Beruflich Dokumente

Kultur Dokumente

Taxation Case Analysis

Hochgeladen von

Amlan Panda0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

45 Ansichten6 Seitencase study

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldencase study

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

45 Ansichten6 SeitenTaxation Case Analysis

Hochgeladen von

Amlan Pandacase study

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

KIIT SCHOOL OF LAW

BHUBANESWAR

2017-2022

BBA LLB(A)

CASE ANALYSIS ON

COMMISSIONER OF INCOME TAX

VS

CHROME LEATHER CO.PVT.LTD

NAME-AMLAN PANDA (1782015)

MAHARISHI BALLAV BORA(1782060)

DATE-13TH SEPTEMBER,2019.

SUBMITED TO-NILIMA PANDA

Pursuant to the direction of this court in T.C.P. No. 369 of 1981 dated April 19, 1982, the

following question of law has been referred by the Appellate Tribunal to this court under section

256(2) of the Income-tax Act, 1961.

“Whether, on the facts and in the circumstances of the case, the Appellate Tribunal was justified

in holding that there was no case for any disallowance under section 40A(3) of the Income-tax

Act, 1961, for the assessment year 1974–75.

FACTS-

The facts as found by the Appellate Tribunal are as under: The Income-tax Officer, in the course

of assessment proceedings of the asses-see for the assessment year 1974–75, the previous year

ending on March 31, 1974, disallowed, inter alia, the payment of a sum of Rs. 16,35,590 relating

to purchase of semi-processed goat skins from India Leather Corporation (Pvt.) Ltd. (hereinafter

referred to as I.L.C. Ltd.). One Nagappa Chettiar was the chairman of the assessee and he was

also the managing director of I.L.C. Ltd. The assessee has a tannery, but it had no purchasing

centres or set up other than I.L.C. Ltd. The said I.L.C. Ltd. has not only purchased goat skins on

behalf of the assessee, but alsosupplied on its own to the assessee. The assessee did further

processing of goat skins which came to it at semi-processed stage from other sister concerns

through I.L.C. Ltd. The purchases of raw skins were largely from shandies and the purchases

from shandies have been made on payment of cash by I.L.C. Ltd. The upcountry tanneries who

bought good exportable items for sale expect ready cash and I.L.C. Ltd. was keeping substantial

cash in its hands to meet such contingencies and cheques were rarely accepted. The assessee and

I.L.C. Ltd. had bank accounts in the same branch and both the companies had overdraft facilities.

The assessee as well as I.L.C. Ltd. thought that the issue of cheque and encashment of the same

would delay the process of purchase, because of the existing overdraft and hence payment of

cash was made by the assessee. The Income-tax Officer, on perusal of the accounts of the

assessee, held that the assessee is not a purchaser within the meaning of sub-rule (f) of rule 6DD

of the Income-tax Rules on the ground that the assessee's purchases were not of raw skins from

primary producers like butchers and I.L.C. Ltd. was not a “producer” as it sold only tanned skins

and not skins in the raw form. The Income-tax Officer also found that I.L.C. Ltd. had only

“South India Tanneries” as its own factory and other semiprocessed skins were purchased by

them from other sister firms under the management of Nagappa Chettiar. The Income-tax

Officer, therefore, held that the requirements of section 40A(3) of the Income-tax Act read with

rule 6DD(f) of the Income-tax Rules were not satisfied and since the purchases were made in

cash, he added back the amount of Rs. 16,35,590 and assessment was made on the assessee. The

assessee preferred an appeal before the Commissioner of Income-tax (Appeals). The

Commissioner of Income-tax (Appeals) held that the provisions of sub-rule (f)(ii) of rule 6DD of

the Income-tax Rules were complied with on the ground that the exemption to raw skins would

also include tanned, semi-tanned and semi-dressed skins. He referred to the provisions of section

14 of the Central Sales Tax Act, 1956 and according to him, the dressed hides and skins were

also hides and skins and the persons who dressed them would also be regarded as producers and

any sale by such persons would qualify for exemption under the provisions of rule 6DD(f)(ii) of

the Income-tax Rules. The Commissioner also held that the assessee would be entitled to

exemption under sub-rule (j) of rule 6DD of the Income-tax Rules on the ground that the debits

given by the I.L.C. Ltd. to the assessee totalled to Rs. 53,81,315 while the purchases made were

only to the extent of Rs. 16,22,392. There were a number of payments made by I.L.C. Ltd. on

behalf of the assessee for its purchases effected through them like payment of freight charges on

its behalf. The payments made by the assesses to I.L.C. were Rs. 58,26,302 including cash drawn

from Central Bank of India, Madras, and paid Rs. 55,62,743.91 and similar payments were

drawn from the State Bank of India and paid Rs. 53,500. The case of the assesses before the

