Beruflich Dokumente

Kultur Dokumente

GEIJMR

Hochgeladen von

Rahul BarnwalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

GEIJMR

Hochgeladen von

Rahul BarnwalCopyright:

Verfügbare Formate

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/324173671

An Analysis of Corporate Governance Issues in the Indian context: Challenges

and prospects

Article · March 2014

CITATION READS

1 1,324

2 authors, including:

Mallikarjun M. Maradi

Rani Channamma University Belgavi

5 PUBLICATIONS 4 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Marketing Strategies for tourism development in Vijayapur View project

Article View project

All content following this page was uploaded by Mallikarjun M. Maradi on 03 April 2018.

The user has requested enhancement of the downloaded file.

VOLUME 2, ISSUE 3, (MARCH, 2014) (ISSN: 2321-1709)

website:- www.gejournal.net

An Analysis of Corporate Governance Issues in the Indian context: Challenges

and prospects

Sri. Mallikarjun M. MaradiM.com,(Ph.D)

Assistant Professor

Dept. of Studies in Commerce

Rani Channamma University, PG Centre, Torvi- Bijapur

Sri. Paramanand Dasar M.com,(Ph.D)

Research Scholar

Dept. of Studies in Commerce, Karnatak University,Dharwad

---------------------------------------------------------------------------------------------------------------------

ABSTRACT:

Corporate governance is the set of processes, customs, policies, laws, and institutions affecting the

way a corporation (or company) is directed, administered or controlled. Corporate governance is a

process that aims to allocate corporate resources in a manner that maximizes value for all

stakeholders – shareholders, investors, employees, customers, suppliers, environment and the

community at large and holds those at the helms to account by evaluating their decisions on

transparency, inclusivity, equity and responsibility. There are many different models of corporate

governance around the world. These differ according to the variety of capitalism in which they are

embedded. The market model, control model of corporate governance, Anglo-American "model"

tends to emphasize the interests of shareholders. The coordinated or multi-stakeholder model

associated with Continental Europe and Japan also recognizes the interests of workers, managers,

suppliers, customers, and the community. In India both the Anglo-American model and business

house model were practicing in the governance and hence, the Indian companies are changing from

family owned and widely held controlled structure to professionalized companies.

KEYWORDS: CG, board effectiveness, CG and its issues, and control mechanisms of CG

GE - International Journal of Management Research

Double-Blind Peer Reviewed Refereed Open Access International Journal

www.gejournal.net email: gejournal.net@gmail.com

Page 9

VOLUME 2, ISSUE 3, (MARCH, 2014) (ISSN: 2321-1709)

website:- www.gejournal.net

INTRODUCTION:

The World Bank defines governance as the exercise of political authority and the use of institutional

resources to manage society's problems and affairs. Governance is a goal and a precondition for

positive development results as well. A responsible private sector is an absolute precondition for

economic growth and for poverty reduction. Corporate governance also includes the relationships

among the many stakeholders involved and the goals for which the corporation is governed. In

contemporary business corporations, the main external stakeholder groups are shareholders, debt

holders, trade creditors, suppliers, customers and communities affected by the corporation's

activities. Internal stakeholders are the board of directors, executives, and other employees.

Regulators face a difficult dilemma in that correction of governance abuses perpetrated by a

dominant shareholder would often imply a micro-management of routine business decisions which

lie beyond the regulators’ mandate or competence. The capital market on the other hand lacks the

coercive power of the regulator, but it has the ability to make business judgements. Corporate

governance is concerned with holding the balance between economic and social goals and between

individuals and company goals. The corporate governance frame work is there to encourage the

efficient use of resources and accountability for the stewardship of these resources. Its aim is to align

as nearly as possible to the interest of individuals, corporations and society3

NEED FOR THE STUDY:

Corporate governance is typically perceived by academic literature as dealing with problems that

result from the separation of ownership and control, accountability, transparency, audit and fair

disclosure of reports to the stakeholders and also emphasize on problems and prospects of corporate

governance in the Indian context. From this perspective, corporate governance would focus on

internal structure and rules of the BOD’s, the creation of independent audit committees, rules for

disclosure of information to shareholders and creditors, and control the management. Hence, An

Analysis of Corporate Governance Issues in the Indian context: Challenges and prospects topic relent

to the current scenario.

OBJECTIVES OF THE STUDY:

To analyze the issues of corporate governance in the Indian context

To know the problems and diagnoses of corporate governance

To understand governance mechanisms and solutions about corporate governance

METHODOLOGY:

The required information has been collected from the secondary source of information. The research

paper is descriptive in nature. The relevant information was gathered from journals, books,

governance reports, related websites, publicly available an annual report, financial report, notice to

call AGMs and AGM results, Companies’ websites, and other relevant information.

