Beruflich Dokumente

Kultur Dokumente

AngelBrokingResearch SpandanaSpoorty LTD IPO 03082019

Hochgeladen von

durgasainathOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

AngelBrokingResearch SpandanaSpoorty LTD IPO 03082019

Hochgeladen von

durgasainathCopyright:

Verfügbare Formate

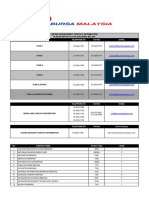

IPO Note | Financials

Aug 03, 2019

Spandana Sphoorty Financial Limited SUBSCRIBE

Issue Open: Aug 05, 2019

Issue Close: Aug 07, 2019

Spandana Sphoorty Financial (SSFL) was established in 2003 and got registered

as an NBFC in 2004. The company provides microfinance largely to women from

lower-income households with an average loan size of `17,768/customer, in

Is s u e D eta i l s

which it follows ‘joint liability group’ model. It also follows a diversified lending

and borrowing strategy. It has wide presence in the nation with presence across Face Value: `10

16 states and 1 union territory. Spandana stands as the 4th largest NBFC-MFI

nationally in terms of AUM with a size of `4,437Cr in FY2019. Present Eq. Paid up Capital: `59.6cr

Continuous improvement in performance: By March 2010, SSFL was the 2nd Offer for Sale: **0.94cr Shares

largest MFI in India in terms of AUM and borrowers. In October 2010, the MFI

industry was severely impacted due to external regulatory action (govt. of formerly Fresh issue: `400cr

unified Andhra Pradesh promulgated AP Microfinance Ordinance 2010),

enforcing several restrictions on the operations of MFIs. This, severely affected Post Eq. Paid up Capital: `64.3cr

Spandana’s collections and the consequent cash-flow shortage impacted its ability

to service debt, impairing SSFL’s growth. Hence, SSFL’s lenders moved the Issue size (amount): *`1,198cr -

company into CDR (Corporate debt restructuring). However, SSFL continued its **1,201 cr

efforts and turned profitable by 2014. SSFL also received capital infusion from its

Price Band: `853-856

Corporate Promoter and Kedaara AIF–1, enabling it to exit from CDR mechanism

successfully. Since exit from CDR, SSFL has improved on all parameters like avg. Lot Size: 17 shares and in multiples

effective cost of borrowing declined from 16.3% to 12.3%; PAR 0+ reduced from thereafter.

`139.1cr to `38.3cr; and AUM grew at CAGR of 52% over FY2017-19.

Post-issue implied mkt. cap: *`5,485cr

Credit rating upgrade post listing to help reduce cost of borrowing: In FY2017, - **`5,504cr

SSFL did not have a credit rating, however, in August 2017 it received a rating of Promoters holding Pre-Issue: 81.20%

BBB-, and since then the rating kept on improving and now it stands at A-. We

believe that post listing there is a strong possibility of a rating upgrade, which will Promoters holding Post-Issue: 62.59%

help to reduce the incremental cost of borrowing.

*Calculated on lower price band

Diversified AUM across 17 states and opportunity to cater unbanked population:

** Calculated on upper price band

SSFL’s operation is well spread across 17 states with 929 branches. No single

state/district/branch contributes more than 20%/1.8%/0.3% to the AUM as of Book Bu ilding

March 2019. Average loan per borrower is at ~`17,800 vs. close peers at more

than `25,000, which clearly shows management’s conservative approach and QIBs 50% of issue

clears risk diversification by limiting AUM by state/ district /branch.

Non-Institutional 15% of issue

Outlook & Valuation: At upper end of the price band, SSFL is valued at 2.7x of

Retail 35% of issue

FY2019 BV (Pre-IPO) and on post dilution basis at 2.4x of Book value, whereas

close peers i.e. CreditAccess Grameen is trading at 3x FY2019 BV. Given SSFL’s

successful exit from CDR in March 2017, healthy NIM, return ratio and low

penetration of financial services in rural India coupled with a well-capitalised Po s t Is s u e Sh a reh o l d i n g Pa ttern

balance sheet and experienced management; we believe the company has an Promoters 63%

excellent base for next level of growth. Based on the positive factors, we assign

