Beruflich Dokumente

Kultur Dokumente

Calculation Formulaes

Hochgeladen von

Principal0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

164 Ansichten10 Seitencf

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldencf

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

164 Ansichten10 SeitenCalculation Formulaes

Hochgeladen von

Principalcf

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 10

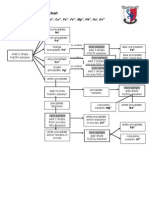

PENSION AND ITS TYPES

Types/Classes Entitlements Formulas for Conditions

of pension calculations

Superannuation 50% of the average (1) 10 years minimum qualifying service

emoluments or the in a pensionable establishment and opted

last pay drawn for GPF. (2) Upon attaining the age of 60

whichever is more years or modified by the Government for

beneficial. certain category of employees. (3)

Retirement is effective from the afternoon

of last day of the month in which the

Govt. servant attains the age of 60 years.

In case date of birth is the first of a

month, retire from service on the

afternoon of the last day of the preceding

month. (3) *

-Rule – 35

Retiring Pension 50% of the average (1) Upon voluntary retirement on

or Pension on emoluments or the completion of minimum 20 years of

voluntarily last pay drawn service.(Rule 56 (k) of FR or Rule 48 or

retirement whichever is more Rule 48-A of CCS (Pension) Rule, 1972 .

beneficial. (2) Upon compulsory retirement as per

Rule 56 (j) of Fundamental Rules.

-Rule – 36

Pension on w.e.f. 01.01.2006 full pension after 50% of the average -Rule 37 & 37 A.

absorption in completing minimum 10 years of emoluments or the

PSU service as Govt. servant. last pay drawn

whichever is more

beneficial.

* Pension on pro-rata

basis calculated on

the length of

qualifying service.

Invalid Pension Medical certificate in form 23 Retirement upon permanent

from the Competent Authority incapacitation due to mental or physical

with full knowledge of the Head of infirmity.

Office - Rule – 38

Compensation If a Government servant is selected Pension granted on abolition of a

Pension for discharge owing to the permanent post held by the employee.

abolition of a permanent post, he - Rule 39

shall, unless he is appointed to

another post the conditions of

which are deemed by the authority

competent to discharge him/her to

be at least equal to those of his

own, have the option.

(a) of taking compensation pension

to which he may be entitled for the

service he had rendered, or

(b) of accepting another

appointment on such pay as may

be offered and continuing to count

his previous service for pension.

Compulsory Pension granted to a Government Not less than two- A Government employee can be

Retirement servant compulsorily retired from thirds and not more compulsorily retired by the competent

Pension service as a penalty. than full authority in public interest, after giving

* Provided that the authority compensation him notice of not less than 3 months or 3

competent to dismiss or remove pension or gratuity or months salary in lieu of such notice after

him from service may, if the case both. he has attained the age of 50 years ( 55

is deserving of special years in case of basic servants) or after he

consideration, sanction a has completed 30 years of qualifying

compassionate allowance not service.( FR 56 (2). Further, Rule 14(2) of

exceeding two-thirds of pension or C.C.A Rules provide for imposing a

gratuity or both which would have punishment of compulsory retirement as a

been admissible to him if he had result of disciplinary action. He will be

retired on compensation pension. entitled to the normal pension under rules,

if he is compulsorily retired under FR

56(2). If he is retired as a result of

disciplinary action as a penalty, an

appropriate authority may impose such

penalty on Pension or Gratuity or both

and allow Pension and Gratuity not less

than two thirds and not more than full

compensation entitlements. This will not

be less than the minimum pension

admissible under rule 43 (5) (Pension

Rule 39).

-Rule-40

Compassionate Pension granted to a Government Amount of Pension In case of Government employees

Allowance servant on removal, if the case is not exceeding two- dismissed, or removed from service,

deserving special consideration. third of pension or normally no pension or gratuity is

gratuity or both payable. But the competent authority may

which would have in deserving case sanction Compassionate

been admissible if allowance not more than two third of

retired on pension or gratuity or both which would

compensation have been admissible, if he had retired on

pension. medical certificate subject to the

minimum pension. Such allowance is not

admissible in case of dismissal or removal

under Proviso (c) to clause 2 of Article

311 of the Constitution of India for anti

national activities. (Pension Rule 40).

