Beruflich Dokumente

Kultur Dokumente

Moodys Gartner Tax Law Income-Sprinking-Flowchart 8.5x11

Hochgeladen von

gurunandanm9838Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Moodys Gartner Tax Law Income-Sprinking-Flowchart 8.5x11

Hochgeladen von

gurunandanm9838Copyright:

Verfügbare Formate

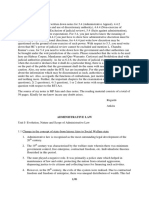

SIMPLIFIED TOSI FLOWCHART

(Tax on Split Income):

Specified Individual Split Income

Are you either an adult who is resident in Canada, or Do you earn any of the following types of split income?

are you under 18 with a parent resident in Canada? a) Non-public corporation taxable dividends and shareholder benefits

b) Partnership income derived from a related business*, or a rental where a related person

(excluding separated spouse/partner) is involved.

NO YES

c) Trust income derived from non-public corporation taxable dividends/benefits, a related business*,

or a rental where a related person (excluding separated spouse/partner) is involved.

d) Indebtedness income from non-public corporation, partnership or trust.

e) Income or gains from dispositions of non-public shares or other property with historical TOSI.

NO YES

Do any of the following apply to you in respect of the income/gain property?

a) Are you under 25 years old and received the property as a result of the death of your parent?

b) Are you under 25 years old and received the property as a result of the death of any person and you are enrolled as a

full-time post-secondary student or entitled to disability tax credit?

YES c) Was the property transferred to you in respect of a separation agreement or judgement resulting from a breakdown

of marriage or common-law partnership?

d) Was the taxable capital gain the result of a deemed disposition on the death?

e) Was the taxable capital gain the result of a disposition of qualified farm or fishing property or qualified small

business corporation shares (unless you are under age 18 and the disposition is to a non-arm’s length person)?

f) Is your spouse age 65 or older (or deceased)—and if so, if the amount were to be received by your spouse, would

the split income have been excluded from TOSI under this flow chart?

NO

Age 18 or over Under age 18

The TOSI

rules do not Related Business Is it a taxable capital gain from the disposition of non-public

NO

apply to you. Is the income or gain in question derived from a corporation shares to a non-arm’s length person?

related business* for the year?

YES NO

YES

Excluded Business**

YES Are you actively engaged on a regular, continuous and substantial basis in the business in the current or any

five preceding years, either on a factual basis or by meeting a threshold of an average of 20 hours/week?

NO

Age 25 or over Age 18 to 24

Excluded Shares Safe Harbour Capital Return

Does the income/gain relate to shares where all below conditions Is the split income in excess of the safe harbour

are met: capital return, i.e. prescribed interest rate multiplied

• Less than 90% of the corporation’s “business income” for the last by the FMV of property contributions to the business?

year was from providing services;

YES • The corporation is not a professional corporation;

Amount Exceeding Within Safe

• You personally own shares that, in aggregate, give you at least 10% Safe Harbour Harbour

of the voting and value of the corporation; and

• Less than 10% of the income of the corporation last year was derived

from a related business* (not carried on by the corporation).

The TOSI rules do not apply

to the portion determined.

NO

Reasonable Return**

Is the split income in excess of a reasonable return based Reasonable Return in respect of

on the relative contributions from you and each related Arm’s Length Capital**

person considering the following in respect of the business: Is the split income in excess of a reasonable return

• The work performed; based on the relative contributions from you and

• The property contributed directly or indirectly; The each related person, but considering only your

• The risks assumed; Reasonable contribution of “arm’s length capital”?

• The total amounts already paid to or for the benefit of Portion

the individual; and Amount The

• Any other factors that may be relevant. Exceeding Reasonable

Reasonable Portion

Amount Exceeding Reasonable

2x taxable capital gain is deemed to be a non-eligible

The TOSI rules apply to tax the income/tax- dividend subject to the highest marginal rate

able capital gain at the highest marginal rate

* Related business generally means any business in which a related person is involved or directly/ ** Attributes generally inherited for property

indirectly own 10% or more. Separated spouses/partners deemed not related for the year. acquired as a result of death.