SUBSCRIBE rating to the issue. Others 37%

Exhibit 1: Key Financial

Y/E Mar ch (` cr ) FY17 FY18 FY19

NII 221.2 335.7 646.5

YoY Growth (%) 51.8 92.6

PAT 432.8 187.3 311.8

YoY Growth (%) (56.7) 66.5

EPS 72.6 31.4 52.3

Book Value 155.5 233.2 317.0

P/E 11.8 27.3 16.4 Jaikishan J Parmar

P/BV 5.5 3.7 2.7 Research Analyst

ROE (%) 50.7 19.0 21.5 +022 39357600, Extn: 6810

ROA (%) 36.2 10.3 9.6 Jaikishan.parmar@angelbroking.com

Note - Valuation done on pre IPO financials

Please refer to important disclosures at the end of this report 1

Spandana Sphoorty Financial Limited I PO Note

Company Background

Spandana Sphoorty Financial (SSFL) is an NBFC-MFI, which was incorporated as a

company in 2003. Later in 2004, the company got registered as an NBFC with the

RBI and subsequently in 2015 it turned into an NBFC-MFI. It offers loan to women

from low-income households and follows a ‘joint liability group’ model. As of 31

March 2019, Spandana was the fourth largest NBFC-MFI in India in terms of AUM

with a size of `4,437Cr. Of the total AUM 88% of the lending is in the rural areas.

It operates in 929 branches across16 states and 1 union territory. In none of the

branches does it concentrate more than 0.3% of its AUM. This diversification in

lending reduces credit risk for the company. Further, its borrowing is also

diversified which helps it balance its borrowing cost.

Exhibit 1: Strong performance in just 24 months since CDR exit

Particular Mar'17 Mar'19

Gross AUM (` Cr) 1,302 4,437

Net worth (` Cr ) 928 1,889

PAR 0+ (` Cr) 139 38

Profit Before Tax (` Cr) 46 474

Cost-I ncome Rati o (%) 41.8 24.9

No. of lender s (x ) 3 28

Avg. E ff. Borr owing Cost (%) 16.3 12.8

Credit Rating NA A- (Stable)

Avg. E ff. Borr owing Cost (%) 16.3 12.8

Exit from (4th large st

CDR) NBFC-MFI in India)

Source:RHP

Key Management Personnel:

Padmaja Gangireddy is the Promoter and Managing Director of the company. She

also serves as a director on the board of directors of Caspian Financial Services

Limited. She has been a Director on the Company Board since April 19, 2003. She

founded Spandana Rural and Urban Development Organisation (“SRUDO”) in

1998.

Sudhesh Chandrasekar is the Chief Financial Officer of the Company. He holds a

post graduate diploma in management from the Indian Institute of Management,

Bangalore and a bachelor’s degree in commerce (honours) from Shri Ram College

of Commerce, University of Delhi, Delhi. Prior to joining the Company he worked

with Unitus Capital and with ICICI Bank . Mr. Sudhesh Chandrasekar joined SSFl

on August 17.

Abdul Feroz Khan is the Chief Strategy Officer of the Company. He holds a

masters’ degree in business administration from Institute of Chartered Financial

Analysts of India University, Dehradun. He joined Company on November 10,

2008 as an assistant finance manager and was designated as Chief Strategy

Officer on May 15, 2018.

Aug 03, 2019 2

Spandana Sphoorty Financial Limited I PO Note

Issue details

This IPO is a mix of OFS and issue of fresh shares. The issue would constitute

fresh issue wor th `400cr and OFS worth `801cr. OFS largely would offer

partial exit to investors (Kedaar a Capital, He lion Venture Par tners, V aliant

Mauritius P artners) and Promoter Padmaja G angireddy.

Under the OFS, the promoters and other investors are offering 9.3 million

equity shares wor th `800Cr.

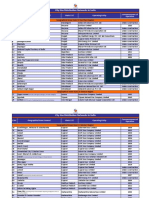

Exhibit 2: Pre and Post-IPO shareholding pattern

No of share s No of share s

Particular % %

(Pre-issue) (Post-i ssue )

Promoter 4,84,31,819 81.2 4,02,45,099 62.59

Investor/Public 1,11,97,364 18.8 2,40,56,981 37.41

5,96,29,183 100.0 6,43,02,080 100.00

Source: RHP Note: Calculated on upper price band

Exhibit 3: Selling Shareholder

Shareholder Shares O ffered

Kangchenjunga Limited 59,67,097

Padmaja Gangireddy 14,23,114

Vijaya Siva Rami 7,96,509

Valiant Mauritius Partner s 7,83,747

Helion Venture Partner s 1,32,831

Kedaar a Capital 1,29,732

Helion Venture Part 1,23,695

Tot al share s 93,56,725

Source: Company

Objects of the offer

The Net Proceeds of the Fresh Issue are proposed to be utilised for

augmenting capital base and general corporate purposes.