-Rule-41

Extraordinary Extraordinary Pension in the form

Pension of Disability pension/extraordinary

family pension may be paid to the

Government servant/his family if

disablement/death (or the

aggravation of disablement/death)

of the Government servant, during

his service, are attributed to the

Government service. For the award

of extraordinary pension, there

should thus be a casual connection

between disablement and

Government service; and death

and Government service, for

attributability or aggravation to be

conceded. The quantum of the

pension, however, depends upon

the category of the

disablement/death.

Government servants appointed on

or after 1.1.2004 are not covered

by the CCS (Extraordinary

Pension) Rules.

Provisional The retired employee, to whom the

Pension Accountant General’s authorization is not

received in time due to administrative

reason, shall be sanctioned provisional

pension and gratuity. (Pension Rule 66).

This can be allowed in the following

cases also :

i) In respect of officers who are permitted

to retire without prejudice to the pending

disciplinary proceedings.

ii) Cases where pension could not be

assessed for want of details of qualifying

services and other particulars.

100% of pension admissible will normally

be allowed as provisional pension. It can

be sanctioned by Government in respect

of head of department, by Head of

department in respect of self drawing

officers and by heads of offices in respect

of other employees (G.O. 14 Fin

05.01.1996) In addition to the Provisional

pension, D.A. Medical allowance shall

also be paid to the retired official.

(G.O.575 Fin 07.07.1994, 326 Fin

28.04.1995). The head of office shall

draw provisional pension for a period of

12 months in the first instance and

thereafter as extended by the Accountant

General (Pension Rule 66). In respect of

self drawing Gazetted Officers, the A.G.

shall authorize anticipatory pension

pending finalization of pension proposals.

(Pension Rule 59).

Family Pension Family pension is granted to the The System of Family Pension was given

widow / widower and where there effect to from 01.04.1964. in a very

is no widow / widower to the restricted way. As per pension rule 49(2)

children of a Government servant (a) if the Government employee dies after

who entered in service in a completion of not less than one year

pensionable establishment on or continuous service at any time during his

after 01/01/1964 but on or before service, the family of the deceased was

31.12.2003 or having entered entitled to a family pension as follows

service prior to that date came to with effect from 1.04.1979

be governed by the provisions of

At least one year service 30% of pay min

the Family Pension Scheme for

Rs.100 Max Rs.500

Central Government Employees,

1964 if such a Government In such cases D.A. was not allowed (G.O.

servant- 748 Fin 26.05.1979).

(i) dies while in service on or after

01/01/1964 or In respect of the persons who died prior to

(ii) retired/died before 31.12.1963 01.04.1964 the family pension to the

or surviving members of the family was

(iii) retires on or after 01/01/1964 allowed from 01.04.1979 ( G.O. 748 Fin

and at the time of his death was in 26.05.1979).

receipt of pension. ii) In the event of death of a Government

Family pension is payable to the employee, while in service after having

children up to 25 years of their put in not less than 7 years of continuous

age, or marriage or till they start service, the rate of family pension shall be

earning a monthly income equal to 50 % of the pay last drawn or

exceeding Rs.9, 000/- + DA twice the family pension admissible @

admissible from time to time p.m. 30% of pay last drawn or Rs.500 which

whichever is earlier. ever is less from the date following the

Widow daughter / divorced date of death of the employee, for a

daughter/ unmarried daughter of period 7 years or for a period upto the

deceased Government servant is date on which the deceased employee

also entitled for the family pension would have attained the age of 65 years

till her remarriage or up to life had he survived which ever is less. (Rule

time or starts earning a monthly 49 (3) (a)).

income exceeding Rs.9,000/- +

DA admissible from time to time iii) Family Pension is not admissible in

p.m. whichever is earlier. cases of family of an employee whose

services were regularized and any one of

Family pension is payable to the family was appointed under

wholly dependent parents of the Compassionate grounds if he died before

deceased Government servants completion of one year of service

w.e.f. 01/01/98, when he/she is not G.O.967 Fin 29.08.1989 Letter 64990/93-

survived by a widow or eligible 2/Fin 26.10.1990 .

child. The family pension will be iv) In case of Unmarried Government

payable to mother first , failing Employee, Family Pension is payable to

which to the father. Father, failing which to the mother who

were dependent on the deceased

If the son or daughter, of a employee for support. Rule 49 (4)(d)

Government servant is suffering G.O.480 Fin 21.05.1977.

from any disorder or disability of

v) If an employee dies after having put in

mind or is physically crippled or service of one year but less than 7 years,

disabled so as to render him or her and is not survived by a widow or

unable to earn a living even after widower but is survived by child or

attaining the age of 25 years, the children, such child or children are

family pension can continue to be eligible for family pension if it is higher

paid for life time subject than that sanction under Extraordinary

to conditions. Pension Rules, if any. Rule 49 (4)(c).

vi) If the Husband has another wife living

at the time of death of the female

employee, it is the same as remarriage and

the husband is not entitled for family

pension. If the minor child is alive, the

family pension could be paid through the

father as guardians of the child subject to

the recognition of his legal guardianship.

