Beruflich Dokumente

Kultur Dokumente

Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095

Hochgeladen von

David PenOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095

Hochgeladen von

David PenCopyright:

Verfügbare Formate

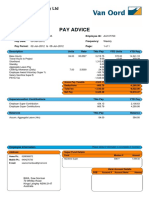

DECCAN CHRONICLE HOLDINGS LIMITED

No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road,Koramangala. Benguluru - 560 095

BENGALURU Payslip for the Month of October2018

Emp id BDC0706 PF No AP/176/1358 UAN No 100262394801

Name P RAVI KUMAR Bank A/c No 000201647543 Paid Days 31

Desig JR ELECTRONICS ENGR PAN No ARMPP1537C Lop Days 0

Earnings BASIC PAY 16,611.00 Deductions

Earn Desc Amount Deduction Desc Amount

BASIC PAY - WAGES 16,611.00 PROFESSIONAL TAX 200.00

VARIABLE DEARNESS ALLOWANCE 11,936.05 EMPLOYEES PROVIDENT FUND 3,426.00

HOUSE RENT ALLOWANCE 2,242.49

MEDICAL EXPENSES 500.00

VARIABLE PAY 5,813.85

Gross Earnings 37,103.39 Gross Deductions 3,626.00

Net Salary 33,477.39

Income Tax Calculations Income Tax Deduction

Particulars Cumulative Add(Rs) Less(Rs) Annual(Rs) Income Tax Payable 0.00

Basic Pay 1,16,277.00 83,055.00 0.00 1,99,332.00

Add : Surcharge on Income Tax 0.00

VDA 81,761.95 59,680.25 0.00 1,41,442.20

HRA 15,697.43 11,212.45 26,620.52 289.36 Add : Health and Education Cess 0.00

Medical 3,500.00 2,500.00 0.00 6,000.00

Conveyance 0.00 0.00 0.00 0.00 Total IT & S/C & Cess Payable 0.00

Special Allw 0.00 0.00 0.00 0.00

40,696.95 29,069.25 0.00 69,766.20 Less : I.Tax paid by Prev.Employer 0.00

Other Earnings

Exgra/SPW/LTC 0.00 0.00 0.00 0.00 I.Tax Recovered till Oct-2018 0.00

Excess Paid Sal. 0.00 0.00 0.00 0.00

Balance I.Tax to be recovered 0.00

Total Income 4,16,829.76

Add : Income receive from Previous Employer 0.00 Avg. Monthly I.Tax to be recovered 0.00

Net Taxable Income 4,16,829.76

40,000.00 Savings Details

Less : Standard Deduction

Less : Prof.Tax recovered by Previous Employer 0.00 LICP/LIC Premium 60,000.00

Less : Prof. Tax recovered by current Employer 2,400.00 0.00

NSC

Gross Taxable Income 3,74,429.76 Principal on Housing Loan 0.00

0.00 EPF 40,636.00

Less : Loss under income from House Property (Sec 24)

Less : Deduction U/s 80DD/80DDB 0.00 0.00

PPF

Less :Deduction U/s 80D 3,000.00 0.00

Children Education Fee

Less : Deduction U/s 80E/80U/80CCD 0.00

BONDS 0.00

Less : SEC 80C/80CCC Total 1,00,636.00

Others 0.00

Less : SEC 80G 0.00

Less : SEC 80E 0.00

1,00,636.00

Less : SEC 80CCF 0.00 Total Savings

Income Chargeable to Tax (Rounded Off) 2,70,793.76 Note: Savings Considered U/S 80C/80CC Up to Rs 1,50,000.00

Das könnte Ihnen auch gefallen

- Last Six MonthPayslip 13074429Dokument6 SeitenLast Six MonthPayslip 13074429Arun RajputNoch keine Bewertungen

- Payslip 1 PDFDokument1 SeitePayslip 1 PDFkrishnaNoch keine Bewertungen

- Pay Slip - 473995 - Apr-21Dokument1 SeitePay Slip - 473995 - Apr-21Siva RamakrishnaNoch keine Bewertungen

- Music Theory - Basic, Intermediate, Advanced PDFDokument80 SeitenMusic Theory - Basic, Intermediate, Advanced PDFCarlos Estrada Marzo50% (10)

- October 18, 2019 November 5, 2019: Credit Card StatementDokument3 SeitenOctober 18, 2019 November 5, 2019: Credit Card StatementDavid PenNoch keine Bewertungen

- October 18, 2019 November 5, 2019: Credit Card StatementDokument3 SeitenOctober 18, 2019 November 5, 2019: Credit Card StatementDavid PenNoch keine Bewertungen

- October 18, 2019 November 5, 2019: Credit Card StatementDokument3 SeitenOctober 18, 2019 November 5, 2019: Credit Card StatementDavid PenNoch keine Bewertungen

