Beruflich Dokumente

Kultur Dokumente

1604-C Guidelines Jan 2018 Final

Hochgeladen von

FedsOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

1604-C Guidelines Jan 2018 Final

Hochgeladen von

FedsCopyright:

Verfügbare Formate

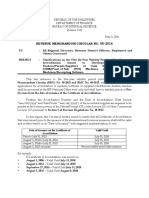

Guidelines and Instructions for BIR Form No.

1604-C (January 2018)

Annual Information of Income Taxes Withheld on Compensation

These instructions are designed to assist taxpayers, or their Item 8 Category of Withholding Agent: Choose Private if the

representatives, with the preparation of the Annual Information Return withholding agent is a private individual/non-individual, or

of Income Taxes Withheld on Compensation. If there are questions government if the withholding agent is the government of the

which are not adequately covered, please consult the local BIR office. Philippines or any political subdivision, agency or

If there appears to be any discrepancies between these instructions and instrumentality.

the applicable laws and regulations, the laws and regulations shall take

precedence. Item 8A Top Withholding Agent: If the withholding agent is

private and belong to top withholding agent (i.e. top 5,000

Who Shall File individual, top 20,000 private corporations, TAMP, medium

taxpayers, large taxpayers, etc.), tick Yes, if not, tick

This return shall be filed by every employer or withholding

agent/payor who is either an individual, estate, trust, partnership, Item 9 Contact Number: Enter the taxpayer’s current contact

corporation, government agency and instrumentality, government number.

owned and controlled corporation, local government unit and other

juridical entity required to deduct and withhold taxes on compensation Item 10 Email Address: Enter requested information. In case the

paid to employees. taxpayer has no email address, leave the space blank

If the person required to withhold and pay/remit the tax is a Item 11 Choose “Yes” if the Withholding Agent released the refund/s

corporation, the return shall be made in the name of the corporation and to its employees in case of overwithholding/overremittance after

shall be signed and verified by the president, vice-president, or any the year-end adjustment on compensation otherwise, choose

authorized officer. “No”.

If the Government of the Philippines or any of its agencies, political

subdivisions or instrumentalities, or a government-owned or controlled Item11A If Item 11 is yes, specify here the date of refund.

corporation, is the withholding agent/payor, the return shall be

accomplished and signed by the officer or employee having control of Item 12 Indicate Total Amount of Overremittance on Tax Withheld

disbursement of income payments or other officer or employee under Compensation.

appropriately designated for the purpose.

With respect to a fiduciary, the return shall be made in the name of Item 13 Indicate Month of First Crediting of Overremittance.

the individual, estate or trust for which such fiduciary acts and shall be

signed and verified by such fiduciary. In case of two or more joint Penalty for failure to file information returns

fiduciaries, the return shall be signed and verified by one of such

fiduciaries. In the case of each failure to file an information return, statement

or list, or keep any record, or supply any information required by the

When and Where to File Code or by the Commissioner on the date prescribed therefor, unless it

is shown that such failure is due to reasonable cause and not to willful

The return shall be filed on or before January 31 of the year neglect, there shall, upon notice and demand by the Commissioner, be

following the calendar year in which the compensation payment and paid by the person failing to file, keep or supply the same, One

other income payments were paid or accrued. Thousand Pesos (Php 1,000.00) for each such failure: Provided,

however, that the aggregate amount imposed for all such failures

The return shall be filed thru Offline eBIRForms Package per during a calendar year shall not exceed Twenty Five Thousand Pesos

Revenue Regulations No. 6-2014, as amended. (Php 25,000.00).

A taxpayer may file a separate return for the head office and for Signature Lines:

each branch or place of business/office or a consolidated return for the

head office and all the branches/offices except in the case of large When all the information required are complete, sign the return in

taxpayers where only one consolidated return is required. the place indicated and provide the necessary details (e.g. title of

signatory and TIN).