Letter 107397/83-4 Fin 02.02.1985.

vii) Provisional Family Pension : In the

case of death of a Government official

while in service, the Head of Office shall

sanction provisional family pension to the

eligible member of family without

insisting legal heir ship certificate to

whom the lump sum amount of Rs.5000/-

was paid for funeral expenses. It is

adjustable against the regular family

pension payable.

Commuted 40 % X Commutation

value of factor* X 12

Pension (CVP)

is CVP

Commutation Lump sum payable =

Amount Commutation factor x

12 x amount of

pension offered for

commutation

GRATUITY

Types/Clas Entitlements Formulas for calculations Conditions

ses of

pension

Service On rendering less than Last drawn salary (basic salary Service Gratuity is calculated as ½ months

Gratuity 10 years qualifying plus dearness allowance) X emoluments (Basic Pay + Non-practicing

service: A Government number of completed years of Allowance + DA) for every completed six

servant who retired on service (Qualifying Service) monthly period of qualifying service.

rendering less than 10 2

years of qualifying

service is not eligible for

pension but is eligible

for Service Gratuity in

lieu of the Pension.

Retirement Retirement Gratuity is Last drawn salary (basic salary

Gratuity admissible to all plus dearness allowance) X

employees who retire number of completed years of

after completion of 5 service (Qualifying Service)

years of qualifying 4

service at the rate of

‘one-fourth of

emoluments for each

completed six monthly

period of qualifying

service subject to

maximum of 16 ½ times

the emoluments or 20

lacks whichever is less.

Death Death Gratuity is paid (i) Less than 1 year = 2 times

Gratuity to the family of a Govt. of emoluments.

servant who dies while (ii) One year or more but less

in service, at the rates than 5 years = 6 times of

given emoluments.

(iii) 5 years or more but less

than 11 years = 12 times of

emoluments.

(iv) 11 years or more but less

than 20 years = 20 times of

emoluments.

(v) 20 years or more = Half of

emoluments x for every

completed six-monthly period

of qualifying service subject to

a maximum of 33 times of

emoluments.

Residuary If a Government If a Government employee dies If a Government employee dies within 5

Gratuity employee dies within 5 within 5 years from the date of years from the date of retirement from

years from the date of retirement from service and service and become eligible for service

retirement from service become eligible for service gratuity or pension and received gratuity, or

and become eligible for gratuity or pension and pension or commuted pension and such

service gratuity or received gratuity, or pension or amount received is less than the amount

pension and received commuted pension and such equal to 12 times of his emoluments, his

gratuity, or pension or amount received is less than family shall be eligible for a residuary

commuted pension and the amount equal to 12 times gratuity equal to the deficiency.

such amount received of his emoluments, his family

is less than the amount shall be eligible for a residuary

equal to 12 times of his gratuity equal to the

emoluments, his family deficiency.

shall be eligible for a

residuary gratuity

equal to the deficiency.

-Rule 50(2)

Interest for delay in

payment of Gratuity: If

the payment of Gratuity

is delayed beyond 3

months from the date of

retirement, interest at the

rate applicable to GPF

deposit is payable to the

pensioner.

-Rule 68

LEAVE ENCASHMENT

Earned Leave Basic pay + DA admissible on the date of

retirement from service x No. of days of un-

utilized earned leave at credit subject to a

maximum of 300 days

30

Half Pay Half of Basic pay + DA thereon admissible on -Rule 39 (2)