GE - International Journal of Management Research

Double-Blind Peer Reviewed Refereed Open Access International Journal

www.gejournal.net email: gejournal.net@gmail.com

Page 10

VOLUME 2, ISSUE 3, (MARCH, 2014) (ISSN: 2321-1709)

website:- www.gejournal.net

POPULARLY CHAMPIONED PRINCIPLES OF CORPORATE GOVERNANCE IN THE

WORLD WIDE:

Good CG is the key to that. CG describes the relationship and the rules that govern the relationship

between the companies’ management, its shareholders, regulators and other stakeholders2. It

characterizes the structures, the framework and the processes of all economic measures. Policy

makers are now more aware to the contribution good CG can have to the financial markets stability,

to the economic growth and to a sustainable development. CG lies at the heart of the global corporate

social responsibility discussion. Businesses all over the world have begun to engage in activities to

enhance their positive impact on societies and good CG is the foundation for everything that comes

after. CG and CSR are both value-driven. They foster the democratic values of fairness,

accountability, responsibility and transparency in corporations and companies. While good CG

serves as the basis, CSR builds upon this basis to foster sustainable development. German companies

are already making good progress in that respect, in particular the many small- and medium-sized

businesses. Often, German enterprises are actually already exceeding legal and international

requirements for labor standards for instance as well as social and ecological standards worldwide.

Corporate governance is of crucial importance for economic development in partner countries. Not

only companies but regulators as well, need to drive forward improvements in CG and collaborate

with others in order to provide the right incentives. Sustainable development policy and CSR are

natural allies.

Rights and equitable treatment of shareholders

Interests of other stakeholders

Good Corporate Governance

Role and responsibilities of the board

Integrity and ethical behavior

Practices

Disclosure and transparency

To protect the interest of the

minarity shareholders

Proper accountability to the

executive’s remuneration:

Effective board optimisation,

effectiveness and evaluation

Responsibilities of the board

GE - International Journal of Management Research

Double-Blind Peer Reviewed Refereed Open Access International Journal

www.gejournal.net email: gejournal.net@gmail.com

Page 11

VOLUME 2, ISSUE 3, (MARCH, 2014) (ISSN: 2321-1709)

website:- www.gejournal.net

1. Rights and equitable treatment of shareholders: Organizations should respect the rights of

shareholders and help shareholders to exercise those rights. They can help shareholders

exercise their rights by effectively communicating information that is understandable and

accessible and encouraging shareholders to participate in general meetings.

2. Interests of other stakeholders: Organizations should recognize that they have legal and

other obligations to all legitimate stakeholders.

3. Role and responsibilities of the board: The board needs a range of skills and understanding

to be able to deal with various business issues and have the ability to review and challenge

management performance. It needs to be of sufficient size and have an appropriate level of

commitment to fulfill its responsibilities and duties. There are issues about the appropriate

mix of executive and non-executive directors.

4. Integrity and ethical behavior: It is a necessary element in risk management and avoiding

lawsuits. Organizations should develop a code of conduct for their directors and executives

that promotes ethical and responsible decision making. Because of this, many organizations

establish Compliance and Ethics Programs to minimize the risk that the firm steps outside of

ethical and legal boundaries.

5. Disclosure and transparency: Organizations should clarify and make publicly known the

roles and responsibilities of board and management to provide shareholders with a level of

accountability. Disclosure of material matters concerning the organization should be timely

and balanced to ensure that all investors have access to clear, factual information.

6. Proper accountability to the executive’s remuneration:

Accountability requires in all level of board and openness will need to implement fair

corporate governance practices. Though well-established corporation significantly implement

the standards governance practices. Corporation must be disclosed and report to all

stakeholders regards executives’ remuneration. The Cadbury committee and Kumar

Mangalam Birla committee has been recommended to all listed companies for disclosure of

performance based executives remuneration.

7. Effective board optimization, effectiveness and evaluation:

The performance of board effectiveness and efficiency preserves on their board optimization.

The board performance appraisal ensured by the board dynamics. In the 21st century

corporations are changing their board pattern in to professionalization.

8. Responsibilities of the board: the OECD guidelines provide a great deal of details about the

functions of the board in protecting the company and its shareholders. These include concerns

about corporate strategy, risk, executive compensation and performance as well as accounting

and reporting system.

GE - International Journal of Management Research

Double-Blind Peer Reviewed Refereed Open Access International Journal

www.gejournal.net email: gejournal.net@gmail.com

Page 12

VOLUME 2, ISSUE 3, (MARCH, 2014) (ISSN: 2321-1709)

website:- www.gejournal.net

CHALLENGES TO EFFECTIVE CORPORATE GOVERNANCE:

Issues and challenge for directors and executive management is to find outside directors who are

sufficiently independent but still knowledgeable about and engaged in the business of the company

on whose board they will sit. Independence reflects qualities of objectivity, experience, insight, and

force of character. The need for directors to possess this blend of knowledge plus independence is

critical, given the increased technical complexity of most business activities and the rapid pace of

change in financial markets and practices. Another challenge in selecting outside directors is how to

balance general business knowledge with specific industry knowledge and technical expertise in

areas such as accounting, finance, and labor markets. Finding such outside directors can involve a

tough balancing act and its very difficulty of finding qualified directors who have the time to devote

to the affairs of the company and who are willing to face the risk of shareholder lawsuits. The risk is

that as outside directors’ compensation increases, their independence may wane and, instead of

functioning as watchdogs for shareholders, they may increasingly function as lapdogs for

management. Getting the right balance of expertise and independence so that the board does not

rubber-stamp the decisions of top management is a major challenge. 1. Unsophisticated equity

market vulnerable to manipulation and with rudimentary, traditional analyst activity. 2. Dominations

and monopoly of family firms. 3. High level of corruption, become visible only after a revelation of

big financial scam. 4. Weak and non-transparent monitoring system. 5. Lack of respect for

shareholders and low financial disclosure.

