Beruflich Dokumente

Kultur Dokumente

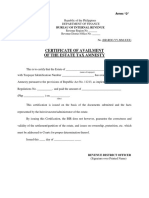

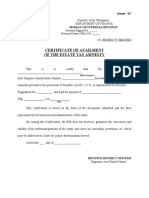

Certificate of Availment of The Estate Tax Amnesty: Annex "B" Ver. 2

Hochgeladen von

Paul0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

49 Ansichten1 SeiteThis certificate certifies that the Estate of [name of taxpayer] with Taxpayer Identification Number [number] has availed of the Estate Tax Amnesty pursuant to Republic Act No. 11213 and Revenue Regulations 6-2019. The estate paid [amount] on [date]. This certification is based on documents submitted by the heirs/executor/administrator but does not guarantee the correctness of the estate settlement, which must be addressed in courts.

Originalbeschreibung:

Annex B - RMC 103-2019

Originaltitel

RMC 103-2019 Annex

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis certificate certifies that the Estate of [name of taxpayer] with Taxpayer Identification Number [number] has availed of the Estate Tax Amnesty pursuant to Republic Act No. 11213 and Revenue Regulations 6-2019. The estate paid [amount] on [date]. This certification is based on documents submitted by the heirs/executor/administrator but does not guarantee the correctness of the estate settlement, which must be addressed in courts.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

49 Ansichten1 SeiteCertificate of Availment of The Estate Tax Amnesty: Annex "B" Ver. 2

Hochgeladen von

PaulThis certificate certifies that the Estate of [name of taxpayer] with Taxpayer Identification Number [number] has availed of the Estate Tax Amnesty pursuant to Republic Act No. 11213 and Revenue Regulations 6-2019. The estate paid [amount] on [date]. This certification is based on documents submitted by the heirs/executor/administrator but does not guarantee the correctness of the estate settlement, which must be addressed in courts.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Annex “B” ver.

Republic of the Philippines

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Revenue Region No. ______

Revenue District Office No. ______

No. (RR-RDO-YY-MM-XXX)

CERTIFICATE OF AVAILMENT

OF THE ESTATE TAX AMNESTY

This is to certify that the Estate of _____________________________________________

(name of taxpayer)

with Taxpayer Identification Number ______________________ has availed of the Estate Tax

Amnesty pursuant to the provisions of Republic Act No. 11213, as implemented by Revenue

Regulations (RR) No. 6-2019, and paid the amount of __________________________________

(Php ______________ ) on _____________.

(date)

This certification is issued on the basis of the documents submitted and the facts

represented by the heirs/executor/administrator of the estate. *

By issuing this Certification, the BIR does not however, guarantee the correctness and

validity of the settlement/partition of the estate, and issues on ownership, preterition, etc. which

must be addressed to Courts for proper determination thereof.

Issued this ____ day of _____________, ____.

REVENUE DISTRICT OFFICER

(Signature over Printed Name)

*In case there are properties covered under Section 3 of RR No. 6-2019 which are included in the

application for estate tax amnesty, the application pertaining to such properties shall be considered

null and void.

Das könnte Ihnen auch gefallen

- Annex B - RMC 103-2019Dokument2 SeitenAnnex B - RMC 103-2019Isaac Dominic MacaranasNoch keine Bewertungen

- Annex B - RMC 103-2019Dokument2 SeitenAnnex B - RMC 103-2019Ra JeNoch keine Bewertungen

- Tax Amnesty CertificateDokument1 SeiteTax Amnesty CertificateJewelyn C. Espares-CioconNoch keine Bewertungen

- Annex D - Certificate of AvailmentDokument1 SeiteAnnex D - Certificate of AvailmentJason YangaNoch keine Bewertungen

- Annex D - Certificate of AvailmentDokument1 SeiteAnnex D - Certificate of AvailmentJason YangaNoch keine Bewertungen

- Annex D - Certificate of AvailmentDokument1 SeiteAnnex D - Certificate of AvailmentMELLICENT LIANZANoch keine Bewertungen

- Sworn Application For Tax Clearance For General Purposes Individual TaxpayersDokument1 SeiteSworn Application For Tax Clearance For General Purposes Individual Taxpayersjdsindustrial23Noch keine Bewertungen

- Annex CDokument1 SeiteAnnex CJoel SyNoch keine Bewertungen

- Annex A - Certificate of AvailmentDokument1 SeiteAnnex A - Certificate of AvailmentJoel SyNoch keine Bewertungen

- Annex A - Format of Notice of Discrepancy - RMC 102-2020 1Dokument2 SeitenAnnex A - Format of Notice of Discrepancy - RMC 102-2020 1Joanna AbañoNoch keine Bewertungen

- Annex A-RR22-2020NOD V03Dokument2 SeitenAnnex A-RR22-2020NOD V03Fo LetNoch keine Bewertungen