Leave the date of retirement from service x No. of

days of Half Pay Leave at credit subject to the

total of earned leave and HPL at credit not

exceeding 300 days

30

PROVISION OF RULES FOR REGULATION OF PAY

Type Case Illustrations

On Reduction to Case: 1 A. Pay when penalty imposed =Rs.15440+

a lower stage in a The penalty of reduction to a lower 4200 = 19640

time scale. stage in the time-scale of pay by B. Reduced Pay} = {(15440+4200) x 100/103 less (4200) rounded

one stage for a period of one year, off to next 10

without cumulative effect and not In Pay Band} = 19067 -4200 = 14867 rounded off to Rs 14870

adversely affecting his pension is C. Reduced Pay w.e.f.13-3-2013

imposed on a Government servant = Rs.14870 +GP Rs.4200 = 19070

w.e.f. 13.03.2013. The Government Increment (notional) 1-7-2013 = 15440 + (19640 x 3%)

servant was drawing Rs. 15440 + GP @@

+4200

Rs.4200 in Pay Band 2 (Rs.9300- = 15440+590@@ +4200

34800) Pay after increment = 16030+4200=20230

@@

rounded off to next 10

D. Pay w.e.f. 13-3-2014 = Rs 16030+ 4200+ Rs.20230

E. Pay w.e.f. 1-7-2014 = Rs 16640+4200 = Rs 20840

Case: 2 A. Pay when penalty imposed = Rs.15440+ 4200 = 19640

The penalty of reduction to a lower B. Reduced Pay in Pay Band

stage in the time-scale of pay by Step -1 First stage reduction

two stages for a period of one year ={ (15440+4200) x 100/103 less (4200) rounded off to next 10

is imposed on a Government servant = 19067-4200 = 14867 rounded off to Rs 14870

w.e.f. 13-03-2013. It is further Pay= 14870+4200=19070

directed that the Government Step-2 Second stage reduction

servant Government servant would ={ (14870+4200) x 100/103 less (4200) rounded off to next 10

earn increment during the period = 18514 -4200 = 14314 rounded off to Rs 14320

and the reduction will not have the Increment (notional) 1-7-2013

effect of postponing future = 15440 + (19640 x 3%) @@ +4200

increments of pay. = 15440+590@@ +4200

The Government servant was Pay after increment= 16030+4200=20230

drawing Rs. 15440 + GP Rs.4200 in @@

rounded off to next 10

Pay Band 2 (Rs.9300-34800)

(same as in Case 1 but reduction by D. Pay w.e.f. 13-3-2014 = Rs 16030+ 4200+ Rs.20230

2 stages) E. Pay w.e.f. 1-7-2014 = Rs 16640+4200 = Rs 20840

Case: 2A A. Pay when penalty imposed = Rs.15440+ 4200 = 19640

The penalty of reduction to a lower B. Reduced Pay in Pay Band

stage in the time-scale of pay by Step -1 First stage reduction

two stages for a period of one year is ={ (15440+4200) x 100/103 less (4200) rounded off to next 10

imposed on a Government servant = 19067 -4200 = 14867 rounded off to Rs 14870

w.e.f. 13-03-2013. It is further Pay= 14870+4200=19070

directed that the Government servant Step-2 Second stage reduction

Government servant would not earn ={ (14870+4200) x 100/103 less (4200) rounded off to next 10

increment during the period and the = 18514 -4200 = 14314 rounded off to Rs 14320

reduction will not have the effect of C. Reduced Pay w.e.f.13-3-2013

postponing future increments of pay. = Rs.14320 +GP Rs.4200 = 18520

The Government servant was

drawing Rs. 15440 + GP Rs.4200 in No increments during the period of penalty

Pay Band 2 (Rs.9300-34800) D. Pay w.e.f. 13-3-2014 = Rs 15440+ 4200+ Rs.19640

(same as in Case 2 but no E. Pay w.e.f. 1-7-2014 = Rs 16030+4200 = Rs 20230

increments during penalty period) (Note: The Government servant has drawn Rs.15440 for six months

including broken periods)

Case: 3 A. Pay when penalty imposed = Rs.15440+ 4200 = 19640

The penalty of reduction to a lower B. Reduced Pay} ={ (15440+4200) x 100/103 less (4200) rounded

stage in the time-scale of pay by one off to next 10 in Pay Band }

stage for a period of two years, = 19067 -4200 = 14867 rounded off to Rs 14870

without cumulative effect and not C. Reduced Pay w.e.f.13-3-2013

adversely affecting his pension is = Rs.14870 +GP Rs.4200 = 19070

imposed on a Government servant

Increment (notional) 1-7-2013 = 15440 + (19640 x 3%)

w.e.f. 13.03.2013. The Government @@

+4200

servant was drawing Rs. 15440 + GP

= 15440+590 +4200

Rs.4200 in Pay Band 2 (Rs.9300-

Pay after increment = 16030+4200=20230

34800) @@

Increment (notional) 1-7-2014

= 16030+ (20230 x 3%)@@ +4200

= 16640+ 4200 =20840 @@ rounded off to next 10

D. Pay w.e.f. 13-3-2015 = Rs 16640+4200 = Rs.20840

E. Pay w.e.f. 1-7-2015 = Rs 17270+4200 = Rs 21470

Withholding of The penalty of Withholding of one

Increment increment for a period of six months, A. Pay when penalty imposed = Rs.15440+ 4200 = 19640

