Beruflich Dokumente

Kultur Dokumente

Intro To Law (9th Week)

Hochgeladen von

mehOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Intro To Law (9th Week)

Hochgeladen von

mehCopyright:

Verfügbare Formate

FINALS: INTRO TO LAW

(9TH WEEK)

TAXATION

a. What is taxation?

➢ Taxation is the power by which the sovereign raises revenue to defray the necessary

expenses of the government.

b. Define taxes.

➢ Taxes are the enforced proportional contribution from persons and property levied by

the State by virtue of its sovereign power for public purposes.

c. What is the lifeblood theory?

➢ The Lifeblood theory posits that taxes are the lifeblood of the nation.

d. Discuss Commissioner of Internal Revenue v. Algue, Inc., 158 SCRA 8.

e. Discuss the principles of a sound tax system.

1. Fiscal Adequacy

➢ Maintains that the sources of government revenue must be sufficient to meet

governmental expenditures and other public needs.

2. Theoretical Justice

➢ Emphasizes that the system of taxation must be based on the taxpayer’s

ability to pay.

3. Administrative Feasibility

➢ Refers to the maintenance of an administrative agency capable of enforcing

tax laws and its collection.

f. Discuss the inherent limitations on the power of taxation.

1. Taxation is for a public purpose.

➢ Taxes may be levied only for public purpose

➢ A tax is for the public purpose where it is for the support of government, or

any of the recognized object of the government, or where it will directly

promote the welfare of the community in equal measure.

1.1 Discuss Pascual v. Secretary of Public Works, 110 Phil. 331

2. Taxation in inherently legislative.

➢ The power to tax being legislative in nature may not be delegated

2.1 Discuss exceptions to this limitation

3. Taxation is territorial.

➢ The State may tax persons and properties under its jurisdiction.

4. Taxation is subject to international comity.

➢ the property of a foreign State may not be taxed by another.

g. What are the sources of revenue under the Tax Code?

➢ Republic Act No. 8424, also known as the Tax Reform Act of 1997

Section 21. Sources of Revenue. - The following taxes, fees and charges are

deemed to be national internal revenue taxes:

(a) Income tax;

(b) Estate and donor's taxes;

(c) Value-added tax;

(d) Other percentage taxes;

(e) Excise taxes;

(f) Documentary stamp taxes; and

(g) Such other taxes as are or hereafter may be imposed and collected by the

Bureau of Internal Revenue.

h. Define income.

➢ Income means all wealth that flows into the taxpayer other than as a mere return of

capital. It includes the forms of income specifically described as gains and profits,

including gains derived from the sale or other disposition of capital assets.

➢ Judicial definitions: (1) gain derived from capital, or from labor, or from both capital

and labor, including the gain derived from the sale or exchange of capital assets; (2)

amount of money coming to a person or corporation within a specified time, whether

as payment for services, interest or profit from investment.

➢ Economist’s definition: (1) money value of the net accretion to one's economic power

between two points of time; (2) it cannot be determined by reckoning cash receipts;

other income determining factors: inventories, accounts receivable, property

acquisition and accounts payable for expenses incurred.

i. Define source of income.

➢ Source of income is any property, activity or service that produced the income. It

may also be in the form of proceeds from sales of transport documents.

➢ The following are the sources of income:

● Property (capital)

● Labor (service)

● Sale/Exchange of capital asset and activity

j. What is income tax?

➢ It is a tax on all yearly profits arising from property, profession, trades or offices or

as a tax on a person's income, emoluments, profits and the like.

k. What are the functions of income tax?

➢ The functions of income tax are:

a.) to provide large amounts of revenues;

b.) to offset regressive sales and consumption taxes;

c.) to mitigate the evils arising from the inequalities in the distribution of income and

wealth which are considered deterrents to social progress, by a progressive scheme

of taxation

l. What is schedular tax treatment?

➢ It classifies income.

➢ It provides different tax rules.

➢ It imposes different tax rates.

m. What is global tax treatment?

➢ It generally provides for uniform rules.

➢ It generally imposes uniform tax rate.

➢ It does not generally classify income.

n. What is Gross Income?

➢ General statutory definition: gross income means all income derived from whatever

source.

➢ Broad definition: gross income means income less income which by statutory

definition or otherwise, is exempt from the tax imposed by law. Stated otherwise,

gross income means all items of income less exclusions.

o. What is included in Gross Income?

➢ Republic Act No. 8424, also known as the Tax Reform Act of 1997

Section 32. Gross Income. -

(A) General Definition. - Except when otherwise provided in this Title, gross income

means all income derived from whatever source, including (but not limited to) the

following items:

(1) Compensation for services in whatever form paid, including, but not limited to

fees, salaries, wages, commissions, and similar items;

(2) Gross income derived from the conduct of trade or business or the exercise of a

profession;

(3) Gains derived from dealings in property;

(4) Interests;

(5) Rents;

(6) Royalties;

(7) Dividends;

(8) Annuities;

(9) Prizes and winnings;

(10) Pensions; and

(11) Partner's distributive share from the net income of the general professional

partnership.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- GR 239644 2021Dokument13 SeitenGR 239644 2021mehNoch keine Bewertungen

- G.R. No. 152219Dokument10 SeitenG.R. No. 152219mehNoch keine Bewertungen

- G.R. No. 200676Dokument6 SeitenG.R. No. 200676mehNoch keine Bewertungen

- G.R. No. 89572Dokument3 SeitenG.R. No. 89572mehNoch keine Bewertungen

- Prelims - SalesDokument57 SeitenPrelims - SalesmehNoch keine Bewertungen

- Week 3 - RTL PrelimsDokument13 SeitenWeek 3 - RTL PrelimsmehNoch keine Bewertungen

