Beruflich Dokumente

Kultur Dokumente

02 Receivable Lec PDF

Hochgeladen von

Ryan CornistaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

02 Receivable Lec PDF

Hochgeladen von

Ryan CornistaCopyright:

Verfügbare Formate

The University of Batangas – Main Notes by: J. S.

Cayetano

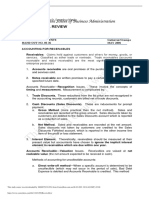

CHAPTER 2: “Trade & Other Receivables” Q: How to compute the allowance for bad debt and bad debt expense?

Method 1 – percentage of ending AR

Topic 1: “Trade Receivable & Allowances” Step 1 – Compute for ending allowance:

Ending balance of accounts receivable – gross XX

Percentage of uncollectiblity X%

Q: How to compute the accounts receivable balance?

Balance of allowance for bad debt XX

A: First, check if the given is the beginning balance and not the ending balance. The if yes,

do it using the “accounts receivable – gross” T –account.

Step 2 – Compute for bad debt expense

Trade Receivable – gross Allowance for bad debt

Beginning balance XX Beginning balance of allowance

(a) Sale on account (a) Collection of accounts receivable Accounts written off XX XX Recovery of accounts written off

(b) Recovery of written of receivables (b) Collection of recovery Bad debt expense

(c) Freight FOB shipping point, prepaid (c) Write off of accounts receivable

XX Ending balance of allowance

(d) Discount taken by customers

(e) Sales actually returned

(f) Other form of payment Squeeze

Ending balance (answer)

Method 2 – percentage of sales

Step 1 – Compute the bad debt expense:

Second. check if the given is the ending balance, it will be the unadjusted ending accounts

receivable that you have to adjust. Below are the usual adjustment to the unadjusted Sales XX

balance. Percentage of uncollectibility X%

Unadjusted accounts receivable XX Bad debt expense XX

1. Reversal of customers: postdated checks / NSF check / stale check XX

2. “netted” debit balance of customer’s account XX Step 2 – Compute the ending allowance:

3. Unrecorded sales return (XX)

4. Adjustment for goods sold still in-transit

Allowance for bad debt

§ FOB shipping point, (+) if not recorded, do nothing if recorded

XX Beginning balance of allowance

§ FOB destination, (–) if recorded, do nothing if not recorded XX/(XX)

Accounts written off XX XX Recovery of accounts written off

Adjusted accounts receivable (answer)

XX Bad debt expense

Ending balance of allowance

Answer

H2: “Trade and Other Receivables” Page 1 of 7

The University of Batangas – Main Notes by: J. S. Cayetano

Q: How to classify receivable into current and noncurrent asset?

Method 3 – aging of accounts receivable Trade Receivable:

ü Current asset, even if collectible beyond 12 months

Step 1 – Compute the required ending allowance: ü Trade receivable arises from sale on account of goods or services from

customers in the ordinary course of business.

AR Age AR Age AR Age Total ü Expected to be realized in cash within one year or within normal operating cycle,

Category 1 Category 2 Category 3 whichever is longer.

AR balance XX XX XX

% per age category x% x% x% Non-Trade Receivable:

Allowance per category XX + XX + XX X

ü Current asset, unless collectible beyond 12 months.

ü If silent, considered as current.

Step 2 – Compute the bad debt expense:

Subscription Receivable:

Allowance for bad debt

ü Contra-equity – if silent, or collectible beyond 12 months.

XX Beginning balance of allowance

Accounts written off XX XX Recovery of accounts written off ü Current receivable – if collectible within 12 months.