without cumulative effect and not Increment (due) 1-7-2013 = 15440 + (19640 x 3%)@@ +4200

adversely affecting his pension is =15440+590 +4200

imposed on an Government servant Pay after increment = 16030+4200=20230

on 13-03-2013. The Government @@

rounded off to next 10

servant was drawing Rs. 15440 + GP This increment is to be withheld for six months i.e. from 1-7-

Rs.4200 in Pay Band 2 (Rs.9300- 2013 to 31-12-2013

34800) B. Pay w.e.f. 1.7.2013 to 31-12-2013 = Rs.15440+4200 =19640

C. Pay w.e.f. 1.1.2014 = Rs 16030 + 4200 = 20230

D. Pay w.e.f. 1.7.2014 = Rs 16640+ 4200 = 20840

On Reduction to The penalty of reduction to the post In this case the pay in GP 4200 would need to be fixed w.e.f.

a lower grade or carrying Grade pay of Rs 4200 for a 13.03.2013 to 12.03.2015 as if he had continued in GP 4200. Pay

post or lower period of two years is imposed on would be regulated as under:

time scale. Government servant in Grade Pay

Rs.4600 w.e.f. 13.03.2013, with Date Pay in GP 4200 Pay in GP 4600

further directions that the reduction 1-8-2009 15070+4200= 19270** 15650+4600= 20250

shall not postpone his future 1-7-2010 15650+4200= 19850** 16260+4600= 20860

increments and on the expiry of the

1-7-2011 16250+4200= 20450** 16890+4600= 21490

period he shall regain his original

seniority in the higher grade. 1-7-2012 16870+4200= 21070** 17540+4600= 22140

On 13.03.2013 the 13-3-2013 16870+4200= 21070**

Government servant was drawing Rs. 1-7-2013 17510+4200= 21710**

17540 + GP Rs.4600 in Pay Band 2 1-7-2014 18170+4200= 22370

(Rs.9300-34800). The Government 13-3-2015 18210+4600=22810@@

servant had been promoted to the 1-7-2015 18900+4600=23500

post in Grade Pay Rs.4600 on 1-8- Note:

2009. At that time his pay was 1. **Notional pay in GP 4200 from 1-8-2009 to 12-03-2013

Rs.15070 + GP 4200 in Pay Band 2. 2. @@ One increment would be allowed on the Pre Penalty pay as

the Government servant would have drawn that pay for more than

six months as on 1-7-2013

3. In case the higher and lower grades are in different Pay Bands

then also the same method would be followed.

4. Under FR-28, the authority which orders the transfer of a

government servant as a penalty from a higher to a lower grade or

post may allow him to draw any pay, not exceeding the maximum of

the lower grade or post which it may think proper. Provided the pay

allowed to be drawn by a government servant shall not exceed the

pay which he would have drawn by the operation of FR 22 read with

clause (b) or (c) as the case may be of FR 26. This illustration is

where no such orders have been passed. Where the disciplinary

authority has specified the pay to be drawn in the lower post pay will

be drawn as per those direct.

With-holding of

Increment with

cumulative

effect

With-holding of

Increment

without

cumulative

effect

Das könnte Ihnen auch gefallen

- D8045-16 Standard Test Method For Acid Number of Crude Oils and Petroleum Products by CatalyticDokument6 SeitenD8045-16 Standard Test Method For Acid Number of Crude Oils and Petroleum Products by CatalytichishamNoch keine Bewertungen

- CCS - Pension - Rules, 1972Dokument26 SeitenCCS - Pension - Rules, 1972Krishnamurthy Raviprakash92% (13)

- On December 1 Curt Walton Began An Auto Repair Shop PDFDokument1 SeiteOn December 1 Curt Walton Began An Auto Repair Shop PDFhassan taimourNoch keine Bewertungen

- PQPDokument60 SeitenPQPlee100% (4)

- Appellate Tribunal For Forfeited Property (Conditions of Service of Chairman and Members) Rules, 1978Dokument4 SeitenAppellate Tribunal For Forfeited Property (Conditions of Service of Chairman and Members) Rules, 1978Latest Laws TeamNoch keine Bewertungen

