Beruflich Dokumente

Kultur Dokumente

Acctg Problem 7

Hochgeladen von

Salvie Perez UtanaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Acctg Problem 7

Hochgeladen von

Salvie Perez UtanaCopyright:

Verfügbare Formate

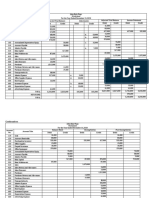

UTANA, SALVIE ANGELA CLARETTE P.

BABA 1-H

Christine Sousa Bags

Worksheet

For the Year Ended December 31, 2019

Trial Balance Adjustments Income Statement Balance Sheet

Account Title Debit Credit Debit Credit Debit Credit Debit Credit

Cash PHP 72,000 PHP 72,000

Accounts Receivable 136,000 136,000

Merchandise Inventory 598,000 PHP 598,000 PHP 723,000 723,000

Prepaid Advertising 75,000 PHP 25,000 50,000

Office Supplies 42,000 25,000 25,000

Land 400,000 400,000

Office Building 1,600,000 1,600,000

Accu. Depreciation-Off. Bldg. PHP 100,000 15,000 PHP 115,000

Office Equipment 570,000 570,000

Accu. Depreciation-Off. Equipt. 150,000 20,000 170,000

Accounts Payable 74,000 74,000

Mortgage Payable 1,100,000 1,100,000

Notes Payable due in 2 yrs. 200,000 200,000

Salaries Payable 21,000 21,000

Sousa, Capital 1,510,000 1,510,000

Sousa, Withdrawals 200,000 200,000

Sales 4,600,000 4,600,000

Sales Discounts 161,000 161,000

Sales Returns and Allow. 187,000 187,000

Purchases 2,643,000 2,643,000

Transportation In 72,000 72,000

Purchases Discounts 172,000 172,000

Purchases Rets. & Allow. 133,000 133,000

Depreciation Expense-Equipment 20,000 20,000

Depreciation Expense-Building 15,000 15,000

Advertising Expense 25,000 25,000

Insurance Expense 25,000 25,000

Interest Expense 208,000 208,000

Salaries Expense 862,000 21,000 883,000

Travel Expense 188,000 188,000

Office Supplies Expense 17,000 17,000

Interest Expense

PHP 8,039,000 PHP 8,039,000 PHP 98,000 PHP 106,000 5,042,000 5,628,000 3,776,000 3,190,000

Profit 586,000 586,000

PHP 5,628,000 PHP 5,628,000 PHP 3,776,000 PHP 3,776,000

UTANA, SALVIE ANGELA CLARETTE P. BABA 1-H

Christine Sousa Bags Christine Sousa Bags

Statement of Income Statement of Financial Position

For the Year Ended December 31, 2019 December 31, 2019.

Net Sales Assets

Gross Sales PHP 4,600,000.00 Current Assets

Less: Sales Returns and Allow. PHP 187,000.00 Cash PHP 72,000.00

Sales Discounts 161,000 348,000 Accounts Receivable 136,000

Net Sales 4,252,000 Merchandise Inventory 723,000

Cost of Sales Office Supplies 25,000

Merchandise Inventory, 1/1/2019 598,000 Prepaid Advertising 50,000

Purchases 2,643,000 Total Current Assets PHP 1,006,000.00

Less: Purchases Returns and Allow. 133,000 Property and Equipment (net)

Purchases Discounts 172,000 Land 400,000

Net Purchases 2,338,000 Office Building 570,000

Tranportation In 72,000 Less: Accu. Depreciation-Off. Bldg. 170,000

Net Cost of Purchases 2,410,000 Office Equipment 1,600,000

Goods Available for Sale 3,008,000 Less: Accu. Depreciation-Off. Equipt. 115,000

Less: Merchandise Inventory, 12/31 723,000 Total Property and Equipment 2,285,000