Bad debt expense

XX Ending balance of allowance General Assumption (silent)

Current Noncurrent

Squeeze (a) Trade receivable less allowances (1) Advances to affiliates

(b) Note receivable less note discounted (2) Advances to associates

Q: How to compute the percentage of uncollectiblity? (c) Accrued income (3) Advances to subsidiary

i. Rent receivable

Total write off over the period – total recovery over the period

= % of uncollectilibity ii. Interest receivable

Net sales over the period

iii. Commission receivable

iv. Dividend receivable

Q: What is the NRV of accounts receivable? (d) Postdated / NSF / Stale checks (4) Advances to officers

• The question is the same as: (e) IOUs (5) Advances to shareholders

1. How much is the amortized cost of the accounts receivable? (f) Loans receivable

2. How much is the carrying amount of the accounts receivable? (g) Advances to employees

3. How much is the book value of the accounts receivable? (h) Advances to personnel

(i) Advances to suppliers

Accounts receivable at December 31 XX (j) Accounts receivable – assigned

(a) Allowance for doubtful accounts (XX) (k) Accounts receivable – pledged

(b) Allowance for estimated sales discount to be taken (XX)

(l) Claims from insurance

(c) Allowance for estimated sales to be returned (XX)

(m) Claims from common carrier

(d) Allowance for freight (sold FOB destination, freight collect) (XX)

(n) Suppliers’ debit balance

NRV of Accounts receivable at December 31 XX

H2: “Trade and Other Receivables” Page 2 of 7

The University of Batangas – Main Notes by: J. S. Cayetano

Topic 2: “Notes Receivables”

• As accounting rule, all receivable and payable should me measured at present value initially IMPORTANT NOTES:

and subsequently. • If the interest is payable semi-annually:

• Theoretically short term notes should be measured at present value, but practically / ü effective interest is divided into half

usually / generally it is measured at face value since the discounting of less than one year is ü the period is doubled

considered immaterial. ü the basis of interest income is more than one, update the carrying amount at interest

• According to PFRS 9, note receivable should be initially measured at fair value plus payment date

transaction cost but notes do not incurred transaction cost therefore the fair value is the 1.

initial measurement • if the note is serial note with equal principal payment:

• Fair value is equal to the present value. ü the principal is payable in equal periodic payment, use PV of annuity then.

ü the interest is payable in unequal periodic payment (since it is based on decreasing

What is the sales / revenue if the company received a note as a consideration?

principal) use PV of 1 then.

Answer: Fair value of the note (also equal to present value)

ü nominal is based on the unpaid principal

What is the gain or loss on sale if the company received a note as a consideration? 2.

Answer: Carrying amount of the non-operating asset sold = XX • If the note is serial note with unequal principal payment:

Fair value of the note received + downpayment = (XX) ü the principal is payable in unequal periodic payment, use PV of 1 then.

Gain or loss on sale = XX ü the interest is payable in unequal periodic payment (since it is based on decreasing

principal) use PV of 1 then.

ü nominal is based on the unpaid principal

How to compute the: 3.

1. Fair value • If the cash price is given, the present value (fair value) of the note is equal to: Cash price

2. Carrying amount minus downpayment.

3. Interest revenue ü If the cash price minus downpayment is not equal to the face value of the note, it is

4. Interest receivable category 2 or 3 note.

5. Current portion ü If it is category 2 or 3 then the effective is not give, you can solve for the effective

6. Noncurrent portion interest by trial and error and interpolation is necessary.

(see next page)

H2: “Trade and Other Receivables” Page 3 of 7

The University of Batangas – Main Notes by: J. S. Cayetano

Category Classification Fair value* Interest revenue Interest receivable Carrying amount Current portion Noncurrent portion

1 Interest bearing Face amount / Principal Nominal interest Nominal interest Remaining unpaid Principal amount that Principal amount that

principal / face amount will be paid within 12 will be paid beyond 12

unpaid months months.

Unpaid principal

x nominal interest Note – you will

Unpaid principal x # of mos. from last separate the note into

x nominal interest interest payment up to original principal current and non current

interest revenue December 31 / 12 mo less : principal payment only if it is a serial note

interest receivable unpaid principal or note were the

principal is payable on

installment.

