Beruflich Dokumente

Kultur Dokumente

2019-Q3 QES - FINAL - tcm1045-412101

Hochgeladen von

FluenceMediaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2019-Q3 QES - FINAL - tcm1045-412101

Hochgeladen von

FluenceMediaCopyright:

Verfügbare Formate

Data on Minnesota Exports for Third Quarter 2019 – Published November 2019

For More Information: Elizabeth Frosch, 651-259-7008

State Exports Drop 2 Percent in Third Quarter

Minnesota exports of goods (including Figure 1. Export Growth for 21 States & D.C.

agricultural, mining and manufactured products)

were valued at $5.6 billion in the third quarter of

2019. The state’s exports dipped 2.2 percent,

while U.S. exports fell 1.7 percent between the

third quarters of 2018 and 2019.

Minnesota manufactured exports fell 2.4 percent,

to $5.3 billion, in the third quarter of 2019, while

U.S. exports fell 2.3 percent. MN: -2%

Between the first nine months of 2018 and 2019, U.S.: -2%

Minnesota exports shrank 1.8 percent, while U.S. Decline 0% Growth

exports decreased 1.2 percent.

Selected Growth Markets Bolster Exports In Midst of Widespread Declines

Countermeasures on U.S. exports by trading partners (including by China, the EU and India), in retaliation to

current U.S. trade policies, continued to create uncertainty and influence trade flows.

Exports weakened the most in Asia (down 4 percent to $2 billion; largely due to declines in China, Taiwan,

the Philippines and India) and in Central & South America (down 21 percent to $246 million; largely due to

declines to Brazil, Chile and Colombia). Sales to Canada, the U.K., Poland and Australia also struggled.

Exports to Mexico (up $49 million), Thailand (up $22 million), Indonesia (up $18 million), France (up $16

million), the Netherlands (up $11 million) and Costa Rica (up $11 million) grew over $10 million.

High-growth emerging markets included Uzbekistan (up $6.6 million), Kazakhstan (up $4.4 million),

Ethiopia (up $4.1 million), Morocco (up $3.9 million) and Cote d’Ivoire (up $3.1 million).

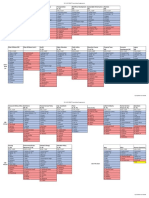

Figure 2. Exports and Trends Among Minnesota’s Top 10 Markets, Third Quarter 2019

2

Upward Trends in Sales of Optics/Medical, Pharmaceuticals, Fertilizers, and Ores

Optics and medical exports grew to China (up 18 percent), France (up 45 percent) and the Netherlands

(up 23 percent), but tumbled Canada (down 12 percent), Singapore (down 17 percent) and Australia

(down 19 percent). Orthopedic/artificial body parts (up 26 percent) and navigational instruments (up 84

percent) gained traction, while regulating instruments and material testing instruments lost ground.

China (up 26 percent) and the U.K. (up 95 Figure 3. Major Markets for Pharmaceuticals

percent) accounted for half of the state’s

Other 23%

pharmaceutical exports. High-growth segments China 38%

were blood products (up 21 percent) and

medications (up 141 percent).

Singapore 4%

Exports jumped in other chemical areas: fertilizers

(up 152 percent), organic chemicals (up 36 Netherlands 4%

percent) and inorganic chemicals (up 61 percent). Germany 6%

Growth in iron ore was built on higher demand in Italy 6% U.K. 12%

Japan (up 26 percent) and Canada (up 4 percent). Japan 7%

In agriculture and food areas, gains in meat, fats/oils, food by-products and other edible preparations

countered declines in cereals, prepared vegetables, oil seeds and prepared cereal/flour goods. Demand

strengthened in Thailand, Mexico and Canada but weakened in Chile, China, and the Philippines.

Demand for electrical equipment and machinery plummeted in markets such as in China, Japan, the

Philippines and the U.K. Most impacted were centrifuges/filters, taps/valves and computers for

machinery; and integrated circuits, diodes/transistors and electrical capacitors for electrical equipment.

Indonesia (up $18 million) and India (down $8 million) most influenced sales of wood pulp (up 21 percent).

Glass ($38 million, up 30 percent) export growth was steered by Mexico (up 246 percent) and Germany

(up 148 percent); and by multi-walled insulated glass (up 27 percent) and glass fibers (up 36 percent).

Sales of plastics faltered in larger (e.g. Mexico, China) and smaller (e.g. Poland, Brazil) markets. Affected

products included self-adhesive plates/sheets, miscellaneous plastics and vinyl chloride polymers.

Mineral fuels exports dropped 39 percent, as petroleum- and coal-related fuels sales plunged to Canada.

