Beruflich Dokumente

Kultur Dokumente

Revision For GCSE Commerce Topic 3

Hochgeladen von

murtaza5500Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Revision For GCSE Commerce Topic 3

Hochgeladen von

murtaza5500Copyright:

Verfügbare Formate

www.fetsystem.

com [GCSE COMMERCE TOPIC 3 REVISION NOTES]

Use of credit

In credit the buyer buys and uses the product but pays later for the product

or service

Promise to buy now and pay later

The buyer is able to use the product even though he/she has not made the

payment

Increased use of credit

The use of credit has increased

All businesses are ready to sell their products or services on credit

The sales have increased due to credit

The bad debts have also increased

Bad debt is the money which is not recovered due to non-payment of buyer

in case of credit sale

Advantages of credit to the buyer

Can buy goods which are not affordable

Increased standard of living

Payment can be made in installments

Convenient (it is easy to use and carry credit card)

Disadvantages of credit to the buyer

The seller will charge interest on credit

Problem in making the payment

Social problems

Fake

Advantages of credit to the seller

Increased sales

Gain customer loyalty

Out of date stock is usually sold on credit to get rid of it

Seller charges interest and offers no discount on goods sold on credit

Disadvantages of credit to the seller

Money is sometimes not recovered from the buyer (bad debts)

Late payment

Cash flow problem

FREE ONLINE LECTURES&REVISION MATERIAL BY FET SYSTEM Page 1

www.fetsystem.com [GCSE COMMERCE TOPIC 3 REVISION NOTES]

Types of credit

Hire purchase

Extended credit

Store cards

Credit cards

Informal credit

Hire purchase

Ownership remains with seller until the last payment

Payment is made in installments

Interest is charged

Examples of things bought on hire purchase: cars, televisions

Advantages of hire purchase

To seller

– Increased sales

– Owns the product until the last payment

To buyer

– Buy products and satisfy needs

– Increased sale revenue

Disadvantages of hire purchase

To seller

– Credit may become bad debts

– Management team has to be hired thus increasing costs

To buyer

– May lose the product if payment is not made

– Social problems

– Higher price than the market paid

Extended credit

Extended credit given to customer

Facility provided by the departmental stores

The buyer buys and uses the product

The buyer can resell the product as he/she is the owner of the product

FREE ONLINE LECTURES&REVISION MATERIAL BY FET SYSTEM Page 2

www.fetsystem.com [GCSE COMMERCE TOPIC 3 REVISION NOTES]

Advantages of extended credit

To seller

– Increased sales

To buyer

– Use the product but pay later

– Can resell the product

Disadvantages of extended credit

To seller

– Recovery of the money is a problem

To buyer

– Buyer has to pay interest

– Buyer cannot return the product if he does deem it as fit

Store cards

Plastic cards issued by departmental stores to the customers

Credit limit is given

The amount used on the card has to be paid off end of the month

Advantages of store cards

To buyer

– Interest free purchase

– Extra services

To seller

– Increased sales

– Customer loyalty

Disadvantages of store cards

To buyer

– The customer tends to overspend as he/she does not have to pay

now

To seller

– Bad debts

FREE ONLINE LECTURES&REVISION MATERIAL BY FET SYSTEM Page 3

www.fetsystem.com [GCSE COMMERCE TOPIC 3 REVISION NOTES]

Credit card

Plastic card owned by the credit card holder and issued by the banks

Credit limit is given

No interest charged if amount paid end of the month

3% of sales given to credit card Company as commission

Master card and Visa

Advantages of credit cards

Convenient to use

Easy obtain cash

Increased standard of living

It is used all over the world

Disadvantages of credit cards

Cards holders normally overspend

Credit card frauds

Disputes and social problems due to payment issues

Use of credit cards in developing countries is limited

FREE ONLINE LECTURES&REVISION MATERIAL BY FET SYSTEM Page 4

Das könnte Ihnen auch gefallen

- Unit 3 Consumer CreditDokument25 SeitenUnit 3 Consumer Creditaayan salimNoch keine Bewertungen

- CUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESVon EverandCUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESNoch keine Bewertungen

- GRADE IX (O Levels) : South: 3 North: 7Dokument15 SeitenGRADE IX (O Levels) : South: 3 North: 7Waqas YousafNoch keine Bewertungen

- Streetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityVon EverandStreetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityBewertung: 5 von 5 Sternen5/5 (1)

