Beruflich Dokumente

Kultur Dokumente

Primary and Secondary Functions of Commercial Banks

Hochgeladen von

Vinod AroraCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Primary and Secondary Functions of Commercial Banks

Hochgeladen von

Vinod AroraCopyright:

Verfügbare Formate

Primary and Secondary Functions of Commercial Banks

Primary Function:

1. Accepting Deposits:

It is the most important function of commercial banks.

They accept deposits in several forms according to requirements of different sections of the society.

The main kinds of deposits are:

(i) Current Account Deposits or Demand Deposits:

These deposits refer to those deposits which are repayable by the banks on demand:

1. Such deposits are generally maintained by businessmen with the intention of making transactions

with such deposits.

2. They can be drawn upon by a cheque without any restriction.

3. Banks do not pay any interest on these accounts. Rather, banks impose service charges for

running these accounts.

ii) Fixed Deposits or Time Deposits:

Fixed deposits refer to those deposits, in which the amount is deposited with the bank for a fixed

period of time.

1. Such deposits do not enjoy cheque-able facility.

2. These deposits carry a high rate of interest.

What is a Demand Deposit

A demand deposit consists of funds held in an account from which deposited funds can be withdrawn at

any time from the depository institution, such as a checking or savings account, accessible by a

teller, ATM or online banking. In contrast, a term deposit is a type of account that cannot be accessed

for a predetermined period of time. M1 is a category of the money supply that includes demand

deposits as well as physical money and negotiable order of withdrawal (NOW) accounts that have no

maturity period but limited withdrawals or transfers.

Basis Demand Deposits Fixed Deposits

Cheque facility They are chequeable deposits. They are non-chequeable deposits.

Interest payments They do not carry any interest. They carry interest which varies directly

with the period of time.

Number of transactions The depositor can make any number of Depositor generally makes only two

transactions for deposit or with drawl of transactions: (i) Deposit of Money in the

money. beginning;(ii) Withdrawal of money on

maturity.

iii) Saving Deposits:

These deposits combine features of both current account deposits and fixed deposits:

1. The depositors are given cheque facility to withdraw money from their account. But, some

restrictions are imposed on number and amount of withdrawals, in order to discourage frequent

use of saving deposits.

2. They carry a rate of interest which is less than interest rate on fixed deposits. It must be noted

that Current Account deposits and saving deposits are chequable deposits, whereas, fixed

deposit is a non-chequable deposit.

2. Advancing of Loans:

The deposits received by banks are not allowed to remain idle. So, after keeping certain cash

reserves, the balance is given to needy borrowers and interest is charged from them, which is the

main source of income for these banks.

Different types of loans and advances made by Commercial banks are:

(i) Cash Credit:

Cash credit refers to a loan given to the borrower against his current assets like shares, stocks,

bonds, etc. A credit limit is sanctioned and the amount is credited in his account. The borrower may

withdraw any amount within his credit limit and interest is charged on the amount actually

withdrawn.

(ii) Demand Loans:

Demand loans refer to those loans which can be recalled on demand by the bank at any time. The

entire sum of demand loan is credited to the account and interest is payable on the entire sum.

iii) Short-term Loans:

They are given as personal loans against some collateral security. The money is credited to the

account of borrower and the borrower can withdraw money from his account and interest is

payable on the entire sum of loan granted.

Secondary Functions:

1. Overdraft Facility:

It refers to a facility in which a customer is allowed to overdraw his current account upto an agreed

limit. This facility is generally given to respectable and reliable customers for a short period.

Customers have to pay interest to the bank on the amount overdrawn by them

2. Discounting Bills of Exchange:

It refers to a facility in which holder of a bill of exchange can get the bill discounted with bank before

the maturity. After deducting the commission, bank pays the balance to the holder. On maturity,

bank gets its payment from the party which had accepted the bill.

3. Agency Functions:

Commercial banks also perform certain agency functions for their customers. For these services,

banks charge some commission from their clients.

Some of the agency functions are:

(i) Transfer of Funds:

Banks provide the facility of economical and easy remittance of funds from place-to-place with the help

of instruments like demand drafts, mail transfers, etc.

(ii) Collection and Payment of Various Items:

Commercial banks collect cheques, bills,’ interest, dividends, subscriptions, rents and other periodical

receipts on behalf of their customers and also make payments of taxes, insurance premium, etc. on

standing instructions of their clients.

(iii) Purchase and Sale of Foreign Exchange:

Some commercial banks are authorized by the central bank to deal in foreign exchange. They buy and

sell foreign exchange on behalf of their customers and help in promoting international trade.

(iv) Purchase and Sale of Securities:

Commercial banks buy and sell stocks and shares of private companies as well as government securities

on behalf of their customers.

(v) Income Tax Consultancy:

They also give advice to their customers on matters relating to income tax and even prepare their

income tax returns.