There are some practices prevalent in the market and in our society which are posing challenges to

corporate governance in our country.

Executive compensation vs. Regulation of RPTs

Board composition vs. Competence of directors

Investor activism vs. State activism

Market-driven incentives vs. Non-market mechanisms

Fiduciary duty to shareholders vs. Subpar disclosure and internal controls

Board-management relations vs. Independence from controlling shareholder

Regulating increasingly sophisticated issues vs. Capacity gaps for rigorous enforcement

Cycles of scandals, corruption and collapse vs. More of same (nepotism, self-dealing, market

abuse)

Board of directors vs. the board have board committees

Protection of shareholder interest, expectation and their rights

Disclosure, communication and audit

A company socially responsible corporate citizen

Appointments to the board and directors’ re-election

MECHANISMS AND CONTROLS:

Corporate governance mechanisms and controls are designed to reduce the inefficiencies that arise

from moral hazard and adverse selection. For example, to monitor managers' behavior, an

GE - International Journal of Management Research

Double-Blind Peer Reviewed Refereed Open Access International Journal

www.gejournal.net email: gejournal.net@gmail.com

Page 13

VOLUME 2, ISSUE 3, (MARCH, 2014) (ISSN: 2321-1709)

website:- www.gejournal.net

independent third party (the external auditor) attests the accuracy of information provided by

management to investors. An ideal control system should regulate both motivation and ability.

Internal corporate governance controls

Internal corporate governance controls monitor activities and then take corrective action to

accomplish organizational goals. Examples include:

Monitoring by the board of directors:

The board of directors, with its legal authority to hire, fire and compensate top management,

safeguards invested capital. Regular board meetings allow potential problems to be identified,

discussed and avoided. Whilst non-executive directors are thought to be more independent, they may

not always result in more effective corporate governance and may not increase performance.

Different board structures are optimal for different firms. Moreover, the ability of the board to

monitor the firm's executives is a function of its access to information. Executive directors possess

superior knowledge of the decision-making process and therefore evaluate top management on the

basis of the quality of its decisions that lead to financial performance outcomes, ex ante. It could be

argued, therefore, that executive directors look beyond the financial criteria.

Internal control procedures and internal auditors: Internal control procedures are policies

implemented by an entity's board of directors, audit committee, management, and other personnel to

provide reasonable assurance of the entity achieving its objectives related to reliable financial

reporting, operating efficiency, and compliance with laws and regulations. Internal auditors are

personnel within an organization who test the design and implementation of the entity's internal

control procedures and the reliability of its financial reporting.

Balance of power: The simplest balance of power is very common; require that the President be a

different person from the Treasurer. This application of separation of power is further developed in

companies where separate divisions check and balance each other's actions. One group may propose

company-wide administrative changes, another group review and can veto the changes, and a third

group check that the interests of people (customers, shareholders, employees) outside the three

groups are being met.

Remuneration: Performance-based remuneration is designed to relate some proportion of salary to

individual performance. It may be in the form of cash or non-cash payments such as shares and share

options, superannuation or other benefits. Such incentive schemes, however, are reactive in the sense

that they provide no mechanism for preventing mistakes or opportunistic behavior, and can elicit

myopic behavior. In publicly-traded U.S. corporations, boards of directors are largely chosen by the

President/CEO and the President/CEO often takes the Chair of the Board position. The practice of

the CEO also being the Chair of the Board is known as "duality". While this practice is common in

the U.S., it is relatively rare elsewhere. It is illegal in the U.K.

External mechanisms of corporate governance controls

GE - International Journal of Management Research

Double-Blind Peer Reviewed Refereed Open Access International Journal

www.gejournal.net email: gejournal.net@gmail.com

Page 14

VOLUME 2, ISSUE 3, (MARCH, 2014) (ISSN: 2321-1709)

website:- www.gejournal.net

Debt covenants: these are agreements between a company and its creditors that the company should

operate within certain limits.

Government regulations: Government has a lot of concern with regulating and administering many

areas of human activity, such as trade, education etc. Different political ideologies hold different

ideas on what the government should or should not do.

Competition: Despite shortcomings in corporate governance in many countries, leading emerging

economies have vibrant products markets and display as much intensity of competition as that

observed in advanced countries.

External auditor: external auditors are personnel outside an organization who test the design and

implementation of the entity's external control procedures and the reliability of its financial reporting.

Managerial external labour market: Globalization of production, technological change, and

continually falling communication and transportation costs all combined to make cross border

transport and trade much more feasible and easier in the 21st century.

Print media: Its helps the external stakeholders to understand financial information which are

disclosed by the company in print media. A periodical provides tremendous information to ensure

financial position of a minority and block shareholders.

Best practices to enhance board effectiveness and independent oversight.