Cost of Sales 2,285,000 Total Assets PHP 3,291,000

Gross Profit 1,967,000

Operating Expenses Liabilities

Depreciation Expense-Equipment 20,000 Current Liabilities

Depreciation Expense-Building 15,000 Accounts Payable 74,000

Advertising Expense 25,000 Total Current Liabilities 21,000 95,000

Insurance Expense 25,000 Non-Current Liabilities

Salaries Expense 883,000 Notes Payable due in 2 yrs. 200,000

Travel Expense 188,000 Mortgage Payable 1,100,000 1,300,000

Office Supplies Expense 17,000 Total Liabilities 1,395,000

Operating Expenses 1,173,000

Operating Profit 794,000 Owner's Equity

Finance Costs 208,000 Sousa, Capital, 12/31 1,896,000

Profit PHP 586,000 Total Liabilities and Owner's Equity PHP 3,291,000

Christine Sousa Bags

Statement of Changes in Owner's Equity

For the Year Ended December 31, 2019

Sousa, Capital, Beg. PHP 1,510,000.00

Add: Profit 586,000

Total 2,096,000

Less: Withdrawals 200,000

Sousa, Owner's Equity PHP 1,896,000

UTANA, SALVIE ANGELA CLARETTE P. BABA 1-H

Adjusting Entries

Office Supplies Expense PHP 17,000

Office Supplies PHP 17,000

Advertising Expense 25,000

Prepaid Advertising 25,000

Salaries Expense 21,000

Salaries Payable 21,000

Depreciation Expense-Building 15,000

Depreciation Expense-Equipment 20,000

Accumulated Depreciation Expense-

Building 15,000

Accumulated Depreciation Expense-

Equipment 20,000

Closing Entries

Dec. 31 Mechandise Inventory, Dec. 31 723,000

Sales 4,600,000

Purchases Returns & Allow. 133,000

Purchases Discounts 172,000

Income Summary 5,628,000

31 Income Summary 5,042,000

Merchandise Inventory, 1/1 598,000

Sales Returns & Allow. 187,000

Sales Discounts 161,000

Purchases 2,643,000

Tranportation In 72,000

Salaries Expense 883,000

Office Supplies Expense 17,000

Insurance Expense 25,000

Depreciation Expense-Office

Building 15,000

Depreciation Expense-Office

Equipment 20,000

Travel Expense 188,000

Advetsing Expense 25,000

Interest Expense 208,000

31 Income Summary 586,000

Sousa, Capital 586,000

31 Sousa, Capital 200,000

Sousa, Withdrawals 200,000

UTANA, SALVIE ANGELA CLARETTE P. BABA 1 H

Problem #3

Net Sales

Gross Sales PHP 1,610,000

Less: Sales Returns and Allow. PHP 45,000

Sales Discounts 15,000 60,000

Net Sales PHP 1,550,000

Cost of Sales

Inventory, 1/1/2019 220,000

Purchases 985,000

Less: Purchases Returns and Allow. PHP 31,000

Purchases Discounts 20,000 51,000

Net Purchases 934,000

Tranportation In 36,000

Net Cost of Purchases 970,000

Goods Available for Sale 1,190,000

Less: Inventory, 12/31/2019 260,000

Cost of Good Sold 930,000

Gross Margin from Sales 620,000

Operating Expenses 465,000

Profit PHP 155,000

Problem #8

Victoriano Navarette Traders

Income Statement

For the Year Ended December 31, 2019

Net Sales

Gross Sales PHP 9,630,000

Less: Sales Returns and Allow. PHP 280,000

Sales Discounts 210,000 490,000

Net Sales PHP 9,140,000

Cost of Sales

Merchandise Inventory, 1/1/2019 2,170,000

Purchases PHP 4,720,000

Less: Purchases Returns and Allow. PHP 110,000

Purchases Discounts 70,000 180,000

Net Purchases 4,540,000

Tranportation In 50,000

Net Cost of Purchases 4,590,000

Goods Available for Sale 6,760,000

Less: Merchandise Inventory, 12/31/2019 1,430,000

Cost of Sales 5,330,000

Gross Profit PHP 3,810,000

Operating Expenses

Selling Expense

Salaries Expense-Selling 1,140,000

Transportation Out 170,000

Depreciation-Store Equipment 160,000

Selling Supllies Expense 80,000

Total Selling Expense 1,550,000

Administrative Selling

Salaries Expense-General 920,000

Office Supplies Expense 460,000

Insurance Expense 55,000

Depreciation-Office Equipment 320,000

Miscellaneous Expenses 30,000

Total Administrative Expenses 1,785,000

Total Operating Expenses 3,335,000

Profit PHP 475,000

Das könnte Ihnen auch gefallen

- Christine Sousa BagsDokument8 SeitenChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Quiz in Module 8 Key AnswerDokument6 SeitenQuiz in Module 8 Key AnswerfabyunaaaNoch keine Bewertungen

- John Bala MapsDokument3 SeitenJohn Bala MapsJayson80% (10)

- Buenaventura Problem 1 10Dokument16 SeitenBuenaventura Problem 1 10Anonn100% (3)

- BuenaventuraEJ BSA1BDokument29 SeitenBuenaventuraEJ BSA1BAnonn100% (2)

- Chapter 8-Problem 2Dokument3 SeitenChapter 8-Problem 2kakao67% (3)