- October 18, 2019 November 5, 2019: Credit Card StatementDokument3 SeitenOctober 18, 2019 November 5, 2019: Credit Card StatementDavid PenNoch keine Bewertungen

- PellaUSOnlinePayslip PDFDokument2 SeitenPellaUSOnlinePayslip PDFJoshuaM.ByrneNoch keine Bewertungen

- Indusind Bank Platinum Aura Edge Credit Card StatementDokument3 SeitenIndusind Bank Platinum Aura Edge Credit Card Statementdarshil100% (1)

- Payslip 2023 2024 5 200000000029454 IGSLDokument2 SeitenPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNoch keine Bewertungen

- Financial Literacy of College StudentsDokument89 SeitenFinancial Literacy of College StudentsAnkh64100% (3)

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDokument1 SeiteMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10Noch keine Bewertungen

- Luminous Power Technologies Private Limited: Earnings DeductionsDokument1 SeiteLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNoch keine Bewertungen

- Salary Slip NovDokument1 SeiteSalary Slip NovRahul RajawatNoch keine Bewertungen

- Salary SlipDokument1 SeiteSalary SlipPhagun BehlNoch keine Bewertungen

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Dokument1 SeitePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNoch keine Bewertungen

- Payslip For: FEB-2022: Louis Berger SASDokument1 SeitePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNoch keine Bewertungen

- Pay No. Period EndingDokument2 SeitenPay No. Period EndingKen Melchizedec MarañonNoch keine Bewertungen

- "Maxim Infrastructure LTD." Old Nlunicipal Jail IndiaDokument3 Seiten"Maxim Infrastructure LTD." Old Nlunicipal Jail IndiaAmanNoch keine Bewertungen

- Earnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedDokument1 SeiteEarnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedShubham GargNoch keine Bewertungen

- Salary Slip - June 2022 - UnlockedDokument2 SeitenSalary Slip - June 2022 - UnlockedRmillionsque FinserveNoch keine Bewertungen

- Sep Pay SlipDokument1 SeiteSep Pay SlipSharma SkNoch keine Bewertungen

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDokument124 SeitenEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNoch keine Bewertungen

- Salary SlipDokument1 SeiteSalary SlipAnkit SinghNoch keine Bewertungen

- Payslip 11 2020Dokument1 SeitePayslip 11 2020Sk Sameer100% (1)

- Employee Details Payment & Leave Details: Arrears Current AmountDokument1 SeiteEmployee Details Payment & Leave Details: Arrears Current AmountswapnilNoch keine Bewertungen

- Salary Slip U Can Edit and UseDokument1 SeiteSalary Slip U Can Edit and Useshail100% (1)

- Payslip For The Month of Oct 2021: Rivigo Services PVT LTDDokument1 SeitePayslip For The Month of Oct 2021: Rivigo Services PVT LTDDeeptimayee SahooNoch keine Bewertungen

- 0451 Pay Advice AU107760 WK 201228 PDFDokument1 Seite0451 Pay Advice AU107760 WK 201228 PDFNorman BwaNoch keine Bewertungen

- Employee DataDokument1 SeiteEmployee DataomkassNoch keine Bewertungen

- SMS0928 - 31 12 2022Dokument1 SeiteSMS0928 - 31 12 2022UTF RecordsNoch keine Bewertungen

- Sutherland Global Services Philippines, Inc. - Philippine BranchDokument3 SeitenSutherland Global Services Philippines, Inc. - Philippine BranchAngelo Mark Ordoña PorgatorioNoch keine Bewertungen

- Non - Negotiable: Notification of DepositDokument1 SeiteNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့Noch keine Bewertungen

- Jones Stub 2Dokument1 SeiteJones Stub 276xzv4kk5vNoch keine Bewertungen

- Tata Business Support Services LTD: 00110283 KhushbuDokument1 SeiteTata Business Support Services LTD: 00110283 KhushbuKhushbu SinghNoch keine Bewertungen

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Dokument1 SeitePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNoch keine Bewertungen

- October PayslipDokument1 SeiteOctober PayslipDaniel CarpenterNoch keine Bewertungen

- Jul 192017Dokument1 SeiteJul 192017Anonymous qqE8o5QNoch keine Bewertungen

- Salary Slip (31503284 June, 2019)Dokument1 SeiteSalary Slip (31503284 June, 2019)Hassan RanaNoch keine Bewertungen

- Payslip 4 2023Dokument1 SeitePayslip 4 2023Aman Jaiswal100% (1)

- Salary Slip OctoberDokument1 SeiteSalary Slip Octoberapi-3846919100% (4)

- Payslip 11582139 PDFDokument1 SeitePayslip 11582139 PDFAnonymous TdcH97bnNoch keine Bewertungen

- Payslip 10 2020Dokument1 SeitePayslip 10 2020anil sangwanNoch keine Bewertungen

