Beruflich Dokumente

Kultur Dokumente

Cantabil IPO Analysis

Hochgeladen von

வேல் முருகன்Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cantabil IPO Analysis

Hochgeladen von

வேல் முருகன்Copyright:

Verfügbare Formate

Cantabil Retail India Ltd - IPO Analysis 20th Sept 2010

Recommendation: Subscribe Object of the Offer

Establishment of new integrated manufacturing facility

Issue Highlights Expansion of Exclusive Brand Outlets

Sector - Retail Additional Working Capital

Issue Opens – 22 Sept 2010 Repayment of Debt

Issue Closes – 27 Sept 2010 General Corporate Purposes

Face value – Rs 10 Expenses for the Issue

Price Band – Rs 127- Rs 135

Bid Size – 50 and in multiple thereof Investment Rationale

Issue Type Integrated Value Chain

The company is an integrated apparel manufacturing and retail company with in-

100% Book Built Issue house capabilities for designing, sourcing of fabric and garment accessories,

manufacturing and retailing of apparels. The company’s core competency lies in

Issue Size: 105 cr its designing and stringent quality control. The company has a centralized

purchasing system for sourcing of fabric directly from mills or from suppliers

Category No of Shares (Lacs) which helps them to reduce cost of inputs and maintain quality of fabrics.

@ Rs 127 @ Rs 135 Expansion of Exclusive Brand Outlets

Public Issue 8267717 7777778 Currently, the company has 381 outlets across India which are either owned by

the company or managed by franchisees. To promote its brands further and to

QIB's 4133858 3888889

further growth, the company has plans in place to open 180 exclusive brand

Non Institutional 2893701 2722222 outlets by March 2011.

Retail 1240157 1166667

Business Model

The company has two chains of exclusive retail outlets under the brand name

Shareholding Pattern (%) “Cantabil” and “La FANSO” which display and sell the respective brands

exclusively. To enhance visibility and to ensure maximum footfalls, the

company’s stores are situated at malls and at prominent locations of the major

Pre - metros, mini metros, large cities and other Tier II cities. The company operates

Issue Post Issue its outlets under two models either company owned & franchisee managed or

@ Rs @ Rs

franchisee owned & operated. The break up of the number of exclusive retail

127 135

outlets under various models as on August 31, 2009.

Promoters 100% 50.84% 52.36%

Public 0.00% 49.16% 47.64% Co. Operated/ Leased & Franchisee Leased/Owned

Franchisee operated

Cantabil La Fanso Cantabil La Fanso

Shares Pre-Issue Post-Issue 107 14 99 161

8,549,830

@ 127 8,267,717 Indian Retail –the Emerging Market

@ 135 7,777,778 The Indian retail market has been ranked the most attractive emerging market for

investment followed by Russia and China in the retail sector by Global Retail

Grade Development Index (GRDI), in 2009. The Indian Retail market is estimated at

Icra Rating - 2 out of 5 about USD 410 billion and constitutes about 60% of private consumption and

about 35% of India’s GDP. With Indian GDP expected to grow at 7-8% in the next

Book Running Lead Managers coming years, the retail market is expected to touch USD 860 billion by 2018.

Spa Merchant Bankers Ltd S. No Country GRDI

Registrar 1 India 68

Beetal Finance & Computer Services Pvt 2 Russia 60

Ltd 3 China 56

4 UAE 56

Listing

NSE, BSE 5 Saudi Arabia 56

6 Vietnam 55

7 Chile 55

8 Brazil 53

9 Slovenia 52

10 Malaysia 51

*Global Retail Development Index-2009

RR, All rights reserved Page 1 of 4

Cantabil Retail India Ltd - IPO Analysis

Financial Performance

Particulars (in cr) FY '08 FY '09

Net Revenue 73.0 137.3

Sales Growth N/A 88.07%

EBIDTA 7.6 15.9

EBIDTA Margins 10.40% 11.57%

Depreciation 0.9 1.6

Other Income 0.4 1.0

EBIT 6.7 14.3

EBIT Margins 9% 10.40%

Interest 2.6 5.8

PAT 2.9 6.2

PAT Margins 3.95% 4.52%

Shares Outstanding (cr) 5.1 5.1

EPS (Rs) 5.66 12.20

Annually

Net revenue of the company increased by 88% to Rs 137.3 cr in the year ended FY’09 as compared to Rs 73 cr in the year

ended FY’08. Net Profit of the company increased by 114% to Rs 6.2 cr in FY’09 as compared to a net profit of Rs 2.9 cr in

FY’09.

