Beruflich Dokumente

Kultur Dokumente

School of Business (SBC) : Module's Information

Hochgeladen von

EinOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

School of Business (SBC) : Module's Information

Hochgeladen von

EinCopyright:

Verfügbare Formate

School of Business (SBC)

Module’s Information:

Module ACC1001 Book keeping Skills

Session AUGUST 2019

Programme CBSi

Coursework Type Individual Assignment

Percentage 15%

Assigned Date Week 8

Due Date Week 13 – in class together with group assignment.

Student’s Declaration:

I declare that:

I understand what is meant by plagiarism.

This assignment is all my own work and I have acknowledged any use of the published or unpublished works

of other people.

I hold a copy of this assignment which I can produce if the original is lost or damaged

Name/ID Signature

Learning Outcomes Assessed:

CLO1 Show the relationships of double entry in Bookkeeping.

CLO2 Prepare a simple set of accounts for sole trader.

Coursework Specifications Page 1

School of Business (SBC)

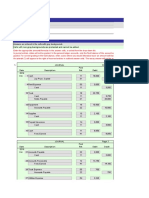

Question 1

Tom, a sole trader, has incurred the following transactions for the month ended 31 December 2015

2015

Dec 1 Tom deposited RM74,000 in the bank and invested goods worth RM12,000 to start the

trading business.

2 Bought an office building for RM7,000 through bank transfer.

2 Bought goods on credit from the following persons: T Jimmy RM 2,100; M Mum RM

2,340; G Man RM 6,600.

3 Cash sales RM14,750

5 Paid wages and salaries by cheque RM5,900

7 Sold goods on credit to: P Pee RM24,200; T Hon RM5,800; S Tee RM23,200

9 Paid RM5,000 for his family travel by business debit card.

11 Bought goods on credit from: K Kong RM12,500; P Magi RM4,100.

12 Paid carriage charges RM1,120 in cash for purchase made on December 11.

15 Tom invested his personal motor vehicle into the business. Tom personally bought the

motor vehicle RM54,000 3-year ago. The current market value on Dec 15 was

RM26,500.

17 Received cheque by selling goods to: K Kenny RM7,300; H Hon RM8,900

19 S Tee returned goods RM2,720 to us and paid the balance by cheque

21 Paid general expense in cash RM120 and carriage outward RM900 by cheque.

22 Returned goods RM40 to G Man.

24 Paid motor expenses RM1,880 in cash.

28 Johnson lent us RM4,000 by cash

29 Owner withdrew RM3,400 by cheque for his salary.

30 Bought furniture; partly paying by cheque RM1,200 and partly RM1,200 on credit

from Ken Furniture.

31 The current market value of the office building, which was bought on 2 December

worth RM12,000.

31 After carefully analyzing the family traveling expenses incurred on December 9, there

was an evidence, confirmed that 40% of traveling times had been used for business

purposes.

Required:

Enter the above transactions for the month of December and balance off all the accounts.

Note: do not prepare a trial balance. (Total=10 marks)

Coursework Specifications Page 2

School of Business (SBC)

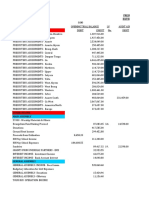

Question 2

GIX Max Collection, a branded office equipment trading business, has extracted the

following balances from its ledger on year-end 28 February 2018.

RM RM

Office equipment 22,800

Purchase 390,000

Return Inward 2,500

Furniture and fittings 22,400

Motor expenses 7,700

Return Outward 6,200

Carriage inward 5,300

Rent received 12,000

Inventory, 1 March 2017 45,300

Wages and salaries 135,300

Rent 135,000

Drawings 24,000

Telephone bill 10,400

Motor vehicles 220,300

Carriage outward 3,400

Bank 27,400

Accounts receivable 60,200

Accounts payable 110,430

Commission received 21,100

Rates 3,100

Commission paid 900

Sales 665,500

Capital ?

