Beruflich Dokumente

Kultur Dokumente

Loans Only. Use Cross-Validation To Determine Your Optimal Parameters, If Necessary, Discuss The Variable

Hochgeladen von

Sarvesh0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

4 Ansichten1 SeiteLending Club is a peer-to-peer lending platform that provides loan data from 2007-2018 including approximately 2.3 million loans and 110 variables. The task is to develop an advanced internal ratings-based (IRB) model using Lending Club's data to estimate capital requirements, including: 1) preparing the data for credit scoring and loss given default (LGD) models, 2) building a probability of default (PD) scorecard, 3) constructing random forest and XGBoost LGD models and comparing performance, and 4) calibrating long-run PD and downturn LGD models using macroeconomic variables.

Originalbeschreibung:

task

Originaltitel

Task 1

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenLending Club is a peer-to-peer lending platform that provides loan data from 2007-2018 including approximately 2.3 million loans and 110 variables. The task is to develop an advanced internal ratings-based (IRB) model using Lending Club's data to estimate capital requirements, including: 1) preparing the data for credit scoring and loss given default (LGD) models, 2) building a probability of default (PD) scorecard, 3) constructing random forest and XGBoost LGD models and comparing performance, and 4) calibrating long-run PD and downturn LGD models using macroeconomic variables.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

4 Ansichten1 SeiteLoans Only. Use Cross-Validation To Determine Your Optimal Parameters, If Necessary, Discuss The Variable

Hochgeladen von

SarveshLending Club is a peer-to-peer lending platform that provides loan data from 2007-2018 including approximately 2.3 million loans and 110 variables. The task is to develop an advanced internal ratings-based (IRB) model using Lending Club's data to estimate capital requirements, including: 1) preparing the data for credit scoring and loss given default (LGD) models, 2) building a probability of default (PD) scorecard, 3) constructing random forest and XGBoost LGD models and comparing performance, and 4) calibrating long-run PD and downturn LGD models using macroeconomic variables.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Lending Club (https://www.lendingclub.

com) is a well-known peer-to-peer (P2P) lenders operating in

North America. Its business model is to let potential investors diversify their risk by splitting their

investments across multiple loans. To add transparency to their models, Lending Club has been realising

their lending history in its entirety, available for the period 2007 to 2018 for the United States, along

with loan performance for them. The dataset has approximately 2.3 million loans and around 110

variables.

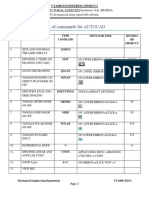

In this task, you will develop a fully compliant advanced IRB model from the data they make available,

from the raw data to the level 2 calibration, using what you have learned in the lectures. The objective

of the task is to estimate the capital requirements for Lending Club were they to be regulated (they are

currently not).

1. Prepare the dataset to make it ready for a credit scoring application model and for a Loss Given

Default model and calculate the default variable and the workout LGD variable. Discuss all your

decisions, particularly focus on which variables can be used to predict PD, which ones to predict LGD,

which ones are variables used to construct your objective variables, and which variables cannot be used.

Note the variable “grade” is not a predictive variable, for example, as it includes the business logic by

Lending Club.

2. Construct a scorecard which can model the probability of default for the loans. As you do not have

information regarding 12-month performance, use the status “Chargeoff” as the objective variable from

variable “loan_status”. Discuss your choice of variables, your decisions regarding Weight of Evidence

and other transforms you choose to make, and your final performance. Discuss the variable importance.

How many variables do you recommend using?

3. Construct two Loss Given Default models, using Random Forest and XGBoosting, over the defaulted

loans only. Use cross-validation to determine your optimal parameters, if necessary, discuss the variable

importance and the accuracy metrics you see relevant. Compare the performance of both models and

discuss your findings. Discuss the variable importance of both models. Do they agree? Why? Apply this

model to the non-defaulters and discuss the average estimated LGD values over these cases.

4. Using the monthly macroeconomic information you consider relevant (see for example

https://stats.oecd.org/Index.aspx), calibrate a long-run PD and downturn LGD model for the loans

granted regressing your monthly Lending Club’s PDs (from your objective variable) per rating (from the

variable ‘grade’) against the macroeconomic variables. Use the long-term forecasts you can find online

from reputable sources (for example the OECD) for your long-term calibrated values. If you cannot find

them, assume a value which makes sense to you and explain why. For the downturn values, select the

worst month GDP-growth-wise and use those macroeconomic values.

