Beruflich Dokumente

Kultur Dokumente

Financial at A Glance

Hochgeladen von

saeedOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial at A Glance

Hochgeladen von

saeedCopyright:

Verfügbare Formate

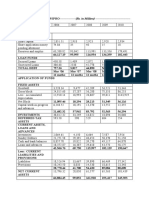

CONSOLIDATED FINANCIAL HIGHLIGHTS

(` in crore)

YEAR-END FINANCIAL POSITION 2015-16 2014-15 2013-14 2012-13 2011-12 2010-11 2009-10 2008 2007 2006

Net Fixed Assets (incl. CWIP) 3,621 3,149 3,024 2,523 3,506 3,468 3,237 3,630 3,071 1,707

Deferred Tax Assets/(Liabilities) (48) (53) (7) 24 (101) 73 47 41 (92) (92)

Investments – 3 3 3 91 90 95 93 71 –

TOTAL 3,573 3,099 3,020 2,550 3,496 3,631 3,379 3,764 3,050 1,615

Current Assets 4,331 3,788 3,597 3,490 2,656 2,073 2,172 2,964 2,011 2,002

Current Liabilities 1,151 1,017 994 1,265 1,189 912 862 1,475 887 581

Net Current Assets 3,180 2,771 2,603 2,225 1,467 1,161 1,310 1,489 1,124 1,421

Sub-Total 6,753 5,870 5,623 4,775 4,963 4,792 4,689 5,253 4,174 3,036

Foreign Currency Translation Reserve (301) (145) (197) (2) 24 183 158 144 26 (7)

Profit & Loss Account – – – – – – 6 – – –

TOTAL CAPITAL EMPLOYED 6,452 5,725 5,426 4,773 4,987 4,975 4,853 5,397 4,200 3,029

Capital

– Equity 55 55 55 55 55 55 55 55 55 55

– Preference 299 299 298 298 761 745 668 – – –

TOTAL 354 354 353 353 816 800 723 55 55 55

Reserves 3,218 3,217 3,031 2,349 679 326 112 1,107 1,245 1,004

NET WORTH 3,572 3,571 3,384 2,702 1,495 1,126 835 1,162 1,300 1,059

Minority Interest 470 144 136 – – – – – – –

Borrowings

– Secured 2,406 2,004 1,900 2,054 3,271 3,379 3,552 3,161 2,344 1,475

– Unsecured 4 6 6 17 221 470 466 1,074 556 495

TOTAL 2,410 2,010 1,906 2,071 3,492 3,849 4,018 4,235 2,900 1,970

TOTAL SOURCES 6,452 5,725 5,426 4,773 4,987 4,975 4,853 5,397 4,200 3,029

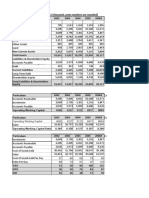

Summary of Operations

(including discontinued operations)

Sales (Excluding Excise) 4,461 4,481 4,830 5,721 4,614 3,751 4,501 3,590 2,491 1,729

Other Income 97 67 39 51 23 16 30 35 208 19

TOTAL INCOME 4,558 4,548 4,869 5,772 4,637 3,767 4,531 3,625 2,699 1,748

Material Consumed 1,604 1,488 1,806 1,814 1,682 1,516 1,973 1,360 993 668

Personnel Cost 944 869 769 663 589 550 735 632 458 269

Other expenses 1,395 1,298 1,276 1,128 903 776 970 812 563 392

EBIDTA 615 893 1,018 2,167 1,463 925 853 821 685 419

Interest Expense/(Income) 116 173 37 243 290 130 395 378 132 3

Depreciation 142 145 140 125 122 117 149 113 79 61

Profit Before Tax & Exceptional Items 357 575 841 1,799 1,051 678 309 330 474 355

Exceptional Items – loss/(gain) – – (50) (62) 474 574 1,295 581 – 61

PBT 357 575 891 1,861 577 104 (986) (251) 474 294

Tax (Expense)/Credit (26) (162) (48) (266) (235) (8) (16) 92 (91) (53)

PROFIT AFTER TAX BEFORE SHARE

OF PROFIT/(LOSS) OF ASSOCIATES

AND MINORITY INTEREST 331 413 843 1,595 342 96 (1,002) (159) 383 241

Share in Profit/(Loss) of Associate

Companies 1 – – (1) 1 (5) 2 21 3 –

Minority Interest – Profit/(Loss) 6 8 2 – – – – – – –

PROFIT AFTER TAX AFTER SHARE

OF PROFIT/(LOSS) OF ASSOCIATES

AND MINORITY INTEREST 326 405 841 1,594 343 91 (1,000) (138) 386 241

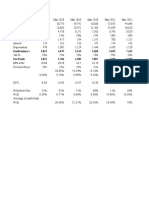

IMPORTANT RATIOS

Current Assets : Liabilities 3.76 3.72 3.62 2.76 2.23 2.27 2.50 2.01 2.27 3.45

Debt : Equity 0.67 0.56 0.56 0.77 2.34 3.42 4.81 3.65 2.23 1.86

PBT/Turnover % 8.0% 12.8% 18.4% 32.5% 12.5% 2.8% (21.9%) (7.0%) 19.0% 17.0%

Return (PBIT) on Capital Employed % 7.0% 12.7% 16.5% 44.1% 17.5% 4.9% (12.6%) 2.4% 14.5% 9.8%