To achieve the benefits of listing the Equity Shares on the Exchanges and to

carry out offer for sale of equity shares

Risk

The operations are concentrated to five states (72% of AUM) and any adverse

sustained economic downturn and political unrest/disruption could change

repayment behaviour of the borrowers.

Unsecured Portfolio –SSGL`s operations involve transactions with relatively

high risk borrowers (Unsecured Loan). Any default from the customers could

adversely affect the business, operations and financial condition.

Aug 03, 2019 3

Spandana Sphoorty Financial Limited I PO Note

Exhibit 4: Relative V aluation

M.cap/ AUM

Particular M.cap AUM P/B P/E ROA ROE Leverage CRAR

AUM Gr owth

FY19 YoY 3 Year FY19 FY19

Spandana 5,505 4,270 1.29 2.4 18 35 52 8.5 19 2.2 40

CreditAccess Gr ameen 7,198 7,160 1.01 3.0 22 44 43 5.2 17 3.3 36

Bhar at Fin 12,596 17,390 0.72 3.0 13 38 31 9.0 27 3.0 50

Credit Satin 1,398 6,730 0.21 1.2 7 33 27 3.1 20 6.5 28

Ujjivan Small Fin 3,948 11,050 0.36 2.1 26 46 27 1.3 8 6.5 19

Bandhan Bank 57,299 34,700 1.65 4.7 29 69 41 3.9 19 4.9 29

Source: Company, Spandana P/B valuation has done considering fresh issue; All other stock Market cap is based on 02/8/2019 and for BFIL last trading

day Mcap.

Exhibit 5: Operational Parameter

A dvance Per AUM Per AUM Per

P articular GNPA/NPA (%)

Borrower Br anch AUM

` in Cr ` in Cr F Y17 F Y18 F Y19

S pandana Sphoorty Fin Ltd 17,792 4.7 0.66 42.1/2.9 25.9/0.3 7.9/ 0

CreditAccess Gr ameen Ltd 28,640 10.7 0.89 0.1/0 0.8/0 0.6/0

Bhar at Fin 23,500 10.1 0.90 6/2.7 2.4/1 0.8/0.2

Credit Satin 21,710 6.9 0.65 14.4/12.8 4.4/2.6 3.9/2.4

Ujjivan Small Finance Bank 27,625 21.1 0.75 0.3/0 0.36/0.7 0.9/0.3

Source: Company, All operation parameter based on FY19 financials

Exhibit 6: Du Pont Analysis for FY19

DuP ont A naly sis BFIL Cre.A ccess Spandana

NII 12.11 12.86 17.57

Provision 0.66 1.20 1.23

A dj NII 11.45 11.66 16.34

Other Inc. 8.38 1.04 1.20

Tot al Income 19.83 12.70 17.54

Opex 8.13 4.71 3.56

PBT 11.71 7.99 13.98

Taxes 2.83 2.82 4.39

RoA 8.88 5.17 9.59

Leverage 3.01 3.28 2.24

RoE 26.75 16.94 21.50

Aug 03, 2019 4

Spandana Sphoorty Financial Limited I PO Note

Income Statement

Y/E Mar ch (` cr ) FY17 FY18 FY19

NII 221.2 335.7 646.5

- YoY Growth (%) 51.8 92.6

Other I ncome 8.0 19.3 44.2

- YoY Growth (%) 141.3 128.8

Oper ating I ncome 229.2 355.0 690.6

- YoY Growth (%) 54.9 94.5

Oper ating Ex penses 95.8 108.5 171.9

- YoY Growth (%) 13.2 58.5

Pre - Pr ovision Profit 133.4 246.6 518.7

- YoY Growth (%) 84.8 110.4

Prov. & Cont. 98.4 (35.4) 45.3

- YoY Growth (%) (136.0) (228.0)