Das könnte Ihnen auch gefallen

- Income TaxDokument71 SeitenIncome TaxMahrukh MalikNoch keine Bewertungen

- Tax Cheat Sheet Exam 2 - CH 7,8,10,11Dokument2 SeitenTax Cheat Sheet Exam 2 - CH 7,8,10,11tyg1992Noch keine Bewertungen

- Tax HW 1Dokument3 SeitenTax HW 1lexyramdeoNoch keine Bewertungen

- Partnerships & LLCs OutlineDokument33 SeitenPartnerships & LLCs OutlineZhang YiNoch keine Bewertungen

- Contracts Essay OutlineDokument5 SeitenContracts Essay OutlineIan SaumNoch keine Bewertungen

- Sample MPT July 2007Dokument19 SeitenSample MPT July 2007izdr1Noch keine Bewertungen

- Partnership AllocationDokument63 SeitenPartnership AllocationMitchelGramaticaNoch keine Bewertungen

- Int TaxDokument24 SeitenInt TaxDane4545Noch keine Bewertungen

- 2A. Civil Law 2006-2019Dokument143 Seiten2A. Civil Law 2006-2019elvinperiaNoch keine Bewertungen

- Fedincometaxoutline 19Dokument17 SeitenFedincometaxoutline 19ashajimerNoch keine Bewertungen

- Flashcards Property 20200409Dokument192 SeitenFlashcards Property 20200409Alison ChanNoch keine Bewertungen

- Corporations Kahan Fall 2008Dokument69 SeitenCorporations Kahan Fall 2008Hamis Rabiam MagundaNoch keine Bewertungen

- Tax of Business Entities Chapter 4Dokument38 SeitenTax of Business Entities Chapter 4craig52292Noch keine Bewertungen

- Helpful Questions For Collaboration People Versus Problems: Connecting RelationshipsDokument2 SeitenHelpful Questions For Collaboration People Versus Problems: Connecting RelationshipsMichael GregoryNoch keine Bewertungen

- Homework Week 4Dokument5 SeitenHomework Week 4Damalie IzaulaNoch keine Bewertungen

- Sec Reg - Carlson - Spring2011Dokument51 SeitenSec Reg - Carlson - Spring2011Akansha SethiNoch keine Bewertungen

- Federal Income Taxation OutlineDokument87 SeitenFederal Income Taxation OutlineSaul100% (1)

- Contracts II OutlineDokument50 SeitenContracts II OutlineAndre SardaryzadehNoch keine Bewertungen

- 2013 Itc TB GlossaryDokument24 Seiten2013 Itc TB Glossaryzhyldyz_88Noch keine Bewertungen

- Erie AnalysisDokument4 SeitenErie AnalysisadamNoch keine Bewertungen

- PropI Estates GridDokument1 SeitePropI Estates GridLAMark06100% (1)

- Exam 2 Income Tax Study Guide (The Better Version)Dokument48 SeitenExam 2 Income Tax Study Guide (The Better Version)Mary Tol100% (1)

- Tax Question BankDokument34 SeitenTax Question BankRahul RajNoch keine Bewertungen

- GUAN - Criminal OUtline 1Dokument160 SeitenGUAN - Criminal OUtline 1XIAOTONG GUAN100% (1)

- ElizabethWarrenBankruptcy PDFDokument41 SeitenElizabethWarrenBankruptcy PDFGustavo Lacerda FrancoNoch keine Bewertungen

- 2022 Bluebook Workshop SlidesDokument34 Seiten2022 Bluebook Workshop SlidesmarkNoch keine Bewertungen

- Choice of Entity OutlineDokument31 SeitenChoice of Entity OutlineKent WhiteNoch keine Bewertungen

- I Trusts Professor Serkin To Estate The Facts Spring 2012Dokument53 SeitenI Trusts Professor Serkin To Estate The Facts Spring 2012Anonymous RIGa6Pj73TNoch keine Bewertungen

- Taxation CheatsheetDokument2 SeitenTaxation CheatsheetKem Hạt DẻNoch keine Bewertungen

- 7 Class HypotheticalDokument5 Seiten7 Class Hypotheticalmoni24184Noch keine Bewertungen

- Contracts OutlineDokument48 SeitenContracts OutlineTodd MixNoch keine Bewertungen

- BA Midterm Wagner 2014Dokument36 SeitenBA Midterm Wagner 2014adamNoch keine Bewertungen

