Beruflich Dokumente

Kultur Dokumente

U01a1 Problem 1-9B Part 1

Hochgeladen von

Mikayla Sanchez0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

122 Ansichten4 Seiten1) The document presents the financial statements for Rivera Roofing Company for the month of July: an income statement, statement of retained earnings, balance sheet, and statement of cash flows.

2) Net income for the month was $18,245. Retained earnings increased to $16,445.

3) Cash provided by operating activities was $12,645, while cash used by investing activities was $3,300. Cash provided by financing activities was $78,200.

4) If the $5,000 purchase of equipment on July 3 was financed through an owner investment instead, total assets would increase to $104,545, total liabilities would increase to $3,100,

Originalbeschreibung:

BUS4060 Unit 1 Assignment 1 Capella University 2019

Originaltitel

U01A1 M.sanchez

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden1) The document presents the financial statements for Rivera Roofing Company for the month of July: an income statement, statement of retained earnings, balance sheet, and statement of cash flows.

2) Net income for the month was $18,245. Retained earnings increased to $16,445.

3) Cash provided by operating activities was $12,645, while cash used by investing activities was $3,300. Cash provided by financing activities was $78,200.

4) If the $5,000 purchase of equipment on July 3 was financed through an owner investment instead, total assets would increase to $104,545, total liabilities would increase to $3,100,

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

122 Ansichten4 SeitenU01a1 Problem 1-9B Part 1

Hochgeladen von

Mikayla Sanchez1) The document presents the financial statements for Rivera Roofing Company for the month of July: an income statement, statement of retained earnings, balance sheet, and statement of cash flows.

2) Net income for the month was $18,245. Retained earnings increased to $16,445.

3) Cash provided by operating activities was $12,645, while cash used by investing activities was $3,300. Cash provided by financing activities was $78,200.

4) If the $5,000 purchase of equipment on July 3 was financed through an owner investment instead, total assets would increase to $104,545, total liabilities would increase to $3,100,

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

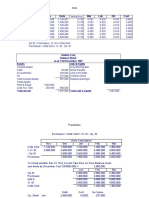

u01a1 Problem 1-9B Part 1

Assets = Liabilities + Equity

Accounts Office Office Electrical Accounts Common

Date Cash + +

Receivable Supplies

+

Equipment

+

Equipment

=

Payable

+

Stock

- Dividends + Revenues - Expenses

July 1 $80,000 = $80,000

2 -$700 - $700

Bal. 79,300 = 80,000 - 700

3 -$1,000 + $5,000 +$4,000

Bal. 78,300 5,000 = 4,000 + 80,000 - 700

6 -$600 + $600

Bal. 77,700 + 600 + 5,000 = 4,000 + 80,000 - 700

8 +$7,600 + $7,600

Bal. 85,300 600 5,000 = 4,000 + 80,000 + 7,600 - 700

10 + $2,300 +2,300

Bal. 85,300 600 + 2,300 + 5,000 = 6,300 + 80,000 + 7,600 - 700

15 + $8,200 + $8,200

Bal. 85,300 + 8,200 + 600 + 2,300 + 5,000 = 6,300 + 80,000 + 15,800 - 700

17 + $3,100 +$3,100

Bal. 85,300 + 8,200 + 3,700 + 2,300 + 5,000 = 9,400 + 80,000 + 15,800 - 700

23 -$2,300 + -$2,300

Bal. 83,000 + 8,200 + 3,700 + 2,300 + 5,000 = 7,100 + 80,000 + 15,800 - 700

25 + $5,000 + $5,000

Bal. 83,000 + 13,200 + 3,700 + 2,300 + 5,000 = 7,100 + 80,000 + 20,800 - 700

28 +$8,200 - $8,200

Bal. 91,200 + 5,000 + 3,700 + 2,300 + 5,000 = 7,100 + 80,000 + 20,800 - 700

30 -$1,560 - $1,560

Bal. 89,640 + 5,000 + 3,700 + 2,300 + 5,000 = 7,100 + 80,000 + 20,800 - 2,260

31 -$295 - $295

Bal. 89,345 + 5,000 + 3,700 + 2,300 + 5,000 = 7,100 + 80,000 + 20,800 - 1,965

31 -$1,800 - $1,800

Bal. $87,545 + $5,000 + $3,700 + $2,300 + $5,000 = $7,100 + $80,000 - $1,800 + $20,800 - $2,555

