Beruflich Dokumente

Kultur Dokumente

Praktika Inventory

Hochgeladen von

RadizaJisiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Praktika Inventory

Hochgeladen von

RadizaJisiCopyright:

Verfügbare Formate

CASE 1

Flamingo Corporation acquired an 80% interest in Stone Corporation several years ago

when the book values and fair values of Stone's assets and liabilities were equal. At the

time of acquisition, the cost of the 80% interest was equal to 80% of the book value of

Stone's net assets. Separate company income statements for Flamingo and Stone for the

year ended December 31, 2017 are summarized as follows:

Flamingo Stone

Sales Revenue $1,000,000 $600,000

Investment income from Stern 85,000

Cost of Goods Sold (600,000) (300,000)

Expenses (200,000) (200,000)

Net Income $285,000 $100,000

During 2016, Flamingo sold merchandise that cost $120,000 to Stone for $180,000. Half

of this merchandise remained in Stone's inventory at December 31, 2016. During 2017,

Flamingo sold merchandise that cost $150,000 to Stone for $225,000. One-third of this

merchandise remained in Stone's December 31, 2017 inventory.

Required:

Prepare a consolidated income statement for Flamingo Corporation and Subsidiary for

2017.

CASE 2

On January 1, 2014, Paar Incorporated paid $38,500 for a 70% interest in Siba

Enterprises, at a time when Siba's stockholder's equity consisted of $20,000 in Capital

stock and $30,000 in Retained Earnings. The fair values of Siba's assets and liabilities

equaled their recorded book values at that time, so any additional amount paid was

attributed to goodwill.

In 2014, Siba purchased merchandise from Paar at a price of $6,000. The products

originally cost Paar $4,000, and 75% of this merchandise remained in inventory at

December 31, 2014. This inventory was sold in 2015. Siba reported net income of

$9,000 and paid dividends of $3,000 during 2014.

In 2015, Siba purchased merchandise from Paar at a price of $8,000. The products had a

cost to Paar of $7,000, and 50% of this merchandise remained in inventory at December

31, 2015. Siba still owed Paar $1,800 for these purchases at December 31, 2015.

Required:

Financial statements of Paar and Siba appear in the first two columns of the partially

completed working papers.

1) Complete the consolidation working papers for Paar Corporation and Subsidiary for

the year ended December 31, 2015.

2) Provide the working paper journalizing necessary for the elimination and

adjustment process in the making of consolidated financial statements.

Das könnte Ihnen auch gefallen

- SSNDokument1.377 SeitenSSNBrymo Suarez100% (9)

- Exercise Answers - Consolidated Financial Position and Comprehensive IncomeDokument8 SeitenExercise Answers - Consolidated Financial Position and Comprehensive IncomeJohn Philip L ConcepcionNoch keine Bewertungen

- Module Assessment Answers - Group Accounts 2Dokument11 SeitenModule Assessment Answers - Group Accounts 2John Philip L Concepcion100% (1)

- Exercise Answers - Consolidated FS - Statement of Comprehensive IncomeDokument6 SeitenExercise Answers - Consolidated FS - Statement of Comprehensive IncomeJohn Philip L Concepcion50% (2)

- Hollywood Game Plan 20 Page Sample PDFDokument20 SeitenHollywood Game Plan 20 Page Sample PDFMichael Wiese Productions0% (1)

- Exotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsVon EverandExotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsNoch keine Bewertungen

- Business combination equipment valuationDokument3 SeitenBusiness combination equipment valuationJohn Philip L ConcepcionNoch keine Bewertungen

- Intercompany TransactionsDokument7 SeitenIntercompany TransactionsJulie Mae Caling MalitNoch keine Bewertungen

- B+V ELEVATOR SIDE DOOR Collar Type VS09 A4Dokument19 SeitenB+V ELEVATOR SIDE DOOR Collar Type VS09 A4Игорь ШиренинNoch keine Bewertungen