Identification of a specific director contact for investor outreach, Board access to timely information

flows, including financial statements and risk management reports, Private meetings of independent

directors without the presence of executive management and controlling shareholders; An

independent board audit committee, whose members have relevant financial experience.

SUGGESTIONS FOR THE EFFECTIVE CORPORATE GOVERNANCE

There are few features of effective corporate governance: Access to external financing which will

lead to greater investment, growth and employment, Lower the cost of capital to reduce risk of

financial crisis, Better resource allocation to win trust of stack holders, to improve social and labour

relations and for environ mental protection and Transparency in all financial and non- financial

matters.

1. The principles for human rights, for fair labor standards, for environmental protection and for

anti-corruption. Ensure that it is an active and interactive learning platform also with regard

to CG issues, such as anti-corruption. Transparency and anti-corruption have been a focal

issue of the Indian companies.

2. Should support the CSR of our partner companies. By coordinating local and international

stakeholders and supporting international policy processes. For instance in India, companies

are supporting responsible finance trends and voluntary standards of Corporate Sustainability.

3. To have a clear cut strategy on anti-corruption. Advise businesses and national governments

on how to apply such anti-corruption measures successfully. A good example of this is

business action against corruption in Africa.

GE - International Journal of Management Research

Double-Blind Peer Reviewed Refereed Open Access International Journal

www.gejournal.net email: gejournal.net@gmail.com

Page 15

VOLUME 2, ISSUE 3, (MARCH, 2014) (ISSN: 2321-1709)

website:- www.gejournal.net

4. Greater transparency in the resource sector will lead to improved accountability and will help

to fight against corruption.

5. Corrective corporate code action taken voluntarily- is not only overdue but also ethically and

morally sound.

6. Due to social, economic and political obstacles in the way of effective corporate governance,

there is needed to adopt some measures.

7. Efficient monitoring system can improve transparency in business management.

8. Adoption of a transparent process of appointment at board and management levels.

9. Proper checks and balance system over managerial rights.

10. Accurate information’s regarding developments, threats and risks related to financial and

economic matters in annual reports and on the company websites.

11. Proper and transparent auditing system to check financial irregularities and frauds.

12. Codes of conduct are ensured to be understood and adhered to by all members of

organisation.

13. Ethical behaviour of organisation or of any member at board or management level should be

rewarded.

14. There should be an independent and transparent process of evaluation of performance of

board members.

15. Independent directors: Even where there are controlling or majority shareholders, there

should be enough quality independent directors to staff key committees, particularly the audit

committee. At a minimum, this implies at least two or three independent directors

constituting at least one-third of the board.

16. Succession planning: The Company should have clear and transparent succession-planning

processes to guide the selection of new executive managers.

CONCLUSION

The above background paper covers the basic concepts of Corporate Governance, as they have

emerged, mainly during the last two decades; it is intended as background study for the Global

convention on Corporate Governance and Sustainability challenges. This paper has argued that

structural characteristics of the Indian corporate sector make the corporate governance problems in

India very different from that in say the US or the UK. The governance issue in the US or the UK is

essentially that of disciplining the management who have ceased to be effectively accountable to the

owners. The solution has been to improve the functioning of vital organs of the company like the

board of directors. Corporate governance has been proving a very efficient and effective system for

our economy and to save the interest of shareholders but some more efficient monitoring and

transparent internal audit system, efficient board and management can lead it to effective corporate

governance. Focus on corporate governance should broaden to encourage emerging market

companies to bolster strategic management of sustainability issues and enhance public disclosure on

sustainability performance

GE - International Journal of Management Research

Double-Blind Peer Reviewed Refereed Open Access International Journal

www.gejournal.net email: gejournal.net@gmail.com

Page 16

VOLUME 2, ISSUE 3, (MARCH, 2014) (ISSN: 2321-1709)

website:- www.gejournal.net

REFERENCE:

1. William J. McDonough, Issues in Corporate Governance, September/October 2002, Volume

8(8)

2. Balasubramaniam, N. (1997) “Towards Excellence in Board Performance”, The IIMB

Management Review, January-March, 67-84.

3. R.A. and S.C. Myers, Principles of Corporate finance, Tata McGraw Hill, Delhi, 1997.

4. Sir Aderian Cadbury, Global corporate Governance forum, world Bank, 2000.

5. India ranks 7th in corporate governance in Asia-Pacific, Business News, Sun, Sep 23, 2012.

6. Low corporate governance in PSUs could hit govt’s disinvestment plan, N Sundarshan

Subramanian, N Delhi Sep 23, 2012.

7. Salmon, W. J. (1993), “Crisis prevention: how to gear up your board”, Harvard Business

Review, January-February, 68-75.

8. Jayanth Rama Varma, Corporate Governance in India: Disciplining the Dominant

Shareholder, published (October-December 1997, 9(4), 5-18).

9. Meenu Assistant Professor, Dept of Public Administration, Need of Effective Corporate

Governance and Its Challenges in India, International Journal of Computational Engineering

& Management, Vol. 15 Issue 6, November 2012 ISSN (Online): 2230-7893

www.IJCEM.org

10. Claessens, S. and B. B. Yurtoglu, 2012, Corporate Governance and Development – An

Update, Focus 10, Global Corporate Governance Forum.