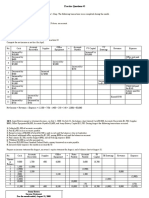

Problem 1-9B (Continued)

Part 2

Rivera Roofing Company

Income Statement

For Month Ended July 31

Revenues

Electrical fees earned ...................... 20,800

Expenses

Rent expense .................................... 700

Salaries expense .............................. +1,560

Utilities expense .............................. +295

Total expenses ................................. 2,555

Net income .................................................. ($20,800 - $2,555)=$18,245

Rivera Roofing Company

Statement of Retained Earnings

For Month Ended July 31

Retained earnings, July 1 .......................... 0

Add: Net income...................................... 18,245

Less: Dividends ........................................ -1,800

Retained earnings, July 31... ..................... $16,445

Rivera Roofing Company

Balance Sheet

July 31

Assets Liabilities

Cash ................................. 87,545 Accounts payable .................... 7,100

Accounts receivable ...... -5,000 Equity

Office supplies ................ -3,700 Common stock ........................ 80,000

Office equipment ............ -2,300 Retained earnings ................... +16,445

Electrical equipment ...... -5,000 Total equity .............................. $96,445

Total assets ..................... $103,545 Total liabilities and equity ......

(7,100+96,445) = $103,545

Problem 1-9B (Concluded)

Part 3

Rivera Roofing Company

Statement of Cash Flows

For Month Ended July 31

Cash flows from operating activities

Cash received from customers .................................. 15,800

Cash paid for rent ........................................................ -700

Cash paid for supplies ................................................ -600

Cash paid for utilities .................................................. -295

Cash paid to employees ............................................. -1,560

Net cash provided by operating activities ................ $12,645

Cash flows from investing activities

Cash paid for office equipment .................................. 2,300

Cash paid for electrical equipment ............................ +1,000

Net cash used by investing activities ........................ $3,300

Cash flows from financing activities

Cash investment from shareholder ........................... 80,000

Cash dividend to shareholder .................................... -1,800

Net cash provided by financing activities ................. $78,200

Net increase in cash .................................................... 89,545

Cash balance, July 1 ................................................... -0.00

Cash balance, July 31 ................................................. $87,545

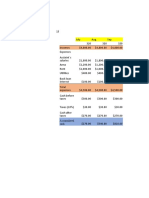

Part 4

Assume that the $5,000 purchase of roofing equipment on July 3 was

financed from an owner investment of another $5,000 cash in the business

in exchange for more common stock (instead of the purchase conditions

described in the transaction above). Compute the dollar effect of this

change on the month-end amounts for:

