Beruflich Dokumente

Kultur Dokumente

169 - CIR v. Procter and Gamble

Hochgeladen von

BananaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

169 - CIR v. Procter and Gamble

Hochgeladen von

BananaCopyright:

Verfügbare Formate

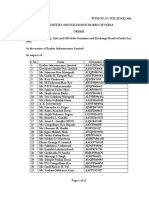

CIR v. PROCTER & GAMBLE, CTA o (c) P&G-Phil.

failed to meet certain conditions necessary in

December 2, 1991 | Feliciano, J. | Non-Resident Foreign order that "the dividends received by its non-resident

Corporations parent company in the US may be subject to the

Digester: Endaya, Ana Kristina R. preferential tax rate of 15% instead of 35%."

P&G-Phil. Filed an MR

SUMMARY: P&G-Phil. declared dividends payableto its parent

company P&G-USA from which a certain amount is deducted RULING: Petition granted. Reinstate CTA’s decision – granted tax

which represented the 35% withholding tax. P&G-Phil then filed a refund. Applied the 15% rate.

claim for refund holding that the rate applicable is 15% not 35%.

The CIR did not respond and CTA granted the refund. The SC 2nd (RELEVANT)Whether P&G-Phil a proper party to claim the

division reversed and ruled that there would be no refund. The SC refund or tax credit – YES

2nd division held, among others, that P&G-US is the proper party to (stated otherwise) Whether P&G-Phil is a tax payer – YES

file the refund not P&G-Phil. BIR should not be allowed to defeat an otherwise valid claim

for refund by raising this question of alleged incapacity for the

The SC finally allowed the refund holding that P&G-Phil, who is a first time on appeal before this Court.

withholding agent, is a proper party to claim the refund as it The law provides that a claim for refund is filed by a tax

considered a tax payer. Also, the applicable rate is 15%. It payer. The question now is if P&G-Phil is a tax payer

examined the provisions of US tax code and held that it complies which SC answers in the affirmative.

with the requirements of Section 24(b) of NIRC. Provisions

DOCTRINE: NIRC Section 309(3) defines "taxpayer" as referring to "any

person subject to tax imposed by the Title [on Tax on Income]."

Under NIRC Section 53 (c), the withholding agent who is

FACTS: "required to deduct and withhold any tax" is made "personally

P&G-Phil. declared dividends payable to its parent company liable for such tax" and indeed is indemnified against any

and sole stockholder, P&G-USA, amounting to P24,164,946 claims and demands which the stockholder might wish to make

o From which the amount of P8,457,731 representing the in questioning the amount of payments effected by the

35% withholding tax at source was deducted. withholding agent in accordance with the provisions of the

P&G-Phil. filed with CIR a claim for refund or tax credit in the NIRC.

amount of P4,832,989 As applied

o Pursuant to NIRC Section 24 (b)(1), the applicable rate of The withholding agent, P&G-Phil., is directly and independently

withholding tax on the dividends remitted was only 15%, liable for the correct amount of the tax that should be withheld

not 35%, of the dividends. from the dividend remittances. The withholding agent is,

CIR did not respond, hence, P&G-Phil. filed a petition for moreover, subject to and liable for deficiency assessments,

review with CTA surcharges and penalties should the amount of the tax withheld

CTA: Ordered CIR to refund or grant the tax credit. be finally found to be less than the amount that should have

SC 2nd division: Reversed CTA / no refund been withheld under law.

o (a) P&G-USA, and not P&G-Phil., was the proper party to A "person liable for tax" has been held to be a "person

claim the refund or tax credit here involved; subject to tax" and properly considered a "taxpayer."

o (b) there is nothing in the US Tax Code that allows a credit The terms liable for tax" and "subject to tax" both

against the US tax due from P&G-USA of taxes deemed to connote legal obligation or duty to pay a tax. It is very

have been paid in the Philippines equivalent to 20% which difficult, indeed conceptually impossible, to consider a

represents the difference between the regular tax 35% on person who is statutorily made "liable for tax" as not

corporations and the tax of 15% on dividends; and "subject to tax." By any reasonable standard, such a

person should be regarded as a party in interest, or as a

person having sufficient legal interest, to bring a suit for issuance of a tax credit certificate. What appears to be vitiated

refund of taxes he believes were illegally collected from by basic unfairness is petitioner's position that, although P&G-

him. Phil. is directly and personally liable to the Government for the

In Philippine Guaranty Company, Inc. v. Commissioner of taxes and any deficiency assessments to be collected, the

