Beruflich Dokumente

Kultur Dokumente

NBT05112019 e

Hochgeladen von

Manal DeenOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

NBT05112019 e

Hochgeladen von

Manal DeenCopyright:

Verfügbare Formate

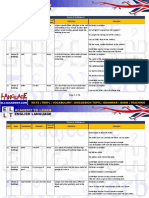

INLAND REVENUE DEPARTMENT

Implementation of Changes to

Nation Building Tax (NBT)

as passed in Parliament on 23rd October 2019

Changes to NBT will be implemented as per the Bill to amend NBT Act and subsequent Committee

Stage Amendments (CSA) as passed in Parliament on the 23rd October 2019 with effect from

November 1, 2019 unless different dates of operation specified and would become law once the Hon.

Speaker certifies the Bill which will be incorporated into the final enactment.

According to the Bill presented in Parliament together with the CSA, the significant changes are set

out below.

1. Removal of Exemption

The following exemptions are removed and made liable for NBT, with effect from November

1, 2019:

- Import of Cigarettes (is liable for NBT at 2%)

- Sale of imported Cigarettes by an importer (is liable for NBT at 2% on its half

of the turnover)

- Sale of locally manufactured Cigarettes by a manufacturer (is liable at 2%)

Accordingly, any person or partnership as an importer or a manufacturer whose liable

turnover from the sale of imported cigarettes and/or locally manufactured cigarettes is not

less than Rs. 3 million for any quarter commencing from October 1, 2019 is liable for NBT

However, for the quarter ended with December 31, 2019 and if the turnover for such quarter

is 3 Mn or more, NBT is liable only for such liable turnover of the month of November and

December of 2019.

2. New Exemptions

- Importation of gem stones by a person registered with the National Gem and

Jewellery Authority, for the purpose of re-exporting such gems upon being

cut and polished and if the payment for such services of cut and polish is made

in foreign currency and remitted to Sri Lanka through a bank

- Turnover of any manufacturer of palm oil manufactured locally out of

imported crude palm oil or imported palm olein subjected to the Special

Commodity Levy charged under the Special Commodity Levy Act, No. 48 of

2007;

- Importation of Lucerne (alfalfa) meal and pellets;

- Importation of yachts and other vessels for pleasure or sports, rowing boats

and canvas as classified under the HS Code of 8903.91.00.

- Importation of any project related article by an enterprise which has entered

into an agreement with the BOI under section 17 of the BOI Law No. 4 of

1978, for the use in any project of such enterprise having a capital investment

of not less than fifty million US Dollars during the project implementation

period and prior to the date of commencement of the commercial operations

- Service on or after November 1, 2019, of a construction contractor or a sub-

contractor in so far as such services are in respect of constructing any building,

road, bridge, water supply, drainage or sewerage system, harbour, airport or

any infrastructure project in telecommunication or electricity.

- Services provided by a hotel, guest house, restaurant or other similar business,

on or after November 1, 2019, where the payment for such service is received

in foreign currency through a bank in Sri Lanka, where such hotel, guest

house, restaurant or other similar business is registered with the Ceylon

Tourist Board

Commissioner General of Inland Revenue

TAXES - FOR A BETTER FUTURE

Das könnte Ihnen auch gefallen

- Desert Magazine 1978 NovemberDokument48 SeitenDesert Magazine 1978 Novemberdm1937Noch keine Bewertungen

- RR No. 13-2018 CorrectedDokument20 SeitenRR No. 13-2018 CorrectedRap BaguioNoch keine Bewertungen

- Domondon Reviewer - Tax 2Dokument38 SeitenDomondon Reviewer - Tax 2Mar DevelosNoch keine Bewertungen

- TAX-302 (VAT-Exempt Transactions)Dokument7 SeitenTAX-302 (VAT-Exempt Transactions)Edith DalidaNoch keine Bewertungen

- Customs Vs CaltexDokument4 SeitenCustoms Vs CaltexKatipunan I DistrictNoch keine Bewertungen

- Tax Remedies SY 2016-2017Dokument39 SeitenTax Remedies SY 2016-2017Al Ter E. GoNoch keine Bewertungen