Peer Comparison

Company LTP M.Cap.(Rs. In Cr.) P/E(x) RONW(%)

Cantabil Retail India 135* 796* 11.0 41.98

Kewal Kiran Clothing 404 493 11.9 9.7

Provogue India 64 740 29.6 5.8

Koutons Retail India 295 908 12.9 26.6

* Higher price of the band

At Rs 135, the higher price of the band, the issue is available at a P/E of 11x indicating undervalued.

Recommendation

The company is introducing itself in retail segment which is the most attractive segment in Indian Industry. The company

has average fundamentals. We recommend subscribe.

About the company

The company was promoted by Mr. Vijay Bansal who has over 20 years of experience in the garment and garment

accessories industry. Presently the company has 3 in-house manufacturing / finishing units and 4 warehouses located in

Delhi. It also have 3 third party dedicated units manufacturing exclusively for them. The company has fabricating

arrangements with 94 manufacturing units to which it outsources cutting and stitching. The company’s manufacturing and

finishing facilities are sufficiently backed by facilities for product development, design, fabric testing to ensure quality

apparels for its customers. The company is setting up a garment washing unit at Sonipat at a cost of Rs 22.09 million, which

is under advance stage of implementation and is slated to start operation by end of March 2010.

RR, All rights reserved Page 2 of 4

Cantabil Retail India Ltd - IPO Analysis

For Further Details/Clarifications Please contact:

RR Information & Investment Research Pvt. Ltd.

47, MM Road Jhandewalan New Delhi-110055 (INDIA)

Tel: 011-23636362/63

research@rrfcl.com

www.rrfinance.com

www.rrfcl.com

RR Research Products and Services:

Online Equity Calls during Market Hours (9:00 AM to 3:30 PM)

Online Commodity Calls during Market Hours (10:00 AM to 11:30 PM)

Daily Morning Pack

Equity Fundamental - Daily

Equity Technical Analysis - Daily

Derivative – Daily

Debt - Daily

Commodity - Daily

Currency – Daily

Daily Market Review

Weekly Pack

Equity Fundamental - Weekly

Equity Technical Analysis - Weekly

Derivative – Weekly

Debt - Weekly

Commodity - Weekly

Currency – Weekly

Mutual Fund Watch

Fundamental Research

Economic Analysis

Industry Analysis

Company Research & Valuations

Result Updates

News Updates

IPO Analysis

Mutual Fund Analysis

Investment Monitor – The complete monthly magazine design for Indian investors

Share Views with Zee Business in FUTURE CALL

And many more…

RR Research can also be viewed and downloaded from following websites:

www.moneycontrol.com

www.valuenotes.com

www.reportjunction.com

www.capitalmarket.com

www.myiris.com

RR, All rights reserved Page 3 of 4

Cantabil Retail India Ltd - IPO Analysis

Disclaimer:

Kindly read the Risk Disclosure Documents carefully before investing in Equity Shares, Derivatives or

other instruments traded on the Stock Exchanges. RR would include RR Financial Consultants Ltd.

and its subsidiaries, group companies, employees and affiliates. The information contained herein is

strictly confidential and meant solely for the selected recipient and may not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent of RR. The information contained herein is

obtained from public sources and sources believed to be reliable, but independent verification has not

been made nor is its accuracy or completeness guaranteed. RR or their employees may have or may

not have an outstanding buy or sell position or holding or interest in the products mentioned herein.

The contents and the information herein is solely for informational purpose and may not be used or

considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or

other financial and insurance products and instruments. Nothing in this report constitutes investment,

legal, accounting and/or tax advice or a representation that any investment or strategy is suitable or

appropriate to recipients specific circumstances. The securities and products discussed and opinions

expressed in this report may not be suitable for all investors, who must make their own investment

decisions, based on their own investment objectives, financial positions and needs. Please note that

fixed deposits, bonds, debentures are loans/lending instruments and the investor must satisfy

himself/herself on the financial health of the company/bank/institution before making any investment.