2 Non-interest Present value of the Effective interest None Amortized cost Carrying amount, end Carrying amount, end

bearing principal less: noncurrent portion x effective interest + 1

current portion less: any principal pay.

Carrying amount at beg forever zero Fair value / beg CA noncurrent portion

Principal x PVF x effective interest x effective interest + 1

interest revenue less: any principal payment Note – it is easier if you Note – you will

use the effective interest in carrying amount at end compute first the separate the note into

getting the PVF noncurrent portion then current and non

the residual is the current only if it is a

current portion serial note or note

were the principal is

payable on

installment.

3 Interest bearing Present value of the Effective interest Nominal interest Amortized cost Carrying amount, end Carrying amount, end

with unrealistic principal plus present value less: noncurrent portion x effective interest + 1

nominal interest of nominal interest. current portion less: nominal interest

Carrying amount at beg Unpaid principal Fair value / beg CA less: any principal pay.

Principal x PVF x effective interest x nominal interest x effective interest + 1 Note – it is easier if you noncurrent portion

in case nominal + interest revenue x # of mos. from last less: nominal interest compute first the

is not equal to Principal x nominal x PVF interest payment up to less: any principal payment noncurrent portion then Note – separate only if

effective December 31 / 12 mo carrying amount at end the residual is the serial note or note on

use the effective interest in interest receivable current portion installment

getting the PVF

H2: “Trade and Other Receivables” Page 4 of 7

The University of Batangas – Main Notes by: J. S. Cayetano

Topic 3: “Loans Receivables”

• Notes receivable are receivables supported by promissory note, loans receivable are 3. – the present value of the new cash flow is your new carrying amount, it will be the

receivables supported by promissory note as well, the main difference is that the note basis of the subsequent interest income.

receivables are receivables by a non-financial institution arising from sale of inventory /

service / non operating assets. While loans receivables are receivables by a financial How to compute reversal of impairment?

institution arising from lending activities in the ordinary course of business. Amortized cost or CA of new loan at the date of reversal XX

• Loans receivable is a financial asset and it is initially measured at fair value plus Present value of the new cash flow: after reversal

transaction cost. New principal amount x PVF XX

• Fair value is usually equal to the face amount / principal of the loan. New principal amount x new nominal interest x PVF XX XX

or (choose the LOWER)

What is the initial measurement of loans receivable? Amortized cost of the loan as if no impairment happened XX (XX)

Face amount of the loan XX Reversal of impairment loss XX

Origination cost XX

Origination fee (XX) ACCOUNTING FOR THE IMPAIRMENT LOSS

Initial measurement XX • we can use two methods to account impairment: (1) allowance method; (2) direct method

• Indirect origination cost should be recognized as outright expense.

Journal entry to record impairment:

• If the transaction incurred origination cost or origination fee, it means the nominal interest is

Direct method Allowance method

different from the effective. dr. Impairment loss dr. Impairment loss

ü Incurred origination cost / origination fee = account same as note category 3. cr. Interest receivable cr. Interest receivable

ü No origination cost / origination fee = account same as note category 1. cr. Loan receivable cr. Allowance for impairment

How much is the impairment loss?

Journal entry to record interest revenue:

Carrying amount of the loan at impairment date XX

Direct method Allowance method

Accrued interest receivable XX

dr. Loan receivable dr. Allowance for impairment

Total carrying amount of receivable XX

cr. Interest income cr. Interest income

New principal amount x PVF (b) XX

New principal amount x new nominal interest x PVF XX (XX)

FS presentation

Impairment loss

Direct method Allowance method

Important note: Loan receivable at amortized cost XX LR at new principal amount XX

1. – if the problem states the company did not accrue the interest, then exclude it in the Allowance for impairment 0 Allowance for impairment (XX)

computation. If the company accrue or recorded the interest receivable or if the problem CA to be presented in FS XX CA to be presented in FS XX

is silent, then include it in the computation.

