Beruflich Dokumente

Kultur Dokumente

La Suerte Cigar V. Court of Appeals Facts

Hochgeladen von

Nelda EnriquezOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

La Suerte Cigar V. Court of Appeals Facts

Hochgeladen von

Nelda EnriquezCopyright:

Verfügbare Formate

LA SUERTE CIGAR V.

COURT OF APPEALS

FACTS:

These cases involve the taxability of stemmed leaf tobacco imported and locally purchased

by cigarette manufacturers for use as raw material in the manufacture of their cigarettes. Under the

Tax Code, if it is to be exported or to be used in the manufacture of cigars, cigarettes, or other tobacco

products on which the excise tax will eventually be paid on the finished product.

La Suerte was assessed by the BIR for excise tax deficiency amounting to more than 34 million

pesos. La Suerte protested invoking the Tax Code which allows the sale of stemmed leaf tobacco as

raw material by one manufacturer directly to another without payment of the excise tax. However,

the CIR insisted that stemmed leaf tobacco is subject to excise tax "unless there is an express grant of

exemption from [the] payment of tax."

La Suerte petitioned for review before the CTA which cancelled the assessment. The CIR

appealed to the CA which reversed the CTA. The CIR invoked a revenue regulation (RR) which limits

the exemption from payment of specific tax on stemmed leaf tobacco to sales transactions between

manufacturers classified as L-7 permittees.

ISSUES:

Is stemmed leaf tobacco subject to excise (specific) tax?

HELD:

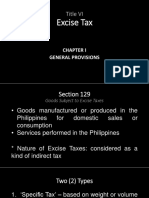

Yes, excise taxes on domestic products shall be paid by the manufacturer or producer

before[the] removal [of those products] from the place of production." "It does not matter to what

use the article[s] subject to tax is put; the excise taxes are still due, even though the articles are

removed merely for storage in someother place and are not actually sold or consumed.

When tobacco is harvested and processed either by hand or by machine, all its products become

subject to specific tax. Section 141 reveals the legislative policy to tax all forms of manufactured

tobacco — in contrast to raw tobacco leaves — including tobacco refuse or all other tobacco which

has been cut, split, twisted, or pressed and is capable of being smoked without further industrial

processing.

Stemmed leaf tobacco is subject to the specific tax under Section 141(b). It is a partially prepared

tobacco. The removal of the stem or midrib from the leaf tobacco makes the resulting stemmed leaf

tobacco a prepared or partially prepared tobacco.

Despite the differing definitions for "stemmed leaf tobacco" under revenue regulations, the onus of

proving that stemmed leaf tobacco is not subject to the specific tax lies with the cigarette

manufacturers. Taxation is the rule, exemption is the exception.

Das könnte Ihnen auch gefallen

- La Suerte Cigar v. CADokument4 SeitenLa Suerte Cigar v. CAKhian Jamer100% (1)

- La Suerte v. CADokument2 SeitenLa Suerte v. CATasneem C BalindongNoch keine Bewertungen

- Taxation Case Digest 1Dokument14 SeitenTaxation Case Digest 1Jong Perraren100% (1)

- Case DigestDokument65 SeitenCase DigestFord OsipNoch keine Bewertungen

- La Suerte Vs CA DigestDokument1 SeiteLa Suerte Vs CA DigestMarc Dave Alcarde100% (2)

- La Suerte v. CaDokument2 SeitenLa Suerte v. CaLuna BaciNoch keine Bewertungen

- Cases 1 58Dokument89 SeitenCases 1 58Anonymous r1cRm7F100% (1)

- Cir V Cta GR No 106611, July 21, 1994 FactsDokument39 SeitenCir V Cta GR No 106611, July 21, 1994 FactsAnonymous r1cRm7FNoch keine Bewertungen

- La Suerte Cigar 0 Cigarette Factory Vs CADokument1 SeiteLa Suerte Cigar 0 Cigarette Factory Vs CAReynald LacabaNoch keine Bewertungen

- Excise Tax On Certain Goods PDFDokument9 SeitenExcise Tax On Certain Goods PDFSABEDO, JONEL MUNDASNoch keine Bewertungen

- LA Suerte Vs CA - CIRDokument1 SeiteLA Suerte Vs CA - CIRJan EchonNoch keine Bewertungen

- Tax - Case DigestsDokument13 SeitenTax - Case DigestsSkylee SoNoch keine Bewertungen