Commissioner of Income-tax (Appeals) was that the payments were practically paid by self-

cliques drawn by the assessee and since Nagappa Chettiar was the chief executive in both the

concerns, the payments by self-cheques should be regarded as payments by cheque. The

Commissioner of Income-tax (Appeals) did not accept this contention of the assessee holding

that the payments made were not by cash. He, however, agreed that the assessee's case would fall

under sub-rule (j) of rule 6DD of the Income-tax Rules on the ground that the genuineness of the

payments and the identity of the payee were not disputed. The Commissioner of Income-tax

(Appeals) also held that it was not practicable to pay by crossed cheques on every occasion and

there was trade necessity to keep cash in hand for immediate cash purchases. According to the

Commissioner of Income-tax (Appeals), payments through crossed cheques would delay the

business operation and having regard to the nature of the relationship between the assessee and

the payee and the need for keeping the cash by the seller who was under the same management

and who was acting on behalf of the assessee for both the purchases and export sales, the

Commissioner of Income-tax (Appeals) held that the requirements of rule 6DD were satisfied

and, hence, the entire payment of Rs. 16,35,590 was held to be admissible.

ARGUMENTS-

The Revenue preferred an appeal before the Appellate Tribunal and the Appellate Tribunal also

held that the payment of cash was justified, having regard to the nature of the transaction and the

necessity for expeditious settlement. The Appellate Tribunal found that the fact that I.L.C. Ltd.

has to keep large amount of cash for making purchases of raw skins from shandies and local

butchers was undisputed. The Appellate Tribunal held that the payee was a well-established

concern and the transactions have also passed through the books of the parties and the

genuineness of the payments and the identities of the payees were not disputed. The Tribunal,

therefore, held that there was no intention to avoid payment of tax and in this view the Tribunal

upheld the order of the Commissioner of Income-tax (Appeals) regarding the allowance of Rs.

16,35,390.

The Income-tax Officer disallowed a sum of Rs. 6,50,303 under the provisions of section 40A(3)

of the Income-tax Act. The Commissioner of Income-tax (Appeals), on the appeal by the

assessee, granted relief on the entire amount. The Tribunal, after examining each item of

disallowance made by the Income-tax Officer, found that in all the cases, the identity of the

payee and genuineness of the payee could not be doubted and it was due to exceptional

circumstances, the payments were made in cash and the parties were reputed dealers in the same

line. The Appellate Tribunal, taking note of the trade practice and the materials furnished, came

to the conclusion that the Commissioner of Income-tax (Appeals) was justified in holding that

the payments made by the parties in cash are not liable to be disallowed and the requirements of

section 40A(3) of the Income-tax Act and rule 6DD(j) of the Income-tax Rules are fully satisfied.

The order of the Appellate Tribunal on both items of disallowance is the subject-matter of the tax

case reference.

Mr. S.V. Subramaniam, learned senior counsel appearing for the Department, submitted that the

Appellate Tribunal has committed a serious error in law in overlooking the banking practice.

According to him, after the Appellate Tribunal has found that the assessee and I.L.C. Ltd. had

bank accounts in the same branch, the view of the Appellate Tribunal that issue of crossed

cheques would amount to delay in encashment is erroneous in law. According to him, where the

assessee and the payee are keeping accounts in the same bank, issue of crossed cheque by one to

another would not delay the encashment of the cheque. The other reason given by the Tribunal is

that both the companies are having overdraft facilities and according to learned counsel,

existence Of overdraft facilities in the same branch would not have any effect on the encashment

of the crossed cheque. Hence, he submitted that the findings arrived at by the Appellate Tribunal

that the existence of the payee is established and hence, it could not be the subject-matter of

disallowance under the provisions of section 40A(3) of the Income-tax Act is erroneous in law.

Mr. S.V. Subramaniam also submitted that under sub-rule (f)(ii) of rule 6DD of the Income-tax

Rules, it must be a purchase of animal husbandry including hides and skins and, therefore, the

rule contemplates only purchase of animal husbandry, that is, raw hides and skins and it does not

include semi-dressed or dressed hides and skins. He, therefore, submitted that the Tribunal was

not correct in holding that the provisions of rule 6DD(f)(ii) of the Income-tax Rules, were

complied with.

