Beruflich Dokumente

Kultur Dokumente

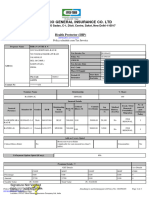

Policy Detail

Hochgeladen von

Jeyavel NagarajanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Policy Detail

Hochgeladen von

Jeyavel NagarajanCopyright:

Verfügbare Formate

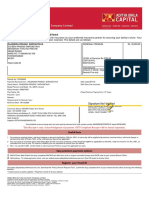

LIFE INSURANCE PREMIUM CERTIFICATE

(Financial Year 2018-2019)

SEBASTIN RAJU Date : 27-03-2019

29/A,,RAMAN STREET, ALLAMPATTI

VIRUDHUNAGAR,

VIRUDHUNAGAR - 626001

State : TAMIL NADU

Phone :

This is to certify the following details:

Policy Number C209929539 Basic Plan Tata AIA Life Insurance Fortune Guar

antee (110N120V05)

Insured Name SEBASTIN RAJU Policyowner Name SEBASTIN RAJU

Mode of Premium ANNUAL Base Sum Assured/Units 500000.00

Date of Issuance 19-03-2019 Next Due date 19-03-2020

Next due premium (Rs.) 50000.00 Death Sum Assured 500000.00

Tax Sections## Amount (Rs.)

80 C of Income Tax Act, 1961* 51000.00

80 CCC of Income Tax Act, 1961** 0.00

80D of Income Tax Act, 1961*** 0.00

Total Premium 51000.00

Goods and Service Tax 2295.00

#Total amount paid during the Financial Year 2018-2019 : 53295.00

Total amount of Top up premium paid during the Financial Year 2018-2019 : 0.00

Amount available in Excess: 0.00

Rider Details

Rider Name Rider Sum assured Rider Premium

Tata AIA Life Insu 500000.00 1000.00

rance Accidental D

eath and Dismember

ment (Long Scale)

(ADDL) Rider

* Includes Life Plans, Riders and Immediate Annuity products.

** Includes Pension Plans. Tax benefit is not available for premium payment through automatic loans from Cash Value of the policy if any, as per the policy provisions.

*** Includes Health Plans & Health Riders. Tax benefit is not available for premium payment in cash or through automatic loans from Cash Value of the policy if any, as per the policy

provisions.

# Subject to realization of payment received.

^ Annualised Premium shall be the premium payable in a year with respect to the basic sum assured chosen by the policy holder,excluding the underwriting extra premiums and loading for

modal premiums, if any.

All applicable taxes, duties, surcharge, cesses or levies, as may be imposed by Government, any statutory or administrative authority from time to time, on the premiums payable and benefits

secured under Policy, shall be borne and paid by the Policyholder.

## Income Tax benefits u/s 80C and 10(10D) would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Tata AIA Life Insurance Company

Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you.

IRDA has mandated for all payouts to be made through NEFT. Please register for NEFT, in case you have not done it already

This is a computer generated statement and does not require signature.

PAN: AABCT3784C

Category of Service: Life Insurance Service and / or Management of investment under ULIP Services

BEWARE OF SPURIOUS PHONE CALLS AND FICITIOUS/FRADULENT OFFERS:

IRDA of India clarifies to public that IRDA of India or its officials do not involve in activities like sale of any kind of insurance or financial products nor invest premiums.

IRDA of India does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of phone call, number.

Tata AIA Life Insurance Company Ltd. (IRDA of India Regn. No. 110)(CIN - U66010MH2000PLC128403)

Regd. & Corporate office: 14th Floor, Tower A, Peninsula Business Park, Senapati Bapat Marg, Lower Parel, Mumbai-400 013 .

Please contact us at 1860-266-9966 (local charges apply) or write to us at customercare@tataaia.com or SMS ‘SERVICE’ to 58888

L&C/Misc/2017/Jun/214

Das könnte Ihnen auch gefallen

- Consolidated Premium Paid STMT 2020-2021 PDFDokument1 SeiteConsolidated Premium Paid STMT 2020-2021 PDFSHITESH KUMARNoch keine Bewertungen

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDokument1 SeiteRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNoch keine Bewertungen

- Prashant (1) CompletedDokument1 SeitePrashant (1) CompletedAsifshaikh7566Noch keine Bewertungen

- Pawan S PDF CompletedDokument1 SeitePawan S PDF CompletedAsifshaikh7566Noch keine Bewertungen