(vi) Trustee and Executor:

Commercial banks preserve the wills of their customers as trustees and execute them after their death

as executors.

(vii) Letters of Reference:

They give information about the economic position of their customers to traders and provide the similar

information about other traders to their customers.

4. General Utility Functions:

Commercial banks render some general utility services like:

(i) Locker Facility:

Commercial banks provide facility of safety vaults or lockers to keep valuable articles of customers in

safe custody.

(ii) Traveller’s Cheques:

Commercial banks issue traveler’s cheques to their customers to avoid risk of taking cash during their

journey.

(iii) Letter of Credit:

They also issue letters of credit to their customers to certify their creditworthiness.

(iv) Underwriting Securities:

Commercial banks also undertake the task of underwriting securities. As public has full faith in the

creditworthiness of banks, public do not hesitate in buying the securities underwritten by banks.

(v) Collection of Statistics:

Banks collect and publish statistics relating to trade, commerce and industry. Hence, they advice

customers on financial matters. Commercial banks receive deposits from the public and use these

deposits to give loans. However, loans offered are many times more than the deposits received by

banks. This function of banks is known as ‘Money Creation’.

Das könnte Ihnen auch gefallen

- Personal Bank Account: West End Ret PK BlanchardstownDokument5 SeitenPersonal Bank Account: West End Ret PK BlanchardstownViorica Zaporojan Iascerinschi100% (3)

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceVon EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceBewertung: 4 von 5 Sternen4/5 (9)

- Islamic Banking And Finance for Beginners!Von EverandIslamic Banking And Finance for Beginners!Bewertung: 2 von 5 Sternen2/5 (1)

- Sbi Project ReportDokument114 SeitenSbi Project Reportthyristorscr78% (9)

- Swift Code BankDokument10 SeitenSwift Code BankQasseh ChintaNoch keine Bewertungen

- Chase Bank FebruaryDokument4 SeitenChase Bank FebruaryAvya Brutus100% (1)

- Commercial Banks and NBFIsDokument17 SeitenCommercial Banks and NBFIsAbhishek kumarNoch keine Bewertungen

- BANK1Dokument30 SeitenBANK1Shaifali GargNoch keine Bewertungen

- Notes On Commercial BankDokument8 SeitenNotes On Commercial BankMr. Rain ManNoch keine Bewertungen

- Commercial BanksDokument7 SeitenCommercial BanksRashi BishtNoch keine Bewertungen

- Commercial Bank: Definition, Function, Credit Creation and SignificancesDokument8 SeitenCommercial Bank: Definition, Function, Credit Creation and SignificancesfendaNoch keine Bewertungen

- C6 BankingDokument16 SeitenC6 BankingKavyansh SharmaNoch keine Bewertungen

- What Are The Functions of Commercial Banks?Dokument8 SeitenWhat Are The Functions of Commercial Banks?Anusha RaoNoch keine Bewertungen

- Commercial BankingDokument4 SeitenCommercial Bankingsn nNoch keine Bewertungen

- Functions of Commercial BanksDokument19 SeitenFunctions of Commercial BanksAravind Kumar G100% (1)

- I) Primary Functions:: A) Accepting DepositsDokument4 SeitenI) Primary Functions:: A) Accepting DepositsJoshna SinghNoch keine Bewertungen

- Commercial Bankes in Sri LankaDokument15 SeitenCommercial Bankes in Sri LankaRaashed RamzanNoch keine Bewertungen

- Function of Commercial BankDokument4 SeitenFunction of Commercial BankMohammad SaadmanNoch keine Bewertungen

- 7 Main Functions of A Commercial BankDokument7 Seiten7 Main Functions of A Commercial BankShang LarifNoch keine Bewertungen

- Chapter Three Commercial Banking: 1 by SityDokument10 SeitenChapter Three Commercial Banking: 1 by SitySeid KassawNoch keine Bewertungen

- Assign3 Fin323Dokument3 SeitenAssign3 Fin323mark_torreonNoch keine Bewertungen

- 03 Banking CH 3 Ana 4Dokument57 Seiten03 Banking CH 3 Ana 4sabit hussenNoch keine Bewertungen

- Unit - Vii Commercial BanksDokument14 SeitenUnit - Vii Commercial Bankssheetal rajputNoch keine Bewertungen

- Function of Commercial BankDokument7 SeitenFunction of Commercial BankEmranul Islam ShovonNoch keine Bewertungen

- (A.) Commercial Banks - FunctionsDokument3 Seiten(A.) Commercial Banks - FunctionsEPP-2004 HaneefaNoch keine Bewertungen

- Banking Chapter OneDokument17 SeitenBanking Chapter OnefikremariamNoch keine Bewertungen

- Banking: 2. Current AccountDokument6 SeitenBanking: 2. Current Accountanika gulatiNoch keine Bewertungen

