Beruflich Dokumente

Kultur Dokumente

Ethics Predetermined Overhead Rate and Capacity

Hochgeladen von

Muhammad UsmanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ethics Predetermined Overhead Rate and Capacity

Hochgeladen von

Muhammad UsmanCopyright:

Verfügbare Formate

Accounting for overhead

expenditure

Learning objectives====================

After studying this chapter, you should be able to:

• explain why departmental overhead rates should be used in preference to a single blanket overhead

rate;

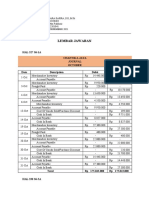

• construct an overhead analysis sheet and calculate departmental overhead absorption rates;

• justify why predetermined overhead rates should be used in preference to actuaJ overhead rates;

• calculate and explain the accounting treatment of the under/over recovery of overheads;

• describe the three different capacity measures which can be used to calculate overhead absorption rates;

• record inter-service department transfers using one of the methods described in Appendix 4.1;

• describe the six different methods of overhead recovery.

In Chapter 3 we discussed the procedure for Product costs are required for two

assigning direct labour and material costs to purposes: first, for financial accounting

products. With direct costs, we can accurately requirements in order to allocate the

measure the resources consumed by products by manufacturing costs incurred during a

recording labour times engaged on specific period between cost of goods sold and

products or tracing the materials issued to a inventories; secondly, to provide useful

particular product. In this chapter we are going information for managerial decision-

to focus on how overhead costs can be allocated making requirements. In order to meet

to products. financial accounting requirements, it may not be

You will recall from Chapter 2 that overhead necessary to accurately trace costs to individual

expenditure consists of indirect labour, indirect products. Consider a situation where a firm

materials and indirect expenses. In other words, produces 1000 different products and the costs

overheads are those costs that cannot be directly incurr~d during a period are £10 million. A well-

assigned to cost objectives such as a product, designed product costing system should

process, sales territory or customer group. Some accurately analyse the £10 million costs incurred

examples of specific items of overhead between cost of sales and inventories. Let us

expenditure include supervision, lighting and assume the true figures are £7 million and £3

heating and rent and rates for produd million. Approximate but inaccurate individual

costing. These items may, however, be directly product costs may provide a reasonable

attributable to another cost objective- for approximation of how much of the £10 million

example, if the cost objective is a sales territory should be attributed to cost of sales and

then they may be direct costs. inventories. Some product costs may be

It is not possible to accurately measure the overstated and others may be understated, but

overhead resources consumed by products, since this would not matter for financial accounting

we cannot trace specific items of overheads to purposes as long as the toto/ of the individual

individual products. Instead, we must estimate the product costs assigned to cost of sales and

overhead resources consumed. Thus product inventories was approximately £7 million and £3

costs are likely to become more inaccurate as the million.

proportion of overheads in a firm's cost structure For decision-making purposes, however, more

mcreases. accurate product costs are required so that we

70 - - - - - - - - - - - - - - - - - - - - - - - - - - - - • ACCOUNTING FOR OVERHEAD EXPENDITURE

C. Drury, Management and Cost Accounting

© J.C. Drury 1992

can distinguish between profitable and to a more competitive climate over the years has

unprofitable products. By more accurately made decision errors due to poor cost

measuring the resources consumed by products, information more probable and more costly.

a firm can identify its sources of profits and The a im of this chapter is to describe a

losses. If the cost system does not capture cost system for accumulating product

sufficiently accurately the consumption of costs for financial accounting purposes.

resources by products, the reported product costs Thus approximate, but inaccurate,

will be distorted, and there is a danger that product costs will suffice. These product

managers may drop profitable products or costs should not, however, be used for

continue production of unprofitable products. decision-making purposes. In Chapters 10

According to Cooper and Kaplan (1988), cost and 11 we ore going to focus on the design of

systems work satisfactorily for accumulating cost systems that will generate information for

product costs for financial accounting purposes decision-making purposes.