(a) Total Assets............ $104,545

(b) Total Liabilities....... $3,100

(c) Total Equity............ $101,445

WORK IS SHOWN BELOW WITH REVISED TRANSACTION ANALYSIS TO

COMPUTE THIS QUESTION

Assets = Liabilities + Equity

Accounts Office Office Electrical Accounts Common

Date Cash + +

Receivable Supplies

+

Equipment

+

Equipment

=

Payable

+

Stock

- Dividends + Revenues - Expenses

July 1 $80,000 = $80,000

2 -$700 - $700

Bal. 79,300 = 80,000 - 700

3 +$5,000 + $5,000

Bal. 84,300 0 = 0 + 85,000 - 700

6 -$600 + $600

Bal. 83,700 + 600 0 = 0 + 85,000 - 700

8 +$7,600 + $7,600

Bal. 91,300 600 0 = 0 + 85,000 + 7,600 - 700

10 + $2,300 +2,300

Bal. 91,300 600 + 2,300 + 0 = 2,300 + 85,000 + 7,600 - 700

15 + $8,200 + $8,200

Bal. 91,300 + 8,200 + 600 + 2,300 + 0 = 2,300 + 85,000 + 15,800 - 700

17 + $3,100 +$3,100

Bal. 91,300 + 8,200 + 3,700 + 2,300 + 0 = 5,400 + 85,000 + 15,800 - 700

23 -$2,300 + -$2,300

Bal. 89,000 + 8,200 + 3,700 + 2,300 + 0 = 3,100 + 85,000 + 15,800 - 700

25 + $5,000 + $5,000

Bal. 89,000 + 13,200 + 3,700 + 2,300 + 0 = 3,100 + 85,000 + 20,800 - 700

28 +$8,200 - $8,200

Bal. 97,200 + 5,000 + 3,700 + 2,300 + 0 = 3,100 + 85,000 + 20,800 - 700

30 -$1,560 - $1,560

Bal. 95,640 + 5,000 + 3,700 + 2,300 + 0 = 3,100 + 85,000 + 20,800 - 2,260

31 -$295 - $295

Bal. 95,345 + 5,000 + 3,700 + 2,300 + 0 = 3,100 + 85,000 + 20,800 - 1,965

31 -$1,800 - $1,800

Bal. $93,545 + $5,000 + $3,700 + $2,300 + $0 = $3,100 + $85,000 - $1,800 + $20,800 - $2,555

Das könnte Ihnen auch gefallen

- 1-m Mastery Problem IsDokument2 Seiten1-m Mastery Problem Isapi-33442031275% (4)

- Application Problems 1 Through 3Dokument5 SeitenApplication Problems 1 Through 3api-4072164490% (1)

- Course Code: Course Title: Submitted To Sahana Kabir Department of Business AdministratorDokument11 SeitenCourse Code: Course Title: Submitted To Sahana Kabir Department of Business AdministratorSaif UR RahmanNoch keine Bewertungen

- Homework 1 and Its SolutionsDokument5 SeitenHomework 1 and Its SolutionsBassam AlyeserNoch keine Bewertungen

- Chapter 1 Sample ProblemsDokument4 SeitenChapter 1 Sample ProblemsMesbaul RatulNoch keine Bewertungen

- Extra Applications - Accounting - Lecture Week 1 - Part 2Dokument3 SeitenExtra Applications - Accounting - Lecture Week 1 - Part 2soliman salmanNoch keine Bewertungen

- Department of Computer Science and Engineering: Green University of BangladeshDokument3 SeitenDepartment of Computer Science and Engineering: Green University of BangladeshAminul IslamNoch keine Bewertungen

- Assignment 1Dokument14 SeitenAssignment 1azimlitamellaNoch keine Bewertungen

- Ap10 1 23Dokument13 SeitenAp10 1 23hieuluu.31221023224Noch keine Bewertungen

- JW1.chp01-Net Income.2440126966-Julian Lukman SimbolonDokument3 SeitenJW1.chp01-Net Income.2440126966-Julian Lukman SimbolonJulian Lukman SimbolonNoch keine Bewertungen

- IIMK - FA - SectionB - Assignment 4Dokument4 SeitenIIMK - FA - SectionB - Assignment 4Jay PatelNoch keine Bewertungen

- P1-2A Lecture Matarial 1 (Slide 1 Er)Dokument3 SeitenP1-2A Lecture Matarial 1 (Slide 1 Er)Movie Magazine100% (1)

- Ex1-Khưu Nguyễn Khai TríDokument1 SeiteEx1-Khưu Nguyễn Khai TríKhai Trí Khưu NguyễnNoch keine Bewertungen

- Show The Effect of The Following Transactions On The Accounting EquationDokument2 SeitenShow The Effect of The Following Transactions On The Accounting EquationKhadra HassanNoch keine Bewertungen

- Tugas 1 Tabular AnalyzeDokument3 SeitenTugas 1 Tabular Analyzealfonsus.wardhana220Noch keine Bewertungen