Profit Before Tax 35.0 282.0 473.4

- YoY Growth (%) 705.6 67.9

Prov. for Tax ation (397.8) 94.7 161.6

-

PAT 432.8 187.3 311.8

- YoY Growth (%) (56.7) 66.5

Balance Sheet

Y/E March (` cr) F Y17 F Y18 F Y19

Share Capital 28 30 60

Reserve & Surplus 899 1,361 1,831

Net Worth 928 1,391 1,890

T otal Borrowings 959 2,346 3,012

- Growth (%) 145 28

Total pr ovisi ons 1 0 0

Other Liabilities 41 27 29

T otal Liabilities 1,929 3,764 4,932

Cash and Cash equivalents 290 105 149

Invest ments 4 169 264

T otal Loans & A dvances 1,195 3,090 4,268

- Growth (%) 159 38

Fixed Assets 9 9 27

Other Assets 431 392 225

T otal A sset s 1,929 3,764 4,932

Aug 03, 2019 5

Spandana Sphoorty Financial Limited I PO Note

Key Ratio

Y/E Mar ch F Y17 F Y18 F Y19

Pr ofitability rati os (%)

NIMs 18.5 15.1 16.6

RoA 36.2 10.3 9.6

RoE 50.7 19.0 21.5

C/I 41.8 30.6 24.9

A sset Quality (%)

Gross NPAs % 42.0 25.9 7.9

Net NPAs % 2.9 0.3 -

Credit Cost 8.2 (1.1) 1.1

Per Share Data (`)

EPS 72.6 31.4 52.3

BVPS 155.5 233.2 317.0

Valuation Ratios

PER (x) 11.8 27.3 16.4

P/BVPS (x) 5.5 3.7 2.7

DuPont Analy sis

NII 17.0 15.7 17.6

Provision 7.6 (1.7) 1.2

A dj NII 9.4 17.3 16.3

Other Inc. 0.6 0.9 1.2

T otal Income 10.0 18.2 17.5

Opex 4.5 3.5 3.6

PBT 5.6 14.7 14.0

Taxes (30.6) 4.4 4.4

RoA 36.2 10.3 9.6

Leverage 1.4 1.8 2.2

RoE 50.7 19.0 21.5

Note: Calculations based on higher end of the price band – ₹856 and without considering fresh

issue.

Aug 03, 2019 6

Spandana Sphoorty Financial Limited I PO Note

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has n ot

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document sho uld

make such investigations as they deem necessary to arrive at an independent eva luation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to de termine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other rel iable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in th is report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingl y, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document . While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this mat erial, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduc ed,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may ari se from or in

connection with the use of this information.

Aug 03, 2019 7

Das könnte Ihnen auch gefallen

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsVon EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNoch keine Bewertungen

- Spandana Sphoorty Financial Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDokument7 SeitenSpandana Sphoorty Financial Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNoch keine Bewertungen

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesVon EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNoch keine Bewertungen

- Icici Bank LTD: Operating Performance On TrackDokument6 SeitenIcici Bank LTD: Operating Performance On TrackADNoch keine Bewertungen

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Von EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Noch keine Bewertungen

- Indiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Dokument12 SeitenIndiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Veronika AkheevaNoch keine Bewertungen

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesVon EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNoch keine Bewertungen

- Shriram City Union Finance Limited - 204 - QuarterUpdateDokument12 SeitenShriram City Union Finance Limited - 204 - QuarterUpdateSaran BaskarNoch keine Bewertungen

- Ujjivan Financial 1QFY20 Result Update - 190808 - Antique ResearchDokument4 SeitenUjjivan Financial 1QFY20 Result Update - 190808 - Antique ResearchdarshanmadeNoch keine Bewertungen

- Federal Bank LTD: Q3FY19 Result UpdateDokument4 SeitenFederal Bank LTD: Q3FY19 Result Updatesaran21Noch keine Bewertungen

- Indostar 20200813 Mosl Ru PG010Dokument10 SeitenIndostar 20200813 Mosl Ru PG010Forall PainNoch keine Bewertungen

- Arman F L: Inancial Services TDDokument10 SeitenArman F L: Inancial Services TDJatin SoniNoch keine Bewertungen

- Axis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDokument7 SeitenAxis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNoch keine Bewertungen

- Accumulate HDFC Bank: Performance HighlightsDokument9 SeitenAccumulate HDFC Bank: Performance Highlightsimran shaikhNoch keine Bewertungen

- Investor Digest: Equity Research - 14 June 2019Dokument8 SeitenInvestor Digest: Equity Research - 14 June 2019Nadila Ulfa S-AkNoch keine Bewertungen