The return shall be e-filed using the eFPS/eBIRForms facilities thru

the BIR website www.bir.gov.ph. NOTE: All background information must be properly filled out

The last 5 digits of the 14-digit TIN refers to the branch code

How to Accomplish the Return All returns filed by an accredited tax agent on behalf of a

taxpayer shall bear the following information:

For Items 1 to 3 A. For Individual (CPAs, members of GPPs, and others)

a.1 Taxpayer Identification Number (TIN); and

Item 1 Indicate the year covered by this return being filed. a.2 BIR Accreditation Number, Date of Issue, and Date of

Item 2 Choose “Yes” if this tax return is amending a previously filed Expiry.

return, “No” if not. B. For members of the Philippine Bar (Lawyers)

Item 3 Indicate total number of sheet/s being attached to the return. b.1 Taxpayer Identification Number (TIN);

b.2 Attorney’s Roll Number;

Part I – Background Information b.3 Mandatory Continuing Legal Education (MCLE)

Compliance Number; and

Item 4 Taxpayer Identification Number (TIN): Enter TIN. If no TIN, b.4 BIR Accreditation Number, Date of Issue, and Date of

apply for one before filing this return using the appropriate Expiry

Application for Registration (BIR Form No. 1901/1903).

Item 5 RDO Code: Enter the appropriate code for the RDO per filed BIR Required attachments: (Electronically submitted using eFPS or

Form No. 1901/1903 and/or Certificate of Registration (BIR Form email to esubmission@bir.gov.ph)

No. 2303).

Item 6 Withholding Agent’s Name: Enter taxpayer’s name as it was 1. Acknowledgement Receipt/Validation Successful message as

entered on the registration form and/or Certificate of Registration. proof of submission thru electronic attachment for eFPS or email

Item 7 Registered Address: Enter Registered Address as indicated in to esubmission@bir.gov.ph of the following:

BIR Form No. 2303. If the taxpayer has moved its registered a. Alphalist of Employees (declared and certified using BIR

address since the previous filing of this return and has NOT Form No. 2316)

updated its registration information with the BIR, fill-up and file b. Alphalist of Minimum Wage Earners (declared and certified

first the BIR Form No. 1905. using BIR Form No. 2316).

Item 7A ZIP Code: Enter required information. 2. Authorization letter, if return is filed by an authorized

representative.

Page 4

Das könnte Ihnen auch gefallen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- BIR Form 1604EDokument2 SeitenBIR Form 1604Ecld_tiger100% (2)

- 53141BIR Form No. 0901 - R (Royalties) PDFDokument2 Seiten53141BIR Form No. 0901 - R (Royalties) PDFjohnbyronjakesNoch keine Bewertungen

- 1702 RTsasaDokument4 Seiten1702 RTsasaEysOc11Noch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesDokument2 SeitenGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlNoch keine Bewertungen

- Bureau of Internal Revenue Form 1604e 2016Dokument2 SeitenBureau of Internal Revenue Form 1604e 2016Lynnard Philip PanesNoch keine Bewertungen

- 1601-EQ Guide January 2019 ENCS RevDokument1 Seite1601-EQ Guide January 2019 ENCS RevErika OrellanoNoch keine Bewertungen

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDokument2 SeitenAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArleneNoch keine Bewertungen

- Guidelines 1701 June 2013 ENCS PDFDokument4 SeitenGuidelines 1701 June 2013 ENCS PDFGil PinoNoch keine Bewertungen

- BIR Form No. 0901-D DividendsDokument2 SeitenBIR Form No. 0901-D DividendsKoji ZerofourNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Dokument1 SeiteGuidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Milds LadaoNoch keine Bewertungen

- 1604 e 99Dokument4 Seiten1604 e 99ILubo AkNoch keine Bewertungen

- BIR Form No. 0901-O (Other Income) Bureau of Internal RevenueDokument2 SeitenBIR Form No. 0901-O (Other Income) Bureau of Internal RevenueChristianNicolasBetantosNoch keine Bewertungen