RR and/or its affiliates take no guarantee of soundness of any company or scheme. RR has/will make

available all required information to the prospective investor if asked for in respect of any

scheme/fixed deposit/bond/loan/debenture. RR is only acting as a broker/distributor and is not

representing any company in any manner except to distribute its schemes. Mutual Fund Investments

are subject to market risks, read the offer document carefully before investing. Any recipient herein

may not take the content in substitution for the exercise of independent judgment. The recipient

should independently evaluate the investment risks of any scheme of a mutual fund. RR and its

affiliates accept no liability for any loss or damage of any kind arising out of the use of any information

contained herein. Past performance is not necessarily a guide to future performance. Actual results

may differ materially from those set forth in projections. RR may have issued other reports that are

inconsistent with and reach different conclusion from the information presented in this report. The

information herein is not directed or intended for distribution to, or use by, any person or entity who is

a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject

RR and its affiliates to any registration or licensing requirement within such jurisdiction. The securities

and products described herein may or may not be eligible for sale in all jurisdictions or to certain

category of investors. Persons in whose possession this document may come are required to inform

them of and to observe such restriction(s). The display, description or references to any products,

services, publications or links herein shall not constitute an endorsement by RR. Insurance is a

subject matter of solicitation. Kindly also note all the risk disclosure documents carefully before

investing in Equity Shares, IPO’s, Mutual Fund Schemes, Insurance Schemes, Fixed Deposit

schemes, Debt offers, Hybrid Instruments, or other instruments traded on Stock Exchanges or

otherwise. Prospective investors can get all details and information from the sites of SEBI, IRDA,

AMFI or respective Mutual Fund Companies, Insurance Companies, Rating Agencies, Stock

Exchanges and individual corporate The companybsites. Prospective investors are advised to fully

satisfy themselves before making any investment decision

NSE - INB 231219636, INF 231219636

BSE - INB 011219632

RR, All rights reserved Page 4 of 4

Das könnte Ihnen auch gefallen

- The Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesVon EverandThe Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesNoch keine Bewertungen

- Indian Retail Sector: Store Profitability and Retail EconomicsDokument13 SeitenIndian Retail Sector: Store Profitability and Retail EconomicsVaibhav SekharNoch keine Bewertungen

- Zomato Limited - Research ReportDokument6 SeitenZomato Limited - Research ReportSunil ManoharNoch keine Bewertungen

- Shoppers' Stop LTD.: TEAM ID - 2301Dokument25 SeitenShoppers' Stop LTD.: TEAM ID - 2301jdsugunaNoch keine Bewertungen

- Toyota MotorsDokument18 SeitenToyota MotorsNadeem82% (11)

- V2 Retail LTD - IC Report - DSPLDokument20 SeitenV2 Retail LTD - IC Report - DSPLSiva KumarNoch keine Bewertungen

- Group Members Kishan Gupta (72) Aditi Gupta (71) Harshit Gupta (70) Dhiraj DubeyDokument16 SeitenGroup Members Kishan Gupta (72) Aditi Gupta (71) Harshit Gupta (70) Dhiraj Dubeyaditig22Noch keine Bewertungen

- ICICI Direct Go Fashions IPO ReviewDokument10 SeitenICICI Direct Go Fashions IPO ReviewPriyankaNoch keine Bewertungen

- Icici Indian Jew Retail IndustryDokument39 SeitenIcici Indian Jew Retail IndustryYash GuptaNoch keine Bewertungen

- Sapphire Foods India LTD: Established QSR Franchisee With Substantial PresenceDokument13 SeitenSapphire Foods India LTD: Established QSR Franchisee With Substantial Presencekesavan91Noch keine Bewertungen

- Invesco India Caterpillar PortfolioDokument1 SeiteInvesco India Caterpillar PortfolioAnkurNoch keine Bewertungen

- Issue Highlights: Rossari Biotech LimitedDokument16 SeitenIssue Highlights: Rossari Biotech LimitedJaackson SabastianNoch keine Bewertungen

- Nuvama On Cantabil Retail India Visit Note High Growth at An AffordableDokument18 SeitenNuvama On Cantabil Retail India Visit Note High Growth at An Affordabletakemederato1Noch keine Bewertungen

- Bajaj Corp LTD.: SubscribeDokument7 SeitenBajaj Corp LTD.: Subscribegowtham005Noch keine Bewertungen

- Assignment 3Dokument20 SeitenAssignment 3joel royNoch keine Bewertungen

- Future Ventures GEPLIPOnote 250411Dokument2 SeitenFuture Ventures GEPLIPOnote 250411vejendla_vinod351Noch keine Bewertungen