- 2016 AICPA FAR - DifficultDokument51 Seiten2016 AICPA FAR - DifficultTai D Giang100% (1)

- CGL Flame - Proof - MotorsDokument15 SeitenCGL Flame - Proof - MotorspriteshNoch keine Bewertungen

- Quiz Number 2 BuscombDokument12 SeitenQuiz Number 2 BuscombRyan CapistranoNoch keine Bewertungen

- Advanced Accounting Homework Week 5 ConsolidationDokument5 SeitenAdvanced Accounting Homework Week 5 ConsolidationFebrina ClaudyaNoch keine Bewertungen

- Soal Latihan 2Dokument4 SeitenSoal Latihan 2Fradila Ayu NabilaNoch keine Bewertungen

- Answer To Practice Set IDokument1 SeiteAnswer To Practice Set IDin Rose Gonzales100% (1)

- Types of Sensor and Their ApplicationDokument6 SeitenTypes of Sensor and Their Applicationpogisimpatiko0% (1)

- Pathways-Childrens Ministry LeaderDokument16 SeitenPathways-Childrens Ministry LeaderNeil AtwoodNoch keine Bewertungen

- Akl Baru BangetDokument10 SeitenAkl Baru BangetRaihan Rohadatul 'AisyNoch keine Bewertungen

- Consolidated FS QuizDokument4 SeitenConsolidated FS QuizCattleya0% (2)

- Tugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Dokument5 SeitenTugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNoch keine Bewertungen

- E3-3 (Based On AICPA) General Problems: Balance Sheet AccountsDokument10 SeitenE3-3 (Based On AICPA) General Problems: Balance Sheet AccountsSintia Marada Hutagalung50% (2)

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesVon EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNoch keine Bewertungen

- Effects of War On EconomyDokument7 SeitenEffects of War On Economyapi-3721555100% (1)

- Soal Latihan 2 AKL 2ADokument3 SeitenSoal Latihan 2 AKL 2ARyza DyandraNoch keine Bewertungen

- Intercompany Inventory TransactionsDokument3 SeitenIntercompany Inventory TransactionsMeysi SoviaNoch keine Bewertungen

- Consolidation Changes in OwnershipDokument13 SeitenConsolidation Changes in Ownershipdoc nurfatkhiyahNoch keine Bewertungen

- Equity InvestmentsDokument2 SeitenEquity InvestmentsNhajNoch keine Bewertungen

- Tutorial Questions Week 4Dokument10 SeitenTutorial Questions Week 4julia chengNoch keine Bewertungen

- KuisDokument2 SeitenKuisAvira RestyantiNoch keine Bewertungen

- Calculating Consolidated Financial Statements and Eliminating Intra-Entity TransactionsDokument2 SeitenCalculating Consolidated Financial Statements and Eliminating Intra-Entity Transactionscrushy2415100% (1)

- Buscom Lecture-3Dokument4 SeitenBuscom Lecture-3Dai SyNoch keine Bewertungen

- Consolidated FS (Financial Position)Dokument4 SeitenConsolidated FS (Financial Position)Arn KylaNoch keine Bewertungen

- (Quiz Uas Take Home) Akl-1 PDFDokument7 Seiten(Quiz Uas Take Home) Akl-1 PDFStephani ElvinaNoch keine Bewertungen

- Buss CombiDokument2 SeitenBuss CombiErika LanezNoch keine Bewertungen

- Long Quiz For InvestmentDokument2 SeitenLong Quiz For InvestmentBarbie BleuNoch keine Bewertungen

- Final ExaminationDokument3 SeitenFinal ExaminationCezanne Pi-ay EckmanNoch keine Bewertungen

- Total P 1,200,000: Refer PDF Problem 1Dokument2 SeitenTotal P 1,200,000: Refer PDF Problem 1Joanna Rose DeciarNoch keine Bewertungen