2. – use the original effective interest (interest at the date of loan). Also note that if the

problem is silent as to the effective interest at the date of loan assume the nominal

interest is the effective interest.

H2: “Trade and Other Receivables” Page 5 of 7

The University of Batangas – Main Notes by: J. S. Cayetano

Topic 3: “Loans Receivables”

• To generate cash prior to the scheduled collection of receivable by either (1) using as a collateral from a loan; or (2) sold the receivable to a financial institution.

• Refer to the table below:

Used as a collateral Sold the receivable

1. Receivable is not derecognized 1) Receivable is derecognized

2. Liability is recognized 2) Liability is not recognized

3. No gain or loss 3) With gain or loss

4. Transactions: 4) Transactions:

i. Pledge a) Factoring without recourse

ii. Assignment – notification b) Factoring – with recourse

iii. Assignment – non notification c) Discounting – without recourse

iv. Discounting – with recourse, conditional sale

v. Discounting – with recourse, secured borrowing

PLEDGING Whether notification or non notification basis, the answer is same.

• Usually no accounting problem in this situation. • Interest is not deducted in advance from the amount of loan.

• Included in the total receivable, requires note disclosure. FACTORING

• Computation of net proceeds from factoring:

ASSIGNMENT

Amount factored XX

• Computation of net proceeds from the loan and assignment transaction. Service / commission / assessment / finance fee (XX)

Amount of loan granted (usually a portion of the assigned receivable) XX Factor’s holdback (XX)

Service / assessment / commission charge (XX) Interest charged ( i% x days / 365), if any (XX)

Net proceeds XX Net proceeds XX

• Service / assessment / commission charge is may be charged on (1) accounts receivable

assigned or (2) loans payable. • With and without recourse:

• Computation of ending balance of Accounts receivable assigned and loans payable. With recourse Without recourse

ü Derecognize receivable ü Derecognize receivable

Accounts receivable assigned Loans payable

ü Recognize liability for recourse ü No recognition of recourse obligation

Balance XX Balance XX

obligation

Collected (XX) Interest expense XX

ü Recognize loss on recourse ü No recognition of loss on recourse

Sales discounts (XX) Remittances (XX)

obligation obligation

Sales returns (XX) Ending balance XX

Write off (XX) • Computation of cost of factoring:

Ending balance xxxx Service / commission / assessment / finance fee XX

• Computation of equity portion of receivable assigned. Interest charged ( i% x days / 365), if any XX

Ending balance of accounts receivable assigned XX Loss on recourse obligation (fair value of the recourse obligation) only if with recourse XX

Ending balance of loans payable (XX) Total cost of factoring XX

Equity balance – disclosures to financial statement XX

H2: “Trade and Other Receivables” Page 6 of 7

The University of Batangas – Main Notes by: J. S. Cayetano

DISCOUNTING

• Computation of net proceeds from discounting:

Maturity value [ face value + (face value x nominal interest x months from date of the note up to maturity date / 12 months)] XX

Discount charge by the bank (maturity value x discount rate x months date sold to bank up to maturity / 12 months) (XX)

Net proceeds from note discounting XX

• Computation of gain or loss from discounting:

Net proceeds from note discounting XX

Carrying amount of total receivable sold (face amount + accrued interest*) (XX)

Gain or loss XX

*face amount x nominal interest x months from date of the note up to date the note was sold to the bank.

• Journal entry; without recourse; with recourse conditional sale; with recourse secured borrowing:

To record discounting of the note to a bank:

Without recourse Conditional sale Secured borrowing

Cash Cash Cash

Loss on discounting Loss on discounting Loss on discounting

Note receivable Note receivable discounted** Liability on note discounted***

Interest income Interest income Interest income

**contra-asset account, presented as deduction to note receivable. Contingent liability is disclosed in the notes.

***liability account, included in the “trade and other payable” line item.

END

H2: “Trade and Other Receivables” Page 7 of 7

Das könnte Ihnen auch gefallen

- Trade Receivable & AllowancesDokument7 SeitenTrade Receivable & Allowancesmobylay0% (1)