- Ricardo Pangan Company Journals FrenzairenDokument15 SeitenRicardo Pangan Company Journals FrenzairenRain Marie DumasNoch keine Bewertungen

- Capter 9, Problem SolvingDokument3 SeitenCapter 9, Problem SolvingJohn JosephNoch keine Bewertungen

- Special JournalsDokument29 SeitenSpecial Journalsninenrqz59% (17)

- Guzon Book Distributors General Journal Date Particulars PR Debit CreditDokument8 SeitenGuzon Book Distributors General Journal Date Particulars PR Debit CreditNermeen C. AlapaNoch keine Bewertungen

- BuenaventuraEJ BSA1B Problem1,2,4.Dokument8 SeitenBuenaventuraEJ BSA1B Problem1,2,4.Anonn75% (4)

- Ricardo Pangan CompanyDokument38 SeitenRicardo Pangan CompanyAndrea Tugot67% (15)

- Transportation Costs, Problem #11Dokument3 SeitenTransportation Costs, Problem #11Feiya LiuNoch keine Bewertungen

- Pilaps & VilsDokument15 SeitenPilaps & VilsGwendolyn PansoyNoch keine Bewertungen

- MerchandisingDokument18 SeitenMerchandisinghamida sarip100% (2)

- Trade and Cash Discount, Problem #1Dokument1 SeiteTrade and Cash Discount, Problem #1Feiya LiuNoch keine Bewertungen

- Lumen AlmacharDokument21 SeitenLumen AlmacharbelliissiimmaaNoch keine Bewertungen

- Teresita Buenaflor Shoes 5 PDF FreeDokument19 SeitenTeresita Buenaflor Shoes 5 PDF FreeAlexandrea San Buenaventura Baay100% (1)

- ACCA101 Leah May SantiagoDokument9 SeitenACCA101 Leah May SantiagoNicole FidelsonNoch keine Bewertungen

- Aguhob FireworksDokument2 SeitenAguhob FireworksAndrea Tugot60% (5)

- Chapter 8-Problem 1Dokument3 SeitenChapter 8-Problem 1kakao100% (1)

- Problem 5xDokument4 SeitenProblem 5xMAXINE CLAIRE CUTINGNoch keine Bewertungen

- Chapter 8-Problem 10Dokument2 SeitenChapter 8-Problem 10kakao100% (1)

- Chapter 7 ProblemsDokument25 SeitenChapter 7 ProblemsRhoda Claire M. Gansobin100% (1)

- Chapter 8-Problem 9Dokument4 SeitenChapter 8-Problem 9kakaoNoch keine Bewertungen

- Medina and DalanginDokument3 SeitenMedina and DalanginHoneybunch beforeNoch keine Bewertungen

- Accounting ProblemsDokument3 SeitenAccounting ProblemsKeitheia Quidlat67% (3)

- Sales Transaction, Problem #6Dokument1 SeiteSales Transaction, Problem #6Feiya Liu83% (6)

- Acctg Ass No. 10 Merchandising BusinessDokument5 SeitenAcctg Ass No. 10 Merchandising BusinessDaisy Marie A. Rosel75% (4)

- Buenaventura Problem 11 15Dokument12 SeitenBuenaventura Problem 11 15Anonn67% (3)

- Noel Hungria, Adjusting EntriesDokument1 SeiteNoel Hungria, Adjusting EntriesFeiya Liu100% (2)

- BuenaventuraEJ BSA1B Pages417 418Dokument14 SeitenBuenaventuraEJ BSA1B Pages417 418AnonnNoch keine Bewertungen

- Journalizing Merchandising Transactions, Problem #13Dokument2 SeitenJournalizing Merchandising Transactions, Problem #13Feiya Liu80% (10)

- Noel Hungria, Adjusting EntriesDokument1 SeiteNoel Hungria, Adjusting EntriesFeiya Liu100% (4)

- Ricard PangabnDokument15 SeitenRicard PangabnTey-yah Malumbres100% (5)

- Leah May Santiago Information System Worksheet December 31, 2021 Trial Balance Adjustments Account Titles Debit Credit Debit CreditDokument5 SeitenLeah May Santiago Information System Worksheet December 31, 2021 Trial Balance Adjustments Account Titles Debit Credit Debit CreditJoy Santos80% (10)

- Account Classification Normal Balance Income Statement / Balance Sheet ColumnDokument13 SeitenAccount Classification Normal Balance Income Statement / Balance Sheet ColumnRhoda Claire M. Gansobin86% (7)

- Compute The Cost of Sales For December 31, 2020.: RequiredDokument3 SeitenCompute The Cost of Sales For December 31, 2020.: RequiredShiela Rengel100% (1)