- Tugas Aklan TM7Dokument7 SeitenTugas Aklan TM7AdnanNoch keine Bewertungen

- Kuis 1 Akuntansi Keuangan Lanjutan Semester Antara 2019/2020Dokument3 SeitenKuis 1 Akuntansi Keuangan Lanjutan Semester Antara 2019/2020danu prayuda0% (1)

- Audit of EquityDokument5 SeitenAudit of EquityKarlo Jude Acidera0% (1)

- Calculating Investment Income from AssociatesDokument2 SeitenCalculating Investment Income from Associatesmiss independent100% (1)

- Quiz On Intercompany Profits Quiz 3 THEORY-The First Four Numbers Should Be Answered Using The FollowingDokument9 SeitenQuiz On Intercompany Profits Quiz 3 THEORY-The First Four Numbers Should Be Answered Using The FollowingAgatha de CastroNoch keine Bewertungen

- AFAR - BC TwoDokument3 SeitenAFAR - BC TwoJoanna Rose DeciarNoch keine Bewertungen

- Consolidated Balance Sheets and Income Statements of Pare and SubsidiaryDokument3 SeitenConsolidated Balance Sheets and Income Statements of Pare and SubsidiaryRaymundo Eirah100% (1)

- FAR - RQ - Investment in AssociatesDokument2 SeitenFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- AKUNTANSI KEUANGAN LANJUTANDokument2 SeitenAKUNTANSI KEUANGAN LANJUTANLaksmi Banowati Sadmoko HadiNoch keine Bewertungen

- Investment in Associate 2022Dokument3 SeitenInvestment in Associate 2022lirva cantonaNoch keine Bewertungen

- Far-1 1Dokument4 SeitenFar-1 1Raymundo EirahNoch keine Bewertungen

- ACTREV 4: Business Combination Review QuestionsDokument6 SeitenACTREV 4: Business Combination Review QuestionsProm GloryNoch keine Bewertungen

- Pine Company Owns 40 PercentDokument1 SeitePine Company Owns 40 PercentKia Potts0% (1)

- Mixed Sample ProblemsDokument11 SeitenMixed Sample ProblemsKathleen MarcialNoch keine Bewertungen

- Partnership and Corporation Comprehensive ProblemDokument2 SeitenPartnership and Corporation Comprehensive ProblemJustin Mae BagaNoch keine Bewertungen

- CA 51024 - Module 3-Various ProblemsDokument4 SeitenCA 51024 - Module 3-Various ProblemsNia BranzuelaNoch keine Bewertungen

- Final Examination in Business Combi 2021Dokument7 SeitenFinal Examination in Business Combi 2021Michael BongalontaNoch keine Bewertungen

- ACCO 420 Midterm Fall 2017Dokument6 SeitenACCO 420 Midterm Fall 2017conu studentNoch keine Bewertungen

- Midterms - Assignment No. 1Dokument1 SeiteMidterms - Assignment No. 1cedrickNoch keine Bewertungen

- Chapter 2 Advanced AccountingDokument9 SeitenChapter 2 Advanced AccountingMohamad Adel Al AyoubiNoch keine Bewertungen

- 2.1 Multiple Choice Questions (Circle The Correct Answer, 2 Points Each)Dokument3 Seiten2.1 Multiple Choice Questions (Circle The Correct Answer, 2 Points Each)Kyle Lee UyNoch keine Bewertungen

- Problem 11 AFARDokument4 SeitenProblem 11 AFARNorman Delirio0% (1)

- Intermediate Accounting CH 14 HWDokument5 SeitenIntermediate Accounting CH 14 HWBreanna WolfordNoch keine Bewertungen

- Latihan Soal Chapter 5 SD 7Dokument6 SeitenLatihan Soal Chapter 5 SD 7Andy warholNoch keine Bewertungen

- MidDokument4 SeitenMidFroilan Arlando BandulaNoch keine Bewertungen

- Financial Statement Analysis Quiz QuestionsDokument3 SeitenFinancial Statement Analysis Quiz Questionsmarie joy ortizNoch keine Bewertungen