Figure 4. Exports and Trends Among Minnesota’s Top 10 Products, Third Quarter 2019

Minnesota Quarterly Export Statistics is the most current resource available for tracking the state’s manufactured export trends and is

prepared for the Minnesota Trade Office (MTO) by the Department of Employment and Economic Development’s (DEED) Economic

Analysis Unit (Thu-Mai Ho-Kim). The quarterly and annual statistics reports primarily cover export data based on the Harmonized Tariff

System (Schedule B), collected by the U.S. Department of Commerce (USDOC) and distributed by IHS Maritime & Trade. Reports are

available on DEED’s website at “Export and Trade Statistics” (https://mn.gov/deed/data/export-stats/current-past/).

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Booking ConfirmationDokument3 SeitenBooking ConfirmationSasidharanNoch keine Bewertungen

- Indian Spices Industry Opportunities in Domestic and Global MarketsDokument60 SeitenIndian Spices Industry Opportunities in Domestic and Global MarketszahidzedNoch keine Bewertungen

- Overview of Ethiopian Manufacturing SectorDokument86 SeitenOverview of Ethiopian Manufacturing Sectorgabisa0% (1)

- Letter From Speaker Melissa Hortman To The MediaDokument1 SeiteLetter From Speaker Melissa Hortman To The MediaFluenceMediaNoch keine Bewertungen

- LETTER: Former Gov. Arne Carlson To Minnesota Governor Tim WalzDokument7 SeitenLETTER: Former Gov. Arne Carlson To Minnesota Governor Tim WalzFluenceMediaNoch keine Bewertungen

- LETTER: Blandin Request For Huber After Action FinalDokument2 SeitenLETTER: Blandin Request For Huber After Action FinalFluenceMedia100% (1)

- Vireo Fact Sheet - MinnesotaDokument4 SeitenVireo Fact Sheet - MinnesotaFluenceMediaNoch keine Bewertungen

- Humphrey Institute Study On Ranked Choice VotingDokument3 SeitenHumphrey Institute Study On Ranked Choice VotingFluenceMediaNoch keine Bewertungen

- 2023 Infrastructure Plan Fact SheetDokument2 Seiten2023 Infrastructure Plan Fact SheetFluenceMediaNoch keine Bewertungen

- Letter: October 11th - Opera Managment Letter To OrchestraDokument6 SeitenLetter: October 11th - Opera Managment Letter To OrchestraFluenceMediaNoch keine Bewertungen

- Press Release December 22Dokument1 SeitePress Release December 22FluenceMediaNoch keine Bewertungen

- Focus On Ag (1-16-23)Dokument3 SeitenFocus On Ag (1-16-23)FluenceMediaNoch keine Bewertungen

- POLL: Key Findings MN Protect Our Charities Feb 2023Dokument4 SeitenPOLL: Key Findings MN Protect Our Charities Feb 2023FluenceMediaNoch keine Bewertungen

- Focus On Ag (1-30-23)Dokument3 SeitenFocus On Ag (1-30-23)FluenceMediaNoch keine Bewertungen

- Minnesotans Against Marijuana Legalization - ScorecardDokument2 SeitenMinnesotans Against Marijuana Legalization - ScorecardFluenceMediaNoch keine Bewertungen

- Focus On Ag (11-14-22)Dokument3 SeitenFocus On Ag (11-14-22)FluenceMediaNoch keine Bewertungen

- MSCA Leadership Press Release 2022Dokument1 SeiteMSCA Leadership Press Release 2022FluenceMediaNoch keine Bewertungen

- 2023 Minnesota Senate Committee AssignmentsDokument9 Seiten2023 Minnesota Senate Committee AssignmentsFluenceMediaNoch keine Bewertungen

- Sen. John Marty Letter To U of MN Regents Regarding Conflict of Interest For President Joan GabelDokument1 SeiteSen. John Marty Letter To U of MN Regents Regarding Conflict of Interest For President Joan GabelFluenceMediaNoch keine Bewertungen

- Wisconsin Take20221219Dokument6 SeitenWisconsin Take20221219FluenceMediaNoch keine Bewertungen

- For Immediate Release - Minnesota Counties Announce Top 2023 Legislative Priorities15DEC22Dokument5 SeitenFor Immediate Release - Minnesota Counties Announce Top 2023 Legislative Priorities15DEC22FluenceMediaNoch keine Bewertungen

- 2023-24 Minnesota House Committee MembershipDokument2 Seiten2023-24 Minnesota House Committee MembershipFluenceMediaNoch keine Bewertungen

- 2023-24 Minnesota House Committee MembershipDokument2 Seiten2023-24 Minnesota House Committee MembershipFluenceMediaNoch keine Bewertungen

- Twins Announce 2023 Spring Training Promo Dates and Ticket InfoDokument3 SeitenTwins Announce 2023 Spring Training Promo Dates and Ticket InfoFluenceMediaNoch keine Bewertungen

- Focus On Ag (12-12-22)Dokument3 SeitenFocus On Ag (12-12-22)FluenceMediaNoch keine Bewertungen

- Webster V DEED Complaint FINAL AcceptedDokument26 SeitenWebster V DEED Complaint FINAL AcceptedFluenceMediaNoch keine Bewertungen