11. Sreeti Raut, Corporate Governance – Concepts and Issues, Research Scholar with Institute of

Directors, India

GE - International Journal of Management Research

Double-Blind Peer Reviewed Refereed Open Access International Journal

www.gejournal.net email: gejournal.net@gmail.com

Page 17

View publication stats

Das könnte Ihnen auch gefallen

- How Behavioral Economics Influences Management Decision-Making: A New ParadigmVon EverandHow Behavioral Economics Influences Management Decision-Making: A New ParadigmBewertung: 5 von 5 Sternen5/5 (1)

- GEIJMRDokument10 SeitenGEIJMRRahul BarnwalNoch keine Bewertungen

- Issues of Corporate Governance PDFDokument20 SeitenIssues of Corporate Governance PDFRahul BarnwalNoch keine Bewertungen

- The Impact of Business Ethics and Corporate Responsibility On Indian Business GrowthDokument4 SeitenThe Impact of Business Ethics and Corporate Responsibility On Indian Business GrowthInternational Journal of Application or Innovation in Engineering & ManagementNoch keine Bewertungen

- Corporate Governance Practices in BangladeshDokument24 SeitenCorporate Governance Practices in BangladeshNiaz RedoyNoch keine Bewertungen

- Paper 4Dokument17 SeitenPaper 4pejuang masa depanNoch keine Bewertungen

- Corporate Law ProjectDokument18 SeitenCorporate Law ProjectTanmay MeshramNoch keine Bewertungen

- A Review Article On Corporate Governance Reforms: in IndiaDokument30 SeitenA Review Article On Corporate Governance Reforms: in IndiaSahib RandhawaNoch keine Bewertungen

- Article - 4 - Apr - 2013 PDFDokument5 SeitenArticle - 4 - Apr - 2013 PDFsandhya parimalaNoch keine Bewertungen

- Corporate GovernmentDokument8 SeitenCorporate GovernmentWalidahmad AlamNoch keine Bewertungen

- Unit 3Dokument68 SeitenUnit 3Gautam BhartiNoch keine Bewertungen

- Corporate Governance Practices: A Comparative Study of Infosys Ltd. and Wipro LTDDokument7 SeitenCorporate Governance Practices: A Comparative Study of Infosys Ltd. and Wipro LTDKESHAV KHARBANDANoch keine Bewertungen

- Euro-Asian Journal of Economics and Finance: Ehsan Razminia, Akram Baladi, Hadi ShafieeDokument7 SeitenEuro-Asian Journal of Economics and Finance: Ehsan Razminia, Akram Baladi, Hadi ShafieeNosheen RafiNoch keine Bewertungen

- Challanges and Oppertuties PDFDokument5 SeitenChallanges and Oppertuties PDFYasir NasirNoch keine Bewertungen

- Original 1089Dokument70 SeitenOriginal 1089Attiya Iqbal AhmedNoch keine Bewertungen

- Internship Proposal Ankan Kuri ID 11530057Dokument8 SeitenInternship Proposal Ankan Kuri ID 11530057Ali AbbasNoch keine Bewertungen

- Sample ProposalDokument10 SeitenSample ProposalccareismchNoch keine Bewertungen

- 10 1108 - Ara 02 2018 0029Dokument32 Seiten10 1108 - Ara 02 2018 0029Ilham FajarNoch keine Bewertungen

- Green HRM - Practices in OrganisationsDokument5 SeitenGreen HRM - Practices in OrganisationsNoha MorsyNoch keine Bewertungen

- Corporate Governance-A Conceptual Guideline: June 2018Dokument36 SeitenCorporate Governance-A Conceptual Guideline: June 2018Muskan GadodiaNoch keine Bewertungen

- CG Report1Dokument23 SeitenCG Report1nabin bkNoch keine Bewertungen

- 49 RKTheoriesof Stakeholder ManagementDokument18 Seiten49 RKTheoriesof Stakeholder Managementesvishnu narayananNoch keine Bewertungen

- IJASREDokument16 SeitenIJASREdanielajai614Noch keine Bewertungen

- Corporate Governance Mini Essay 1Dokument7 SeitenCorporate Governance Mini Essay 1varunabyNoch keine Bewertungen

- Corporate Governance Digital Marketing StrategiesDokument15 SeitenCorporate Governance Digital Marketing Strategiesnatbarlal701Noch keine Bewertungen

- Contemporary Approaches in Internal Audit 2014 Procedia Economics and FinancDokument8 SeitenContemporary Approaches in Internal Audit 2014 Procedia Economics and FinancIrwan AdimasNoch keine Bewertungen

- Lean and Its Basic Components: Academic Journal of Research in Business and Accounting May 2014Dokument11 SeitenLean and Its Basic Components: Academic Journal of Research in Business and Accounting May 2014sandyrulzNoch keine Bewertungen

- Challenges - of - Human - Resource - Management-Muntashir MamunDokument13 SeitenChallenges - of - Human - Resource - Management-Muntashir MamunMuntashir Mamun BwadhonNoch keine Bewertungen