- Retirement Policy ResearchesDokument4 SeitenRetirement Policy ResearchesGrace NudaloNoch keine Bewertungen

- FR 525354 e 0Dokument6 SeitenFR 525354 e 0Himanshu AgnihotriNoch keine Bewertungen

- CCS (Pension) Rules, 1972Dokument28 SeitenCCS (Pension) Rules, 1972saritaNoch keine Bewertungen

- Ap Revised Pension RulesDokument2 SeitenAp Revised Pension Rulesmd yusufNoch keine Bewertungen

- Labor Gsis ReportDokument35 SeitenLabor Gsis ReportIbarra ConradNoch keine Bewertungen

- EOT MaterialDokument21 SeitenEOT Materialpavan bNoch keine Bewertungen

- Leave 25032013 PDFDokument7 SeitenLeave 25032013 PDFprasannandaNoch keine Bewertungen

- Indian Railways PortalDokument7 SeitenIndian Railways PortalujjwalNoch keine Bewertungen

- Pension / T B: Erminal EnefitDokument38 SeitenPension / T B: Erminal EnefitsaravananNoch keine Bewertungen

- Prakasam VRO-1Dokument14 SeitenPrakasam VRO-1crda rayuduNoch keine Bewertungen

- SECTION 1. Presidential Decree No. 1146, As Amended, Otherwise Known As The "RevisedDokument12 SeitenSECTION 1. Presidential Decree No. 1146, As Amended, Otherwise Known As The "RevisedBrian DuelaNoch keine Bewertungen

- Summary of Gsis BenefitsDokument4 SeitenSummary of Gsis BenefitsFrank Lloyd CadornaNoch keine Bewertungen

- Fundamental Rules PDFDokument11 SeitenFundamental Rules PDFKESAVA RAO TINKUNoch keine Bewertungen

- Rule 99 - WRT SuspensionDokument2 SeitenRule 99 - WRT SuspensionDharmraj SumanNoch keine Bewertungen

- Finals Reviewer DeeDokument10 SeitenFinals Reviewer DeeDianne ComonNoch keine Bewertungen

- Occupational Disability Web BrochureDokument9 SeitenOccupational Disability Web BrochureLetlhogonolo RangwetsiNoch keine Bewertungen

- Cap 30 LawDokument30 SeitenCap 30 Lawnanayaw asareNoch keine Bewertungen

- P 1871 01-Sep-2015 421Dokument5 SeitenP 1871 01-Sep-2015 421Salman BhaiNoch keine Bewertungen

- Agra (Group 3) - GsisDokument43 SeitenAgra (Group 3) - GsisPatatas SayoteNoch keine Bewertungen

- Agra (Group 3) - GsisDokument43 SeitenAgra (Group 3) - GsisChristopher Jan DotimasNoch keine Bewertungen

- 201908021564725703-Pension RulesDokument12 Seiten201908021564725703-Pension RulesanassaleemNoch keine Bewertungen

- FR 52 To 55Dokument8 SeitenFR 52 To 55Pozhath Narayanan KuttyNoch keine Bewertungen

- Pension / T B: Erminal EnefitDokument38 SeitenPension / T B: Erminal EnefitsaravananNoch keine Bewertungen

- Bank Employees Pension Scheme & Computation of PensionDokument4 SeitenBank Employees Pension Scheme & Computation of PensionRohit RaiNoch keine Bewertungen

- RSR Rules Chapter-10 Eng PDFDokument23 SeitenRSR Rules Chapter-10 Eng PDFNarendra AjmeraNoch keine Bewertungen

- Leave Regulation TNEBDokument94 SeitenLeave Regulation TNEBRinjumon RinjuNoch keine Bewertungen

- Allowances During Period of Suspension: Chapter - Vii Dismissal, Removal and SuspensionDokument32 SeitenAllowances During Period of Suspension: Chapter - Vii Dismissal, Removal and Suspensionyasirarfat111Noch keine Bewertungen

- SSS, GSIS, ECP Table of BenefitsDokument16 SeitenSSS, GSIS, ECP Table of BenefitsVincentRaymondFuellasNoch keine Bewertungen

- Agra - Gsis LawDokument13 SeitenAgra - Gsis LawRB BalanayNoch keine Bewertungen

- Dole Circular On Ra 7641Dokument4 SeitenDole Circular On Ra 7641Ferdinand MacolNoch keine Bewertungen

- Republic Act No. 8291Dokument13 SeitenRepublic Act No. 8291qwertycrushq17Noch keine Bewertungen

