Beruflich Dokumente

Kultur Dokumente

Intro To Government Accounting

Hochgeladen von

ralph anthony macahiligOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Intro To Government Accounting

Hochgeladen von

ralph anthony macahiligCopyright:

Verfügbare Formate

GOVERNMENT ACCOUNTING

Definition of Terms:

a. Accrual basis – means a basis of accounting under which transactions and other events are recognized when

they occur (and not only when cash or its equivalent is received or paid). Therefore, the transactions and events

are recognized in the accounting records and recognized in the financial statements of the periods to which they

relate. The elements recognized under accrual accounting are assets, liabilities, net assets/equity, revenue, and

expenses.

b. Assets – are resources controlled by an entity as a result of past events, and from which future economic

benefits or service potential are expected to flow to the entity.

c. Entity – refers to a government agency, department or operating/field unit. It may be referred to in this GAM as

an agency.

d. Expenses – are decreases in economic benefits or service potential during the reporting period in the form of

outflows or consumption of assets or incurrence of liabilities that result in decreases in net assets/equity, other

than those relating to distributions to owners.

e. Government Accounting – encompasses the processes of analyzing, recording, classifying, summarizing and

communicating all transactions involving the receipt and disposition of government funds and property, and

interpreting the results thereof. (Sec. 109, Presidential Decree (P.D.) No. 1445)

f. Government Budget – is the financial plan of a government for a given period, usually for a fiscal year, which

shows what its resources are, and how they will be generated 3 and used over the fiscal period. The budget is

the government's key instrument for promoting its socio-economic objectives. The government budget also

refers to the income, expenditures and sources of borrowings of the National Government (NG) that are used to

achieve national objectives, strategies and programs.

g. Liabilities – are firm obligations of the entity arising from past events, the settlement of which is expected to

result in an outflow from the entity of resources embodying economic benefits or service potential.

h. Net assets/equity – is the residual interest in the assets of the entity after deducting all its liabilities.

i. Revenue – is the gross inflow of economic benefits or service potential during the reporting period when those

inflows result in an increase in net assets/equity, other than increases relating to contributions from owners.

j. Revenue funds – comprise all funds derived from the income of any agency of the government and available for

appropriation or expenditure in accordance with law.

k. Allotment – is an authorization issued by the DBM to NGAs to incur obligations for specified amounts contained

in a legislative appropriation in the form of budget release documents. It is also referred to as Obligational

Authority.

l. Appropriations – is the authorization made by a legislative body to allocate funds for purposes specified by the

legislative or similar authority.

m. Approved Budget – is the expenditure authority derived from appropriation laws, government ordinances, and

other decisions related to the anticipated revenue or receipts for the budgetary period.

The approved budget consists of the following:

UACS Code New General Appropriations

01 Continuing Appropriations

02 Supplemental Appropriations

03 Automatic Appropriations

04 Unprogrammed Funds

05 Retained Income/Funds

06 Revolving Funds

07 Trust Receipts

n. Automatic Appropriations – are the authorizations programmed annually or for some other period prescribed by

law, by virtue of outstanding legislation which does not require periodic action by Congress.

o. Budget Information – the budgetary information consists of, among others, data on appropriations or the

approved budget, allotments, obligations, revenues and other receipts, and disbursements.

p. Continuing Appropriations – are the authorizations to support obligations for a specific purpose or project, such

as multi-year construction projects which require the incurrence of obligations even beyond the budget year.

q. Disbursements – are the actual amounts spent or paid out of the budgeted amounts.

r. Final Budget – is the original budget adjusted for all reserves, carry-over amounts, transfers, allocations and

other authorized legislative or similar authority changes applicable to the budget period.

s. New General Appropriations – are annual authorizations for incurring obligations during a specified budget year,

as listed in the GAA.

t. Obligation – is an act of a duly authorized official which binds the government to the immediate or eventual

payment of a sum of money. Obligation maybe referred to as a commitment that encompasses possible future

liabilities based on current contractual agreement.

u. Original Budget – is the initial approved budget for the budget period usually the General Appropriations Act

(GAA). The original budget may include residual appropriated amounts automatically carried over from prior

years by law such as prior year commitments or possible future liabilities based on a current contractual

agreement.

v. Revenues – are increases in economic benefits or service potential during the accounting period in the form of

inflows or increases of assets or decreases of liabilities that result in increases in net assets/equity, other than

those relating to contributions from owners.