- Notice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnDokument1 SeiteNotice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnWarlie Zambales DiazNoch keine Bewertungen

- ANNEX eDokument2 SeitenANNEX eChristian Sadia0% (1)

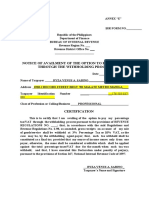

- Notice of Availment of The Option To Pay The Tax Through The Withholding ProcessDokument2 SeitenNotice of Availment of The Option To Pay The Tax Through The Withholding ProcessArgielJedTabalBorrasNoch keine Bewertungen

- RMC No. 102-2020 Annex ADokument2 SeitenRMC No. 102-2020 Annex AHerzl Hali V. HermosaNoch keine Bewertungen

- Sworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersDokument1 SeiteSworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersdiopenesjoelNoch keine Bewertungen

- Annex E RR14 - 2003Dokument1 SeiteAnnex E RR14 - 2003Jomar Teneza100% (1)

- Sworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayersDokument1 SeiteSworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayerscharmedbytinnieNoch keine Bewertungen

- Rmo No 9-06 TCVD Tax Mapping Annex A-C, FDokument5 SeitenRmo No 9-06 TCVD Tax Mapping Annex A-C, FGil PinoNoch keine Bewertungen

- Application For Tax Compliance Verification Certificate Individual TaxpayersDokument1 SeiteApplication For Tax Compliance Verification Certificate Individual TaxpayerslynmarieloverNoch keine Bewertungen

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDokument1 SeiteNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- Annex C.1: Sworn Application For Tax ClearanceDokument1 SeiteAnnex C.1: Sworn Application For Tax ClearanceJoy Mangale AmidaoNoch keine Bewertungen

- Notice of Availment of Substituted Filing of Percentage Tax ReturnsDokument1 SeiteNotice of Availment of Substituted Filing of Percentage Tax ReturnsJomar TenezaNoch keine Bewertungen

- BIR Abatement FormDokument1 SeiteBIR Abatement FormJecky Delos ReyesNoch keine Bewertungen

- Tax FormDokument1 SeiteTax FormChriestal SorianoNoch keine Bewertungen

- Mission Order S: Bir Form No. JANUARY, 2001Dokument1 SeiteMission Order S: Bir Form No. JANUARY, 2001Gil Pino0% (2)

- Bir Form For Tax ExceptionDokument1 SeiteBir Form For Tax ExceptionPublic Safety OfficeNoch keine Bewertungen

- Annex A - Mission OrderDokument1 SeiteAnnex A - Mission OrderReymund S BumanglagNoch keine Bewertungen

- Annex A - Mission OrderDokument1 SeiteAnnex A - Mission OrderLeomar ContilloNoch keine Bewertungen

- Philippine Economic Zone Authority: Republic of The PhilippinesDokument2 SeitenPhilippine Economic Zone Authority: Republic of The PhilippinesPaul GeorgeNoch keine Bewertungen

- Application Form For Tax Compliance Verification Certificate (Individual Taxpayers)Dokument1 SeiteApplication Form For Tax Compliance Verification Certificate (Individual Taxpayers)abmbookkeepingofficeNoch keine Bewertungen

- Annex C Tax ClearanceDokument1 SeiteAnnex C Tax Clearanceanalisa sealmoyNoch keine Bewertungen

- Mission Order (Rmo 15-2018)Dokument1 SeiteMission Order (Rmo 15-2018)Christian Albert HerreraNoch keine Bewertungen

- Annex C.1: Sworn Application For Tax ClearanceDokument1 SeiteAnnex C.1: Sworn Application For Tax ClearanceKrizza MadridNoch keine Bewertungen

- Annex C.1Dokument1 SeiteAnnex C.1Eric OlayNoch keine Bewertungen

- Application For Tax Compliance Verification Certificate Non-Individual TaxpayersDokument1 SeiteApplication For Tax Compliance Verification Certificate Non-Individual TaxpayersanabuaNoch keine Bewertungen

- Tax ExamDokument2 SeitenTax ExamCzarina Joy PenaNoch keine Bewertungen

- Annex C.1: Sworn Application For Tax ClearanceDokument1 SeiteAnnex C.1: Sworn Application For Tax ClearanceKimberly MayNoch keine Bewertungen

- Sworn Application For Tax Clearance - Non-IndDokument2 SeitenSworn Application For Tax Clearance - Non-IndJyznareth Tapia75% (4)

- Sworn Application For Tax Clearance - Non-IndDokument2 SeitenSworn Application For Tax Clearance - Non-Indejay niel100% (1)

- Sworn Application For Tax Clearance - Non-IndDokument2 SeitenSworn Application For Tax Clearance - Non-IndArchie Lazaro0% (1)