- Reg No: Dl8Cav0116: Registration Certificate For VehicleDokument1 SeiteReg No: Dl8Cav0116: Registration Certificate For Vehicleh4ckerNoch keine Bewertungen

- Interest Certificate: Shivam Garg and Ramkrishna GargDokument1 SeiteInterest Certificate: Shivam Garg and Ramkrishna GargShivamNoch keine Bewertungen

- Renewal of Your Ican Essential Advanced Insurance PolicyDokument3 SeitenRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNoch keine Bewertungen

- Health DocumentDokument2 SeitenHealth Documentramki240Noch keine Bewertungen

- Tax Certificate - 008927742 - 131310Dokument2 SeitenTax Certificate - 008927742 - 131310Vignesh MahadevanNoch keine Bewertungen

- Mediclaim Policy Parents - H1096407Dokument3 SeitenMediclaim Policy Parents - H1096407Lokesh AnandNoch keine Bewertungen

- BA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanDokument2 SeitenBA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanSudesh ChauhanNoch keine Bewertungen

- Bill 12sep2023Dokument1 SeiteBill 12sep2023UR12ME148 PrafullaNoch keine Bewertungen

- Dengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateDokument1 SeiteDengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateAbhishek GoelNoch keine Bewertungen

- LIC Sikha PDFDokument1 SeiteLIC Sikha PDFsikha singh100% (1)

- Renewal NoticeDokument2 SeitenRenewal NoticeJerry LamaNoch keine Bewertungen

- 1865362Dokument1 Seite1865362Bhavesh ParekhNoch keine Bewertungen

- New - Life Insurance Corporation of India - Sowmya - 2023Dokument1 SeiteNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNoch keine Bewertungen

- Premium Paid CertificateDokument1 SeitePremium Paid CertificateVishal DNoch keine Bewertungen

- 80D.pdf-Piyush - Copy 3Dokument1 Seite80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNoch keine Bewertungen

- Gym FeesDokument1 SeiteGym FeesMrityunjay AryanNoch keine Bewertungen

- Rajendra Prasad ShrivastavaDokument2 SeitenRajendra Prasad ShrivastavaSourabh ShrivastavaNoch keine Bewertungen

- Siti Broadband (Sep-Oct) BillDokument1 SeiteSiti Broadband (Sep-Oct) BillBARUN BIKASH DENoch keine Bewertungen

- Tax Certificate - of Anjali Lalwani PDFDokument2 SeitenTax Certificate - of Anjali Lalwani PDFBasant GakhrejaNoch keine Bewertungen

- For HDFC ERGO General Insurance Company LTDDokument2 SeitenFor HDFC ERGO General Insurance Company LTDNAVEEN H ENoch keine Bewertungen

- Religare PDFDokument5 SeitenReligare PDFsomnathNoch keine Bewertungen

- PolicyDokument55 SeitenPolicyBaneNoch keine Bewertungen

- 80D Pdf-AnkitDokument1 Seite80D Pdf-AnkitSaurabh RaghuvanshiNoch keine Bewertungen

- Mani HealthDokument7 SeitenMani HealthManish Tewari50% (2)

- Gym Bill JuneDokument1 SeiteGym Bill Junemaheshwari.neeraj1Noch keine Bewertungen

- Registration Certificate of Vehicle: Issuing Authority: Madhubani, BiharDokument1 SeiteRegistration Certificate of Vehicle: Issuing Authority: Madhubani, Bihartabrez alamNoch keine Bewertungen

- Premium Paid Acknowledgement PDFDokument1 SeitePremium Paid Acknowledgement PDFsanto02Noch keine Bewertungen

- Icici Lombard Mh!49966Dokument3 SeitenIcici Lombard Mh!49966suresh sivadasanNoch keine Bewertungen

- Premium Receipt - 008927742 - 131423Dokument2 SeitenPremium Receipt - 008927742 - 131423Vignesh MahadevanNoch keine Bewertungen

- FeeReceipt Sep2019Dokument1 SeiteFeeReceipt Sep2019KavitaNoch keine Bewertungen

- Health Insurance Policy Certificate Section80DDokument1 SeiteHealth Insurance Policy Certificate Section80DDebosmita DasNoch keine Bewertungen

- LIC Premium Receipt StatementDokument2 SeitenLIC Premium Receipt StatementRMNoch keine Bewertungen

- 2866100498386100000Dokument4 Seiten2866100498386100000E-World Cyber ZoneNoch keine Bewertungen

- Elss - Fy 2021-22Dokument2 SeitenElss - Fy 2021-22Amit SinghNoch keine Bewertungen