- CRS Self Certification Form For IndividualsDokument6 SeitenCRS Self Certification Form For IndividualsSergeyNoch keine Bewertungen

- Quiz Number 2 TaxnDokument17 SeitenQuiz Number 2 Taxnjustine cabanaNoch keine Bewertungen

- 1601 C CompensationDokument2 Seiten1601 C Compensationjon_cpaNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsDokument1 SeiteGuidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsAlyssa Hallasgo-Lopez AtabeloNoch keine Bewertungen

- f4506c AccessibleDokument2 Seitenf4506c AccessibleRoberto Monterrosa100% (1)

- BIR Form No. 0901-T (Transport and Shipping)Dokument2 SeitenBIR Form No. 0901-T (Transport and Shipping)ChristianNicolasBetantosNoch keine Bewertungen

- 1601C GuidelinesDokument1 Seite1601C GuidelinesAnonymous 1tTxK4Noch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDokument1 SeiteGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNoch keine Bewertungen

- IVES Request For Transcript of Tax Return: First)Dokument2 SeitenIVES Request For Transcript of Tax Return: First)GlendaNoch keine Bewertungen

- Tax 3 - Unit 3 Chapter 10 Tax Remedies of TaxpayersDokument7 SeitenTax 3 - Unit 3 Chapter 10 Tax Remedies of TaxpayersJeni ManobanNoch keine Bewertungen

- Form 801Dokument3 SeitenForm 801Beatriz AlvaradoNoch keine Bewertungen

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDokument1 SeiteBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNoch keine Bewertungen

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDokument1 SeiteBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNoch keine Bewertungen

- Form 4506 CDokument2 SeitenForm 4506 CKabano CoNoch keine Bewertungen

- Guidelines 1702-EX June 2013 PDFDokument4 SeitenGuidelines 1702-EX June 2013 PDFRica Rianni GisonNoch keine Bewertungen

- 2200-S Jan 2018 Guide RevisedDokument2 Seiten2200-S Jan 2018 Guide RevisedJoseph DoctoNoch keine Bewertungen

- 1701 GuidelinesDokument4 Seiten1701 GuidelinesJazz techNoch keine Bewertungen

- Javier Assignment 28Dokument9 SeitenJavier Assignment 28Shamraj E. SunderamurthyNoch keine Bewertungen

- 0619-E Jan 2018 GuidelinesDokument1 Seite0619-E Jan 2018 GuidelinesFarida Wahab Mama-BasagNoch keine Bewertungen

- 2848 - Arnold Part 2Dokument2 Seiten2848 - Arnold Part 2Arnissia Dior100% (5)

- Request For Transcript of Tax ReturnDokument2 SeitenRequest For Transcript of Tax Returnjimb boifNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnDokument1 SeiteGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuNoch keine Bewertungen

- Request For Transcript of Tax ReturnDokument2 SeitenRequest For Transcript of Tax ReturnMuhammad Faheem Mohd EzaniNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDokument1 SeiteGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaNoch keine Bewertungen

- 1604CDokument1 Seite1604CNguyen LinhNoch keine Bewertungen

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDokument1 SeiteBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNoch keine Bewertungen

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDokument1 SeiteBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNoch keine Bewertungen

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDokument1 SeiteBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNoch keine Bewertungen

- Bir Form 0605Dokument4 SeitenBir Form 0605Manoy BermeoNoch keine Bewertungen

- Request For Transcript of Tax ReturnDokument2 SeitenRequest For Transcript of Tax Returntemp ashisNoch keine Bewertungen

- Bir FormsDokument25 SeitenBir FormsAngel Mae ToreniadoNoch keine Bewertungen

- Vendor Onboard PackageDokument6 SeitenVendor Onboard PackageNick BlanchetteNoch keine Bewertungen