- Trade & Other Receivables Lecture NotesDokument7 SeitenTrade & Other Receivables Lecture NotesRena Lyn ManzanoNoch keine Bewertungen

- 06 Receivable FinancingDokument10 Seiten06 Receivable Financingsharielles /Noch keine Bewertungen

- FAR - 207 Receivable FinancingDokument12 SeitenFAR - 207 Receivable FinancingJai BacalsoNoch keine Bewertungen

- Module 3 - Accounts Receivable Part II - 111702467Dokument11 SeitenModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53Noch keine Bewertungen

- Control Accounts NDokument2 SeitenControl Accounts NFaizan MahmoodNoch keine Bewertungen

- 04 Trade Accounts ReceivableDokument7 Seiten04 Trade Accounts Receivablesharielles /Noch keine Bewertungen

- Handout 04 Trade ARDokument7 SeitenHandout 04 Trade ARMARY GRACE VARGASNoch keine Bewertungen

- Summarized Notes: Let'S Go!Dokument7 SeitenSummarized Notes: Let'S Go!Naiv Yer NagaliNoch keine Bewertungen

- Adjusting Entries: Accrued Expense Accrued IncomeDokument3 SeitenAdjusting Entries: Accrued Expense Accrued IncomeRyanKingNoch keine Bewertungen

- 04 Trade Accounts ReceivableDokument7 Seiten04 Trade Accounts ReceivableKhen HannaNoch keine Bewertungen

- Accounts ReceivableDokument5 SeitenAccounts ReceivableEj BalbzNoch keine Bewertungen

- Bank ReconciliationDokument1 SeiteBank ReconciliationMary Jullianne Caile SalcedoNoch keine Bewertungen

- Receivable FinancingDokument6 SeitenReceivable FinancingErla PilapilNoch keine Bewertungen

- Receivable FinancingDokument34 SeitenReceivable FinancingmaryzeenNoch keine Bewertungen

- 6 Branch AccountingDokument48 Seiten6 Branch AccountingsmartshivenduNoch keine Bewertungen

- Receivable FinancingDokument15 SeitenReceivable FinancingArt EezyNoch keine Bewertungen

- AT Least: CPA Exam Review 2018Dokument6 SeitenAT Least: CPA Exam Review 2018At Least Know This CPANoch keine Bewertungen

- ACC 102 Receivable FinancingDokument5 SeitenACC 102 Receivable Financingwerter werterNoch keine Bewertungen

- Ch#7 BANK RECONCILIATION STATEMENTDokument4 SeitenCh#7 BANK RECONCILIATION STATEMENTeaglerealestate31Noch keine Bewertungen

- 112.material For Receivable FinancingDokument8 Seiten112.material For Receivable FinancingJalanur MarohomNoch keine Bewertungen

- Receivable Financing: Pledge, Assignment, and FactoringDokument30 SeitenReceivable Financing: Pledge, Assignment, and FactoringJoy UyNoch keine Bewertungen

- Topic 6 - Bank ReconciliationRev (Students)Dokument32 SeitenTopic 6 - Bank ReconciliationRev (Students)Novian Dwi RamadanaNoch keine Bewertungen

- CMAINTER SelfBalLedgDokument13 SeitenCMAINTER SelfBalLedgnobi85804Noch keine Bewertungen

- Provision For DD-Reference MaterialDokument3 SeitenProvision For DD-Reference MaterialMohamed MuizNoch keine Bewertungen

- Auditing Problems SummaryDokument16 SeitenAuditing Problems SummaryErika LanezNoch keine Bewertungen

- 04 Accounts Receivable Answer KeyDokument9 Seiten04 Accounts Receivable Answer Keywheein aegiNoch keine Bewertungen

- Bank ReconciliationDokument3 SeitenBank ReconciliationAngelika Mari RabeNoch keine Bewertungen