Mr. Janarthana Raja, learned counsel for the assessee, on the other hand, submitted that the

Tribunal has come to the conclusion that the provisions of rule 6DD of the Income-tax Rules

were satisfied and the Tribunal has come to the conclusion that the provisions of rule 6DD of the

Income-tax Rules were fully complied with and, hence, it is not open to the Revenue to challenge

the finding of fact by the Appellate Tribunal.

We have considered the rival contentions. The provisions of section 40A(3) of the Income-tax

Act along with rule 6DD of the Income-tax Rules deal with the subject of payment made by the

assessee in cash and not by cheque or draft for more than the prescribed amount. The

constitutional validity of the provisions of section 40A(3) of the Income-tax Act was the subject-

matter of consideration before the Supreme Court in the case of Attar Singh Gurmukh

Singh v. ITO, [1991] 191 ITR 667, and the Supreme Court, after considering the object of the

section held that the payment by crossed cheque or crossed bank draft is insisted upon to enable

the assessing authority to ascertain whether the payment was genuine or whether it was out of

income from undisclosed sources. The Supreme Court also held that consideration of business

expediency and other relevant factors are not excluded in examining the applicability of the

provisions of section 40A(3) of the Income-tax Act. Genuine and bona fide transactions, as held

by the Supreme Court, are not taken out of the sweep of the section, and it is open to the assessee

to furnish to the satisfaction of the Assessing Officer the circumstances under which the payment

in the manner prescribed under section 40A(3) was not practicable or would have caused genuine

difficulty to the payee. The Supreme Court also held that it is open to the assessee to identify the

person who has received the cash payment. It is relevant to notice that rule 6DD of the Income-

tax Rules provides that an assessee can be exempted from payment by crossed cheque or crossed

bank draft in the circumstances specified in the rule. The above decision of the Supreme Court

makes it clear that the assessee can be exempted from the requirements of payment by crossed

cheque or crossed bank draft where the purchases are made in certain agricultural or horticultural

commodity or from a village where there is no banking facility.

The Central Board of Direct Taxes has issued certain guidelines giving certain circumstances,

and those circumstances are illustrative and not exhaustive and the underlying idea of the circular

is that if the identity of the payee is known, it would be possible for the Income-tax Officer to

cross-check whether the transaction had in fact taken place. The Tribunal took into account the

commercial need in keeping cash and referred to the need for keeping cash for making purchases

of raw skins from shandies when the upcountry tanneries insist upon payment of ready cash. It

was also found that the cheques were rarely accepted. It is no doubt true that the payee is having

a bank account in the same branch in which the assessee is having a bank account. But, working

hours of the bank are of limited duration. Though both the payee and payer may have accounts in

the same branch of the bank, but it may not be possible to issue a crossed cheque after the

banking hours. Further, the criticism of Mr. S.V. Subramaniam is that the assessee could have

made payments in advance in anticipation of purchase. It is well established that it is not for the

Revenue to dictate as to how the assessee should carry on his business. The Appellate Tribunal,

after noticing the trade practice and the necessity to keep cash in hand, has found, that there was

necessity on the part of the assessee to keep substantial cash in its hands to meet contingencies at

the time of purchase. It was also found, taking into account other factors, that there was a trade

necessity and issue of crossed cheque would delay the business operation. The Tribunal also

found that the issue of crossed cheque is not practicable and having regard to the nature of the

transaction and the necessity for expeditious settlement and the nature of the relationship

between the ayer and payee, it found that the issue of payment by crossed cheque would have

caused genuine difficulty to the payee and the identity of the-payee is not doubted and there is no

reason to doubt the genuineness of the payee in cash payment. The Appellate Tribunal

considered all the relevant materials on record and came to the conclusion that there was no

justification to disallow the entire payment, merely because Cash payments have been made. As

regards the other amount of Rs. 6,50,303, the Tribunal examined the materials with reference to

item-wise expenditure and found that there was justification for the payments to be made in cash.

The Tribunal also found that the identity of the payee was established and the genuineness of the

payment was established beyond doubt, and the requirements of section 40A(3) of the Income-

tax Act and rule 6DD of the Income-tax Rules were fully satisfied. The finding recorded by the

Appellate Tribunal is a finding arrived at on the facts of the case. The Tribunal has accepted the

materials produced before it in support of its finding that only at the time of purchase, the actual

amount would be known and the identity of the party was successfully established and the

decision of the Tribunal is based entirely on the facts of the case.