- Q1 FY23 Investors PresentationDokument19 SeitenQ1 FY23 Investors Presentationbig shortNoch keine Bewertungen

- Credo Brands Marketing Limited - IPO NoteDokument9 SeitenCredo Brands Marketing Limited - IPO NotedeepaksinghbishtNoch keine Bewertungen

- The Best Stock To Add To Your Portfolio This Month Is Here!: September 2020Dokument9 SeitenThe Best Stock To Add To Your Portfolio This Month Is Here!: September 2020ASIFNoch keine Bewertungen

- Adani Wilmar IPO Note Angel OneDokument7 SeitenAdani Wilmar IPO Note Angel OneRevant SatiNoch keine Bewertungen

- Adani Wilmar Limited IpoDokument19 SeitenAdani Wilmar Limited IpoTejesh GoudNoch keine Bewertungen

- Big BazaarDokument66 SeitenBig BazaarShubham KhuranaNoch keine Bewertungen

- Nirmal Bang (Ipo)Dokument11 SeitenNirmal Bang (Ipo)financeharsh6Noch keine Bewertungen

- Devyani 020821Dokument12 SeitenDevyani 020821gbNoch keine Bewertungen

- Castrol India LTD: November 06, 2018Dokument17 SeitenCastrol India LTD: November 06, 2018Yash AgarwalNoch keine Bewertungen

- Gandhar Oil Refinery IPO NoteDokument3 SeitenGandhar Oil Refinery IPO NoteShivani NirmalNoch keine Bewertungen

- Fine Organics AnalysisDokument2 SeitenFine Organics AnalysisKS TeotiaNoch keine Bewertungen

- Vishal Mega MartDokument67 SeitenVishal Mega MartShubham Khurana100% (1)

- Sip CentralDokument40 SeitenSip CentralAshish LohaniNoch keine Bewertungen

- Toyota MotorsDokument19 SeitenToyota MotorsPakassignmentNoch keine Bewertungen

- Monarch Network Capital Initiating Coverage On Landmark Cars WithDokument37 SeitenMonarch Network Capital Initiating Coverage On Landmark Cars WithDusk TilldownNoch keine Bewertungen

- Zomato IPO NoteDokument9 SeitenZomato IPO NoteCrest WolfNoch keine Bewertungen

- Sushil Finance Initiating Coverage On Eveready Industries IndiaDokument15 SeitenSushil Finance Initiating Coverage On Eveready Industries IndiamisfitmedicoNoch keine Bewertungen

- Initiating Coverage - Gulf Oil Lubricants India Ltd. - 290822Dokument17 SeitenInitiating Coverage - Gulf Oil Lubricants India Ltd. - 290822dbi003lavrajNoch keine Bewertungen

- Indian Oil Corporation: Presented By: Gyan Prakash Gupta Pgdm-CiimDokument19 SeitenIndian Oil Corporation: Presented By: Gyan Prakash Gupta Pgdm-CiimG P GuptaNoch keine Bewertungen

- FEL ReportDokument14 SeitenFEL ReportAteeque MohdNoch keine Bewertungen

- Sultan Annual ReportDokument91 SeitenSultan Annual ReportAlizaNoch keine Bewertungen

- By-Vaibhav Godse UpesDokument31 SeitenBy-Vaibhav Godse Upesfirefry2Noch keine Bewertungen

- Marico LTD: A Safe Parachute!: Recommendation: BUYDokument14 SeitenMarico LTD: A Safe Parachute!: Recommendation: BUYAnandNoch keine Bewertungen

- Module 6. Financial StrategyDokument22 SeitenModule 6. Financial StrategyKyle Anne CamingueNoch keine Bewertungen

- Asianpaintppt 191211182449Dokument19 SeitenAsianpaintppt 191211182449Meena MalcheNoch keine Bewertungen

- How To Price and Trade OptionsDokument2 SeitenHow To Price and Trade OptionsCharu Bhatt0% (1)

- Sunil Singhania - The CA Whose Focus Is On Mastering The Art of Generating Alpha On Dalal Street - The Economic TimesDokument2 SeitenSunil Singhania - The CA Whose Focus Is On Mastering The Art of Generating Alpha On Dalal Street - The Economic TimesSam vermNoch keine Bewertungen

- 338 - AUM - Metro Brands Ltd. - IPO NoteDokument4 Seiten338 - AUM - Metro Brands Ltd. - IPO NoteKunal SoniNoch keine Bewertungen