- ID 193120001 Final Assignment.Dokument64 SeitenID 193120001 Final Assignment.CSE 1033Naymur RahmanNoch keine Bewertungen

- Answer To The Question Number 1 (B)Dokument14 SeitenAnswer To The Question Number 1 (B)tonmoyNoch keine Bewertungen

- Accounting Equation SampleDokument2 SeitenAccounting Equation SampleMark Joseph E VisdaNoch keine Bewertungen

- Rivera Roofing Company Balance Date Cash Accounts Receivable Office Supplies Office Equipment Roofing Equipment Accounts Payable Common StockDokument5 SeitenRivera Roofing Company Balance Date Cash Accounts Receivable Office Supplies Office Equipment Roofing Equipment Accounts Payable Common StockMuskan ValbaniNoch keine Bewertungen

- Name of The Business: Egreen Shop Nature of Business: Online Grossary ShopDokument7 SeitenName of The Business: Egreen Shop Nature of Business: Online Grossary ShopShakil AhsanNoch keine Bewertungen

- M Arkan Hafidz - 2602297301 - Assignment Week 1Dokument5 SeitenM Arkan Hafidz - 2602297301 - Assignment Week 1Arkan HafidzNoch keine Bewertungen

- Name of The Business: Egreen Shop Nature of Business: Online Grossary ShopDokument7 SeitenName of The Business: Egreen Shop Nature of Business: Online Grossary ShopShakil AhsanNoch keine Bewertungen

- Ch1 - Exercises SolutionsDokument3 SeitenCh1 - Exercises SolutionsReem AbanmiNoch keine Bewertungen

- Transaction Analysis: Transaction 1. Investment by Owner Ray Neal Decides ToDokument31 SeitenTransaction Analysis: Transaction 1. Investment by Owner Ray Neal Decides ToSophia LocreNoch keine Bewertungen

- Trial BalaneDokument2 SeitenTrial BalaneBang BangNoch keine Bewertungen

- 181-15-933 Assignment01 ACT301Dokument13 Seiten181-15-933 Assignment01 ACT301Noor Alam Abir 181-15-933Noch keine Bewertungen

- ASSIGNMENTDokument2 SeitenASSIGNMENTArsh Syed100% (1)

- Ch+1b+-+accounting+in+actionDokument29 SeitenCh+1b+-+accounting+in+actionUcup Blak-blakanNoch keine Bewertungen

- Financial Transaction WorksheetDokument3 SeitenFinancial Transaction WorksheetRachel OtazaNoch keine Bewertungen

- Income Statement: IVAN IZO Law OfficeDokument4 SeitenIncome Statement: IVAN IZO Law OfficeClaudio AbinenoNoch keine Bewertungen

- Lecture 2Dokument36 SeitenLecture 2Aram NawaisehNoch keine Bewertungen

- Izabela Cullumber Opened A Medical Office Under The Name Izabela CullumberDokument4 SeitenIzabela Cullumber Opened A Medical Office Under The Name Izabela CullumberJalaj GuptaNoch keine Bewertungen

- Accounting Assignment cpt-1Dokument9 SeitenAccounting Assignment cpt-1Parvez RahmanNoch keine Bewertungen

- Fundamentals of Accounting AssignmentDokument5 SeitenFundamentals of Accounting AssignmentFiromsa Ahmednur Tesfaye100% (1)

- Accounting ExercisesDokument17 SeitenAccounting ExercisesKarenNoch keine Bewertungen

- Assignment 4 - MCQ AnswerDokument2 SeitenAssignment 4 - MCQ AnswerCarl Elmo Bernardo MurosNoch keine Bewertungen

- Legal Services Company Ltd. Book1Dokument9 SeitenLegal Services Company Ltd. Book1Firomsa Ahmednur TesfayeNoch keine Bewertungen

- Tugas 3 AP 1Dokument3 SeitenTugas 3 AP 1Amirrul Fahriza AndaruNoch keine Bewertungen

- Huỳnh Hiếu Hậu 2000002356 Accounting PrinciplesDokument4 SeitenHuỳnh Hiếu Hậu 2000002356 Accounting PrinciplesTuấn DươngNoch keine Bewertungen