JUDGEMENT-

The Punjab and Haryana High Court in the case of CIT v. Avtar Singh and Sons, [1992] 194 ITR

80 held that where the identity of the party to whom payments were made was known and the

payments were found to be genuine, the payments could not be disallowed on the ground that the

payments were made by cash. The Punjab and Haryana High Court also noticed that where

money was urgently required after the banking hours and the receipt of the crossed cheque or

banking draft would delay the payment and would cause unnecessary hurdles in the proper

conduct of the business, it would be a relevant factor in considering the applicability of the

provisions of section 40A(3) of the Income-tax Act and rule 6DD of the Income-tax Rules. The

insistence on cash payment by the payee where such payee is identifiable and the payment is

genuine and is made on business expediency would be sufficient enough not to make any

disallowance because the payment was made in cash. The Allahabad High Court in CIT v. Ram

Agya Shyarn Narain, [1991] 189 ITR 470 held that such a finding of the Tribunal is a finding of

fact. The Punjab and Haryana High Court in the case of CIT v. Brij Mohan Singh and

Co., [1994] 209 ITR 753, held that the finding arrived at by the Tribunal on the facts of the case

that the provisions of section 40A(3) of the Act were fully satisfied is a finding of fact. We have

noticed that the Tribunal has taken note of the relevant factors and found that the payments were

duly accounted for in the accounts of the assessee as well as in the accounts of the payee. The

Tribunal has taken into account the trading practice and need for keeping cash and found that the

identity of the payee was established and genuineness of the payee was successfully established

and issue of, cheque would have delayed the transaction. Considering all these materials on

record, the Tribunal came to the conclusion that it was not practicable to accept the payment by

cheique. We are of the view that the finding arrived at by the Appellate Tribunal is a finding of

fact and since the Tribunal has correctly come to the conclusion on the materials available on

record, we are of the opinion that no referable question arose out of its order. Since we have held

that the payments made by the assessee is not liable to be disallowed while computing the

business income, on the facts of the case, it is unnecessary to consider the applicability of rule

6DD(j) of the Rules.

We, therefore, answer the question referred to us in the affirmative and against the Revenue.

Costs of the reference is Rs. 500.

BIBLIOGRAPHY-

MANUPATRA.COM

SCCONLINE.COM

INDIAKANOON.COM

CASEMINE.COM

Das könnte Ihnen auch gefallen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Pooja Expenses' in Temple Located Inside Factory Premises Is For Business Purpose & AllowableDokument4 SeitenPooja Expenses' in Temple Located Inside Factory Premises Is For Business Purpose & AllowableyagayNoch keine Bewertungen

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintVon EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintBewertung: 4 von 5 Sternen4/5 (1)

- Judgement: Liberty Indiaappellant Commissioner of Income TaxrespondentsDokument7 SeitenJudgement: Liberty Indiaappellant Commissioner of Income TaxrespondentsraaziqNoch keine Bewertungen

- ITAT Upheld Addition of 100% of Bogus Purchases - Taxguru - inDokument12 SeitenITAT Upheld Addition of 100% of Bogus Purchases - Taxguru - invijay40.laxmiNoch keine Bewertungen

- Ios ProjectDokument11 SeitenIos Projectmahathi bokkasamNoch keine Bewertungen

- J 2023 SCC OnLine ITAT 550 Dhruvba2046 Hpnluacin 20231209 110237 1 12Dokument12 SeitenJ 2023 SCC OnLine ITAT 550 Dhruvba2046 Hpnluacin 20231209 110237 1 12Dhruv ThakurNoch keine Bewertungen

- Termination of Insolvency Process by NCLT – Landmark Judgement - Taxguru - inDokument9 SeitenTermination of Insolvency Process by NCLT – Landmark Judgement - Taxguru - inVaibhav is liveNoch keine Bewertungen

- Jwalamala JewellersDokument9 SeitenJwalamala Jewellersbharath289Noch keine Bewertungen

- Unit 2 Case LawsDokument7 SeitenUnit 2 Case LawsDeepak SuranaNoch keine Bewertungen

- 005 - 1965 - Law Relating To TaxationDokument15 Seiten005 - 1965 - Law Relating To TaxationSubhayan BoralNoch keine Bewertungen

- Sudhi Ranjan Das, C.J., S.K. Das, A.K. Sarkar, T.L. Venkatarama Aiyyar and Vivian Bose, JJDokument16 SeitenSudhi Ranjan Das, C.J., S.K. Das, A.K. Sarkar, T.L. Venkatarama Aiyyar and Vivian Bose, JJAnesh kumarNoch keine Bewertungen