but fail to provide product cost information that is For financial accounting and inventory

useful for decision-making purposes. The valuation purposes the Statement of Standard

management accounting literature advocates that Accounting Practice (SSAP 9) on Stocks and Work

product costs, based on the methods of tracing in Progress states that all direct manufacturing

overheads to products described in this chapter, costs and overheads must be allocated to

should not be used for decision-making products, and non-manufacturing overheads

purposes. These product costs are only recorded as period costs. The justification for this

appropriate for financial accounting purposes. is that all manufacturing overheads are incurred

Nevertheless, there is a considerable amount of in the production of the firm's output, and so each

evidence to suggest that product costs, computed unit of the product produced receives some

in the manner described in this chapter, are used benefit from these costs. It follows that each unit

by firms for decision-making purposes (see e.g. of output should be charged with some of the

Cooper, 1990; Drury el a/., 1992). overhead costs. For an explanation of why

Most firms use simplistic methods to allocate period costs are not traced to products and

overhead costs to products. These methods were included in the stock valuation you should refer

developed decades ago when most companies back to the section relating to period and

manufactured a narrow range of products, and product costs in Chapter 2.

direct labour and materials were the dominant In this chapter we a re going to

factory costs. Overhead costs were relatively concentrate mainly on a llocating

small and the distortions arising from using manufacturing overhe ads to products.

simplistic methods were not significant. However, some firms do allocate non-

Information costs were high, and it was therefore manufacturing overheads to products for

difficult to justify the use of more sophisticated decision-making purposes, and the procedures

methods. they adopt are briefly described. Finally, it is

Today companies produce a wide range of important to note that, since our objective in this

products; direct labour cost represents only a chapter is to design a cost system that assigns

small fraction of total costs, and overhead costs costs between cost of goods sold and inventories,

are of considerable importance. Simplistic approximate but inaccurate product costs should

overhead allocations are difficult to justify, suffice. The additional benefits arising from

particularly when information processing costs designing cost systems that will generate more

have declined dramatically and ore no longer a accurate product costs may not exceed the

barrier to introducing more sophisticated cost additional costs of implementing and operating

accumulation systems. Furthermore, the change the system.

Most companies allocate overheads to products using a two-stage procedure. In the

first stage overheads are assigned to cost centres, while the second stage allocates An overview of

the costs accumulated in the cost centres to products. You will recall from Chapter 2

that a cost centre is a responsibility centre where managers are accountable for the the procedure

expenses that are under their control. Normally cost centres consist of departments, for allocating

but in some instance they consist of smaller segments such as groups of machines

within a department. In this chapter we are going to assume that cost centres consist overheads to

of departments. In the United States the term cost pool is used to describe any products

group of individual costs to which overheads are assigned to in the first stage of the

PROCEDURE FOR ALLOCATING OVERHEADS TO PRODUCTS - - - - - - - - - - - - - - - - - - - - - - - 71

Das könnte Ihnen auch gefallen

- ACCA F5 - Part A - Specialist Cost and Management Accounting TechniquesDokument5 SeitenACCA F5 - Part A - Specialist Cost and Management Accounting TechniquesMuneera Al Hassan100% (2)

- Intacc SolmanDokument104 SeitenIntacc Solmanpam92% (36)

- Test Bank Principles of Cost Accounting 14th Edition VanderbeckDokument29 SeitenTest Bank Principles of Cost Accounting 14th Edition VanderbeckFor GamesNoch keine Bewertungen

- Lesson 6-Activity Based Costing SystemDokument11 SeitenLesson 6-Activity Based Costing SystemOmotayo OpeniyiNoch keine Bewertungen

- Philippine Review Institute for Accountancy (PRIA) Advanced Financial Accounting and Reporting (AFAR) Cost Accounting SystemsDokument7 SeitenPhilippine Review Institute for Accountancy (PRIA) Advanced Financial Accounting and Reporting (AFAR) Cost Accounting SystemsPau SantosNoch keine Bewertungen

- Factory Overhead Accounting MethodsDokument7 SeitenFactory Overhead Accounting MethodsMitsuko OgatisNoch keine Bewertungen

- NotesDokument155 SeitenNotesZainab Syeda100% (1)

- ACC-122 Inventory QuizDokument2 SeitenACC-122 Inventory QuizPea Del Monte Añana100% (1)