Internal Revenue, it was held that a withholding agent is in fact Government is not legally liable for a refund simply because it

the agent both of the government and of the taxpayer, and that did not demand a written confirmation of P&G-Phil.'s implied

the withholding agent is not an ordinary government agent authority from the very beginning. A sovereign government

o The law sets no condition for the personal liability of should act honorably and fairly at all times, even vis-a-vis

the withholding agent to attach. The reason is to compel taxpayers.

the withholding agent to withhold the tax under all

circumstances. In effect, the responsibility for the collection Applicability to the dividend remittances by P&G-Phil. to

of the tax as well as the payment thereof is concentrated P&G-USA of the 15% tax rate (this is dependent on whether the

upon the person over whom the Government has US tax code complies with requirements of Section 24(b) of NIRC)

jurisdiction. Thus, the withholding agent is constituted

the agent of both the Government and the taxpayer. Provision

With respect to the collection and/or withholding of the tax, Section 24 (b) Tax on foreign corporations.—

he is the Government's agent. In regard to the filing of

the necessary income tax return and the payment of (1) Non-resident corporation. — A foreign corporation not engaged

the tax to the Government, he is the agent of the in trade and business in the Philippines, . . ., shall pay a tax equal

taxpayer. The withholding agent, therefore, is no to 35% of the gross income receipt during its taxable year from all

ordinary government agent especially because under sources within the Philippines, as . . . dividends . . . Provided, still

Section 53 (c) he is held personally liable for the tax further, that on dividends received from a domestic corporation

he is duty bound to withhold; whereas the liable to tax under this Chapter, the tax shall be 15% of the

Commissioner and his deputies are not made liable by dividends, which shall be collected and paid as provided in Section

law. 53 (d) of this Code, subject to the condition that the country in

If, as pointed out in Philippine Guaranty, the withholding agent which the non-resident foreign corporation, is domiciled shall

is also an agent of the beneficial owner of the dividends with allow a credit against the tax due from the non-resident foreign

respect to the filing of the necessary income tax return and corporation, taxes deemed to have been paid in the Philippines

with respect to actual payment of the tax to the government, equivalent to 20% which represents the difference between the

such authority may reasonably be held to include the authority regular tax (35%) on corporations and the tax (15%) on dividends

to file a claim for refund and to bring an action for recovery of as provided in this Section

such claim. This implied authority is especially warranted

where, is in the instant case, the withholding agent is the Analysis of provision

wholly owned subsidiary of the parent-stockholder and The ordinary 35% tax rate applicable to dividend remittances

therefore, at all times, under the effective control of such to non-resident corporate stockholders of a Philippine

parent-stockholder. In the circumstances of this case, it seems corporation, goes down to 15% if the country of domicile of the

particularly unreal to deny the implied authority of P&G-Phil. foreign stockholder corporation "shall allow" such foreign

to claim a refund and to commence an action for such refund. corporation a tax credit for "taxes deemed paid in the

We believe that, there is nothing to preclude the BIR from Philippines," applicable against the tax payable to the

requiring P&G-Phil. to show some written or telexed domiciliary country by the foreign stockholder corporation.

confirmation by P&G-USA of the subsidiary's authority to claim In the instant case, the reduced 15% dividend tax rate is

the refund or tax credit and to remit the proceeds of the applicable if the USA "shall allow" to P&G-USA a tax credit for

refund., or to apply the tax credit to some Philippine tax "taxes deemed paid in the Philippines" applicable against the

obligation of, P&G-USA, before actual payment of the refund or US taxes of P&G-USA.

The NIRC specifies that such tax credit for "taxes deemed paid by P&G- USA are not "phantom taxes" but instead Philippine

in the Philippines" must, as a minimum, reach an amount corporate income taxes actually paid here by P&G-Phil., which

equivalent to 20% points which represents the difference are very real indeed.

between the regular 35% dividend tax rate and the preferred It is also useful to note that both (i) the tax credit for the

15% dividend tax rate. It is important to note that Section 24 Philippine dividend tax actually withheld, and (ii) the tax credit

(b) (1), NIRC, does not require that the US must give a for the Philippine corporate income tax actually paid by P&G

"deemed paid" tax credit for the dividend tax (20 percentage Phil. but "deemed paid" by P&G-USA, are tax credits available

points) waived by the Philippines in making applicable the or applicable against the US corporate income tax of P&G-USA.