- The Prescribed Leave Rules, 1959Dokument6 SeitenThe Prescribed Leave Rules, 1959ENGR ABRAR IMTIAZNoch keine Bewertungen

- Sub Decree 32 On Social Security Scheme On Pension EngDokument15 SeitenSub Decree 32 On Social Security Scheme On Pension EngRam MacaraigNoch keine Bewertungen

- BIR Ruling DA-083-03Dokument5 SeitenBIR Ruling DA-083-03Em EmNoch keine Bewertungen

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDokument11 SeitenBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledMJ PerryNoch keine Bewertungen

- GSIS LawDokument17 SeitenGSIS LawKirk LabowskiNoch keine Bewertungen

- Frequently Asked Questions (Faqs) (Central Civil Services) : 1. Pension PolicyDokument36 SeitenFrequently Asked Questions (Faqs) (Central Civil Services) : 1. Pension PolicyStanleyNoch keine Bewertungen

- University of Santo Tomas Faculty of Civil Law: Academic Year 2020-2021, Term 1Dokument42 SeitenUniversity of Santo Tomas Faculty of Civil Law: Academic Year 2020-2021, Term 1Miguel Joshua Gange AguirreNoch keine Bewertungen

- SocAg Tables (Prelims)Dokument10 SeitenSocAg Tables (Prelims)KDNoch keine Bewertungen

- Postal Manual Volume IV Part-IDokument33 SeitenPostal Manual Volume IV Part-ILatest Laws TeamNoch keine Bewertungen

- SocLeg HW 2Dokument7 SeitenSocLeg HW 2Pre PacionelaNoch keine Bewertungen

- PRB Reading MaterialDokument77 SeitenPRB Reading MaterialGK TiwariNoch keine Bewertungen

- Prescribed Leave Rules, 1959Dokument11 SeitenPrescribed Leave Rules, 1959Abdullah AbdullahNoch keine Bewertungen

- Leave Rules For Non TeachingDokument27 SeitenLeave Rules For Non Teachingzahir uddinNoch keine Bewertungen

- Central Civil Services (Fixation of Pay of Re-Employed Pensioners) ORDERS, 1986 1. Short Title and CommencementDokument11 SeitenCentral Civil Services (Fixation of Pay of Re-Employed Pensioners) ORDERS, 1986 1. Short Title and CommencementDEVI SINGH MEENANoch keine Bewertungen

- General Entitlement of LeaveDokument7 SeitenGeneral Entitlement of LeaveThirugnanam KandhanNoch keine Bewertungen

- CCS (Pension) Rules-2021Dokument57 SeitenCCS (Pension) Rules-2021Bhaskar MajumderNoch keine Bewertungen

- Chapter 10Dokument4 SeitenChapter 10conal laneNoch keine Bewertungen

- GSIS Law 1Dokument13 SeitenGSIS Law 1Arbie Dela TorreNoch keine Bewertungen

- Retirement BenefitsDokument9 SeitenRetirement BenefitsSaptarshi PalNoch keine Bewertungen

- SL ReviewerDokument38 SeitenSL ReviewerErgel Mae Encarnacion RosalNoch keine Bewertungen

- Lesson 7 CRI 168Dokument2 SeitenLesson 7 CRI 168Kiray RobianesNoch keine Bewertungen

- RA 8291 GSIS ActDokument19 SeitenRA 8291 GSIS ActAicing Namingit-VelascoNoch keine Bewertungen

- WN On National Pension System 2023 FBDokument4 SeitenWN On National Pension System 2023 FBRavi Prakash MeenaNoch keine Bewertungen

- Pension SettlementDokument3 SeitenPension SettlementSatyaranjan KoduruNoch keine Bewertungen

- Voluntary Retirement Scheme: VRS-Aug'07Dokument5 SeitenVoluntary Retirement Scheme: VRS-Aug'07psychicnutNoch keine Bewertungen

- AgDokument24 SeitenAgPrincipalNoch keine Bewertungen

- ParbaagDokument72 SeitenParbaagravi kumarNoch keine Bewertungen

- Question BankDokument2 SeitenQuestion BankPrincipalNoch keine Bewertungen

- Fundamental RulesDokument86 SeitenFundamental RulesRupakDas50% (4)