Objectives of General Purpose Financial Statements.

The objectives of general purpose financial statements (GPFSs) are to provide information about the financial position,

financial performance, and cash flows of an entity that is useful to a wide range of users in making and evaluating

decisions about the allocation of resources. Specifically, the objectives of general purpose financial reporting in the

public sector are to provide information useful for decision-making, and to demonstrate the accountability of the entity

for the resources entrusted to it.

Components of General Purpose Financial Statements.

The complete set of GPFSs consists of:

a. Statement of Financial Position (Annex A)

b. Statement of Financial Performance (Annex B)

c. Statement of Changes in Net Assets/Equity (Annex C)

d. Statement of Cash Flows (Annex D)

e. Statement of Comparison of Budget and Actual Amounts (Annex E)

f. Notes to the Financial Statements, comprising a summary of significant accounting policies and other explanatory

notes. (Annex F)

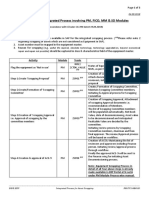

Registries of Allotments, Obligations and Disbursements

The Registries of Allotments, Obligations and Disbursements (RAOD) shall be maintained by the Budget Division/Unit of

agencies to record allotments, obligations and disbursements. It shall show the allotments received for the year,

obligations incurred against the corresponding allotment and the actual disbursements made. The balance is extracted

every time an entry is made to prevent incurrence of obligations in excess of allotment and overdraft in disbursements

against obligations incurred. The RAODs shall be maintained by appropriation act, fund cluster, MFO/PAP, and allotment

class.

a. Registry of Allotments, Obligations and Disbursements-Personnel Services (RAOD-PS) (Appendix 9A) shall be

used to record the allotments received, obligations incurred and disbursements classified under PS.

b. b. Registry of Allotments, Obligations and Disbursements-Maintenance and Other Operating Expenses (RAOD-

MOOE) (Appendix 9B) shall be used to record the allotments received, obligations incurred and disbursements

classified under MOOE.

c. Registry of Allotments, Obligations and Disbursements-Financial Expenses (RAOD-FE) (Appendix 9C) shall be

used to record the allotments received, obligations incurred and disbursements classified under FE.

d. Registry of Allotments, Obligations and Disbursements-Capital Outlays (RAOD-CO) (Appendix 9D) shall be used

to record the allotments received, obligations incurred and disbursements classified under CO.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Basic Accounting Qualifying ExamDokument6 SeitenBasic Accounting Qualifying Examiamjnschrstn70% (10)

- COA Construction General ContractorDokument16 SeitenCOA Construction General ContractorLarryMatiasNoch keine Bewertungen

- BSA 1101 Fundamentals of Accounting 1 and 2 Prelim PDFDokument14 SeitenBSA 1101 Fundamentals of Accounting 1 and 2 Prelim PDFAnn Santos100% (1)

- The Professional CPA Review School: Advanced Financial Accounting & Reporting Summary Notes On Government AccountingDokument14 SeitenThe Professional CPA Review School: Advanced Financial Accounting & Reporting Summary Notes On Government Accountingjohn francisNoch keine Bewertungen

- Accounting For Income Tax ExamDokument6 SeitenAccounting For Income Tax ExamAnn Christine C. Chua100% (2)

- Gul AhmedDokument18 SeitenGul AhmedMINDPOW100% (1)

- Audit of InventoryDokument7 SeitenAudit of InventoryDianne Antoinette Basallo0% (1)

- Mock Cpa Board Exams Rfjpia R 12 WDokument17 SeitenMock Cpa Board Exams Rfjpia R 12 Wlongix100% (2)

- Rizal Chapter 15 The Destiny of The Filipino People 1Dokument15 SeitenRizal Chapter 15 The Destiny of The Filipino People 1ralph anthony macahilig100% (3)

- Renaissance and Mannerism .PPTX 5Dokument78 SeitenRenaissance and Mannerism .PPTX 5ralph anthony macahiligNoch keine Bewertungen

- Chapter 5 and 6Dokument15 SeitenChapter 5 and 6ralph anthony macahiligNoch keine Bewertungen

- Chapter 7 Market StructuresDokument30 SeitenChapter 7 Market Structuresralph anthony macahiligNoch keine Bewertungen

- Thesis TallyDokument35 SeitenThesis Tallyralph anthony macahiligNoch keine Bewertungen

- Agrarian ReformDokument21 SeitenAgrarian Reformralph anthony macahiligNoch keine Bewertungen