Das könnte Ihnen auch gefallen

- Moodys Analytics Riskcalc Transfer Pricing SolutionDokument9 SeitenMoodys Analytics Riskcalc Transfer Pricing SolutionManuel CámacNoch keine Bewertungen

- Portfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationVon EverandPortfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationBewertung: 3 von 5 Sternen3/5 (1)

- Literature Review of Credit Appraisal ProcessDokument7 SeitenLiterature Review of Credit Appraisal Processtqpkpiukg100% (1)

- Sample Thesis On Credit Risk ManagementDokument6 SeitenSample Thesis On Credit Risk ManagementINeedSomeoneToWriteMyPaperUK100% (2)

- Internal Credit Risk Rating Model by Badar-E-MunirDokument53 SeitenInternal Credit Risk Rating Model by Badar-E-Munirsimone333Noch keine Bewertungen

- Unit 4 Receivables - ManagementDokument27 SeitenUnit 4 Receivables - ManagementrehaarocksNoch keine Bewertungen

- Research Papers On Credit Risk ManagementDokument7 SeitenResearch Papers On Credit Risk Managementgvzexnzh100% (1)

- Digital MSME - Module 2 TemplateDokument6 SeitenDigital MSME - Module 2 Templatenew placeNoch keine Bewertungen

- Term Paper On Credit ManagementDokument7 SeitenTerm Paper On Credit Managementea428adh100% (1)

- Logit Model For PDDokument9 SeitenLogit Model For PDpuja_goyalNoch keine Bewertungen

- Thesis Loan ManagementDokument7 SeitenThesis Loan ManagementPaperWritingServicesReviewsCanada100% (2)

- Credit Risk Project, Installment 4: Indian School of Business Mohali CampusDokument5 SeitenCredit Risk Project, Installment 4: Indian School of Business Mohali CampusAmar ParulekarNoch keine Bewertungen

- c3379476 Predictive AnalysisDokument28 Seitenc3379476 Predictive Analysisconfidence udehNoch keine Bewertungen

- Indi AssignmentDokument4 SeitenIndi AssignmentAugmentatton AxerNoch keine Bewertungen

- Lending Club Data Analysis PDFDokument3 SeitenLending Club Data Analysis PDFazeezvidhyaNoch keine Bewertungen

- Key Performance IndicatorsDokument3 SeitenKey Performance IndicatorsASHWIN RATHINoch keine Bewertungen

- Equity Valuation ThesisDokument5 SeitenEquity Valuation ThesisJose Katab100% (2)

- Auto Loan ABSDokument26 SeitenAuto Loan ABSAnonymous 0zdN4FNoch keine Bewertungen

- Credit Score Research PapersDokument7 SeitenCredit Score Research Papershxmchprhf100% (1)

- Credit Risk Management Master ThesisDokument5 SeitenCredit Risk Management Master ThesisPapersHelpEvansville100% (2)

- Dissertation On Debtors ManagementDokument8 SeitenDissertation On Debtors ManagementWriteMyPapersAtlanta100% (1)

- Content ServerDokument12 SeitenContent Serverangelamonteiro1234Noch keine Bewertungen

- Predictive Modeling: Project Documentation Team 10Dokument16 SeitenPredictive Modeling: Project Documentation Team 10Eka PonkratovaNoch keine Bewertungen

- Research Paper On Credit Appraisal ProcessDokument6 SeitenResearch Paper On Credit Appraisal Processgatewivojez3100% (1)

- Summer Intership Presentation ON State Bank of India: Presented By: Supreet Gupta PGFB1354Dokument14 SeitenSummer Intership Presentation ON State Bank of India: Presented By: Supreet Gupta PGFB1354Supreet GuptaNoch keine Bewertungen

- Literature Review On Loan DefaultDokument7 SeitenLiterature Review On Loan Defaultea1yd6vn100% (1)

- Credit Risk Management DissertationDokument8 SeitenCredit Risk Management DissertationPaperHelpSingapore100% (1)

- Credit Risk Management Dissertation PDFDokument7 SeitenCredit Risk Management Dissertation PDFPaperWritingServicesCanada100% (1)

- Credit Worthiness: What Is A Corporate Credit RatingDokument23 SeitenCredit Worthiness: What Is A Corporate Credit RatingSudarshan ChitlangiaNoch keine Bewertungen

- Credit Risk Research PapersDokument4 SeitenCredit Risk Research Papersh00yfcc9100% (1)

- Credit Risk Management Literature ReviewDokument6 SeitenCredit Risk Management Literature Reviewaflsbdfoj100% (1)

- A Literature Review of Concepts of Credit Ratings and Corporate ValuationDokument26 SeitenA Literature Review of Concepts of Credit Ratings and Corporate ValuationHarsh Vyas100% (1)

- Credit Management DissertationDokument5 SeitenCredit Management DissertationWriteMyPaperCoUK100% (1)