- ICICI Bank 1QFY20 Result Update - 190729 - Antique ResearchDokument10 SeitenICICI Bank 1QFY20 Result Update - 190729 - Antique ResearchdarshanmadeNoch keine Bewertungen

- Icici Bank: CMP: INR396 TP: INR520 (+31%)Dokument22 SeitenIcici Bank: CMP: INR396 TP: INR520 (+31%)saran21Noch keine Bewertungen

- AngelBrokingResearch STFC Result Update 3QFY2020Dokument6 SeitenAngelBrokingResearch STFC Result Update 3QFY2020avinashkeswaniNoch keine Bewertungen

- Icici ResultsDokument7 SeitenIcici ResultsKishore IrctcNoch keine Bewertungen

- Jpmorgan Chase & Co. (JPM) : Price, Consensus & SurpriseDokument8 SeitenJpmorgan Chase & Co. (JPM) : Price, Consensus & SurpriseIan MutukuNoch keine Bewertungen

- Federal Bank LTD.: PCG ResearchDokument11 SeitenFederal Bank LTD.: PCG Researcharun_algoNoch keine Bewertungen

- Indian Bank Investment Note - QIPDokument5 SeitenIndian Bank Investment Note - QIPAyushi somaniNoch keine Bewertungen

- Manappuram Finance - 3QFY17Dokument7 SeitenManappuram Finance - 3QFY17chatuuuu123Noch keine Bewertungen

- JSTREET Volume 330Dokument10 SeitenJSTREET Volume 330JhaveritradeNoch keine Bewertungen

- BOB Analyis ReportDokument7 SeitenBOB Analyis ReportSudhanshu Kumar SinghNoch keine Bewertungen

- JM Fy2019Dokument35 SeitenJM Fy2019Krishna ParikhNoch keine Bewertungen

- Spandana Sphoorty Financial Limited IPO Note-201908050934443167041Dokument13 SeitenSpandana Sphoorty Financial Limited IPO Note-201908050934443167041tanmayNoch keine Bewertungen

- PB Fintech Icici SecuritiesDokument33 SeitenPB Fintech Icici SecuritieshamsNoch keine Bewertungen

- RBL Bank - 4QFY19 - HDFC Sec-201904191845245959765Dokument12 SeitenRBL Bank - 4QFY19 - HDFC Sec-201904191845245959765SachinNoch keine Bewertungen

- Muthoot Finance: Steady QuarterDokument7 SeitenMuthoot Finance: Steady QuarterMukeshChauhanNoch keine Bewertungen

- AU Small Finance Bank - IC - HDFC Sec-201710030810174398816Dokument30 SeitenAU Small Finance Bank - IC - HDFC Sec-201710030810174398816Anonymous y3hYf50mTNoch keine Bewertungen

- FivestarDokument8 SeitenFivestarAnkit KumarNoch keine Bewertungen

- JM Financial - Initiating CoverageDokument11 SeitenJM Financial - Initiating Coveragerchawdhry123Noch keine Bewertungen

- Banks - HBL - Expense Burden Trims ROE Protential For 2018-19 - JSDokument4 SeitenBanks - HBL - Expense Burden Trims ROE Protential For 2018-19 - JSmuddasir1980Noch keine Bewertungen

- Bandhan Bank (BANBAN) : Best Yields With Lower Cost of Funds Unique ModelDokument30 SeitenBandhan Bank (BANBAN) : Best Yields With Lower Cost of Funds Unique ModelCare India Finvest LimitedNoch keine Bewertungen

- Ptmail m1219 Ss Two Stock Special Report PDFDokument18 SeitenPtmail m1219 Ss Two Stock Special Report PDFAaron MartinNoch keine Bewertungen

- Financial Statement Analysis: Draft For ReviewDokument21 SeitenFinancial Statement Analysis: Draft For ReviewDisha RupaniNoch keine Bewertungen

- Account Closer Form - 19022018Dokument13 SeitenAccount Closer Form - 19022018RajeshNoch keine Bewertungen

- AP Moderate Portfolio 040219Dokument20 SeitenAP Moderate Portfolio 040219sujeet panditNoch keine Bewertungen

- PickoftheWeek 13082022Dokument3 SeitenPickoftheWeek 13082022Photo SharingNoch keine Bewertungen

- Indiabulls Housing Finance: CMP: INR514Dokument12 SeitenIndiabulls Housing Finance: CMP: INR514Tanya SinghNoch keine Bewertungen