- Blocher8e EOC SM Ch15 Final StudentDokument53 SeitenBlocher8e EOC SM Ch15 Final StudentKatelynNoch keine Bewertungen

- Chapter 11Dokument13 SeitenChapter 11Stephanie SundiangNoch keine Bewertungen

- Cost AccountingDokument14 SeitenCost Accountingkiros100% (1)

- CV Cendana financial reports analysisDokument28 SeitenCV Cendana financial reports analysisArum100% (1)

- Automobile Diagnostic Car Detailing Rs. 1.9 Million May-2020Dokument24 SeitenAutomobile Diagnostic Car Detailing Rs. 1.9 Million May-2020nwoutNoch keine Bewertungen

- Food Processing TLE 7 - AFA-FP - M4 - v3Dokument23 SeitenFood Processing TLE 7 - AFA-FP - M4 - v3manuel advinculaNoch keine Bewertungen

- Cost Control & Cost ReductionsDokument92 SeitenCost Control & Cost ReductionsAniketh Upadrasta100% (3)

- Cost Management: A Case for Business Process Re-engineeringVon EverandCost Management: A Case for Business Process Re-engineeringNoch keine Bewertungen

- Cost Accounting and Control OutputDokument21 SeitenCost Accounting and Control OutputApril Joy Obedoza100% (5)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageVon EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageBewertung: 5 von 5 Sternen5/5 (1)

- Coursematerial mmzg511 MOML15Dokument6 SeitenCoursematerial mmzg511 MOML15srikanth_bhairiNoch keine Bewertungen

- Costing SystemsDokument33 SeitenCosting Systemselizabeth.awaiyeNoch keine Bewertungen

- Cost CH 3Dokument20 SeitenCost CH 3Yonas AyeleNoch keine Bewertungen

- Module 2: Job-Order Costing: Required ReadingDokument32 SeitenModule 2: Job-Order Costing: Required Readingianglenn100Noch keine Bewertungen

- AB-B - Rizky Fadillah Salam - Assignment Week 4 5Dokument13 SeitenAB-B - Rizky Fadillah Salam - Assignment Week 4 5Reta AzkaNoch keine Bewertungen

- Operation CostingDokument5 SeitenOperation CostingAshmanur RhamanNoch keine Bewertungen

- Activity Based CostingDokument19 SeitenActivity Based CostingthejojoseNoch keine Bewertungen

- Accounting 202 Exam 1 Study Guide: Chapter 1: Managerial Accounting and Cost Concepts (12 Questions)Dokument4 SeitenAccounting 202 Exam 1 Study Guide: Chapter 1: Managerial Accounting and Cost Concepts (12 Questions)zoedmoleNoch keine Bewertungen

- CmaDokument10 SeitenCmabhagathnagarNoch keine Bewertungen

- Managerial Accounting 5th Edition Jiambalvo Solutions ManualDokument25 SeitenManagerial Accounting 5th Edition Jiambalvo Solutions ManualChristopherSchmidtxjs100% (52)

- Absorption CostingDokument23 SeitenAbsorption Costingarman_277276271Noch keine Bewertungen

- Strategic ManagementDokument42 SeitenStrategic ManagementElvira CuadraNoch keine Bewertungen

- UNIT 3 Absorption Variable CostingDokument19 SeitenUNIT 3 Absorption Variable Costingannabelle albaoNoch keine Bewertungen

- CHAPTER 4 Product and Service Costing: Overhead Application and Job-Order SystemDokument28 SeitenCHAPTER 4 Product and Service Costing: Overhead Application and Job-Order SystemMudassar Hassan100% (1)

- Standard Costing and The Balance ScorecardDokument76 SeitenStandard Costing and The Balance ScorecardSaifurKomolNoch keine Bewertungen

- Standard Costing vs Absorption Costing ProjectDokument21 SeitenStandard Costing vs Absorption Costing ProjectMukesh ManwaniNoch keine Bewertungen

- Job Order CostingDokument5 SeitenJob Order CostingNishanth PrabhakarNoch keine Bewertungen