- 80D SelfDokument1 Seite80D Selfnikhil nadakuditiNoch keine Bewertungen

- Mr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Dokument7 SeitenMr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Bhanu Pratap Simgh YadavNoch keine Bewertungen

- Asf Shaikh TAX NEW2014Dokument1 SeiteAsf Shaikh TAX NEW2014Asifshaikh7566Noch keine Bewertungen

- 80D SelfDokument1 Seite80D Selfnikhil nadakuditiNoch keine Bewertungen

- Fee Receipt - 22208522 - 2 - 15 - 2022 10 - 09 - 39 AMDokument1 SeiteFee Receipt - 22208522 - 2 - 15 - 2022 10 - 09 - 39 AMKRISHNoch keine Bewertungen

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDokument2 SeitenStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- Ashwani KumarDokument1 SeiteAshwani KumarTarunNoch keine Bewertungen

- Max Health InsuranceDokument1 SeiteMax Health InsuranceanuNoch keine Bewertungen

- Donation ReceiptDokument1 SeiteDonation Receiptshiva krishna100% (1)

- Star Health Policy DocDokument6 SeitenStar Health Policy DocDev PandayNoch keine Bewertungen

- Premium Paid Certificate: Date: 14-DEC-2017Dokument1 SeitePremium Paid Certificate: Date: 14-DEC-2017zuhebNoch keine Bewertungen

- Amazon BlazerDokument1 SeiteAmazon BlazerRomNoch keine Bewertungen

- 80D CertificateDokument2 Seiten80D CertificateSiva KadaliNoch keine Bewertungen

- AugDokument1 SeiteAugsrikanth0483287Noch keine Bewertungen

- Bill 10835410 ExcitelDokument1 SeiteBill 10835410 ExcitelAbhinav TiwariNoch keine Bewertungen

- Premium Paid AcknowledgementDokument1 SeitePremium Paid AcknowledgementArpit SinghalNoch keine Bewertungen

- Health Policy SiddharthDokument9 SeitenHealth Policy SiddharthSiddharth DasNoch keine Bewertungen

- Renewal of Your Optima Restore Floater Insurance PolicyDokument4 SeitenRenewal of Your Optima Restore Floater Insurance PolicyNikky KapoorNoch keine Bewertungen

- PremiumRept MDS - RameshDokument2 SeitenPremiumRept MDS - Rameshnavengg521Noch keine Bewertungen

- Subject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inDokument31 SeitenSubject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inUday NainNoch keine Bewertungen

- Life Insurance Premium Certificate: (Financial Year 2018-2019)Dokument1 SeiteLife Insurance Premium Certificate: (Financial Year 2018-2019)Sugar SugarNoch keine Bewertungen

- Life Insurance Premium Certificate: (Financial Year 2018-2019)Dokument1 SeiteLife Insurance Premium Certificate: (Financial Year 2018-2019)Barnali ChakrabortyNoch keine Bewertungen

- Do You HaveDokument3 SeitenDo You HaveJeyavel NagarajanNoch keine Bewertungen

- Good Morning TeamDokument1 SeiteGood Morning TeamJeyavel NagarajanNoch keine Bewertungen

- RR ProgramDokument7 SeitenRR ProgramJeyavel NagarajanNoch keine Bewertungen

- Incentive Scheme Document For UMs IY 16-17 RDokument11 SeitenIncentive Scheme Document For UMs IY 16-17 RJeyavel NagarajanNoch keine Bewertungen

- Agreement 2017-2019Dokument9 SeitenAgreement 2017-2019Jeyavel NagarajanNoch keine Bewertungen

- 13 Digit Mobile Numbers 5 Feb 18 - BSNLDokument1 Seite13 Digit Mobile Numbers 5 Feb 18 - BSNLSubhrojit MallickNoch keine Bewertungen

- Branch)Dokument3 SeitenBranch)Jeyavel NagarajanNoch keine Bewertungen

- Wealth MGT PDFDokument4 SeitenWealth MGT PDFMunna SharmaNoch keine Bewertungen

- Appendix SDokument1 SeiteAppendix SJeyavel NagarajanNoch keine Bewertungen

- Avm Carbons: 4/318A, Thathampatti Road, Puliyankulam, Inamrettiyapatti, VIRUDHUNAGAR - 626 003Dokument1 SeiteAvm Carbons: 4/318A, Thathampatti Road, Puliyankulam, Inamrettiyapatti, VIRUDHUNAGAR - 626 003Jeyavel NagarajanNoch keine Bewertungen