preferred divided tax rate of 15%. In other words, our NIRC These tax credits are allowed because of the US congressional

does not require that the US tax law deem the parent- desire to avoid or reduce double taxation of the same income

corporation to have paid the 20 percentage points of dividend stream.

tax waived by the Philippines. The NIRC only requires that the

US "shall allow" P&G-USA a "deemed paid" tax credit in an Factors used to determine if US complies

amount equivalent to the 20 percentage points waived by the (Amount A) To determine the amount of the 20 percentage

Philippines. points dividend tax waived by the Philippine government under

Section 24 (b) (1), NIRC, and which hence goes to P&G-USA;

Whether US Tax Code complies with the requirements of o Amount (a) is P13.00 for every P100.00 of pre-tax net

Section 24(b) – YES, US tax code complies. income earned by P&G-Phil. Amount (a) is also the

minimum amount of the "deemed paid" tax credit that US

Close reading of Section 901 and 902 of US tax code shows tax law shall allow if P&G-USA is to qualify for the reduced

the following (Notes for the full provision) or preferential dividend tax rate under Section 24 (b) (1),

NIRC. (Computation at notes)

(Amount B) To determine the amount of the "deemed paid" tax

a) US law (Section 901, Tax Code) grants P&G-USA a tax

credit which US tax law must allow to P&G-USA

credit for the amount of the dividend tax actually paid (i.e.,

o For every P55.25 of dividends actually remitted (after

withheld) from the dividend remittances to P&G-USA;

withholding at the rate of 15%) by P&G-Phil. to its US

b) US law (Section 902, US Tax Code) grants to P&G-USA a

parent P&G-USA, a tax credit of P29.75 is allowed by

"deemed paid' tax credit for a proportionate part of the corporate Section 902 US Tax Code for Philippine corporate income

income tax actually paid to the Philippines by P&G-Phil. tax "deemed paid" by the parent but actually paid by the

wholly-owned subsidiary. (Computation at notes)

Preface (Factor C) To ascertain that the amount of the "deemed paid"

The parent-corporation P&G-USA is "deemed to have paid" a

tax credit allowed by US law is at least equal to the amount of

portion of the Philippine corporate income tax although that the dividend tax waived by the Philippine Government.

tax was actually paid by its Philippine subsidiary, P&G-Phil., not o Since P29.75 is much higher than P13.00 (the amount of

by P&G-USA. This "deemed paid" concept merely reflects

dividend tax waived by the Philippine government), Section

economic reality, since the Philippine corporate income tax was

902, US Tax Code, specifically and clearly complies with the

in fact paid and deducted from revenues earned in the

requirements of Section 24 (b) (1), NIRC.

Philippines, thus reducing the amount remittable as dividends

to P&G-USA.

This interpretation is affirmed by BIR administrative

In other words, US tax law treats the Philippine corporate

issuances and rulings.

income tax as if it came out of the pocket, as it were, of P&G-

USA as a part of the economic cost of carrying on business

operations in the Philippines through the medium of P&G-Phil. NOTES:

and here earning profits. What is, under US law, deemed paid

Sec. 901 — Taxes of foreign countries and possessions of United (2) to the extent such dividends are paid by such foreign

States. corporation out of accumulated profits [as defined in

subsection (c) (1) (b)] of a year for which such foreign

(a) Allowance of credit. — If the taxpayer chooses to have the corporation is a less developed country corporation, be

benefits of this subpart, the tax imposed by this chapter shall, deemed to have paid the same proportion of any income,

subject to the applicable limitation of section 904, be credited war profits, or excess profits taxes paid or deemed to be paid

with the amounts provided in the applicable paragraph of by such foreign corporation to any foreign country or to

subsection (b) plus, in the case of a corporation, the any possession of the United States on or with respect to

taxes deemed to have been paid under sections 902 and such accumulated profits, which the amount of such

960. Such choice for any taxable year may be made or changed dividends bears to the amount of such accumulated

at any time before the expiration of the period prescribed for profits.