- Indian Income-Tax Act Ss. 10 (2) (XV) 33Dokument5 SeitenIndian Income-Tax Act Ss. 10 (2) (XV) 33keyur moriNoch keine Bewertungen

- Income TaxDokument57 SeitenIncome TaxDenis FernandesNoch keine Bewertungen

- Bharat Raj Punj Vs Commissioner of Central Goods and Service Tax (Rajasthan High Court)Dokument5 SeitenBharat Raj Punj Vs Commissioner of Central Goods and Service Tax (Rajasthan High Court)Arun Vignesh MylvagananNoch keine Bewertungen

- Department Must Not Take Advantage of Ignorance of The Assessee About His Rights - Taxguru - inDokument1 SeiteDepartment Must Not Take Advantage of Ignorance of The Assessee About His Rights - Taxguru - inaccounts bsasteelsNoch keine Bewertungen

- SC Upholds Linking of Aadhaar Number With PANDokument13 SeitenSC Upholds Linking of Aadhaar Number With PANPratyash KhannaNoch keine Bewertungen

- 2020 P T D Trib 614Dokument8 Seiten2020 P T D Trib 614haseeb AhsanNoch keine Bewertungen

- 187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Dokument7 Seiten187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Nithyananda N LNoch keine Bewertungen

- Cheminor Drugs Ltd. vs. Income Tax OfficerDokument6 SeitenCheminor Drugs Ltd. vs. Income Tax OfficerVenkat Rao MarellaNoch keine Bewertungen

- Judicial UpdateDokument10 SeitenJudicial UpdateRajbir SinghNoch keine Bewertungen

- Project of Taxation LawDokument5 SeitenProject of Taxation Lawzaiba rehmanNoch keine Bewertungen

- GST Weekly Update - 21-2022-23Dokument4 SeitenGST Weekly Update - 21-2022-232480054Noch keine Bewertungen

- DTRC May 2022Dokument4 SeitenDTRC May 2022King KingNoch keine Bewertungen

- National Company Law Appellate Tribunal Principal Bench, New DelhiDokument11 SeitenNational Company Law Appellate Tribunal Principal Bench, New DelhiNivasNoch keine Bewertungen

- Recent Decisions On RecoveryDokument7 SeitenRecent Decisions On RecoveryArun KarthikNoch keine Bewertungen

- DT CASE STUDY SERIES FOR FINAL STUDENTs - SET 3Dokument8 SeitenDT CASE STUDY SERIES FOR FINAL STUDENTs - SET 3tusharjaipur7Noch keine Bewertungen

- Tax Law CasesDokument5 SeitenTax Law CasesramkodNoch keine Bewertungen

- Case Laws - Diret TaxDokument40 SeitenCase Laws - Diret TaxKushalKaleNoch keine Bewertungen

- Delhi ITAT (Bar) Reports - December 2020Dokument23 SeitenDelhi ITAT (Bar) Reports - December 2020PARVATI KUMARINoch keine Bewertungen

- 2022 P T D 51Dokument6 Seiten2022 P T D 51Umar ArifNoch keine Bewertungen

- Shree ChaudharyDokument23 SeitenShree Chaudharykhushi sethiaNoch keine Bewertungen

- AJK TEVTA Vs Commissioner Inland RevenueDokument11 SeitenAJK TEVTA Vs Commissioner Inland RevenueRashid Hussain TunioNoch keine Bewertungen

- Adjudication Order Against Himachal Tubes and Wires Limited in Matter of Non-Redressal of Investor GrievancesDokument6 SeitenAdjudication Order Against Himachal Tubes and Wires Limited in Matter of Non-Redressal of Investor GrievancesShyam SunderNoch keine Bewertungen

- City Mills CaseDokument7 SeitenCity Mills CaseTushar Choudhary100% (1)

- Reportable: M/S. Vellanki Frame Works Vs Commercial Tax Officer On 13 January, 2021Dokument48 SeitenReportable: M/S. Vellanki Frame Works Vs Commercial Tax Officer On 13 January, 2021VV SNoch keine Bewertungen

- IBC CA4 PortionDokument12 SeitenIBC CA4 PortionRaghav GoyalNoch keine Bewertungen

- Article On Madhav SteelDokument5 SeitenArticle On Madhav SteelAbhay DesaiNoch keine Bewertungen

- Delhi ITAT BAR Reporter - January 2021Dokument43 SeitenDelhi ITAT BAR Reporter - January 2021Trisha MajumdarNoch keine Bewertungen