- PGDokument10 SeitenPGPrincipalNoch keine Bewertungen

- PGDokument10 SeitenPGPrincipalNoch keine Bewertungen

- DiscussionDokument3 SeitenDiscussionPranesh DebnathNoch keine Bewertungen

- Numerical Modelling of Brine Dispersion in Shallow Coastal WatersDokument13 SeitenNumerical Modelling of Brine Dispersion in Shallow Coastal WatersIAEME PublicationNoch keine Bewertungen

- Leoline Installation and MaintenanceDokument8 SeitenLeoline Installation and MaintenanceFloorkitNoch keine Bewertungen

- Quorum Sensing PDFDokument9 SeitenQuorum Sensing PDFShareenMuneebNoch keine Bewertungen

- UNIT-5 International Dimensions To Industrial Relations: ObjectivesDokument27 SeitenUNIT-5 International Dimensions To Industrial Relations: ObjectivesManish DwivediNoch keine Bewertungen

- CPVC Price ListDokument8 SeitenCPVC Price ListYashwanth GowdaNoch keine Bewertungen

- IFAD Vietnam RIMS Training Workshop 2011 (1 of 7)Dokument18 SeitenIFAD Vietnam RIMS Training Workshop 2011 (1 of 7)IFAD VietnamNoch keine Bewertungen

- GAD OrientationDokument58 SeitenGAD OrientationKevin Dalangin100% (2)

- CD Compre Exam 2 Key AnswerDokument6 SeitenCD Compre Exam 2 Key AnswerGrace LazaroNoch keine Bewertungen

- Pathological Anatomy IntroDokument27 SeitenPathological Anatomy IntroJoiya KhanNoch keine Bewertungen

- NWO Plans Exposed by Insider in 1969Dokument36 SeitenNWO Plans Exposed by Insider in 1969Stig Dragholm100% (3)

- Healing and Keeping Prayer (2013)Dokument2 SeitenHealing and Keeping Prayer (2013)Kylie DanielsNoch keine Bewertungen

- Challenges in The Functional Diagnosis of Thyroid Nodules Before Surgery For TSH-producing Pituitary AdenomaDokument5 SeitenChallenges in The Functional Diagnosis of Thyroid Nodules Before Surgery For TSH-producing Pituitary AdenomaAthul IgnatiusNoch keine Bewertungen

- Testing For Cations Flow ChartDokument2 SeitenTesting For Cations Flow Chartapi-252561013Noch keine Bewertungen

- Financial Problems Are Commonly Faced by EveryoneDokument2 SeitenFinancial Problems Are Commonly Faced by EveryoneGrace Ann Mancao PototNoch keine Bewertungen

- Neicchi 270 ManualDokument33 SeitenNeicchi 270 Manualmits2004Noch keine Bewertungen

- 10.4324 9781315717289 PreviewpdfDokument179 Seiten10.4324 9781315717289 PreviewpdfMahdi GargouriNoch keine Bewertungen

- Pipe Thickness CalculationDokument4 SeitenPipe Thickness CalculationHarryNoch keine Bewertungen

- ENT Head and Neck ExamDokument21 SeitenENT Head and Neck ExamvickyNoch keine Bewertungen

- API 16C ErrataDokument1 SeiteAPI 16C ErrataDinesh KumarNoch keine Bewertungen

- Single Conductor 15KV, Shielded, MV-105Dokument2 SeitenSingle Conductor 15KV, Shielded, MV-105henry hernandezNoch keine Bewertungen

- MB Marine Product Guide 2022 RevNDokument35 SeitenMB Marine Product Guide 2022 RevNamir sadighiNoch keine Bewertungen

- AlaTOP Allergy Screen OUS - IMMULITE 2000 Systems - Rev 21 DXDCM 09017fe98067cfcb-1645658153157Dokument28 SeitenAlaTOP Allergy Screen OUS - IMMULITE 2000 Systems - Rev 21 DXDCM 09017fe98067cfcb-1645658153157Pierre LavoisierNoch keine Bewertungen

- Megapower: Electrosurgical GeneratorDokument45 SeitenMegapower: Electrosurgical GeneratorAnibal Alfaro VillatoroNoch keine Bewertungen

- Endovascular Skills CourseDokument20 SeitenEndovascular Skills CourseAbdullah JibawiNoch keine Bewertungen

- Complications of Diabetes MellitusDokument46 SeitenComplications of Diabetes MellitusAbhijith MenonNoch keine Bewertungen

- Flock MenuDokument5 SeitenFlock MenuWilson TayNoch keine Bewertungen

- Lithium Primary Batteries (Jauch)Dokument72 SeitenLithium Primary Batteries (Jauch)MedSparkNoch keine Bewertungen