- Request For Transcript of Tax ReturnDokument2 SeitenRequest For Transcript of Tax ReturnAlaizaTanaligaTampilicNoch keine Bewertungen

- Guidelines 1702-EX June 2013Dokument4 SeitenGuidelines 1702-EX June 2013Julio Gabriel AseronNoch keine Bewertungen

- Lecture 12 Tax Law - UpdatedDokument39 SeitenLecture 12 Tax Law - UpdatedAatir ImranNoch keine Bewertungen

- 1701 Guide Nov 2011Dokument1 Seite1701 Guide Nov 2011Cy YolipseNoch keine Bewertungen

- Rmo 72 2010Dokument11 SeitenRmo 72 2010Alyssa BorjaNoch keine Bewertungen

- New ITRs 2014Dokument72 SeitenNew ITRs 2014miles1280Noch keine Bewertungen

- Tax Hand Book of KPTCL 16-02-16Dokument111 SeitenTax Hand Book of KPTCL 16-02-16Prasad IyengarNoch keine Bewertungen

- ELA0Request For Transcript of Tax Ret BDokument1 SeiteELA0Request For Transcript of Tax Ret BDavid FreiheitNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDokument1 SeiteGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNoch keine Bewertungen

- Request For Transcript of Tax Return: Sign HereDokument2 SeitenRequest For Transcript of Tax Return: Sign HereAnonymous OSyY7VNoch keine Bewertungen

- 1704 MqyDokument1 Seite1704 MqyRizza Mae RodriguezNoch keine Bewertungen

- 3 - Irs 2849Dokument2 Seiten3 - Irs 2849Hï FrequencyNoch keine Bewertungen

- Bacore 3 Course Packet 2Dokument15 SeitenBacore 3 Course Packet 2Jenifer Borja BacayoNoch keine Bewertungen

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- BiddingDokument75 SeitenBiddingFedsNoch keine Bewertungen

- 1604e 2018Dokument2 Seiten1604e 2018FedsNoch keine Bewertungen

- 2316Dokument1 Seite2316FedsNoch keine Bewertungen

- 1604E Jan 2018 ENCS Final Annex BDokument2 Seiten1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Preservation of Books of Accounts and Accounting Records in Philippines - Tax and Accounting Center, IncDokument7 SeitenPreservation of Books of Accounts and Accounting Records in Philippines - Tax and Accounting Center, IncFedsNoch keine Bewertungen

- CTA CaseDokument9 SeitenCTA CaseFedsNoch keine Bewertungen

- 1604E Jan 2018 ENCS Final Annex BDokument2 Seiten1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Revenue Memorandum Circular No. 55-2016: For ExampleDokument2 SeitenRevenue Memorandum Circular No. 55-2016: For ExampleFedsNoch keine Bewertungen

- Deciding On The Donee: Step3Dokument4 SeitenDeciding On The Donee: Step3FedsNoch keine Bewertungen

- PWC Client AdvisoryDokument8 SeitenPWC Client AdvisoryFedsNoch keine Bewertungen

- Nypd AcronymDokument4 SeitenNypd AcronymMr .X100% (1)

- Tectabs Private: IndiaDokument1 SeiteTectabs Private: IndiaTanya sheetalNoch keine Bewertungen

- List of Cases Selected For Audit Through Computer Ballot - Income TaxDokument49 SeitenList of Cases Selected For Audit Through Computer Ballot - Income TaxFahid AslamNoch keine Bewertungen

- Form PDF 344472690310722Dokument11 SeitenForm PDF 344472690310722NandhakumarNoch keine Bewertungen

- Motion To Disqualify MCAO - 7-31-13Dokument14 SeitenMotion To Disqualify MCAO - 7-31-13crimefileNoch keine Bewertungen

- 2015-08-24 065059 4.blood RelationsDokument20 Seiten2015-08-24 065059 4.blood Relationsჯონ ფრაატეეკNoch keine Bewertungen