- NBFC Sector ReportDokument20 SeitenNBFC Sector ReportAshutosh GuptaNoch keine Bewertungen

- Indian Railway Finance Corporation LTD IPO: All You Need To Know AboutDokument7 SeitenIndian Railway Finance Corporation LTD IPO: All You Need To Know Aboutbest commentator barackNoch keine Bewertungen

- Shriram Transport Finance: CMP: INR1,043 Growth DeceleratingDokument14 SeitenShriram Transport Finance: CMP: INR1,043 Growth DeceleratingDarshitNoch keine Bewertungen

- Jstreet 343Dokument10 SeitenJstreet 343JhaveritradeNoch keine Bewertungen

- Bajaj Finance Sell: Result UpdateDokument5 SeitenBajaj Finance Sell: Result UpdateJeedula ManasaNoch keine Bewertungen

- Team RD-3 Banking & FinanceDokument21 SeitenTeam RD-3 Banking & FinancesukeshNoch keine Bewertungen

- Investor DigestDokument7 SeitenInvestor DigestVerin IchiharaNoch keine Bewertungen

- Bank of Baroda - KRC - 15 10 09Dokument2 SeitenBank of Baroda - KRC - 15 10 09sudhirbansalNoch keine Bewertungen

- JainMatrix Investments Bajaj Finance Jan2012Dokument6 SeitenJainMatrix Investments Bajaj Finance Jan2012Punit JainNoch keine Bewertungen

- Report On Bajaj Finance: Group 1 Crew 2Dokument14 SeitenReport On Bajaj Finance: Group 1 Crew 2MUKESH KUMARNoch keine Bewertungen

- State Bank of India 4 QuarterUpdateDokument6 SeitenState Bank of India 4 QuarterUpdatedarshan pNoch keine Bewertungen

- JM Financial Home - CRISIL - CleanedDokument8 SeitenJM Financial Home - CRISIL - CleanedSrinivasNoch keine Bewertungen

- Project Report: Submitted byDokument20 SeitenProject Report: Submitted byathiraNoch keine Bewertungen

- Spritzer MIDS Initiation Thrist For Growth MIDF 020617 PDFDokument13 SeitenSpritzer MIDS Initiation Thrist For Growth MIDF 020617 PDFAnonymous UfsZYUVcNoch keine Bewertungen

- Future Corporate Resources - R - 05052020Dokument7 SeitenFuture Corporate Resources - R - 05052020ChristianStefanNoch keine Bewertungen

- Final Project Report Radhika KhandelwalDokument36 SeitenFinal Project Report Radhika KhandelwalradhikaNoch keine Bewertungen

- The Megatrend in Financialization of Savings in India-Explained in Three ChartsDokument5 SeitenThe Megatrend in Financialization of Savings in India-Explained in Three ChartsSumangalNoch keine Bewertungen

- J-STREET Volume 349Dokument10 SeitenJ-STREET Volume 349JhaveritradeNoch keine Bewertungen

- Metro South Cooperative Bank of NCR Group ViciousDokument9 SeitenMetro South Cooperative Bank of NCR Group ViciousLenard Garcia50% (2)

- AngelBrokingResearch - Prince Pipes & Fittings LTD - IPONote - 171219Dokument8 SeitenAngelBrokingResearch - Prince Pipes & Fittings LTD - IPONote - 171219durgasainathNoch keine Bewertungen

- AngelBrokingResearch MSTC IPO 120319Dokument7 SeitenAngelBrokingResearch MSTC IPO 120319durgasainathNoch keine Bewertungen

- Emerge Web2020Dokument1 SeiteEmerge Web2020durgasainathNoch keine Bewertungen

- 0-CISSP Flash Cards Draft 6-6-2010Dokument126 Seiten0-CISSP Flash Cards Draft 6-6-2010Maurício SilvaNoch keine Bewertungen

- SpandanaDokument11 SeitenSpandanadurgasainathNoch keine Bewertungen

- SOC TrainingDokument27 SeitenSOC Trainingdurgasainath100% (5)

- Sterling Ipo IciciDokument12 SeitenSterling Ipo IcicidurgasainathNoch keine Bewertungen

- IRCTC IPONoteDokument8 SeitenIRCTC IPONotedurgasainathNoch keine Bewertungen

- GDPR Compliance On AWSDokument32 SeitenGDPR Compliance On AWSdurgasainathNoch keine Bewertungen