- 1: Traditional/Advanced Costing Methods: Why Need To Know Cost/unit?Dokument52 Seiten1: Traditional/Advanced Costing Methods: Why Need To Know Cost/unit?dwalcotNoch keine Bewertungen

- Managerial Accounting 5th Edition Jiambalvo Solutions ManualDokument35 SeitenManagerial Accounting 5th Edition Jiambalvo Solutions Manualwannesswoodsarehv0t06100% (25)

- Purpose of costing: value inventory, record costs, price products, make decisionsDokument13 SeitenPurpose of costing: value inventory, record costs, price products, make decisionsSiddiqua KashifNoch keine Bewertungen

- Account 203Dokument1 SeiteAccount 203RAVI KISHANNoch keine Bewertungen

- Chap 002Dokument62 SeitenChap 002WOw WongNoch keine Bewertungen

- Capture 4Dokument6 SeitenCapture 4sagung anindyaNoch keine Bewertungen

- Chapter 10Dokument11 SeitenChapter 10clarice razonNoch keine Bewertungen

- Activity Based Costing Provides Accurate InsightsDokument7 SeitenActivity Based Costing Provides Accurate Insightsrachel 1564Noch keine Bewertungen

- Absorption Costing: CHAPTER 1: Specialist Cost and Management Accounting TechniquesDokument21 SeitenAbsorption Costing: CHAPTER 1: Specialist Cost and Management Accounting TechniquesYashna SohawonNoch keine Bewertungen

- Activity Based Costing IntroductionDokument32 SeitenActivity Based Costing IntroductionHARSHIT KUMAR GUPTA 1923334Noch keine Bewertungen

- Chapter 3 Cost IDokument64 SeitenChapter 3 Cost IBikila MalasaNoch keine Bewertungen

- Unit 12Dokument13 SeitenUnit 12Linh Trang Nguyễn ThịNoch keine Bewertungen

- Acctg201 JobOrderCostingLectureNotesDokument20 SeitenAcctg201 JobOrderCostingLectureNotesaaron manacapNoch keine Bewertungen

- MAS Variable and Absorption CostingDokument11 SeitenMAS Variable and Absorption CostingGwyneth TorrefloresNoch keine Bewertungen

- Job Order CostDokument16 SeitenJob Order CostPaolo Immanuel OlanoNoch keine Bewertungen

- Direct Costing Financial Statements: PurposeDokument18 SeitenDirect Costing Financial Statements: Purposesadanand_petkar_1Noch keine Bewertungen

- Topic 3 Cost AssignmentDokument10 SeitenTopic 3 Cost AssignmentEvelyn B NinsiimaNoch keine Bewertungen

- Modul Akuntansi Manajemen (TM7)Dokument7 SeitenModul Akuntansi Manajemen (TM7)Aurelique NatalieNoch keine Bewertungen

- 02 Cost AccountingDokument13 Seiten02 Cost AccountingAmparo Grados100% (1)

- Bba 2003zxcvaeDokument28 SeitenBba 2003zxcvaeKLFelixChewNoch keine Bewertungen

- 08 Accounting Study NotesDokument5 Seiten08 Accounting Study NotesJonas ScheckNoch keine Bewertungen

- Determine Product Costs with Costing Systems (39Dokument11 SeitenDetermine Product Costs with Costing Systems (39Cherwin bentulanNoch keine Bewertungen

- Kinney 8e - CH 05Dokument16 SeitenKinney 8e - CH 05Ashik Uz ZamanNoch keine Bewertungen

- Learning Objectives: Cost Terms, Concepts, and ClassificationsDokument5 SeitenLearning Objectives: Cost Terms, Concepts, and ClassificationsEnp Gus AgostoNoch keine Bewertungen

- Chapter 3 Hilton 10th Instructor NotesDokument16 SeitenChapter 3 Hilton 10th Instructor NotesDananggitscribdNoch keine Bewertungen

- Standard Cost DefinitionDokument45 SeitenStandard Cost DefinitionSandeep ShahNoch keine Bewertungen