- Bfar Chapter 8 Problems 6 7Dokument9 SeitenBfar Chapter 8 Problems 6 7Rhoda Claire M. GansobinNoch keine Bewertungen

- Eva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Dokument7 SeitenEva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Stephen ReloxNoch keine Bewertungen

- ACTIVITY NO1and2Dokument5 SeitenACTIVITY NO1and2Patricia Nicole Barrios100% (1)

- Illustrative Problem Worksheet ADokument6 SeitenIllustrative Problem Worksheet AJoy Santos80% (5)

- Chapter 8-Problem 3Dokument3 SeitenChapter 8-Problem 3kakao100% (1)

- Problem# 17 Mariano Lerin Bookstore Journalizing MARCH 2021 Date Account Titles PR Debit CreditDokument3 SeitenProblem# 17 Mariano Lerin Bookstore Journalizing MARCH 2021 Date Account Titles PR Debit CreditAndrea Tugot50% (2)

- Bfar Chapter 8 Problem 8Dokument2 SeitenBfar Chapter 8 Problem 8AdiraNoch keine Bewertungen

- Lumen Almachar PharmacyDokument22 SeitenLumen Almachar PharmacyGei Galaboc33% (3)

- Teresita Buenaflor ShoesDokument19 SeitenTeresita Buenaflor ShoesGiselle Martinez87% (30)

- WorksheetsDokument2 SeitenWorksheetsSarifeMacawadibSaid100% (5)

- Teresita Buenaflor ShoesDokument2 SeitenTeresita Buenaflor ShoesMarie Manansala100% (8)

- Comprehensive Problem 23Dokument29 SeitenComprehensive Problem 23Nicole Fidelson100% (2)

- Catherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Dokument4 SeitenCatherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Jamycka Antolin100% (1)

- Comprehensive ProblemDokument17 SeitenComprehensive ProblemVianca FernilleNoch keine Bewertungen

- Chapter 8Dokument14 SeitenChapter 8Kanton FernandezNoch keine Bewertungen

- Chapter 9 Special and Combination Journals, and Voucher SystemDokument3 SeitenChapter 9 Special and Combination Journals, and Voucher SystemZyrene Kei Reyes100% (3)

- On June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDokument63 SeitenOn June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDachell Chiva SantiagoNoch keine Bewertungen

- Chapter 8Dokument6 SeitenChapter 8SabNoch keine Bewertungen

- ULOa Let's Analyze Week 8 9Dokument4 SeitenULOa Let's Analyze Week 8 9emem resuentoNoch keine Bewertungen

- Accounting 1 (Chapter 9)Dokument3 SeitenAccounting 1 (Chapter 9)angel cao100% (2)

- DB6 - Worksheet & FS Prep For Merchandising BusinessDokument4 SeitenDB6 - Worksheet & FS Prep For Merchandising BusinessArrianeNoch keine Bewertungen

- ACTIVITY111111101Dokument6 SeitenACTIVITY111111101VanessaNoch keine Bewertungen

- Recognition and DerecognitionDokument27 SeitenRecognition and DerecognitionSalvie Perez UtanaNoch keine Bewertungen

- The Impact of Culture On Body Image and Self EsteemDokument7 SeitenThe Impact of Culture On Body Image and Self EsteemSalvie Perez UtanaNoch keine Bewertungen

- Vocabulary Journal: A Substance Used For Sticking Objects or Materials TogetherDokument1 SeiteVocabulary Journal: A Substance Used For Sticking Objects or Materials TogetherSalvie Perez UtanaNoch keine Bewertungen

- (Stewart, p73) - Is A Mathematical Concept - Is An Aesthetic Concept - It Allows Us To Classify and Distinguish Regular PatternsDokument63 Seiten(Stewart, p73) - Is A Mathematical Concept - Is An Aesthetic Concept - It Allows Us To Classify and Distinguish Regular PatternsSalvie Perez UtanaNoch keine Bewertungen

- Handouts Ngec 9Dokument12 SeitenHandouts Ngec 9Salvie Perez UtanaNoch keine Bewertungen

- Accounting For Merchandising OperationsDokument58 SeitenAccounting For Merchandising OperationsSalvie Perez UtanaNoch keine Bewertungen

- (Stewart, p73) - Is A Mathematical Concept - Is An Aesthetic Concept - It Allows Us To Classify and Distinguish Regular PatternsDokument63 Seiten(Stewart, p73) - Is A Mathematical Concept - Is An Aesthetic Concept - It Allows Us To Classify and Distinguish Regular PatternsSalvie Perez UtanaNoch keine Bewertungen