- EPF Universal Account NumberDokument1 SeiteEPF Universal Account NumberetrshillongNoch keine Bewertungen

- Payslip 2018 2019 1 100000000421201 IGSLDokument1 SeitePayslip 2018 2019 1 100000000421201 IGSLArivu AkilNoch keine Bewertungen

- Paystub 202102Dokument1 SeitePaystub 202102dsnreddyNoch keine Bewertungen

- SSPUSADVDokument1 SeiteSSPUSADVJamesNoch keine Bewertungen

- Afzal Khan - Payslip (May 2021)Dokument1 SeiteAfzal Khan - Payslip (May 2021)afzal khanNoch keine Bewertungen

- Credit Card BackupDokument2 SeitenCredit Card Backupuyên đỗNoch keine Bewertungen

- Pay Slip - 604316 - Nov-22Dokument1 SeitePay Slip - 604316 - Nov-22ArchanaNoch keine Bewertungen

- Pay SlipDokument1 SeitePay SlipLakshman Samanth ReddyNoch keine Bewertungen

- Payslip To Print - Report Design 03 06 2023Dokument1 SeitePayslip To Print - Report Design 03 06 2023shani ChahalNoch keine Bewertungen

- Presto Mart SDN BHD (757250-V) : Pay Slip Month EndDokument1 SeitePresto Mart SDN BHD (757250-V) : Pay Slip Month EndAwais IqbalNoch keine Bewertungen

- Payslip 11260856Dokument1 SeitePayslip 11260856Naga Venkatesh Balijepalli100% (2)

- Amara Raja Batteries LimitedDokument1 SeiteAmara Raja Batteries LimitedNani AnugaNoch keine Bewertungen

- Pay Slip For The Month of OCt-09Dokument1 SeitePay Slip For The Month of OCt-09shah_rahul1981Noch keine Bewertungen

- April2018 PDFDokument1 SeiteApril2018 PDFomkassNoch keine Bewertungen

- Payslip 172820180712150142Dokument1 SeitePayslip 172820180712150142LakshmananNoch keine Bewertungen

- Nov 2015 Payslip PDFDokument1 SeiteNov 2015 Payslip PDFkarthikaNoch keine Bewertungen

- Employee Pay Stub: 15094 Dakota StreetDokument1 SeiteEmployee Pay Stub: 15094 Dakota StreetAnonymous Te07NMbvaNoch keine Bewertungen

- SalarySlip - (1001) - 6 - 2019 (1) - MergedDokument18 SeitenSalarySlip - (1001) - 6 - 2019 (1) - MergedLaavanyah ManimaranNoch keine Bewertungen

- Salary Slip JunevijayDokument5 SeitenSalary Slip JunevijayKaruna DubeyNoch keine Bewertungen

- Salary SlipDokument1 SeiteSalary SlipPhagun BehlNoch keine Bewertungen

- March 2019Dokument1 SeiteMarch 2019Anonymous 2uvubjzzNoch keine Bewertungen

- Salary Slip EDIT-AUGDokument4 SeitenSalary Slip EDIT-AUGpathyashisNoch keine Bewertungen

- Progressive Rhythm GuitarDokument11 SeitenProgressive Rhythm GuitarLucio Bianchi0% (3)

- New Doc 2020-06-07 19.29.42 - 1 PDFDokument1 SeiteNew Doc 2020-06-07 19.29.42 - 1 PDFDavid PenNoch keine Bewertungen

- 07 - Chapter 3 PDFDokument22 Seiten07 - Chapter 3 PDFAnonymous c40tCnNoch keine Bewertungen

- Hindustani Vocals Syllabus Levels 1 4Dokument4 SeitenHindustani Vocals Syllabus Levels 1 4Salu RoseNoch keine Bewertungen

- 07 - Chapter 3 PDFDokument22 Seiten07 - Chapter 3 PDFAnonymous c40tCnNoch keine Bewertungen

- Song: Pillaa Raa Album: RX 100 Composer: Chaitan Bharadwaj Lyrics: Chaitanya Prasad Singer(s) : Anurag Kulkarni Music On: Mango MusicDokument3 SeitenSong: Pillaa Raa Album: RX 100 Composer: Chaitan Bharadwaj Lyrics: Chaitanya Prasad Singer(s) : Anurag Kulkarni Music On: Mango MusicDavid PenNoch keine Bewertungen

- New Doc 2020-06-07 19.29.42 - 1 PDFDokument1 SeiteNew Doc 2020-06-07 19.29.42 - 1 PDFDavid PenNoch keine Bewertungen

- New Doc 2020-06-07 19.29.42 - 1 PDFDokument1 SeiteNew Doc 2020-06-07 19.29.42 - 1 PDFDavid PenNoch keine Bewertungen

