consolidation Warehousing 2Dokument25 SeitenConsolidation Warehousing 2sanjeev kumarNoch keine Bewertungen

- Southern University BangladeshDokument1 SeiteSouthern University BangladeshRaihanNoch keine Bewertungen

- CV - Caroline YohanaDokument1 SeiteCV - Caroline YohanaCaroline YohanaNoch keine Bewertungen