- A Comparative Study of Customer Satisfaction and Preferences in Leading E-TailersDokument39 SeitenA Comparative Study of Customer Satisfaction and Preferences in Leading E-TailersShruti ModiNoch keine Bewertungen

- Consumer Credit CreditcardsDokument26 SeitenConsumer Credit CreditcardsMirudhubashini JaganathanNoch keine Bewertungen

- Namrata 1 N 2Dokument17 SeitenNamrata 1 N 2lavanyasundar7Noch keine Bewertungen

- Plastic Money: Subject - Financial ServicesDokument24 SeitenPlastic Money: Subject - Financial Servicesshashikumarb2277Noch keine Bewertungen

- Advantages and Disadvantages MortgageDokument6 SeitenAdvantages and Disadvantages MortgageNurAmyliyanaNoch keine Bewertungen

- Finance PPT 2Dokument40 SeitenFinance PPT 2api-679810879Noch keine Bewertungen

- Chapter 3-Consumer Credit & Credit CardsDokument37 SeitenChapter 3-Consumer Credit & Credit Cardsbarbarian11Noch keine Bewertungen

- Plastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank TripathiDokument25 SeitenPlastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank Tripathitarunavasyani100% (3)

- Types of E-PaymentsDokument11 SeitenTypes of E-Paymentssuaidmulla100% (8)

- Credit Card: Dr. Yamini Sharma D.M.SDokument31 SeitenCredit Card: Dr. Yamini Sharma D.M.SJames RossNoch keine Bewertungen

- FEMA FinalDokument28 SeitenFEMA Finalmave_vNoch keine Bewertungen

- Discounting, Factoring and Forfeiting Finance Methods ExplainedDokument33 SeitenDiscounting, Factoring and Forfeiting Finance Methods Explainednandini_mba4870Noch keine Bewertungen

- Using CreditDokument39 SeitenUsing CreditAbigail ConstantinoNoch keine Bewertungen

- Literature Review On The Credit Card IndustryDokument4 SeitenLiterature Review On The Credit Card IndustryKhushbooNoch keine Bewertungen

- Understanding Plastic MoneyDokument25 SeitenUnderstanding Plastic Moneyhaz00850% (2)

- Plastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank TripathiDokument25 SeitenPlastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank Tripathihaz008Noch keine Bewertungen

- How to Manage Credit WiselyDokument36 SeitenHow to Manage Credit WiselyAmara MaduagwuNoch keine Bewertungen

- Payment Terms in International TradeDokument15 SeitenPayment Terms in International TradeLIZMARIA SEBYNoch keine Bewertungen

- Estimating the Cost of Short-Term Credit OptionsDokument6 SeitenEstimating the Cost of Short-Term Credit OptionsKristine AlcantaraNoch keine Bewertungen

- Da Afghanistan Bank Afghanistan Payments System: "The National E-Payment Switch of Afghanistan"Dokument34 SeitenDa Afghanistan Bank Afghanistan Payments System: "The National E-Payment Switch of Afghanistan"Asef KhademiNoch keine Bewertungen

- Consumer Credit: Submitted By: Aayush Behal Shashank Singh Manik MittalDokument61 SeitenConsumer Credit: Submitted By: Aayush Behal Shashank Singh Manik Mittalmanik_mittal30% (1)

- Consumer FinanceDokument18 SeitenConsumer FinanceRavneet Kaur100% (1)

- Methods of PaymentsDokument42 SeitenMethods of PaymentsShameem KhodaNoch keine Bewertungen

- GENERAL FUNCTIONS in Credit ReviewerDokument1 SeiteGENERAL FUNCTIONS in Credit ReviewerJAM CLNoch keine Bewertungen

- Customer Credit: Reasons For Giving CreditDokument4 SeitenCustomer Credit: Reasons For Giving CreditAshraf A RaheemNoch keine Bewertungen

- All About CreditDokument4 SeitenAll About CreditShaira VeronicaNoch keine Bewertungen

- Ecommerce Unit 4Dokument12 SeitenEcommerce Unit 4jhanviNoch keine Bewertungen

- History of Credit CardDokument21 SeitenHistory of Credit CardMichael Balmes0% (1)

- Consumer Finance Guide: Types, Sources, Terms & AdvantagesDokument4 SeitenConsumer Finance Guide: Types, Sources, Terms & AdvantagesrhythmkannanNoch keine Bewertungen

- Credit Card by Urmimala MukherjeeDokument47 SeitenCredit Card by Urmimala Mukherjeeurmimala21Noch keine Bewertungen

