Beruflich Dokumente

Kultur Dokumente

Halaman 470 (P9-3B)

Hochgeladen von

anon_21838122Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Halaman 470 (P9-3B)

Hochgeladen von

anon_21838122Copyright:

Verfügbare Formate

Forum Accounting

Fiona Avangeline Jonathan / 2201735464

Halaman 470 (P9-3B)

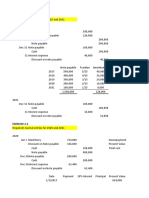

A.

1.

Factory Machinery

Cash price € 55.000

Sales taxes € 3.300

Shipping costs € 325

Insurance during shipping € 75

Installation and testing € 1.300

Cost at facto € 60.000

Journal:

Account Title Debit Credit

Equipment € 60.000 € 60.000

Cash

2.

Cost - Residual Value = Depreciable Cost

€ 60.000 - € 6.000 = € 54.000

Depreciable Cost / Useful Life (years) = Annual Depreciation Expense

€ 54.000 / 4 = € 13.500

Journal:

Account Title Debit Credit

Depreciation Expense € 13.500 € 13.500

Acc. Depreciation Equipment

B.

1. Cost - Residual Value = Depreciable Cost

€ 130.000 - € 10.000 = € 120.000

Depreciable Cost / Useful Life (years) = Annual Depreciation Expense

€ 120.000 / 5 = € 24.000

Forum Accounting

Fiona Avangeline Jonathan / 2201735464

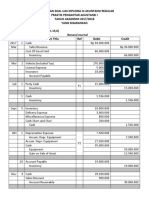

2.

Year Book Value Depreciation Annual End of Year

Beginning of Year Rate Depreciation

Expense Acc Dep Book

Value

2017 € 130.000 40% € 52.000 € 52.000 € 78.000

2018 € 78.000 40% € 31.200 € 83.200 € 46.800

2019 € 46.800 40% € 18.720 € 101.920 € 28.080

2020 € 28.080 40% € 11.232 € 113.152 € 16.848

2021 € 16.848 40% € 6.848 € 120.000 € 10.000

3. Depreciation Cost / Total Units of Activity = Depreciable Cost / unit

€ 120.000 / 24.000 = € 5 / unit

Year Units of Activity Depreciation Annual End of Year

Cost / unit Depreciation

Expense Acc Dep Book

Value

2017 4.700 €5 € 23.500 € 23.500 € 106.500

2018 8.200 €5 € 41.000 € 64.500 € 65.500

2019 6.800 €5 € 34.000 € 98.500 € 31.500

2020 2.500 €5 € 12.500 € 111.000 € 19.000

2021 1.800 €5 € 9.000 € 120.000 € 10.000

C. The lowest amount of depreciation expense is in year 2017 shown from the units of activity method

reports. Declining balance method report shows the lowest amount of depreciable expense in year

2021. All 3 methods have the same total amount over the 5 years period.

Halaman 471 (P9-5B)

A.

Date Account Title Debit Credit

March 1 Land 1.350.000

Cash 1.350.000

April 1 Depreciation Expense 248.000

Acc. Depreciation Equipment 178.500

Land 420.000

Gain on Disposal of Plant Assets 6.500

June 1 Cash 1.000.000

Land 310.000

Gain on Disposal of Plant Assets 690.000

October 1 Equipment 1.260.000

Cash 1.260.000

Forum Accounting

Fiona Avangeline Jonathan / 2201735464

December 1 Depreciation Expense 30.000

Acc. Depreciation Equipment 30.000

Acc. Depreciation Equipment 300.000

Equipment 300.000

B.

December 1 Depreciation expense 570.000

Acc. Depreciation buildings

570.000

December 31 Depreciation expense 2.959.500

Acc. Depreciation equipment

2.959.500

Land

Balance 2.000.000 June 1| 1.310.000

March 1| 1.350.000

Balance 3.040.000

Buildings

Balance 28.500.000

Balance 28.500.000

Acc. Depeciation buildings

Balance 12.100.000

December 31 adj. | 570.000

Balance 12.670.000

Equipment

Bal. 30.000.000 April 1 | 420.000

October 1 | 1.260.000 December 31 | 300.000

Balance 30.540.000

Forum Accounting

Fiona Avangeline Jonathan / 2201735464

Acc. Depreciation equipment

April 1 |178.500 Balance 4.000.000

December 31 | 300.000 April 1 | 10.500

December 31 | 30.000

December 31 adj | 2.959.000

Balance 6.521.500

C.