- New Doc 2020-06-07 19.29.42 - 1 PDFDokument1 SeiteNew Doc 2020-06-07 19.29.42 - 1 PDFDavid PenNoch keine Bewertungen

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Dokument1 SeiteDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNoch keine Bewertungen

- Broken DreamsDokument3 SeitenBroken DreamsDavid PenNoch keine Bewertungen

- Bank Recon PDFDokument1 SeiteBank Recon PDFCristy Martin YumulNoch keine Bewertungen

- CHAPTER 2 StudentsDokument13 SeitenCHAPTER 2 Studentsirenep banhan21Noch keine Bewertungen

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDokument7 Seiten2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNoch keine Bewertungen

- Di H o B Nkrupt: G SC Arge Fa ADokument2 SeitenDi H o B Nkrupt: G SC Arge Fa AZeyad El-sayedNoch keine Bewertungen

- Week 8 Long Term Financing - DebtDokument26 SeitenWeek 8 Long Term Financing - DebtAmelia MatherNoch keine Bewertungen

- Tentative Comp - Egsismo - Eml - 2005425303 - Pring, Robert V - Deped Tarlac Province - TarDokument1 SeiteTentative Comp - Egsismo - Eml - 2005425303 - Pring, Robert V - Deped Tarlac Province - TarNgirp Alliv TreborNoch keine Bewertungen

- Chapter 8 - The Deposit FunctionDokument17 SeitenChapter 8 - The Deposit FunctionBoRaHaENoch keine Bewertungen

- Nri-Forms NRE NRODokument12 SeitenNri-Forms NRE NROsinaNoch keine Bewertungen

- Payments Statistics: Methodological NotesDokument966 SeitenPayments Statistics: Methodological NotesdanoeNoch keine Bewertungen

- FAIZDokument83 SeitenFAIZMohammad RizwanNoch keine Bewertungen

- 1683017424040KE12qarqkpITHwM4 PDFDokument3 Seiten1683017424040KE12qarqkpITHwM4 PDFselvavinayaga AssociatesNoch keine Bewertungen

- Sanction LetterDokument3 SeitenSanction Lettern5b859ryf6Noch keine Bewertungen

- Profit and Loss Statement Bank-of-AmericaDokument1 SeiteProfit and Loss Statement Bank-of-AmericaAdi PutraNoch keine Bewertungen

- Icici Mortgage Pacustomer Raj Mandal 7727040114 150923Dokument6 SeitenIcici Mortgage Pacustomer Raj Mandal 7727040114 150923Live lifeNoch keine Bewertungen

- Business Math Interest Sample ProblemsDokument1 SeiteBusiness Math Interest Sample ProblemsBear GummyNoch keine Bewertungen

- Bank Statement Tanvir Hasan RakinDokument1 SeiteBank Statement Tanvir Hasan RakinTanvir Hasan RakinNoch keine Bewertungen

- Term Loan and Lease Financing Worked-Out ProblemsDokument13 SeitenTerm Loan and Lease Financing Worked-Out ProblemsSoo CealNoch keine Bewertungen

- Ro81bacx0000001363339000 Ron 092023Dokument2 SeitenRo81bacx0000001363339000 Ron 092023adrianabirceanuNoch keine Bewertungen

- Real Estate MortgageDokument3 SeitenReal Estate Mortgageapbacani100% (1)

- Insolvency and Bankruptcy Code, 2016Dokument4 SeitenInsolvency and Bankruptcy Code, 2016Ayush BhadauriaNoch keine Bewertungen

- Global Edge Software Limited: Payslip For The Month of December - 2018Dokument1 SeiteGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNoch keine Bewertungen

- f1040s8 2021Dokument3 Seitenf1040s8 2021さくら樱花Noch keine Bewertungen

- Personal Insolvency and Bankruptcy 2019Dokument90 SeitenPersonal Insolvency and Bankruptcy 2019sakirahinNoch keine Bewertungen

- Last 6 Months RBI in News Part 2 NiharDokument6 SeitenLast 6 Months RBI in News Part 2 NiharbuhhbubuhgNoch keine Bewertungen

- Rent Vs Buy Calculator - AssetyogiDokument1 SeiteRent Vs Buy Calculator - AssetyogiRanjit MishraNoch keine Bewertungen

- Compound Interest and Geometric ProgressionDokument23 SeitenCompound Interest and Geometric ProgressionTuhin ParvesNoch keine Bewertungen

- Latihan Soal Akuntansi Untuk PensionDokument4 SeitenLatihan Soal Akuntansi Untuk PensionRini SusantyNoch keine Bewertungen

- Customer Account StatementDokument1 SeiteCustomer Account StatementChemo NgosweNoch keine Bewertungen

- CASH BUDGET Video Solution Review 5Dokument4 SeitenCASH BUDGET Video Solution Review 5RolivhuwaNoch keine Bewertungen