Additional information:

1. Inventory at 28 February 2018 RM98,000

Required:

Prepare an income statement for the year ended 28 February 2018 and statement of financial

position as at that date

(Total=10 marks)

Coursework Specifications Page 3

Das könnte Ihnen auch gefallen

- Problem 2-3B: Name: Section: ScoreDokument10 SeitenProblem 2-3B: Name: Section: ScoreAlba LunaNoch keine Bewertungen

- Final Accounts SumDokument2 SeitenFinal Accounts SumRohit Aswani25% (4)

- Acc133 PQ4Dokument2 SeitenAcc133 PQ4Karina Barretto Agnes0% (2)

- Acc1001 AssignmentDokument8 SeitenAcc1001 AssignmentAndrew TanNoch keine Bewertungen

- N Moss Commenced Business On 1 May 20x3 With ADokument1 SeiteN Moss Commenced Business On 1 May 20x3 With AMiroslav GegoskiNoch keine Bewertungen

- PR 2-2A Chapter 2Dokument4 SeitenPR 2-2A Chapter 2Naufal I L100% (2)

- FIN1161 - Introduction To Finance For Business - Report 1-Case Scenario Briefs - 2023-24Dokument2 SeitenFIN1161 - Introduction To Finance For Business - Report 1-Case Scenario Briefs - 2023-24Kiên NguyễnNoch keine Bewertungen

- CH 03Dokument4 SeitenCH 03flrnciairnNoch keine Bewertungen

- ACBP5122wA1 PDFDokument9 SeitenACBP5122wA1 PDFAmmarah Ramnarain0% (1)

- Solved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFDokument1 SeiteSolved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFAnbu jaromiaNoch keine Bewertungen

- CIBC Bank StatementDokument5 SeitenCIBC Bank StatementJordan Grey100% (2)

- DFA5058 Tutorial Chapter 3 SolutionDokument9 SeitenDFA5058 Tutorial Chapter 3 SolutionArabella Summer100% (1)

- 39.1 SolutionDokument5 Seiten39.1 SolutionJeanelle ColaireNoch keine Bewertungen

- 4.0 Curly KaleDokument2 Seiten4.0 Curly KaleAkik HasanNoch keine Bewertungen

- This Study Resource Was: Adjust CreditDokument4 SeitenThis Study Resource Was: Adjust CreditJalaj GuptaNoch keine Bewertungen

- Chapter 9 Solutions PDFDokument7 SeitenChapter 9 Solutions PDFAA BB MMNoch keine Bewertungen

- 5 The Digital Disruption of Banking and Payment Services: David Arnold and Paul JefferyDokument18 Seiten5 The Digital Disruption of Banking and Payment Services: David Arnold and Paul JefferyMokkymokky mokkyNoch keine Bewertungen

- Sample Paper: Toles Advanced ExaminationDokument20 SeitenSample Paper: Toles Advanced ExaminationFLORETA100% (1)

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDokument3 SeitenInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNoch keine Bewertungen

- Assignment MBA 1003Dokument34 SeitenAssignment MBA 1003KAWongCy100% (1)

- POADokument7 SeitenPOAjohnnyNoch keine Bewertungen

- Exercise 7-9 Credit Card and Debit Card Transactions LO5Dokument2 SeitenExercise 7-9 Credit Card and Debit Card Transactions LO5Jehiel Mathew100% (1)

- Revision Sheet - 2023 - 2024Dokument27 SeitenRevision Sheet - 2023 - 2024Yuvraj Chaudhari100% (1)

- Higher National Diploma in Accountancy Hnda 2 Year, Second Semester Examination - 2018 2202-Computer Applications For AccountingDokument14 SeitenHigher National Diploma in Accountancy Hnda 2 Year, Second Semester Examination - 2018 2202-Computer Applications For AccountingName of RoshanNoch keine Bewertungen

- Mirri TaxDokument10 SeitenMirri TaxMandanda LovemoreNoch keine Bewertungen

- FIN1161 - Introduction To Finance For Business - Report 2Dokument6 SeitenFIN1161 - Introduction To Finance For Business - Report 2thunlagbd230128Noch keine Bewertungen

- Assignment 2 P 3.7 & P3.8Dokument6 SeitenAssignment 2 P 3.7 & P3.8ehte19797177100% (2)

- 11 ACC CH 6.11 To 6.16 MemosDokument19 Seiten11 ACC CH 6.11 To 6.16 Memosora mashaNoch keine Bewertungen

- Class Exercise Session 1,2Dokument7 SeitenClass Exercise Session 1,2sheheryar50% (4)

- AccountDokument4 SeitenAccountCarlos AlphonceNoch keine Bewertungen

- Assignment # 2 - Chapter 3 - March 2023Dokument2 SeitenAssignment # 2 - Chapter 3 - March 2023GIAN ALEXANDER CARTAGENA100% (1)