- Bustax Midtem Quiz 1 Answer Key Problem SolvingDokument2 SeitenBustax Midtem Quiz 1 Answer Key Problem Solvingralph anthony macahiligNoch keine Bewertungen

- Nonstock Articles of Incorporation and Bylaws June2015v2Dokument11 SeitenNonstock Articles of Incorporation and Bylaws June2015v2Cathleen HernandezNoch keine Bewertungen

- La Liga FilipinaDokument21 SeitenLa Liga Filipinaralph anthony macahilig100% (1)

- Kay Breeze Balance SheetDokument9 SeitenKay Breeze Balance Sheetdaniel whitelyNoch keine Bewertungen

- Corporate - Income - Tax (CIT) 2022Dokument44 SeitenCorporate - Income - Tax (CIT) 2022Thảo Nhi Đinh TrầnNoch keine Bewertungen

- FB3410 Lecture NotesDokument141 SeitenFB3410 Lecture NotesJessica Adharana Kurnia100% (1)

- KKCL - Investor Presentation Q2 & H1FY24Dokument45 SeitenKKCL - Investor Presentation Q2 & H1FY24Variable SeperableNoch keine Bewertungen

- CHAPTER 7 - Corporation in Financial Difficulty - LiquidationDokument34 SeitenCHAPTER 7 - Corporation in Financial Difficulty - LiquidationmonneNoch keine Bewertungen

- Chp14 ConceptsDokument9 SeitenChp14 ConceptsMohd Hafiz AhmadNoch keine Bewertungen

- 05 ALCAR ApproachDokument25 Seiten05 ALCAR ApproachVaidyanathan Ravichandran100% (2)

- Human Resource Accounting: An Implication For Managerial Decisions in Indian Hotel IndustryDokument8 SeitenHuman Resource Accounting: An Implication For Managerial Decisions in Indian Hotel IndustryNEXT LEVEL BASSNoch keine Bewertungen

- Activity No.3Dokument2 SeitenActivity No.3Krung KrungNoch keine Bewertungen

- Excel Files Flame Final Accounts 2k6Dokument15 SeitenExcel Files Flame Final Accounts 2k6api-3700469Noch keine Bewertungen

- Asset ImpairmentDokument5 SeitenAsset Impairmentanishokm2992Noch keine Bewertungen

- Basic Practice of Ratio Analysis NumericalDokument9 SeitenBasic Practice of Ratio Analysis NumericalhammadmajeedNoch keine Bewertungen

- The Impact of A New Accounting Standard To An EntityDokument4 SeitenThe Impact of A New Accounting Standard To An EntityDhenzel AntonioNoch keine Bewertungen

- Protein Trio Young LivingDokument52 SeitenProtein Trio Young Livingandina juniarNoch keine Bewertungen

- PMG 324 Resource Managment PlanDokument9 SeitenPMG 324 Resource Managment Planapi-719624868Noch keine Bewertungen

- Inernship Project at BhagyarekhaDokument40 SeitenInernship Project at BhagyarekhaVishal MehtaNoch keine Bewertungen

- Asset Scrapping - PM FICO MM SD Integrated ProcessDokument3 SeitenAsset Scrapping - PM FICO MM SD Integrated ProcessSub Divisional Engineer C & ERP BSNL PuducherryNoch keine Bewertungen

- Operating Segment: Intermediate Accounting 3Dokument51 SeitenOperating Segment: Intermediate Accounting 3Trisha Mae AlburoNoch keine Bewertungen

- AsdasfDokument11 SeitenAsdasfTanvir Ahamed TuhinNoch keine Bewertungen

- 2001 Financial Statements enDokument63 Seiten2001 Financial Statements enEarn8348Noch keine Bewertungen

- Assignment of Depreciation PDFDokument50 SeitenAssignment of Depreciation PDFMuhammad Arslan0% (2)

- Stock Report On Crompton Greevs in India May 23 2020Dokument10 SeitenStock Report On Crompton Greevs in India May 23 2020PranavPillaiNoch keine Bewertungen

- Comprehensive Problem On Financial Statement PositionDokument2 SeitenComprehensive Problem On Financial Statement PositionLesa RobinsonNoch keine Bewertungen

- Consolidated Financial Statement From BPCL Website - 2019 - 20Dokument10 SeitenConsolidated Financial Statement From BPCL Website - 2019 - 20Mahesh RamamurthyNoch keine Bewertungen