- Credit Delivery Modes March 8 22Dokument2 SeitenCredit Delivery Modes March 8 22bhavi kocharNoch keine Bewertungen

- Chapter - : Money and Banking: Best Higher Secondary SchoolDokument11 SeitenChapter - : Money and Banking: Best Higher Secondary Schoolapi-232747878Noch keine Bewertungen

- COMMERCIAL BANKS FunctionDokument2 SeitenCOMMERCIAL BANKS FunctionVanlalbiakdiki ChhangteNoch keine Bewertungen

- April 23 2021 12B, C, D, E, F, GChapter14BANKS NotesDokument16 SeitenApril 23 2021 12B, C, D, E, F, GChapter14BANKS NotesStephine BochuNoch keine Bewertungen

- Meaning and Functions of Commercial BankDokument4 SeitenMeaning and Functions of Commercial BankP Janaki Raman100% (6)

- Banking Functions: Navjeet Parvez Rakesh Majid NavjotDokument13 SeitenBanking Functions: Navjeet Parvez Rakesh Majid Navjotharesh KNoch keine Bewertungen

- Banking NotesDokument84 SeitenBanking NotesNitesh MahatoNoch keine Bewertungen

- Chapter 2 Business Support Services - TheDokument12 SeitenChapter 2 Business Support Services - TheradhaNoch keine Bewertungen

- PanchatantraDokument10 SeitenPanchatantraBinaya SahooNoch keine Bewertungen

- Banking HandoutDokument6 SeitenBanking Handoutsandeepa madanNoch keine Bewertungen

- 3 Chapter: Commercial BankDokument5 Seiten3 Chapter: Commercial BanksakibarsNoch keine Bewertungen

- Money and CreditDokument11 SeitenMoney and CreditDaksh SharmaNoch keine Bewertungen

- Ethiopian Banking Sector: 2.1. Organization and Structure of Ethiopian Banking Industry BanksDokument9 SeitenEthiopian Banking Sector: 2.1. Organization and Structure of Ethiopian Banking Industry Banksመስቀል ኃይላችን ነውNoch keine Bewertungen

- Important Functions of Bank: What Is A Bank?Dokument3 SeitenImportant Functions of Bank: What Is A Bank?Samiksha PawarNoch keine Bewertungen

- Chap 1. Banking System in IndiaDokument24 SeitenChap 1. Banking System in IndiaShankha MaitiNoch keine Bewertungen

- Role of Commercial BanksDokument16 SeitenRole of Commercial BanksJayant MishraNoch keine Bewertungen

- BankinglawDokument108 SeitenBankinglawStuti SinhaNoch keine Bewertungen

- Commercial BankingDokument12 SeitenCommercial BankingwubeNoch keine Bewertungen

- 2.1 Types and Procedures of Opening and Operating Bank Deposit AccountsDokument6 Seiten2.1 Types and Procedures of Opening and Operating Bank Deposit AccountswalterNoch keine Bewertungen

- Functions of Commercial BanksDokument14 SeitenFunctions of Commercial Banksroobhini100% (6)

- BanksDokument5 SeitenBanksparvezbub_490779093Noch keine Bewertungen

- Commercial Banking: Chapter ThreeDokument39 SeitenCommercial Banking: Chapter ThreeYoseph KassaNoch keine Bewertungen

- Banking Pricnciples and Practices Lecture Notes ch3Dokument17 SeitenBanking Pricnciples and Practices Lecture Notes ch3ejigu nigussieNoch keine Bewertungen

- Functions of Commercial Banks Commercial Banks Perform A Variety of Functions Which Can Be Divided AsDokument3 SeitenFunctions of Commercial Banks Commercial Banks Perform A Variety of Functions Which Can Be Divided AsBalaji GajendranNoch keine Bewertungen

- Special Accounts For Banking Firm - M.com (BM) II Sem. - DR - Rajeshri DesaiDokument5 SeitenSpecial Accounts For Banking Firm - M.com (BM) II Sem. - DR - Rajeshri DesaiOMARA BMF-2024100% (1)

- Reading Advancing Functions of BankDokument2 SeitenReading Advancing Functions of BankKim DungNoch keine Bewertungen

- Type of BanksDokument31 SeitenType of BanksKasthuri SelvamNoch keine Bewertungen

- Chapter 5 EditedDokument10 SeitenChapter 5 EditedSeid KassawNoch keine Bewertungen

- Types of BankingDokument3 SeitenTypes of BankingSunni ZaraNoch keine Bewertungen

- Bank Fundamentals: An Introduction to the World of Finance and BankingVon EverandBank Fundamentals: An Introduction to the World of Finance and BankingBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Mutual Funds for Beginners Learning Mutual Funds BasicsVon EverandMutual Funds for Beginners Learning Mutual Funds BasicsNoch keine Bewertungen