- Examples of Trading and Profit and Loss Account and Balance SheetDokument5 SeitenExamples of Trading and Profit and Loss Account and Balance SheetSaad Arshad Mughal83% (6)

- Solution To Exercise Set Chapter 3-4Dokument22 SeitenSolution To Exercise Set Chapter 3-4Pham Le Tram Anh (K16HCM)Noch keine Bewertungen

- Advanced Taxation Practice Question QuestionDokument8 SeitenAdvanced Taxation Practice Question QuestionDanisa NdhlovuNoch keine Bewertungen

- Problem P2 2ADokument2 SeitenProblem P2 2ASHAMSUN NAHARNoch keine Bewertungen

- Week 3 Discussion ProblemsDokument23 SeitenWeek 3 Discussion ProblemsKiran JojiNoch keine Bewertungen

- Accounting Assignment Acc1103Dokument13 SeitenAccounting Assignment Acc1103api-549748043Noch keine Bewertungen

- Accrual and ProvisionDokument66 SeitenAccrual and ProvisionVeronica Bailey100% (1)

- ch01 PDFDokument2 Seitench01 PDFDanish BaigNoch keine Bewertungen

- Palindia Computer Education: Ledger CreationDokument12 SeitenPalindia Computer Education: Ledger CreationRuturaj KadamNoch keine Bewertungen

- Kic02 Nhóm9 Topic2 Ktqt1enDokument10 SeitenKic02 Nhóm9 Topic2 Ktqt1enLy BùiNoch keine Bewertungen

- Accounting EquationDokument15 SeitenAccounting EquationArkaprava ChakrabortyNoch keine Bewertungen

- Bca Semester-II 2023-24 (1) 2Dokument49 SeitenBca Semester-II 2023-24 (1) 2kimberlyeric009Noch keine Bewertungen

- Presbyterian Church of Ghana 2018Dokument55 SeitenPresbyterian Church of Ghana 2018Daniel Padi100% (1)

- Partnership - I: Change in Profit Sharing RatioDokument33 SeitenPartnership - I: Change in Profit Sharing RatioUjjwal BeriwalNoch keine Bewertungen

- Day Books FA1Dokument3 SeitenDay Books FA1amirNoch keine Bewertungen

- LLP SolutionDokument22 SeitenLLP SolutionOm JogiNoch keine Bewertungen

- TM 7 Tugas PDF Bank ConsiliationDokument2 SeitenTM 7 Tugas PDF Bank ConsiliationNajla Aura KhansaNoch keine Bewertungen

- Project On Pharmaceuticals DistributionDokument13 SeitenProject On Pharmaceuticals Distributiongourav rameNoch keine Bewertungen

- Department AccountingDokument12 SeitenDepartment AccountingRajesh NangaliaNoch keine Bewertungen

- Urc StatementsDokument6 SeitenUrc StatementsErvin CabangalNoch keine Bewertungen

- Examples Topic 2. Af 121Dokument3 SeitenExamples Topic 2. Af 121Adorf JamesNoch keine Bewertungen

- ACC601 Xero Assignment S1 2020 v1 PDFDokument9 SeitenACC601 Xero Assignment S1 2020 v1 PDFbhavikaNoch keine Bewertungen

- Mishal Mustafa BTA111 Prof. WuDokument2 SeitenMishal Mustafa BTA111 Prof. WuMishalm96Noch keine Bewertungen

- CAF 1 BASICS Lec 1 To 11 Notes by Umair SherazDokument34 SeitenCAF 1 BASICS Lec 1 To 11 Notes by Umair SherazQalb E MominNoch keine Bewertungen

- F6mwi 2007 Dec QDokument8 SeitenF6mwi 2007 Dec Qanga100% (1)

- BB A 122 Financial Accounting I Assignment OneDokument4 SeitenBB A 122 Financial Accounting I Assignment OneHEBBERT KAPUMBUNoch keine Bewertungen

- Group AssignmentDokument12 SeitenGroup AssignmentAn Phan Thị HoàiNoch keine Bewertungen

- Cash Flow Statement and Financial Ratio AssignDokument4 SeitenCash Flow Statement and Financial Ratio AssignChristian TanNoch keine Bewertungen

- Colegio de Dagupan: Solve The Following Problems in The Space ProvidedDokument5 SeitenColegio de Dagupan: Solve The Following Problems in The Space ProvidedKurt dela TorreNoch keine Bewertungen

- Solutions To Problems AFAR2 Chapter 13Dokument18 SeitenSolutions To Problems AFAR2 Chapter 13Jane DizonNoch keine Bewertungen