- Research Proposal Submitted in Partial Fulfillment of The Requirements of The Master of Business Administration of The University of CumbriaDokument12 SeitenResearch Proposal Submitted in Partial Fulfillment of The Requirements of The Master of Business Administration of The University of CumbriaNabeela MushtaqNoch keine Bewertungen

- Synopsis - Importance of Human Resource ManagementDokument8 SeitenSynopsis - Importance of Human Resource ManagementMansi TyagiNoch keine Bewertungen

- Edsml - U3 - SCM - Lo - 3-4 - Saumodeb DasDokument20 SeitenEdsml - U3 - SCM - Lo - 3-4 - Saumodeb DasSaumodeb DasNoch keine Bewertungen

- Corporate Governance - A Comparative StudyDokument26 SeitenCorporate Governance - A Comparative StudyNutan Deshmukh100% (1)

- Corporate GovernanceDokument17 SeitenCorporate GovernanceDella Putri Reba UtamyNoch keine Bewertungen

- A Study On Employee Empowerment: February 2022Dokument9 SeitenA Study On Employee Empowerment: February 2022venkatNoch keine Bewertungen

- 10 1108 - Ajb 01 2020 0003Dokument13 Seiten10 1108 - Ajb 01 2020 0003Farid BakhtazmaNoch keine Bewertungen

- Brochure ESG SOM AITDokument13 SeitenBrochure ESG SOM AITnguyennth09Noch keine Bewertungen

- Management and Organization Dynamics AssignmentDokument20 SeitenManagement and Organization Dynamics AssignmentSyedfaizan AliNoch keine Bewertungen

- Nilotpal - 36 Corporate GovernanceDokument11 SeitenNilotpal - 36 Corporate GovernanceNilotpal RaiNoch keine Bewertungen

- CSR Project MMS 2018 - 2020Dokument60 SeitenCSR Project MMS 2018 - 2020shahin shekh100% (2)

- International Seminar - Risk Management, Compliance and Corporate GovernanceDokument10 SeitenInternational Seminar - Risk Management, Compliance and Corporate GovernanceDivya SaranuNoch keine Bewertungen

- Impact of Corporate Governance-2269Dokument8 SeitenImpact of Corporate Governance-2269DirgaSuryaNoch keine Bewertungen

- 1.1abcd Resea RCH PropoDokument19 Seiten1.1abcd Resea RCH PropoYeshambel EwunetuNoch keine Bewertungen

- Serretta Bendixen Sutherland SAJEMSDokument18 SeitenSerretta Bendixen Sutherland SAJEMSAli AwamiNoch keine Bewertungen

- EmergingTrendsinManagementPractice AnEvaluationDokument8 SeitenEmergingTrendsinManagementPractice AnEvaluationLeonetta 353Noch keine Bewertungen

- Seminar Paper. The ERA of ESG... by Dr. Ashok D. Gaur Dr. Pareshkumar U. MordharaDokument10 SeitenSeminar Paper. The ERA of ESG... by Dr. Ashok D. Gaur Dr. Pareshkumar U. MordharaashokdgaurNoch keine Bewertungen

- Final - Research Methodology PDFDokument34 SeitenFinal - Research Methodology PDFDanveer Kaur Birdi100% (2)

- SLLA471 - 20200401105 - Tushar BhatiDokument13 SeitenSLLA471 - 20200401105 - Tushar BhatiTUSHAARBHATINoch keine Bewertungen

- Ehics in Corporate GovernanceDokument40 SeitenEhics in Corporate GovernanceHardeep Sharma100% (1)

- Managing Through Finance - First Assessment Point 1Dokument17 SeitenManaging Through Finance - First Assessment Point 1Mojeed KasheemNoch keine Bewertungen

- The Role of Leadership Style As A Moderator in The PDFDokument7 SeitenThe Role of Leadership Style As A Moderator in The PDFImtiaz BashirNoch keine Bewertungen

- Analysis of Opportunistic Behavior of Management To Company PerformanceDokument11 SeitenAnalysis of Opportunistic Behavior of Management To Company PerformancesnurchusNoch keine Bewertungen

- A Study On Influencing Factors and Challenges of Ethics in Business in Indian ContextDokument8 SeitenA Study On Influencing Factors and Challenges of Ethics in Business in Indian ContextManagement Journal for Advanced ResearchNoch keine Bewertungen

- Organizational Theory & Behavior MGT 5320 Chapter 1: IntroductionDokument14 SeitenOrganizational Theory & Behavior MGT 5320 Chapter 1: IntroductionVinothNoch keine Bewertungen

- The Concept of Competence: A Thematic Review and Discussion: ArticleDokument27 SeitenThe Concept of Competence: A Thematic Review and Discussion: ArticleNgos JeanNoch keine Bewertungen

- Corporate Governance and Tata Steel GovernanceDokument6 SeitenCorporate Governance and Tata Steel GovernanceInternational Journal in Management Research and Social ScienceNoch keine Bewertungen

- MBA 9 - Gov & Sus - June 2020 Take Home AssessmentDokument5 SeitenMBA 9 - Gov & Sus - June 2020 Take Home AssessmentAshleyNoch keine Bewertungen

- The Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)Dokument67 SeitenThe Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)meseret sisayNoch keine Bewertungen