- 376808061899518109713$5 1REFNOITA No.109-Alld-2012 Shiv Shakti BuildersDokument11 Seiten376808061899518109713$5 1REFNOITA No.109-Alld-2012 Shiv Shakti BuildersPrabhash ChandNoch keine Bewertungen

- Supreme Court of India Page 1 of 7Dokument7 SeitenSupreme Court of India Page 1 of 7Aarthi GNoch keine Bewertungen

- SC ECom Gill Sec 70 KVATDokument20 SeitenSC ECom Gill Sec 70 KVATGVKNoch keine Bewertungen

- Doctrines/Theories/Conceptsinvoked: 1972 83 ITR 794 BomDokument4 SeitenDoctrines/Theories/Conceptsinvoked: 1972 83 ITR 794 BomAjit jaiswalNoch keine Bewertungen

- Taxguru - In-Higher Rate of Duty Drawback IGST Refund Under GST RegimeDokument8 SeitenTaxguru - In-Higher Rate of Duty Drawback IGST Refund Under GST RegimeNITIN KUMARNoch keine Bewertungen

- Amit Cotton Industries vs. Principal Commissioner of Customs Gujarat High CourtDokument49 SeitenAmit Cotton Industries vs. Principal Commissioner of Customs Gujarat High CourtMaragani MuraligangadhararaoNoch keine Bewertungen

- 2019 P T D 1780Dokument4 Seiten2019 P T D 1780haseeb AhsanNoch keine Bewertungen

- (1980) 003taxman00052 (SC)Dokument4 Seiten(1980) 003taxman00052 (SC)DeepakNoch keine Bewertungen

- Key Propositions 148 SHRI KAPIL GOELDokument89 SeitenKey Propositions 148 SHRI KAPIL GOELRajivShahNoch keine Bewertungen

- Case Law Relating To Section 153C of Income Tax ActDokument9 SeitenCase Law Relating To Section 153C of Income Tax Actyegawo4725Noch keine Bewertungen

- Airspeed Vs AC 19-10Dokument20 SeitenAirspeed Vs AC 19-10Usama malikNoch keine Bewertungen

- LEgal CaseDokument14 SeitenLEgal Caseqy4015807Noch keine Bewertungen

- Appeal Before The Commissioner of Income Tax (Appeals) - 12, BangaloreDokument4 SeitenAppeal Before The Commissioner of Income Tax (Appeals) - 12, BangaloreKrishna ChaitanyaNoch keine Bewertungen

- Appeal Regarding Excise-Stamp Duty (DRAFT)Dokument33 SeitenAppeal Regarding Excise-Stamp Duty (DRAFT)Anuj100% (1)

- Tax Law 2019BALLB35Dokument11 SeitenTax Law 2019BALLB35thatnerdkiddoNoch keine Bewertungen

- 1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeDokument5 Seiten1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeAnanya SNoch keine Bewertungen

- Bangalore Club CaseDokument37 SeitenBangalore Club CaseVaishnavi BorlepwarNoch keine Bewertungen

- Wipro Finance LTD Vs The Commissioner of Income Tax On 12 April 2022Dokument14 SeitenWipro Finance LTD Vs The Commissioner of Income Tax On 12 April 2022Umashankar SinhaNoch keine Bewertungen

- Merely Signing The Statement During Investigation Under Coercion and Admitting Tax Liability Not Amounts To Self-Assessment or SelfDokument5 SeitenMerely Signing The Statement During Investigation Under Coercion and Admitting Tax Liability Not Amounts To Self-Assessment or SelfShrey SharmaNoch keine Bewertungen

- 2004 SLD 288 (Input Tax Allowance Based Upon Invoice)Dokument3 Seiten2004 SLD 288 (Input Tax Allowance Based Upon Invoice)Zayn ShaukatNoch keine Bewertungen

- Vinit Kumar, - WatermarkDokument6 SeitenVinit Kumar, - WatermarkSiiddharth S DubeyNoch keine Bewertungen

- A Study On Credit Risk Management at Canara Bank: Project Report Submitted in Partial Fulfilment of The Requirement ofDokument10 SeitenA Study On Credit Risk Management at Canara Bank: Project Report Submitted in Partial Fulfilment of The Requirement ofbabuluckyNoch keine Bewertungen

- Safe Tally SheetDokument1 SeiteSafe Tally Sheetraman_bhoomi9910Noch keine Bewertungen

- Analysis of Banking Requirements of Various Business UnitsDokument49 SeitenAnalysis of Banking Requirements of Various Business Unitsagr_belaNoch keine Bewertungen

- CONTENTDokument51 SeitenCONTENTMuhammed Salim v0% (1)