- La Suerte V CADokument6 SeitenLa Suerte V CA2234933Noch keine Bewertungen

- La Suerte v. CA (2014)Dokument77 SeitenLa Suerte v. CA (2014)Paolo Ervin PerezNoch keine Bewertungen

- Taxation Two 2Dokument23 SeitenTaxation Two 2Truman TemperanteNoch keine Bewertungen

- Liggett Myers Tobacco Company vs. Collector of Internal Revenue G.R. No. L 9415Dokument2 SeitenLiggett Myers Tobacco Company vs. Collector of Internal Revenue G.R. No. L 9415NMNGNoch keine Bewertungen

- Tobacco Products TaxDokument19 SeitenTobacco Products TaxTobacco IndustryNoch keine Bewertungen

- San Beda Chair Cases (2021) - 04. Taxation LawDokument52 SeitenSan Beda Chair Cases (2021) - 04. Taxation LawAngela Parado100% (1)

- 3, 4. Hand: I OivisionDokument17 Seiten3, 4. Hand: I Oivisionmypinoy taxNoch keine Bewertungen

- Chapter IV Excise Tax On Tobacco ProductsDokument45 SeitenChapter IV Excise Tax On Tobacco ProductsZhee BillarinaNoch keine Bewertungen

- Tax Cases CompilationDokument18 SeitenTax Cases Compilationbrian jay hernandezNoch keine Bewertungen

- Siazar, Mizraim IDokument11 SeitenSiazar, Mizraim IAnonymous 5k7iGyNoch keine Bewertungen

- 03 CIR V La Campana Fabrica de TobacosDokument10 Seiten03 CIR V La Campana Fabrica de TobacosAna Marie LomboyNoch keine Bewertungen

- Excise TaxesDokument5 SeitenExcise TaxesJoAnne Yaptinchay Claudio100% (2)

- TaxDokument10 SeitenTaxAna leah Orbeta-mamburamNoch keine Bewertungen

- Police PowerDokument14 SeitenPolice PowerGracie Lao SabongNoch keine Bewertungen

- ID Penegakan Hukum Peredaran Rokok Ilegal TDokument15 SeitenID Penegakan Hukum Peredaran Rokok Ilegal TericNoch keine Bewertungen

- Tax232 - Excise Tax PDFDokument37 SeitenTax232 - Excise Tax PDFClaire Ann ParasNoch keine Bewertungen

- Commissioner of Internal Revenue V CaDokument3 SeitenCommissioner of Internal Revenue V CaJimenez LorenzNoch keine Bewertungen

- Tariff 4: Cycle 2Dokument19 SeitenTariff 4: Cycle 2Sofia Arceo SanchezNoch keine Bewertungen

- The SHELL CO. of P.I., LTD., vs. E. E. VAÑO, As Municipal Treasurer of The MunicipalityDokument2 SeitenThe SHELL CO. of P.I., LTD., vs. E. E. VAÑO, As Municipal Treasurer of The MunicipalityeogyramNoch keine Bewertungen

- GR No. 188497 Dated February 19, 2014: Separate Opinion of Justice Bersamin in CIR vs. Pilipinas ShellDokument19 SeitenGR No. 188497 Dated February 19, 2014: Separate Opinion of Justice Bersamin in CIR vs. Pilipinas ShellPaul Joshua SubaNoch keine Bewertungen

- Excise Tax - ReportingDokument64 SeitenExcise Tax - ReportingFiliusdeiNoch keine Bewertungen

- La SuerteDokument2 SeitenLa Suertezol dyckNoch keine Bewertungen

- Excise Tax AnjDokument4 SeitenExcise Tax AnjAngelyn Marie SavilloNoch keine Bewertungen

- La Suerte v. CA DigestDokument6 SeitenLa Suerte v. CA DigestLi-an Rodrigazo100% (1)

- CIR-vs-PhilAirplinesDokument11 SeitenCIR-vs-PhilAirplinesPernia Orsal RomeoNoch keine Bewertungen

- Philippine Petroleum Corporation Vs Municipality of PilillaDokument2 SeitenPhilippine Petroleum Corporation Vs Municipality of PilillaAlmarius CadigalNoch keine Bewertungen

- Republic Act No. 11346: CD Technologies Asia, Inc. 2020Dokument15 SeitenRepublic Act No. 11346: CD Technologies Asia, Inc. 2020Randolph Jon GuerzonNoch keine Bewertungen

- Republic Act No 10351Dokument15 SeitenRepublic Act No 10351Isabelle Bañadera LcbNoch keine Bewertungen