making a claim for credit or refund of the tax imposed by this

chapter for such taxable year. The credit shall not be allowed xxx xxx xxx

against the tax imposed by section 531 (relating to the tax on

accumulated earnings), against the additional tax imposed for (c) Applicable Rules

the taxable year under section 1333 (relating to war loss

recoveries) or under section 1351 (relating to recoveries of (1) Accumulated profits defined. — For purposes of this section,

foreign expropriation losses), or against the personal holding the term "accumulated profits" means with respect to any

company tax imposed by section 541. foreign corporation,

(b) Amount allowed. — Subject to the applicable limitation of (A) for purposes of subsections (a) (1) and (b) (1), the amount of its

section 904, the following amounts shall be allowed as the gains, profits, or income computed without reduction by the

credit under subsection (a): amount of the income, war profits, and excess profits taxes

imposed on or with respect to such profits or income by any

(a) Citizens and domestic corporations. — In the case of a foreign country. . . .; and

citizen of the United States and of a domestic

corporation, the amount of any income, war profits, and (B) for purposes of subsections (a) (2) and (b) (2), the amount of

excess profits taxes paid or accrued during the taxable its gains, profits, or income in excess of the income, war

year to any foreign country or to any possession of the profits, and excess profits taxes imposed on or with respect to

United States; and such profits or income.

xxx xxx xxx The Secretary or his delegate shall have full power to determine

from the accumulated profits of what year or years such dividends

Sec. 902. — Credit for corporate stockholders in foreign were paid, treating dividends paid in the first 20 days of any year

corporation. as having been paid from the accumulated profits of the preceding

year or years (unless to his satisfaction shows otherwise), and in

(A) Treatment of Taxes Paid by Foreign Corporation. — For other respects treating dividends as having been paid from the

purposes of this subject, a domestic corporation which owns most recently accumulated gains, profits, or earning

at least 10 percent of the voting stock of a foreign corporation

from which it receives dividends in any taxable year shall Amount (a)

— Amount (a), i.e., the amount of the dividend tax waived by the

Philippine government is arithmetically determined in the

xxx xxx xxx following manner:

P100.00 — Pretax net corporate income earned by P&G-Phil.

x 35% — Regular Philippine corporate income tax rate profits earned by

——— P&G-Phil. in excess

P35.00 — Paid to the BIR by P&G-Phil. as Philippine of income tax

corporate income tax.

P100.00

-35.00

———

P65.00 — Available for remittance as dividends to P&G-USA

P65.00 — Dividends remittable to P&G-USA

x 35% — Regular Philippine dividend tax rate under Section 24

——— (b) (1), NIRC

P22.75 — Regular dividend tax

P65.00 — Dividends remittable to P&G-USA

x 15% — Reduced dividend tax rate under Section 24 (b) (1), NIRC

———

P9.75 — Reduced dividend tax

P22.75 — Regular dividend tax under Section 24 (b) (1), NIRC

-9.75 — Reduced dividend tax under Section 24 (b) (1), NIRC

———

P13.00 — Amount of dividend tax waived by Philippine

===== government under Section 24 (b) (1), NIRC.

Amount (b)

Amount (b), i.e., the amount of the "deemed paid" tax credit which

US tax law allows under Section 902, Tax Code, may be computed

arithmetically as follows:

P65.00 — Dividends remittable to P&G-USA

- 9.75 — Dividend tax withheld at the reduced (15%) rate

———

P55.25 — Dividends actually remitted to P&G-USA

P35.00 — Philippine corporate income tax paid by P&G-Phil.

to the BIR

Dividends actually

remitted by P&G-Phil.

to P&G-USA P55.25

——————— = ——— x P35.00 = P29.75 10

Amount of accumulated P65.00 ======

Das könnte Ihnen auch gefallen

- Commissioner of Internal Revenue v. P&G-Philippines 1991Dokument3 SeitenCommissioner of Internal Revenue v. P&G-Philippines 1991Binkee VillaramaNoch keine Bewertungen

- CIR v. P&G Philippine tax credit deniedDokument2 SeitenCIR v. P&G Philippine tax credit deniedNaomi QuimpoNoch keine Bewertungen

- CIR vs. Procter and GambleDokument3 SeitenCIR vs. Procter and GambleRobNoch keine Bewertungen

- Nueva Ecija II Electric Cooperative Inc.20220913-11-H8h0weDokument3 SeitenNueva Ecija II Electric Cooperative Inc.20220913-11-H8h0weReynaldo GasparNoch keine Bewertungen

- 2 - CIR V Filinvest PDFDokument2 Seiten2 - CIR V Filinvest PDFSelynn CoNoch keine Bewertungen

- Western Minolco v. CommissionerDokument2 SeitenWestern Minolco v. CommissionerEva TrinidadNoch keine Bewertungen