- Introduction To E-Commerce E Commerce IntroductionDokument11 SeitenIntroduction To E-Commerce E Commerce IntroductionKaushal Premsingh AilsinghaniNoch keine Bewertungen

- Mia Suzzette B. Illescas Bsat-3CDokument11 SeitenMia Suzzette B. Illescas Bsat-3CJoseph SeriritanNoch keine Bewertungen

- Unit 4 - Consumer Finance and Credit RatingDokument24 SeitenUnit 4 - Consumer Finance and Credit RatingAzhar GaziNoch keine Bewertungen

- CreditcardsDokument22 SeitenCreditcardsSandeep AroraNoch keine Bewertungen

- Banking Law & Practice: Atm, Debit Card, Credit CardDokument16 SeitenBanking Law & Practice: Atm, Debit Card, Credit CardAAAANoch keine Bewertungen

- Payments For Electronic CommerceDokument48 SeitenPayments For Electronic CommerceMariaSangsterNoch keine Bewertungen

- Unit 2Dokument5 SeitenUnit 2Maria IezhitsaNoch keine Bewertungen

- AttachmentDokument31 SeitenAttachmentHambaNoch keine Bewertungen

- On Credit CardDokument31 SeitenOn Credit Cardoureducation.in100% (1)

- Phân Tích TCDNNCDokument2 SeitenPhân Tích TCDNNCtranthicamngan03Noch keine Bewertungen

- Common Methods of International PaymentDokument7 SeitenCommon Methods of International PaymentTewodros SetargieNoch keine Bewertungen

- UNIT 5. PAYMENT. L3Dokument2 SeitenUNIT 5. PAYMENT. L3halam29051997Noch keine Bewertungen

- Credit and Debit Card Differentiation Assignment ResearchDokument9 SeitenCredit and Debit Card Differentiation Assignment Researchsaravana kumarNoch keine Bewertungen

- Credit Card and Debit Card WorkingDokument18 SeitenCredit Card and Debit Card WorkingSidharth VarshneyNoch keine Bewertungen

- Cards and Payments: Roles of Key Players in Processing TransactionsDokument2 SeitenCards and Payments: Roles of Key Players in Processing TransactionsmahesheiruvuriNoch keine Bewertungen

- JAIPURIA INSTITUTE OF MANAGEMENT LUCKNOW WORKING OF CARD SEGMENTDokument16 SeitenJAIPURIA INSTITUTE OF MANAGEMENT LUCKNOW WORKING OF CARD SEGMENTVinod KumarNoch keine Bewertungen

- ch4 EcommerceDokument51 Seitench4 EcommercecheruNoch keine Bewertungen

- Unit 5Dokument16 SeitenUnit 5rishavNoch keine Bewertungen

- A Presentation On: Credit CardsDokument26 SeitenA Presentation On: Credit CardsJagjeet AjmaniNoch keine Bewertungen

- How Credit Cards Work Guide: Understanding Interest, Rewards & MoreDokument22 SeitenHow Credit Cards Work Guide: Understanding Interest, Rewards & MoreEti Prince BajajNoch keine Bewertungen

- Credit and CollectionDokument126 SeitenCredit and CollectionRosalyn MauricioNoch keine Bewertungen

- 21.customer Finance and Credit Card RatingDokument11 Seiten21.customer Finance and Credit Card RatingParth MuniNoch keine Bewertungen

- Installment SaleDokument16 SeitenInstallment Salerenuka03Noch keine Bewertungen

- How Credit Cards Work, Benefits & FeesDokument28 SeitenHow Credit Cards Work, Benefits & FeesDeepak R PatelNoch keine Bewertungen

- Plastic Money PDFDokument6 SeitenPlastic Money PDFJosé BurgeiroNoch keine Bewertungen

- What Is Financial AccountingDokument2 SeitenWhat Is Financial Accountingmurtaza5500Noch keine Bewertungen

- Online Web-Based Roll No Slip1Dokument1 SeiteOnline Web-Based Roll No Slip1murtaza5500Noch keine Bewertungen

- Hasan MohsinDokument1 SeiteHasan Mohsinmurtaza5500Noch keine Bewertungen

- GCU Affiliation Extension Request 2018Dokument1 SeiteGCU Affiliation Extension Request 2018murtaza5500Noch keine Bewertungen

- Class 10 English Notes and QuestionsDokument32 SeitenClass 10 English Notes and Questionsmurtaza5500Noch keine Bewertungen