- Biff Brewster Mystery #9 Egyptian Scarab MysteryDokument189 SeitenBiff Brewster Mystery #9 Egyptian Scarab MysteryPastPresentFuture67% (3)

- Istanbullu Dictionary of IstanbulDokument226 SeitenIstanbullu Dictionary of Istanbulncarolina785100% (2)

- Rulings2000 DigestDokument21 SeitenRulings2000 DigestArriane MartinezNoch keine Bewertungen

- Sample Project of The Month 01Dokument46 SeitenSample Project of The Month 01Nana Melani Astari PutriNoch keine Bewertungen

- Module 5 - Chapter 2 Business and Other Local Taxes FinalDokument82 SeitenModule 5 - Chapter 2 Business and Other Local Taxes Finalanne villarin100% (1)

- RR 13-2018Dokument20 SeitenRR 13-2018Nikka Bianca Remulla-IcallaNoch keine Bewertungen

- Excise Taxes On Certain GoodsDokument4 SeitenExcise Taxes On Certain GoodsshakiraNoch keine Bewertungen

- A Feasibility Study On Backpackers Lodging House BusinessDokument13 SeitenA Feasibility Study On Backpackers Lodging House BusinessJameia Medrano100% (1)

- Kumarakom Lake ResortDokument4 SeitenKumarakom Lake ResortArpankaj Kumar92% (24)

- Housekeeping NC II Week 9 To 10Dokument9 SeitenHousekeeping NC II Week 9 To 10Alain AlotsipeNoch keine Bewertungen

- I. Abandonment: Customs Administrative Order (CAO) No. 17-2019Dokument5 SeitenI. Abandonment: Customs Administrative Order (CAO) No. 17-2019Arya Padrino100% (1)

- PH Tax in A Dot Implementing Rules Regulations Train Law 21mar2018 PDFDokument6 SeitenPH Tax in A Dot Implementing Rules Regulations Train Law 21mar2018 PDFWilmar AbriolNoch keine Bewertungen

- Zero-Rated Sales PDFDokument24 SeitenZero-Rated Sales PDFNEstandaNoch keine Bewertungen

- Digest RR 13-2018Dokument9 SeitenDigest RR 13-2018Maria Rose Ann BacilloteNoch keine Bewertungen

- Tax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Dokument5 SeitenTax Particulars National Internal Revenue Code of 1997 R. A. No. 10963blackmail1Noch keine Bewertungen

- TRAIN (Changes) ???? Pages 12, 14, 16, 17Dokument4 SeitenTRAIN (Changes) ???? Pages 12, 14, 16, 17blackmail1Noch keine Bewertungen

- CIR-vs-PhilAirplinesDokument11 SeitenCIR-vs-PhilAirplinesPernia Orsal RomeoNoch keine Bewertungen

- Business Taxation 3Dokument47 SeitenBusiness Taxation 3Prince Isaiah JacobNoch keine Bewertungen

- Antonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenDokument22 SeitenAntonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenJayvee FelipeNoch keine Bewertungen

- Value Added Tax 3Dokument8 SeitenValue Added Tax 3Nerish PlazaNoch keine Bewertungen

- Other Percentage Taxes: Three Percent (3%) Percentage TaxDokument9 SeitenOther Percentage Taxes: Three Percent (3%) Percentage TaxShanelle NapolesNoch keine Bewertungen

- Excise Duty-1Dokument11 SeitenExcise Duty-1AftabKhanNoch keine Bewertungen

- Title ViDokument30 SeitenTitle Vimiss independentNoch keine Bewertungen

- Title VDokument5 SeitenTitle VErica Mae GuzmanNoch keine Bewertungen

- Title ViDokument23 SeitenTitle ViErica Mae GuzmanNoch keine Bewertungen

- DomondonDokument40 SeitenDomondonCharles TamNoch keine Bewertungen

- G.R. No. L-24192 May 22, 1968 COMMISSIONER OF CUSTOMS, Petitioner, CALTEX (PHILIPPINES), INC., and COURT of TAX APPEALS, RespondentsDokument12 SeitenG.R. No. L-24192 May 22, 1968 COMMISSIONER OF CUSTOMS, Petitioner, CALTEX (PHILIPPINES), INC., and COURT of TAX APPEALS, RespondentsVenusNoch keine Bewertungen

- Revenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Dokument17 SeitenRevenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Lance MorilloNoch keine Bewertungen

- Tax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Dokument4 SeitenTax Particulars National Internal Revenue Code of 1997 R. A. No. 10963blackmail1Noch keine Bewertungen

- Tax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Dokument4 SeitenTax Particulars National Internal Revenue Code of 1997 R. A. No. 10963blackmail1Noch keine Bewertungen

- Lesson 5 BtaxDokument6 SeitenLesson 5 Btaxdin matanguihanNoch keine Bewertungen

- Provided, Further, That Importations of Cigars and Cigarettes, Distilled Spirits and Wines by A Government-Owned and Operated DutyDokument8 SeitenProvided, Further, That Importations of Cigars and Cigarettes, Distilled Spirits and Wines by A Government-Owned and Operated DutyJongJongNoch keine Bewertungen

- VAT Summary of Changes Under The TRAIN LawDokument4 SeitenVAT Summary of Changes Under The TRAIN LawrafastilNoch keine Bewertungen

- Cir & Coc v. PALDokument11 SeitenCir & Coc v. PALHi Law SchoolNoch keine Bewertungen

- Title V: - Other Percentage TaxesDokument9 SeitenTitle V: - Other Percentage TaxesArnold BernasNoch keine Bewertungen

- TCCP Vol. IiDokument89 SeitenTCCP Vol. Iiladyfat100% (5)

- Zero Rated Sales Sale of GoodsDokument2 SeitenZero Rated Sales Sale of GoodsFabiano JoeyNoch keine Bewertungen

- 24.-Republic v. Caguioa, G.R No. 168584Dokument17 Seiten24.-Republic v. Caguioa, G.R No. 168584Christine Rose Bonilla LikiganNoch keine Bewertungen

- Percentage Tax Who Are Required To File?Dokument4 SeitenPercentage Tax Who Are Required To File?Angelyn SamandeNoch keine Bewertungen

- Value Added TaxDokument14 SeitenValue Added TaxWyndell AlajenoNoch keine Bewertungen

- Valution and Taxation - TocDokument21 SeitenValution and Taxation - Tocraymondzikusooka10Noch keine Bewertungen

- Tax Supplemental Reviewer - October 2019Dokument48 SeitenTax Supplemental Reviewer - October 2019Queenie ValleNoch keine Bewertungen

- Foreign Investment Tax Rules 2020 1963Dokument8 SeitenForeign Investment Tax Rules 2020 1963Sanam GiriNoch keine Bewertungen

- Other Percentage TaxesreportDokument40 SeitenOther Percentage TaxesreportZhee BillarinaNoch keine Bewertungen

- Lesson 15: TaxationDokument15 SeitenLesson 15: TaxationRheanne OseaNoch keine Bewertungen

- BUSTAXADokument9 SeitenBUSTAXATitania ErzaNoch keine Bewertungen

- PubCorp Digitel Vs Province of PangasinanDokument6 SeitenPubCorp Digitel Vs Province of PangasinanElla CardenasNoch keine Bewertungen

- RR No. 13-2018 (VAT Refund)Dokument23 SeitenRR No. 13-2018 (VAT Refund)Hailin QuintosNoch keine Bewertungen

- Activi: Taxation 219Dokument14 SeitenActivi: Taxation 219Block escapeNoch keine Bewertungen

- Comparison VAT.Dokument11 SeitenComparison VAT.Francis Ian BirondoNoch keine Bewertungen

- Secret Files For TXDokument118 SeitenSecret Files For TXGrace EnriquezNoch keine Bewertungen

- VAT ModuleDokument50 SeitenVAT ModuleRovi Anne IgoyNoch keine Bewertungen

- TAXATION 2 Chapter 8 Percentage Tax PDFDokument4 SeitenTAXATION 2 Chapter 8 Percentage Tax PDFKim Cristian MaañoNoch keine Bewertungen

- RMC 1-80Dokument1.167 SeitenRMC 1-80Ramon Augusto Melad LacambraNoch keine Bewertungen

- 4 Asia Intl Auctioneers V Parayno JRDokument16 Seiten4 Asia Intl Auctioneers V Parayno JRAlexandraSoledadNoch keine Bewertungen