Durango Ltd.

Partial Statement of Financial Position

December 31, 2017

_________________________________________________________________________________

Plant Assets

Land € 3.040.000

Buildings € 28.500.000

Less: Acc. Dep. Buildings € 12.670.000

€ 15.830.000

Equipment € 30.540.000

Less: Acc. Dep. Equipment € 6.521.500

€ 24.018.500

___________

Total Plant Assets € 42.888.500

Das könnte Ihnen auch gefallen

- Accounting-Formats For Cambridge IGCSEDokument11 SeitenAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (8)

- Home Office ExampleDokument5 SeitenHome Office ExampleGwenn VillamorNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Chapter 9Dokument10 SeitenChapter 9Kanton FernandezNoch keine Bewertungen

- Posting Transactions to the General LedgerDokument19 SeitenPosting Transactions to the General Ledgerdanica gomez88% (8)

- Pup-Ppe5-Src 2-1Dokument15 SeitenPup-Ppe5-Src 2-1Jerome BaluseroNoch keine Bewertungen

- What Is AuditDokument12 SeitenWhat Is Auditzahid_497Noch keine Bewertungen

- FAR Problem Quiz 1 SolDokument3 SeitenFAR Problem Quiz 1 SolEdnalyn CruzNoch keine Bewertungen

- Intermediate Accounting Volume 3 ValixDokument12 SeitenIntermediate Accounting Volume 3 ValixVyonne Ariane Ediong0% (1)

- Afar 01 P'ship Formation QuizDokument3 SeitenAfar 01 P'ship Formation QuizJohn Laurence Loplop0% (1)

- Depreciation Expense - Asset A 3,900Dokument4 SeitenDepreciation Expense - Asset A 3,900ZeeNoch keine Bewertungen

- Accountancy Project On Trial BalanceDokument13 SeitenAccountancy Project On Trial BalanceBiplab Swain67% (3)

- Tugas Sesi 5Dokument5 SeitenTugas Sesi 5mutmainnahNoch keine Bewertungen

- Syllabus in Accounting Information SystemDokument10 SeitenSyllabus in Accounting Information SystemChristine LealNoch keine Bewertungen

- Jimenez Enterprises journal entries and financial statementsDokument9 SeitenJimenez Enterprises journal entries and financial statementshelmyNoch keine Bewertungen

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDokument5 SeitenExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNoch keine Bewertungen

- Pengakun CH 09Dokument10 SeitenPengakun CH 09nadia salsabilaNoch keine Bewertungen

- Sesi 11 & 12 SharedDokument28 SeitenSesi 11 & 12 SharedDian Permata SariNoch keine Bewertungen

- Ia2 SolisveronicaDokument6 SeitenIa2 SolisveronicaElizabeth SaleNoch keine Bewertungen

- Less - Cash PaymentDokument16 SeitenLess - Cash PaymentEsanka FernandoNoch keine Bewertungen

- Key To Corrections - LEVEL 2 MODULE 7Dokument9 SeitenKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNoch keine Bewertungen

- Answers For Master BudgetDokument2 SeitenAnswers For Master BudgetEtana WirtuNoch keine Bewertungen

- PPE1&2Dokument3 SeitenPPE1&2Kailah CalinogNoch keine Bewertungen

- Tugas Kelompok 3 Intermediate Accounting IDokument9 SeitenTugas Kelompok 3 Intermediate Accounting IEvelyn Purnama SariNoch keine Bewertungen

- Adjustment journal entries explainedDokument4 SeitenAdjustment journal entries explainedchristian ferryNoch keine Bewertungen

- Chapter 9-1Dokument5 SeitenChapter 9-1jou20220354Noch keine Bewertungen

- IA3 Chapter 14 Problem 31Dokument3 SeitenIA3 Chapter 14 Problem 31Bea TumulakNoch keine Bewertungen

- Geme CostDokument6 SeitenGeme CostBiruk Chuchu NigusuNoch keine Bewertungen

- Depreciation Methods and CalculationsDokument5 SeitenDepreciation Methods and CalculationsAvox EverdeenNoch keine Bewertungen

- Exercise AKM Chapter 3 Kelompok 2Dokument34 SeitenExercise AKM Chapter 3 Kelompok 2RizalMawardiNoch keine Bewertungen

- Preparation of Financial StatementsDokument13 SeitenPreparation of Financial StatementsSharina Mhyca SamonteNoch keine Bewertungen