- Focus On Ag (10-10-22)Dokument3 SeitenFocus On Ag (10-10-22)FluenceMediaNoch keine Bewertungen

- Focus On Ag (11-21-22)Dokument3 SeitenFocus On Ag (11-21-22)FluenceMediaNoch keine Bewertungen

- Media AdvisoryDokument1 SeiteMedia AdvisoryFluenceMediaNoch keine Bewertungen

- Focus On Ag (11-07-22)Dokument3 SeitenFocus On Ag (11-07-22)FluenceMediaNoch keine Bewertungen

- 2022-10-03 Madel Letter To NauenDokument15 Seiten2022-10-03 Madel Letter To NauenFluenceMediaNoch keine Bewertungen

- Focus On Ag (10-17-22)Dokument3 SeitenFocus On Ag (10-17-22)FluenceMediaNoch keine Bewertungen

- Focus On Ag (10-24-22)Dokument3 SeitenFocus On Ag (10-24-22)FluenceMediaNoch keine Bewertungen

- International Trade TheoriesDokument6 SeitenInternational Trade TheoriesQueenie Gallardo AngelesNoch keine Bewertungen

- Industrialisation Class 10 NotesDokument11 SeitenIndustrialisation Class 10 NotesArnav TayalNoch keine Bewertungen

- Importation Cycle 2019Dokument3 SeitenImportation Cycle 2019Jey DiNoch keine Bewertungen

- Chapter 9Dokument18 SeitenChapter 9JoNoch keine Bewertungen

- Taxation CourseDokument170 SeitenTaxation CourseNaseef Us SakibNoch keine Bewertungen

- Anti Dumping Duty and IndiaDokument39 SeitenAnti Dumping Duty and Indiasagarkhedekar999Noch keine Bewertungen

- ProtectionismDokument51 SeitenProtectionismKhy Nellas-LeonorNoch keine Bewertungen

- Chapter One: Understanding Malaysian EconomyDokument56 SeitenChapter One: Understanding Malaysian EconomybukhrosliNoch keine Bewertungen

- Indias Global Tea TradeDokument173 SeitenIndias Global Tea TradePrakash KcNoch keine Bewertungen

- Estonia in TransitionDokument5 SeitenEstonia in TransitionErwinsyah RusliNoch keine Bewertungen

- Export ProcedureDokument2 SeitenExport ProcedureKalpesh Singh SinghNoch keine Bewertungen

- Aggregate Supply and Demand in MexicoDokument4 SeitenAggregate Supply and Demand in MexicoanaNoch keine Bewertungen

- Economic Sanctions - The Case of The American Embargo On CubaDokument52 SeitenEconomic Sanctions - The Case of The American Embargo On CubagreenouksNoch keine Bewertungen

- CHP 5Dokument5 SeitenCHP 5Mert CordukNoch keine Bewertungen

- World Agricultural Supply and Demand EstimatesDokument40 SeitenWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNoch keine Bewertungen

- GST Presentation - Place of Supply of GoodsDokument15 SeitenGST Presentation - Place of Supply of GoodsAditi AgarwalNoch keine Bewertungen

- Jim Powell Protectionist ParadiseDokument11 SeitenJim Powell Protectionist ParadiseGeorgeNoch keine Bewertungen

- INDUSTRY & COMPANY ProfileDokument22 SeitenINDUSTRY & COMPANY Profilepranav chandruNoch keine Bewertungen

- Exporting Fresh Avocados To Europe: Contents of This PageDokument16 SeitenExporting Fresh Avocados To Europe: Contents of This PageGaitan YiselaNoch keine Bewertungen

- Deemed Export BenefitDokument37 SeitenDeemed Export BenefitSamNoch keine Bewertungen

- Agro IndustrialDokument14 SeitenAgro IndustrialJerome ArtezaNoch keine Bewertungen

- Cusno7 Important List of Cmos CaosDokument8 SeitenCusno7 Important List of Cmos CaosCrisle EspeletaNoch keine Bewertungen

- CBEC Press Release 29.11.2017 GST RefundDokument2 SeitenCBEC Press Release 29.11.2017 GST Refundkumar45caNoch keine Bewertungen

- STEP 1: Enquiry:The Starting Point For Any Export Transaction Is An EnquiryDokument5 SeitenSTEP 1: Enquiry:The Starting Point For Any Export Transaction Is An EnquiryAnusha AmbatiNoch keine Bewertungen

- Capacity Planning Unit 9Dokument5 SeitenCapacity Planning Unit 9Benjamin Adelwini BugriNoch keine Bewertungen

- Appendix 1 - How To Read GraphsDokument6 SeitenAppendix 1 - How To Read GraphsStevenRJClarkeNoch keine Bewertungen

- Indian Minerals Yearbook 2016 - GraniteDokument14 SeitenIndian Minerals Yearbook 2016 - GraniteWinterstone W. DiamantNoch keine Bewertungen