- Slip 111295 PDFDokument1 SeiteSlip 111295 PDFmurtaza5500Noch keine Bewertungen

- Admission Advertisement Fall 2019 01Dokument2 SeitenAdmission Advertisement Fall 2019 01Ahsan aliNoch keine Bewertungen

- Largest ND BiggestDokument2 SeitenLargest ND Biggestmurtaza5500Noch keine Bewertungen

- BISE Faisalabad HSSC Admission FormDokument3 SeitenBISE Faisalabad HSSC Admission Formmurtaza5500Noch keine Bewertungen

- Online verification medical technology one year diplomaDokument1 SeiteOnline verification medical technology one year diplomamurtaza5500Noch keine Bewertungen

- Chishti Group of Colleges FaisalabadDokument1 SeiteChishti Group of Colleges Faisalabadmurtaza5500Noch keine Bewertungen

- MahamDokument1 SeiteMahammurtaza5500Noch keine Bewertungen

- Haseeb TahirDokument3 SeitenHaseeb Tahirmurtaza5500Noch keine Bewertungen

- BISE Faisalabad HSSC Admission FormDokument3 SeitenBISE Faisalabad HSSC Admission Formmurtaza5500Noch keine Bewertungen

- Board of Intermediate & Secondary Education, Faisalabad.: (Private Candidate)Dokument1 SeiteBoard of Intermediate & Secondary Education, Faisalabad.: (Private Candidate)murtaza5500Noch keine Bewertungen

- Board of Intermediate & Secondary Education, Faisalabad.: (Private Candidate)Dokument1 SeiteBoard of Intermediate & Secondary Education, Faisalabad.: (Private Candidate)murtaza5500Noch keine Bewertungen

- MathematicsDokument1 SeiteMathematicsmurtaza5500Noch keine Bewertungen

- BISE Faisalabad HSSC Admission FormDokument3 SeitenBISE Faisalabad HSSC Admission Formmurtaza5500Noch keine Bewertungen

- Hassan RazaDokument1 SeiteHassan Razamurtaza5500Noch keine Bewertungen

- Akmal HayatDokument1 SeiteAkmal Hayatmurtaza5500Noch keine Bewertungen

- AMNADokument1 SeiteAMNAmurtaza55000% (1)

- Farhan ZiaDokument1 SeiteFarhan Ziamurtaza5500Noch keine Bewertungen

- Amina ManshaDokument1 SeiteAmina Manshamurtaza5500Noch keine Bewertungen

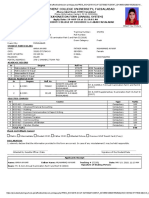

- Government College University, Faisalabad: Examination Form (Annual System)Dokument1 SeiteGovernment College University, Faisalabad: Examination Form (Annual System)murtaza5500Noch keine Bewertungen

- Amna Anwar 5000Dokument1 SeiteAmna Anwar 5000murtaza5500Noch keine Bewertungen

- 0438Dokument7 Seiten0438murtaza5500Noch keine Bewertungen

- Government College University, Faisalabad: Examination Form (Annual System)Dokument1 SeiteGovernment College University, Faisalabad: Examination Form (Annual System)murtaza5500Noch keine Bewertungen

- Government College University, Faisalabad: Examination Form (Annual System)Dokument1 SeiteGovernment College University, Faisalabad: Examination Form (Annual System)murtaza5500Noch keine Bewertungen

- Advertisement No.22 2018 12-07-2018Dokument1 SeiteAdvertisement No.22 2018 12-07-2018murtaza5500Noch keine Bewertungen

- ZBC AccountingDokument22 SeitenZBC AccountingedoNoch keine Bewertungen

- 13 Sentence ArrangementDokument43 Seiten13 Sentence Arrangementram prasadNoch keine Bewertungen

- Accounting (2) Chapter (5) : LevelDokument14 SeitenAccounting (2) Chapter (5) : LevelMohamed DiabNoch keine Bewertungen

- Distribution Channel Division: BSTKDDokument62 SeitenDistribution Channel Division: BSTKDTalha KhalidNoch keine Bewertungen

- Buy Amanda Fabric 3 Seater Sofa in Charcoal Grey Colour at 24% OFF by Casacraft From Pepperfry - PepperfryDokument5 SeitenBuy Amanda Fabric 3 Seater Sofa in Charcoal Grey Colour at 24% OFF by Casacraft From Pepperfry - PepperfryAveNoch keine Bewertungen