- Proof of CashDokument7 SeitenProof of CashPeachy80% (5)

- Chap 9 - Proof of Cash Fin Acct 1 - Barter Summary Team PDFDokument7 SeitenChap 9 - Proof of Cash Fin Acct 1 - Barter Summary Team PDFCarl James Austria100% (1)

- Activity 5 1Dokument13 SeitenActivity 5 1Trice DomingoNoch keine Bewertungen

- 2 Adjusting Journal EntriesDokument6 Seiten2 Adjusting Journal EntriesJerric CristobalNoch keine Bewertungen

- RECEIVABLESDokument8 SeitenRECEIVABLESE.D.JNoch keine Bewertungen

- Cash and Receivable - Pre Rev - Questions ONLY PDFDokument9 SeitenCash and Receivable - Pre Rev - Questions ONLY PDFNove Joy Majadas PatacNoch keine Bewertungen

- Adjustment To Financial Statements-1-1Dokument6 SeitenAdjustment To Financial Statements-1-1Usman AttiqueNoch keine Bewertungen

- Are Present Obligation of An Entity: As A Result of Past EventsDokument14 SeitenAre Present Obligation of An Entity: As A Result of Past EventsMARY ACOSTANoch keine Bewertungen

- Chapter 6 Bank ReconciliationRev StudentsDokument20 SeitenChapter 6 Bank ReconciliationRev StudentsNemalai VitalNoch keine Bewertungen

- Receivable Financing: Quick Review!Dokument9 SeitenReceivable Financing: Quick Review!Barbie BleuNoch keine Bewertungen

- Topic 6 - Bank ReconciliationRev (Students)Dokument26 SeitenTopic 6 - Bank ReconciliationRev (Students)Romzi100% (1)

- Accounts ReceivableDokument4 SeitenAccounts ReceivableErla PilapilNoch keine Bewertungen

- Chapter 14 - Control AccountDokument12 SeitenChapter 14 - Control AccountFalila Banu ShaikhNoch keine Bewertungen

- ACT103 - Topic 5Dokument4 SeitenACT103 - Topic 5Juan FrivaldoNoch keine Bewertungen

- This Study Resource Was: Philippine School of Business AdministrationDokument6 SeitenThis Study Resource Was: Philippine School of Business AdministrationNah HamzaNoch keine Bewertungen

- Accounts From Incomplete RecordsDokument4 SeitenAccounts From Incomplete RecordsGargiNoch keine Bewertungen

- Receivable Financing CH14 by LailaneDokument30 SeitenReceivable Financing CH14 by LailaneEunice BernalNoch keine Bewertungen

- Provisions For Bad BedtDokument10 SeitenProvisions For Bad BedtwilbertNoch keine Bewertungen

- PDF Installment Sales Reviewer Problems - CompressDokument43 SeitenPDF Installment Sales Reviewer Problems - CompressMischievous Mae0% (1)

- CHAP 7 - LECTURER'S NOTES (1) (AutoRecovered)Dokument11 SeitenCHAP 7 - LECTURER'S NOTES (1) (AutoRecovered)ManzMalayaNoch keine Bewertungen

- Receivable Financing (Pledging, Assignment and Factoring)Dokument2 SeitenReceivable Financing (Pledging, Assignment and Factoring)lcNoch keine Bewertungen

- Chapter 11: Error Correction Cash/Accrual and Single EntryDokument27 SeitenChapter 11: Error Correction Cash/Accrual and Single EntryYoshidaNoch keine Bewertungen

- FAR 04 ReceivablesDokument10 SeitenFAR 04 ReceivablesRoseNoch keine Bewertungen

- Cash and Accrual Basis: Topic OverviewDokument20 SeitenCash and Accrual Basis: Topic OverviewAngelieNoch keine Bewertungen

- Intermediate Accounting - FormulasDokument8 SeitenIntermediate Accounting - FormulasC/PVT DAET, SHAINA JOYNoch keine Bewertungen