- Republic v. TeamDokument2 SeitenRepublic v. TeamannedefrancoNoch keine Bewertungen

- Zamora V CIRDokument2 SeitenZamora V CIRSuiNoch keine Bewertungen

- Exclusions from gross income; compensation incomeDokument2 SeitenExclusions from gross income; compensation incomeHomer SimpsonNoch keine Bewertungen

- Helvering v. HorstDokument3 SeitenHelvering v. HorstLeslie Joy PantorgoNoch keine Bewertungen

- China Banking Corp Vs CADokument19 SeitenChina Banking Corp Vs CAChristelle Ayn BaldosNoch keine Bewertungen

- CIR Vs CA, CTA, and GCL Retirement Plan TAXDokument2 SeitenCIR Vs CA, CTA, and GCL Retirement Plan TAXLemuel Angelo M. Eleccion100% (1)

- Lladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGESTDokument1 SeiteLladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGESTHarleneNoch keine Bewertungen

- CIR v. LednickyDokument2 SeitenCIR v. LednickyBananaNoch keine Bewertungen

- Case Digests No. 45-52Dokument9 SeitenCase Digests No. 45-52Auvrei MartinNoch keine Bewertungen

- 11 NDC V CIRDokument3 Seiten11 NDC V CIRTricia MontoyaNoch keine Bewertungen

- CIR V Vda. de PrietoDokument2 SeitenCIR V Vda. de PrietoSophiaFrancescaEspinosa100% (1)

- Cir Vs Procter and GambleDokument1 SeiteCir Vs Procter and GambleEANoch keine Bewertungen

- Limpan Investment Corporation vs. Commissioner of Internal Revenue, Et Al., 17 SCRA 703Dokument10 SeitenLimpan Investment Corporation vs. Commissioner of Internal Revenue, Et Al., 17 SCRA 703fritz frances danielleNoch keine Bewertungen

- Marubeni Corporation vs. CIRDokument2 SeitenMarubeni Corporation vs. CIRVel JuneNoch keine Bewertungen

- Gulf Resorts Insurance Case Analyzes Earthquake Coverage IntentDokument9 SeitenGulf Resorts Insurance Case Analyzes Earthquake Coverage Intentmartina lopezNoch keine Bewertungen

- Apostolic Prefect v. Treasurer of Baguio, 71 Phil 547Dokument1 SeiteApostolic Prefect v. Treasurer of Baguio, 71 Phil 547Pat EspinozaNoch keine Bewertungen

- CIR Vs BurroughsDokument1 SeiteCIR Vs BurroughsAlexis Von TeNoch keine Bewertungen

- CIR V Benguet Corporation DIGESTDokument3 SeitenCIR V Benguet Corporation DIGESTGretchen MondragonNoch keine Bewertungen

- Javier vs CA, GR No L-78953, January 22, 1990 (Tax Fraud PenaltyDokument1 SeiteJavier vs CA, GR No L-78953, January 22, 1990 (Tax Fraud PenaltyAmee Bagtang-dapingNoch keine Bewertungen

- CIR vs. Lednicky (1964)Dokument1 SeiteCIR vs. Lednicky (1964)Emil BautistaNoch keine Bewertungen

- ME Holding Corp vs. CADokument2 SeitenME Holding Corp vs. CAJeremae Ann CeriacoNoch keine Bewertungen

- 61 Fernandez Hermanos v. CIRDokument2 Seiten61 Fernandez Hermanos v. CIRAgus DiazNoch keine Bewertungen

- G.R. No. 211666, February 25, 2015 Republic of The Philippines, Represented by The Department of Public WORKS AND HIGHWAYS, Petitioners, v. ARLENE R. SORIANO, RespondentDokument1 SeiteG.R. No. 211666, February 25, 2015 Republic of The Philippines, Represented by The Department of Public WORKS AND HIGHWAYS, Petitioners, v. ARLENE R. SORIANO, RespondentKennethAnthonyMagdamitNoch keine Bewertungen

- WHO Building Construction Contractor's Tax ExemptionDokument1 SeiteWHO Building Construction Contractor's Tax ExemptionJomar TenezaNoch keine Bewertungen

- CIR V Pilipinas ShellDokument4 SeitenCIR V Pilipinas ShellCedric Enriquez100% (2)

- Collector Vs HendersonDokument11 SeitenCollector Vs HendersonBenedick LedesmaNoch keine Bewertungen