- Complaint Affidavit Pag Ibig FundDokument3 SeitenComplaint Affidavit Pag Ibig FundHaider De LeonNoch keine Bewertungen

- Sea Freight Sop Our Sales Routing OrderDokument7 SeitenSea Freight Sop Our Sales Routing OrderDeepak JhaNoch keine Bewertungen

- Stevens V University of Birmingham (2016) 4 All ER 258Dokument25 SeitenStevens V University of Birmingham (2016) 4 All ER 258JYhkNoch keine Bewertungen

- Focus Notes - Philippine Standard On Auditing 120Dokument1 SeiteFocus Notes - Philippine Standard On Auditing 120Kristine Apale100% (1)

- Reference and RevisionDokument6 SeitenReference and RevisionRohit kumar SharmaNoch keine Bewertungen

- Shariah Law IIDokument3 SeitenShariah Law IIJulie JimenezNoch keine Bewertungen

- VOLIITSPart IDokument271 SeitenVOLIITSPart IrkprasadNoch keine Bewertungen

- Dwnload Full Managerial Accounting Tools For Business Decision Making Canadian 4th Edition Weygandt Solutions Manual PDFDokument36 SeitenDwnload Full Managerial Accounting Tools For Business Decision Making Canadian 4th Edition Weygandt Solutions Manual PDFzojerdknanio100% (10)

- Share-Based Payments With Answer PDFDokument9 SeitenShare-Based Payments With Answer PDFAyaka FujiharaNoch keine Bewertungen

- GRR - APRR - 2021 (Singapore 84-99)Dokument120 SeitenGRR - APRR - 2021 (Singapore 84-99)chloeNoch keine Bewertungen

- Work Allocation - Department of Financial Services - Ministry of Finance - Government of IndiaDokument3 SeitenWork Allocation - Department of Financial Services - Ministry of Finance - Government of IndiaTushar ShrivastavNoch keine Bewertungen

- Adelfa V CADokument3 SeitenAdelfa V CAEd Karell GamboaNoch keine Bewertungen

- Arnold Emergency Motion 22cv41008 Joseph Et AlDokument13 SeitenArnold Emergency Motion 22cv41008 Joseph Et AlKaitlin AthertonNoch keine Bewertungen

- Article 62 of The Limitation ActDokument1 SeiteArticle 62 of The Limitation ActGirish KallaNoch keine Bewertungen

- NCP CarsDokument7 SeitenNCP CarsNayab NoorNoch keine Bewertungen

- Payroll Procedures: For Work Within 8 HoursDokument2 SeitenPayroll Procedures: For Work Within 8 HoursMeghan Kaye LiwenNoch keine Bewertungen

- MedMen HochulDokument67 SeitenMedMen HochulChris Bragg100% (1)

- Union Govt Apex Body PDFDokument2 SeitenUnion Govt Apex Body PDFAjivam AnvesakaNoch keine Bewertungen

- Heat and Other Essential Services - 72-Hour Notice - Terminate LeaseDokument2 SeitenHeat and Other Essential Services - 72-Hour Notice - Terminate LeaseMegNoch keine Bewertungen

- Pre Counseling Notice Jexpo Voclet17Dokument2 SeitenPre Counseling Notice Jexpo Voclet17Shilak BhaumikNoch keine Bewertungen

- List of Tallest Buildings in Delhi - Wikipedia, The Free EncyclopediaDokument13 SeitenList of Tallest Buildings in Delhi - Wikipedia, The Free EncyclopediaSandeep MishraNoch keine Bewertungen

- Craig Hanush Thompson, A044 854 402 (BIA Oct. 1, 2014)Dokument12 SeitenCraig Hanush Thompson, A044 854 402 (BIA Oct. 1, 2014)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Lledo V Lledo PDFDokument5 SeitenLledo V Lledo PDFJanica DivinagraciaNoch keine Bewertungen