- Republic of The Philippines Baguio City en BancDokument58 SeitenRepublic of The Philippines Baguio City en BancmehNoch keine Bewertungen

- G.R. No. 183059Dokument4 SeitenG.R. No. 183059mehNoch keine Bewertungen

- G.R. No. 188526Dokument10 SeitenG.R. No. 188526mehNoch keine Bewertungen

- Supreme Court: Assails The October 25, 2007 DecisionDokument8 SeitenSupreme Court: Assails The October 25, 2007 DecisionmehNoch keine Bewertungen

- G.R. No. 159402Dokument6 SeitenG.R. No. 159402mehNoch keine Bewertungen

- G.R. No. 177861Dokument3 SeitenG.R. No. 177861mehNoch keine Bewertungen

- G.R. No. 177861 LongDokument3 SeitenG.R. No. 177861 LongmehNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Unit 9:: What Did You See at The Zoo?Dokument11 SeitenUnit 9:: What Did You See at The Zoo?ARiFin MoHaMedNoch keine Bewertungen

- The Effectiveness of Peppermint Oil (Mentha X Pepipirita) As Mosquito RepellentDokument4 SeitenThe Effectiveness of Peppermint Oil (Mentha X Pepipirita) As Mosquito RepellentKester PlaydaNoch keine Bewertungen

- A Step by Step Approach To The Modeling of Chemical Engineering Processes, Using Excel For Simulation (2018)Dokument182 SeitenA Step by Step Approach To The Modeling of Chemical Engineering Processes, Using Excel For Simulation (2018)Anonymous NxpnI6jC100% (7)

- Case KohortDokument37 SeitenCase KohortNasir AhmadNoch keine Bewertungen

- Technology in EducationDokument3 SeitenTechnology in EducationDinesh MadhavanNoch keine Bewertungen

- Constitutional Law Sem 5Dokument5 SeitenConstitutional Law Sem 5Ichchhit SrivastavaNoch keine Bewertungen

- Retaining Talent: Replacing Misconceptions With Evidence-Based StrategiesDokument18 SeitenRetaining Talent: Replacing Misconceptions With Evidence-Based StrategiesShams Ul HayatNoch keine Bewertungen

- TransModeler BrochureDokument12 SeitenTransModeler BrochureedgarabrahamNoch keine Bewertungen

- The Example of Text That Contains Present Perfect TenseDokument2 SeitenThe Example of Text That Contains Present Perfect TenseRahmiSyariif100% (1)

- Longman Communication 3000Dokument37 SeitenLongman Communication 3000irfanece100% (5)

- Reported Speech Rd1Dokument3 SeitenReported Speech Rd1Jose ChavezNoch keine Bewertungen

- Background Essay LSA Skills (Speaking)Dokument12 SeitenBackground Essay LSA Skills (Speaking)Zeynep BeydeşNoch keine Bewertungen

- Lesson Plan Tower of LondonDokument5 SeitenLesson Plan Tower of Londonmacrinabratu4458Noch keine Bewertungen

- Making Effective Pres. Academic Lit I. Weeks 4 5Dokument27 SeitenMaking Effective Pres. Academic Lit I. Weeks 4 5irfanaNoch keine Bewertungen

- "Management of Change ": A PR Recommendation ForDokument60 Seiten"Management of Change ": A PR Recommendation ForNitin MehtaNoch keine Bewertungen

- Xenophanes' ScepticismDokument22 SeitenXenophanes' Scepticismvince34Noch keine Bewertungen

- Teacher LOA & TermsDokument3 SeitenTeacher LOA & TermsMike SchmoronoffNoch keine Bewertungen

- Victorian AOD Intake Tool Turning Point AuditDokument8 SeitenVictorian AOD Intake Tool Turning Point AuditHarjotBrarNoch keine Bewertungen

- Boado Notes On Criminal LawDokument55 SeitenBoado Notes On Criminal LawJoy100% (3)

- Study On Perfromance Appraisal System in HPCLDokument12 SeitenStudy On Perfromance Appraisal System in HPCLomkinggNoch keine Bewertungen

- Chapter 4 - Transfer FunctionsDokument36 SeitenChapter 4 - Transfer FunctionsFakhrulShahrilEzanie100% (1)

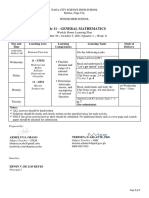

- General Mathematics - Module #3Dokument7 SeitenGeneral Mathematics - Module #3Archie Artemis NoblezaNoch keine Bewertungen

- Sand Casting Lit ReDokument77 SeitenSand Casting Lit ReIxora MyNoch keine Bewertungen

- Noli Me Tangere CharactersDokument4 SeitenNoli Me Tangere CharactersDiemNoch keine Bewertungen

- SSPC - Guia 12Dokument6 SeitenSSPC - Guia 12José Alvaro Herrera Ramos50% (2)

- Description: S&P 500 Dividend AristocratsDokument7 SeitenDescription: S&P 500 Dividend AristocratsCalvin YeohNoch keine Bewertungen

- SMF Update Barang 05 Desember 2022Dokument58 SeitenSMF Update Barang 05 Desember 2022Apotek Ibnu RusydNoch keine Bewertungen

- Sanskrit LessonsDokument195 SeitenSanskrit LessonsSuganya100% (1)

- RBG - CRM BRD - Marketing - v4.1Dokument68 SeitenRBG - CRM BRD - Marketing - v4.1Manvi Pareek100% (2)

- Electoral Politics Module-2, Hand Out 2, Class 9, Civics, Lesson-3, Electoral PoliticsDokument4 SeitenElectoral Politics Module-2, Hand Out 2, Class 9, Civics, Lesson-3, Electoral PoliticsSaiNoch keine Bewertungen