- My FileDokument56 SeitenMy FileVinod AroraNoch keine Bewertungen

- An Introduction To Fastag: A Game Changer in Automatic Toll Collection Systems in IndiaDokument6 SeitenAn Introduction To Fastag: A Game Changer in Automatic Toll Collection Systems in IndiaVinod AroraNoch keine Bewertungen

- International Bank: Working CapitalDokument10 SeitenInternational Bank: Working CapitalVinod AroraNoch keine Bewertungen

- What Is Equity MarketDokument2 SeitenWhat Is Equity MarketVinod AroraNoch keine Bewertungen

- International BankingDokument10 SeitenInternational BankingVinod AroraNoch keine Bewertungen

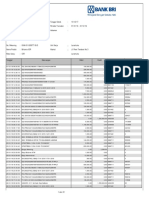

- Laporan Transaksi: Kepada Yth, Dr. Rosmelia Esther Gloria SilabanDokument21 SeitenLaporan Transaksi: Kepada Yth, Dr. Rosmelia Esther Gloria SilabanRosalindaNoch keine Bewertungen

- Module 14 EquityDokument17 SeitenModule 14 EquityZyril RamosNoch keine Bewertungen

- Abhinay Axis Project FinalDokument97 SeitenAbhinay Axis Project FinalabhinaygoenkaNoch keine Bewertungen

- GPF No.: Subscriber's Name Date of Birth:-DDO Code & Name: - Rate of Interest FromDokument8 SeitenGPF No.: Subscriber's Name Date of Birth:-DDO Code & Name: - Rate of Interest FromHema SoodNoch keine Bewertungen

- FC Shift Sales Report: Sales Transactions Manual / POSDokument3 SeitenFC Shift Sales Report: Sales Transactions Manual / POSKayne CervantesNoch keine Bewertungen

- Mishkin PPT Ch02Dokument17 SeitenMishkin PPT Ch02atulkirar100% (1)

- Accounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonDokument3 SeitenAccounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonCj GarciaNoch keine Bewertungen

- OpTransactionHistory23 01 2024Dokument11 SeitenOpTransactionHistory23 01 2024kvpNoch keine Bewertungen

- CLaim Procedure and FormDokument4 SeitenCLaim Procedure and FormVenkata Rao NaiduNoch keine Bewertungen

- PNB Vs Rodriguez and PNB Vs Concepcion MiningDokument3 SeitenPNB Vs Rodriguez and PNB Vs Concepcion MiningDanielleNoch keine Bewertungen

- Studi Kasus Pada PT Damar Bandha Jaya Corp. BogorDokument10 SeitenStudi Kasus Pada PT Damar Bandha Jaya Corp. BogorMayHan13Noch keine Bewertungen

- MAS.06 Drill Short-Term Budgeting, AFN and ForecastingDokument4 SeitenMAS.06 Drill Short-Term Budgeting, AFN and Forecastingace ender zeroNoch keine Bewertungen

- Cash Management:: Revenue DepositsDokument26 SeitenCash Management:: Revenue DepositsMomel FatimaNoch keine Bewertungen

- Nets User GuideDokument16 SeitenNets User Guidehwyap2022Noch keine Bewertungen

- Apy ChartDokument1 SeiteApy ChartpraveenaNoch keine Bewertungen

- Sample PDF Economics-12 Exam Handbook For Term-I Exam 2021Dokument24 SeitenSample PDF Economics-12 Exam Handbook For Term-I Exam 2021Disha100% (1)

- Indian Financial SystemDokument91 SeitenIndian Financial SystemAnkit Sablok100% (2)

- Ch20 SolutionsDokument19 SeitenCh20 SolutionsAlexir Thatayaone NdovieNoch keine Bewertungen

- 新建文本文档Dokument7 Seiten新建文本文档Ozzy LinaNoch keine Bewertungen

- Alhabib Income FundDokument2 SeitenAlhabib Income FundsmashinguzairNoch keine Bewertungen

- T BillsDokument1 SeiteT Billsvinit_jaiswalNoch keine Bewertungen

- NpaDokument182 SeitenNpaabhishek heerfNoch keine Bewertungen

- Customer Acceptance in R12 Order ManagementDokument17 SeitenCustomer Acceptance in R12 Order ManagementJuan carlos Pérez riveroNoch keine Bewertungen

- Definition of BankDokument14 SeitenDefinition of BankSuman RoyNoch keine Bewertungen

- Account Statement From 1 Mar 2023 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument3 SeitenAccount Statement From 1 Mar 2023 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSuresh VatipalliNoch keine Bewertungen

- Mortgage Under Transfer of Property Act 1882Dokument3 SeitenMortgage Under Transfer of Property Act 188218212 NEELESH CHANDRANoch keine Bewertungen