- Cir v. MeralcoDokument2 SeitenCir v. MeralcoKhaiye De Asis AggabaoNoch keine Bewertungen

- 49 CIR V Glenshaw GlassDokument2 Seiten49 CIR V Glenshaw GlassMiguel AlonzoNoch keine Bewertungen

- Filipinas Compania de Seguros v. Francisco Y. MandanasDokument1 SeiteFilipinas Compania de Seguros v. Francisco Y. MandanasHoney GilNoch keine Bewertungen

- Medicard vs. CIRDokument6 SeitenMedicard vs. CIRYodh Jamin OngNoch keine Bewertungen

- Cebu Shipyard liable for sinking of Manila City passenger vesselDokument2 SeitenCebu Shipyard liable for sinking of Manila City passenger vesselDominique PobeNoch keine Bewertungen

- CIR V Batangas Tayabas Bus CoDokument3 SeitenCIR V Batangas Tayabas Bus CoViolet ParkerNoch keine Bewertungen

- Diageo Philippines Lacks StandingDokument1 SeiteDiageo Philippines Lacks StandingArmstrong BosantogNoch keine Bewertungen

- China Banking Corp V CIRDokument2 SeitenChina Banking Corp V CIRWayne Michael NoveraNoch keine Bewertungen

- CIR v. Mirant PagbilaoDokument4 SeitenCIR v. Mirant Pagbilaoamareia yap100% (1)

- CM Hoskins V CIRDokument2 SeitenCM Hoskins V CIRSui100% (4)

- Case 59 CS Garments Vs CirDokument3 SeitenCase 59 CS Garments Vs CirJulian Guevarra0% (1)

- CIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Dokument3 SeitenCIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Pamela Camille Barredo100% (1)

- Fernandez Hermanos Case DigestDokument2 SeitenFernandez Hermanos Case DigestLean Robyn Ledesma-Pabon100% (1)

- 30 - CIR V Botelho Shipping CorpDokument2 Seiten30 - CIR V Botelho Shipping CorpDoel LozanoNoch keine Bewertungen

- 40 - CAPITAL INSURANCE v. PLASTIC ERADokument2 Seiten40 - CAPITAL INSURANCE v. PLASTIC ERAperlitainocencioNoch keine Bewertungen

- CIR Vs CA, CTA, GCLDokument3 SeitenCIR Vs CA, CTA, GCLNoel GalitNoch keine Bewertungen

- G.R. L-15290 - May 31, 1963: Cases Nos. L-15290 and L-15280Dokument2 SeitenG.R. L-15290 - May 31, 1963: Cases Nos. L-15290 and L-15280Aila AmpNoch keine Bewertungen

- II-c. Cir Vs S.C. JohnsonDokument2 SeitenII-c. Cir Vs S.C. JohnsonPia SottoNoch keine Bewertungen

- Cir VS VisayanDokument2 SeitenCir VS VisayanJosh Napiza100% (1)

- TRANSLINERDokument2 SeitenTRANSLINERMARRYROSE LASHERASNoch keine Bewertungen

- 1 Tax Rev - CIR Vs Javier 199 Scra 824Dokument8 Seiten1 Tax Rev - CIR Vs Javier 199 Scra 824LucioJr Avergonzado100% (1)

- CIR vs. Lincoln Philippine Life Insurance Company, IncDokument2 SeitenCIR vs. Lincoln Philippine Life Insurance Company, IncCecil MoriNoch keine Bewertungen

- Commissioner V Duberstein DigestDokument2 SeitenCommissioner V Duberstein DigestKTNoch keine Bewertungen

- US Citizens Cannot Deduct Foreign Taxes from Philippine IncomeDokument2 SeitenUS Citizens Cannot Deduct Foreign Taxes from Philippine IncomeShariqah Hanimai Indol Macumbal-YusophNoch keine Bewertungen

- Procter & Gamble Philippine Manufacturing Corporation vs Commissioner of Internal RevenueDokument36 SeitenProcter & Gamble Philippine Manufacturing Corporation vs Commissioner of Internal Revenuemceline19Noch keine Bewertungen

- CIR Vs Procter and Gamble 1Dokument1 SeiteCIR Vs Procter and Gamble 1JVLNoch keine Bewertungen

- Cir v. Procter & Gamble Philippines Manufacturing Corpoation, & CtaDokument2 SeitenCir v. Procter & Gamble Philippines Manufacturing Corpoation, & CtaDirect LukeNoch keine Bewertungen