- Irctc Ipo IciciDokument14 SeitenIrctc Ipo IcicidurgasainathNoch keine Bewertungen

- Aviatrix GCP UservpnDokument10 SeitenAviatrix GCP UservpndurgasainathNoch keine Bewertungen

- 2018 - 9 - Newsletter - Avoiding Many Types of MalwareDokument2 Seiten2018 - 9 - Newsletter - Avoiding Many Types of MalwaredurgasainathNoch keine Bewertungen

- Ujjivan Ipo Report IciciDokument9 SeitenUjjivan Ipo Report IcicidurgasainathNoch keine Bewertungen

- CSB Ipo Report IciciDokument11 SeitenCSB Ipo Report IcicidurgasainathNoch keine Bewertungen

- ExamBankChallanN PDFDokument2 SeitenExamBankChallanN PDFRathnaNoch keine Bewertungen

- Student Result Management System PDFDokument1 SeiteStudent Result Management System PDFdurgasainathNoch keine Bewertungen

- Information Security Auditor: Delhi/Mumbai - Experience: 3 To 5 YearsDokument1 SeiteInformation Security Auditor: Delhi/Mumbai - Experience: 3 To 5 YearsdurgasainathNoch keine Bewertungen

- IsacaDokument7 SeitenIsacadurgasainathNoch keine Bewertungen

- How To Conduct A Risk AssessmentDokument23 SeitenHow To Conduct A Risk Assessmentdurgasainath100% (1)

- Dde UgcDokument5 SeitenDde UgcdurgasainathNoch keine Bewertungen

- Long Term Skill Shortage ListDokument8 SeitenLong Term Skill Shortage ListAjesh mohanNoch keine Bewertungen

- Aviatrix GCP UservpnDokument10 SeitenAviatrix GCP UservpndurgasainathNoch keine Bewertungen

- PC Eng Tam 05092019Dokument15 SeitenPC Eng Tam 05092019durgasainathNoch keine Bewertungen

- 2018 - 9 - Newsletter - Avoiding Many Types of MalwareDokument2 Seiten2018 - 9 - Newsletter - Avoiding Many Types of MalwaredurgasainathNoch keine Bewertungen

- Security Tips: Mississippi Department of Information Technology ServicesDokument2 SeitenSecurity Tips: Mississippi Department of Information Technology ServicesdurgasainathNoch keine Bewertungen

- C LicenseDokument2 SeitenC Licensechetamilaa50% (2)

- Thompson Complaint PDFDokument12 SeitenThompson Complaint PDFdurgasainathNoch keine Bewertungen

- Aviatrix GCP UservpnDokument10 SeitenAviatrix GCP UservpndurgasainathNoch keine Bewertungen

- 2016 10 Beware of MalwareDokument2 Seiten2016 10 Beware of MalwaredurgasainathNoch keine Bewertungen

- Voluntary Winding Up in India-A Comparative Analysis: Cia IiiDokument6 SeitenVoluntary Winding Up in India-A Comparative Analysis: Cia IiiJiss PalelilNoch keine Bewertungen

- Bursa Data - ContactList-14January2020Dokument19 SeitenBursa Data - ContactList-14January2020AdamZain788Noch keine Bewertungen

- Analysis of Amendments Made To Clause 49 of Listing Agreement of SEBI - IPleadersDokument11 SeitenAnalysis of Amendments Made To Clause 49 of Listing Agreement of SEBI - IPleadersAvaniJainNoch keine Bewertungen

- Chap 1 To 5 Ito Na NgaDokument43 SeitenChap 1 To 5 Ito Na NgaFery Ann C. BravoNoch keine Bewertungen

- Law 4 FRIA QuestionsDokument7 SeitenLaw 4 FRIA QuestionsWilson50% (2)

- 2023 - Corporate Customer TemplateDokument77 Seiten2023 - Corporate Customer TemplateBurhanNoch keine Bewertungen

- CDL CompaniesDokument20 SeitenCDL CompaniesSneha LiveitNoch keine Bewertungen

- 10 - List of Banks PDFDokument3 Seiten10 - List of Banks PDFAyush ParakhNoch keine Bewertungen

- CGD Data For Website 7.10.2016Dokument3 SeitenCGD Data For Website 7.10.2016arbaz khanNoch keine Bewertungen