- Accounting For Incomplete Record PDFDokument23 SeitenAccounting For Incomplete Record PDFSumiya YousefNoch keine Bewertungen

- Self Balancing LedgersDokument15 SeitenSelf Balancing LedgersSRIHARSHANoch keine Bewertungen

- Summary For Account ReceivablesDokument6 SeitenSummary For Account ReceivablesDevine Grace A. Maghinay100% (1)

- M10 TranscriptDokument3 SeitenM10 TranscriptJanna RodriguezNoch keine Bewertungen

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionVon EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionBewertung: 2.5 von 5 Sternen2.5/5 (2)

- Cash & Investment Management for Nonprofit OrganizationsVon EverandCash & Investment Management for Nonprofit OrganizationsNoch keine Bewertungen

- Electronic Equipment Insurance: What It CoversDokument2 SeitenElectronic Equipment Insurance: What It CoversRyan CornistaNoch keine Bewertungen

- 4 Home Office Agency Handout SolutionDokument15 Seiten4 Home Office Agency Handout SolutionRyan CornistaNoch keine Bewertungen

- Inforgraphic, MercuryDokument1 SeiteInforgraphic, MercuryRyan CornistaNoch keine Bewertungen

- Inforgraphic, MercuryDokument1 SeiteInforgraphic, MercuryRyan CornistaNoch keine Bewertungen

- 8506 - Installment Sales - 113910598Dokument4 Seiten8506 - Installment Sales - 113910598Ryan CornistaNoch keine Bewertungen

- Ang Pilosopiya Ni Pierre Bourdieu Bilang PDFDokument28 SeitenAng Pilosopiya Ni Pierre Bourdieu Bilang PDFRyan CornistaNoch keine Bewertungen

- HSBC Case StudyDokument2 SeitenHSBC Case StudyRyan Cornista50% (2)

- Social Dimensions in EducationDokument23 SeitenSocial Dimensions in EducationRyan Cornista100% (1)

- 59 and Below 0.00 F 75 and Below 0.00 FDokument1 Seite59 and Below 0.00 F 75 and Below 0.00 FRyan CornistaNoch keine Bewertungen

- 59 and Below 0.00 F 75 and Below 0.00 FDokument1 Seite59 and Below 0.00 F 75 and Below 0.00 FRyan CornistaNoch keine Bewertungen

- Principles & Theories of Learning & MotivationDokument69 SeitenPrinciples & Theories of Learning & MotivationRyan Cornista70% (10)

- Principles and Strategies of TeachingDokument27 SeitenPrinciples and Strategies of TeachingRyan Cornista100% (3)

- Relevant Laws For TeachersDokument33 SeitenRelevant Laws For TeachersRyan Cornista100% (2)

- Study and Thinking SkillsDokument23 SeitenStudy and Thinking SkillsRyan Cornista100% (1)

- Writing in The DisciplineDokument29 SeitenWriting in The DisciplineRyan CornistaNoch keine Bewertungen

- Study and Thinking SkillsDokument21 SeitenStudy and Thinking SkillsRyan Cornista88% (24)

- Exercise #1 - Intro To MacroeconomicsDokument2 SeitenExercise #1 - Intro To MacroeconomicsRyan CornistaNoch keine Bewertungen

- ArtAp4 SculptureDokument10 SeitenArtAp4 SculptureRyan CornistaNoch keine Bewertungen

- Title: Accounting Information System and ItsDokument44 SeitenTitle: Accounting Information System and ItsEmebet TesemaNoch keine Bewertungen

- Najma Sugar Mills LTDDokument68 SeitenNajma Sugar Mills LTDmuhammadtaimoorkhan67% (3)

- CommerceDokument4 SeitenCommerceBRAINSTORM Haroon RasheedNoch keine Bewertungen

- Chap 4 MNGT Acctng PDFDokument4 SeitenChap 4 MNGT Acctng PDFRose Ann YaboraNoch keine Bewertungen