- Sample Answer MPT 1Dokument5 SeitenSample Answer MPT 1Ashley Crooks100% (1)

- OutlineDokument71 SeitenOutlineMaxwell NdunguNoch keine Bewertungen

- Week 3 - NuisanceDokument23 SeitenWeek 3 - NuisanceFasihah FatahNoch keine Bewertungen

- FedTax OutlineDokument28 SeitenFedTax OutlineAstha AdhikaryNoch keine Bewertungen

- 15 Tax On S CorpDokument90 Seiten15 Tax On S CorpWahyudiNoch keine Bewertungen

- Basic Tax OutlineDokument29 SeitenBasic Tax OutlinestaceyNoch keine Bewertungen

- Tax Notes Ch. 1-6Dokument3 SeitenTax Notes Ch. 1-6tyg1992Noch keine Bewertungen

- DamagesDokument19 SeitenDamagesWarly PabloNoch keine Bewertungen

- Alder Outline KDokument31 SeitenAlder Outline KnicoleNoch keine Bewertungen

- T&e Spring 2019Dokument143 SeitenT&e Spring 2019egg pucher masterNoch keine Bewertungen

- Bar Exams BEDokument22 SeitenBar Exams BEEmma SvebekNoch keine Bewertungen

- Business - Associations - by - Ssozi RajjabuDokument82 SeitenBusiness - Associations - by - Ssozi RajjabuNAYIGA DEMITNoch keine Bewertungen

- US Taxation - Outline: I. Types of Tax Rate StructuresDokument12 SeitenUS Taxation - Outline: I. Types of Tax Rate Structuresvarghese2007Noch keine Bewertungen

- DCC Chart Rules.11.17.22Dokument14 SeitenDCC Chart Rules.11.17.22Maya El CheikhNoch keine Bewertungen

- Spring 2012 EGT OutlineDokument63 SeitenSpring 2012 EGT OutlineJessica Rae FarrisNoch keine Bewertungen

- Asset Purchase Agreement AmendedDokument11 SeitenAsset Purchase Agreement AmendedBaseer HaqqieNoch keine Bewertungen

- Fed Tax - Final OutlineDokument52 SeitenFed Tax - Final OutlineMike Binka KusiNoch keine Bewertungen

- 1L - Torts - Final OnlyDokument47 Seiten1L - Torts - Final OnlyKelsea NolotNoch keine Bewertungen

- MBCADokument172 SeitenMBCAlissettm08Noch keine Bewertungen

- Ariana Peterson Recently Opened Her Own Law Office Which SheDokument1 SeiteAriana Peterson Recently Opened Her Own Law Office Which Shehassan taimourNoch keine Bewertungen

- Snow Ip 2016Dokument2 SeitenSnow Ip 2016api-240547583Noch keine Bewertungen

- Florida Real Estate Exam Prep: Everything You Need to Know to PassVon EverandFlorida Real Estate Exam Prep: Everything You Need to Know to PassNoch keine Bewertungen

- Insurance Official OutlineDokument60 SeitenInsurance Official OutlineDylan WheelerNoch keine Bewertungen

- Torts - Case ChartDokument8 SeitenTorts - Case ChartMolly ElizabethNoch keine Bewertungen

- Law of Alternative Dispute ResolutionDokument11 SeitenLaw of Alternative Dispute Resolutionmacdaddy23100% (1)

- 15gift and Estate Tax - Katzenstein - Fall 2002Dokument95 Seiten15gift and Estate Tax - Katzenstein - Fall 2002proveitwasmeNoch keine Bewertungen

- Ruskola ContractsDokument45 SeitenRuskola ContractsGeneTeamNoch keine Bewertungen

- International Taxation OutlineDokument138 SeitenInternational Taxation OutlineMa FajardoNoch keine Bewertungen

- Royo HomesDokument36 SeitenRoyo HomesAmardeep Singh PalNoch keine Bewertungen

- IrvingCC Packet 2010-09-23Dokument520 SeitenIrvingCC Packet 2010-09-23Irving BlogNoch keine Bewertungen

- Batangas State University: College of Engineering, Architecture, Fine Arts and Computing SciencesDokument5 SeitenBatangas State University: College of Engineering, Architecture, Fine Arts and Computing SciencesMeynard MagsinoNoch keine Bewertungen