- Ethos LTD ReportDokument19 SeitenEthos LTD ReportRavi KiranNoch keine Bewertungen

- 2021年全球品牌500强(英文) BrandFinance 2021.1 61页Dokument62 Seiten2021年全球品牌500强(英文) BrandFinance 2021.1 61页Jack Jianyi WangNoch keine Bewertungen

- Brand Finance Global 500 2021 PreviewDokument61 SeitenBrand Finance Global 500 2021 PreviewLimi MulyantoNoch keine Bewertungen

- V.I.P. Industries LTD.: On Acquisition SpreeDokument3 SeitenV.I.P. Industries LTD.: On Acquisition SpreeShikha Shikha SNoch keine Bewertungen

- Castrol IndiaDokument8 SeitenCastrol IndiaRohit Chawla100% (1)

- Aditya Birla Fashion Initiating CoverageDokument13 SeitenAditya Birla Fashion Initiating Coveragekrishna_buntyNoch keine Bewertungen

- Nps 8 D17Dokument2 SeitenNps 8 D17tesykuttyNoch keine Bewertungen

- Piu FinalDokument16 SeitenPiu FinalSoumyadeep ChaudhuriNoch keine Bewertungen

- Earnings Presentation For December 31, 2016 (Company Update)Dokument14 SeitenEarnings Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Subject: Financial Management: Indira Institute of Management, PuneDokument23 SeitenSubject: Financial Management: Indira Institute of Management, PunePrasad RandheNoch keine Bewertungen

- Pitch Deck - QuadmaticsDokument12 SeitenPitch Deck - QuadmaticsBluehill ApplieoNoch keine Bewertungen

- Castrol Investor-presentation-May2018-v1Dokument21 SeitenCastrol Investor-presentation-May2018-v1ADNoch keine Bewertungen

- Avenues For Future Growth: Re-Inventing Retail IndiaDokument7 SeitenAvenues For Future Growth: Re-Inventing Retail IndiaAnkit ThakralNoch keine Bewertungen

- DMart CaseDokument8 SeitenDMart CaseSINAL PANCHOLINoch keine Bewertungen

- Investing with Intelligent ETFs: Strategies for Profiting from the New Breed of SecuritiesVon EverandInvesting with Intelligent ETFs: Strategies for Profiting from the New Breed of SecuritiesNoch keine Bewertungen

- Improvement of The Energy Density of Rice Husk Using Dry and Chemicaltreated Torrefaction 2090 4568 1000185Dokument6 SeitenImprovement of The Energy Density of Rice Husk Using Dry and Chemicaltreated Torrefaction 2090 4568 1000185வேல் முருகன்Noch keine Bewertungen

- A New Route For Ethylene Glycol Metabolism in Mycobacterium E44Dokument7 SeitenA New Route For Ethylene Glycol Metabolism in Mycobacterium E44வேல் முருகன்Noch keine Bewertungen

- Cryo-SFM: Instruction ManualDokument1 SeiteCryo-SFM: Instruction Manualவேல் முருகன்Noch keine Bewertungen

- Priority Substances List Assessment Report: Canadian Environmental Protection Act, 1999Dokument54 SeitenPriority Substances List Assessment Report: Canadian Environmental Protection Act, 1999வேல் முருகன்Noch keine Bewertungen

- Data Use in Education: Alluring Attributes and Productive ProcessesDokument6 SeitenData Use in Education: Alluring Attributes and Productive Processesவேல் முருகன்Noch keine Bewertungen

- Gross National Income 2018, Atlas Method: Ranking EconomyDokument4 SeitenGross National Income 2018, Atlas Method: Ranking Economyவேல் முருகன்Noch keine Bewertungen

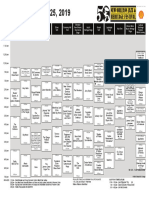

- 2019 Nojhf 8 Day CubesDokument8 Seiten2019 Nojhf 8 Day Cubesவேல் முருகன்Noch keine Bewertungen

- D V P S P: Omestic Iolence Ersonalized Afety LANDokument5 SeitenD V P S P: Omestic Iolence Ersonalized Afety LANவேல் முருகன்Noch keine Bewertungen

- Falcon 8 Plus Datasheet 7010 2243 Reva SM 1Dokument2 SeitenFalcon 8 Plus Datasheet 7010 2243 Reva SM 1வேல் முருகன்Noch keine Bewertungen