- Synopsis Shital Padhiyar For PHD - 591906 PDFDokument15 SeitenSynopsis Shital Padhiyar For PHD - 591906 PDFMahtab100% (1)

- The Millennium University: Class Lecture of MBA ProgrammeDokument3 SeitenThe Millennium University: Class Lecture of MBA ProgrammeMd WhaheduzzamanNoch keine Bewertungen

- Disaster Risk ManagementDokument3 SeitenDisaster Risk ManagementRahul BarnwalNoch keine Bewertungen

- Sanjeev Shriya and Ors Vs State Bank of India and UP2017180917161040203COM366947Dokument22 SeitenSanjeev Shriya and Ors Vs State Bank of India and UP2017180917161040203COM366947Rahul BarnwalNoch keine Bewertungen

- SubjectDokument17 SeitenSubjectRahul BarnwalNoch keine Bewertungen

- 5 6064547753856336583Dokument1 Seite5 6064547753856336583Rahul BarnwalNoch keine Bewertungen

- Organisations An Policies Related To Disaster Management Framework at National LevelDokument3 SeitenOrganisations An Policies Related To Disaster Management Framework at National LevelRahul BarnwalNoch keine Bewertungen

- JK Jute Mills Company Limited Vs Surendra Trading NL2017050517163156110COM620844Dokument14 SeitenJK Jute Mills Company Limited Vs Surendra Trading NL2017050517163156110COM620844Rahul BarnwalNoch keine Bewertungen

- 5 6183832297179972078Dokument2 Seiten5 6183832297179972078Rahul BarnwalNoch keine Bewertungen

- Disaster Management: Vulnerability Atlas of IndiaDokument8 SeitenDisaster Management: Vulnerability Atlas of IndiaRahul BarnwalNoch keine Bewertungen

- Himanshu Soni SearchDokument4 SeitenHimanshu Soni SearchRahul BarnwalNoch keine Bewertungen

- List of Important Tiger Reserve in IndiaDokument3 SeitenList of Important Tiger Reserve in IndiaRahul BarnwalNoch keine Bewertungen

- List of National Parks in India Is Given BelowDokument7 SeitenList of National Parks in India Is Given BelowRahul BarnwalNoch keine Bewertungen

- Tribal GroupsDokument5 SeitenTribal GroupsRahul BarnwalNoch keine Bewertungen

- Curriculum Vitae NidhiDokument2 SeitenCurriculum Vitae NidhiRahul BarnwalNoch keine Bewertungen

- Himanshu Soni SearchDokument4 SeitenHimanshu Soni SearchRahul BarnwalNoch keine Bewertungen

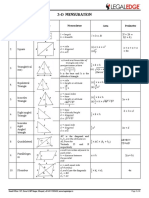

- Mensuration 2D and 3D FormulaDokument4 SeitenMensuration 2D and 3D FormulaRahul Barnwal100% (10)

- Rough Draft of Managerial Economics 3 SemDokument2 SeitenRough Draft of Managerial Economics 3 SemRahul BarnwalNoch keine Bewertungen

- 2018 LLM RegulationsDokument10 Seiten2018 LLM RegulationsReverse OsmosisNoch keine Bewertungen

- Reply 36 (2) and (3) of A&c ActDokument8 SeitenReply 36 (2) and (3) of A&c ActRahul BarnwalNoch keine Bewertungen

- Rajneesh Prajapati PCC CVDokument2 SeitenRajneesh Prajapati PCC CVRahul BarnwalNoch keine Bewertungen

- 10 10 Test Identification ParadeDokument13 Seiten10 10 Test Identification Paradeharsh vardhanNoch keine Bewertungen

- Rough Draft of Law of Evidence 4 SemDokument2 SeitenRough Draft of Law of Evidence 4 SemRahul BarnwalNoch keine Bewertungen

- Rough Draft of HRM 1 SemDokument3 SeitenRough Draft of HRM 1 SemRahul BarnwalNoch keine Bewertungen

- Rough Draft of Hindulaw 4 SemDokument3 SeitenRough Draft of Hindulaw 4 SemRahul BarnwalNoch keine Bewertungen

- Rough Draft of Hindulaw 4 SemDokument3 SeitenRough Draft of Hindulaw 4 SemRahul BarnwalNoch keine Bewertungen

- Rahul CVDokument2 SeitenRahul CVRahul BarnwalNoch keine Bewertungen

- Rough Draft of Business Enviroment1 4semDokument3 SeitenRough Draft of Business Enviroment1 4semRahul BarnwalNoch keine Bewertungen

- Rough Draft of CR P C 4 SemDokument3 SeitenRough Draft of CR P C 4 SemRahul BarnwalNoch keine Bewertungen

- Rough Draft of Labour Law 4 SemDokument2 SeitenRough Draft of Labour Law 4 SemRahul BarnwalNoch keine Bewertungen

- Rahul CVDokument2 SeitenRahul CVRahul BarnwalNoch keine Bewertungen

- Res Ipsa Loquitur: Chanakya National Law UniversityDokument20 SeitenRes Ipsa Loquitur: Chanakya National Law UniversityRahul BarnwalNoch keine Bewertungen