- Screenshot 2023-12-02 at 6.15.54 PMDokument5 SeitenScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9Noch keine Bewertungen

- BAAB1014 Assignment EliteDokument5 SeitenBAAB1014 Assignment Elitejinosini ramadasNoch keine Bewertungen

- Comparative Study of The Public Sector Amp Private Sector BankDokument67 SeitenComparative Study of The Public Sector Amp Private Sector Bankvandana_daki3941Noch keine Bewertungen

- Collectors Investments: South Africa Coin ListDokument5 SeitenCollectors Investments: South Africa Coin ListbelebelNoch keine Bewertungen

- Universidad Iberoamericana - Unibe-: Disbursement RecordDokument2 SeitenUniversidad Iberoamericana - Unibe-: Disbursement Recordodontologia unibeNoch keine Bewertungen

- Dissertation Topics in Accounting and Finance Related To AuditingDokument6 SeitenDissertation Topics in Accounting and Finance Related To AuditingPaySomeoneToWriteMyPaperGilbertNoch keine Bewertungen

- Statement of Account - 08 - 25 - 16Dokument3 SeitenStatement of Account - 08 - 25 - 16Radhe ShyamNoch keine Bewertungen

- Chapter 3 SolutionsDokument3 SeitenChapter 3 Solutionsriders29Noch keine Bewertungen

- Erj 2 BTDokument43 SeitenErj 2 BTlimtekkaunNoch keine Bewertungen

- Annual Report 2010 2011 PDFDokument31 SeitenAnnual Report 2010 2011 PDFbekele abomsaNoch keine Bewertungen

- IRA Blank Form 2017 1Dokument1 SeiteIRA Blank Form 2017 1ValerieAnnVilleroAlvarezValienteNoch keine Bewertungen

- Modul 10Dokument9 SeitenModul 10Herdian KusumahNoch keine Bewertungen

- Correction of Errors and The Suspense Account: Basic Transaction Used For Examples BelowDokument7 SeitenCorrection of Errors and The Suspense Account: Basic Transaction Used For Examples BelowKashifntcNoch keine Bewertungen

- General Electric Case StudyDokument14 SeitenGeneral Electric Case StudySherif ElfarNoch keine Bewertungen

- Guideline 2: Suspicious TransactionsDokument41 SeitenGuideline 2: Suspicious TransactionsGodsonNoch keine Bewertungen

- E-Payment Request Form: Payment Details Payment InstructionsDokument1 SeiteE-Payment Request Form: Payment Details Payment InstructionsSiva ReddyNoch keine Bewertungen

- 15 BibliographyDokument14 Seiten15 Bibliographyakkisantosh7444Noch keine Bewertungen

- Shimeles Asaminew Research Final-NewDokument70 SeitenShimeles Asaminew Research Final-NewKalkidan ZerihunNoch keine Bewertungen

- Legal EnglishDokument8 SeitenLegal EnglishJuliana Perez PolancoNoch keine Bewertungen

- Apc 111Dokument11 SeitenApc 111pamela dequillamorteNoch keine Bewertungen

- Ra 8424Dokument220 SeitenRa 8424embiesNoch keine Bewertungen

- International Trade Assignment 2Dokument22 SeitenInternational Trade Assignment 2Gayatri PanjwaniNoch keine Bewertungen

- Transferring Funds : International Personal BankDokument4 SeitenTransferring Funds : International Personal BankGarbo BentleyNoch keine Bewertungen

- Paytm Payment Solutions Feb15 PDFDokument30 SeitenPaytm Payment Solutions Feb15 PDFRomeo MalikNoch keine Bewertungen

- Quest: Shaking Value Out of The FEVERtreeDokument14 SeitenQuest: Shaking Value Out of The FEVERtreegusoneNoch keine Bewertungen

- Comparative Study of HDFC Bank SBI Bank MBA ProjectDokument9 SeitenComparative Study of HDFC Bank SBI Bank MBA ProjectAsif shaikhNoch keine Bewertungen

- Cityam 2011-09-19Dokument36 SeitenCityam 2011-09-19City A.M.Noch keine Bewertungen

- Unit 2. CashDokument8 SeitenUnit 2. CashDaphne100% (1)

- 1) Introduction: Currency ConvertibilityDokument34 Seiten1) Introduction: Currency ConvertibilityZeenat AnsariNoch keine Bewertungen