- Financial Reporting for Merchandising BusinessesDokument81 SeitenFinancial Reporting for Merchandising BusinessesAbdulla MacarayaNoch keine Bewertungen

- Administering SAP R/3: SD-Sales and Distribution Module - 3 - Pricing Products and Services To Improve SalesDokument15 SeitenAdministering SAP R/3: SD-Sales and Distribution Module - 3 - Pricing Products and Services To Improve SalesSimhan SriramNoch keine Bewertungen

- Unit 05 - Principles of Bank LendingDokument18 SeitenUnit 05 - Principles of Bank LendingSayak GhoshNoch keine Bewertungen

- Stock Manager Advance RC3.0.1.1 Documentation V1.2.4.2Dokument28 SeitenStock Manager Advance RC3.0.1.1 Documentation V1.2.4.2Shadi DabbourNoch keine Bewertungen

- Philippine Folk DanceDokument6 SeitenPhilippine Folk DanceAnna CabreraNoch keine Bewertungen

- Filoteo S. Uy Jr. Acctg 11- 5:20-7:00Dokument11 SeitenFiloteo S. Uy Jr. Acctg 11- 5:20-7:00KAii Magno GuiaNoch keine Bewertungen

- Pricing Procedure StepsDokument12 SeitenPricing Procedure StepsPrasanna Kumar SethiNoch keine Bewertungen

- PRINCIPLES OF MARKETING Reviewer FinalsDokument3 SeitenPRINCIPLES OF MARKETING Reviewer FinalsKristine Angela RanotNoch keine Bewertungen

- Bonus Buy From SapDokument6 SeitenBonus Buy From SapKarunGaur100% (2)

- Statement of Comprehensive Income (SCI) : Quarter 1 - Module 2Dokument21 SeitenStatement of Comprehensive Income (SCI) : Quarter 1 - Module 2Aestherielle MartinezNoch keine Bewertungen

- The Discount Pharmacy Business PlanDokument30 SeitenThe Discount Pharmacy Business PlanHumphrey Hessel-Appiah100% (1)

- ACCT1101 Wk4 Tutorial 3 SolutionsDokument8 SeitenACCT1101 Wk4 Tutorial 3 SolutionskyleNoch keine Bewertungen

- Partner Ordering Brown Bag External SessionDokument30 SeitenPartner Ordering Brown Bag External SessionHope HimuyandiNoch keine Bewertungen

- Pos User Guide: Retail Management Hero (RMH)Dokument50 SeitenPos User Guide: Retail Management Hero (RMH)md ShabirNoch keine Bewertungen

- Unit-II Elements of Market Promotion MixDokument34 SeitenUnit-II Elements of Market Promotion MixAbin VargheseNoch keine Bewertungen

- Merchandising ReviewerDokument23 SeitenMerchandising ReviewerCatherine LegaspiNoch keine Bewertungen

- Central Excise ManualDokument108 SeitenCentral Excise ManualAnand PrakashNoch keine Bewertungen

- Project Title A Market Study On Sales Promotion at Sri Sai Tvs MotorsDokument62 SeitenProject Title A Market Study On Sales Promotion at Sri Sai Tvs MotorsSunil Reddy100% (2)

- Tip 21a01-05Dokument3 SeitenTip 21a01-05Melissa R.Noch keine Bewertungen

- Adapting Price StrategiesDokument8 SeitenAdapting Price StrategiesTheju ThejasreeNoch keine Bewertungen

- How To Setup Up A Modifier To Give Different Discounts, On The Line Total, Based On The Ordered QuantityDokument10 SeitenHow To Setup Up A Modifier To Give Different Discounts, On The Line Total, Based On The Ordered QuantityAhmedNoch keine Bewertungen

- Supply Chain Management (3rd Edition) : Managing Economies of Scale in The Supply Chain: Cycle InventoryDokument45 SeitenSupply Chain Management (3rd Edition) : Managing Economies of Scale in The Supply Chain: Cycle Inventory0825Pratyush TiwariNoch keine Bewertungen

- Negotation SilvanaGaitanDokument6 SeitenNegotation SilvanaGaitanSilvana Gaitan KühneNoch keine Bewertungen

- Ecommerce Website Generic Features ListDokument6 SeitenEcommerce Website Generic Features ListTechpro CompSoft Pvt Ltd.Noch keine Bewertungen

- Chapter 16 2021Dokument2 SeitenChapter 16 2021Rabie HarounNoch keine Bewertungen