- Acctg Problem 7Dokument5 SeitenAcctg Problem 7Salvie Perez Utana82% (11)

- Gelay Project Final PrintDokument6 SeitenGelay Project Final PrintSalvie Perez UtanaNoch keine Bewertungen

- 5664accountancy XIDokument9 Seiten5664accountancy XIAryan VishwakarmaNoch keine Bewertungen

- 03-Chapters - I-XIV Accounting ManualDokument115 Seiten03-Chapters - I-XIV Accounting ManualMarie AlejoNoch keine Bewertungen

- MCQ-Financial AccountingDokument13 SeitenMCQ-Financial AccountingArchana100% (1)

- Depreciation Worksheet Straightline MethodDokument12 SeitenDepreciation Worksheet Straightline MethodJamie-Lee O'ConnorNoch keine Bewertungen

- Audit-Of ReceivablesDokument5 SeitenAudit-Of ReceivablesCathleen VillalvitoNoch keine Bewertungen

- Case StudyDokument6 SeitenCase StudyMelissa WhiteNoch keine Bewertungen

- LFAR Ready Reckoner 31.03.2020 by Kuldeep GuptaDokument13 SeitenLFAR Ready Reckoner 31.03.2020 by Kuldeep GuptaJAY SHARMA100% (1)

- M2U SA 128457 Sep 2023Dokument6 SeitenM2U SA 128457 Sep 2023syafiqah.mohdali38Noch keine Bewertungen

- Cash & Cash Equivalents, Lecture &exercisesDokument16 SeitenCash & Cash Equivalents, Lecture &exercisesDessa GarongNoch keine Bewertungen

- Midterm 1Dokument26 SeitenMidterm 1Saeym SegoviaNoch keine Bewertungen

- 2016A FE AM QuestionDokument31 Seiten2016A FE AM QuestionPham Tien ThanhNoch keine Bewertungen

- Merchandising OperationsDokument2 SeitenMerchandising OperationsMary JullianneNoch keine Bewertungen

- Taxpnl TQ8297 2022 - 2023 Q1 Q4Dokument34 SeitenTaxpnl TQ8297 2022 - 2023 Q1 Q4raghav guptaNoch keine Bewertungen

- Kashato: Worksheet For TheDokument6 SeitenKashato: Worksheet For TheCha DumpyNoch keine Bewertungen

- INVESTMENTS ReviewerDokument35 SeitenINVESTMENTS ReviewerRyze100% (1)

- Issue of SharesDokument16 SeitenIssue of SharesAdan HoodaNoch keine Bewertungen

- Q1Dokument3 SeitenQ1ALMA MORENANoch keine Bewertungen

- Equity HandoutDokument14 SeitenEquity HandoutJohn Vicente BalanquitNoch keine Bewertungen

- Bank Reconciliation Statement PracticeDokument16 SeitenBank Reconciliation Statement Practicesyed kabir uddinNoch keine Bewertungen

- 01 ABM Financial Accounting Session1Dokument36 Seiten01 ABM Financial Accounting Session1DentatusNoch keine Bewertungen

- Chapter 10 - Page: 392-393: Problem: 10B-3Dokument5 SeitenChapter 10 - Page: 392-393: Problem: 10B-3Bob RutonNoch keine Bewertungen

- 3512 Chapter 23 Cash Flows HW Exercises ProblemsDokument12 Seiten3512 Chapter 23 Cash Flows HW Exercises ProblemsM MustafaNoch keine Bewertungen

- FAR2 ModelpaperDokument7 SeitenFAR2 ModelpaperSaif SiddNoch keine Bewertungen

- Toa PreboardDokument9 SeitenToa PreboardLeisleiRagoNoch keine Bewertungen

- SAP FICO QuestionnaireDokument7 SeitenSAP FICO QuestionnaireSambhaji50% (2)

- - 如何改錯 correction of errorsDokument32 Seiten- 如何改錯 correction of errors20/21-5B-(05) HoMeiYi/何美誼Noch keine Bewertungen

- FAR Cash and Cash EquivalentsDokument2 SeitenFAR Cash and Cash EquivalentsXander AquinoNoch keine Bewertungen

- Course Objectives & Competences To Be AcquiredDokument2 SeitenCourse Objectives & Competences To Be AcquiredHussen AbdulkadirNoch keine Bewertungen

- Capital ProjectsDokument39 SeitenCapital ProjectsYugwan MittalNoch keine Bewertungen

- Chapter 10 Homework and Solutions 1.: Account Titles and Explanation Debit CreditDokument24 SeitenChapter 10 Homework and Solutions 1.: Account Titles and Explanation Debit Creditlana del reyNoch keine Bewertungen