Beruflich Dokumente

Kultur Dokumente

Budget English PDF

Hochgeladen von

JAy BoneOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Budget English PDF

Hochgeladen von

JAy BoneCopyright:

Verfügbare Formate

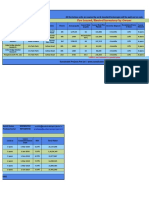

Monthly Budget

For: __________________________________ Date: ______________________________________

INCOME

EXPENSES

Take Home Pay $ ________

HOUSEHOLD Allowance $ ________

Rent/Mortgage $ ________ Gifts $ ________

Utilities (electric, gas, trash, water) $ ________ Part-time Jobs and Chores $ ________

Cable/Satellite TV and Internet $ ________ Other Sources $ ________

Telephone and Long Distance $ ________ TOTAL $ ________

Cell Phone $ ________

Other Household Expenses $ ________

TOTAL $ ________ LOOKING GOOD

Clothes and Shoes $ ________

FOOD Toiletries $ ________

Groceries $ ________ Laundry and Cleaners $ ________

Lunches and Snacks $ ________ Hair Care $ ________

Eating Out $ ________ Other Looking Good Expenses $ ________

TOTAL $ ________ TOTAL $ ________

TRANSPORTATION JUST FOR FUN

Car Payment $ ________ Movies/Games/Concerts $ ________

Insurance $ ________ Dates/Trips $ ________

Gasoline $ ________ Music Purchases $ ________

Maintenance and Repairs $ ________ Books/Magazines/Newspaper $ ________

Public Transportation $ ________ Hobbies $ ________

Other (parking, tolls) $ ________ Other $ ________

TOTAL $ ________ TOTAL $ ________

HEALTHCARE MISCELLANEOUS

Doctor $ ________ Credit Card $ ________

Dentist $ ________ Savings and Investments $ ________

Prescriptions $ ________ Education (tuition, books, fees) $ ________

Medical Insurance $ ________ Gifts and Charity $ ________

Other Healthcare Expenses $ ________ Pets $ ________

TOTAL $ ________ TOTAL $ ________

GRAND TOTAL

TOTAL ALL INCOME $ ________

• Divide annual income and expenses by 12 to get a Subtract –

monthly figure. TOTAL ALL EXPENSES $ ________

• Some expenses (like utilities) will change throughout BOTTOM LINE $ ________

the year, so use a monthly average.

© ABA Education Foundation, Washington, D.C.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Chainsaw Operator's Manual - The Safe Use of Chainsaws (PDFDrive - Com) 2 PDFDokument105 SeitenChainsaw Operator's Manual - The Safe Use of Chainsaws (PDFDrive - Com) 2 PDFJAy Bone100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Preaching Verse by Verse PDFDokument151 SeitenPreaching Verse by Verse PDFJAy Bone100% (2)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Great Doctrines of The Bible (T - Martyn Lloyd-Jones PDFDokument1.374 SeitenGreat Doctrines of The Bible (T - Martyn Lloyd-Jones PDFMichaelMarie Onuoha100% (35)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Great Doctrines of The Bible (T - Martyn Lloyd-Jones PDFDokument1.374 SeitenGreat Doctrines of The Bible (T - Martyn Lloyd-Jones PDFMichaelMarie Onuoha100% (35)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Johnny 1Dokument119 SeitenJohnny 1JAy Bone100% (1)

- Johnny 1Dokument119 SeitenJohnny 1JAy Bone100% (1)

- Fintelum Opens Investment Into New Tokenisation Project KEEPPDokument3 SeitenFintelum Opens Investment Into New Tokenisation Project KEEPPPR.comNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Interim ReportDokument20 SeitenInterim ReportanushaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- MorganCapital ITrade - User ManualDokument27 SeitenMorganCapital ITrade - User ManualemmaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Financial Statement Theory Notes PDFDokument6 SeitenFinancial Statement Theory Notes PDFAejaz MohamedNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Philippine National Construction Corporation Executive Summary 2019Dokument5 SeitenPhilippine National Construction Corporation Executive Summary 2019reslazaroNoch keine Bewertungen

- Bài TTDokument3 SeitenBài TTPhạm Như HuỳnhNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Student Name: Luu Gia Bao Student ID: 1567033: HW Assignment For Week 3Dokument5 SeitenStudent Name: Luu Gia Bao Student ID: 1567033: HW Assignment For Week 3Lưu Gia BảoNoch keine Bewertungen

- Payroll Summary For The Month of AugustDokument46 SeitenPayroll Summary For The Month of AugustAida MohammedNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- New Zealand 2009 Financial Knowledge SurveyDokument11 SeitenNew Zealand 2009 Financial Knowledge SurveywmhuthnanceNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- True-False Questions: Supply-Chain StrategyDokument3 SeitenTrue-False Questions: Supply-Chain Strategysarakhan0622Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Etf Gold VS E-GoldDokument22 SeitenEtf Gold VS E-GoldRia ShayNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDokument2 SeitenForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- JKH 2015 2016 Low 1Dokument304 SeitenJKH 2015 2016 Low 1Rufus LintonNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Traders Dynamic Indicator TDIDokument26 SeitenTraders Dynamic Indicator TDIPurity G. Mugo100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Class TestDokument6 SeitenClass TestMayank kaushikNoch keine Bewertungen

- 2016 ObliconDokument2 Seiten2016 ObliconKarla KatNoch keine Bewertungen

- Sustainable Pre Leased 06122019Dokument2 SeitenSustainable Pre Leased 06122019vaibhav vermaNoch keine Bewertungen

- Company ProfileDokument15 SeitenCompany ProfileAslam HossainNoch keine Bewertungen

- EXPANZS Registration - DayalanDokument1 SeiteEXPANZS Registration - DayalanManikandan BaskaranNoch keine Bewertungen

- Shree Rama Multi-Tech Ltd1 140114Dokument2 SeitenShree Rama Multi-Tech Ltd1 140114Chaitanya JagarlapudiNoch keine Bewertungen

- Case StudyDokument3 SeitenCase StudyPrincess SalazarNoch keine Bewertungen

- SFM PDFDokument731 SeitenSFM PDFRam IyerNoch keine Bewertungen

- Summer Internship Report On Indian Stock MarketsDokument18 SeitenSummer Internship Report On Indian Stock Marketssujayphatak070% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- 06 - Global Supply Chains - EditedDokument37 Seiten06 - Global Supply Chains - EditedShershah AdnanNoch keine Bewertungen

- Payroll Management SystemDokument8 SeitenPayroll Management SystemMayur Jondhale MJNoch keine Bewertungen

- Lords of Finance - Liaquat Ahamed PDFDokument12 SeitenLords of Finance - Liaquat Ahamed PDFasaid100% (2)

- Break - Even Questions ActivityDokument2 SeitenBreak - Even Questions ActivityJeevith Soumya SuhasNoch keine Bewertungen

- Principles of Macro Economics Part 4Dokument6 SeitenPrinciples of Macro Economics Part 4Duaa WajidNoch keine Bewertungen

- JOD13969Dokument2 SeitenJOD13969Abhishek SinghviNoch keine Bewertungen

- Strengths, Weaknesses, Opportunities, Threats The SWOT Analysis - KWHSDokument1 SeiteStrengths, Weaknesses, Opportunities, Threats The SWOT Analysis - KWHSAyushi AggarwalNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)