- Excise TaxDokument4 SeitenExcise TaxCalvin Cempron100% (1)

- Pepsi-Cola Bottling Company of The Phils, INc., vs. Mun. of Tanauan, LeyteDokument5 SeitenPepsi-Cola Bottling Company of The Phils, INc., vs. Mun. of Tanauan, LeyteI took her to my penthouse and i freaked itNoch keine Bewertungen

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDokument34 SeitenConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveEmerson NunezNoch keine Bewertungen

- Bureau of Internal RevenueDokument11 SeitenBureau of Internal RevenueRomer LesondatoNoch keine Bewertungen

- Provided, Further, That Importations of Cigars and Cigarettes, Distilled Spirits and Wines by A Government-Owned and Operated DutyDokument8 SeitenProvided, Further, That Importations of Cigars and Cigarettes, Distilled Spirits and Wines by A Government-Owned and Operated DutyJongJongNoch keine Bewertungen

- CIR Vs Pilipinas Shell Petroleum Corporation: CaseDokument3 SeitenCIR Vs Pilipinas Shell Petroleum Corporation: CaseBoom EbronNoch keine Bewertungen

- CIR Vs Hawaiian - Nitafan Vs CIR - Meralco Vs VeraDokument2 SeitenCIR Vs Hawaiian - Nitafan Vs CIR - Meralco Vs VeraRed Loreno100% (1)

- CIR v. Fortune Tobacco GR Nos 167274-75, 21 July 2008Dokument12 SeitenCIR v. Fortune Tobacco GR Nos 167274-75, 21 July 2008Rascille LaranasNoch keine Bewertungen

- Title ViDokument30 SeitenTitle Vimiss independentNoch keine Bewertungen

- Lesson 10Dokument19 SeitenLesson 10visiontanzania2022Noch keine Bewertungen

- 5 CIR V CADokument2 Seiten5 CIR V CAJezreel Y. ChanNoch keine Bewertungen

- Tax Rev 20 CasesDokument296 SeitenTax Rev 20 CasesdominiqueNoch keine Bewertungen

- Tally Erp 9.0 Material Excise For Manufacturers in Tally Erp 9.0Dokument128 SeitenTally Erp 9.0 Material Excise For Manufacturers in Tally Erp 9.0Raghavendra yadav KMNoch keine Bewertungen

- Cir v. FortuneDokument14 SeitenCir v. FortunezacNoch keine Bewertungen

- SEction 110 of The NIRC of 1977Dokument2 SeitenSEction 110 of The NIRC of 1977Tyrone HernandezNoch keine Bewertungen

- Commissioner of Internal Revenue v. Court of AppealsDokument2 SeitenCommissioner of Internal Revenue v. Court of AppealsLance Lagman100% (1)

- Committee On Health Policy: CS/CS/CS/SB 810 - Tobacco and Nicotine ProductsDokument3 SeitenCommittee On Health Policy: CS/CS/CS/SB 810 - Tobacco and Nicotine ProductsABC Action NewsNoch keine Bewertungen

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesVon EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNoch keine Bewertungen

- ABAKADA GURO PARTY VS. PURISIMA (G.R. No. 166715 Aug 14, 2008)Dokument2 SeitenABAKADA GURO PARTY VS. PURISIMA (G.R. No. 166715 Aug 14, 2008)Nelda EnriquezNoch keine Bewertungen

- Sanidad vs. Comelec G.R. No. L-44640 October 12, 1976 Petitioners: Pablo C. Sanidad, Pablito V. Sanidad Respondents: Honorable Commission On Elections and Honorable National Treasurer FactsDokument3 SeitenSanidad vs. Comelec G.R. No. L-44640 October 12, 1976 Petitioners: Pablo C. Sanidad, Pablito V. Sanidad Respondents: Honorable Commission On Elections and Honorable National Treasurer FactsNelda EnriquezNoch keine Bewertungen

- Chavez V Judicial and Bar Council FactsDokument2 SeitenChavez V Judicial and Bar Council FactsNelda EnriquezNoch keine Bewertungen

- IceDokument2 SeitenIceNelda EnriquezNoch keine Bewertungen

- Senate May Propose or Concur With Amendments." in The Exercise of This Power, TheDokument2 SeitenSenate May Propose or Concur With Amendments." in The Exercise of This Power, TheNelda Enriquez100% (1)