- BBFA1103 INTRODUCTORY ACCOUNTING Muhammad SufianDokument5 SeitenBBFA1103 INTRODUCTORY ACCOUNTING Muhammad SufianSufian Abd RahimNoch keine Bewertungen

- FIN427 Home Work 02 AnswerDokument4 SeitenFIN427 Home Work 02 AnswerB M Rakib HassanNoch keine Bewertungen

- Course 2 Recording in Journals & Posting in Ledgers22Dokument1 SeiteCourse 2 Recording in Journals & Posting in Ledgers22scrbdthowaway271023Noch keine Bewertungen

- Final Requirement Ba 315 - EnoveroDokument20 SeitenFinal Requirement Ba 315 - EnoveroDan Andrei BongoNoch keine Bewertungen

- Type Month Sales Units Mat Lab OH Cost: Current AssetsDokument7 SeitenType Month Sales Units Mat Lab OH Cost: Current AssetsdanishzakiNoch keine Bewertungen

- Solution Chapter 1Dokument8 SeitenSolution Chapter 1Khải Hưng NguyễnNoch keine Bewertungen

- Acctg Problem 2-9Dokument4 SeitenAcctg Problem 2-9Honeybunch beforeNoch keine Bewertungen

- Exercise of Chapter 1 - Introduction To Accounting and Businesses - Page 45Dokument1 SeiteExercise of Chapter 1 - Introduction To Accounting and Businesses - Page 45Yến HuỳnhNoch keine Bewertungen

- Corporate Finance II Section: 01 Homework No: 02Dokument5 SeitenCorporate Finance II Section: 01 Homework No: 02Sumaiya TithiNoch keine Bewertungen

- Practice Questions # 3 - With AnswersDokument14 SeitenPractice Questions # 3 - With AnswersAhadullah KhawajaNoch keine Bewertungen

- Assignment # 1 Feb 2023Dokument5 SeitenAssignment # 1 Feb 2023GIAN ALEXANDER CARTAGENANoch keine Bewertungen

- H.W ch4q7 Acc418Dokument4 SeitenH.W ch4q7 Acc418SARA ALKHODAIRNoch keine Bewertungen

- FANFE File-1Dokument5 SeitenFANFE File-1Asad NaveedNoch keine Bewertungen

- Fanfe File 1Dokument5 SeitenFanfe File 1Asad NaveedNoch keine Bewertungen

- Name Rami Surname: Mechergui Group: G8 Serial Problem: Part1Dokument5 SeitenName Rami Surname: Mechergui Group: G8 Serial Problem: Part1Mechergui RamiNoch keine Bewertungen

- Partnership AccountingDokument46 SeitenPartnership AccountingAether SkywardNoch keine Bewertungen

- CHP 1 and 2 Exercise - Fatimatuz Zahro - 2401986913Dokument4 SeitenCHP 1 and 2 Exercise - Fatimatuz Zahro - 2401986913Drwskincare SuirabayaNoch keine Bewertungen

- Asset Liabilities + EquityDokument1 SeiteAsset Liabilities + Equityhieuluu.31221023224Noch keine Bewertungen

- HomeworkDokument2 SeitenHomeworkĐạt BiNoch keine Bewertungen

- Cash Flow 10.10.56Dokument10 SeitenCash Flow 10.10.56Katherine PandoNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Search Engine MarketingDokument6 SeitenSearch Engine MarketingSachinShingoteNoch keine Bewertungen

- Enterprise Account Sales Manager in San Diego CA Resume Thomas WoodDokument3 SeitenEnterprise Account Sales Manager in San Diego CA Resume Thomas WoodThomasWoodNoch keine Bewertungen

- Primary Research AnalysisDokument5 SeitenPrimary Research Analysisbhoven2nrbNoch keine Bewertungen

- 2017/eur/pdf/DEVNET 2023 PDFDokument45 Seiten2017/eur/pdf/DEVNET 2023 PDFSayaOtanashiNoch keine Bewertungen