- Research Paper On Credit Appraisal in BanksDokument7 SeitenResearch Paper On Credit Appraisal in Banksh02ngq6c100% (1)

- PHD Thesis Credit RiskDokument8 SeitenPHD Thesis Credit Riskfjn3d3mc100% (2)

- Credit Risk Modelling Literature ReviewDokument5 SeitenCredit Risk Modelling Literature Reviewea3h1c1p100% (1)

- Loan Eligibility Prediction: Machine LearningDokument8 SeitenLoan Eligibility Prediction: Machine LearningJeet MaruNoch keine Bewertungen

- What Do We Know About Loss Given Default?: Financial Institutions CenterDokument32 SeitenWhat Do We Know About Loss Given Default?: Financial Institutions CenterNhat HoangNoch keine Bewertungen

- Project Report - Lendingclub - FINALDokument24 SeitenProject Report - Lendingclub - FINALAmitNoch keine Bewertungen

- Credit Scoring ModelDokument15 SeitenCredit Scoring ModelBatchu Satish100% (1)

- Different Types of Financial Models For Financial ModellingDokument4 SeitenDifferent Types of Financial Models For Financial Modellingshivansh nangiaNoch keine Bewertungen

- Although Univariate Models Are Still in Use TodayDokument8 SeitenAlthough Univariate Models Are Still in Use Todayyuyung709Noch keine Bewertungen

- Unresolved Defaults LGD Study - Large CorporatesDokument15 SeitenUnresolved Defaults LGD Study - Large CorporatesSushantNoch keine Bewertungen

- Economic and Political Weekly Economic and Political WeeklyDokument11 SeitenEconomic and Political Weekly Economic and Political WeeklyjayaNoch keine Bewertungen

- Volcker's Rule: UNION BUDGET 2015 - Banking SectorDokument6 SeitenVolcker's Rule: UNION BUDGET 2015 - Banking SectorManu RameshNoch keine Bewertungen

- Loan PredictionDokument3 SeitenLoan Predictionswami thatiNoch keine Bewertungen

- Credit Management: Credit Management 336816434.doc Effective Mm/dd/yy Page 1 of 34 Rev 1Dokument34 SeitenCredit Management: Credit Management 336816434.doc Effective Mm/dd/yy Page 1 of 34 Rev 1venkatNoch keine Bewertungen

- Dissertation Presentation Bidyut MondalDokument22 SeitenDissertation Presentation Bidyut MondalRano JoyNoch keine Bewertungen

- EasyChair Preprint 8693Dokument22 SeitenEasyChair Preprint 8693Thy Nguyễn HàNoch keine Bewertungen

- Credit RiskDokument15 SeitenCredit RiskjoshdreamzNoch keine Bewertungen

- Brso97lm PDFDokument14 SeitenBrso97lm PDFAyoub BelgachaNoch keine Bewertungen

- Credit EDA Case Study Problem StatementDokument4 SeitenCredit EDA Case Study Problem StatementPlaydo kidsNoch keine Bewertungen

- Guidelines of Term Paper (Banking)Dokument2 SeitenGuidelines of Term Paper (Banking)মেহের আব তমালNoch keine Bewertungen

- Developing A Credit Risk Model Using SAS: Amos Taiwo Odeleye, TD BankDokument16 SeitenDeveloping A Credit Risk Model Using SAS: Amos Taiwo Odeleye, TD BankTapash DebNoch keine Bewertungen

- Credit Risk Management Dissertation TopicsDokument8 SeitenCredit Risk Management Dissertation TopicsBestOnlinePaperWritersUK100% (1)

- ACC561 AccountingDokument21 SeitenACC561 AccountingG JhaNoch keine Bewertungen

- Chapter 4 D Measurement of Credit RiskDokument7 SeitenChapter 4 D Measurement of Credit RiskCarl AbruquahNoch keine Bewertungen

- Income Statements and Two Years of Balance Sheets: Case StudyDokument6 SeitenIncome Statements and Two Years of Balance Sheets: Case StudyNana Kweku Asifo OkyereNoch keine Bewertungen

- Interpreting Validity Indexes For Diagnostic TestsDokument10 SeitenInterpreting Validity Indexes For Diagnostic TestsJudson BorgesNoch keine Bewertungen

- AI CLIPS TutorialDokument30 SeitenAI CLIPS Tutorialintonation iNoch keine Bewertungen

- SootblowerDokument9 SeitenSootblowerVan LudwigNoch keine Bewertungen

- Ishii 1992Dokument24 SeitenIshii 1992Dheeraj ThakurNoch keine Bewertungen

- Corporate Tax Avoidance and Performance: Evidence From China's Listed CompaniesDokument23 SeitenCorporate Tax Avoidance and Performance: Evidence From China's Listed CompaniesReynardo GosalNoch keine Bewertungen