No. of Equity Shares (in crore) 11.05 11.01 10.97 10.96 10.94 10.94 10.94 10.94 10.94 10.94

Dividend (per share) – 20.00 10.00 5.00 – – – – 11.25 5.00

Basic Earnings (per share) 29.50 36.81 76.6 145.6 31.3 8.3 (91.4) (12.7) 35.3 22.0

Net Worth (per share) 29.29 36.39 308.5 246.6 136.6 102.9 76.3 106.1 118.8 96.8

Notes: (1) In the year 2004 each equity share of ` 10/- each was sub-divided into 2 equity shares of ` 5/- each and bonus shares in the

ratio of 1 share for every two shares held were issued.

(2) The Figures for 2009-10 are for 15 month period ended March 31, 2010.

Das könnte Ihnen auch gefallen

- Super Gloves 2Dokument6 SeitenSuper Gloves 2anon_149445490Noch keine Bewertungen

- Bloody Practice !!Dokument4 SeitenBloody Practice !!Hardesh Kumar HiraNoch keine Bewertungen

- AnalysisDokument20 SeitenAnalysisSAHEB SAHANoch keine Bewertungen

- Royal Dutch Shell PLC: IndexDokument16 SeitenRoyal Dutch Shell PLC: IndexedriceNoch keine Bewertungen

- Starbucks Corporation (SBUX) Income Statement: Análisis de Estados FinancierosDokument7 SeitenStarbucks Corporation (SBUX) Income Statement: Análisis de Estados FinancierosjosolcebNoch keine Bewertungen

- Activity # 1 - KPIT Cummins Infosystems Ltd.Dokument22 SeitenActivity # 1 - KPIT Cummins Infosystems Ltd.Arun C PNoch keine Bewertungen

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Dokument1 SeiteSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCNoch keine Bewertungen

- Income Statement For Astra Agro Lestari TBK (AALI) From Morningstar PDFDokument1 SeiteIncome Statement For Astra Agro Lestari TBK (AALI) From Morningstar PDFGvz HndraNoch keine Bewertungen

- Financial ModelDokument38 SeitenFinancial ModelufareezNoch keine Bewertungen

- Balance Sheet As at March 31 of HDFC LTDDokument3 SeitenBalance Sheet As at March 31 of HDFC LTDAmith AravindNoch keine Bewertungen

- Fin 254 Group Project ExcelDokument12 SeitenFin 254 Group Project Excelapi-422062723Noch keine Bewertungen

- Swedish Match 9 212 017Dokument6 SeitenSwedish Match 9 212 017Karan AggarwalNoch keine Bewertungen

- Consolicated PL AccountDokument1 SeiteConsolicated PL AccountDarshan KumarNoch keine Bewertungen

- Apollo Tyres FSADokument12 SeitenApollo Tyres FSAChirag GugnaniNoch keine Bewertungen

- Bata Info3Dokument1 SeiteBata Info3harisinamNoch keine Bewertungen

- 3rd Quarter 15Dokument4 Seiten3rd Quarter 15TanayNoch keine Bewertungen

- 4019 XLS EngDokument4 Seiten4019 XLS EngAnonymous 1997Noch keine Bewertungen

- Balance Sheet of WiproDokument3 SeitenBalance Sheet of WiproRinni JainNoch keine Bewertungen

- UBL Annual Report 2018-128Dokument1 SeiteUBL Annual Report 2018-128IFRS LabNoch keine Bewertungen

- We Are Not Above Nature, We Are A Part of NatureDokument216 SeitenWe Are Not Above Nature, We Are A Part of NaturePRIYADARSHI GOURAVNoch keine Bewertungen

- iMNS7jsuRvmEyLaZkLer - APS Balance SheetDokument3 SeiteniMNS7jsuRvmEyLaZkLer - APS Balance SheetWajahat MazharNoch keine Bewertungen

- SIRA1H11Dokument8 SeitenSIRA1H11Inde Pendent LkNoch keine Bewertungen

- Exide Pakistan Limited: Five Year Financial AnalysisDokument13 SeitenExide Pakistan Limited: Five Year Financial AnalysisziaNoch keine Bewertungen

- CPIN Financial Report-2020Q4-2023Q1Dokument4 SeitenCPIN Financial Report-2020Q4-2023Q1Abdullah MNoch keine Bewertungen