- What is a Costing System ExplainedDokument4 SeitenWhat is a Costing System ExplainedNeriza PonceNoch keine Bewertungen

- Cost Accounting and Control OutputDokument21 SeitenCost Accounting and Control OutputApril Joy ObedozaNoch keine Bewertungen

- Cost Accounting and Control OutputDokument21 SeitenCost Accounting and Control OutputApril Joy ObedozaNoch keine Bewertungen

- Chapter 5 NotesDokument6 SeitenChapter 5 NotesXenia MusteataNoch keine Bewertungen

- MODULE 8 Standard CostingDokument11 SeitenMODULE 8 Standard CostingAlexandra AbasNoch keine Bewertungen

- ACTIVITY BASED COSTING g1Dokument8 SeitenACTIVITY BASED COSTING g1Iqra AliNoch keine Bewertungen

- Accounting For Managers-Questions - TestDokument13 SeitenAccounting For Managers-Questions - TestIvy TulesiNoch keine Bewertungen

- Cost DJB - MTP Oct21Dokument10 SeitenCost DJB - MTP Oct21Bharath Krishna MVNoch keine Bewertungen

- INVENTORY STUDY AT ELMECADokument25 SeitenINVENTORY STUDY AT ELMECAbest video of every timeNoch keine Bewertungen

- Applied Enterprenuership (Q4W4)Dokument10 SeitenApplied Enterprenuership (Q4W4)Eunel PeñarandaNoch keine Bewertungen

- Accounting ExamDokument7 SeitenAccounting Examjerrytanny100% (1)

- Cash Budget for Calgon Products for September 20x4Dokument11 SeitenCash Budget for Calgon Products for September 20x4신두Noch keine Bewertungen

- With Answeracca107 Prefinals Nov 14 2022Dokument6 SeitenWith Answeracca107 Prefinals Nov 14 2022padayonmhieNoch keine Bewertungen

- p2 Long SeatworkDokument6 Seitenp2 Long SeatworkLeisleiRagoNoch keine Bewertungen

- Financial Accounting Ch03Dokument32 SeitenFinancial Accounting Ch03Diana FuNoch keine Bewertungen

- Answer Keys - Test Bank - Fabm2Dokument10 SeitenAnswer Keys - Test Bank - Fabm2Kevin Pereña GuinsisanaNoch keine Bewertungen

- Analysisof Financial StatementsDokument208 SeitenAnalysisof Financial StatementsSebastianNoch keine Bewertungen

- SCM-4-Master BudgetDokument21 SeitenSCM-4-Master BudgetChin FiguraNoch keine Bewertungen

- Comprehensive Income Taxation Somera (4!29!14)Dokument200 SeitenComprehensive Income Taxation Somera (4!29!14)Moi Warhead0% (1)

- Cost Management MCQDokument37 SeitenCost Management MCQKinjal patilNoch keine Bewertungen

- Profit or Loss Prior To IncorporationDokument7 SeitenProfit or Loss Prior To IncorporationJavid QuadirNoch keine Bewertungen

- Scheduler's ImpressiveDokument7 SeitenScheduler's Impressivemaria ronoraNoch keine Bewertungen

- MIS Income Statement Differences by Business TypeDokument2 SeitenMIS Income Statement Differences by Business TypejbanegazNoch keine Bewertungen

- Sample Chart of AccountsDokument5 SeitenSample Chart of AccountslkuchinNoch keine Bewertungen

- CH5 Accounting QuizDokument7 SeitenCH5 Accounting QuizTarun ImandiNoch keine Bewertungen

- Queen MannylynDokument15 SeitenQueen MannylynSeoonnho KimNoch keine Bewertungen

- Intermediate Accounting 17Th Edition Kieso Test Bank Full Chapter PDFDokument67 SeitenIntermediate Accounting 17Th Edition Kieso Test Bank Full Chapter PDFDebraWhitecxgn100% (8)

- Bai Tap Chap 3Dokument4 SeitenBai Tap Chap 3SonNoch keine Bewertungen

- Inter Accounts Super 20 QuestionsDokument41 SeitenInter Accounts Super 20 QuestionsOm AgarwalNoch keine Bewertungen