- Tax Declaration Form 2021Dokument1 SeiteTax Declaration Form 2021Jessica SantosNoch keine Bewertungen

- Republic of The Philippines: Quezon CityDokument1 SeiteRepublic of The Philippines: Quezon CityCharina Marie CaduaNoch keine Bewertungen

- Sworn Application For Tax Clearance - Non-IndDokument2 SeitenSworn Application For Tax Clearance - Non-IndKeith HernandezNoch keine Bewertungen

- Annex B - Delinquency Verification Certificate 1 CorrectedDokument2 SeitenAnnex B - Delinquency Verification Certificate 1 CorrectedKirk Yngwie EnriquezNoch keine Bewertungen

- Sworn Application For Tax Clearance Annex C 1 RufDokument1 SeiteSworn Application For Tax Clearance Annex C 1 RufellenNoch keine Bewertungen

- Sworn Application For Tax Clearance: Annex CDokument1 SeiteSworn Application For Tax Clearance: Annex Cbarsy piadorNoch keine Bewertungen

- RMO No 9-06 TCVD Tax Mapping Annex N-QDokument5 SeitenRMO No 9-06 TCVD Tax Mapping Annex N-QGil PinoNoch keine Bewertungen

- Sworn Application For Tax Clearance - Non-IndDokument1 SeiteSworn Application For Tax Clearance - Non-IndIdan AguirreNoch keine Bewertungen

- Annex FDokument1 SeiteAnnex FJoyNoch keine Bewertungen

- Sworn Statement For Tax Clearance SampleDokument1 SeiteSworn Statement For Tax Clearance SampleRachel ChanNoch keine Bewertungen

- Lessee Information StatementDokument1 SeiteLessee Information Statementmja.carilloNoch keine Bewertungen

- Application For Delinquency Verification Report Non-Individual TaxpayersDokument1 SeiteApplication For Delinquency Verification Report Non-Individual TaxpayersClark GuilasNoch keine Bewertungen

- Warrant of Levy On Real Property TaxDokument1 SeiteWarrant of Levy On Real Property TaxRhestie IlaganNoch keine Bewertungen

- BIR RR 12-2011 Reportorial Requirements For Commercial Leasing BusinessesDokument5 SeitenBIR RR 12-2011 Reportorial Requirements For Commercial Leasing BusinessesPilosopo LiveNoch keine Bewertungen

- Sworn Application For Tax Clearance For Bidding Purposes - EdrDokument2 SeitenSworn Application For Tax Clearance For Bidding Purposes - Edranabua0% (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- Republic of The Philippines Quezon City: Court of Tax AppealsDokument4 SeitenRepublic of The Philippines Quezon City: Court of Tax AppealsPaulNoch keine Bewertungen

- RMO No. 36-2020 Annex DDokument1 SeiteRMO No. 36-2020 Annex DPaulNoch keine Bewertungen

- Court of Tax Appeals: Republic of The Philippines Quezon CityDokument2 SeitenCourt of Tax Appeals: Republic of The Philippines Quezon CityPaulNoch keine Bewertungen

- Republic of The Philippines Court of Tax Appeals Quezon City DivisionDokument8 SeitenRepublic of The Philippines Court of Tax Appeals Quezon City DivisionPaulNoch keine Bewertungen

- RMO No. 36-2020 Annex A2Dokument1 SeiteRMO No. 36-2020 Annex A2PaulNoch keine Bewertungen

- Republic of The Philippines Court of Tax Appeals Quezon City Second DivisionDokument10 SeitenRepublic of The Philippines Court of Tax Appeals Quezon City Second DivisionPaulNoch keine Bewertungen

- 0620 Monthly Remittance Form of WT On Amount Withdrawn From Decedent's Deposit Account PDFDokument1 Seite0620 Monthly Remittance Form of WT On Amount Withdrawn From Decedent's Deposit Account PDFPaul100% (1)

- Cta Eb CV 01535 D 2018jan04 AssDokument18 SeitenCta Eb CV 01535 D 2018jan04 AssPaulNoch keine Bewertungen

- Republic of The Philippines Court of Tax Appeals Quezon City Second DivisionDokument5 SeitenRepublic of The Philippines Court of Tax Appeals Quezon City Second DivisionPaulNoch keine Bewertungen

- Flyer For All Types of Registration PDFDokument2 SeitenFlyer For All Types of Registration PDFPaulNoch keine Bewertungen

- Cta 3D Co 00330 D 2017sep06 VTC PDFDokument39 SeitenCta 3D Co 00330 D 2017sep06 VTC PDFPaulNoch keine Bewertungen

- FountainDokument1 SeiteFountainPaulNoch keine Bewertungen

- RDO No. 40 - CubaoDokument332 SeitenRDO No. 40 - CubaoPaulNoch keine Bewertungen

- 40Dokument3 Seiten40PaulNoch keine Bewertungen