- A New Versatile Electronic Speckle Pattern Interferometer For VibDokument318 SeitenA New Versatile Electronic Speckle Pattern Interferometer For Vibssunil7432Noch keine Bewertungen

- Introduction To Fluid Mechanics - TocDokument3 SeitenIntroduction To Fluid Mechanics - TocNguyễn Hồng Quân100% (2)

- Report-Motion in 1d-Part IIDokument10 SeitenReport-Motion in 1d-Part IIAlper SaglamNoch keine Bewertungen

- David Roylance - Mechanics of MaterialsDokument357 SeitenDavid Roylance - Mechanics of MaterialsHezi HilikNoch keine Bewertungen

- Minevent 2006 PDFDokument12 SeitenMinevent 2006 PDFJosé Manuel Berrospi CruzNoch keine Bewertungen

- A K 2 0 0 e R R o R M e S S A G e e X P L A N A T I o N SDokument142 SeitenA K 2 0 0 e R R o R M e S S A G e e X P L A N A T I o N SYatno GomiNoch keine Bewertungen

- Deflection Considerations in Two-Way Reinforced CoDokument13 SeitenDeflection Considerations in Two-Way Reinforced CoHamid HassanzadaNoch keine Bewertungen

- Boyle's Law: PV Constant. See Also GasesDokument2 SeitenBoyle's Law: PV Constant. See Also GasesMarc Eric Redondo100% (1)

- Research Process, Phases and 10 Step ModelDokument5 SeitenResearch Process, Phases and 10 Step ModelJ.B ChoNoch keine Bewertungen

- Marasigan, Christian M. CE-2202 Hydrology Problem Set - Chapter 4 Streamflow MeasurementDokument10 SeitenMarasigan, Christian M. CE-2202 Hydrology Problem Set - Chapter 4 Streamflow Measurementchrstnmrsgn100% (1)

- Solving Word Problems Involving Exponential FunctionsDokument15 SeitenSolving Word Problems Involving Exponential FunctionsSherwin Jay Bentazar100% (1)

- Download: Coulomb Force (Static) Vocabulary: Prior Knowledge Questions (Do These BEFORE Using The Gizmo.)Dokument3 SeitenDownload: Coulomb Force (Static) Vocabulary: Prior Knowledge Questions (Do These BEFORE Using The Gizmo.)Xavier McCulloughNoch keine Bewertungen

- Pattern in Nature and The Regularities in The WorldDokument11 SeitenPattern in Nature and The Regularities in The Worldjake simNoch keine Bewertungen

- Dyonic Born-Infeld Black Hole in 4D Einstein-Gauss-Bonnet GravityDokument12 SeitenDyonic Born-Infeld Black Hole in 4D Einstein-Gauss-Bonnet GravitymazhariNoch keine Bewertungen

- AP Stats Reference SheetDokument7 SeitenAP Stats Reference SheetRamenKing12Noch keine Bewertungen

- Frequency Distribution Table GraphDokument10 SeitenFrequency Distribution Table GraphHannah ArañaNoch keine Bewertungen

- Descriptive STatistics For Qualitative DataDokument34 SeitenDescriptive STatistics For Qualitative DataMwanjala GasambiNoch keine Bewertungen

- GD&T PDFDokument109 SeitenGD&T PDFBikash Chandra SahooNoch keine Bewertungen

- BlastingAKRaina Flyrock Factor of Safety Based Risk AnalysisDokument14 SeitenBlastingAKRaina Flyrock Factor of Safety Based Risk Analysisshaik sakeemNoch keine Bewertungen

- List of Commands For Autocad: Cad Lab Tutorial Exercises Instructor: S.K. Sharma To Be Practiced Using Autocad SoftwareDokument15 SeitenList of Commands For Autocad: Cad Lab Tutorial Exercises Instructor: S.K. Sharma To Be Practiced Using Autocad SoftwareShakeelNoch keine Bewertungen

- AgglomerationDokument16 SeitenAgglomerationMusanje MartinNoch keine Bewertungen

- Java Syntax Reference IDokument14 SeitenJava Syntax Reference ITom BertinNoch keine Bewertungen

- s2 TrigonometryDokument31 Seitens2 TrigonometryClaire PadronesNoch keine Bewertungen

- The Undiscovered Self - Carl Gustav JungDokument25 SeitenThe Undiscovered Self - Carl Gustav JungYusuf IrawanNoch keine Bewertungen

- Resolução Do Capítulo 4 - Equilíbrio de Corpos Rígidos PDFDokument231 SeitenResolução Do Capítulo 4 - Equilíbrio de Corpos Rígidos PDFMalik PassosNoch keine Bewertungen