- Auditing Practice Problem 5Dokument2 SeitenAuditing Practice Problem 5Maria Fe FerrarizNoch keine Bewertungen

- Zoom SlidesDokument10 SeitenZoom SlidesTuấn Kiệt NguyễnNoch keine Bewertungen

- Flynn Design AgencyDokument4 SeitenFlynn Design Agencycalsey azzahraNoch keine Bewertungen

- Latihan - Aset Tidak Berwujud-JAWABDokument7 SeitenLatihan - Aset Tidak Berwujud-JAWABAndreas HottoNoch keine Bewertungen

- Practice Tests Government Grant EtcDokument10 SeitenPractice Tests Government Grant EtcgnlynNoch keine Bewertungen

- Solution Case 1Dokument2 SeitenSolution Case 1Ario LintangNoch keine Bewertungen

- Intermediate Accounting 3 Activity 2 ProblemsDokument4 SeitenIntermediate Accounting 3 Activity 2 ProblemsLars FriasNoch keine Bewertungen

- Group Assignment On Fundamentals of Accounting IDokument6 SeitenGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNoch keine Bewertungen

- TK3 IntermediateAccountingI Kelompok5Dokument9 SeitenTK3 IntermediateAccountingI Kelompok5ali akbarNoch keine Bewertungen

- Q7 Mguni LimitedDokument2 SeitenQ7 Mguni Limitedamosmalusi5Noch keine Bewertungen

- ACCO20093Dokument7 SeitenACCO20093jfcNoch keine Bewertungen

- Sample Problems Cash Flow AnalysisDokument2 SeitenSample Problems Cash Flow AnalysisTeresa AlbertoNoch keine Bewertungen

- Frias Activity 6Dokument6 SeitenFrias Activity 6Lars FriasNoch keine Bewertungen

- CPA Financial Accounting Exam PrepDokument10 SeitenCPA Financial Accounting Exam PrepTuryamureeba JuliusNoch keine Bewertungen

- Task AccountingDokument2 SeitenTask AccountingQudsia BanoNoch keine Bewertungen

- 1st QTR PETA - 2021 - New 1Dokument12 Seiten1st QTR PETA - 2021 - New 1FranceeNoch keine Bewertungen

- Case 10 CLAUS StatementDokument6 SeitenCase 10 CLAUS StatementClaudia AgüeraNoch keine Bewertungen

- Individual Assignmen1Dokument8 SeitenIndividual Assignmen1Nguyen Ha Phuong (K16HL)Noch keine Bewertungen

- Case 1-Mano Sa: Additional InformationDokument17 SeitenCase 1-Mano Sa: Additional InformationDavid MajánNoch keine Bewertungen

- Financial StatementsDokument4 SeitenFinancial StatementsLana Lei Delos SantosNoch keine Bewertungen

- Marcelo Transport ServicesDokument3 SeitenMarcelo Transport ServicessyraNoch keine Bewertungen

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDokument2 SeitenOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123Noch keine Bewertungen

- Rab WinshoesDokument7 SeitenRab WinshoesRatri Devy ArimbiNoch keine Bewertungen

- Assignment On TaxationDokument2 SeitenAssignment On TaxationKal KalNoch keine Bewertungen

- Projections TemplateDokument4 SeitenProjections TemplateAlfonso Coke ResellerNoch keine Bewertungen

- Batch 18 1st Preboard (P1)Dokument14 SeitenBatch 18 1st Preboard (P1)Jericho PedragosaNoch keine Bewertungen

- M3 - Tugas Akuntansi Keuangan Menengah 1A - 1B - Salma Putri RDokument9 SeitenM3 - Tugas Akuntansi Keuangan Menengah 1A - 1B - Salma Putri Rrully movizarNoch keine Bewertungen

- Chapter 4 Best Master Budget IllustrationDokument23 SeitenChapter 4 Best Master Budget IllustrationLeykun GizealemNoch keine Bewertungen

- Computation For Exercise 1Dokument10 SeitenComputation For Exercise 1Xyzra AlfonsoNoch keine Bewertungen

- AC3202 WK2 Exercises SolutionsDokument11 SeitenAC3202 WK2 Exercises SolutionsLong LongNoch keine Bewertungen

- DUAZO - 6th EXAM SIM ANSWERSDokument7 SeitenDUAZO - 6th EXAM SIM ANSWERSJeric TorionNoch keine Bewertungen

- Kunjaw UasDokument11 SeitenKunjaw UasIvan Katibul FaiziNoch keine Bewertungen

- Assignment On LCNRV and GP MethodDokument6 SeitenAssignment On LCNRV and GP MethodAdam CuencaNoch keine Bewertungen