- Exercise 6Dokument4 SeitenExercise 6Tania MaharaniNoch keine Bewertungen

- Illustrative Problems On IAS 2 InventoriesDokument2 SeitenIllustrative Problems On IAS 2 InventoriesAnne Marieline BuenaventuraNoch keine Bewertungen

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationVon EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Module 3 Paired and Two Sample T TestDokument18 SeitenModule 3 Paired and Two Sample T TestLastica, Geralyn Mae F.Noch keine Bewertungen

- Beyond B2 English CourseDokument1 SeiteBeyond B2 English Coursecarlitos_coolNoch keine Bewertungen

- VFD ManualDokument187 SeitenVFD ManualgpradiptaNoch keine Bewertungen

- SRC400C Rough-Terrain Crane 40 Ton Lifting CapacityDokument1 SeiteSRC400C Rough-Terrain Crane 40 Ton Lifting CapacityStephen LowNoch keine Bewertungen

- Questions - TrasportationDokument13 SeitenQuestions - TrasportationAbhijeet GholapNoch keine Bewertungen

- Priming An Airplane EngineDokument6 SeitenPriming An Airplane Enginejmoore4678Noch keine Bewertungen

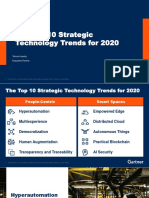

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerDokument31 SeitenThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloNoch keine Bewertungen

- Sceduling and Maintenance MTP ShutdownDokument18 SeitenSceduling and Maintenance MTP ShutdownAnonymous yODS5VNoch keine Bewertungen

- AP World History: Islamic Empires and Scientific AdvancementDokument55 SeitenAP World History: Islamic Empires and Scientific AdvancementJa'TasiaNoch keine Bewertungen

- An RNA Vaccine Drives Expansion and Efficacy of claudin-CAR-T Cells Against Solid TumorsDokument9 SeitenAn RNA Vaccine Drives Expansion and Efficacy of claudin-CAR-T Cells Against Solid TumorsYusuf DemirNoch keine Bewertungen

- ROM Magazine V1i6Dokument64 SeitenROM Magazine V1i6Mao AriasNoch keine Bewertungen

- Opamp TIDokument5 SeitenOpamp TIAmogh Gajaré100% (1)

- Case Study - Help DocumentDokument2 SeitenCase Study - Help DocumentRahNoch keine Bewertungen

- EGMM - Training Partner MOUDokument32 SeitenEGMM - Training Partner MOUShaik HussainNoch keine Bewertungen

- Modification Adjustment During Upgrade - Software Logistics - SCN WikiDokument4 SeitenModification Adjustment During Upgrade - Software Logistics - SCN Wikipal singhNoch keine Bewertungen

- 8086 Microprocessor: J Srinivasa Rao Govt Polytechnic Kothagudem KhammamDokument129 Seiten8086 Microprocessor: J Srinivasa Rao Govt Polytechnic Kothagudem KhammamAnonymous J32rzNf6ONoch keine Bewertungen

- Past Paper Booklet - QPDokument506 SeitenPast Paper Booklet - QPMukeshNoch keine Bewertungen

- Climate Change in Bryce CanyonDokument8 SeitenClimate Change in Bryce CanyonClaire CriseNoch keine Bewertungen

- Performance of a Pelton WheelDokument17 SeitenPerformance of a Pelton Wheellimakupang_matNoch keine Bewertungen

- Lignan & NeolignanDokument12 SeitenLignan & NeolignanUle UleNoch keine Bewertungen

- Irc SP 65-2005 PDFDokument32 SeitenIrc SP 65-2005 PDFAjay Kumar JainNoch keine Bewertungen

- Speech TravellingDokument4 SeitenSpeech Travellingshafidah ZainiNoch keine Bewertungen

- EE114-1 Homework 2: Building Electrical SystemsDokument2 SeitenEE114-1 Homework 2: Building Electrical SystemsGuiaSanchezNoch keine Bewertungen