- FastCat's Compensation ReportDokument7 SeitenFastCat's Compensation ReportKevin GarnerNoch keine Bewertungen

- Basic Settings For SAP EWM in SAP S/4HANA 1809: Community Topics Answers Blogs Events Programs Resources What's NewDokument65 SeitenBasic Settings For SAP EWM in SAP S/4HANA 1809: Community Topics Answers Blogs Events Programs Resources What's NewAlfred KomboraNoch keine Bewertungen

- Chap 11 Tanner - Setting Goals & Managing The Sales Force Performance 01 Feb 2017Dokument30 SeitenChap 11 Tanner - Setting Goals & Managing The Sales Force Performance 01 Feb 2017NISAR AHMEDNoch keine Bewertungen

- Cristina Laroa MedinaDokument2 SeitenCristina Laroa Medinaapi-620979504Noch keine Bewertungen

- Research Paper On Effective ManagementDokument8 SeitenResearch Paper On Effective Managementxkcwaaqlg100% (1)

- UT Dallas Syllabus For Psy4327.501 06f Taught by Edward Davis (Ecd022000)Dokument5 SeitenUT Dallas Syllabus For Psy4327.501 06f Taught by Edward Davis (Ecd022000)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- SCM Strategic Cost Management Cabrera 2021 Edition Multiple Choice Questions With - Compress PDFDokument119 SeitenSCM Strategic Cost Management Cabrera 2021 Edition Multiple Choice Questions With - Compress PDFMark Vincent Estanislao100% (3)

- Lean Champion Bootcamp V.: ESAB India, Chennai 19 - 30 July 2010Dokument43 SeitenLean Champion Bootcamp V.: ESAB India, Chennai 19 - 30 July 2010LakshmiVishwanathanNoch keine Bewertungen

- Discussion 5Dokument2 SeitenDiscussion 5Christian MirandaNoch keine Bewertungen

- Fundamentals of Cost AccountingDokument24 SeitenFundamentals of Cost AccountingHarshad100% (10)

- Business Mumbai Mba Pharma Curriculum PDFDokument4 SeitenBusiness Mumbai Mba Pharma Curriculum PDFTech WizardNoch keine Bewertungen

- TQM Lecture # 4Dokument27 SeitenTQM Lecture # 4Dr. Mushtaq AhmedNoch keine Bewertungen

- Porter's Five Forces Analysis of Tata Tea Ltd.Dokument8 SeitenPorter's Five Forces Analysis of Tata Tea Ltd.AMAZING FACTSNoch keine Bewertungen

- APPLICATION DEVELOPMENT Syllabus (1031)Dokument55 SeitenAPPLICATION DEVELOPMENT Syllabus (1031)chipy75% (4)

- IT Risk Register IntroductionDokument48 SeitenIT Risk Register IntroductionjramkiNoch keine Bewertungen

- Accounting Information SystemDokument21 SeitenAccounting Information SystemTaira Marie Macalinao100% (1)

- Kaizen Facilitator BookletDokument46 SeitenKaizen Facilitator BookletAnonymous FpRJ8oDdNoch keine Bewertungen

- Draft On Case Study at HilbroDokument2 SeitenDraft On Case Study at HilbroUsman AsifNoch keine Bewertungen

- Measure Supplier PerformanceDokument6 SeitenMeasure Supplier PerformanceDharmesh MistryNoch keine Bewertungen

- CAEA 2218 Lecture 1 - Introduction-AnytoPDFDokument281 SeitenCAEA 2218 Lecture 1 - Introduction-AnytoPDFMuhammad Syafiq HaidzirNoch keine Bewertungen

- CV of Uttam SahuDokument6 SeitenCV of Uttam SahuVishalSarinNoch keine Bewertungen

- Curriculum Master ASTP: Classroom/ Private Workload (H) ECTS 12Dokument1 SeiteCurriculum Master ASTP: Classroom/ Private Workload (H) ECTS 12aafreen sayyadNoch keine Bewertungen

- Chapter - 3 Designing and Managing ServicesDokument22 SeitenChapter - 3 Designing and Managing ServicesEashaa SaraogiNoch keine Bewertungen

- WORK BREAKDOWN SCTRUCTURE Gedung Lantai 10Dokument2 SeitenWORK BREAKDOWN SCTRUCTURE Gedung Lantai 10deanNoch keine Bewertungen

- Project-Guidelines-for-MBA-2nd YearDokument7 SeitenProject-Guidelines-for-MBA-2nd YearAmit Kumar MahthaNoch keine Bewertungen

- RB - Ecommerce - TORDokument7 SeitenRB - Ecommerce - TORosamaNoch keine Bewertungen

- Eddie PGBM16 Assignment May2011-Ong Meng Seng FinalDokument26 SeitenEddie PGBM16 Assignment May2011-Ong Meng Seng FinalBigmen AndyNoch keine Bewertungen

- CH 25Dokument11 SeitenCH 25x1y2z3qNoch keine Bewertungen

- Calander of ActivityDokument7 SeitenCalander of ActivityWaseemullah KhanNoch keine Bewertungen

- Chapter 5 QuizDokument8 SeitenChapter 5 Quizjoyce nacuteNoch keine Bewertungen