- Tax-RegulationsDokument12 SeitenTax-RegulationsMichelle Jude TinioNoch keine Bewertungen

- Law On InvestimentDokument18 SeitenLaw On InvestimentArcénio R WassoteNoch keine Bewertungen

- Other Percentage TaxDokument3 SeitenOther Percentage TaxBon BonsNoch keine Bewertungen

- KNCCI Vihiga: enabling county revenue raising legislationVon EverandKNCCI Vihiga: enabling county revenue raising legislationNoch keine Bewertungen

- KNCCI Vihiga: enabling county revenue raising legislationVon EverandKNCCI Vihiga: enabling county revenue raising legislationNoch keine Bewertungen

- 2 Decades: PT Metropolitan Land TBKDokument24 Seiten2 Decades: PT Metropolitan Land TBKZakiatul MukaromahNoch keine Bewertungen

- Hotel KoreaDokument2 SeitenHotel KoreamegawatitampuNoch keine Bewertungen

- B18Dokument46 SeitenB18asdjkfnasdbifbadNoch keine Bewertungen

- Home & Building A1Dokument13 SeitenHome & Building A1amin.soozaniNoch keine Bewertungen

- 37 Palmerston Place West End: FIXED PRICE 750,000Dokument4 Seiten37 Palmerston Place West End: FIXED PRICE 750,000lauralamoNoch keine Bewertungen

- Events & Shows 'Dokument7 SeitenEvents & Shows 'Chirag ChadhaNoch keine Bewertungen

- House Keeping Do's and Don'tsDokument3 SeitenHouse Keeping Do's and Don'tschinomsoNoch keine Bewertungen

- Inverloch History: For More InformationDokument2 SeitenInverloch History: For More InformationChrisNoch keine Bewertungen

- Hotel Management 1Dokument7 SeitenHotel Management 1vruddhiNoch keine Bewertungen

- 2022-Hotel Lock SeriesDokument8 Seiten2022-Hotel Lock SeriesJohn Carlo PlanasNoch keine Bewertungen

- TourismDokument5 SeitenTourismKimiepressurepoint CareyNoch keine Bewertungen

- The Effect of Customer Satisfaction On Service QualityDokument4 SeitenThe Effect of Customer Satisfaction On Service QualityANOSHA SALEEMNoch keine Bewertungen

- IR Hotel Horison Nayumi GorontaloDokument2 SeitenIR Hotel Horison Nayumi GorontaloPink Services MakassarNoch keine Bewertungen

- Types of Linen Including Bed MakingDokument8 SeitenTypes of Linen Including Bed MakingmritunjayNoch keine Bewertungen

- Rwanda MICE PlannerGuide 2019Dokument56 SeitenRwanda MICE PlannerGuide 2019Mushinzimana SergeNoch keine Bewertungen

- South Yorkshire Paranormal ghost/myths/UFO's ReportingsDokument5 SeitenSouth Yorkshire Paranormal ghost/myths/UFO's Reportingslee steerNoch keine Bewertungen

- Thesis SynopsisDokument10 SeitenThesis SynopsisAvinash ChoudharyNoch keine Bewertungen

- Architecture, Design, and Allied ArtsDokument6 SeitenArchitecture, Design, and Allied ArtsJennymae CamarilloNoch keine Bewertungen

- Anjum Hotel Ramadan TA Suite Rates 1438 HDokument3 SeitenAnjum Hotel Ramadan TA Suite Rates 1438 HBensaid SaidNoch keine Bewertungen

- YangonDokument10 SeitenYangonSuhail FaridNoch keine Bewertungen

- 0010 - Antecedents and Consequences of Job Satisfaction in The Hotel Industry, 2010Dokument11 Seiten0010 - Antecedents and Consequences of Job Satisfaction in The Hotel Industry, 2010Zaki CumazakiNoch keine Bewertungen

- Uda REGULATIONS PDFDokument48 SeitenUda REGULATIONS PDFsanjeewacecNoch keine Bewertungen

- MANT 217 2011 Final Examination PREVIEWDokument21 SeitenMANT 217 2011 Final Examination PREVIEWThibault BoulangerNoch keine Bewertungen