- Services Quality Analysis in SBI BankDokument110 SeitenServices Quality Analysis in SBI Bankvinodksrini007100% (4)

- 2021 07 10 EOD File ChangeDokument22 Seiten2021 07 10 EOD File Changelalit bhandariNoch keine Bewertungen

- FM09-CH 09Dokument12 SeitenFM09-CH 09Mukul KadyanNoch keine Bewertungen

- Chapter 5 - Effects of InflationDokument19 SeitenChapter 5 - Effects of InflationTanveer Ahmed HakroNoch keine Bewertungen

- Finance Lecture 2: TVM: Time LineDokument5 SeitenFinance Lecture 2: TVM: Time LinedfsdfsdfdsNoch keine Bewertungen

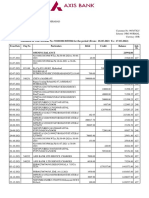

- Account STMTDokument4 SeitenAccount STMTsreehas sreehasNoch keine Bewertungen

- IAS 40 Investment Property PresentationDokument29 SeitenIAS 40 Investment Property PresentationNollecy Takudzwa BereNoch keine Bewertungen

- Statement of AccountDokument1 SeiteStatement of Accountsneha1299sharmaNoch keine Bewertungen

- Blockchain AdoptionDokument46 SeitenBlockchain AdoptionChima UzombaNoch keine Bewertungen

- Fintech in Asean 2022Dokument52 SeitenFintech in Asean 2022Trần Thị Hà MyNoch keine Bewertungen

- First Time Home Buyers Seminar: Welcome!Dokument31 SeitenFirst Time Home Buyers Seminar: Welcome!DianaNoch keine Bewertungen

- Midterm 3 AnswersDokument7 SeitenMidterm 3 AnswersDuc TranNoch keine Bewertungen

- FI - Reading 44 - Fundamentals of Credit AnalysisDokument42 SeitenFI - Reading 44 - Fundamentals of Credit Analysisshaili shahNoch keine Bewertungen

- 03 - Literature Review PDFDokument12 Seiten03 - Literature Review PDFPreet kaurNoch keine Bewertungen

- Marriott Corporation Case SolutionDokument9 SeitenMarriott Corporation Case SolutionZaim Zain100% (2)

- Class Notes Redemption of Preference Share - PDFDokument4 SeitenClass Notes Redemption of Preference Share - PDFBhavya MehtaNoch keine Bewertungen

- Answers BSBFIM501Dokument13 SeitenAnswers BSBFIM501Gurpreet Kaur80% (5)

- In This Report, We Discuss Recent Changes in The Credit Quality ofDokument15 SeitenIn This Report, We Discuss Recent Changes in The Credit Quality ofbekarareNoch keine Bewertungen

- Financial Supervisory System in Korea: RYU, Min Hae HWANG, Jae HakDokument43 SeitenFinancial Supervisory System in Korea: RYU, Min Hae HWANG, Jae HakstaimoukNoch keine Bewertungen

- FAFDokument8 SeitenFAFShaminiNoch keine Bewertungen

- Aswath Damodaran - Investment PhilosophyDokument4 SeitenAswath Damodaran - Investment Philosophyprasaddhake14910% (1)

- Chapter 1: Introduction To Accounting: Activity 1: A Chapter DiscussionDokument9 SeitenChapter 1: Introduction To Accounting: Activity 1: A Chapter DiscussionFaith ClaireNoch keine Bewertungen

- Banking CompaniesDokument68 SeitenBanking CompaniesKiran100% (2)

- IMT Covid19 PDFDokument10 SeitenIMT Covid19 PDFPrabhat Mishra100% (2)

- John Maynard Keynes The General Theory of Employment Interest and Money A Critique by Brett DiDonatoDokument23 SeitenJohn Maynard Keynes The General Theory of Employment Interest and Money A Critique by Brett DiDonatosoyouthinkyoucaninvest100% (1)

- Delayed: Intermediaries, They CollecDokument16 SeitenDelayed: Intermediaries, They CollecNadeesha UdayanganiNoch keine Bewertungen

- Lady Killers: Deadly Women Throughout HistoryVon EverandLady Killers: Deadly Women Throughout HistoryBewertung: 4 von 5 Sternen4/5 (155)

- Dean Corll: The True Story of The Houston Mass MurdersVon EverandDean Corll: The True Story of The Houston Mass MurdersBewertung: 4 von 5 Sternen4/5 (29)

- For the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoVon EverandFor the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoBewertung: 4 von 5 Sternen4/5 (97)