- CaseDokument1 SeiteCaseCesarey B. MestidioNoch keine Bewertungen

- Imbong vs. Ochoa PDFDokument6 SeitenImbong vs. Ochoa PDFNelda EnriquezNoch keine Bewertungen

- Media, Can Be Implemented"Dokument2 SeitenMedia, Can Be Implemented"Nelda EnriquezNoch keine Bewertungen

- Plaintiff-Appellee Vs Vs Defendant-Appellant Jose Rivera Yap Solicitor-General HiladoDokument6 SeitenPlaintiff-Appellee Vs Vs Defendant-Appellant Jose Rivera Yap Solicitor-General HiladoLeona SanchezNoch keine Bewertungen

- CRIM Cases 2019 2020Dokument655 SeitenCRIM Cases 2019 2020Nelda EnriquezNoch keine Bewertungen

- Mecano vs. CoaDokument3 SeitenMecano vs. CoaIrene PacaoNoch keine Bewertungen

- Jacinto v. PeopleDokument2 SeitenJacinto v. PeopleNelda EnriquezNoch keine Bewertungen

- PERSONS Cases 2019 2020Dokument458 SeitenPERSONS Cases 2019 2020Nelda EnriquezNoch keine Bewertungen

- PERSONS Cases 2019 2020Dokument458 SeitenPERSONS Cases 2019 2020Nelda EnriquezNoch keine Bewertungen

- 7 - Martinez V Van Buskirk - ArticleDokument1 Seite7 - Martinez V Van Buskirk - ArticleNelda EnriquezNoch keine Bewertungen

- CRIM Cases 2019 2020Dokument655 SeitenCRIM Cases 2019 2020Nelda EnriquezNoch keine Bewertungen

- Van Dorn V RomilloDokument2 SeitenVan Dorn V RomilloNelda EnriquezNoch keine Bewertungen

- Salva, Chelsea O. - 1R - Ora, Ora Et Labora, Labora, LaboraDokument2 SeitenSalva, Chelsea O. - 1R - Ora, Ora Et Labora, Labora, LaboraNelda EnriquezNoch keine Bewertungen

- Mecano vs. CoaDokument3 SeitenMecano vs. CoaIrene PacaoNoch keine Bewertungen

- Mecano vs. CoaDokument3 SeitenMecano vs. CoaIrene PacaoNoch keine Bewertungen

- 7 - Martinez V Van Buskirk - ArticleDokument1 Seite7 - Martinez V Van Buskirk - ArticleNelda EnriquezNoch keine Bewertungen

- 6 - People vs. Purisima - Article. 10Dokument2 Seiten6 - People vs. Purisima - Article. 10Nelda EnriquezNoch keine Bewertungen

- 8 - Yao Kee V Sy-Gonzales - Arts. 11 and 12Dokument2 Seiten8 - Yao Kee V Sy-Gonzales - Arts. 11 and 12Nelda EnriquezNoch keine Bewertungen

- Van Dorn V RomilloDokument2 SeitenVan Dorn V RomilloNelda EnriquezNoch keine Bewertungen

- People of The Philippines, PetitionerDokument2 SeitenPeople of The Philippines, PetitionerNelda EnriquezNoch keine Bewertungen

- Urban Jungle Where Dreams Are Made ofDokument2 SeitenUrban Jungle Where Dreams Are Made ofNelda EnriquezNoch keine Bewertungen

- Ivler DigestDokument2 SeitenIvler DigestJette SalvacionNoch keine Bewertungen

- People V LiceraDokument2 SeitenPeople V LiceraNelda EnriquezNoch keine Bewertungen

- Airball Make It RainDokument2 SeitenAirball Make It RainNelda EnriquezNoch keine Bewertungen

- Horry County, SOUTH CAROLINA InjunctionDokument4 SeitenHorry County, SOUTH CAROLINA InjunctionDavid L HucksNoch keine Bewertungen

- Karen Salvacion CaseDokument2 SeitenKaren Salvacion CaseDave Lumasag CanumhayNoch keine Bewertungen

- Escobedo v. THQDokument7 SeitenEscobedo v. THQMaria Crimi SpethNoch keine Bewertungen

- HR On UP-DND Accord, Academic FreedomDokument4 SeitenHR On UP-DND Accord, Academic FreedomRapplerNoch keine Bewertungen

- Monday, December 08, 2014 EditionDokument16 SeitenMonday, December 08, 2014 EditionFrontPageAfricaNoch keine Bewertungen