- 2019 Indonesia Salary GuideDokument32 Seiten2019 Indonesia Salary Guideiman100% (1)

- Rakuten - Affiliate Report 2016 - Forrester ConsultingDokument13 SeitenRakuten - Affiliate Report 2016 - Forrester ConsultingtheghostinthepostNoch keine Bewertungen

- Practice Questions Chapter 4Dokument26 SeitenPractice Questions Chapter 4subash1111@gmail.com100% (1)

- Understanding Service FailureDokument20 SeitenUnderstanding Service FailureAnonymous H0SJWZE8Noch keine Bewertungen

- Exam 1 OnlineDokument2 SeitenExam 1 OnlineGreg N Michelle SuddethNoch keine Bewertungen

- SVR Price List-Sep 2019Dokument4 SeitenSVR Price List-Sep 2019divyaNoch keine Bewertungen

- 9708 s04 QP 4Dokument4 Seiten9708 s04 QP 4Diksha KoossoolNoch keine Bewertungen

- Strategic Acceleration SummaryDokument6 SeitenStrategic Acceleration SummarycoacherslandNoch keine Bewertungen

- Abid RehmatDokument5 SeitenAbid RehmatSheikh Aabid RehmatNoch keine Bewertungen

- Paypal Resolution PackageDokument46 SeitenPaypal Resolution PackageTavon LewisNoch keine Bewertungen

- Price List Scorpio NDokument1 SeitePrice List Scorpio NSHITESH KUMARNoch keine Bewertungen

- Compendium of GOs For Epc in AP PDFDokument444 SeitenCompendium of GOs For Epc in AP PDFPavan CCDMC100% (1)

- Banking Statistics: 2.1.1. Statistics Based On Statutory ReturnsDokument63 SeitenBanking Statistics: 2.1.1. Statistics Based On Statutory ReturnsKirubaker PrabuNoch keine Bewertungen

- Complete Assignment - Docx (Final)Dokument15 SeitenComplete Assignment - Docx (Final)anmeannNoch keine Bewertungen

- Fact and Fact Types DWH CONCEPTDokument2 SeitenFact and Fact Types DWH CONCEPTDeepanshuNoch keine Bewertungen

- Resume Formats: Choose The Best... !!Dokument10 SeitenResume Formats: Choose The Best... !!Anonymous LMJCoKqNoch keine Bewertungen

- Work Breakdown-WPS OfficeDokument3 SeitenWork Breakdown-WPS OfficeamanuelNoch keine Bewertungen

- Computer Integrated ManufacturingDokument45 SeitenComputer Integrated ManufacturingVinoth KumarNoch keine Bewertungen

- Philippines As An Emerging Market: Mentor - Dr. Shalini TiwariDokument10 SeitenPhilippines As An Emerging Market: Mentor - Dr. Shalini TiwariRahul ChauhanNoch keine Bewertungen

- Final Gola Ganda Marketing PlanDokument40 SeitenFinal Gola Ganda Marketing PlansamiraZehra100% (3)

- Engineering Economics FormularsDokument9 SeitenEngineering Economics FormularsFe Ca Jr.Noch keine Bewertungen

- G.R. No. 117188 - Loyola Grand Villas Homeowners (South) AssociationDokument12 SeitenG.R. No. 117188 - Loyola Grand Villas Homeowners (South) AssociationKristine VillanuevaNoch keine Bewertungen

- Project List (Updated 11 30 12) BADokument140 SeitenProject List (Updated 11 30 12) BALiey BustamanteNoch keine Bewertungen

- Islamic Economic SystemDokument5 SeitenIslamic Economic Systemhelperforeu100% (1)

- Sources of Exchange-Rate Volatility: Impulses or Propagation?Dokument14 SeitenSources of Exchange-Rate Volatility: Impulses or Propagation?Anonymous xjWuFPN3iNoch keine Bewertungen

- Bar Frauds & FormsDokument41 SeitenBar Frauds & FormsOm Singh100% (6)