- Service Tax Is Not Applicable On Selling of Space For Advertisement in Print Media As Per EntryDokument4 SeitenService Tax Is Not Applicable On Selling of Space For Advertisement in Print Media As Per EntryJitendra Suraaj TripathiNoch keine Bewertungen

- SDFFDokument10 SeitenSDFFNidhi AshokNoch keine Bewertungen

- Xacc280 Week3 Reading2Dokument56 SeitenXacc280 Week3 Reading2osharpening9402Noch keine Bewertungen

- TAXATION Finals ReviewerDokument38 SeitenTAXATION Finals ReviewerJunivenReyUmadhay100% (1)

- Tax Exemptions On Retirement PlansDokument3 SeitenTax Exemptions On Retirement PlansVola AriNoch keine Bewertungen

- Engineering EconomyDokument47 SeitenEngineering EconomyChris Thel MayNoch keine Bewertungen

- CH 10Dokument47 SeitenCH 10Ismadth2918388100% (1)

- Corporate Professionals Discounted Cash Flow Slideshare MondayDokument5 SeitenCorporate Professionals Discounted Cash Flow Slideshare MondayCorporate ProfessionalsNoch keine Bewertungen

- CRDB Bank PLC - Press Release 2Dokument5 SeitenCRDB Bank PLC - Press Release 2Anonymous FnM14a0Noch keine Bewertungen

- Chapter 4Dokument65 SeitenChapter 4NCTNoch keine Bewertungen

- Leverage PPTDokument13 SeitenLeverage PPTamdNoch keine Bewertungen

- Chapter Four Accounting Cycle For Manufacturing BusinessDokument5 SeitenChapter Four Accounting Cycle For Manufacturing BusinessAbrha636Noch keine Bewertungen

- Chapter 2 WileyDokument29 SeitenChapter 2 Wileyp876468Noch keine Bewertungen

- 6.06 A.b.03 CIR V Kudos Metal Corp - G.R. No. 178087Dokument14 Seiten6.06 A.b.03 CIR V Kudos Metal Corp - G.R. No. 178087Julia BalanagNoch keine Bewertungen

- Microsoft IPO ProspectusDokument52 SeitenMicrosoft IPO Prospectusjohnnyg31100% (1)

- Jblab Company Chart of AccountsDokument5 SeitenJblab Company Chart of AccountsVillanueva MenosaNoch keine Bewertungen

- Tenancy Agreement (Kamal Carwash)Dokument3 SeitenTenancy Agreement (Kamal Carwash)Syed Isamil75% (8)

- ProjectDokument11 SeitenProjectKrizia Mae LoricaNoch keine Bewertungen

- (HO 1) ERG-TAX 1-Estate TaxDokument15 Seiten(HO 1) ERG-TAX 1-Estate Taxyna kyleneNoch keine Bewertungen

- ch02 SM FA7e-1 (Doc - Wendoc.com)Dokument68 Seitench02 SM FA7e-1 (Doc - Wendoc.com)letuan8vnNoch keine Bewertungen

- PFRS 3, Business CombinationsDokument39 SeitenPFRS 3, Business Combinationsjulia4razoNoch keine Bewertungen

- Global President CEO in Detroit MI Resume Richard McCorryDokument5 SeitenGlobal President CEO in Detroit MI Resume Richard McCorryRichardMcCorryNoch keine Bewertungen

- Shree Renuka Sugars LTDDokument103 SeitenShree Renuka Sugars LTDsaikrishna858Noch keine Bewertungen

- Bone of ContentionDokument4 SeitenBone of ContentionKay Hydee PabellonNoch keine Bewertungen

- Test Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition GranofDokument15 SeitenTest Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition Granofsamuel debebe100% (1)

- Coffee Shop Bplan PDFDokument24 SeitenCoffee Shop Bplan PDFHenry SoehardimanNoch keine Bewertungen

- Les DJMS 31 PDFDokument1 SeiteLes DJMS 31 PDFBennie ReidNoch keine Bewertungen

- E9-8 Dan E9-13 - AKL 1 - Elisabet Siregar - 023001801106Dokument2 SeitenE9-8 Dan E9-13 - AKL 1 - Elisabet Siregar - 023001801106novita sariNoch keine Bewertungen

- GSTR3B PDFDokument48 SeitenGSTR3B PDFmalhar develkarNoch keine Bewertungen

- ch05 SM Carlon 5eDokument68 Seitench05 SM Carlon 5eKyleNoch keine Bewertungen