- Future of Collegium System Transforming Judicial Appointments For TransparencyDokument5 SeitenFuture of Collegium System Transforming Judicial Appointments For TransparencyTanay BansalNoch keine Bewertungen

- MemorialDokument13 SeitenMemorialHarshil ShahNoch keine Bewertungen

- Civil Law 1981Dokument13 SeitenCivil Law 1981Carlo ReyesNoch keine Bewertungen

- Reflection On The Dissenting Opinion of Justice BrionDokument2 SeitenReflection On The Dissenting Opinion of Justice BrionacNoch keine Bewertungen

- Reviewer in Philippine ConstitutionDokument7 SeitenReviewer in Philippine ConstitutionMarvin Cabantac50% (2)

- MUNAVVAR-UL-ISLAM v. RISHU ARORADokument30 SeitenMUNAVVAR-UL-ISLAM v. RISHU ARORALive LawNoch keine Bewertungen

- 2018 BAR (Remedial Law)Dokument4 Seiten2018 BAR (Remedial Law)Jake MendozaNoch keine Bewertungen

- Civil Procedure Case DigestDokument24 SeitenCivil Procedure Case DigestPrincess Nhesren Ali0% (1)

- Will of James Wyatt The ElderDokument2 SeitenWill of James Wyatt The ElderLynn RobertsNoch keine Bewertungen

- Stephen Bishop v. Medical Records Officer, Prison of New Mexico Prison of New Mexico, North Facility Robert Tansy, Warden, 948 F.2d 1294, 10th Cir. (1991)Dokument6 SeitenStephen Bishop v. Medical Records Officer, Prison of New Mexico Prison of New Mexico, North Facility Robert Tansy, Warden, 948 F.2d 1294, 10th Cir. (1991)Scribd Government DocsNoch keine Bewertungen

- Articles of PartnershipDokument2 SeitenArticles of Partnershiprethiram100% (4)

- Partnership and AgencyDokument40 SeitenPartnership and AgencyDezs Fernandez MatitoNoch keine Bewertungen

- IB History Paper 1 Review-2Dokument10 SeitenIB History Paper 1 Review-2Kelly Lim100% (1)

- NSA Docs (EFF FOIA)Dokument616 SeitenNSA Docs (EFF FOIA)LeakSourceInfoNoch keine Bewertungen

- 3L00116 PDFDokument1 Seite3L00116 PDFMinal Khedekar DhamanaskarNoch keine Bewertungen

- Simon v. CHR, G.R. No. 100150, 5 January 1994Dokument14 SeitenSimon v. CHR, G.R. No. 100150, 5 January 1994Jazem AnsamaNoch keine Bewertungen

- Exclusive Artist AgreementDokument9 SeitenExclusive Artist AgreementSamuel Kagoru GichuruNoch keine Bewertungen

- Gaerlan v. CatubigDokument6 SeitenGaerlan v. CatubigBianca BNoch keine Bewertungen

- Luz vs. People, 667 SCRA 421, February 29, 2012Dokument17 SeitenLuz vs. People, 667 SCRA 421, February 29, 2012TNVTRL100% (1)

- Independent Paralegals HandbookDokument401 SeitenIndependent Paralegals HandbookWb Warnabrother Hatchet100% (13)

- Response and Objection To Motion To Reconsider VenueDokument3 SeitenResponse and Objection To Motion To Reconsider Venuekc wildmoonNoch keine Bewertungen

- Ronald ReaganDokument6 SeitenRonald ReaganVictoria VeringaNoch keine Bewertungen

- Motor Vehicle Sale AgreementDokument2 SeitenMotor Vehicle Sale AgreementBagath SinghNoch keine Bewertungen

- G.R. No. L-28379 March 27, 1929 The Government of The Philippine Islands, ApplicantDokument6 SeitenG.R. No. L-28379 March 27, 1929 The Government of The Philippine Islands, Applicantbbbmmm123Noch keine Bewertungen

- ML Aggarwal I S Chawla J Agarwal Munish Sethi Ravinder Singh - Self-Help To ICSE Class 10 X Understanding Mathematics Solutions of ML Aggarwal I S Chawla J Agarwal Munish Sethi Ravinder Singh and SonsDokument692 SeitenML Aggarwal I S Chawla J Agarwal Munish Sethi Ravinder Singh - Self-Help To ICSE Class 10 X Understanding Mathematics Solutions of ML Aggarwal I S Chawla J Agarwal Munish Sethi Ravinder Singh and SonsUtkarsh JainNoch keine Bewertungen