- Yondoo Channel Lineup by Package 2017 March 16 WebsiteDokument6 SeitenYondoo Channel Lineup by Package 2017 March 16 WebsiteBITZJUNKIENoch keine Bewertungen

- Types of Companies PDFDokument8 SeitenTypes of Companies PDFHadiBies100% (3)

- Classification of CompanyDokument20 SeitenClassification of CompanygautamNoch keine Bewertungen

- Ifrs at A Glance IFRS 11 Joint ArrangementsDokument7 SeitenIfrs at A Glance IFRS 11 Joint ArrangementsNoor Ul Hussain MirzaNoch keine Bewertungen

- Federal Court of AustraliaDokument201 SeitenFederal Court of AustraliaDennis De SilabanNoch keine Bewertungen

- Varottil UDokument447 SeitenVarottil UpriyaNoch keine Bewertungen

- Joint VentureDokument28 SeitenJoint VentureJovani TomaleNoch keine Bewertungen

- October 2016 Advanced Financial Accounting Reporting Final Pre BoardDokument18 SeitenOctober 2016 Advanced Financial Accounting Reporting Final Pre BoardhellokittysaranghaeNoch keine Bewertungen

- Securities and Commodities Authority (SCA) RegulationsDokument4 SeitenSecurities and Commodities Authority (SCA) RegulationsZæńäb MůśhţäqNoch keine Bewertungen

- Advacc 2 Chapter 1 ProblemsDokument5 SeitenAdvacc 2 Chapter 1 ProblemsClint-Daniel Abenoja100% (1)

- Law On Private CorporationDokument7 SeitenLaw On Private CorporationCharles OrgandoNoch keine Bewertungen

- SEC Vs Jonnie WilliamsDokument8 SeitenSEC Vs Jonnie WilliamsFuzzy PandaNoch keine Bewertungen

- Lotte Department StoreDokument8 SeitenLotte Department StoreRebecca ViolaNoch keine Bewertungen

- Company Career Page Links PDF 1670692311Dokument3 SeitenCompany Career Page Links PDF 1670692311Mayank PandeyNoch keine Bewertungen

- Annual Reprt SOECHI LINESDokument272 SeitenAnnual Reprt SOECHI LINESLoker KalimantanNoch keine Bewertungen

- Danone CaseDokument4 SeitenDanone CaseThomas AtkinsNoch keine Bewertungen

- Equity Method VS Cost MethodDokument14 SeitenEquity Method VS Cost MethodMerliza JusayanNoch keine Bewertungen

- PreliminaryDokument30 SeitenPreliminaryADYASA CHOUDHURY100% (1)

- Bank Negara Malaysia Guidelines Related Party TransactionDokument12 SeitenBank Negara Malaysia Guidelines Related Party TransactionYan QingNoch keine Bewertungen

- UniliverDokument38 SeitenUniliversalmanahmedkhi1Noch keine Bewertungen

- Purnima BhasinDokument2 SeitenPurnima BhasinASHWANI CHAUHANNoch keine Bewertungen

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successVon EverandReady, Set, Growth hack:: A beginners guide to growth hacking successBewertung: 4.5 von 5 Sternen4.5/5 (93)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Creating Shareholder Value: A Guide For Managers And InvestorsVon EverandCreating Shareholder Value: A Guide For Managers And InvestorsBewertung: 4.5 von 5 Sternen4.5/5 (8)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursVon EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursBewertung: 4.5 von 5 Sternen4.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthVon EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthBewertung: 4 von 5 Sternen4/5 (20)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 3.5 von 5 Sternen3.5/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- Financial Risk Management: A Simple IntroductionVon EverandFinancial Risk Management: A Simple IntroductionBewertung: 4.5 von 5 Sternen4.5/5 (7)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsVon EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsBewertung: 5 von 5 Sternen5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Von EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressVon EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressNoch keine Bewertungen

- Joy of Agility: How to Solve Problems and Succeed SoonerVon EverandJoy of Agility: How to Solve Problems and Succeed SoonerBewertung: 4 von 5 Sternen4/5 (1)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetVon EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetBewertung: 5 von 5 Sternen5/5 (2)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityVon EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityBewertung: 4.5 von 5 Sternen4.5/5 (4)

- How to Measure Anything: Finding the Value of Intangibles in BusinessVon EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessBewertung: 3.5 von 5 Sternen3.5/5 (4)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)