- Applied Auditing ComprehensiveDokument6 SeitenApplied Auditing ComprehensiveLEnz AngelNoch keine Bewertungen

- ACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Dokument76 SeitenACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Christel Oruga100% (1)

- Cash Flow and Ratio AnalysisDokument7 SeitenCash Flow and Ratio AnalysisShalal Bin YousufNoch keine Bewertungen

- SAP FI Certification Actual QuestionDokument4 SeitenSAP FI Certification Actual QuestionkhalidmahmoodqumarNoch keine Bewertungen

- CBSE Class 11 Accountancy Worksheet - Theory Base of AccountingDokument3 SeitenCBSE Class 11 Accountancy Worksheet - Theory Base of AccountingUmesh JaiswalNoch keine Bewertungen

- Accounting PretestDokument4 SeitenAccounting PretestseymourwardNoch keine Bewertungen

- Loocust IncorpDokument25 SeitenLoocust IncorpPriyaNoch keine Bewertungen

- Final Ac Problem1Dokument12 SeitenFinal Ac Problem1Pratap NavayanNoch keine Bewertungen

- Balance of PaymentsDokument27 SeitenBalance of PaymentsJayaChandra VissamsettiNoch keine Bewertungen

- Theory of Accounts Cash and Cash EquivalentsDokument9 SeitenTheory of Accounts Cash and Cash Equivalentsida_takahashi43% (14)

- The Assets That Can Be Converted Into Cash Within A Short Period (1 Year or Less) Are Known AsDokument17 SeitenThe Assets That Can Be Converted Into Cash Within A Short Period (1 Year or Less) Are Known As4- Desiree FuaNoch keine Bewertungen

- Financial Accounting An Integrated Approach Australia 6th Edition Trotman Test BankDokument8 SeitenFinancial Accounting An Integrated Approach Australia 6th Edition Trotman Test Bankharveyhuypky0u100% (27)

- Audit of Shareholders EquityDokument6 SeitenAudit of Shareholders EquityMark Lord Morales Bumagat71% (7)

- Credits and Debits ExplainedDokument2 SeitenCredits and Debits ExplainedCristine Jean Dela CruzNoch keine Bewertungen

- CAJEGAS CHLOE WorksheetDokument8 SeitenCAJEGAS CHLOE WorksheetChloe Cataluna100% (1)

- FI/CO Frequently Used Reports: ControllingDokument9 SeitenFI/CO Frequently Used Reports: ControllingfinerpmanyamNoch keine Bewertungen

- WRD FinMan 13e - SE PPT - CH 04Dokument23 SeitenWRD FinMan 13e - SE PPT - CH 04Bill JonNoch keine Bewertungen

- 13 Bank AccountingDokument22 Seiten13 Bank AccountingChaitra Muralidhara100% (1)

- Audit GuideDokument318 SeitenAudit GuideOmkar BibikarNoch keine Bewertungen

- TEMENOS Reference Processes Inventory R18Dokument269 SeitenTEMENOS Reference Processes Inventory R18AJ Amine100% (1)

- Session 12 CH 17 Partnership LiquidationDokument33 SeitenSession 12 CH 17 Partnership LiquidationAnnie AtmanNoch keine Bewertungen

- FI - Customer Ageing Functional Spec.Dokument3 SeitenFI - Customer Ageing Functional Spec.sanjusivan100% (1)

- Accounting ProcessesDokument80 SeitenAccounting ProcessesTikMoj Tube100% (1)

- Financial Accounting Week 3Dokument17 SeitenFinancial Accounting Week 3Siva PraveenNoch keine Bewertungen

- Reviewer Entrep Prelim ExamDokument2 SeitenReviewer Entrep Prelim ExamJune Martin BanguilanNoch keine Bewertungen

- Adms 2500 FinalDokument20 SeitenAdms 2500 Finalmuyy1Noch keine Bewertungen