- MamaDokument3 SeitenMamaLucky LuckyNoch keine Bewertungen

- Ratios and WACCDokument70 SeitenRatios and WACCABHIJEET BHUNIA MBA 2021-23 (Delhi)Noch keine Bewertungen

- Solution KPITDokument28 SeitenSolution KPITsuryasandeepc111Noch keine Bewertungen

- Petron Corp - Financial Analysis From 2014 - 2018Dokument4 SeitenPetron Corp - Financial Analysis From 2014 - 2018Neil Nadua100% (1)

- Group 3 FS Forecasting Jollibee SourceDokument43 SeitenGroup 3 FS Forecasting Jollibee SourceChristian VillarNoch keine Bewertungen

- Spyder Student ExcelDokument21 SeitenSpyder Student ExcelNatasha PerryNoch keine Bewertungen

- Ceres SpreadsheetDokument1 SeiteCeres SpreadsheetShannan RichardsNoch keine Bewertungen

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Dokument30 Seiten"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Consolidated Profit CanarabankDokument1 SeiteConsolidated Profit CanarabankMadhav LuthraNoch keine Bewertungen

- PROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetDokument17 SeitenPROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetmissphNoch keine Bewertungen

- Askari Bank Limited Financial Statement AnalysisDokument16 SeitenAskari Bank Limited Financial Statement AnalysisAleeza FatimaNoch keine Bewertungen

- Premier CementDokument13 SeitenPremier CementWasif KhanNoch keine Bewertungen

- BHEL Valuation FinalDokument33 SeitenBHEL Valuation FinalragulNoch keine Bewertungen

- Ceres Gardening CalculationsDokument9 SeitenCeres Gardening CalculationsJuliana Marques0% (2)

- Atlas Honda: Analysis of Financial Statements Balance SheetDokument4 SeitenAtlas Honda: Analysis of Financial Statements Balance Sheetrouf786Noch keine Bewertungen

- Dersnot 1372 1684245035Dokument6 SeitenDersnot 1372 1684245035Murat SiyahkayaNoch keine Bewertungen

- ExcelDokument15 SeitenExcelBhargavi RathodNoch keine Bewertungen

- (Rs. in '000s) Year Ended March 31, 2010 Year Ended March 31, 2009Dokument27 Seiten(Rs. in '000s) Year Ended March 31, 2010 Year Ended March 31, 2009Shankar NathNoch keine Bewertungen

- Financial Statement 2017 - 2019Dokument14 SeitenFinancial Statement 2017 - 2019Audi Imam LazuardiNoch keine Bewertungen

- CIA DraftDokument10 SeitenCIA DraftJohnsey RoyNoch keine Bewertungen

- Atlas Honda (2019 22)Dokument6 SeitenAtlas Honda (2019 22)husnainbutt2025Noch keine Bewertungen

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDokument2 SeitenKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithNoch keine Bewertungen

- Excel Proyeksi KeuanganDokument26 SeitenExcel Proyeksi KeuanganMeliana WandaNoch keine Bewertungen

- Ceres Gardening Company - Spreadsheet For StudentsDokument1 SeiteCeres Gardening Company - Spreadsheet For Studentsandres felipe restrepo arango0% (1)

- Financial+Statements-Ceres+Gardening+Company 1Dokument5 SeitenFinancial+Statements-Ceres+Gardening+Company 1AG InteriorNoch keine Bewertungen

- BousteadDokument2 SeitenBousteadKam Kheen KanNoch keine Bewertungen

- UBL Annual Report 2018-129Dokument1 SeiteUBL Annual Report 2018-129IFRS LabNoch keine Bewertungen

- Ultratech Cement Working TemplateDokument42 SeitenUltratech Cement Working TemplateBcomE ANoch keine Bewertungen

- 31 March 2020Dokument8 Seiten31 March 2020lojanbabunNoch keine Bewertungen

- Paramount Student SpreadsheetDokument12 SeitenParamount Student Spreadsheetanshu sinhaNoch keine Bewertungen

- Lululemon Financial Highlights ($000) : Fiscal Year Ended Unaudited UnauditedDokument1 SeiteLululemon Financial Highlights ($000) : Fiscal Year Ended Unaudited UnauditedLI WilliamNoch keine Bewertungen

- Tiffany & Co's Analysis: Student Name Institutional Affiliation Course Name Instructor Name DateDokument6 SeitenTiffany & Co's Analysis: Student Name Institutional Affiliation Course Name Instructor Name DateOmer KhanNoch keine Bewertungen

- Profit Before T 3,853 4,879 5,543 5,058 5,953 7,452 Net Profit 2,851 3,786 4,289 3,897 4,353 5,630Dokument19 SeitenProfit Before T 3,853 4,879 5,543 5,058 5,953 7,452 Net Profit 2,851 3,786 4,289 3,897 4,353 5,630Abhishek M. ANoch keine Bewertungen