- Case DigestDokument33 SeitenCase DigestAngela AngelesNoch keine Bewertungen

- SpecPro Rules 78-83Dokument27 SeitenSpecPro Rules 78-83BananaNoch keine Bewertungen

- SpecPro Rules 84-88Dokument47 SeitenSpecPro Rules 84-88BananaNoch keine Bewertungen

- Rule 89 and Estate Sale ApprovalDokument18 SeitenRule 89 and Estate Sale ApprovalBananaNoch keine Bewertungen

- 05 Cayetano vs. LeonidasDokument6 Seiten05 Cayetano vs. LeonidasBananaNoch keine Bewertungen

- 133 International v. Ley Construction (Butalid)Dokument3 Seiten133 International v. Ley Construction (Butalid)BananaNoch keine Bewertungen

- SpecPro Rules 92-95Dokument28 SeitenSpecPro Rules 92-95BananaNoch keine Bewertungen

- Rule 92-Paciente v. DacuycuyDokument4 SeitenRule 92-Paciente v. DacuycuyBananaNoch keine Bewertungen

- 09 Pio Barretto Realty Development, Inc. vs. Court of AppealsDokument11 Seiten09 Pio Barretto Realty Development, Inc. vs. Court of AppealsBananaNoch keine Bewertungen

- Trusteeship, Adoption CasesDokument52 SeitenTrusteeship, Adoption CasesBanana100% (1)

- 08 Jimenez vs. Intermediate Appellate CourtDokument5 Seiten08 Jimenez vs. Intermediate Appellate CourtBananaNoch keine Bewertungen

- 06 Garcia Fule vs. Court of AppealsDokument10 Seiten06 Garcia Fule vs. Court of AppealsBananaNoch keine Bewertungen

- Go v. BSPDokument2 SeitenGo v. BSPBananaNoch keine Bewertungen

- III - Rule 117 (1) Los BaÑos v. PedroDokument3 SeitenIII - Rule 117 (1) Los BaÑos v. PedroBananaNoch keine Bewertungen

- 18 Ong Bun v. BPIDokument3 Seiten18 Ong Bun v. BPIearlanthonyNoch keine Bewertungen

- 04 Polymer v. SalamudingDokument2 Seiten04 Polymer v. SalamudingBananaNoch keine Bewertungen

- Remedial Law Review of UP College of LawDokument5 SeitenRemedial Law Review of UP College of LawBananaNoch keine Bewertungen

- See - Polymer V SalamudingDokument3 SeitenSee - Polymer V SalamudingBananaNoch keine Bewertungen

- People v. Cachapero, Case DigestDokument1 SeitePeople v. Cachapero, Case DigestBanana100% (1)

- Digest By: Jocs Dilag (Lifted From Ateneo)Dokument2 SeitenDigest By: Jocs Dilag (Lifted From Ateneo)Joshua AbadNoch keine Bewertungen

- III - Rule 116 (3) Virata V SandiganbayanDokument5 SeitenIII - Rule 116 (3) Virata V SandiganbayanBananaNoch keine Bewertungen

- III - Rule 116 (2) People V DocumentoDokument1 SeiteIII - Rule 116 (2) People V DocumentoBananaNoch keine Bewertungen

- Coscoluella V SandiganbayanDokument2 SeitenCoscoluella V SandiganbayanBananaNoch keine Bewertungen

- Sanson V CADokument2 SeitenSanson V CAJoshua AbadNoch keine Bewertungen

- Manongsong V EstimoDokument2 SeitenManongsong V EstimoJoshua AbadNoch keine Bewertungen

- People V GolimlimDokument2 SeitenPeople V GolimlimJoshua AbadNoch keine Bewertungen

- Chua v. MetrobankDokument2 SeitenChua v. MetrobankBananaNoch keine Bewertungen

- Rimorin V People - DigestDokument1 SeiteRimorin V People - DigestJoshua Abad0% (1)

- Philip Turner v. Lorenzo Shipping Corp.Dokument3 SeitenPhilip Turner v. Lorenzo Shipping Corp.BananaNoch keine Bewertungen

- 5 Chu V Sps CunananDokument3 Seiten5 Chu V Sps CunananBananaNoch keine Bewertungen

- Dolores Macaslang v. Renato ZamoraDokument2 SeitenDolores Macaslang v. Renato ZamoraBananaNoch keine Bewertungen