- Acc - 565 - PH Fed12 Corp Partnr EstDokument160 SeitenAcc - 565 - PH Fed12 Corp Partnr EstLaKessica B. Kates-CarterNoch keine Bewertungen

- Responsible Leadership: Tax-Free Savings AccountDokument2 SeitenResponsible Leadership: Tax-Free Savings AccountbaxterNoch keine Bewertungen

- Journals of The House of Burgesses Volume 9Dokument346 SeitenJournals of The House of Burgesses Volume 9Robert ValeNoch keine Bewertungen

- GROUP 1 TAX INCENTIVES (HOTEL & TOURISM) EditedDokument20 SeitenGROUP 1 TAX INCENTIVES (HOTEL & TOURISM) Editedmeera yusufNoch keine Bewertungen

- FICO Module Course ContentsDokument3 SeitenFICO Module Course ContentsMohammed Nawaz Shariff100% (1)

- Dividends TaxationDokument3 SeitenDividends TaxationGuruNoch keine Bewertungen

- The Omnibus Investments Code of 1987Dokument71 SeitenThe Omnibus Investments Code of 1987Karen Calma100% (1)

- HUL Directors Report Ar 2013 14Dokument24 SeitenHUL Directors Report Ar 2013 14Lakshmi MNoch keine Bewertungen

- Corpo Digests Set IDokument40 SeitenCorpo Digests Set IKalai Soleil Rosal100% (2)

- T778 Child Care Expenses DeductionDokument4 SeitenT778 Child Care Expenses DeductionbatmanbittuNoch keine Bewertungen

- Robinhood FinalDokument11 SeitenRobinhood FinalViely AngNoch keine Bewertungen

- Soft Drinks in The PhilippinesDokument20 SeitenSoft Drinks in The PhilippinesHandrich Hernando100% (2)

- From: Melquiades A. Cancela, CPADokument6 SeitenFrom: Melquiades A. Cancela, CPAFaith BariasNoch keine Bewertungen

- Sach Writing Task 2 Ver 2.0Dokument270 SeitenSach Writing Task 2 Ver 2.0Nguyễn Hoài Anh ThưNoch keine Bewertungen

- Benefit Illustration For Your Policy EQuote Number 520040229470Dokument2 SeitenBenefit Illustration For Your Policy EQuote Number 520040229470Shobha RaniNoch keine Bewertungen

- Administrative Law - Smart NotesDokument65 SeitenAdministrative Law - Smart NotesAchyut TewariNoch keine Bewertungen

- New DEED OF ABSOLUTE SALE With SPADokument2 SeitenNew DEED OF ABSOLUTE SALE With SPAOliver Raymundo50% (2)

- ITC StrategyDokument13 SeitenITC StrategyPranav Goyal100% (1)

- Economics and Business EnvironmentDokument70 SeitenEconomics and Business Environmentm agarwalNoch keine Bewertungen

- Pest Analysis of Pharma IndustryDokument12 SeitenPest Analysis of Pharma IndustrynaviguguNoch keine Bewertungen

- Blakemore Freeman Fellowship InformationDokument6 SeitenBlakemore Freeman Fellowship InformationTaiwanSummerProgramsNoch keine Bewertungen

- Summary of Tax Deducted at Source: Part-ADokument5 SeitenSummary of Tax Deducted at Source: Part-Achakrala_sirishNoch keine Bewertungen

- Case DigestsDokument59 SeitenCase DigestsCamille PalmaNoch keine Bewertungen

- 01 - Progressive Development Corp. v. Quezon CityDokument2 Seiten01 - Progressive Development Corp. v. Quezon CityJustine GalandinesNoch keine Bewertungen

- Daily US Treasury Statement 4/12/11Dokument2 SeitenDaily US Treasury Statement 4/12/11Darla DawaldNoch keine Bewertungen

- Financial and Economic Analysis of Projects: PDC Training ManualDokument7 SeitenFinancial and Economic Analysis of Projects: PDC Training Manualtie. mcsNoch keine Bewertungen

- Income From Interest On SecuritiesDokument4 SeitenIncome From Interest On SecuritiesSohidul IslamNoch keine Bewertungen