- gmr514 PDFDokument6 Seitengmr514 PDFவேல் முருகன்Noch keine Bewertungen

- Rules and Regulations of Asian Parliamentary Debating FormatDokument2 SeitenRules and Regulations of Asian Parliamentary Debating FormatmahmudNoch keine Bewertungen

- University of MauritiusDokument4 SeitenUniversity of MauritiusAtish KissoonNoch keine Bewertungen

- Java PT Android PDFDokument201 SeitenJava PT Android PDFlaurablue96Noch keine Bewertungen

- OD426741449627129100Dokument1 SeiteOD426741449627129100SethuNoch keine Bewertungen

- BSBMGT516 Facilitate Continuous Improvement: Summative Assessment 1Dokument4 SeitenBSBMGT516 Facilitate Continuous Improvement: Summative Assessment 1Mmc MixNoch keine Bewertungen

- Autonics KRN1000 DatasheetDokument14 SeitenAutonics KRN1000 DatasheetAditia Dwi SaputraNoch keine Bewertungen

- Video Case 1.1 Burke: Learning and Growing Through Marketing ResearchDokument3 SeitenVideo Case 1.1 Burke: Learning and Growing Through Marketing ResearchAdeeba 1Noch keine Bewertungen

- FLIPKART MayankDokument65 SeitenFLIPKART MayankNeeraj DwivediNoch keine Bewertungen

- 73-87 Chevy Truck 09 WebDokument132 Seiten73-87 Chevy Truck 09 WebBlaster Web Services100% (2)

- Manual Teclado GK - 340Dokument24 SeitenManual Teclado GK - 340gciamissNoch keine Bewertungen

- Pay Policy and Salary ScalesDokument22 SeitenPay Policy and Salary ScalesGodwin MendezNoch keine Bewertungen

- Enhancing LAN Using CryptographyDokument2 SeitenEnhancing LAN Using CryptographyMonim Moni100% (1)

- New Car Info PDFDokument1 SeiteNew Car Info PDFSelwyn GullinNoch keine Bewertungen

- Ch-3 BUFFETDokument9 SeitenCh-3 BUFFETJanith prakash567Noch keine Bewertungen

- Employee Involvement TQMDokument33 SeitenEmployee Involvement TQMAli RazaNoch keine Bewertungen

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDokument29 SeitenPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNoch keine Bewertungen

- SS 531 2006 Code of Practice For Lighting of Work Places Part 1 PDFDokument13 SeitenSS 531 2006 Code of Practice For Lighting of Work Places Part 1 PDFEdmund YoongNoch keine Bewertungen

- Calio Z: Type Series BookletDokument24 SeitenCalio Z: Type Series BookletDan PopescuNoch keine Bewertungen

- Objectives in DraftingDokument1 SeiteObjectives in Draftingshannejanoras03Noch keine Bewertungen

- 10.isca RJCS 2015 106Dokument5 Seiten10.isca RJCS 2015 106Touhid IslamNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledsai gamingNoch keine Bewertungen

- Class Assignment 2Dokument3 SeitenClass Assignment 2fathiahNoch keine Bewertungen

- DRPL Data Record Output SDP Version 4.17Dokument143 SeitenDRPL Data Record Output SDP Version 4.17rickebvNoch keine Bewertungen

- 173089Dokument22 Seiten173089aiabbasi9615100% (1)

- July2020 Month Transaction Summary PDFDokument4 SeitenJuly2020 Month Transaction Summary PDFJason GaskillNoch keine Bewertungen

- BroucherDokument2 SeitenBroucherVishal PoulNoch keine Bewertungen

- IllustratorDokument27 SeitenIllustratorVinti MalikNoch keine Bewertungen

- Option - 1 Option - 2 Option - 3 Option - 4 Correct Answer MarksDokument4 SeitenOption - 1 Option - 2 Option - 3 Option - 4 Correct Answer MarksKISHORE BADANANoch keine Bewertungen

- Toyota Auris Corolla 2007 2013 Electrical Wiring DiagramDokument22 SeitenToyota Auris Corolla 2007 2013 Electrical Wiring Diagrampriscillasalas040195ori100% (125)

- Cross-Compilers: / / Running ARM Grub On U-Boot On QemuDokument5 SeitenCross-Compilers: / / Running ARM Grub On U-Boot On QemuSoukous LoverNoch keine Bewertungen