- Perversion of Justice: The Jeffrey Epstein StoryVon EverandPerversion of Justice: The Jeffrey Epstein StoryBewertung: 4.5 von 5 Sternen4.5/5 (10)

- The Edge of Innocence: The Trial of Casper BennettVon EverandThe Edge of Innocence: The Trial of Casper BennettBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Reasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemVon EverandReasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemBewertung: 4 von 5 Sternen4/5 (25)

- Conviction: The Untold Story of Putting Jodi Arias Behind BarsVon EverandConviction: The Untold Story of Putting Jodi Arias Behind BarsBewertung: 4.5 von 5 Sternen4.5/5 (16)

- Hunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossVon EverandHunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossBewertung: 3.5 von 5 Sternen3.5/5 (6)

- The Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterVon EverandThe Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterBewertung: 4.5 von 5 Sternen4.5/5 (456)

- Three Felonies A Day: How the Feds Target the InnocentVon EverandThree Felonies A Day: How the Feds Target the InnocentBewertung: 4 von 5 Sternen4/5 (25)

- The Death of Punishment: Searching for Justice among the Worst of the WorstVon EverandThe Death of Punishment: Searching for Justice among the Worst of the WorstNoch keine Bewertungen

- Innocent Blood: A True Story of Obsession and Serial MurderVon EverandInnocent Blood: A True Story of Obsession and Serial MurderBewertung: 4.5 von 5 Sternen4.5/5 (72)

- Ice and Bone: Tracking an Alaskan Serial KillerVon EverandIce and Bone: Tracking an Alaskan Serial KillerBewertung: 3.5 von 5 Sternen3.5/5 (7)

- A Warrant to Kill: A True Story of Obsession, Lies and a Killer CopVon EverandA Warrant to Kill: A True Story of Obsession, Lies and a Killer CopBewertung: 4 von 5 Sternen4/5 (21)

- The Secret Barrister: Stories of the Law and How It's BrokenVon EverandThe Secret Barrister: Stories of the Law and How It's BrokenBewertung: 4.5 von 5 Sternen4.5/5 (12)

- O.J. Is Innocent and I Can Prove It: The Shocking Truth about the Murders of Nicole Brown Simpson and Ron GoldmanVon EverandO.J. Is Innocent and I Can Prove It: The Shocking Truth about the Murders of Nicole Brown Simpson and Ron GoldmanBewertung: 4 von 5 Sternen4/5 (2)

- Can't Forgive: My 20-Year Battle With O.J. SimpsonVon EverandCan't Forgive: My 20-Year Battle With O.J. SimpsonBewertung: 3 von 5 Sternen3/5 (3)

- Wolf Boys: Two American Teenagers and Mexico's Most Dangerous Drug CartelVon EverandWolf Boys: Two American Teenagers and Mexico's Most Dangerous Drug CartelBewertung: 4.5 von 5 Sternen4.5/5 (61)

- Who Really Killed Nicole?: O. J. Simpson's Closest Confidant Tells AllVon EverandWho Really Killed Nicole?: O. J. Simpson's Closest Confidant Tells AllBewertung: 3 von 5 Sternen3/5 (1)

- The Protector's Handbook: A Comprehensive Guide to Close ProtectionVon EverandThe Protector's Handbook: A Comprehensive Guide to Close ProtectionNoch keine Bewertungen

- Just Mercy: a story of justice and redemptionVon EverandJust Mercy: a story of justice and redemptionBewertung: 4.5 von 5 Sternen4.5/5 (175)

- Kidnapped by a Client: The Incredible True Story of an Attorney's Fight for JusticeVon EverandKidnapped by a Client: The Incredible True Story of an Attorney's Fight for JusticeBewertung: 3 von 5 Sternen3/5 (1)

- Rogue Prosecutors: How Radical Soros Lawyers Are Destroying America's CommunitiesVon EverandRogue Prosecutors: How Radical Soros Lawyers Are Destroying America's CommunitiesNoch keine Bewertungen

- A Toast to Silence: Avoid Becoming Another Victim of Deceptive Police Tactics By Knowing When and How to Use the Power of SilenceVon EverandA Toast to Silence: Avoid Becoming Another Victim of Deceptive Police Tactics By Knowing When and How to Use the Power of SilenceBewertung: 5 von 5 Sternen5/5 (1)

- Mass Supervision: Probation, Parole, and the Illusion of Safety and FreedomVon EverandMass Supervision: Probation, Parole, and the Illusion of Safety and FreedomBewertung: 1 von 5 Sternen1/5 (2)