- PHD Thesis - Table of ContentsDokument13 SeitenPHD Thesis - Table of ContentsDr Amit Rangnekar100% (15)

- Careers in Corporate FinanceDokument7 SeitenCareers in Corporate FinanceDigambar JangamNoch keine Bewertungen

- HW1 NPVDokument4 SeitenHW1 NPVLalit GuptaNoch keine Bewertungen

- Environmental Justice and Nigerian OilDokument26 SeitenEnvironmental Justice and Nigerian OilLiz Miranda100% (1)

- Chapter 1Dokument11 SeitenChapter 1Anand GuptaNoch keine Bewertungen

- Guide to PhilHealth Benefits for FamiliesDokument65 SeitenGuide to PhilHealth Benefits for FamiliesMark Johnuel DuavisNoch keine Bewertungen

- Financial Management and PolicyDokument658 SeitenFinancial Management and PolicyJovana Veselinović100% (1)

- Accredited partners in constructionDokument2 SeitenAccredited partners in constructionHershey GabiNoch keine Bewertungen

- Order in The Matter of Exelon Infrastructure LimitedDokument22 SeitenOrder in The Matter of Exelon Infrastructure LimitedShyam SunderNoch keine Bewertungen

- Rulings2000 DigestDokument21 SeitenRulings2000 DigestArriane MartinezNoch keine Bewertungen

- AFI Gift Card partner stores in Cotroceni (Bucharest) and PloiestiDokument3 SeitenAFI Gift Card partner stores in Cotroceni (Bucharest) and PloiestiOtilia BîlbîieNoch keine Bewertungen

- Karnataka Power Transmission Corporation Limited: KPTCLDokument5 SeitenKarnataka Power Transmission Corporation Limited: KPTCLaeesrs dvgNoch keine Bewertungen

- Fca Board 25 October 2018Dokument10 SeitenFca Board 25 October 2018leseNoch keine Bewertungen

- Mitsubishi GroupDokument3 SeitenMitsubishi GroupAurang Zeb KhanNoch keine Bewertungen

- Trade Map JK PaperDokument6 SeitenTrade Map JK PaperAsutosh PatroNoch keine Bewertungen

- Partial Withdrawal FormDokument1 SeitePartial Withdrawal Formmohd uzaini mat jusohNoch keine Bewertungen

- P Accounts Teacher FINALDokument74 SeitenP Accounts Teacher FINALLàtishà Puràñ100% (1)

- Missed call balance checking numbers for major Indian banksDokument17 SeitenMissed call balance checking numbers for major Indian banksS.N.RajasekaranNoch keine Bewertungen

- DPD Transport PresentationDokument11 SeitenDPD Transport PresentationFlorimela PenteleiciucNoch keine Bewertungen

- Top City Financial PRsDokument4 SeitenTop City Financial PRsvinothj86Noch keine Bewertungen

- The Founding Fathers, 30 Years OnDokument8 SeitenThe Founding Fathers, 30 Years OnJames WarrenNoch keine Bewertungen

- Table B5: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2006Dokument2 SeitenTable B5: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2006Rekha BaiNoch keine Bewertungen

- Chapter 01 Review Questions and Cases for Governmental and Not-for-Profit AccountingDokument3 SeitenChapter 01 Review Questions and Cases for Governmental and Not-for-Profit Accountingfernbern0131Noch keine Bewertungen

- Reliance Group of Companies 2003Dokument22 SeitenReliance Group of Companies 2003Aadil AslamNoch keine Bewertungen

- Aditya Birla Nuvo Columbian ChemicalsDokument21 SeitenAditya Birla Nuvo Columbian ChemicalssearchingnobodyNoch keine Bewertungen

- Deegan Technical Update June 11Dokument55 SeitenDeegan Technical Update June 11Mida SonbayNoch keine Bewertungen

- Skin Care - Malaysia Insights - August 2016Dokument37 SeitenSkin Care - Malaysia Insights - August 2016Yeong YeeNoch keine Bewertungen

- Financial Accounting and Accounting StandardDokument18 SeitenFinancial Accounting and Accounting StandardZahidnsuNoch keine Bewertungen

- P6 - Management Accounting - Business StrategyDokument16 SeitenP6 - Management Accounting - Business StrategyIrfan AliNoch keine Bewertungen

- A Project Report On CSR New SagarDokument66 SeitenA Project Report On CSR New SagarMahesh Tanpure100% (1)