- Annual Report 2022Dokument512 SeitenAnnual Report 2022JohnNoch keine Bewertungen

- Extra 3Dokument2 SeitenExtra 3Ahmed GemyNoch keine Bewertungen

- F.Lundberg - The Rich and The Super-Rich (1968)Dokument632 SeitenF.Lundberg - The Rich and The Super-Rich (1968)Bob100% (1)

- SITXFIN004 PresentationDokument37 SeitenSITXFIN004 PresentationKomalben ChaudharyNoch keine Bewertungen

- Alpha New Trader GuideDokument9 SeitenAlpha New Trader GuideChaitanya ShethNoch keine Bewertungen

- An Analysis of The Suitability of The CME CF BRR For The Creation of Regulated Financial Products (UPDATED) PDFDokument24 SeitenAn Analysis of The Suitability of The CME CF BRR For The Creation of Regulated Financial Products (UPDATED) PDFJsNoch keine Bewertungen

- Housing ReportDokument6 SeitenHousing ReportJasmin QuebidoNoch keine Bewertungen

- 2 Major Types of AccountsDokument18 Seiten2 Major Types of AccountsLUKE ADAM CAYETANONoch keine Bewertungen

- Quiz 1: Attempt HistoryDokument33 SeitenQuiz 1: Attempt HistoryRNoch keine Bewertungen

- Business Partner Configuration in SAP REFXDokument3 SeitenBusiness Partner Configuration in SAP REFXdrdjdNoch keine Bewertungen

- Goldilocks-All Bout GoldilocksDokument13 SeitenGoldilocks-All Bout GoldilocksCharisse Nhet Clemente64% (14)

- HSBC HK Inward-PaymentsDokument2 SeitenHSBC HK Inward-PaymentsBenedict Wong Cheng WaiNoch keine Bewertungen

- Muntiariani - NTUC Income-Security BondDokument2 SeitenMuntiariani - NTUC Income-Security BondSyscom PrintingNoch keine Bewertungen

- Final EconomyDokument6 SeitenFinal EconomyA.Rahman Salah100% (1)

- Bank of The South An Alternative To The IMF World BankDokument45 SeitenBank of The South An Alternative To The IMF World BankCADTMNoch keine Bewertungen

- Chapter 1: Introduction To The Study of GlobalizationDokument80 SeitenChapter 1: Introduction To The Study of GlobalizationAshton Travis HawksNoch keine Bewertungen

- Coursera Financial Aid Answers (Sal) AdDokument2 SeitenCoursera Financial Aid Answers (Sal) AdAnkit SarkarNoch keine Bewertungen

- (PPT) Performance of Systematic Investment Plan On Selected Mutual Funds - SynopsisDokument9 Seiten(PPT) Performance of Systematic Investment Plan On Selected Mutual Funds - SynopsiskhayyumNoch keine Bewertungen

- Jeankeat TreatiseDokument96 SeitenJeankeat Treatisereadit777100% (9)

- 5479-Article Text-9982-1-10-20210515Dokument7 Seiten5479-Article Text-9982-1-10-20210515overkillNoch keine Bewertungen

- ExcelDokument55 SeitenExcelJashNoch keine Bewertungen

- Jhurzel Anne S. Aguilar BSBA MM-2105: Personal Income/expenses of The HeirsDokument4 SeitenJhurzel Anne S. Aguilar BSBA MM-2105: Personal Income/expenses of The HeirsJESTONI RAMOSNoch keine Bewertungen

- Internship ReportDokument22 SeitenInternship ReportBadari Nadh100% (1)

- Powers of Corporation TableDokument2 SeitenPowers of Corporation TableAna MendezNoch keine Bewertungen

- SIA Lab 5Dokument4 SeitenSIA Lab 5Matematika ekonomi Bu amelia hayatiNoch keine Bewertungen

- Week 7 Chapter 15Dokument27 SeitenWeek 7 Chapter 15Ogweno OgwenoNoch keine Bewertungen

- Real Estate Black BookDokument9 SeitenReal Estate Black BookVishal Dhekale0% (2)

- Working Capital ParleDokument95 SeitenWorking Capital Parlesanjaywasan100% (1)

- Notes - Chapter 4Dokument6 SeitenNotes - Chapter 4OneishaL.HughesNoch keine Bewertungen

- Research Proposal: Changes in Oil Prices and Their Impact On Emerging Markets ReturnsDokument11 SeitenResearch Proposal: Changes in Oil Prices and Their Impact On Emerging Markets ReturnsMehran Arshad100% (1)

- Taxation (Mock Exam)Dokument16 SeitenTaxation (Mock Exam)shahirah rahimNoch keine Bewertungen