- Yellow Jack Corporation Depreciation Schedule & RatesDokument57 SeitenYellow Jack Corporation Depreciation Schedule & RatesLorraineMartinNoch keine Bewertungen

- Republic Central Colleges Angeles City Prelim QuizDokument3 SeitenRepublic Central Colleges Angeles City Prelim QuizPaupauNoch keine Bewertungen

- Re Engineering Accounting EducationDokument13 SeitenRe Engineering Accounting EducationHafsat IbrahimNoch keine Bewertungen

- Ali CV PDFDokument2 SeitenAli CV PDFAbdelrahman ElkhollyNoch keine Bewertungen

- Saraiva Livreiros S.A. - Under Judicial Reorganization (Formerly "Saraiva S.A. Livreiros Editores")Dokument73 SeitenSaraiva Livreiros S.A. - Under Judicial Reorganization (Formerly "Saraiva S.A. Livreiros Editores")Mizael RobertoNoch keine Bewertungen

- Accounting The Purpose of Accounting: Michał Suchanek Keifpt, University of GdańskDokument38 SeitenAccounting The Purpose of Accounting: Michał Suchanek Keifpt, University of GdańskMercio AdozilioNoch keine Bewertungen

- Financial Accounting: Advantages and Disadvantages of Accounting Measurement (Dokument4 SeitenFinancial Accounting: Advantages and Disadvantages of Accounting Measurement (Mhmood Al-saadNoch keine Bewertungen

- Ifrs 13 Fair Value MeasurementDokument9 SeitenIfrs 13 Fair Value Measurementapi-292644739Noch keine Bewertungen

- System of Financial Control and Budgeting in PakistanDokument47 SeitenSystem of Financial Control and Budgeting in Pakistanjamilkiani70% (10)

- Chapter 4Dokument36 SeitenChapter 4WilliamNoch keine Bewertungen

- Auditing and Attestation Content Specification OutlineDokument5 SeitenAuditing and Attestation Content Specification OutlineLisa GoldmanNoch keine Bewertungen

- AssignmentDokument6 SeitenAssignmentmohammad bilalNoch keine Bewertungen

- Advanced Financial Accounting Reporting Part 2Dokument20 SeitenAdvanced Financial Accounting Reporting Part 2Jamie Rose AragonesNoch keine Bewertungen

- Mind Map 1Dokument1 SeiteMind Map 1darylle roblesNoch keine Bewertungen

- Annual Report 2011: Riverview Rubber Estates 73rd AGMDokument111 SeitenAnnual Report 2011: Riverview Rubber Estates 73rd AGMJames Warren0% (1)

- Bank Reconciliation AprilDokument3 SeitenBank Reconciliation AprilAnonymous FAlrXF100% (1)

- Ce Toa 13-14Dokument17 SeitenCe Toa 13-14shudayeNoch keine Bewertungen

- The Financial Statement Auditing Environment: © 2017 Mcgraw-Hill Education (Malaysia) SDN BHDDokument30 SeitenThe Financial Statement Auditing Environment: © 2017 Mcgraw-Hill Education (Malaysia) SDN BHDSarannyaRajendraNoch keine Bewertungen

- 5th Sem I Unit Auditing PPT 1.pdf334Dokument26 Seiten5th Sem I Unit Auditing PPT 1.pdf334Asad RNoch keine Bewertungen

- Answer Key: Chapter 19 Additional Assurance Services: Historical Financial InformationDokument21 SeitenAnswer Key: Chapter 19 Additional Assurance Services: Historical Financial InformationAira Jaimee GonzalesNoch keine Bewertungen

- Experienced Finance Professional with 21+ Years in Accounting and Financial ManagementDokument3 SeitenExperienced Finance Professional with 21+ Years in Accounting and Financial ManagementSTC QatarNoch keine Bewertungen

- Capital Budgeting Solution1Dokument100 SeitenCapital Budgeting Solution1MBaralNoch keine Bewertungen

- Fs Squash CookiesDokument10 SeitenFs Squash CookiesDanah Jane GarciaNoch keine Bewertungen

- BKAN1013 Chapter 2Dokument70 SeitenBKAN1013 Chapter 2Halinnie SueNoch keine Bewertungen

- Muhammed Abul Kalam CV LatestDokument1 SeiteMuhammed Abul Kalam CV LatestSami AzadNoch keine Bewertungen